If you work in fintech, you already know that onboarding can make or break your app. Those first few moments from sign-up to verification carry real weight. They define how much users trust you with their financial data and how confidently your team can scale.

We’ve seen that even a small delay or confusing form can trigger user drop-offs. It’s so important that over 74% of companies have a dedicated customer onboarding team. But it’s not just about the customer journey.

For fintech companies, developer onboarding is just as critical. When engineers can quickly set up secure environments and integrate APIs safely, your onboarding process becomes a long-term competitive advantage.

At Trio, we’ve worked with fintech startups and enterprise teams that underestimated the importance of onboarding early on. The difference between those that succeeded and those that stalled often came down to this: they treated onboarding as infrastructure.

Understanding FinTech Onboarding

Onboarding in fintech involves more than UI screens and welcome emails.

It’s a cross-functional process that connects design, development, and compliance into one experience that feels simple to the user but is deeply secure underneath.

What Is FinTech Onboarding?

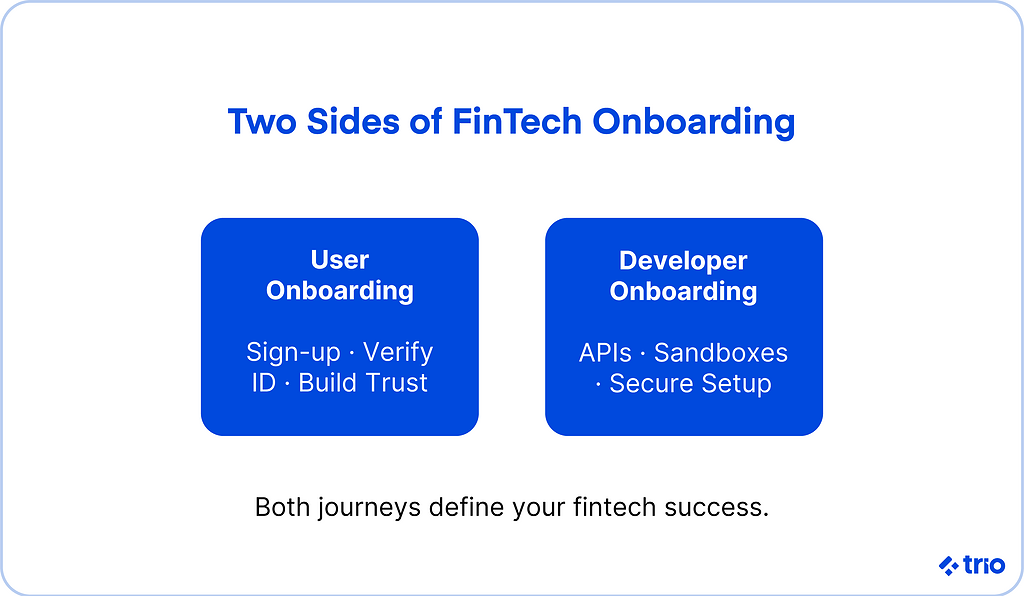

The term fintech onboarding covers both user onboarding and developer onboarding.

For users, it’s the step-by-step guide that takes them from sign-up to activation, often including identity verification and consent.

For developers, it’s the structured way they’re introduced to your APIs, data models, and compliance frameworks.

Together, they define how efficiently your product can scale.

User vs. Developer Onboarding

From a user’s point of view, onboarding success depends on how easy it feels to start. They want to create an account, verify identity, and make their first deposit without friction.

For software developers, onboarding involves understanding how to maintain security measures, manage sensitive information such as Social Security numbers, and comply with AML requirements.

We’ve noticed that companies that prioritize developer onboarding early tend to ship features faster and with fewer incidents. A well-structured backend leads to fewer support tickets, smoother KYC flows, and fewer app onboarding errors.

Why Onboarding Shapes Retention and Trust

A thoughtful onboarding also builds credibility.

A confusing or slow onboarding flow can make users doubt your reliability.

Meanwhile, a transparent, secure onboarding process signals that your fintech app values safety and user experience equally.

