Blockchains started out like separate islands with their own rules and assets. That was fine until people wanted to move value between them.

Users wanted easy transfers. Developers wanted apps that worked across chains. Enterprises wanted systems that could finally talk to each other.

That is the role of blockchain interoperability.

It lets independent blockchains exchange value and information and turns fragmented systems into a connected network.

Sitting in the middle are crypto bridge protocols, which move tokens and data from one blockchain to another.

Let’s look at how bridges work, where they struggle, and how they are likely to evolve.

If you build cross-chain apps or just want fewer wallet hops, understanding bridges will help you navigate the next phase of Web3. Our expert fintech developers here at Trio may be of some help.

Understanding Blockchain Interoperability

As already mentioned, blockchains rarely speak the same language out of the box.

Interoperability aims to fix that by enabling separate networks to share data and assets without relying on a centralized intermediary.

It also sits alongside other blockchain technologies that reduce fragmentation, making it easier for value and messages to move consistently across different blockchain networks.

What Is Blockchain Interoperability?

Blockchain interoperability is the ability for separate networks like Ethereum, Solana, and BNB Chain to move digital assets, messages, or smart contract calls between them.

In practice, it’s what lets liquidity, NFTs, and application logic travel across blockchains without being confined to a single ecosystem.

For individual users, that means transferring value without depending on centralized exchanges. For fintech developers, it enables a single application to interact with multiple blockchains, improving reach and functionality.

The result is a more connected and efficient blockchain ecosystem, though the technology still feels early in some areas.

Right now, the industry mainly simulates interoperability through lock, burn, and verification mechanisms. These have laid the groundwork for the next generation of cross-chain technologies.

We expect this to change going forward, moving to the proper cross-chain interoperability protocols. Our developers are excited to be a part of this future.

Why Interoperability Matters for Users, Developers, and Enterprises

Users want fewer steps. If you can swap or stake across networks without switching wallets or facing hidden fees, adoption naturally increases.

Developers gain flexibility, too. You can target ecosystems based on their strengths, such as Ethereum for liquidity, Solana for throughput, or Cosmos for customization.

This modular approach helps enhance interoperability and enable seamless performance of decentralized applications.

For enterprises, interoperability is a prerequisite for real-world blockchain use cases such as supply chain tracking or digital identity management.

When data can move securely across systems, pilot projects can evolve into production-ready platforms. The tradeoff, however, is a larger attack surface and higher operational complexity, which is why architecture, audits, and governance controls matter just as much as code.

The Current Fragmentation Challenge in Web3

Each blockchain platform comes with its own tools, consensus mechanisms, and token standards. Moving value between them often still means multiple signatures, wallet switches, and waiting times.

The result is a collection of network silos, where liquidity and data cluster within ecosystems but rarely interact across them.

Bridge assets aim to close those gaps.

Some bridges still rely on centralized validators or opaque smart contracts, which introduces risk. But the technology is improving, and the best teams now treat bridges not as quick fixes but as critical infrastructure for Web3.

We focus on training our developers in such changes, especially in the fintech sector, so they can set you up for success and seamless interoperability in the future.

Key Challenges in Achieving Interoperability

The main hurdles you’ll encounter are liquidity fragmentation, complex developer environments, security vulnerabilities, and regulatory uncertainty.

Fragmented Liquidity and Network Silos

Every blockchain has its own native assets and liquidity pools. That’s fine until you want to use them together.

Fragmented liquidity traps value, causes uneven pricing, and reduces overall capital efficiency across blockchain networks.

For example, if you hold ETH but want to lend on Solana, you’ll need to sell, wrap, or bridge your tokens. Each step adds cost, time, and risk.

