Merging payment systems during a merger or acquisition is one of those things that looks straightforward on a slide deck but gets complicated once you get inside real systems and workflows.

It affects cash flow, customer experience, compliance, and treasury operations, so it rarely works out well if treated as a bolt-on task.

After watching many financial organizations move through this process, we’ve been able to pick up a clear pattern. Strong planning early makes the difference between a smooth post-merger transition and a rushed scramble that puts money movement and reporting at risk.

At Trio, our team of specialist developers has supported fintechs, banks, and payment platforms through these transitions, and almost every successful integration had one thing in common: payment infrastructure was treated as core infrastructure.

If you are interested in hiring fintech developers through Trio to assist with merging payment systems post M&A, our staff augmentation hiring model may interest you.

Understanding Mergers and Acquisitions

There are plenty of reasons companies choose to merge or pursue an acquisition, and most of them stem from growth and capability expansion rather than cost-cutting alone.

In fintech and banking, acquiring a business can mean gaining licenses, infrastructure, or developer-ready rails that would take years to build internally.

What M&A Means in Financial Services

In this industry, a merger or acquisition usually brings together two different operating models, each with its own compliance posture, payment stack, and data flow.

The value might lie in acquiring modern tech, entering a new market with different currency and settlement rules, or improving routing and fraud intelligence.

The deal always sounds exciting at the announcement stage. The real test begins during the post-merger integration phase when systems need to actually unify.

M&A examples like PayPal and Braintree show how tech-driven acquisitions shape the market.

Types of Mergers and Their Effect on System Integration

Different deal types change how you integrate.

Horizontal mergers often bring overlapping payment systems and duplicate tools that eventually need to be consolidated. Vertical transactions tend to focus more on connecting services and data flows.

Conglomerate deals, which bring together two very different environments, call for flexible orchestration and a steady compliance lens.

No matter the structure, the integration process works best when there is clarity around what infrastructure stays, what gets migrated, and how the operating model should evolve.

Rushing to rip and replace systems often creates more risk than value, especially when payment gateways, fraud engines, and merchant accounts are involved.

Why Payment Systems Shape Post-Merger Success

If payments stop, the business feels it immediately. That is why payment integration plays a critical role in merger or acquisition success.

You can introduce new branding and update internal systems later, but payment processing cannot falter.

Payments as the Foundation of Continuity

We have seen situations where everything but payments moved quickly in an m&a deal, and that choice paid off.

Protecting payment flows means protecting customer trust, settlement cycles, and working capital.

Even a few hours of downtime during payment migration can shake confidence across merchants and internal teams.

Challenges With Legacy and Disparate Systems

One of the hardest parts of merging payment stacks is dealing with legacy systems or disparate payment systems that were never designed to connect.

Maybe one company relies on batch processing, and the other uses modern APIs. Or one uses token vault A, while the acquired company relies on vault B.

These mismatches slow engineers down and introduce compliance and security considerations that demand careful sequencing.

Modern Integration Approaches

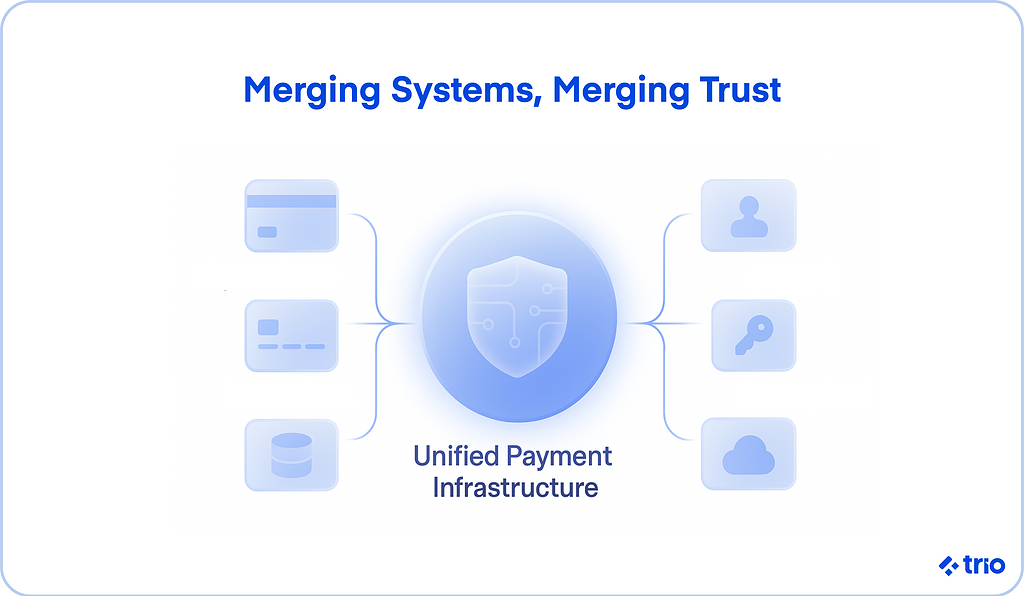

To streamline and reduce disruption, many organizations use a payment orchestration layer to unify systems while they phase in deeper consolidation.

