Every year, billions move between accounts that were never meant to receive them. Sometimes it’s a typo. Sometimes it’s a scam that looks convincing until it’s too late.

In the United States alone, $2.088 billion was lost to only fraudulent transfers in 2024. That’s excluding any legitimate mistakes.

Either way, the result is the same: lost money, regulatory pressure, and shaken trust.

That’s where Verification of Payee (VoP) comes in. It’s a new framework designed to check that the person you think you’re paying is actually the account holder receiving the money.

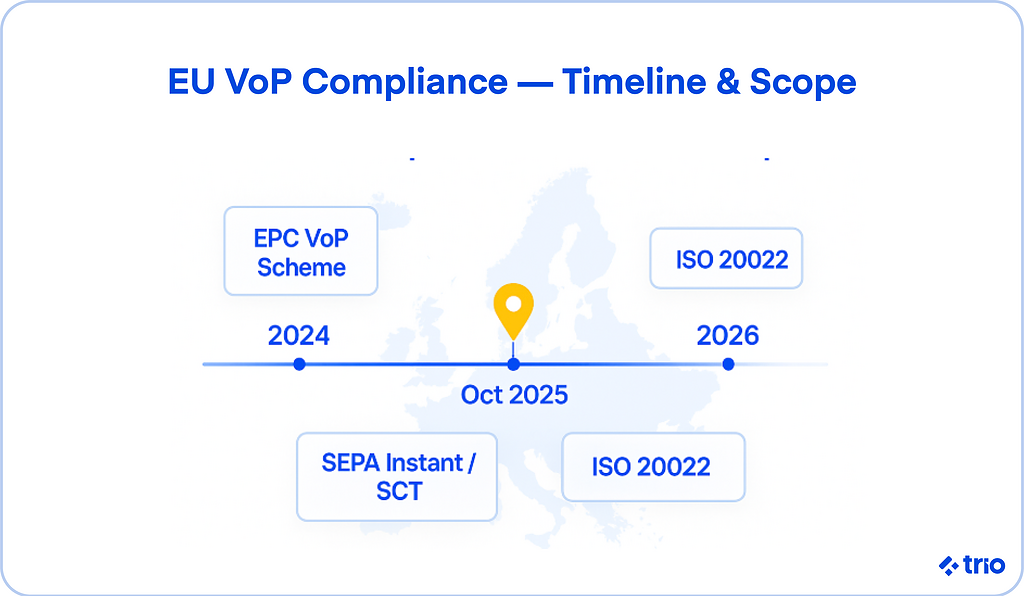

The framework is already a mandatory requirement in the EU as of October 2025, and it is quickly becoming the bare minimum globally.

As the world moves toward full instant payments, VoP is set to become the missing link that protects users from both mistakes and fraudsters.

If you work with payments, compliance, or infrastructure, this change matters.

Payment Service Providers (PSPs)across the EU will need to integrate VoP checks. If you are working in the EU or expect to expand into the region, you need to consider the regulations.

Done right, it could reshape how Europe, and eventually the rest of the world, handles payment verification and fraud prevention altogether.

To make sure you implement this framework effectively to not only reduce fraud but also to make sure that you pass any regulatory scrutiny, you need an expert fintech developer on your team.

At Trio, we provide cost-effective developers familiar with the regulatory environment of both the US and the EU, through outsourcing and staff augmentation, taking the pressure off your HR teams, while making sure you have the necessary skills on hand within a few days, instead of months.

Understanding Verification of Payee (VoP)

Before we take a look at why this matters, it helps to know what VoP actually does under the hood.

What Is Verification of Payee?