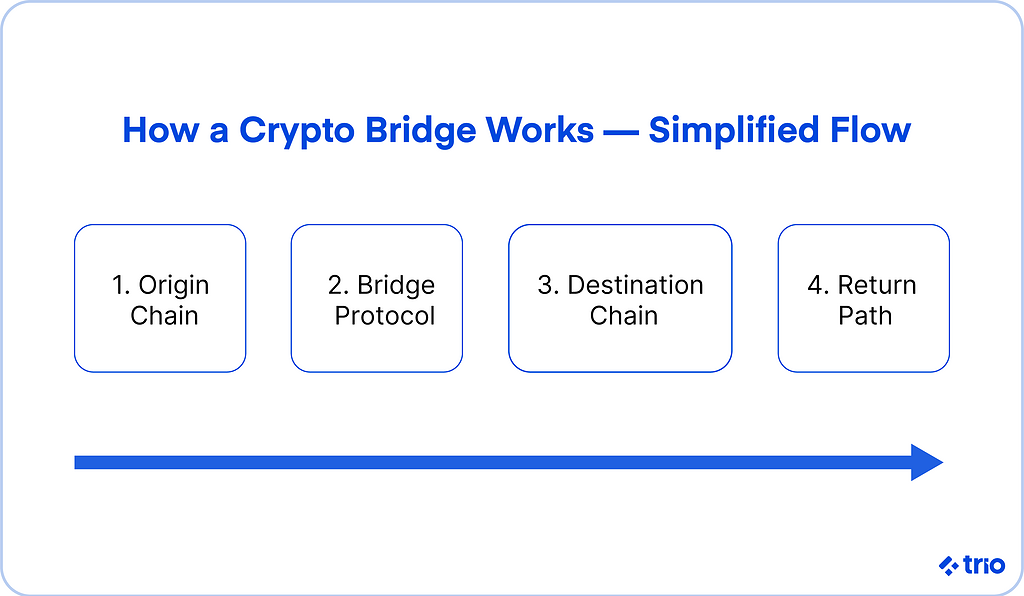

Crypto bridge protocols address this by locking or burning assets on the origin chain and creating an equivalent token on the destination.

However, peg maintenance, validator reliability, and pool depth still affect outcomes. Until liquidity becomes truly chain-agnostic, slippage and friction will remain common.

Complex Developer Environments and Integration Barriers

Each chain effectively speaks its own dialect. Tooling differs, SDKs behave inconsistently, and even among EVM-based chains, gas handling and event logic vary.

Without shared standards, developers often spend more time managing integrations than delivering user value.

Frameworks like Cosmos IBC, Polkadot XCMP, and LayerZero reduce this pain by supplying a communication layer, although they do not eliminate it.

Security Vulnerabilities in Cross-Chain Bridges

Bridges sit at the intersection of multiple systems, which makes them a prime target. Attackers exploit validator key compromises, faulty proof verification, or contract logic flaws to mint unbacked tokens or unlock locked assets.

Because many bridge protocols use lock-and-mint or burn-and-mint models, a single exploit can cascade across multiple chains.

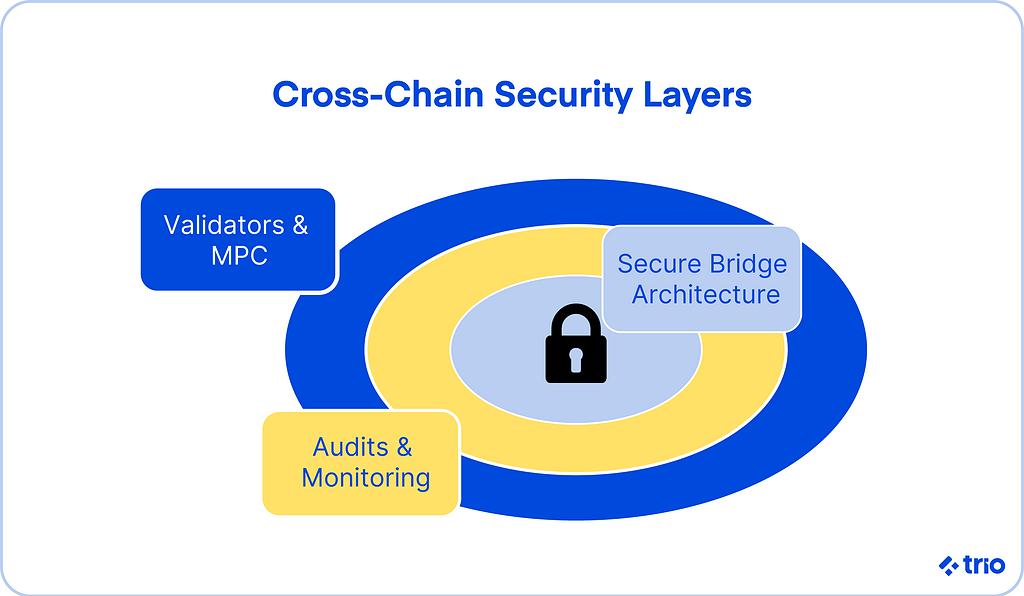

Multi-signature setups, MPC (multi-party computation), strict separation of duties, and conservative rate limits help mitigate risks, but they are not perfect solutions.

