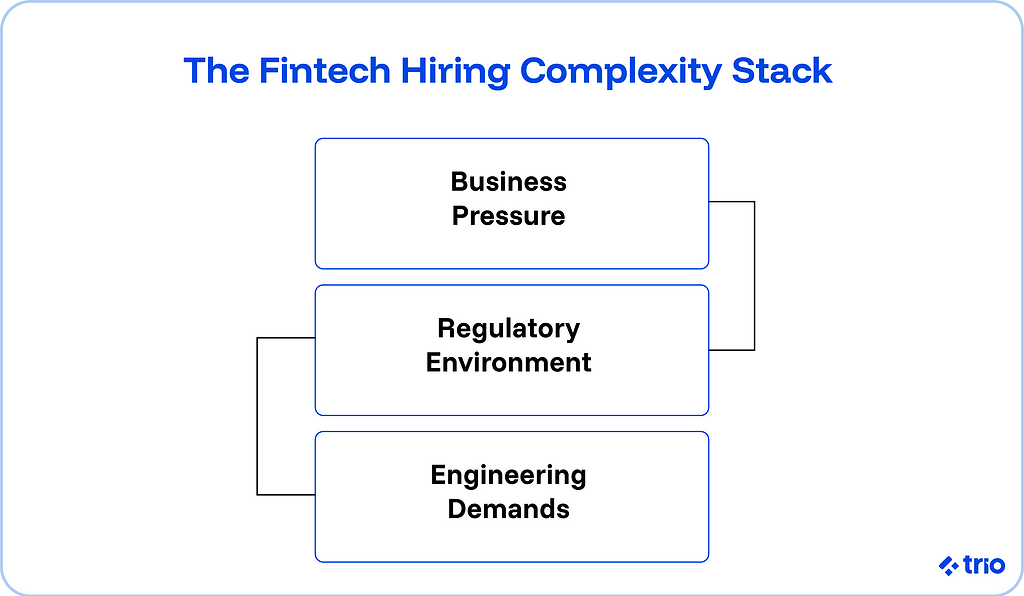

There are many factors that make it hard to hire fintech engineers.

Teams expect some turbulence in tech hiring, but financial technology creates its own set of obstacles.

Some of these hurdles seem small at first glance, yet they can dramatically change how long it takes to find the right people. Over time, the gap between what fintech companies need and what the talent pool can actually offer has widened.

Fintech companies now manage real-time money transfer systems, stricter oversight, and fast-evolving fraud detection models.

You also see more use of machine learning, generative AI features, and multi-cloud setups.

When engineers need both great technical skill and familiarity with regulated environments, the pool gets small very quickly. Everyone competing for the same top talent makes the bottleneck even tighter.

To hire expert fintech developers today, get in touch!

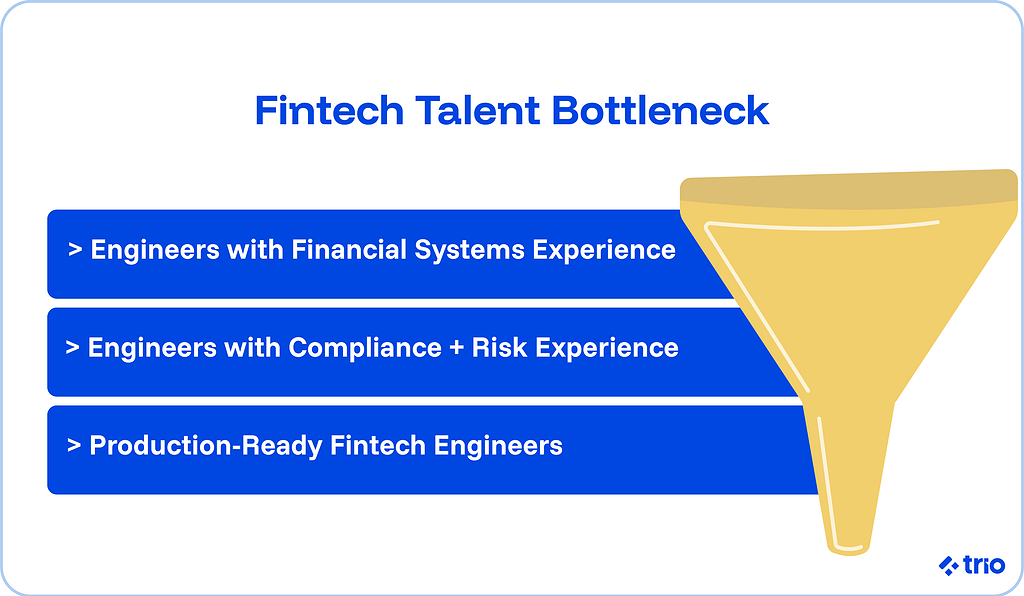

The fintech talent pool is narrow, and the bar is unusually high

A strong generalist might thrive in many tech companies, but fintechs rarely have that luxury. Financial technology blends backend engineering, security expectations, data protection requirements, and regulatory pressure.

Engineers need to understand how financial data moves, why certain logs matter, and where the risks hide.

You might find someone who can build large systems but has never touched KYC, incident response, or transaction patterns. Or someone who knows data science but hasn’t worked in a domain where one mistake can harm customer trust.

Fintech compliance isn’t something you can skim during onboarding, and teams feel the impact when an engineer needs weeks of context before writing reliable code.

Modern fintech stacks are more complex than they look.

