A big reason why fintech has been advancing so quickly is the use of APIs (Application Programming Interfaces). API development for fintech apps has allowed companies to integrate with banking and regulatory frameworks, existing payment infrastructure, and even third-party services.

If you use APIs in your app, you can utilize all of these fintech solutions and even collaborate with large financial institutions to help you scale rapidly.

According to a 2025 report by McKinsey, large banks are allocating as much as 14% of their budget towards APIs, and 81% of respondents thought APIs were a priority for business and information technology.

You would be a fool not to take advantage of everything API integration has to offer.

In this article, we’ll take a look at everything you need to know about APIs in fintech app development so that you can take advantage of all the financial service integrations they offer. We’ll also go into some examples of how APIs have become a critical part of many fintech companies, so you can better understand how your competitors are taking advantage of these tools.

If you are interested in getting an experienced fintech developer on your team, you are in the right place. At Trio, we provide a variety of hiring models that give you access to the top 1% of fintech developers. Our focus on putting together custom solutions has allowed us to maintain a 97% success rate since we were founded in 2019.

What Are Fintech APIs?

APIs are essentially a set of rules that let software connect seamlessly.

Traditional fintech software development used to be heavily focused on building monolithic architecture. This means they would have had to integrate directly and individually with banking and financial services systems. As you can imagine, this was a slow process, with a large propensity for error, and very high upkeep costs.

On the other hand, modern financial APIs are modular and lightweight. These modern APIs let your developers integrate with existing services far faster. Think of it like a standardized connection point that lets sensitive financial data and other information flow seamlessly between software.

Since these financial APIs have become almost standardized, you not only cut down on development costs, but also increase overall development speed.

Common API Types in Fintech (Open Banking, Payments, KYC, RegTech, Investment)

You could, in theory, develop an endless number of financial APIs. This means that development teams need to stay up to date with industry trends so they know what software is available and what market opportunities might be available, specifically in the fintech industry.

Here are some of the most common types of fintech APIs being used at the moment, but it is by no means an exhaustive list:

- Open Banking APIs: Allow for financial information to be shared.

- Payment APIs: Enable transaction services through existing payment gateways.

- KYC/AML APIs: Automate security, such as onboarding and identity verification.

- Investment APIs: Power practical trading and automated investment advice.

- RegTech APIs: Manage regulatory compliance, reporting, and any event preparations.

Top Fintech API Use Cases

There are many ways companies use the power of APIs in fintech, but a couple of examples stand out, such as the way non-financial companies can integrate financial services into their products, APIs facilitate secure, international payments in multiple currencies with real-time conversion rates and compliance, and APIs allow users to interact with smart contracts, digital wallets, and more.

APIs are also commonly used to access markets in real time, whether this is to trade or just to gather information. In general, the API marketplaces also offer bundles that can be particularly useful if you are a startup and don’t have the resources to code everything yourself.

However, one of our favorite ways of using APIs in fintech apps is to simplify onboarding and security measures, which is becoming more critical in fields like finance, healthcare, and even education.

Real-World Examples of Fintech APIs

Now that you understand what APIs are and what the most common types are, let’s go over some real-world examples of financial APIs in action. Plaid, Stripe, Trulioo, and RazorpayX are some of the most popular examples. You’ve likely heard of many of them or seen them used in web and mobile apps.

Plaid lets payment apps like Venmo or personal finance apps like Robinhood link to banking services, giving them access to users’ bank accounts. Similarly, Stripe is used by SaaS or e-commerce platforms that take advantage of their payment infrastructure.

RazorpayX is another financial API that lets non-fintech apps use embedded payments, while Trulioo is one of the most popular options for KYC and regulatory compliance.

How Fintech APIs Work

To ensure successful fintech API integration, it is important to understand how they work.

Request and Authentication Flows

Modern fintech APIs need to focus on security above all else. To do this, the first step is to ensure secure access through authentication.

API keys are seen quite often. They are simple and useful for private or internal APIs. If you are working with the public, OAuth2 is pretty standard.

JWT (JSON Web Tokens) is another popular security measure and is used for stateless, scalable authentication.

As the industry evolves, new threats emerge, and companies need to ensure they adapt their financial solutions. It is crucial to stay on top of the latest industry trends. Getting a fintech specialist developer on board to evaluate your financial services APIs can help you guarantee all parts of your app are secure, including your APIs.

Data Retrieval and Exchange Protocols

Once security has been confirmed, APIs will initiate data retrieval and exchange protocols.

REST is probably the most common and uses HTTP methods for CRUD operations. Our developers have also seen GraphQL and Webhooks, which are often used in fintech API platforms for data fetching and ‘push’ updates, respectively.