Regulatory Ambiguity and Compliance Risks

Cross-chain transactions blur jurisdictional lines.

If a wallet in one country interacts with a decentralized app hosted in another, whose laws apply?

Regulators are paying closer attention, and compliance expectations are growing. Some teams now experiment with optional KYC, wallet risk scoring, and on-chain audit trails.

Enterprises are likely to demand such controls before committing significant transaction volumes across multiple networks.

Types of Crypto Bridge Protocols

There’s no one-size-fits-all approach. Different bridge designs make tradeoffs between speed, decentralization, and security. Most fit into a few broad categories.

Lock-and-Mint Bridges

A lock-and-mint bridge locks tokens on the source chain and mints a wrapped version on the destination.

For example, moving ETH to Solana via a bridge means locking ETH on Ethereum and issuing wETH on Solana.

When the user returns, the wrapped token is burned, and the original is released. It’s simple, intuitive, and widely used, although it relies heavily on validator security and accurate proof verification.

Burn-and-Mint Bridges

In this model, tokens are permanently burned on the source chain and newly minted on the destination.

This eliminates large pools of locked funds, reducing single points of failure, but adds verification complexity.

You’ll often see this approach in newer interoperability protocols or layer-two environments.

Liquidity Network Bridges

Liquidity bridges work more like decentralized exchanges. Instead of minting wrapped assets, they use pre-funded pools on both sides to enable instant swaps.

Transfers feel faster and more predictable, but liquidity providers carry inventory and balance risk, particularly during market volatility.

Hybrid and Layer-0 Protocols

Hybrid and Layer-0 approaches aim to make interoperability native to the system.

For example, Polkadot coordinates connected parachains through a Relay Chain, while Cosmos IBC allows app-specific chains to communicate as equals.

These models reduce wrapping risk and central points of failure but depend on compatible frameworks and governance models, which can slow adoption outside their ecosystems.

Cross-Chain Communication Mechanisms

Every bridge relies on a secure and reliable method to send messages between blockchains.

Relays and Validators

Relays monitor a source chain for specific events, then pass proofs to the destination. Validators verify these proofs and authorize minting or release.

A decentralized validator set reduces capture risk, but too much fragmentation can slow processing.

Many modern bridges use threshold signatures or committee-based systems to balance safety with performance.

Oracles and Messaging Layers

Messaging protocols like LayerZero or Axelar use oracles and relayers to confirm that events occurred on one chain before executing actions on another.

Developers can choose providers and define security assumptions based on their application’s risk tolerance.

This flexibility makes it easier to enable cross-chain smart contract calls and build blockchain applications that span multiple networks.

Popular Interoperability Protocols and Bridge Protocols

A few projects have evolved from theory to real infrastructure, now supporting substantial on-chain traffic.

Cosmos IBC (Inter-Blockchain Communication)

Cosmos IBC connects independent zones via hubs using standardized packet protocols. Assets and data move natively, not as wrapped tokens.

If you build using the Cosmos SDK, IBC integration comes naturally, lowering development friction.

Teams still manage their own validators and security, so shared security remains optional. Even so, IBC has proven practical for both asset transfers and cross-chain data exchange.

Polkadot and XCMP (Cross-Chain Message Passing)

Polkadot anchors security in its Relay Chain and allows parachains to communicate via XCMP.

Because parachains share security, message passing is more reliable than ad hoc bridges. The tradeoff is a slower onboarding and governance process.

This model suits ecosystems that value strong guarantees and coordinated security.

LayerZero: Lightweight Messaging for Multi-Chain Apps

LayerZero focuses on messaging rather than custody. It splits validation between an oracle and a relayer, allowing smart contracts to interact across networks.

Developers can select providers and balance cost against trust assumptions. Its adoption across DeFi, NFT, and gaming projects shows that it’s a practical option for multi-chain development today.

Wormhole Bridge: Case Study in Cross-Chain Asset Transfer

Wormhole connects major blockchains such as Ethereum, Solana, and BNB Chain using a lock-and-mint design.

It’s widely used for token and NFT transfers, but also serves as a cautionary example: a 2022 exploit allowed attackers to mint unbacked ETH due to a smart contract bug.

