As we enter 2026, the conversation around fintech hiring feels very different from the optimism that carried the sector through its rapid hiring years.

Teams that once struggled to keep up with growth now talk about stalled headcount plans, longer hiring cycles, and open roles that linger without much movement.

The job market still has bright spots, but the slowdown shapes nearly every discussion across fintech companies, financial institutions, and the broader financial technology space.

It has not been a dramatic collapse. It is more like a series of adjustments that have built up over time, making both employers and job seekers rethink how they approach recruitment.

Let’s look at what you can expect.

The fintech job market in 2025 and why a slowdown was eventually unavoidable

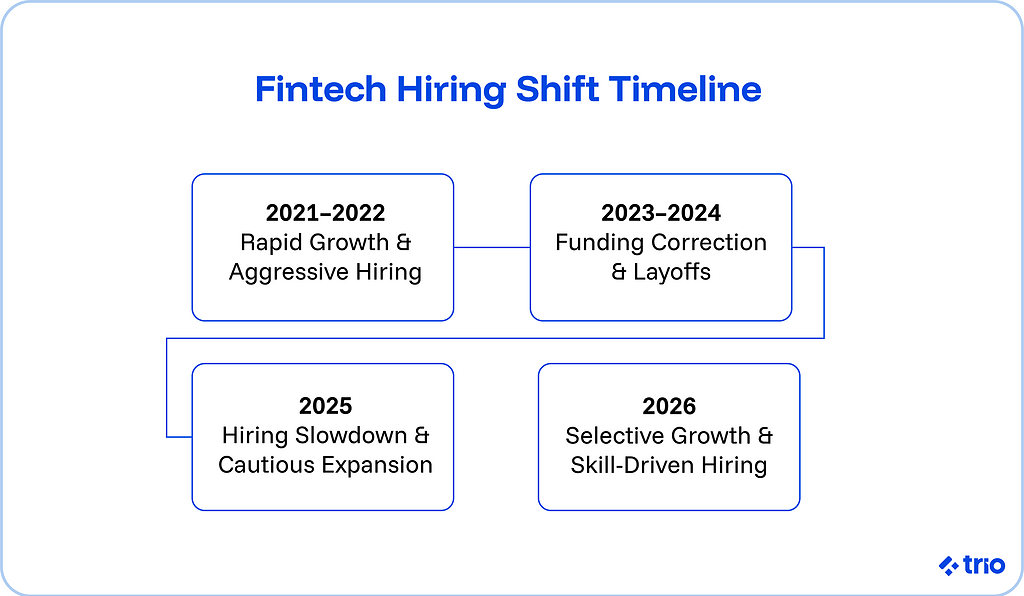

If you look back at 2021 and 2022, hiring momentum ran hot enough that a correction seemed likely, even if nobody wanted to call it.

Venture funding encouraged rapid hiring, often faster than teams could onboard new engineers. By 2023, the environment cooled, and economic conditions moved from mildly unpredictable to genuinely difficult for many fintechs.

By 2024, the pressure intensified. Reports showed fintech workers facing cost-cutting, expanded duties, and ongoing layoffs across payments and lending teams.

At the same time, many startups restructuring to survive a tightening funding landscape admitted they were recalibrating everything from product plans to hiring needs.

Even the broader tech sector saw continued reductions, with large, ongoing layoffs through 2025 that signaled a market still under strain.

By early 2025, the overlap of these trends became clearer. Global hiring trend reports showed slower job postings, longer decision cycles, and more leadership hesitation around adding headcount, largely due to geopolitical uncertainty and uneven economic signals.

It has all added up to a noticeable slowdown that carried straight into 2026.

AI, automation, and the changing definition of fintech talent

The rise of AI has been part of the story, though not in a catastrophic way.

Teams are not replacing entire departments with AI tools, but AI-driven workflows keep reshaping what roles actually look like.

The combination of AI and automation changes how mission-critical work gets handled and what skills feel non-negotiable.

Demand for skills in cybersecurity, data analytics, regulatory technology, machine learning, and blockchain has continued, even when hiring in other areas slows.

These are functions where measurable impact is easier to trace.

Digital fluency has become a genuine differentiator, especially as teams want people who can operate confidently in environments full of risk scoring models, identity checks, and complex transaction flows.

Some companies appear eager to upskill existing teams rather than bring in new hires, which fits a cautious budget year.

Upskilling also helps retain talent, a priority for leaders who cannot afford disruptions to pipelines or product roadmaps.

