Fintech founders often talk about scaling, although the moment they try to expand their engineering capacity, the numbers start looking uncomfortable.

You may already know the pattern.

You raise a round, feel pressure from investors to accelerate product development, and suddenly the hiring roadmap appears to balloon far faster than your revenue.

The gap between what you need to build and what you can afford becomes pretty obvious.

It may help to admit something up front. Scaling a fintech is not the same as scaling a general SaaS product.

You are dealing with finance, regulation, compliance, reputational risk, and a regulator or two watching your every move. The conditions are strict, the expectations are high, and customers rarely forgive mistakes that touch money.

That tension makes cheap engineering seem unrealistic. Yet many fintech companies find a way to expand engineering efficiently without losing clarity, compliance, or quality.

Let’s look at how fintechs can scale engineering cheaply and sustainably, so you can do the same.

Why scaling engineering feels harder in fintech

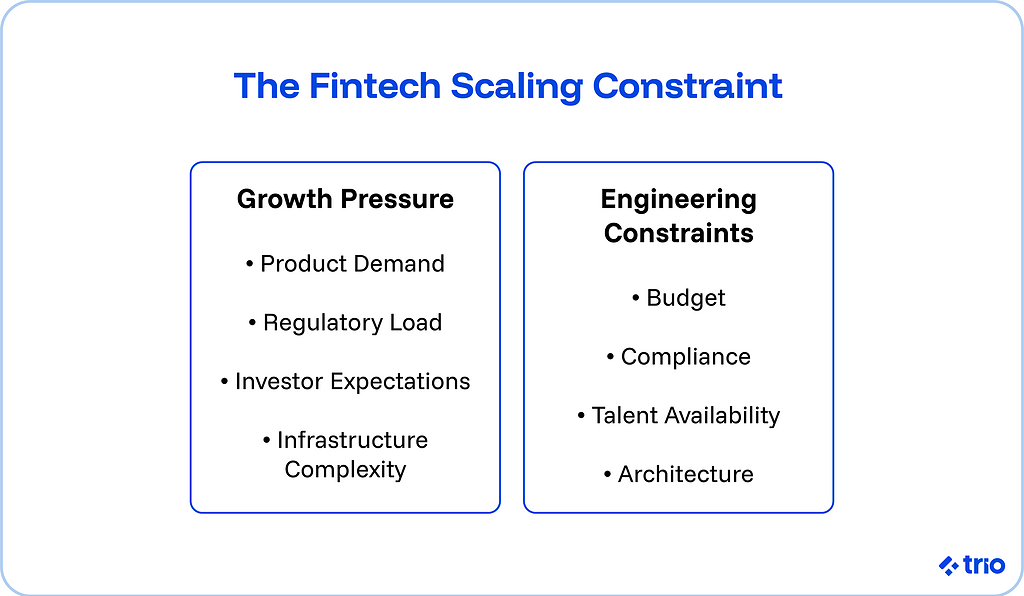

Most growing fintechs sit at the intersection of technology, regulation, and investor momentum.

You are balancing product velocity with scrutiny.

You also need engineers who understand financial data flows, banking integrations, identity validation, payment rails, and the internal logic that keeps everything secure. Those people are expensive and scarce.

Compliance requirements evolve every quarter. Infrastructure can get complicated quickly as you add new features. And just when you think the architecture is stabilizing, investor expectations shift again.

If you are building in insurtech, lending, crypto, or a mobile finance app, the pressure doubles.

Your team is shaping financial products that people depend on every day.

The traps many fintech companies fall into

Cost optimization usually begins with urgency.

A founder feels behind, tries to scale rapidly, and ends up hiring too many engineers too early. That may help for a few months until burn rates spike.

We have seen teams freeze hiring entirely simply because one ambitious hiring quarter pushed them past their funding comfort zone.

Another trap appears harmless at first. You bring in generalist engineers who are excellent but unfamiliar with regulatory workflows.

