For decades, credit underwriting has revolved around credit bureaus and a narrow set of financial metrics.

But this traditional model leaves too many people out, those who pay rent, utilities, or phone bills on time but have no formal credit history to create the traditional data these bureaus use.

As open finance gains traction, alternative data is reshaping how lenders evaluate creditworthiness and how borrowers prove they deserve a fair chance.

At Trio, our software developers are fintech specialists. They spend time actively working in the industry, and are aware of not only emerging expectations, but also the best practices to facilitate them.

If you are interested in getting these experts on your team, our outsourcing or staff augmentation hiring models are incredibly cost-effective.

Understanding Alternative Data

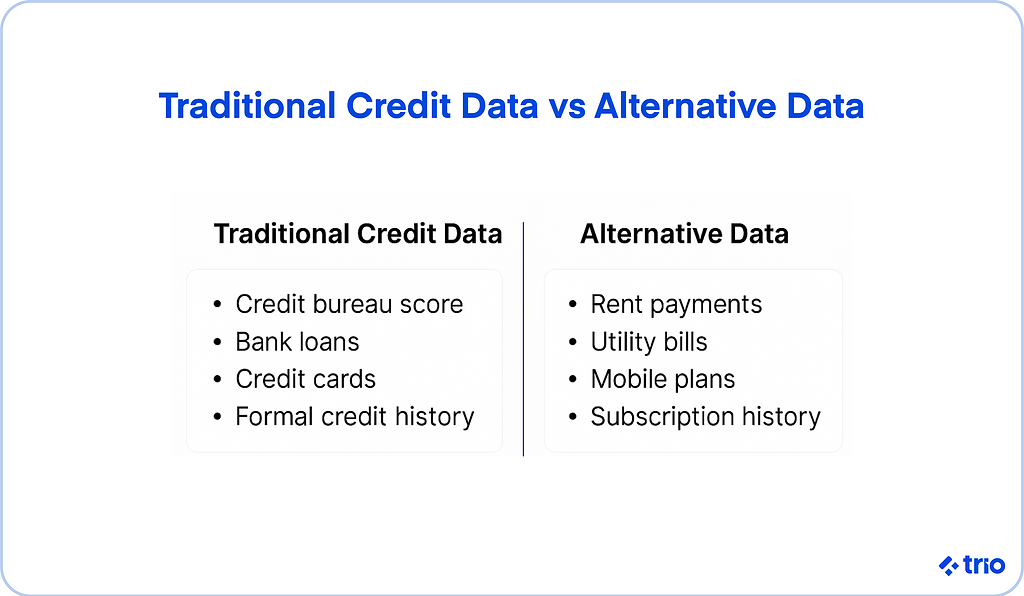

The phrase alternative data gets thrown around a lot, but what does it actually mean? It’s worth unpacking before we talk about how lenders use it.

What Is Alternative Data?

In plain terms, alternative data refers to financial information that doesn’t come from credit bureaus. Think rent payments, payroll deposits, mobile top-ups, or even subscription activity.

These details, while mundane on their own, can show consistent behavior and reliability that a traditional credit file misses.

Where old credit reports offer a snapshot, alternative data often tells an unfolding story, updated, continuous, and closer to real life.

Why Alternative Data Matters in Financial Services

There’s a growing awareness that too many people remain “credit invisible.”

In some countries, that’s more than half the adult population.

Using alternative data gives lenders a broader view and helps close that gap. Patterns of consistent bill payments or stable income flows can reveal creditworthiness where a low or missing score once stood.