Layoffs, recruitment fatigue, and the human side of the last two years

From late 2023 into all of 2024, layoffs hit fintechs unevenly but persistently enough to unsettle the industry.

Many mid-career professionals describe the emotional whiplash of being in a high-growth team one season and a restructuring conversation the next.

Even those not directly affected still feel the weight of job security concerns, especially as layoffs continue to pop up across regions.

Recruitment has not been simple either.

Some recruiters manage shifting priorities every week, which naturally leads to slow communication or stalled processes.

Talent pools are fuller, but movement inside them is sticky.

Candidates hesitate to leave stable roles. Companies hesitate to commit to headcount. It creates friction that everyone can feel.

What fintechs and financial institutions continue to hire for in 2026

Despite the slowdown, hiring has not frozen. It has narrowed.

Teams still recruit for roles tied to security, compliance alignment, and advanced data work.

Skilled professionals with backgrounds in analytics, digital payments, risk engineering, or identity verification remain in demand because the work cannot be deferred.

Startups with steady funding continue to invest in core engineering, though often with more care than in earlier years.

Traditional banking teams also show interest in fintech talent, especially those who bring both technical ability and familiarity with regulated environments.

Entry-level roles show inconsistency.

Some teams paused them entirely in 2024, while others found that junior hires offered flexibility during uncertain budgets. Even so, the hardest open roles tend to sit in specialist categories where experience is required.

This is where partners like Trio can steady the pace.

Trio gives fintech teams access to senior engineers who already understand compliance, financial data flows, and the constraints of regulated work environments.

When internal hiring slows, having support that plugs into existing product cycles without long delays can keep projects moving.

Hiring strategies that actually help when the market slows

Companies that navigate this landscape well tend to shift their recruitment strategies in a few noticeable ways.

They communicate clearly with candidates. They treat their talent pipelines as long-term relationships rather than quick transactions. They invest in lifelong learning for their teams, especially where AI and automation influence daily workflows.

And they revisit their hiring decisions more often to avoid unnecessary pauses.

Top candidates want thoughtful processes. They want clarity about expectations and timelines, and also value teams that offer real opportunities for learning, especially as technologies shift faster than in previous cycles.

For teams struggling to maintain momentum, Trio provides a practical path forward.

Rather than waiting months to secure a specialist hire, teams can integrate fintech-ready engineers quickly and continue delivering product work at the pace stakeholders expect.

Trio focuses on fintech exclusively, so the support feels more like adding to your core team than outsourcing.

Looking ahead to 2026 and the uncertainty that comes with it.

Predicting the next year of fintech hiring is difficult, partly because the geopolitical climate continues to shift and partly because technology trends move faster than most planning cycles.

Still, there is a reasonable chance that hiring will stay cautious rather than contract further. Companies appear focused on retaining talent, shaping clearer roles, and expanding capacity slowly.

The challenges and opportunities will continue to coexist.

Teams that adapt by refining their recruitment strategies, strengthening their internal pipelines, and investing in the right skill sets will likely remain competitive.

And when capacity becomes a constraint, Trio steps in as the fintech development partner that brings vetted, domain-fluent engineers to keep critical initiatives on track.

If your team needs additional support as you plan for the year ahead, get in touch.

FAQ

What is causing the fintech hiring slowdown in 2026?

The fintech hiring slowdown in 2026 comes from tighter budgets, shifting investor expectations, and teams rethinking headcount after earlier rapid hiring cycles.

Is the slowdown affecting all fintech roles equally?

The slowdown affecting all fintech roles is uneven, with security, data, AI, and compliance positions staying active while general engineering roles move more slowly.

Are layoffs still happening across fintech in 2026?

Layoffs happening across fintech in 2026 remain scattered but continue in pockets where restructuring or stalled revenue puts pressure on operating costs.

Which fintech skill sets are still in demand despite the slowdown?

The fintech skill sets still in demand include cybersecurity, analytics, AI-driven engineering, regulatory tech, and work tied to measurable risk and compliance outcomes.

Are fintech startups still hiring?

Fintech startups still hiring tend to be those with stable funding, focusing on roles that directly influence product delivery, infrastructure, or market readiness.

How long will fintech recruitment cycles take in 2026?

Fintech recruitment cycles in 2026 may take longer than before as teams move carefully, often reviewing hiring decisions multiple times before making an offer.

Is AI replacing fintech jobs?

AI replacing fintech jobs is overstated, since most teams use AI to support workflows rather than remove roles, although job definitions are shifting.