Fintech app development is a dynamic and challenging field, especially for tech start-ups and emerging innovators.

You will likely find that you need rapid, scalable solutions that can handle the demands of a growing user base while staying ahead of the competition.

Here at Trio, we have a collection that is thoroughly vetted. This article delves into the complexities of developers on hand.

Our focus on retaining top talent, such as for iOS and Android app development, means we can connect you with someone experienced, saving you countless hours searching for developers or replacing incorrect hires.

Our goal is also to build long-term partnerships, which can only happen if you understand both the challenges and solutions in FinTech app development as well as we do.

Are you ready to start your development project?

We have the developers you need to take your development project in the right direction.

Companies are proven to grow their business faster with Trio.

Understanding the Complexities of Fintech App Development

Exploring the Landscape of Fintech Industry

For tech start-ups and emerging innovators, the fintech industry offers a fertile ground for disruption and innovation.

Finance and technology are both incredibly lucrative fields, but they are also very competitive because of constant innovations.

If you are focused on fintech B2C applications, you need to understand the diverse financial needs of consumers and how to address them through user-friendly and scalable solutions.

In particular, you need to understand the needs of financial institutions. Ultimately, the financial industry is in it to make money. They provide banking services or other personalized services that solve problems and keep users coming back.

Whether it’s providing seamless payment solutions or innovative mobile banking features, understanding the fintech landscape and trends is incredibly important to help you stand out.

You also need to understand what tools other people are using to their advantage. For example, big data and artificial intelligence are becoming increasingly popular additions to application development.

Addressing User Experience Concerns

In the fintech sector, user experience can make or break an app.

Put yourself in the shoes of the consumer. Would they be more likely to download a mobile app from a trusted source, like a global bank, or from a start-up?

The answer is the seemingly more trustworthy and reputable company.

In order to ensure that you make yourself as professional and trustworthy as possible by relation, focus on a seamless user experience.

Similarly, when marketing your mobile application to financial institutions, understand that they have their own image and credibility that they need to maintain.

Early-stage companies must prioritize creating intuitive, engaging interfaces that simplify complex financial transactions.

Using technologies like React Native and Vue.js can help streamline development processes, enabling rapid iteration and testing to ensure a polished user experience.

The last thing you want is increasingly low loading times, animations that don’t work, or even full-on crashes.

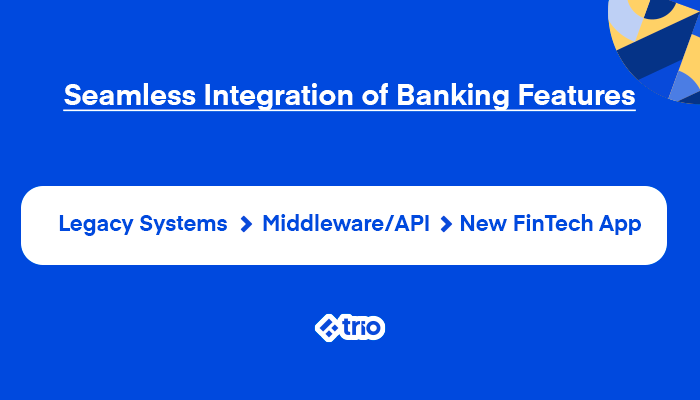

Integrating Banking Features Seamlessly

Seamless integration of banking features is essential for delivering a cohesive user experience.

This involves incorporating functionalities such as account management, real-time notifications, and secure fund transfers.

In order to do this, you will need to focus on leveraging APIs and modern development frameworks to simplify this integration, making it easier to provide comprehensive financial services.

This is one of the many reasons why React Native is popular when creating a FinTech app.

Key Challenges in Fintech App Development

There are a couple of challenges that are universal to all development services. However, there are also challenges that are unique to the FinTech market.

It is important to be aware of as many of these as possible before starting the software development process.

Scalability

This is one of the top challenges of any app.

As the apps grow, they need to handle increasing loads without compromising performance. Scalability is crucial to maintain user satisfaction and operational efficiency.

