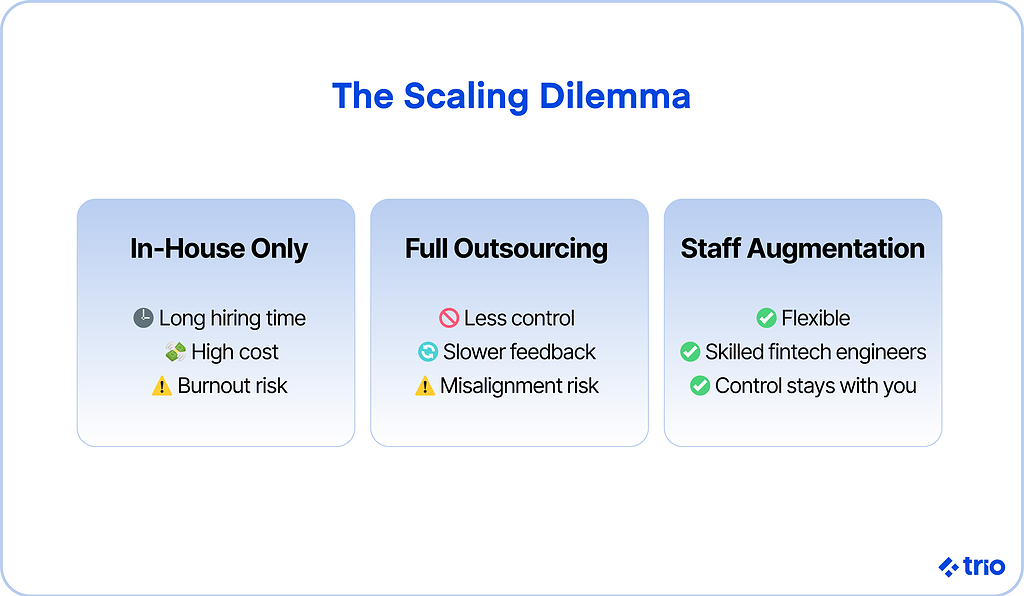

Scaling software development teams in fintech sounds simple on a whiteboard and turns messy in real life.

You may assume the first 20 engineers should be in-house; that feels safe. Yet as your roadmap expands, bandwidth thins, hiring fintech developers becomes more difficult, and critical work (KYC/AML features, PCI tasks, that long-promised iOS parity) starts slipping.

Hiring the perfect fit can stretch into months, and in the meantime, competitors appear to ship faster with smaller internal teams. At the same time, outsourcing your talent pool comes with its own risks.

None of this guarantees failure, but it does make success feel further away than it should.

Fintech engineering team staff augmentation offers a pragmatic middle path.

Instead of handing an entire project to a dedicated team of outsourced developers, you augment your fintech team by embedding vetted specialists who work inside your process and tools.

You maintain control over direction while acquiring the exact skills you’re missing, whether that’s payments integrations, fraud modeling, or mobile engineering. You’ll also decrease the workload of your full-time employees, so your MVP can scale without a bloated headcount that’s not possible to maintain as a startup or smaller company.

If you decide to bring in outside help, hiring fintech engineers, software developers, and project managers who understand compliance, data security, and the pace of release cycles is likely to matter more than sheer numbers.

Trio can help here. We have a host of fintech specialists on hand so that you can add the right people, at the right time, in a way that preserves your product’s momentum and your team’s sanity.

Our individualistic approach and specialized skill set have allowed us to maintain a 97% placement success rate.

Understanding Team Augmentation in Fintech

Team augmentation in fintech sits somewhere between hiring full-time staff and outsourcing an entire project.

The idea is pretty straightforward. Instead of building a bigger in-house team or handing everything off to an agency, you temporarily extend your team with people who already have the skills you’re missing, usually through a hiring firm that offers staff augmentation services.

The hiring model works well for many and is expected to reach $857.2 billion by 2031. But, is it the right option for you?

What is Team Augmentation?

Team augmentation is essentially a staff augmentation model that lets fintech companies plug in external talent where they need it most.

With Trio, that might mean bringing on a compliance-focused backend developer or a mobile engineer who’s already familiar with payments APIs.

The key difference is that these people don’t swoop in to deliver a project and then disappear. They work alongside your own developers, attend the same standups, and help chip away at the same backlog.

That integration is what allows you to keep control while filling the gaps that might otherwise stall your roadmap.

