The global fintech industry has grown at a remarkable pace, reshaping how financial services are delivered.

Mobile wallets, peer-to-peer lending platforms, and instant payment apps are all examples of financial technologies now part of everyday life.

But with growth comes a thorny reality: the rules governing financial services aren’t standing still. Every new product has to contend with shifting regulatory requirements, from data privacy laws to identity verification checks.

For leaders, this creates constant friction.

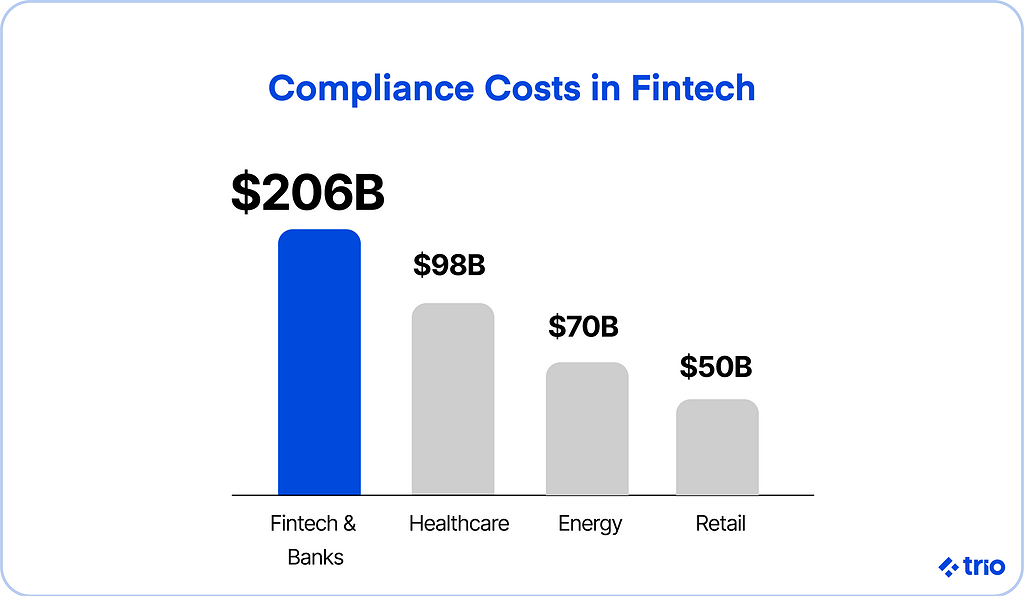

Compliance costs eat into margins, rollout timelines get delayed, and promising ideas sometimes die before reaching the evolving fintech market. Currently, fintechs and banks spend as much as $206 billion per year on compliance!

The fintechs that win are the ones that treat regulation not as a blocker but as a design principle, building compliance into strategy, product design, and customer experience from day one.

Let’s examine how regulatory changes influence innovation, the origins of compliance challenges, and the strategies leaders can employ to maintain their competitive edge.

If you need assistance baking regulatory compliance into your products from the ground up, our fintech-savvy developers are here to help. Our specialists can also help you comply with a variety of regulatory frameworks and set your products up to account for strategic risk management.

The Impact of Regulatory Changes on Fintech Innovation

Fintech innovation is shaped at every turn by regulatory forces that can accelerate or slow its pace. This is one of the many reasons why the RegTech market was expected to reach $81,48 billion by the end of 2024.

How New Regulations Shape Fintech Solutions

New regulations don’t simply exist in the background; they often redirect innovation and alter business roadmaps.

Each time a regulator introduces a new requirement, say, around data privacy or digital identity verification, fintech firms must adjust.

Sometimes that means tweaking back-end processes; other times, it requires redesigning entire systems to remain compliant. A data privacy law, for instance, may force a payments app to rethink how it stores transaction histories or manages user consent.

Large incumbents with compliance teams may find these adjustments irritating but manageable. For startups, though, the same changes can feel overwhelming.

The Balance Between Compliance and Innovation

Overly strict requirements implemented by regulatory bodies can slow down the rollout of promising services. But the opposite extreme, too little oversight and financial regulation, can create systemic risks: fraud, consumer exploitation, and unstable markets.

Some regulators have tried to strike a middle ground with regulatory sandboxes and innovation hubs. These allow companies in the financial services industry to test products in a controlled environment, where specific rules are relaxed.

It’s a clever idea, though not without limits.

Critics point out that what works in a sandbox doesn’t always translate to the complex realities of the global financial industry. Still, for many firms, it provides a valuable space to experiment while managing regulatory exposure.