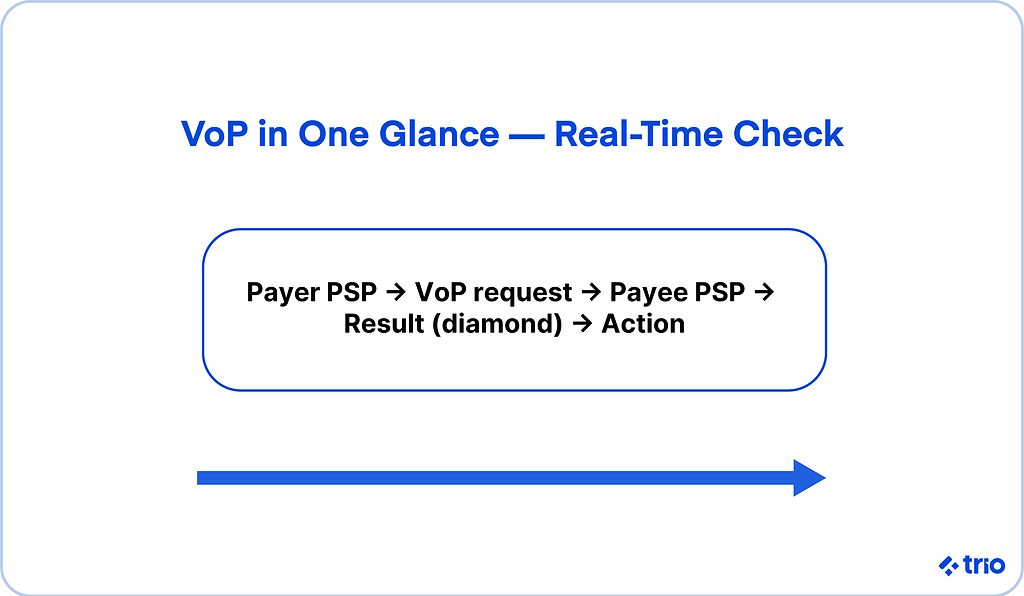

Verification of Payee, or VoP, is a name-account matching system that runs a check before a transaction is executed.

When a payer enters an IBAN or account number, the sending PSP asks the receiving PSP to confirm whether the account holder’s name matches what was entered.

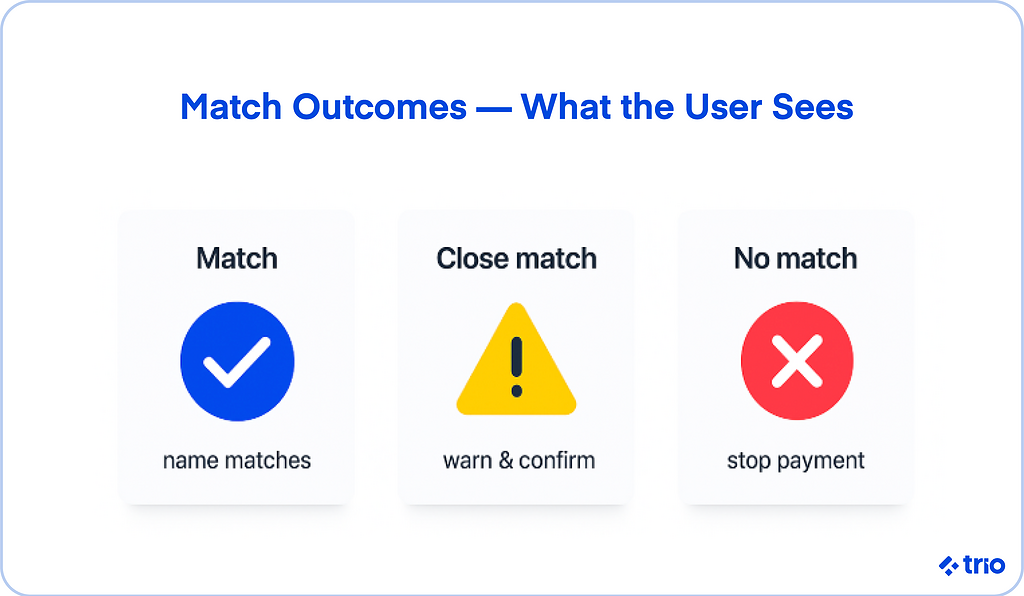

If it matches, the payment proceeds. If it’s a “close match,” the payer gets a polite warning. If it’s a “no match,” the transfer is stopped.

The idea is to catch misdirected payments and authorised push payment (APP) fraud before they happen, instead of cleaning up after the fact.

It’s a simple idea, but it tackles one of the most persistent weaknesses in digital banking: trust without verification.

How VoP Works to Secure Payments

Behind the scenes, VoP runs quietly and quickly. Instead of changing the entire payment flow, it inserts an extra check before funds move.

Name-Account Matching in Real Time

The system compares the payer’s input against the beneficiary’s registered name in real time.

For example, if you type “John A. Smith” but the account details are “Jon Smith,” the PSP might flag it as a close match and ask you to confirm.

If implemented correctly, the process should be seamless.