Key Components of a FinTech Onboarding Flow

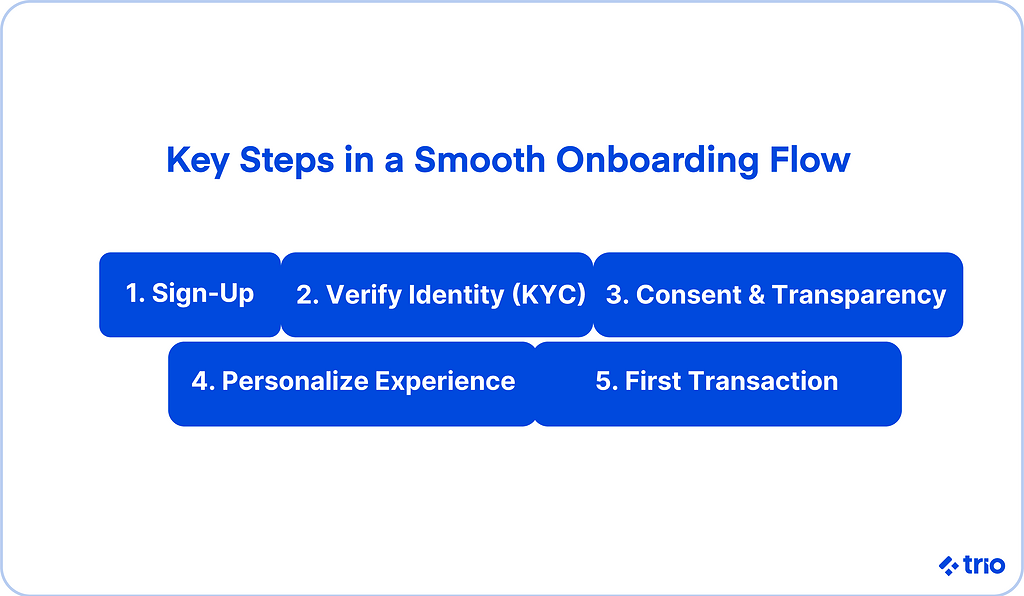

Building a strong onboarding process means blending UX simplicity with technical rigor.

Identity Verification and KYC

Identity verification and KYC (Know Your Customer) are the backbone of any secure onboarding process.

Regulations like AML can feel heavy, but automation helps. Tools like real-time document verification and two-factor authentication can verify users while keeping friction low.

One great technique we’ve noted to decrease onboarding time in the fintech apps we’ve worked on is implementing API-driven KYC checks and progressive validation. The faster users can get verified, the faster they trust your brand.

Security, Transparency, and Data Consent

Every interaction inside a fintech app involves sensitive information. Be upfront about how it’s handled.

Clear messaging, “your data is encrypted,” “we comply with GDPR,” or “you can revoke consent anytime”, reassures users.

We’ve seen fintech companies build trust through small transparency cues like progress bars during verification or visual locks during data entry.

These subtle touches turn security into part of the UX.

Personalization and Guidance

Different users have different financial needs.

A budgeting app might focus on linking a bank account, while a crypto platform emphasizes wallet verification.

By using personalized prompts, contextual help, and in-app guidance, fintech companies can make the onboarding flow feel tailored, not templated.

Developer Onboarding for FinTech Projects

Developer onboarding often decides how fast a product can evolve.

If new engineers can’t understand your codebase, APIs, or compliance setup, even simple updates can break something downstream.

Setting Up a FinTech Developer Environment

A clear developer onboarding process usually starts with:

- Sandbox environments for testing APIs safely

- Mock financial data for simulating real-world flows

- Consistent documentation that explains error codes and security rules

At Trio, we have helped companies offering financial services, for example, those creating a budgeting app, to build a developer sandbox where engineers could test KYC flows using mock accounts.

The result? Fewer bugs, faster deployment, and more reliable onboarding data.

Integrating Core APIs and Compliance Tools

Fintech apps depend on integrations, from open banking to identity verification. Developers need clarity on data flow and failure states.

Documenting each API’s purpose, limits, and expected response reduces onboarding confusion for engineers.

We often recommend API-first onboarding with example payloads in the developer dashboard. It’s one of the most effective ways to speed up integration and reduce the risk of compliance errors.