Benefits of Team Augmentation in Software Development

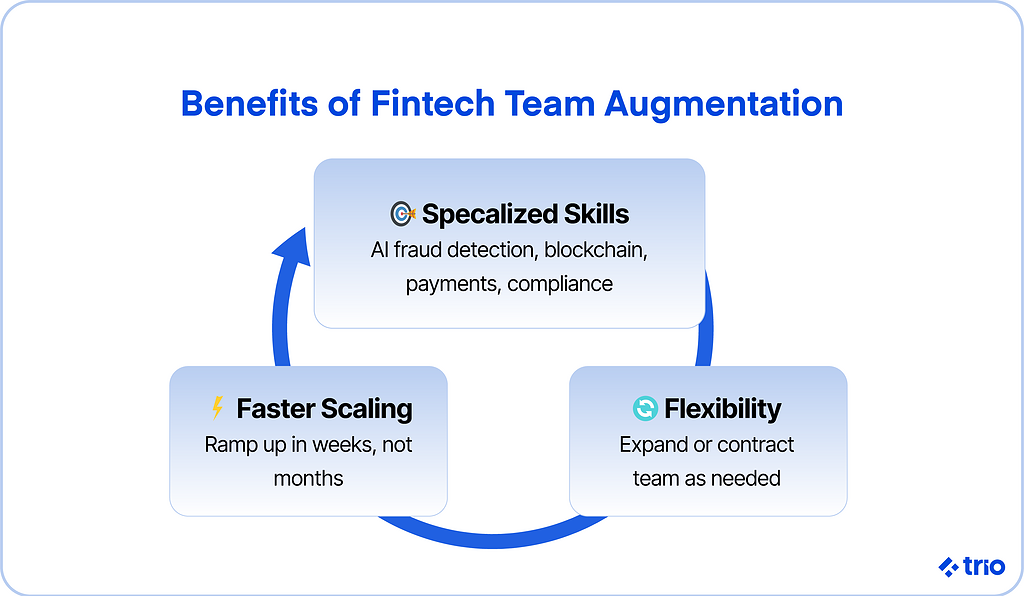

The benefits are more apparent if you’ve ever spent months trying and failing to hire a senior fintech engineer. Team augmentation means you can:

- Access specialized skills: not just general developers, but people with experience in AI-driven fraud detection, blockchain, or regulatory reporting.

- Scale quickly: spin up extra capacity when a deadline looms or a compliance audit approaches.

- Stay flexible: adjust your team size without the expense or commitment of full-time hires.

It’s also worth pointing out what hiring an augmented team does not allow.

Team augmentation won’t replace the need for long-term hiring if you’re building a core engineering culture.

But for periods of intense growth or crunch-time delivery, it can be the difference between shipping on time and missing market opportunities.

How Team Augmentation Differs from Outsourcing

Outsourcing often means handing over an entire project to another company.

That approach can work, but it comes with trade-offs: less day-to-day visibility, slower feedback loops, and a real risk of misalignment with your product vision.

Team augmentation, by contrast, keeps the project in your hands.

You’re still the one steering the roadmap. The additional fintech talent adds velocity, working under your managers and alongside your staff.

If you are a fintech firm founder, that distinction matters, especially when compliance or security concerns make it uncomfortable to send everything to an external team.

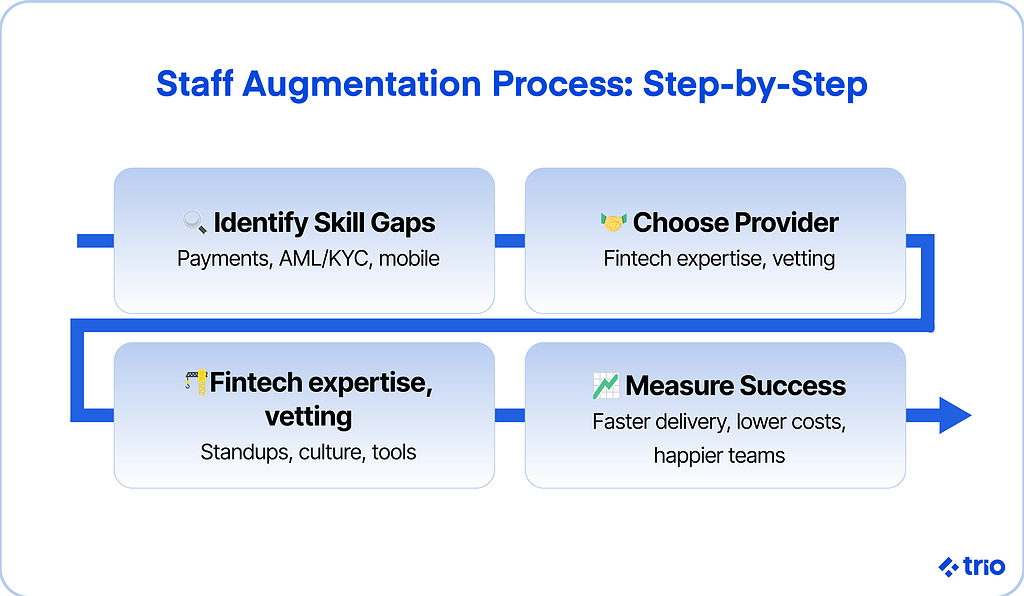

The Staff Augmentation Process: A Step-by-Step Guide

Staff augmentation is a process, and skipping steps increases the risks of misalignment, wasted money, or unhappy teams. A rigid formula won’t always work, but it can guide you to ensure your hires meet your company’s needs.

Vetting and Choosing the Right Partner

Not every provider is equal, and a bad fit can cost more than doing nothing. You’ll want to weigh a few factors:

- Do they have genuine fintech experience, or are they just a general IT body shop?