The process of account verification usually takes less than a second, but it can stop a fraudulent transaction worth thousands.

Confirming Beneficiary Identity Before Payment Execution

Once the responding PSP returns its result, you’ll see one of three messages: “Match,” “Close Match,” or “No Match.”

Those alerts give you a chance to double-check before sending money to the wrong person.

It’s a straightforward way to reduce the risk of fraud and misdirected payments.

The Role of Payment Service Providers (PSPs) and Banks

PSPs are the real backbone of VoP. One side sends the verification request, and the other side confirms it.

Both need to maintain secure, standardized communication so private data doesn’t leak during the check.

The European Payments Council (EPC) manages this coordination through a shared VoP scheme, which ensures every PSP in the Single Euro Payments Area (SEPA) can run the same process, regardless of size or location.

Benefits of Verification of Payee

Regulators tend to focus on compliance, but for many companies, the real benefit of VoP is confidence, for both institutions and customers.

Fraud Prevention and Loss Reduction

APP (Authorized Push Payment) fraud has exploded in recent years, particularly with instant transfers that can’t be reversed.

In the UK, where a similar system called Confirmation of Payee already exists, banks reported double-digit drops in payment fraud after rollout.

The data may vary, but the trend is clear. Confirming account names before a payment leaves the sender’s bank significantly lowers the odds of a scam succeeding.

Regulatory Compliance and Risk Management

Under the Instant Payment Regulation (IPR), PSPs had to implement VoP by 9 October 2025.

This requirement ties directly to SEPA instant and SEPA credit transfers.

For banks and fintechs, the regulation is a structured way to meet requirements while effectively improving your operational security.

Of course, this is not the only regulation to consider. Having someone familiar with the global regulatory landscape on your team can ensure you are set up for success and avoid both potential fines and loss of user trust.

That is one of many reasons companies like to hire financial developers through Trio.

Smoother Customer Journeys and Fewer Payment Delays

Customers hate friction. This has been a long-known fact, affecting every form of e-commerce.

But VoP, when done well, won’t slow down your payment processes. In fact, users might even find the overall experience of sending money smoother.

Real-time validation means fewer failed transactions, less confusion, and fewer calls to customer support.

Cross-Border Payment Accuracy and Speed

Cross-border payments often break down because of mismatched data and different standards.

Adding a VoP check improves payment accuracy and helps keep transfers flowing seamlessly between banks in eurozone countries, and even across other continents.

It’s not perfect yet, but it’s a step toward consistent payment security across Europe, and hopefully the entire world.

Implementation Framework and Technical Requirements

Getting VoP live is a technical project that affects APIs, data flow, and security policies.

APIs, Data Validation, and Name Matching Tools

Most PSPs will integrate VoP into their payment systems through API connections between sending and receiving systems.

The API sends a query, and the VoP service responds with a code, as we have already mentioned.

Some PSPs may choose commercial VoP solutions that already handle this logic, while others will build it internally.

Regardless, you will probably need skilled developers. In the first case, to ensure that the product and integration meet regulatory requirements, and in the second, of course, to actually build your solution.

Secure Communication Between PSPs

Because these requests involve personal data, encryption is essential.

Each financial institution must implement secure communication protocols so account names and identifiers aren’t exposed in transit.

One such protocol that our developers have been exploring recently includes tokenization.

Response Codes and Handling Mismatches

Too many “false positives” frustrate users; too few create risk.

We expect that institutions may experiment with thresholds that balance fraud prevention and user experience, guided by EPC standards.

Challenges and Solutions in Implementation

There are some potential issues that you need to be aware of to ensure a successful VoP rollout through your services.

Data Privacy and GDPR Compliance

VoP introduces data-sharing between PSPs, so it must align with GDPR.

That means sharing only what’s necessary and documenting how responses are stored or anonymized.

Some PSPs might limit name data retention altogether to simplify compliance.

Standardization Across the EU

To keep interoperability smooth, the EPC provides unified standards for request formats and responses.

Without that, VoP frameworks would quickly fragment.

The hope is that every PSP, from a national bank to a niche fintech, can integrate without reinventing the wheel.

Managing False Positives and Exceptions

False positives are inevitable, as we have already mentioned above.

Someone may go by a nickname, or a company’s account might be registered under its legal name instead of its trade name.

These small inconsistencies can confuse users, but improved matching algorithms and contextual hints (“The name entered appears slightly different from the registered account holder”) make the process more intuitive.

