The idea of a single app handling all your financial needs once sounded far-fetched. Yet that’s exactly where fintech is heading.

The fintech super app brings payments, savings, credit, investing, and even lifestyle features together on one seamless platform.

Across Asia, this model has already reshaped how people manage money.

In Europe and the U.S., it’s still emerging, but fast.

As banking and fintech companies race to build connected ecosystems, the super app isn’t just another digital trend. It may define the next decade of financial services.

Let’s explore what makes super apps different, how they’re transforming the fintech landscape, and what it takes to build one that customers actually trust. If you need specialist fintech developers to advise on your own products, you are in the right place.

Understanding the Super App Concept

A super app is almost like an ecosystem.

Instead of offering one or two financial products, a super app combines various financial services into a single platform where users can spend, save, invest, borrow, and pay bills without switching between multiple apps.

What Makes a Fintech Super App Different?

The difference between a super app and a traditional fintech app lies in integration.

While most fintech apps serve a narrow function, such as digital payments or trading, super apps provide an all-in-one experience.

They bring together multiple services like mobile payments, insurance, investment platforms, and personal finance tracking under one digital roof.

A well-designed fintech super app creates a connected financial ecosystem where users move naturally between services. Pay a bill, get cashback, invest it in a savings product, and then use the returns for a microloan, all without leaving the app.

This is what makes the super app experience so sticky.

The challenge, however, is that combining various services creates complexity.

Apps must maintain performance, meet financial regulations, and deliver consistent UX.

That’s why fintech super apps are designed around modular architectures and open APIs, letting developers integrate new functions without breaking what already works.

Core Features and User Experience

Most successful fintech super apps offer three defining features.

First, a unified financial experience. Users can see their full financial picture, balances, debts, and investments on one platform.

Second, embedded services. Digital payments, lending, and wealth management are often pre-integrated, so users can move funds instantly between accounts.

And third, personalization. Using AI and data analytics, super apps personalize insights, recommend tailored products, and even nudge users toward healthier spending habits.

The Ecosystem Model: Partners, APIs, and Open Banking

No super app stands alone. The ecosystem model depends on partnerships between banks, payment networks, and third-party service providers.

Open banking regulations in the EU and UK have accelerated this shift by requiring financial institutions to share data securely through APIs.

This model lets fintech companies integrate financial and lifestyle services, from more typical banking services to retail discounts and travel insurance, within one platform.

The result is a financial ecosystem that feels seamless for users but is powered by a network of specialized providers.

For fintech developers, building that ecosystem means balancing speed and security. API gateways must remain watertight while allowing third-party access.

At Trio, our fintech engineers often help clients design these integrations safely, ensuring compliance with open banking and data protection rules.

The Rise of Super Apps in Banking

Super apps are not new.

The concept first took hold in Asia, where apps like WeChat and Alipay turned messaging tools into multi-service ecosystems. In banking, this approach is now spreading globally.

Why Super Apps Are Emerging Now

Several factors are driving the rise of fintech super apps.

Consumers expect digital platforms to work across needs as well as functions. Younger generations treat banking as a service, not an institution, and want financial tools that fit naturally into their digital lifestyles.

Open banking has also made integration easier, as we have already mentioned.

Regulations like PSD2 and PSD3 enable fintechs to connect directly with banks, letting users manage multiple accounts through one interface.

Combine that with advances in mobile technology, faster cloud infrastructure, and AI-driven personalization, and the timing feels right.

It’s also worth noting that traditional banking systems appear to be reaching a limit. Many established financial institutions are struggling to keep up with user expectations around seamless digital experiences.

The super app model offers a faster path to relevance.

Global Momentum and Market Trends

The rise of super apps started in Asia, but the momentum is spreading.

Alipay, WeChat Pay, and Grab have become household names, offering everything from digital payments to loans, insurance, and lifestyle perks.

In Latin America, apps like Nubank and Mercado Pago are reshaping consumer finance by making it mobile-first and inclusive.

Europe and the U.S. are catching up. Revolut, Paytm, and Monzo are expanding from single-product fintech apps to full-fledged financial super apps.

Each is building its own super app ecosystem, one platform for a range of financial services.

This global trend signals a shift from fragmented fintech tools to connected financial platforms.

Building a Successful Fintech Super App

Designing a financial super app involves building an architecture that can adapt, scale, and maintain user confidence.

Integrating Multiple Financial Services

As mentioned already, integration is at the heart of every super app.

Payments, lending, wealth management, and insurance must work together seamlessly. APIs handle the connectivity, but orchestration is what makes it feel unified.

Embedded finance plays a major role here.

By partnering with traditional banks, fintech companies can offer credit, accounts, or savings products directly within their own platform.

It’s a mutually beneficial model: fintechs expand their range of financial services, and banks gain digital distribution without building everything themselves.

The Role of Developers and Technical Partners

You need skilled developers who understand both code and compliance. Integration across open banking APIs, regulatory frameworks, and diverse data sources requires deep domain knowledge.

At Trio, we’ve seen firsthand how fintech super apps are designed from the ground up for scalability and compliance.

Our developers help fintechs integrate complex financial systems securely, ensuring that each service, from payments to lending, meets both technical and regulatory expectations.

Strategies for Engagement and Retention

Once the ecosystem is live, keeping users engaged becomes the next challenge.

Many super apps use gamified loyalty programs, personalized dashboards, and small incentives to keep customers active.

AI-driven analytics can identify user patterns and offer timely nudges, such as recommending an investment product right after a paycheck arrives.

