The Federal Reserve’s FedNow Service marks one of the biggest shifts in how money moves across the U.S. payment network.

Banks, fintechs, and other financial institutions are now preparing for a new standard of instant payment delivery, around the clock, every day of the year.

If you work in payments or financial services, the question isn’t whether to adopt real-time payments, but how to do it intelligently.

That’s where guidance, timing, and the right technology partners come in. Companies like Trio are helping organizations navigate that process by providing industry experts who understand the unique challenges of the fintech industry, ensuring each step, from infrastructure upgrades to integration, is not just compliant but forward-looking.

Understanding Real-Time Payments

When people hear “real-time,” they often think “fast.” But in banking, instant means something more precise: funds that clear and settle in seconds, not hours or days.

With real-time payments, both sender and receiver have immediate access to funds, and transactions operate 24/7/365.

Why Instant Payment Matters

For financial institutions, this functionality improves liquidity management and provides faster access to funds for businesses, merchants, and customers.

The benefit is simple: better cash flow and fewer delays.

On the customer side, instant confirmation builds trust, and that trust drives usage.

Key Features of Modern Instant Payment Services

The FedNow Service runs on the ISO 20022 messaging standard, which improves data transparency and reduces reconciliation friction.

Real-time monitoring and layered fraud controls help banks operate securely in an always-on environment. And because these payments are irrevocable, accuracy and authentication are more important than ever.

The U.S. Instant Payment Landscape Before FedNow

Until recently, the U.S. market relied on legacy systems that struggled to keep up with time-sensitive payment needs.

The RTP network from The Clearing House made progress, but access remained limited to larger institutions. Smaller banks and credit unions often lacked an affordable path to join.

The FedNow® Service aims to close that gap.

By enabling a broader range of institutions to connect directly with the Federal Reserve’s instant payment platform, it appears likely to democratize access to real-time payments across the U.S. financial ecosystem.

If the FedNow Explorer resource is any indication, the Federal Reserve intends to make onboarding educational, with clear learning materials and technical guidance.

Still, adoption will vary.

Some community banks may take a cautious approach, waiting to see how early adopters perform. Others, particularly fintechs, are moving fast, leveraging the service to deliver seamless customer experiences and improve market agility.

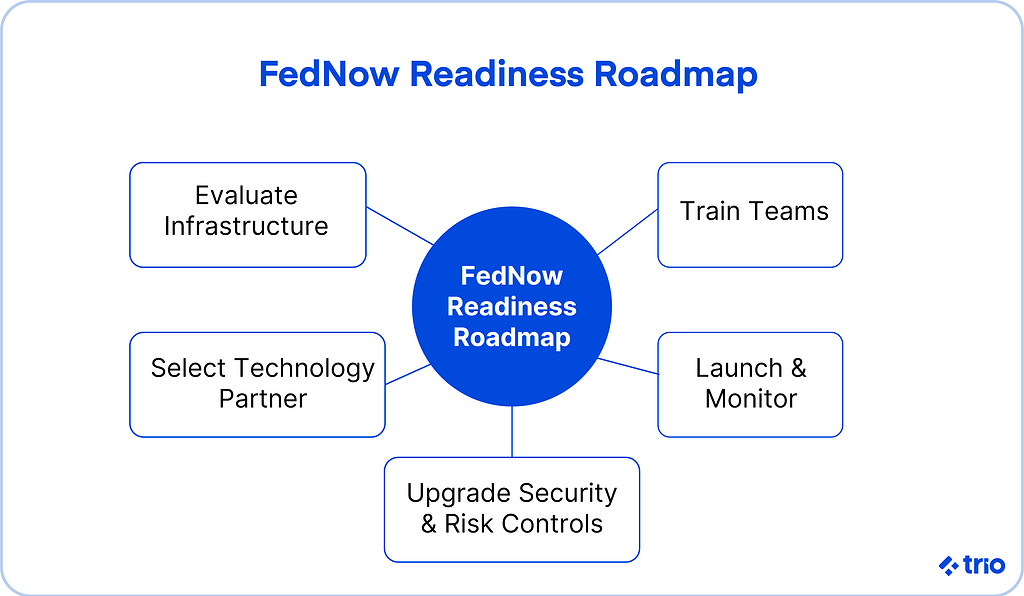

Preparing for the FedNow Service

Getting ready for FedNow is not a one-step process.

It requires planning, coordination, and a clear understanding of your institution’s infrastructure and goals.

Readiness Steps for Financial Institutions

- Evaluate Your Infrastructure: Start with an internal analysis of how your core systems handle payments today. Many banks may find they need to modernize their middleware or switch to service providers who can support continuous, real-time operations.

- Select a Technology Partner: Integration with the FedNow network will depend on API quality and security. An outsourcing company like Trio can help design or customize those integrations, connecting legacy systems with the modern standards that FedNow requires.

- Upgrade Security and Risk Controls: Instant transfers mean risk moves just as quickly. Fraud detection tools and AI-based monitoring are becoming standard components of real-time systems.

- Train and Enable Teams: It’s easy to underestimate this part. Staff must understand new workflows, timing expectations, and what to do if a transaction fails. The right learning resources can make or break early adoption.

When we provide developers, you can rest easy knowing they are fully trained, not only in FedNow requirements, but in everything fintech.