Impact on Cross-Border Payments

VoP’s influence won’t stop at domestic payments. We expect to see it spreading far and wide in the future.

Extending VoP Beyond Domestic Transactions

The EU aims to extend VoP checks across cross-border instant payments within the SEPA zone.

This will likely build on existing SWIFT GPI and ISO 20022 data standards to ensure data consistency and interoperability.

It’s a technically ambitious step, but one that could make European transfers feel as simple as domestic ones.

How VoP Strengthens Trust in Cross-Border Payment Flows

Trust is the foundation of cross-border transactions.

When every payer knows that recipient identities are verified before money moves, confidence grows.

That trust makes instant payments more attractive and cuts reliance on intermediaries who add cost and delay.

Synergy With SWIFT GPI and ISO 20022 Standards

SWIFT GPI already tracks payments globally with improved transparency.

Combining that with VoP systems and ISO 20022 message formats could standardize verification from initiation to settlement.

That alignment is incredibly technical, but it’s how interoperability actually happens.

The Role of Data Consistency and Interoperability

Consistency is what makes VoP scalable. The fewer format differences between PSPs, the faster payments clear.

Long term, the EU wants this shared data layer to power more than name checks, potentially broader payment verification tools across currencies.

The Role of Ethereum and Blockchain in Payment Verification

Our developers are already thinking about what happens when on-chain identity meets regulated finance.

Exploring On-Chain Identity Verification Concepts

In theory, blockchain-based identity systems could carry verified credentials that interact with traditional payment rails.

It’s early-stage, but it hints at a world where you could verify ownership of an address or wallet in a similar way to a bank account number today.

Potential Future Use of Smart Contracts in VoP Processes

Smart contracts could eventually enforce VoP-like logic by releasing funds only if a payee’s name matches verified credentials.

That’s not part of the 2025 rollout, but it’s an interesting direction for hybrid models that mix open banking APIs with on-chain verification.

The Future of Verification of Payee

We’ve already mentioned some future developments of these robust verification mechanisms. Some of these possibilities seem more likely to occur in the near future than others.

Upcoming Enhancements and EU-Wide Expansion

After 2025, we expect VoP services to expand beyond SEPA and into other European corridors.

PSPs may add fields like company identifiers or aliases to handle complex payees more easily.

AI and Machine Learning for Real-Time Fraud Detection

Artificial intelligence may soon play a supporting role.

By learning from millions of VoP checks, systems could flag fraudulent patterns even before a transaction reaches the verification stage.

That doesn’t replace human oversight, as we have learned in all the other implementations of AI, but it adds another layer of fraud prevention.

Potential Global Adoption of VoP Principles

If VoP succeeds in Europe, it could set a precedent globally.

The same idea, verifying recipient identity before sending funds, works just as well for USD, GBP, or crypto transfers.

Global standards will take time, but the principle travels easily.

Predictions for the Future of Payment Verification in Cross-Border Ecosystems

By the end of the decade, we think it is very likely that VoP frameworks may run automatically in the background of every instant payment.

You might never see the prompt, because the system will already know whether the name matches. It’s not flashy technology, but it’s the kind that quietly keeps trust intact.

Conclusion

Verification of Payee (VoP) represents a practical leap forward for payment security in Europe. It helps prevent fraud, reduces manual checks, and brings a level of verification that should have existed years ago.

If you manage compliance, infrastructure, or customer experience, now is the time to plan. The 9 October 2025 deadline has already passed, and it set the tone for what “secure payments” mean in the EU by closing one of the biggest gaps in digital banking.

It’s a major step toward safer, smarter, and more trusted cross-border payments.

If you need to hire fintech developers to help you prevent fraud and ensure regulatory compliance, get in touch to schedule a free consultation.

FAQs

What is Verification of Payee (VoP)?

Verification of Payee (VoP) is a system that checks whether a recipient’s account name matches their IBAN before a payment is sent, helping prevent fraud and misdirected transfers.

How does VoP prevent fraud?

VoP prevents fraud by flagging mismatches between a payer’s entered name and the registered account holder’s name, stopping fraudulent or mistyped payments in real time.

When will VoP become mandatory in Europe?

Under the EU’s Instant Payment Regulation, PSPs must implement VoP by 9 October 2025 to continue offering SEPA instant and credit transfer services.