If you work in financial services, you already know the balancing act. You innovate quickly, handle sensitive customer information, respond to regulators, and try not to drown in manual compliance tasks while scaling.

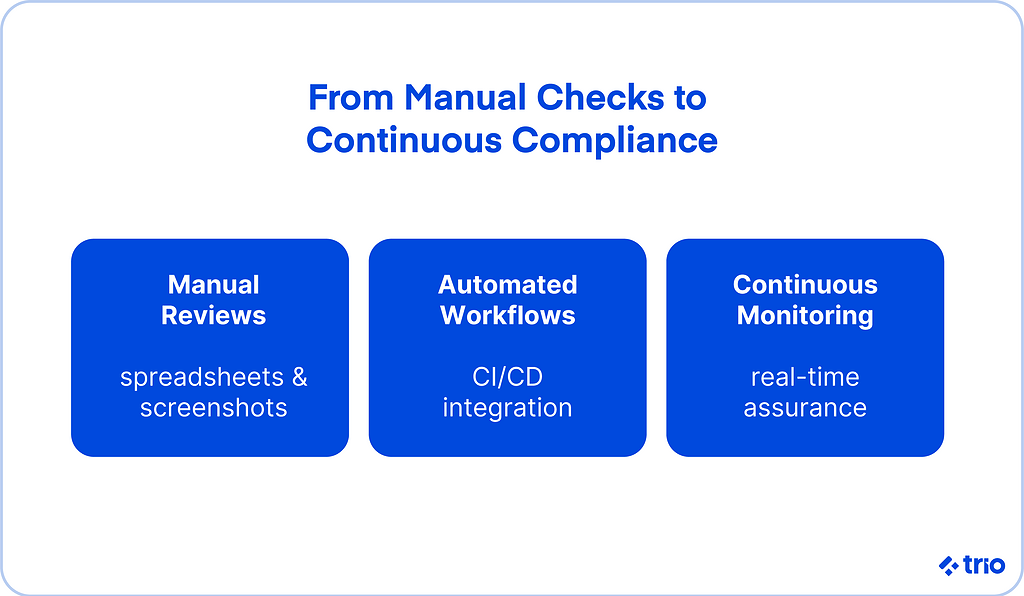

At some point, spreadsheets and screenshots stop cutting it. That moment usually comes faster in FinTech than anywhere else.

Continuous compliance automation and real-time audit capabilities are no longer just nice to have. They help FinTech companies stay compliant without slowing product delivery, and they spare your team from the panic cycles that come with audit season.

Let’s look at how you can implement continuous compliance monitoring, automating real‑time audits for your FinTech.

We’ll draw from our experience here at Trio, where our expert fintech developers have helped countless companies streamline compliance, giving the tools they need to scale long-term.

Understanding FinTech Compliance Today

Compliance in a FinTech environment stretches beyond a SOC 2 sticker or a PCI DSS checklist.

It means proving control adherence day-to-day across changing environments.

A bank integration, a new cloud service, or even changing a permission in IAM can have compliance implications.

Most teams are juggling SOC 2, PCI DSS, ISO 27001, and partner-specific regulatory requirements.

There may also be obligations tied to the General Data Protection Regulation or state privacy laws like the California Consumer Privacy Act.

With this mix, the compliance landscape shifts often and quickly.

Traditional compliance methods rarely keep pace.

Manual effort introduces risk. Gaps in audit trails invite fines as well as losses in user trust.

That is why continuous monitoring, automated workflows, and structured oversight are becoming standard practice in financial services.

Why Continuous Compliance Matters For FinTech

At its core, continuous compliance protects customers and accelerates trust with partners.

Banks, processors, and enterprise clients expect strong security compliance. Many want evidence before signing anything.

Real-time audit automation lets you sidestep the scramble. Instead of chasing screenshots before an internal audit, data is collected automatically as part of normal operations.

When someone asks for proof, you already have it.

Faster due diligence cycles and less internal stress are welcome side effects.

This shift also cuts the risk of non-compliance issues lingering until a quarterly review. You catch and address problems early, when fixes are small and inexpensive.

Continuous Compliance Automation In Practice

Compliance automation looks different for every business, but the common thread is replacing manual checks with workflows and code.

For example, instead of asking engineers to confirm encryption settings by hand, the system verifies configurations continuously and notifies the right person if they drift.