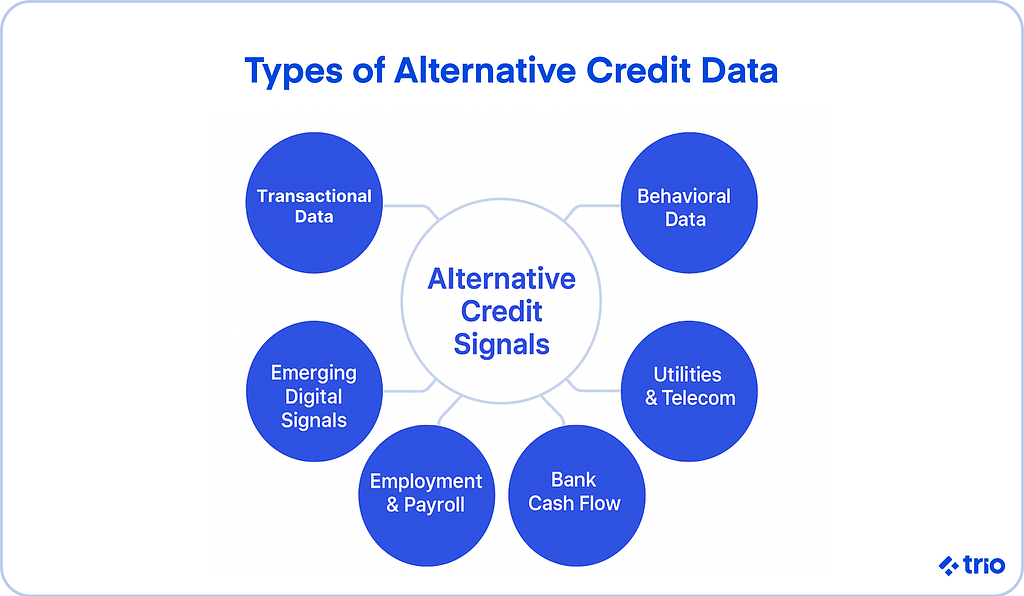

Types of Alternative Credit Data

Alternative data is quite a wide field. Lenders use a mix of sources depending on what fits their models:

- Transactional data, such as debit card usage or peer-to-peer payments, shows how someone manages cash flow.

- Behavioral data drawn from mobile or online activity that hints at consistency and spending habits.

- Employment and payroll data confirming income stability.

- Utility and telecom data reflecting punctual payments.

- Cash-flow data from connected bank accounts.

- Emerging signals like subscription renewals, digital wallet top-ups, or IoT-enabled transactions through open-finance APIs.

At Trio, we often see fintech teams struggle to make these diverse sources work together. Turning scattered, messy data into something lenders can actually trust requires good engineering and a strong sense of how credit systems think. In other words, it requires experience in similar projects.

Rethinking Credit Underwriting with Alternate Data

Credit underwriting, in essence, is about assessing risk. But risk looks very different today than it did when most credit models were designed.

Traditional Credit Underwriting Practices

Many lenders still lean on bureau reports and FICO-style scores. These tools rely on past borrowing and repayment records, which sounds logical until you realize how much that leaves out.

Someone who’s never had a credit card, for instance, may appear risky on paper despite years of responsible rent and bill payments.

Why Traditional Scores Fall Short

Traditional credit scores can lag behind reality.

Financial lives shift quickly, especially for gig workers, small business owners, and younger borrowers. Static models built on delayed reporting don’t capture those shifts.

A person might appear overextended one month and fully solvent the next, but that nuance rarely shows up in a bureau report.

Alternative Credit Scoring Models

Alternative credit scoring models approach the problem differently. They combine structured and unstructured data to build a richer view of the applicant.

A lender might analyze daily transaction data, income volatility, or even subscription stability to see whether repayment capacity holds steady over time.

The models aren’t perfect, but they’re flexible and tend to learn faster than conventional systems.

How Lenders Use Alternative Data

Lenders use alternative data in a few key ways.

Some integrate APIs from companies like Plaid or Trulioo to verify income and spending habits in real time. Others use machine learning to analyze patterns that signal reliability.

Benefits of Alternative Credit Scoring

The appeal of alternative credit scoring lies in its practicality. It often makes lending decisions faster and more accurate while cutting default rates. And it opens the door to borrowers who would otherwise remain invisible.