Overcoming Early Challenges

Every new payment system faces hurdles.

For the FedNow Service, the main challenges will include interoperability with existing payment rails, managing fraud in real time, and encouraging adoption among hesitant users.

Education will play a major role in helping customers and small businesses understand why instant payment is more than a convenience.

Strategies to Accelerate Adoption

Institutions that want to lead should consider pilot programs, cross-bank collaborations, or embedded payment features inside their existing digital platforms.

Trio’s development team often works with fintech startups and mid-size banks to enable instant settlement inside mobile apps, payroll tools, or B2B platforms.

The point is to redesign the customer experience around that speed rather than to just process payments faster.

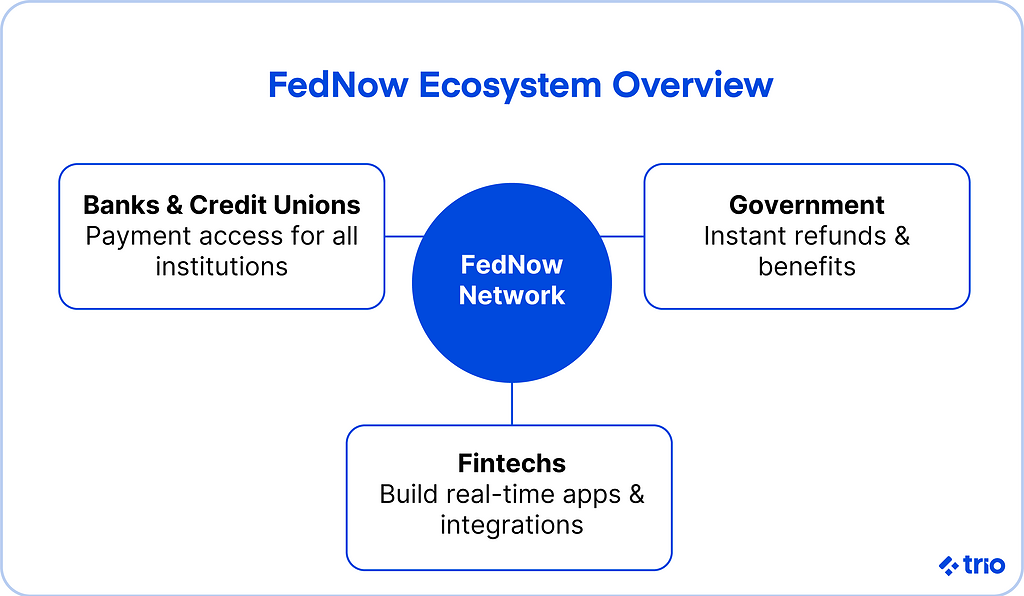

Use Cases for Instant Payments

Once live, the FedNow Service will open the door to a variety of real-time payment applications.

For Consumers

Think of peer-to-peer transfers that land in seconds, or bill payments that settle instantly, no more “pending” notifications.

These use cases may appear simple, but they dramatically change how customers manage money day to day.

For Businesses

Faster payroll and vendor payments free up working capital and improve accounting efficiency.

Businesses will likely see reduced costs and less manual reconciliation.

Trio has already helped fintech companies design tools that send funds immediately through real-time payment APIs, improving both delivery and flexibility.

For Government

The public sector stands to gain, too.

Instant refunds, emergency disbursements, or benefit payments can be delivered in real time, making the process more transparent and responsive for citizens.

The Future of Real-Time Payments in the U.S.

The FedNow Service may signal a broader shift in how the U.S. approaches money movement.

In other markets, such as India with UPI or the European Union with SEPA Instant, instant payment systems have become a national infrastructure. The U.S. appears to be heading in the same direction, albeit with its own timing and regulatory complexity.

As service providers expand offerings, innovations in AI-driven fraud prevention, cross-border functionality, and embedded finance will likely shape the next chapter.

Financial institutions that prepare early will be best positioned to grow with the market rather than chase it later.

Trio’s role is to support that growth by building, testing, and integrating instant payment services that help your organization operate confidently in real-time.

Conclusion: The Road Ahead for Financial Institutions

The FedNow Service represents more than another payment option; it’s a new foundation for how financial services operate across the U.S.

If your organization wants to stay relevant, start by assessing your readiness and finding a partner who understands both the technology and the business case.

At Trio, we’ve helped banks, fintechs, and startups accelerate their payments journey by developing flexible, compliant, and customer-centered solutions.

If you’re preparing for FedNow or want to explore how real-time payments could strengthen your company’s offering, get in touch.

FAQs

What is the FedNow Service?

The FedNow Service is an instant payment platform developed by the Federal Reserve that enables financial institutions in the U.S. to send and receive funds immediately, 24/7/365.

How do banks prepare for the FedNow Service?

Banks prepare for the FedNow Service by upgrading core infrastructure, adopting ISO 20022 standards, and integrating APIs that enable real-time payments and instant settlement.

What are the benefits of instant payment services?

The benefits of instant payment services include faster access to funds, improved liquidity management, and a more seamless customer experience for both consumers and businesses.

How does FedNow differ from RTP?

FedNow differs from RTP by being operated by the Federal Reserve, offering broader access for smaller banks and credit unions, and aiming for nationwide real-time payment connectivity.