Early efforts often involve:

- tying compliance checks to CI builds

- centralizing audit evidence in a secure store

- automating permission and configuration checks

Even simple steps like pulling configuration snapshots into an evidence repository on a schedule provide value because they remove time-consuming backtracking later.

As automation expands, you start seeing policies validated at deployment time, real-time monitoring for drift, and automated alerts when controls move out of bounds.

Real-Time Audit Automation And Evidence Collection

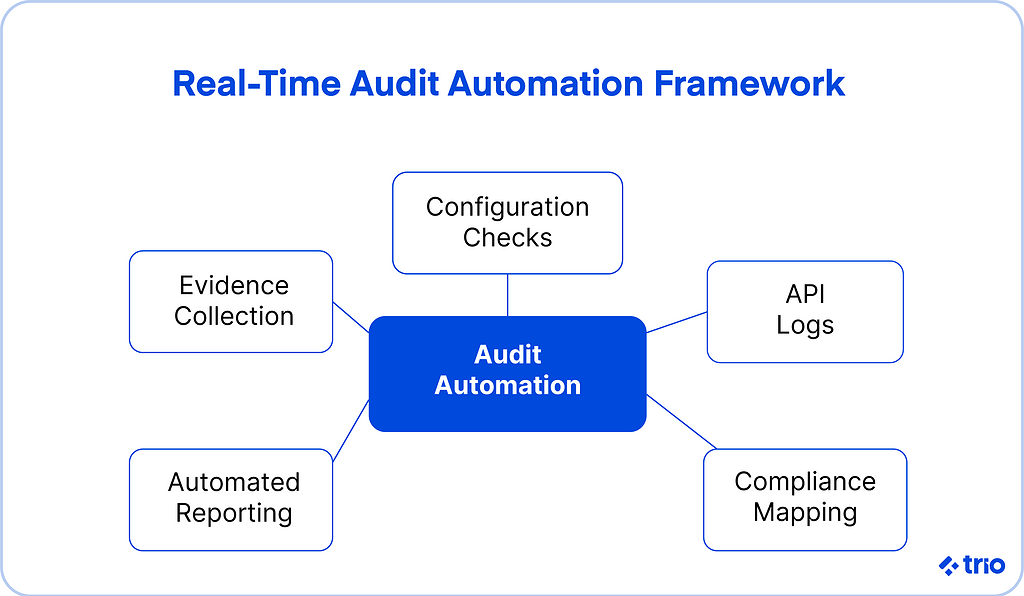

Real-time audit automation means audit readiness becomes a by-product of normal operations.

The system collects logs, configuration states, and control results continuously, so you do not need sprints dedicated to audit preparation.

This approach typically uses API-driven evidence capture, immutable audit logging, and automated reporting tied to your compliance framework. It reduces manual effort without sacrificing transparency.

A caution here: do not automate blindly.

If every alert escalates to the entire team, people eventually ignore them. If evidence is collected but not labeled clearly, auditors still ask questions.

Good automation is structured and intentional.