Fintech startups are leading the charge here. At Trio, our engineers often help these teams integrate credit decision systems that can balance speed, data accuracy, and compliance without sacrificing control.

Implementation and Integration

Bringing alternative data into credit underwriting sounds simple, but the reality is complex.

How to Incorporate Alternative Data into Credit Decisions

The best systems start with clean, validated data. Lenders often work with aggregators like Yodlee or Plaid to pull account and transaction data directly from the source.

Cloud-based decision engines then analyze this information against internal policies.

Each data point, including rent payments, utility bills, and even recurring transfers, must be verified, traceable, and correctable if errors arise. Regulations demand it as well as your users, who see it as a matter of trust.

Key Challenges in Adoption

Borrowers are rightly cautious about who sees their data and how it’s used, even if the efforts are to expand credit access.

Regulations differ by country, and many lenders are still finding their footing in this new territory.

Then there’s explainability: machine learning models can predict accurately, but sometimes struggle to justify why. The challenge lies in balancing predictive power with transparency, a tension every fintech grapples with.

Regulation and Responsible AI

The push to use alternative data for credit underwriting coincides with growing scrutiny from regulators. That’s not a bad thing.

Rules create guardrails, and guardrails build trust.

Global Regulatory Frameworks

In the United States, the Fair Credit Reporting Act (FCRA) and Equal Credit Opportunity Act (ECOA), enforced by the Consumer Financial Protection Bureau (CFPB), govern how lenders handle consumer data.

The European Union’s GDPR and the UK’s open-banking rules push for transparency and consent.

Elsewhere, countries in LATAM and APAC are developing frameworks that blend innovation with caution, each with its own flavor of fairness.

Responsible AI and Fair Credit Practices

AI has enormous potential in credit risk assessment, but it can also replicate the very biases it’s meant to solve.

Responsible AI is going to be critical.

Lenders must continuously audit their systems, explain outcomes in plain language, and respect the consumer’s right to understand how a decision was made.

Anticipating Future Standards

Financial regulators appear to be moving toward more consistent global guidelines on data use and algorithmic accountability.

Lenders who document their data sources, model logic, and human review processes now will likely adapt more easily when these standards formalize.

The Future of Credit Underwriting

The shift toward alternative data in credit underwriting isn’t slowing down. If anything, it’s gaining momentum as open-finance infrastructure matures.

Key Trends Shaping the Next Wave

We expect to see more cash-flow-based underwriting, where lenders evaluate live transaction data instead of backward-looking credit scores.

Open-finance APIs are quickly becoming the connective tissue of this ecosystem.

Meanwhile, AI-driven scoring models are evolving to become adaptive, learning, and recalibrating as borrower behavior changes.

Conclusion

The use of alternative data may create a cultural shift as people gain access to financial institutions. It helps lenders, but also asks them to trust new signals, borrowers to share more of their financial lives, and developers to build systems that honor that exchange responsibly.

As financial data becomes richer and more dynamic, the industry’s success may depend on including alternative data sources. Lenders who combine solid governance with human insight will not only make smarter lending decisions but also build fairer financial systems.

And that’s where partners like Trio come in, helping fintechs move from concept to code, turning the promise of alternative data into real-world lending confidence.

If you are interested in hiring fintech developers through Trio, get in touch!

FAQs

What is alternative data for credit underwriting?

Alternative data for credit underwriting refers to nontraditional financial information (like rent, utility, or payroll records) that lenders use to evaluate a borrower’s creditworthiness.

How do lenders use alternative data?

Lenders use alternative data to assess repayment behavior and financial stability, often integrating it through APIs or decision engines for faster, fairer credit decisions.

Why is alternative data important for fair lending?

Alternative data is important for fair lending because it includes people with thin or no credit files, helping expand access to loans without lowering credit standards.

What are the main types of alternative data?

The main types of alternative data include transactional, behavioral, employment, payroll, utility, telecom, and cash-flow information.