The point is that compliance doesn’t have to kill innovation. The firms that treat regulatory concerns as a design constraint, rather than a blocker, often produce safer, more scalable solutions, and in some cases, even turn compliance features into market differentiators.

Case Studies of Regulatory Impact on Fintech Companies

The push for stronger anti-money laundering (AML) and know-your-customer (KYC) rules offers a clear case study.

Digital payment platforms, from international remittance apps to buy-now-pay-later services, have had to invest heavily in verifying user identities and tracking suspicious activity.

These changes add friction to the user experience, but compliance here is non-negotiable.

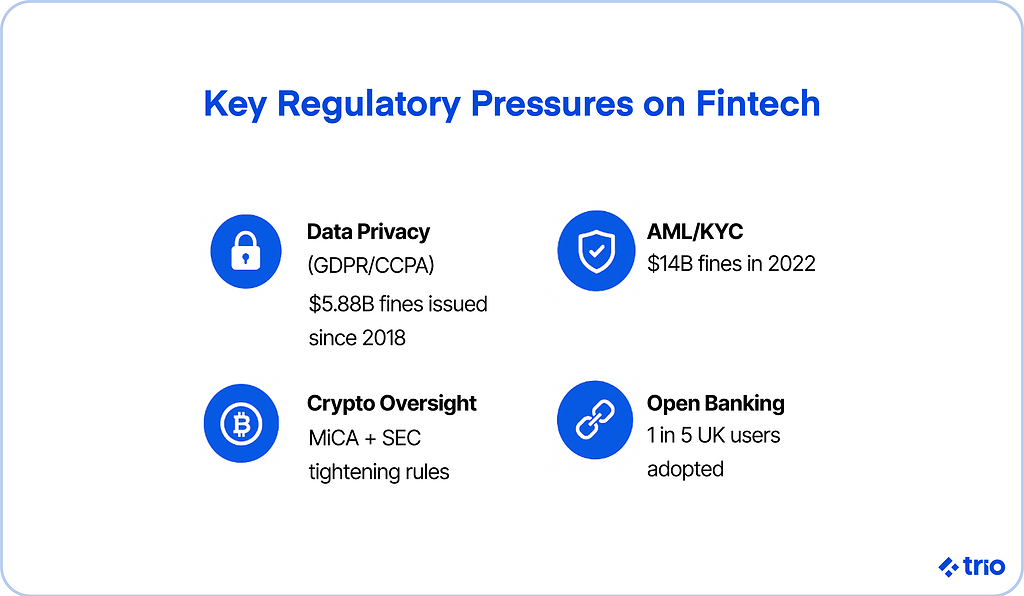

In 2022 alone, the United States issued more than $14 billion in AML-related fines, a reminder that skipping compliance is not just risky, it’s financially devastating. It can have a significant impact on the growth of banks and other financial institutions.

Cryptocurrency provides another sharp example.

When jurisdictions like the EU introduced stricter rules on trading and custody, exchanges had several options. They could leave those markets, or they could adapt, but struggle with profitability under the new frameworks.

In fact, after the EU’s MiCA legislation began taking shape, several industry reports anticipated an increase in the overall cost of compliance, squeezing already thin margins.

Meanwhile, traditional banks, once slow to respond, are now racing to integrate their own fintech-like services, sometimes as a way of staying relevant in a shifting regulatory climate. This represents an incredible opportunity for RegTech firms and related fintech platforms.

Companies that anticipate and adapt early often gain an edge. Those that treat compliance and regulatory shifts as an afterthought tend to fall behind or disappear altogether, even if they are massive institutions.

It’s inevitable, so instead of wasting time asking whether regulation will change, you need to consider how quickly your company can pivot when it does.

Perhaps, by accessing the right developers who work with these shifting laws and regulations at a moment’s notice, our staff augmentation hiring model could be particularly useful.

Understanding the Regulatory Landscape in Fintech

To make wise decisions, you need a clear view of the evolving regulatory landscape and its implications.

For many, regulatory uncertainty is one of the most considerable operational risks.

The Role of Regulation in the Fintech Sector

The fintech sector thrives on speed and novelty, but without rules, the risks present in the evolving fintech landscape quickly outweigh the rewards.

Think about the explosion of mobile lending apps: convenient for consumers, yes, but also a tempting target for fraudsters if left unchecked. Enter complex regulatory shifts.