The scalability of an app depends on certain factors being considered during the mobile app development process, such as the use of a suitable language and framework, as well as a variety of best practices in coding.

You need to take the future into consideration when you start working on your FinTech app or working with a FinTech app development company.

For example, a payment app that starts with a few thousand users might face performance issues when scaling up to millions of transactions per day.

Trio specializes in building scalable fintech solutions using cloud-native architectures and microservices.

This approach ensures that the application can handle increased loads by distributing tasks across multiple servers and services.

Our developers are also able to implement auto-scaling features in our fintech application development that automatically adjust resources based on current demand, ensuring consistent performance even during peak usage times.

By planning for scalability from the start, Trio can help you avoid bottlenecks and provide seamless user experiences as they grow.

Dealing with Legacy Systems Integration

Integrating modern fintech applications with legacy banking systems is one of the major challenges of FinTech.

Legacy systems that run existing banking applications are often outdated and lack the flexibility needed for seamless integration, creating a bottleneck for innovation.

Here at Trio, we can assist by developing robust middleware solutions that act as a bridge between the new FinTech application and the legacy system, helping you overcome this significant challenge.

Our team of experienced developers is capable of creating APIs that facilitate smooth data transfer and interaction between old and new systems, ensuring that the new FinTech solutions can operate efficiently.

We can also provide ongoing support to monitor and update these integrations as needed, ensuring long-term compatibility and performance.

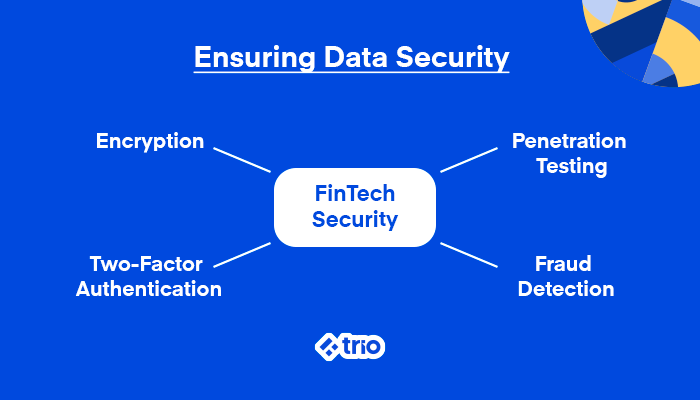

Ensuring Data Security in Fintech Applications

Data security is paramount in fintech, given the sensitivity of financial information. High-profile data breaches can lead to severe financial losses and damage to reputation.

In 2019, Capital One experienced a data breach that affected over 100 million customers. This incident underscored the critical need for robust security measures in fintech.

Trio employs a multi-layered security approach to protect financial data.

This includes security approaches like implementing encryption for data at rest and in transit and utilizing two-factor authentication (TFA) or multi-factor authentication (MFA) to secure user accounts.

It is also important to conduct regular penetration testing to identify and address vulnerabilities and ensure data privacy, which is especially crucial for FinTech applications.

Our developers are also experienced in creating real-time fraud detection systems powered by machine learning, which can analyze transaction patterns and flag suspicious activities promptly.

By staying ahead of potential security threats, Trio ensures that fintech applications remain secure and trustworthy.

Regulatory Compliance in Fintech Development

Navigating the regulatory landscape is a complex challenge for fintech companies. Compliance with regulations such as GDPR, PCI DSS, AML, and KYC is crucial to avoid legal penalties and maintain user trust.

The European Union’s GDPR requires stringent data protection measures, and non-compliance can result in fines of up to 4% of a company’s global annual revenue.

Trio offers comprehensive compliance solutions to help FinTech companies adhere to regulatory requirements and other FinTech app development challenges.

You need a team of experts that stays updated with the latest regulatory changes and integrates compliance into the development process from the outset.

We can assist in setting up automated compliance checks, implementing robust data protection protocols, and conducting regular audits to ensure ongoing adherence when developing FinTech applications.

We can also provide detailed documentation and reporting tools to help you demonstrate compliance to regulators, thereby mitigating the risk of penalties and enhancing credibility.

