Payment systems are supposed to quietly work in the background, yet anyone who has run a global payment flow knows they rarely behave that politely.

A single routing misstep or poorly timed retry can mean lost revenue, extra support load, and a frustrated customer who never comes back.

Improving your approval rate and reducing processing costs only happens because your routing logic pays attention.

This guide breaks down how smart payment routing, intelligent payment routing, and smart retries work in real environments.

We will look at how payment routing strategies evolve as your business grows, why dynamic routing often outperforms static routing, and how to build a payment flow that learns over time instead of relying on guesswork.

Payment Routing Fundamentals

Before jumping into orchestration and machine learning, it helps to understand the fundamentals of payment routing.

Payment routing is the process of deciding where a payment goes. The routing system looks at each transaction, evaluates the options, and tries to route payments through the path most likely to succeed at the lowest processing cost.

A simple payment stack often uses a single provider.

That works until you need to scale or improve the success rate across regions.

Once you support multiple payment processors or operate globally, routing becomes a performance lever instead of a configuration setting.

At that point, you are balancing approval likelihood, latency, and uptime, regulatory constraints, fraud posture, tokenization status, and the cost of a successful transaction alongside simply choosing a payment gateway.

The right choice depends on context, such as issuer, BIN range, card brand, geography, payment method, authentication state, and even the time of day.

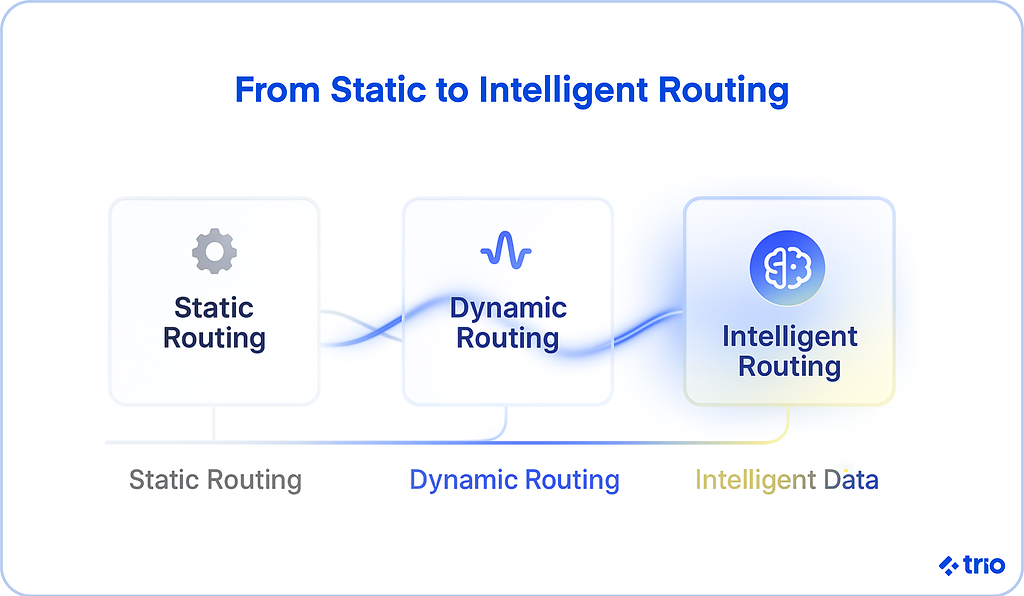

Static Routing vs Dynamic Routing

Many companies start with static routing rules. For example, “send everything to Stripe” or “all EU cards go to Processor A.”

That seems fine on day one, but static routing ages poorly.

Issuer behavior fluctuates, network performance varies, and certain card types will simply do better with different payment service providers.

Dynamic routing reacts instead of assuming.

It checks live performance indicators, looks at factors like card type and geography, and adjusts routing decisions.

Think of it as real-time selection rather than a hard-coded rule. That flexibility is what leads to higher approval rates, especially when you scale internationally.

Moving Toward Intelligent Payment Routing

Once you stop treating payments as a fixed pipeline and start treating them as a real-time system, you enter the territory of intelligent routing or smart routing.

Here, your routing logic learns patterns. It predicts which route will perform best for a certain card issuer or region.

It may be noticed that certain BIN ranges perform better with a local acquirer, or that retrying a Visa card on a specific provider first thing Monday morning is more successful than doing so Friday night.

How Intelligent Payment Routing Works

Smart routing systems combine:

- Card metadata (like card type or issuing region)

- Live acquirer performance

- Historical payment data and decline codes

- Fraud signals and authentication status

- Processing cost patterns across routes

Then they decide how to route transactions or when to shift payment traffic elsewhere.

Over time, intelligent routing optimizes payment experiences by increasing the likelihood of successful authorization while quietly trimming unnecessary processing costs.