That decision often postpones development. Engineers spend weeks learning compliance basics and trying to understand why seemingly harmless shortcuts are not allowed.

A third trap is architectural. Early fintechs build quickly, which is normal, although the software architecture becomes harder to extend. Teams then throw more engineers at the problem, which usually makes things costlier instead of faster.

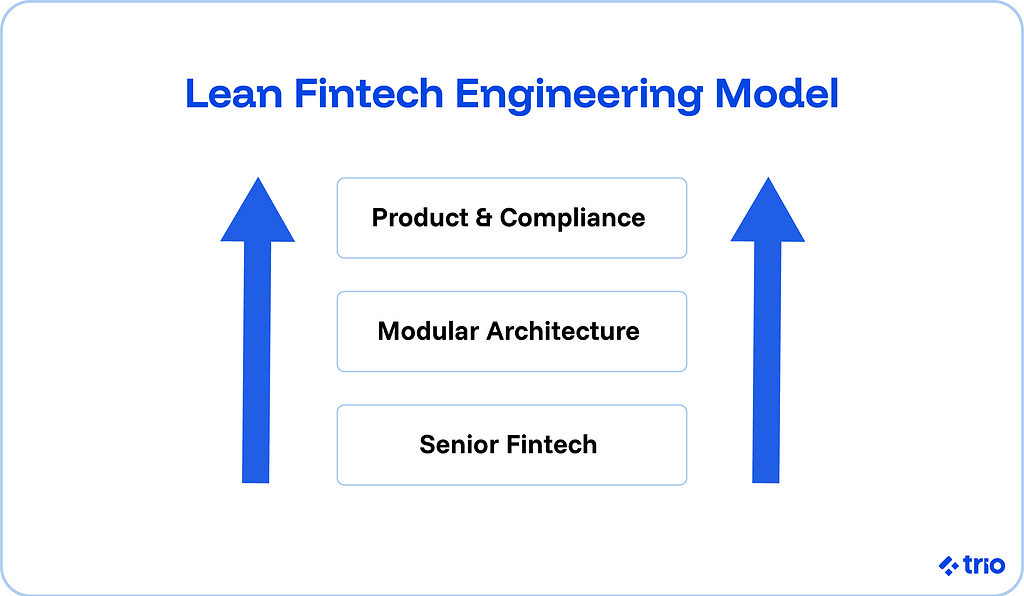

A lean engineering model that still fits regulated environments

If you want to scale cheaply, a lean mindset may be your safest starting point.

Instead of adding bodies, you design a system that allows a small team to work efficiently.

A modular architecture helps here.

It lets you expand a financial platform one segment at a time rather than rewriting the entire codebase when a new customer asks for an edge case. It also protects you when new regulations appear.

A focused workflow matters too.

When your engineers know exactly how an idea moves from product to execution, iteration becomes predictable. You gain continuous momentum without inflating headcount.

Practical ways fintechs can reduce engineering costs without creating risk

Several strategies tend to show strong results.

Use senior engineers who already understand the domain. It might sound counterintuitive because senior talent costs more per hour, but they often reduce total cost by cutting ramp time.

Trio emphasizes this idea explicitly. You get engineers who understand financial infrastructure, compliance, lending systems, banking integrations, and the realities of regulated environments.

They arrive ready to contribute with minimal onboarding. That reduces ramp time and avoids costly mistakes.

Lean into AI and automation where it makes sense.

AI-assisted testing, documentation, and analysis frees your team for the parts that require deep reasoning. You can maintain engineering clarity without adding another full-time engineer.

AI-driven tooling is not magic, though it can streamline repeatable tasks throughout the product development lifecycle.

Automate compliance validation.

Many fintechs still handle regulatory steps manually. Simple automation may lower both risk and cost. It often reduces the need for extra staff during audits or regulator check-ins.

Build an infrastructure that evolves rather than explodes. When your technology foundations are stable, scalable, and modular, you avoid the costly cliffs that force expensive rewrites.

It is one of the quietest cost savers in scaling fintech.

Adopt remote-friendly structures.