That tension explains why regulators step in, not to kill innovation, but to set guardrails that protect consumers and preserve trust in the financial system.

At its best, regulatory action creates a level playing field. It helps prevent money laundering and other abuses, and it reassures everyday customers that new services won’t vanish overnight with their savings.

Still, it’s not flawless.

You could argue that regulators lag behind technology, reacting only after problems surface.

This may be true, but the alternative, a completely unregulated fintech sector, would likely prove far more damaging to the growth of fintech.

The collapse of Wirecard in 2020 is often cited as an example of what happens when oversight fails to keep pace, billions lost, confidence shaken, and new rules introduced only after the damage was done.

Key Effects of Regulatory Changes in Fintech

A few shifts stand out as especially influential for fintech businesses right now:

Data privacy and security:

Rules such as GDPR in Europe or CCPA in California mean firms can’t just collect and use customer data freely.

Consent must be explicit, and protections airtight.

For fintech startups, this often means hiring compliance experts earlier than planned or redesigning apps to give users clearer consent options.

Since GDPR’s enforcement in 2018, more than €5.88 billion in fines have been issued, a figure that shows regulators aren’t hesitating to punish non-compliance.

AML and KYC requirements:

Regulators demand stronger checks to ensure platforms that provide fintech services aren’t unwittingly processing funds tied to crime or terrorism.

That has pushed even small players to adopt sophisticated identity verification tools.

We have helped countless fintech firms integrate and use some form of automated KYC solution to help them comply with regulations.

Cryptocurrency oversight:

What once felt like a regulatory gray zone is rapidly narrowing.

Whether it’s the SEC in the U.S. or the MiCA framework in the EU, rules are reshaping how exchanges and wallet providers operate.

Business models that thrived in loose environments may no longer be viable.

The collapse of FTX in 2022 accelerated this trend, convincing regulators worldwide that crypto oversight could no longer be optional.

Open banking:

Instead of restricting competition, open banking initiatives aim to encourage it by forcing banks to share data (securely) with third-party providers.

It’s a mixed blessing for fintech firms: more opportunities for collaboration, but also higher expectations for compliance and security in their different fintech products and services. In the UK alone, 1 in 5 consumers and small businesses now use open banking services, proof that compliance-driven initiatives can still create huge new markets, promoting growth in fintech.

For leaders, the challenge isn’t just knowing the rules; it’s interpreting and operationalizing them in real time.

The firms that build regulatory awareness into strategy are better equipped to pivot when the landscape shifts and are less likely to find themselves reacting under pressure.

Regulatory Compliance Challenges for Fintech Businesses

Regulations don’t arrive neatly packaged; they come as dense legal texts open to interpretation.

Large financial institutions may have teams of lawyers to untangle them, but a small fintech startup might only have a part-time compliance officer.

That imbalance can slow growth or even prevent promising ideas from reaching the market.

Then there’s the problem of legacy systems.

Traditional banks often struggle to retrofit decades-old infrastructure to meet today’s expectations. Meanwhile, newer fintech firms need to invest in dedicated compliance technology, everything from automated risk-monitoring tools to machine-learning models that flag suspicious activity.

Skipping these investments isn’t really an option, considering the potentially high fines.

So, how do you maintain compliance without draining resources and scaling compliance processes as the company grows?

Instead of spending an arm and a leg on developing the systems that facilitate KYC and AML onboarding checks, consider hiring nearshore or offshore developers who have worked with U.S. companies in similar situations and understand the complex regulatory landscape. This approach can help you cut costs without sacrificing quality.

Global Perspectives on Fintech Regulation

Because fintech is inherently global, the regulatory environment varies widely across regions, and these differences matter.

You will inevitably want to expand so that your business can grow. But expanding to different regions and trying to comply with all of the regulations in your cross-border fintech operations can be tricky.

Comparative Analysis of Regulatory Changes in Different Regions

Zooming out, the regulatory map looks uneven.