Teams sometimes worry that this sounds too complex to maintain, but the alternative is complexity hidden in support tickets, finance reconciliations, and lost revenue.

Related Reading: Best Budgeting Apps

Payment Routing Strategies That Improve Success Rate and Lower Costs

Global merchants often see a two to four percent lift in approval rate once they adopt intelligent payment routing. That uplift alone can justify the investment.

The most common success driver is local acquiring.

Local acquirers often present transactions domestically, which issuers favor. It is not uncommon to see a drop in payment failures when routing European cards to a European acquirer instead of sending them across borders.

Network tokenization also plays a role. Tokenized transactions often achieve a higher success rate for stored card business models, since issuers recognize tokens more reliably over time.

Another aspect that may not seem obvious early on is cost.

Sometimes the highest-approval route is also the most expensive route. Sometimes, a slightly lower-approval route is acceptable at off-peak hours if it substantially reduces the cost per successful transaction.

Add on regional rules about US debit routing, PSD2 requirements in Europe, and the way Latin American banks often approve payments more reliably when routed through local acquirers and domestic rails like PIX (Brazil) or SPEI (Mexico), and it becomes clear why intelligent routing matters.

One size simply does not fit all if you want to optimize payment performance across markets.

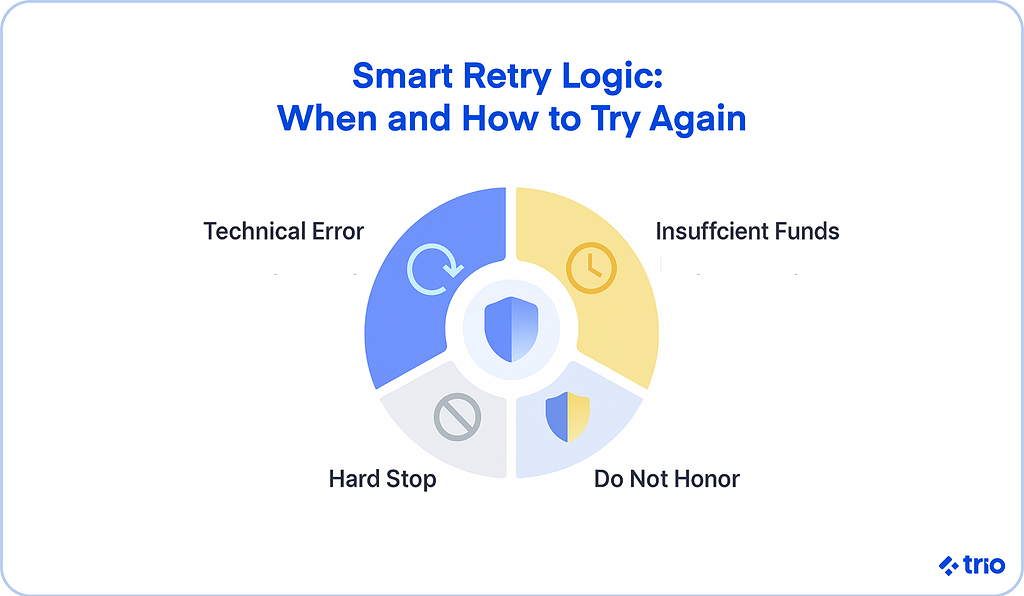

Smart Retries That Actually Work

Even with the best routing logic, failures will happen. Smart retries give you a second chance to recover revenue without annoying banks or users.

Basic retry logic usually goes like this: payment fails, try again.

That might work for temporary network blips, but it often makes things worse. Card networks notice aggressive retry behavior, and banks may view repeated attempts as suspicious.

Smart retries look different.

They consider why the payment failed, when to retry, and which route to use next. A decline due to insufficient funds may call for a delayed retry rather than an immediate one. A technical decline may suggest shifting to a secondary acquirer right away. Issuer-specific patterns matter as much here as in routing.

Here is an example of how you may consider smart retries to optimize your payment operations:

| Decline category | Typical signals | Next action | Timing guidance |

|---|---|---|---|

| Temporary technical | timeouts, unavailable, unclear errors | Fail over to a healthy acquirer on the first retry; stop if repeated | Immediate or within seconds |

| Insufficient funds | code 51, NSF wording | Retry on the same or alternate route; notify for updates on subscriptions | 6–24 hours, then 2–3 days, aligned to local pay cycles |

| Do not honor/suspected risk | codes like 05, 65 | Consider adding 3DS or extra signals, then switch acquirer if history supports it | 30–120 minutes after adding authentication |

| Hard stop | lost, stolen, expired, or invalid PAN | Do not retry; ask for updated credentials or an alternate method | No further attempts |

The goal is to retry intelligently, without harming your reputation with issuers or irritating your customers.