A distributed team gives you access to global senior talent without paying inflated local salaries. It is one of the easiest ways to maintain quality while keeping costs predictable.

When external engineering partners actually help

Some founders hesitate to use external partners, and in many cases, the hesitation is valid.

A generic staffing firm may give you engineers with little fintech experience, which shifts the burden back to your internal team. That is usually a poor use of money.

If you decide to bring in outside help, look for engineers who already understand compliance, risk, and how financial systems behave.

You want people who integrate quickly and do not require heavy hand-holding.

Trio positions itself precisely in that category. We focus exclusively on fintech and vet every engineer for domain expertise.

Our model removes friction, slows the hiring spiral, and gives you scalable capacity that adjusts to shifting roadmaps. It also maintains trust and regulatory alignment, which can be difficult to achieve with cheaper generalist options.

Measures that help you track scalability and cost efficiency

You do not have to measure everything. A few indicators tend to matter more than others.

Velocity shows how quickly your team ships viable features. If velocity drops while headcount increases, you probably have architectural bottlenecks.

Tracking the cost per shipped feature can help you see whether your engineering investment aligns with revenue.

Another helpful indicator is onboarding time. When onboarding takes too long, engineering costs rise. Engineers who arrive fintech-ready usually shorten that cycle.

Some teams also track the ratio of planned work to unplanned work. A high number may suggest the architecture is fragile or that compliance steps are not properly automated.

Final thoughts for founders navigating growth and scrutiny

Scaling a fintech cheaply requires clarity around the real constraints: compliance, regulation, infrastructure, investor expectations, and the everyday realities of finance.

Many fintechs overcomplicate the solution. You may simply need engineers who already speak the language of financial products and a workflow that keeps your team moving without costly turbulence.

When you approach scaling with this mindset, you maintain quality, satisfy regulators, and keep engineering costs from spiraling.

You also create a platform that can expand as the fintech ecosystem reshapes itself. And if you choose to work with a partner, make sure they treat you like a collaborator instead of a vendor.

Trio’s promise is built around that exact idea: fintech-ready engineers who plug in quickly, support your trajectory, and help your team build the future of finance with confidence.

To hire these specialist fintech software developers, get in touch!

FAQs

How can fintechs scale engineering cheaply without losing quality?

Scaling engineering cheaply for fintechs usually means finding ways to expand capacity without lowering quality, and the simplest route is using engineers who already understand finance, so you avoid long ramp times and rework.

What engineering roles are most cost-efficient for a scaling fintech?

The most cost-efficient roles tend to be senior engineers with fintech experience, since they reduce onboarding time and keep compliance-related decisions on track.

Does using external engineering partners actually save money?

Using external partners often saves money when the engineers arrive fintech-ready, since that avoids training, delays, and the extra staff needed to manage unfamiliar teams.

How can AI reduce engineering costs for fintech companies?

AI may reduce engineering costs by handling repetitive work like testing or documentation, which frees your team for the harder financial and regulatory tasks.

Why is compliance important when expanding a fintech engineering team?

Compliance matters during expansion because new engineers need to understand regulated workflows, and ignoring that creates costly delays and potential audit headaches.

What should a founder look for in a fintech engineering partner?

A founder usually looks for a partner with domain expertise, predictable integration, and engineers who understand payments, lending, or banking from day one.

How do you measure whether engineering is scaling efficiently?

You measure scaling efficiency by watching indicators like velocity, onboarding time, and the cost required to ship a meaningful feature.

Is it risky to hire generalist engineers at a fintech startup?

Hiring generalists can be risky because they often lack experience with regulated finance, which slows development and increases the chance of compliance mistakes.

When is the right time for a fintech to increase engineering headcount?

The right time to increase headcount usually comes when product velocity stalls and your current team cannot keep up with the roadmap or regulatory demands.

Can a small engineering team support a growing fintech platform?

A small team can often support growth if the architecture is modular and the engineers understand financial systems well enough to maintain clarity under pressure.