Following the breach, Wormhole strengthened validator coordination, implemented real-time monitoring, and added emergency response mechanisms.

The takeaway is simple: popular bridges must combine usability with continuous, rigorous security work.

Security Considerations and Best Practices for Crypto Bridges

Security is the make-or-break factor for cross-chain interoperability. Incidents have cost users billions.

Common Vulnerabilities in Bridge Architectures

Weak validator controls, flawed proof checks, and smart contract bugs (which we already mentioned above) tend to cause the largest losses.

Validator Compromise and Replay Attacks

If too few validators control release functions, a single key compromise can drain funds. Replay attacks can also occur when valid messages are reused to mint or unlock assets multiple times.

Mitigations include threshold signatures, key rotation, and strict message sequencing.

Smart Contract Exploits and Token Wrapping Risks

Unchecked assumptions in minting, locking, or token accounting can create unbacked assets. Wrapped tokens depend on the integrity of their collateral. If that breaks, downstream protocols can fail too.

That’s why conservative parameters, continuous audits, and layered validation are essential.

Best Practices for Secure Bridge Implementation

Security should be part of your stack, not a feature. If you do not build it into your offerings from the ground up, it is very likely that you are going to run into issues later on.

Multi-Signature and MPC Approaches

Multi-signature and MPC (multi-party computation) systems distribute control so that no single key can move funds.

MPC avoids ever reconstructing a full private key, reducing obvious attack vectors. It can be slower and costlier to maintain, but it often pays off in resilience.

Audit Frameworks and Continuous Monitoring

Pre-launch audits are essential, but real security comes from ongoing vigilance. Monitoring helps catch issues that only appear under production load.

Watch for anomalies in liquidity, validator health, and transaction flow. Budget for re-audits whenever contracts are upgraded, and test incident response plans as thoroughly as you test code.

Emergency Pauses and Rate-Limiting Systems

Circuit breakers and temporary pauses can buy time during an incident.

Rate limits help reduce blast radius while teams coordinate with exchanges, apply patches, and communicate with users.

Enhancing User Experience Across Blockchain Networks

Even the best engineering doesn’t matter if the experience feels confusing. Users have so many options, they are incredibly likely to abandon anything they find remotely difficult or unpleasant to use.

Simplifying Cross-Chain Transfers

Aggregators such as LI.FI and Socket automatically search for the best routes and lowest fees when moving assets across chains.

Modern wallets integrate bridge flows directly, removing the need to jump between multiple apps.

The goal is confidence. When users stop thinking about which chain they’re on, adoption starts to grow naturally.

Improving Speed, Fees, and Reliability

Liquidity network bridges eliminate minting delays by swapping against pre-funded pools.

Pair that with Layer 2 scaling solutions like Arbitrum or Optimism, and both costs and confirmation times drop dramatically.

Reliability improves through redundancy, clear error messages, and transparent time and fee estimates.

It sounds mundane, but it’s exactly what users need.

Abstracting Technical Complexity for End Users

Most people don’t want to manage networks or tokens manually.

Intent-based systems let users describe what they want, and the protocol figures out how to do it.

“Swap 1 ETH for SOL” becomes a single action that happens automatically across chains behind the scenes.

Web browsers abstracted complexity in the early Internet. Wallets and aggregators are now doing the same for Web3.

The Role of Wallets, Aggregators, and dApps in UX

Wallets like Rabby and Ctrl (previously XDEFI) already manage multiple networks in one place.

Aggregators combine dozens of interoperability protocols to find the best available paths.

When decentralized apps integrate these tools, the entire experience feels unified and consistent.

If the industry gets this right, users will stop asking which chain they’re on. Instead, they’ll just use the application.

Regulatory Compliance and Risk Management

As interoperability matures, it becomes part of the global financial infrastructure. Oversight isn’t optional, especially if you’re targeting institutional adoption.

Global Oversight on Cross-Chain Transactions

Cross-chain transactions don’t align neatly with national jurisdictions, which makes enforcement difficult.

Regulatory bodies such as FATF and FinCEN are now clarifying their expectations.

You might not need full KYC on every interaction, but a mix of wallet risk scoring, sanctions screening, and transparent audit trails will likely become standard for enterprise-grade operations.

AML, KYC, and Asset Tracing in Multi-Chain Environments

New privacy-preserving techniques, including zero-knowledge proofs, can confirm a user’s eligibility without revealing personal information.