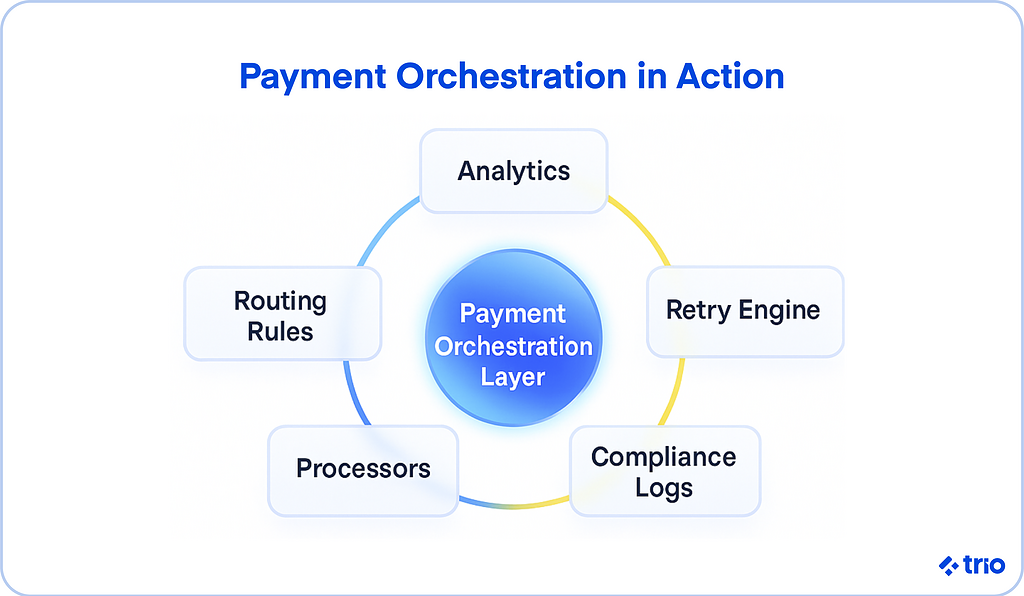

Why Payment Orchestration Makes This Easier

As routing logic grows, most teams realize spreadsheets and conditional statements do not scale. That is why payment orchestration exists.

Instead of duct-taping logic across multiple gateways, a payment orchestration platform centralizes routing rules, retries, analytics, and monitoring.

When you have one hub coordinating everything, you do not need to manually babysit routing engines or patch logic when you add another payment method.

You can see exactly how transactions behave, test new routing rules safely, and evolve the system without rewriting the world every quarter.

Measuring and Improving Payment Performance

Approval rate alone will not tell you whether your routing system is healthy. You need to track decline patterns, success rate by region and BIN, latency, and cost per successful transaction.

It helps to zoom out occasionally and compare acquirers across weeks or months rather than reacting to occasional dips.

Temporary fluctuations happen. What matters is trend and opportunity.

Smart teams make incremental routing improvements and run controlled tests rather than rewriting the playbook overnight.

Conclusion

Modern payment routing is about setting up a payment flow that scales with your business, adapts when markets shift, and protects customer trust.

Smart payment routing and smart retries give you that control, especially when combined with a thoughtful payment orchestration layer.

A mature routing system does not appear overnight. It evolves. It becomes sharper as payment data grows. And it becomes easier to manage when you have developers who understand how payment stacks actually behave.

If you want help building intelligent payment routing, implementing smart retries, or designing a modern payment orchestration layer, Trio can connect you with engineers who have done this before. We specialize in matching companies with developers experienced in fintech infrastructure, payments logic, and high-reliability systems.

Hiring fintech developers who already speak this language saves months. It reduces mistakes. It helps you scale faster without reinventing the fundamentals.

If you are ready to build smarter payment routing and lift your approval rate while controlling processing costs, we can help you put the right team in place.

Get in touch.

FAQs

What is intelligent payment routing?

Intelligent payment routing is the process of choosing the best payment path based on data. This routing logic analyzes card type, issuer behavior, and real-time performance to improve approval rate and reduce processing costs.

How does smart routing improve approval rates?

Smart routing improves approval rates by sending each transaction to the acquirer most likely to approve it. It evaluates live success patterns and adjusts routing decisions dynamically.

What is the difference between static routing and dynamic routing?

The difference between static routing and dynamic routing is that static routing follows fixed rules, while dynamic routing adapts based on real-time performance data to route payments more effectively.

What are smart retries in payments?

Smart retries in payments use decline reasons and timing logic to decide when and how to retry a failed transaction. Instead of retrying blindly, they optimize recovery without harming issuer trust.

Do payment orchestration platforms help with routing?

Payment orchestration platforms help with routing by centralizing routing logic, data, and retry workflows. They make it easier to manage multiple payment processors and optimize the success rate.