Raising Venture Capital

Securing venture capital is a critical step for FinTech start-ups looking to scale. However, convincing investors requires a solid business plan, a clear long-term strategy, and proof of concept.

Many fintech start-ups struggle to get funding because they fail to demonstrate a unique value proposition or a clear path to profitability.

You need to start by preparing compelling pitches and business plans that highlight your unique strengths and market potential.

Additionally, you will have to provide detailed financial models, market analysis reports, and product roadmaps that showcase the start-up’s vision and growth strategy.

Our experience in fintech allows us to provide valuable insights into what investors are looking for, increasing the chances of securing the necessary funding to scale operations and innovate further.

Harnessing Technology for Fintech Advancements

Utilizing AI and Machine Learning in Financial Apps

AI and Machine Learning (ML) are revolutionizing FinTech by providing advanced analytics, fraud detection, and personalized user experiences.

You can leverage AI to analyze vast datasets, identify trends, and automate processes, thereby enhancing the functionality and efficiency of your applications.

These technologies are particularly valuable for early-stage companies looking to differentiate themselves in a competitive market.

AI-driven chatbots and virtual assistants can also improve customer service by providing 24/7 support and personalized interactions.

Implementing Real-time Solutions for Financial Transactions

Users increasingly expect real-time financial transactions.

Implementing technologies that enable instant payment processing, fund transfers, and account updates can provide a competitive edge.

When developing your ideal app, you should focus on integrating real-time payment networks and APIs to meet these demands, ensuring that users have immediate access to their financial data.

Utilizing blockchain technology can further enhance the security and speed of real-time transactions, providing transparency and reducing fraud.

Competing with huge brands requires start-ups to find market niches where tech giants are weakest and solve significant pain points to stand out.

Leveraging Blockchain for Secure Fintech Operations

Blockchain technology offers unparalleled security features, making it an ideal solution for fintech applications.

By using decentralized ledgers, blockchain ensures data integrity, transparency, and immutability.

You can leverage blockchain to enhance security, create smart contracts, and develop innovative financial products, positioning yourself at the forefront of the fintech revolution.

Service personalization is crucial for user retention and engagement. Using AI to personalize fintech software based on consumer interests can significantly enhance user experience.

Overcoming Common Hurdles in Fintech App Development

Personalizing Financial Services for Users

Personalization in fintech apps is essential for enhancing user engagement and satisfaction.

By leveraging AI, machine learning, and big data in FinTech, companies can analyze user behavior and preferences to offer tailored financial advice, personalized notifications, and customized product recommendations.

For instance, AI algorithms can help identify spending patterns, suggest budgeting tips, or recommend investment opportunities based on user profiles.

Trio can help you implement advanced analytics and AI-driven personalization features to ensure users receive relevant and meaningful financial services, increasing user loyalty and app usage.

Mitigating Risks of Data Breaches in Fintech Apps

We’ve already mentioned one big data breach, but they are one of the biggest issues that FinTech businesses have struggled with and is surprisingly common.

Data breaches pose significant risks to FinTech applications, potentially leading to financial losses and reputational damage.

It is crucial to adopt a multi-layered security approach to mitigate these risks. This includes implementing strong encryption methods, using secure coding practices, and conducting regular security audits.

Additionally, incorporating real-time monitoring and anomaly detection can help identify and respond to suspicious activities promptly.

Trio can help you build comprehensive security solutions, including penetration testing, biometric authentication to access an app, and robust fraud detection systems to safeguard sensitive financial data and maintain user trust.

Optimizing User-friendly Features in Fintech Applications

Creating a user-friendly fintech app involves designing intuitive interfaces and ensuring smooth navigation.

Features such as easy account setup, seamless fund transfers, and real-time notifications contribute to a positive user experience.

Additionally, providing users with clear and accessible information about their financial activities can help build trust and engagement.

Trio focuses on user-centered design principles, utilizing modern development frameworks like React Native and Vue.js to build responsive and visually appealing interfaces.

By prioritizing user experience, Trio’s developers ensure that your FinTech applications are not only functional but also enjoyable to use, driving higher user retention and satisfaction.