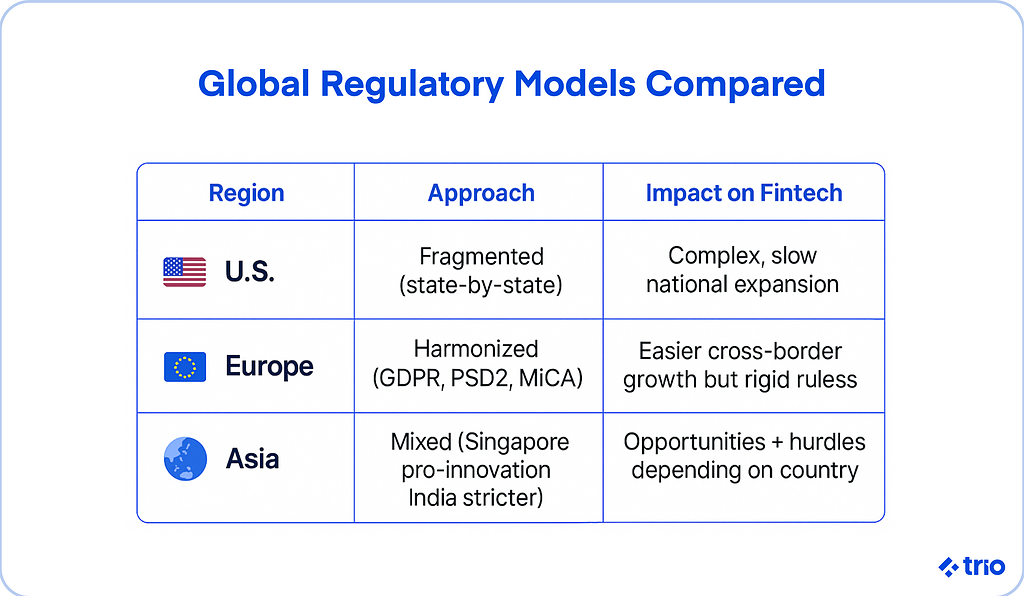

The U.S. takes a fragmented approach; each state can set its own rules, making nationwide expansion complicated for fintech firms. For instance, a payments startup wanting to operate across all 50 states may need to secure more than 40 separate money transmitter licenses, a process that can take years.

Europe has leaned in the opposite direction, creating continent-wide frameworks like GDPR and PSD2. That harmonization reduces legal and compliance friction for companies operating across borders, though it also means the rules tend to be broad and sometimes rigid.

Asia is more varied still. Singapore and Hong Kong have actively courted fintech firms with sandboxes and government-backed programs, hoping to become regional hubs.

Meanwhile, other markets remain cautious, tightening restrictions in response to concerns about consumer debt or speculative crypto trading. In India, for example, regulators have tightened rules on digital lending apps, forcing hundreds of smaller players out of the market.

The Future of Fintech Regulation in the UK

The UK has carved out a reputation as one of the friendlier homes for fintech.

The Financial Conduct Authority (FCA) has been unusually open to experimenting with regulatory models, from sandboxes to consultations on how AI might be used for compliance. In the future, the emphasis will likely be on balancing growth with consumer protection.

That said, Brexit complicated matters.

While the UK is free to chart its own regulatory path, it also needs to ensure interoperability with European standards to avoid cutting itself off from a vast market.

UK fintechs are already concerned about regulatory misalignment with Europe, which is hindering their cross-border expansion.

We can only expect continued collaboration with international regulators, but also a push for rules that reflect the UK’s unique financial ecosystem and London’s role as a global hub for banks and fintechs.

Global Fintech Regulation and Compliance Trends

A few big themes are shaping the future across borders:

- Data privacy and security: As cyberattacks and breaches grab headlines, regulators are doubling down. It’s no longer enough to encrypt data; firms are expected to prove their systems can withstand sophisticated threats.

- AML and KYC: The push for stronger defenses against financial crime isn’t slowing. If anything, standards are becoming more stringent and more uniform worldwide.

- Cross-border cooperation: Regulators are increasingly aware that financial services don’t respect national boundaries. Expect more attempts to harmonize standards, even if perfect alignment remains elusive.

Emerging technologies like blockchain and artificial intelligence only add to the urgency. They promise efficiency but also carry risks that traditional regulatory bodies are still learning how to manage.

Preparing for Regulatory Changes in the Fintech Sector

Since innovation in fintech is only speeding up, staying ahead of regulatory change demands forward-looking strategies and a culture of preparedness.

Strategies for Fintech Companies to Ensure Compliance

When regulations shift, fintech companies can’t afford to be caught flat-footed.

As we have already mentioned, the firms that stay ahead usually treat compliance as a living system rather than a set of static checkboxes.

That means building programs with clear policies and controls, but also testing whether those rules actually work in day-to-day operations.

Technology helps.

Automating KYC and AML checks, or streamlining regulatory reporting, cuts down human error and can save startups from drowning in manual paperwork. Still, tech isn’t a silver bullet.