Security and Error Handling

It can be tempting to neglect aspects such as security and error handling, but the most robust APIs provide ways to handle both of these. We recommend that you only consider these APIs if you are a fintech startup or scale-up, as users place an incredible emphasis on security and consistency for platforms that handle their money and personal information.

So, how do fintech API providers ensure their products are suitable?

We’ve seen many use rate limiting and throttling to prevent their APIs from being misused. You should be familiar with how APIs also use structured error codes like 401 Unauthorized or 429 Too Many Requests, as these error codes often make an appearance in user interfaces.

To further guard against more nefarious threats like injection attacks, it’s pretty standard practice to include API security measures like input validation and sanitization.

As a general tool, most of the modern fintech APIs that we have mentioned above include all of these security and error-handling measures, but it is still important to double-check and ensure these features work correctly.

API Monitoring and Versioning

Finally, most modern fintech APIs will have some monitoring or versioning provision.

In terms of monitoring, you’ll need some knowledge of uptime, latency, and usage. A lot of the APIs we’ve observed use tools like Postman and Datadog to facilitate this monitoring.

Versioning can be done manually, which involves considering previous versions of the API and making sure that the latest version is compatible with the last.

Benefits of APIs in Fintech Development

We’ve already touched on the benefits of using an API in fintech development. However, it’s important to ensure you fully understand the business potential of fintech APIs so you can decide if it is worthwhile for you to consider building an API or using an existing one in your apps.

- Faster Time-to-Market: You don’t need to build every function from scratch every time, and can integrate the relevant services in days instead of months.

- Better User Experiences and Customization: APIs enable features like instant transfers, transaction alerts, personalization, and others, which users want to see in top fintech apps.

- Lower Development and Integration Costs: Especially when using third-party APIs, you reduce overhead and accelerate time-to-market.

- Increased Security and Compliance Automation: Most renowned third-party APIs are compliance-ready, with features like data security, authentication, logging, etc.

- Platform Interoperability and Scalability: Microservices architecture, when powered by APIs, can scale modularly. Financial API integration is also efficient on various platforms and ecosystems.

- Expandable Ecosystem for Banking-as-a-Service (BaaS): Bank apps are powered by APIs, which can easily add additional services that they can then market to clients.

Key Principles of Building Fintech APIs

What if you decide there are APIs out there that provide exactly what you are looking for, or maybe you want to play a role in creating the latest APIS for fintech companies? In those cases, you can delve into the world of building the best fintech APIs on your own.

Define a Long-Term API Strategy

Before you even start the development process, you need to make sure that you know who you are developing for. If you are developing the API for yourself, then you just need to cover your needs. However, you may want to make the API available to others, to allow fintech companies all over the world to use your software.

You can break possible long-term strategies into three options: internal, partner, and public.

Internal tools serve your own modularity, while partner APIs might drive growth in a specific ecosystem. Public APIs enable any developer to adopt the API in many fintech applications.

Prioritize Developer Experience (DX)

Unlike many other aspects of app creation, where you want developers to build with the users in mind, in the case of APIs, you need to consider developer experience.

You want to make it as easy as possible for developers to integrate your API into their app or to make adjustments and find issues if required. Create clear documentation and SDKs. If you are taking a partner or public approach, consider creating sandbox environments where developers can experiment, and make sure you have responsive support.

Choose the Right Protocols and Standards

A protocol is the way data is exchanged between systems. Choosing the right protocol for your API is critical to make sure it is compatible with the software out there. For example, a payment processing API might work well on the same protocol as an open banking API.

There are many options out there, but OpenAPI and gRPC are some of the most popular examples.

OpenAPI tends to work best if you are struggling with compatibility, while gRPC is a great option if you are really concerned about performance.

Implement Strong Authentication and Rate Limiting

We’ve already mentioned protection mechanisms like OAuth2, JWT, and fine-grained scope controls that you need to look for when looking for an external API. Don’t forget to build them into your own.

Advertising these steps for security can also be beneficial if you decide to partner with others or take your API public later on, as it demonstrates your compliance and attention to detail, which is a critical factor in building trust and cementing your reputation in the fintech industry.

Designing Secure and Compliant Fintech APIs

Security, we cannot emphasize enough, is incredibly important when you are providing access to financial services or playing some role in the functioning of financial institutions and fintech apps. Here’s how you can ensure your apps are not only secure but also compliant with regulations:

- Sensitive Data Protection and Encryption: Make sure that you use TLS 1.3 for data transfer security and field-level encryption at other times. Also, avoid storing important information unless you absolutely have to.