Security and Regulatory Contexts for Developers

Part of onboarding developers means educating them on the security context.

Introduce encryption protocols, key management standards, and audit trail expectations from the start.

Developers who understand why a rule exists are more likely to implement it correctly.

When you hire fintech developers with Trio, you can rest easy knowing you are getting an industry expert who already understands the reason behind things like security measures and only needs to familiarize themselves with your specific protocols.

The result is a developer you can onboard in a couple of days, instead of one who needs weeks or months of training regarding the unique challenges in fintech security.

Collaboration Between Product, Legal, and Engineering Teams

Fintech development lives at the intersection of business goals and regulation.

When product, legal, and engineering teams work together, compliance stops feeling like a roadblock and starts feeling like a shared mission.

Designing a Seamless Onboarding Experience

A seamless onboarding flow might look simple, but it’s built on countless developer decisions behind the scenes.

Reducing Friction With Smart Form Design

Long forms are onboarding killers. A best practice is to break them up.

You can also use autofill and real-time validation to make the process feel interactive instead of tedious.

Progressive Disclosure and Clear Guidance

Instead of overwhelming users with every requirement at once, reveal steps gradually.

For example, ask for identity documents only after basic info is complete.

This creates momentum in the overall customer experience and lowers drop-off rates.

Optimizing Mobile Experience

Since most fintech onboarding happens on mobile, every screen should load fast, look clean, and adapt gracefully.

A mobile-first UX ensures that people can finish onboarding whether they’re in a café or on the move.

This means a uniform user experience is crucial for everyone in the fintech industry.

Sustaining Developer Onboarding Quality

Once developer onboarding is established, the challenge becomes keeping it healthy.

Building Reliable and Compliant Onboarding APIs

Reliable APIs are at the heart of fintech onboarding.

They should handle edge cases gracefully and log errors clearly.

We sometimes recommend that teams expose basic metrics, such as latency, uptime, and error codes, directly in the developer dashboard.

Monitoring and Automation

Automation tools can detect problems faster than any human review.

For instance, alerts can flag unusual KYC delays or API outages in real-time.

Proactive monitoring reduces both user frustration and developer guesswork.

Testing and Continuous Integration

Integrate onboarding scenarios into your CI/CD pipelines.

Every deployment should include automated onboarding tests that confirm security measures, consent flows, and KYC checks continue to function as expected.

Building Trust Through Transparency

Trust is earned through transparency and predictability.

Showing How Data Is Used and Protected

Fintech users are handing over personal and financial data, so clarity matters.

Explain how data is stored, when it’s encrypted, and how users can control it.

This level of openness reassures people that their information won’t be misused.

Highlighting Compliance Credentials

Badges like SOC 2, PCI DSS, or GDPR-compliant serve as visible trust signals.

Many fintech apps display them at the bottom of sign-up screens or inside verification flows to reassure users mid-process.

Combining UX and Legal Clarity in Consent Flows

Avoid dense legal jargon. Replace it with plain, respectful language that still meets legal standards.

A line like “We never share your data without your consent” is far more effective than a wall of text.

Addressing Onboarding Challenges

Even strong onboarding systems encounter issues.

The goal is to detect and fix them early.

Common Drop-Off Points

Most user drop-offs occur during verification or when users encounter unexpected friction, such as additional ID requests or slow document uploads.

Developers experience their own version of drop-offs when internal APIs are undocumented, or sandbox data is outdated.

Strategies to Reduce Abandonment

You can reduce drop-offs with thoughtful UX details:

- Pre-fill data when possible

- Add a progress bar to show completion

- Use SMS or in-app push notifications to re-engage users who pause mid-flow

For developers, a clear onboarding checklist and open error logs can prevent confusion before it starts.