But beyond clever engagement, long-term retention depends on credibility.

Apps that educate users through financial coaching tools or provide transparent insights into spending behavior tend to build stronger loyalty.

Building Secure, AI-Enabled Infrastructure

A true fintech super app runs on microservices, a modular, cloud-native architecture that allows updates without downtime.

API gateways connect external partners securely, while encryption and multifactor authentication protect user data.

AI in fintech adds another layer, monitoring transactions for real-time fraud detection and producing insights that personalize offers.

Still, developers must ensure models remain ethical and explainable.

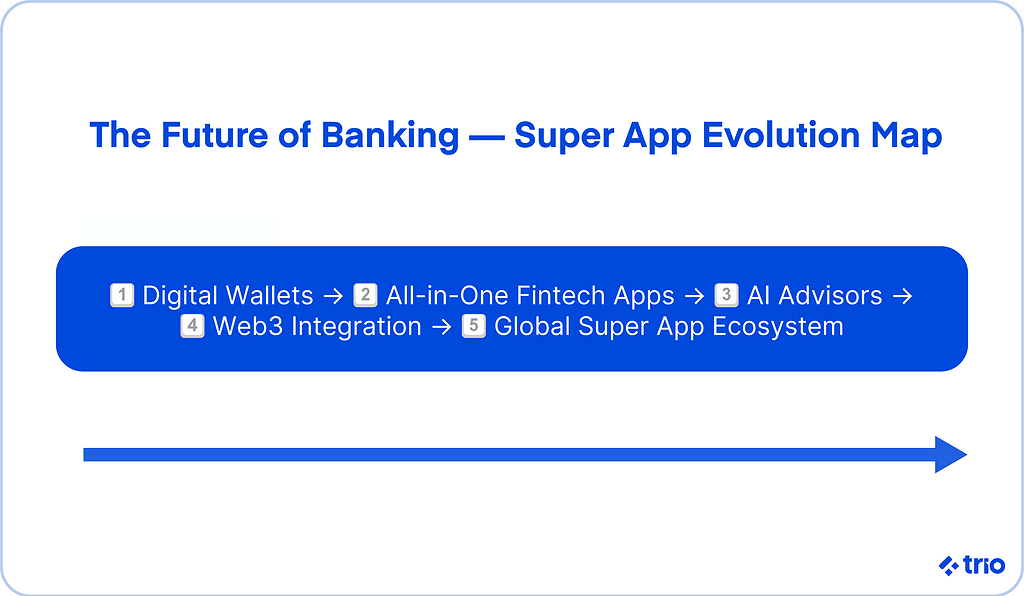

The Future of Banking Super Apps

The future of financial services will likely be shaped by super apps.

As boundaries blur between financial and lifestyle platforms, the next wave of competition will come from companies that can combine trust, usability, and ecosystem depth.

AI-Powered Financial Advisors

Super apps are already experimenting with AI-powered personal financial advisors, virtual assistants that can forecast spending, recommend savings goals, and even negotiate recurring bills.

These tools have the potential to democratize financial planning, especially for younger users entering the financial system for the first time.

Expansion Into Non-Financial Services

The next generation of super apps won’t stop at finance. Many are branching into travel, retail, health, and entertainment.

By integrating third-party services, they become daily lifestyle hubs that also handle financial transactions.

The super app model, once limited to fintech, is slowly becoming the blueprint for the entire digital economy.

The Convergence of Web3 and Fintech

Web3 technologies could further expand what super apps offer.

Tokenized assets, decentralized lending, and blockchain-based identity systems are being tested for integration into fintech ecosystems.

While adoption appears gradual, it seems clear that future apps will combine both centralized and decentralized finance in one platform.

The Regulatory Path Forward

As super apps grow, so does the attention from regulators.

Financial authorities across the EU, Asia, and the Americas are working to define how these all-in-one platforms fit into existing laws.

Licensing requirements under PSD3, data ethics under GDPR, and cybersecurity mandates under DORA will shape how fintech super apps operate in Europe.

In Asia and Latin America, regulators are emphasizing interoperability and data sovereignty.

Global coordination remains challenging.

A super app operating across regions must manage multiple licenses, adhere to varied anti-money-laundering frameworks, and maintain clear audit trails for every financial transaction.

Conclusion

The fintech super app is a redefinition of what banking and financial services can be. One app, one ecosystem, and one experience.

For fintech companies, the opportunity is enormous but complex.

Success will depend on thoughtful integration, secure architecture, and a genuine understanding of user needs.

At Trio, we help fintechs build scalable, secure ecosystems that can grow into tomorrow’s financial super apps. From API integration to AI-driven compliance systems, our developers bring the technical depth and fintech fluency that make ambitious platforms work.

To find out more about hiring with us, get in touch!

FAQs

What is a fintech super app?

A fintech super app is a single platform that combines multiple financial services like payments, lending, and investments into one seamless experience for users.

How does a super app differ from a traditional fintech app?

A super app differs from a traditional fintech app by integrating various financial services and lifestyle tools in one app, rather than focusing on a single product or feature.

Why are super apps becoming popular in banking?

Super apps are becoming popular in banking because customers expect integrated digital experiences where they can manage all financial transactions in one app.

What are the biggest challenges in building a super app?

The biggest challenges in building a super app include ensuring regulatory compliance, maintaining data security, and earning user trust while integrating multiple services.

How can financial institutions benefit from the super app model?

Financial institutions can benefit from the super app model by reaching more customers through partnerships, embedded finance, and open banking integrations.