- Strong Customer Authentication (SCA): Two-factor and biometric authentication have become industry standards and user expectations at this point.

- Token Lifecycle and Secrets Management: You need to rotate your API tokens and use secure vaults like AWS Secrets Manager for credential storage.

- GDPR, PSD2, and Other Regulatory Considerations: Consent, minimal data storage, and logging are all required to various degrees globally, so make sure you are compliant with regional regulations.

- API Security Testing and Monitoring Tools: You always need to test and monitor with tools like OWASP API security or others, and keep track of these tests for potential audits.

Common Challenges of Implementing Fintech API Development

While hiring experienced developers from a company like Trio can mitigate most issues, knowing where most people tend to go wrong can also help you avoid some of the most common mistakes, regardless of the type of API you are creating.

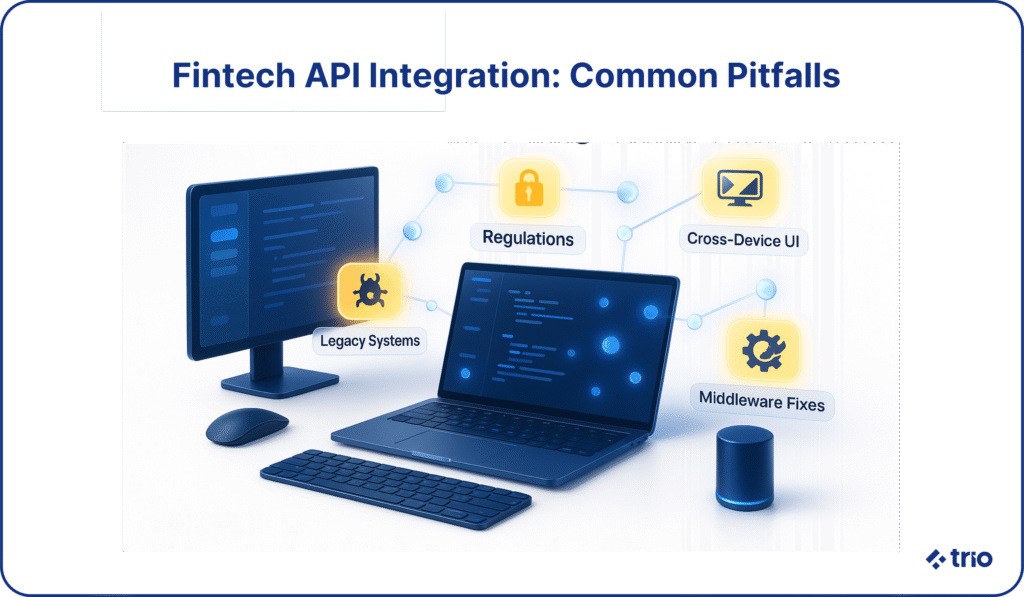

Some obvious challenges we’ve already alluded to include things like data privacy and regulations, which you need to research before you start developing.

If you are working with banks or similar institutions with outdated legacy systems, you may also struggle with API integration and may have to use some sort of middleware. This is usually worthwhile if these institutions are larger, but you need experience to deal with these issues quickly and efficiently.

You’ll likely be using your APIs across different ecosystems and devices. Be prepared to standardize your error formats, response structures, and anything else that may have some sort of visual response that could be affected by factors like screen size.

How to Unlock the Full Potential of Fintech APIs

If you are reckless with APIs, you may end up paying for a bunch of features you don’t use or that don’t work adequately for your financial apps. So, how can you unlock the full potential of your APIs?

First, make sure that they align with your business goals, whether that’s onboarding, user experience, providing you with a new form of monetization, or anything else. Once you find the right API or decide to build it yourself, you then need to consider a scalable, modular microservices architecture so you don’t limit yourself now or later.

To ensure your team is happy with the addition, make sure to encourage collaboration. This will also assist them in learning new skills if required. If you are sharing your API externally, include clear onboarding steps for developers, and perhaps offer a variety of pricing options, like usage-based options and subscriptions with a limited free option.

Finally, don’t forget to measure performance so you can make adjustments as you need to and keep your API relevant.

API development for fintech apps can be a game-changer, but only if you do it right. In many cases, you may benefit from leveraging fintech APIs that already exist, but as your company continues to grow, building your own API can promote the scalability of fintech solutions without redundant coding practices.

If you think an API is the right choice for your fintech project, you are in the right place. Trio’s experienced fintech developers will be able to help you integrate an existing API or even build one of your own that is optimized for scalability, security, and compliance. Our focus on the fintech industry has allowed us to build niche expertise that you can trust!

For more information or to get started connecting with a developer through staff augmentation or outsourcing, schedule a free consultation.