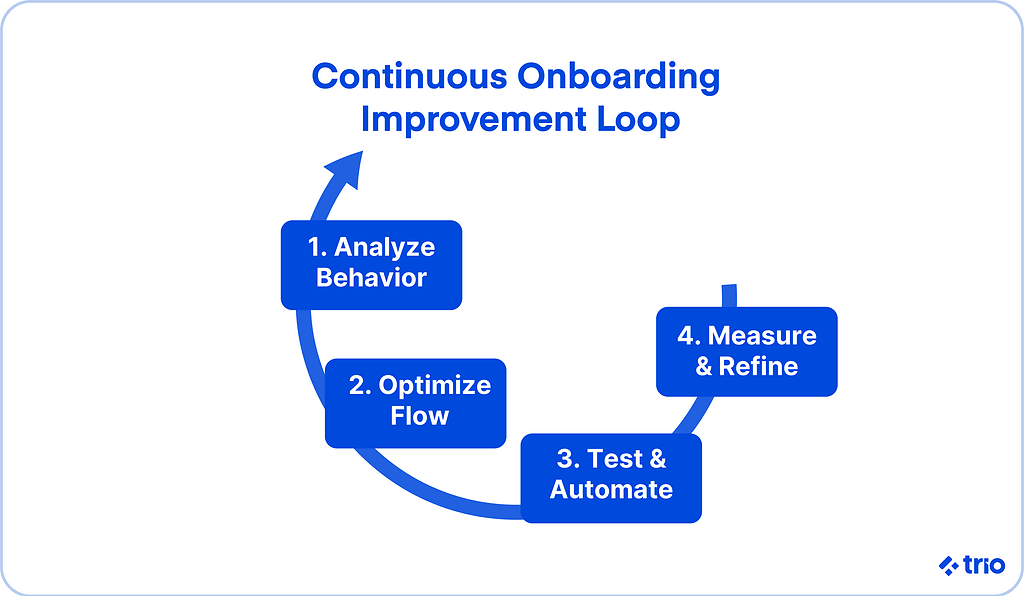

Using Behavioral Analytics to Improve Flows

Behavioral analytics can reveal subtle patterns.

Perhaps people hesitate in a certain field or exit immediately before final consent.

Knowing where that friction occurs allows your team to improve onboarding for fintech users with data-backed changes.

Emerging Approaches to FinTech Onboarding

The next wave of fintech onboarding is about adaptability.

AI-Driven Personalization

Some fintech apps now utilize machine learning to personalize onboarding steps in real-time.

If a user hesitates on a certain page, the system can offer instant support or reduce the number of visible fields to help them.

It’s still an emerging approach, but it appears to improve conversion rates when used carefully.

Predictive Drop-Off Prevention

Analytics can now identify early signs of friction, such as repeated verification retries or slow uploads, and provide gentle guidance.

Even a small reminder can recover users who might otherwise abandon the process.

Continuous Feedback Loops

The most successful fintech companies treat onboarding as a living process, not a one-time setup.

Feedback loops between UX designers, developers, and compliance teams ensure that onboarding stays relevant as regulations and expectations shift.

Conclusion

Fintech onboarding is a shared effort between design, engineering, and compliance.

When teams coordinate, onboarding becomes an opportunity to build trust, reduce friction, and support long-term retention.

We’ve seen this firsthand at Trio.

When fintech teams invest in straightforward developer onboarding, they also deliver better user onboarding. Faster integrations, fewer drop-offs, stronger compliance- it all starts there.

That is one of the many reasons we assist our clients with onboarding, taking the pressure off their resources while ensuring it is done properly.

If you’re ready to start hiring and onboarding developers for your fintech projects, get in touch!

FAQs

What is fintech onboarding?

Fintech onboarding is the process of guiding users and developers through account creation, verification, and secure setup within a fintech app.

Why is developer onboarding important for fintech projects?

Developer onboarding for fintech projects ensures engineers can quickly integrate APIs, maintain compliance, and support seamless onboarding experiences for users.

How can fintech companies reduce onboarding drop-offs?

Fintech companies can reduce onboarding drop-offs by simplifying forms, using real-time validation, and adding progress indicators or reminders.

What are the best practices for fintech onboarding?

Best practices for fintech onboarding include clear guidance, strong KYC security, personalized UX, and transparent data protection.

How does identity verification impact the onboarding process?

Identity verification impacts the onboarding process by balancing speed with compliance through automated KYC and secure verification tools.