Meanwhile, on-chain analytics tools track assets across multiple networks, supporting anti-money-laundering (AML) and know-your-customer (KYC) efforts.

It’s not perfect, but it strikes a balance between user privacy and regulatory responsibility.

Building Compliance Into Bridge Architecture

Think of compliance as something you code, not something you bolt on later.

Smart contracts can include programmable limits, jurisdiction flags, and optional verification gates.

When fiat or custody comes into play, partnering with regulated custodians is a practical way to stay compliant without stalling innovation.

This hybrid model, made of part code and part policy, may prove to be the most sustainable way to grow across multiple chains.

How Regulation Could Shape the Future of Interoperability

Clearer standards are likely to accelerate adoption.

Expect to see interoperability alliances and shared guidelines for proof formats, incident response, and audit data collection.

Legal compatibility will soon matter as much as technical compatibility.

The Role of Ethereum in Blockchain Interoperability

You can’t talk about interoperability without mentioning Ethereum.

It remains the largest source of liquidity and the foundation for many blockchain standards.

Ethereum’s Foundational Role in Multi-Chain Ecosystems

Token formats like ERC-20 and ERC-721 make it easier to move assets between Ethereum and compatible blockchains such as Polygon or Avalanche.

High gas fees have driven some projects elsewhere, but Ethereum’s developer tools, mature security model, and vast ecosystem keep it central to most cross-chain designs.

Leveraging Ethereum for Decentralized Finance (DeFi)

Most DeFi liquidity still sits on Ethereum. That’s why cross-chain DEXs, lending platforms, and liquidity aggregators often start or settle there.

Some critics argue that this concentration slows innovation. The counterpoint is that shared standards reduce fragmentation and make true interoperability possible.

In many ways, Ethereum’s gravity helps new ecosystems grow around it rather than apart from it.

Layer-2 Solutions and Rollups Enabling Cross-Chain Connectivity

Layer-2 solutions such as Arbitrum, Optimism, and zkSync process transactions off-chain, then anchor proofs to Ethereum.

Bridges link these rollups with the mainnet, enabling fast, low-cost transfers between them.

As cryptographic proofs improve, Ethereum starts to look less like a single chain and more like a coordination layer, becoming the backbone of a broader, interconnected blockchain network.

Future of Blockchain Interoperability Solutions

The next phase isn’t just about connecting blockchains.

It’s about hiding that complexity so the system feels seamless to the user.

Potential Impact on the Blockchain Ecosystem

If interoperability continues improving, DeFi could function like a single global marketplace instead of fragmented silos.

Game assets might move freely between virtual worlds.

Institutions could use blockchain systems across departments without rebuilding from scratch for every network.

Still, increased connectivity brings risk. If everything becomes too tightly linked, systemic vulnerabilities can spread more easily.

That’s a valid concern.

Predictions for the Next 3 to 5 Years

Expect to see standardization efforts and interoperability alliances between major ecosystems such as Ethereum, Solana, Polkadot, and Cosmos.

Regulatory frameworks will mature, encouraging banks and fintechs to participate more directly.

As technology stabilizes, bridges themselves will fade into the background, much like internet routers today.

When that happens, blockchain interoperability will feel like part of the internet, not a separate layer you have to think about.

Conclusion

Crypto bridge protocols have turned isolated blockchains into a connected network.

They’re far from perfect, but they’re essential.

The teams that combine strong architecture, rigorous security, and thoughtful compliance will define how value moves across multiple blockchain networks.

If you’re building in this space, design for failure before it happens. Test your incident response plans, and keep users insulated from potential fallout.

If you’re choosing tools, prioritize bridges with multi-signature or MPC setups, continuous monitoring, and transparent audits.

A skilled developer who is familiar with not only blockchain but also the complexities of industries like fintech is going to be essential to set you up for success and avoid any interoperability challenges going forward.

To hire fintech software developers, get in touch for a free consultation.

FAQs

What is a blockchain bridge?

A blockchain bridge lets you transfer assets or data between different blockchains by locking/burning on the source and minting/releasing on the destination.

Why does blockchain interoperability matter?

Blockchain interoperability matters because it lets you use liquidity, apps, and smart contracts across multiple blockchain networks without relying on centralized exchanges.

Are crypto bridges safe to use?

Crypto bridges can be safe to use, but risk varies; you should favor bridges with audits, multi-sig/MPC, monitoring, and clear incident response.