Many fintech products rely on multi-cloud infrastructure, advanced observability, and automation across internal services.

Add in fraud scoring, embedded financial technology, and integrations that shift constantly, and you get a stack that demands real experience.

Engineers who know how to keep these systems stable under regulatory scrutiny are hard to find.

As fintech jobs become increasingly specialized, the hiring process stretches longer.

Candidates often receive offers from tech companies, banks, and similar companies working on financial software.

Competitive salaries also create distance between startups and larger players, which slows hiring even further.

Regulatory scrutiny raises the stakes for every hire

Fintech development involves more than writing secure code.

Engineers must understand frameworks that change frequently, privacy policy standards, data protection rules, and audit expectations. Even seasoned engineers sometimes hesitate to join the space because the margin for error feels razor-thin.

In financial software, a bug could freeze withdrawals, misroute funds, or disrupt interest calculations.

Engineers must handle systems with strict uptime expectations and collaborate closely with compliance and product managers. Strong soft skills matter as much as technical depth.

Compensation pressure and a global market reshape recruitment

As remote hiring expands, companies compete with teams in LATAM, Europe, and Asia for the same people.

Candidates often know they can negotiate aggressively. Once you factor in banks, insurance groups, and larger fintech firms with wider budgets, it becomes clear why early-stage teams struggle.

If your sourcing relies heavily on job descriptions posted to LinkedIn or traditional recruitment pipelines, finding suitable candidates can take significantly longer.

The pool of candidates with actual fintech experience is small, and they are rarely on the market for long.

Culture, expectations, and workload influence decisions more than leaders expect

Fintech has a reputation for constant motion. Incident response, rapid product updates, and shifting roadmaps can eat into work-life balance.

While not universal, this perception nudges some engineers toward other industries.

Gender diversity also remains limited in several technical areas, particularly backend development and data science.

When the pool is already small, these disparities magnify hiring challenges. Correcting this takes ongoing investment, not quick fixes.

Why are more teams exploring outsourcing or augmentation?

Hiring in-house remains ideal for many product teams, but it’s difficult to maintain momentum when the search takes months.

Some fintechs choose to outsource or augment their team to keep shipping while they continue long-term hiring.

If engineers already understand regulated environments, fintech solutions, compliant workflows, and the domain they understand, onboarding becomes quick and predictable.

This approach is especially useful for startups navigating scaling challenges or growing fintech firms with shifting priorities.

How a fintech-ready partner can help

Here is where a specialized development partner becomes valuable.

Trio, for example, focuses entirely on fintech and vets engineers for real experience with payments, lending, banking, identity, and fraud detection.

New developers join with minimal friction, which shortens ramp time and keeps product delivery moving.

The model also gives you flexibility when your roadmap expands or contracts.

Instead of navigating a drawn-out fintech recruitment cycle, you get contributors who understand software engineering within regulated industries and can slot into your in-house team quickly.

A partner like this also shields you from the uncertainty that comes with traditional recruitment and helps maintain pace without compromising compliant engineering practices.

What to do next

If hiring fintech engineers feels harder than it used to, you’re not imagining it. The industry’s mix of risk, regulation, technical complexity, and competition has created a hiring environment that demands patience and strategy.

You can refine your hiring process, widen your talent pool, and update how you recruit, but if you need people who can contribute immediately, a fintech-focused partner such as Trio can help you maintain momentum while avoiding costly delays.

If you want to explore a smoother path to building or augmenting your engineering team, get in touch!

FAQs

Why is it hard to hire fintech engineers?

Hiring fintech engineers is difficult because fintech roles require technical depth plus knowledge of compliance, financial data flows, and regulated environments. The mix shrinks the candidate pool and increases competition.

What skills do fintech engineers need?

Fintech engineers need strong software engineering skills paired with an understanding of financial systems, risk, security expectations, and compliance workflows. This combination is uncommon, which drives hiring challenges.

Why is fintech recruitment more competitive than other tech fields?

Fintech recruitment is more competitive because fintech companies compete with banks, trading firms, and global tech companies for the same specialists. Few engineers have hands-on experience with regulated financial technology.

How long does it usually take to hire a fintech engineer?

Hiring a fintech engineer often takes longer than standard tech roles because you’re filtering for domain experience as well as technical skill. Most qualified candidates already field multiple offers.

Why do fintech companies struggle to attract top talent?

Fintech companies struggle to attract top talent because many engineers prefer less-regulated environments with fewer constraints. Others seek higher compensation from finance institutions or large tech brands.

Are fintech engineers in short supply?

Fintech engineers are in short supply because only a small group has experience with payments, lending, identity, money movement, or fraud detection. Demand is rising faster than the talent pool.

What makes fintech engineering roles harder to fill?

Fintech engineering roles are harder to fill because the stakes are higher than in typical software jobs. Systems must remain stable, compliant, and secure, and that narrows the set of suitable candidates.

How can companies hire fintech engineers faster?

Companies hire fintech engineers faster when they simplify their process and source candidates with existing fintech experience. Reducing onboarding time and widening the search also makes a noticeable difference.

Why do startups struggle more with fintech hiring?

Startups struggle more with fintech hiring because they can’t always match compensation from larger fintech firms or financial institutions. They also need engineers who can contribute immediately with minimal guidance.

Is outsourcing fintech engineering a good option?

Outsourcing fintech engineering can be a good option when hiring delays slow product delivery. Teams often use it to access engineers who already understand regulated environments and can begin contributing quickly.