Even the most advanced compliance software needs people who understand the regulations behind the algorithms. Fintech companies need regular risk assessments and internal audits, which, though often unglamorous, can uncover cracks before regulators or customers do.

There’s also value in dialogue. Too many companies view regulators as adversaries when, in reality, seeking guidance early can prevent expensive missteps later.

Proactive engagement not only reduces uncertainty but also signals credibility, a critical currency in financial services, which will only help you gain more clients and keep them long-term.

The Importance of Staying Updated with Regulatory Changes

New amendments, new directives, and even entirely new frameworks emerge every year. The challenge is staying aware of when requirements change and how those changes ripple through their business models.

Some companies subscribe to legal digests or industry newsletters.

Others send teams to regulatory conferences or lean on external counsel when things get complicated.

The method matters less than the consistency.

Missing a key update can mean redesigning products under pressure, delaying launches, or facing penalties for non-compliance.

It’s easy to dismiss regulatory updates as bureaucratic noise, but history shows otherwise. Think of the GDPR rollout: firms that prepared early avoided chaos, while others scrambled to meet requirements and, in some cases, pulled services from entire markets.

Building a Culture of Compliance in Fintech Organizations

A culture of compliance keeps you there for the long run. That culture starts at the top. When leadership treats compliance as more than a cost center, employees are more likely to take it seriously, too.

Training plays a role here.

Employees need to know not just what the rules are, but why they exist. Open channels for reporting potential issues can turn minor problems into early warnings instead of scandals. Clear accountability structures also matter. If nobody owns compliance, it tends to fall through the cracks.

That said, culture doesn’t have to clash with innovation.

In fact, the two can reinforce each other. A team trained to think critically about regulatory risk is often better equipped to design resilient, innovative solutions.

When compliance becomes part of the organizational DNA, fintechs can move fast without constantly looking over their shoulders.

Our developers have worked in a variety of different companies and have experienced how easy compliance requirements are to meet when done right.

Emerging Technologies and the Future of Compliance

Artificial intelligence and machine learning are showing up in fraud detection, transaction monitoring, and even the automation of regulatory reporting.

Mastercard, for example, has said its AI-driven fraud systems blocked about $20 billion in fraud in 2023, an impressive figure.

However, it also raises questions about transparency and how much human oversight is still needed. How does the AI handle data, and are you opening yourself up to security breaches?

These tools don’t eliminate risk, but they appear to provide firms with a means to scale compliance more quickly and, in many cases, at a lower cost.

Blockchain is also playing a big role in the world right now. It’s being tested for identity verification and cross-border payments, with some governments running pilot projects.

Singapore’s Project Guardian is often cited here, and while early results look promising, critics suggest it’s still too controlled to prove blockchain can handle the messy realities of global finance.

That said, hesitation is everywhere.

Regulators are still figuring out how to oversee AI models that sometimes behave unpredictably, and how to validate the security claims of blockchain-based systems.

Don’t gamble on a single technology, but try to design compliance programs flexible enough to absorb whatever tools eventually prove both practical and regulator-approved.

Conclusion

Compliance, when treated as an afterthought, is expensive and limiting. But compliance, when treated as a design principle, can actually clear the way for sustainable growth.

You see it in startups that bake KYC checks directly into their onboarding flows, or in payment apps that treat privacy features not as a burden but as a selling point. These companies aren’t just following the rules; they’re using the rules to build trust.

At Trio, we’ve seen this play out across fintech teams of every size. Our work often begins with founders or executives who feel boxed in by compliance, and ends with them realizing that it can be the very thing that makes their product scalable, secure, and market-ready.

If you need fintech specialist developers on your team or want to know more about how you can approach regulatory challenges and compliance in your company’s tech, reach out to us.

FAQ

What are the most significant regulatory challenges facing fintech companies today?

The most significant regulatory challenges facing fintech companies today usually come down to four areas: data privacy, AML/KYC requirements, cryptocurrency oversight, and open banking.

How do regulatory changes impact fintech innovation?

The impact of regulatory changes on fintech innovation depends on how quickly a company can adapt. On the one hand, new rules can slow down product launches or force costly redesigns. But regulation doesn’t always have to be a roadblock. Some of the most successful fintechs are the ones that see compliance as part of their design constraints.

What is a regulatory sandbox, and how does it help fintech firms?

A regulatory sandbox, and how it helps fintech firms, is essentially about experimentation under supervision. Regulators create a space where companies can test new products without being immediately subject to every single rule, allowing them to validate an idea without risking fines or shutdowns.