This avoids a big-bang migration and lets you optimize routing, test new processors, and gradually retire older platforms.

APIs and middleware bridge systems long enough to move at a realistic pace without losing visibility or control.

Post-Merger Integration Strategy for Payments

A thoughtful post-merger integration plan separates healthy m&a execution from firefighting. The strongest payment integrations tend to start long before cutover day.

Setting Expectations and Aligning Teams

Post-merger integration succeeds when engineering, compliance, product, and treasury teams align early.

Everyone needs shared visibility into fraud procedures, reporting requirements, and data handling.

It helps to appoint a dedicated integration group so decisions are consistent and internal messaging stays clear.

We have noticed friction usually shows up when one group assumes migration must happen faster than reality allows.

Core Steps to Integrate Payment Systems

A reliable sequence usually looks like this:

- Map existing payment flows, including settlement and reconciliation paths

- Document dependencies across processors, gateways, and fraud tools

- Identify compliance gaps and regulatory expectations across markets

- Plan phasing, rather than rushing to consolidate platforms

- Test migrations in parallel to protect transaction continuity

It may sound obvious, but many teams forget to involve treasury and customer support early. Including them changes everything because they see risks that engineering might not spot immediately.

Compliance and Risk Oversight

M&A activity brings heightened regulatory attention, so documentation and monitoring become non-negotiable.

You do not want auditors flagging mismatched AML rules or incomplete KYC transfers.

Incremental migration with sandbox testing and shared audit trails usually minimizes issues and helps avoid disruption to merchants and customers.

Technology and Tools That Support Integration

The tools you choose can simplify technical work or make it harder than it needs to be.

Working With Payment Providers and PSPs

Evaluate payment providers for scalability, cross-border capability, and m&A awareness.

Some PSPs handle acquisitions regularly and provide structured migration support. Others expect immediate cutover, which increases risk.

At Trio, we often help companies assess providers, or integrate alternative ones where required, and design routing logic that supports business continuity throughout the integration process.

Using Automation and Intelligence

Automation and API-driven workflows cut manual reconciliation work and reduce error risk.

Machine learning helps refine fraud rules and routing decisions as the newly combined organization grows.

The goal is to give your teams more clarity and catch issues early.

Reducing Complexity and Cost Over Time

Once systems stabilize, many teams move toward consolidating gateways and reducing redundant systems.

Centralizing payment hubs and retiring overlapping software helps reduce costs and strengthen the financial performance of the integration.

You do not need to collapse everything at once. Phased simplification usually works better.

Managing Risk During Payment Integration

Even with the best planning, there are potential risks associated with m&a payment integration. Recognizing them early gives your organization more control.

Key Risks and How to Handle Them

Common risk points include system downtime, tokenization conflicts, data mapping errors, and culture gaps between teams.

Gradual rollout, communication across internal and external stakeholders, and real-time monitoring help keep operations stable while you migrate.

Testing and Phased Launches

Shadow or parallel processing lets teams validate behavior before fully switching over.

This matters more in payments than almost any other system in the business.

When teams see transactions flowing correctly in test and early phases, confidence grows.

Measuring and Improving Integration Success

A merger or acquisition does not end once systems connect. Strong teams keep refining.

What to Track

Useful metrics include settlement timing, approval rates, error rates, and cost improvements.

Regular review cycles keep your integration efforts aligned with business goals and reveal where to optimize next.

Continuous Improvement and Knowledge Sharing

Once the integration stabilizes, build playbooks, update documentation, and train teams.

A small center of excellence can accelerate improvements.

At Trio, we have seen companies thrive long after the deal because they treated integration as an ongoing investment instead of a one-time project.

Conclusion

Payment integration during mergers and acquisitions does not always get the spotlight, but it should.

When you integrate systems thoughtfully, protect payment continuity, and support compliance at each step, you give the newly combined organization room to grow and innovate without losing control of core financial workflows.

If you are preparing for a merger or acquisition and want support in unifying payment platforms, migrating legacy systems, or automating reconciliation safely, our fintech engineers at Trio have guided teams through this journey before.

We would be glad to explore how our developers can use their experience to streamline your integration process and help ensure a steady, confident transition. Get in touch!

FAQs

What is payment integration in mergers and acquisitions?

Payment integration in mergers and acquisitions means combining two organizations’ payment systems and processes, and successful payment integration ensures smooth payment processing, cash flow visibility, and compliance after the deal closes.

Why is payment integration important in a merger or acquisition?

Payment integration is important in a merger or acquisition because it protects transaction continuity, customer trust, and financial reporting accuracy, and merging payment systems properly helps avoid downtime and reconciliation gaps.

What are the biggest challenges in post-merger payment integration?

The biggest challenges post-merger payment integration include legacy systems, varied compliance requirements, data models, and payment gateways, and integrating disparate payment infrastructure can be complex and time-consuming.

How long does payment integration take after an acquisition?

Payment integration after an acquisition varies by system complexity and business scope, and timelines may range from a few months to more than a year, depending on architecture and regulatory requirements.