Compliance Monitoring And Tracking

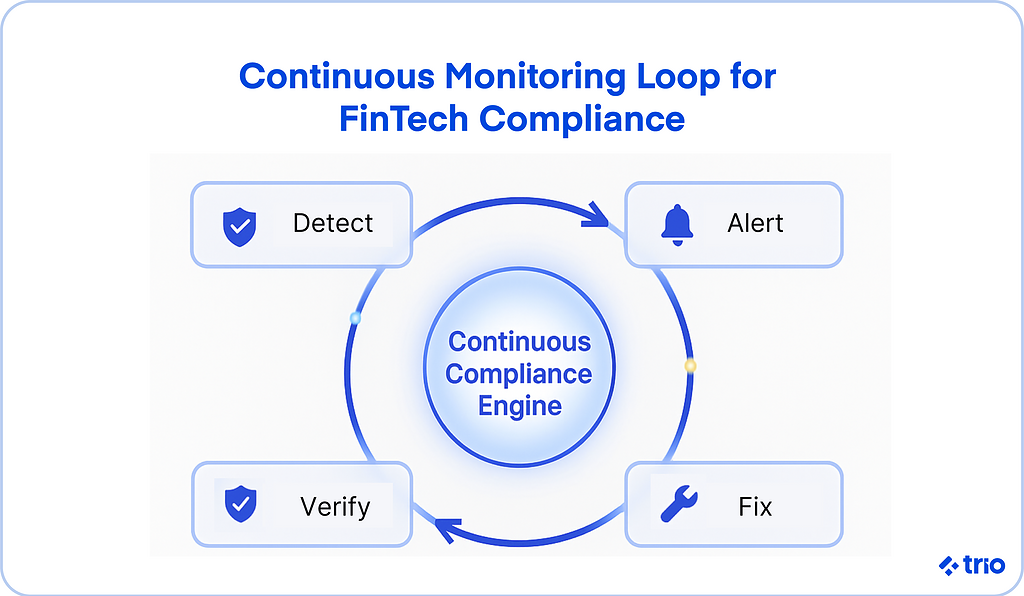

Continuous monitoring makes sure compliance remains intact after deployment.

A lot can change in a cloud environment within a day. Someone rotates keys. A role gets new privileges. A system update shifts a default configuration. Without real-time oversight, small changes can introduce security risks.

Effective compliance monitoring usually involves real-time visibility into system state, alerts for policy deviations, and simple reporting so leaders can see what is happening without digging through logs.

AI can assist, especially with anomaly detection, but clarity and ownership matter more than deep tech here.

Think of this layer as your early-warning system. It helps you catch issues before they escalate and supports quick risk mitigation.

Risk Management And Compliance Requirements

Risk management and regulatory compliance go hand in hand.

FinTech companies navigate operational, cybersecurity, and regulatory risks all at once. If your risk assessment model and compliance efforts do not talk to each other, you end up duplicating work or missing context.

High-risk systems need tighter automated controls and more frequent oversight. Routine systems need enough structure to stay safe without slowing momentum.

The better your mapping between risk levels and automated controls, the easier it becomes to maintain compliance without friction.

When regulations change, your compliance framework should adapt instead of lagging.

Continuous monitoring helps organizations stay on top of regulatory shifts and respond before there is a problem.

Culture Still Matters

Automation is an incredible tool for your teams, but we have seen too many instances where it becomes an excuse to avoid accountability.

You still need clear decision ownership, regular internal audits, and a shared understanding of why compliance exists in the first place.

A helpful cultural marker is when engineers see compliance guardrails as part of reliable delivery rather than a barrier to shipping code.

That mindset usually comes from good communication and reasonable systems. Industry experience can also help, making it one of many reasons you should consider hiring fintech developers instead of generic ones.

Where Trio Helps FinTech Teams Succeed

Many FinTech leaders lack sufficient engineering bandwidth to execute the automations they would like to implement flawlessly.

Building compliance automation, real-time monitoring, secure CI workflows, and audit trails often requires specialized experience.

Trio provides FinTech developers and DevSecOps engineers who have done this before, connecting these experts with your team in as little as a week, as opposed to months.

They help teams integrate compliance into their development workflow, automate evidence collection, and build continuous monitoring that scales without slowing delivery.

If your organization needs engineers who understand compliance and security controls from the inside, that support can be a difference-maker.

Conclusion

If you are starting this journey, a simple path forward might include the following:

- Pick one critical compliance workflow and automate it

- Centralize logs and evidence in one place

- Add alerting for one or two high-risk drift scenarios

Small wins build momentum. Once you see audit prep time shrink and confidence rise, expanding automation becomes easier.

When you want to move faster or avoid expensive mistakes, you can bring in FinTech-experienced developers who already understand compliance tools and regulatory requirements.

Trio can match you with senior engineers who can build continuous compliance automation systems that fit your workflow.

FAQs

What is continuous compliance in FinTech?

Continuous compliance in FinTech means continuously validating controls and collecting audit evidence instead of relying on periodic checks. This approach reduces risk and keeps you audit-ready at all times.

How do FinTech companies automate compliance?

FinTech companies automate compliance by embedding control checks into CI workflows, automating evidence capture, and using real-time monitoring. This removes manual steps and reduces compliance fatigue.

Why is real-time audit automation important?

Real-time audit automation matters because it replaces scrambling for screenshots with automatic evidence collection. It keeps organizations prepared and lowers the odds of non-compliance surprises.

What frameworks matter most for FinTech compliance?

The frameworks that matter most for FinTech compliance include SOC 2, PCI DSS, ISO 27001, and GDPR. Many FinTech teams also meet partner bank and card network requirements.

How does continuous monitoring improve compliance?

Continuous monitoring improves compliance by catching deviations as they occur instead of during quarterly reviews. This helps teams fix issues before they escalate into risk or fines.