- Can they surface engineers with the niche skills you’re missing (say, blockchain audits or mobile security)?

- What do their past clients say, not just in glossy testimonials, but in specifics about delivery and culture fit?

Case studies and references are helpful, but you’ll also want to test whether their process for sourcing and screening talent matches your expectations.

Some providers shuffle resumes; others pre-vet with technical interviews and scenario testing. That difference will likely matter when deadlines are tight.

Onboarding and Integration

Even the most qualified engineer needs a proper ramp-up to ensure they fit into your extended team.

Companies sometimes treat augmentation as plug-and-play, but without thoughtful onboarding, those hires won’t be immediately effective, and you risk mistakes caused by miscommunication.

At a minimum, introduce new staff to your culture, development workflow, and current priorities. Pair them with an internal mentor who can explain not just “how we do things” but “why.”

Set clear channels for daily communication.

It may sound like overkill for a short-term engagement, but in practice, these steps pay back fast.

Engineers who understand context contribute sooner, and you spend less time revisiting avoidable missteps.

In many fintech settings, where compliance mistakes can snowball, that alignment is more than a nice-to-have.

Key Considerations for Choosing the Right Staff for Scaling

Staff augmentation only works if you know what problem you’re solving.

You can’t just expand your tech team without thinking through whether they actually need depth in payments, compliance, or data science. You’ll end up with more people, but the same bottlenecks.

Identifying Your Software Development Needs

Start by identifying what’s slowing you down.

Is it a missing skill set, like React Native or blockchain audits? Or is it the need for someone who understands how KYC/AML rules shape product design?

Fintech teams in particular may need engineers familiar with PCI standards, fraud detection models, or banking APIs.

Getting specific about gaps matters so you don’t risk filling seats with generalists when what you really need are specialists who can move the roadmap forward.

Evaluating Team Augmentation Service Providers

Choosing a provider requires great care, especially with all the options available in the software development industry. You’ll want to know:

- Do they understand fintech or just generic SaaS?

- How do they screen engineers: quick resume matching, or deeper technical and cultural vetting?

- What’s their track record with deadlines, compliance-heavy projects, or scaling MVPs into production systems?

Pricing transparency and cultural fit aren’t minor details either.

A provider who initially appears inexpensive but drags out onboarding may cost more than a pricier one who delivers quickly.

Assessing the Skills of Augmented Team Members

Don’t skip due diligence on the individuals themselves.

Run technical interviews. Set small coding challenges that reflect your stack. Check whether they’ve worked on similar fintech projects, not just enterprise apps in general.

And perhaps most overlooked: pay attention to communication.

Someone who’s technically sharp but can’t collaborate in your daily standups is unlikely to accelerate delivery. Staff augmentation succeeds when engineers feel like part of the team, not just temporary contractors.

We ensure that all our developers possess the necessary soft skills to excel in your team. If we identify a gap, we provide the training to fill it.

Key Roles for a Fintech Augmented Team

Not every role benefits equally from augmentation. Some positions require long-term continuity and deep product ownership, while others lend themselves to short bursts of specialized expertise.

In fintech, a few areas tend to stand out.

Product and UX Design

Design isn’t just about making an app look pretty, especially in finance.

If users don’t trust your interface or find it confusing, they’ll abandon it fast.

Augmenting your team with designers experienced in user research, accessibility, and financial workflows can help close that gap.

Backend and Frontend Development

Most fintech companies eventually hit a wall where feature demand outpaces backend and frontend capacity.

Augmented engineers here can help you catch up, whether it’s building real-time transaction processing, integrating with banking APIs, or smoothing out clunky dashboards.

This is one of the most common uses of augmentation because it directly affects delivery speed.

Cybersecurity and Compliance

Few founders enjoy thinking about compliance, but ignoring it isn’t an option. Regulations like PCI DSS, PSD2, or GDPR come with serious consequences if not considered.

Augmenting with security engineers or compliance specialists can save painful remediation later. You also avoid shutdowns and loss of trust later.

Roles in Data Science and Machine Learning

Data science is easy to underestimate until fraud detection fails or credit scoring models start producing noise.

Augmented data scientists and ML engineers can help build models that actually fit financial data, from anomaly detection in payments to customer personalization.

These roles are more challenging to hire for permanently, which makes them prime candidates for augmentation.

Implementing Staff Augmentation in Your Development Process

Bringing in augmented engineers is just the start of speeding up your software development project. As we have already mentioned, how you fold them into your workflows will make the difference between smooth acceleration and added friction.

The Staff Augmentation Process Explained

The process usually begins with communicating where you are short on skills and what kind of expertise will actually move the roadmap forward.

Once that’s defined, a partner can help you source and screen candidates.

From there, augmented engineers join your existing team, not as outsiders running a parallel track, but as contributors embedded in your day-to-day development cycle.

We’ve already discussed how daily standups, sprint planning, and code reviews are where alignment happens.

Regular check-ins are less about micromanaging and more about ensuring that both internal and external engineers are working towards a common goal.

It’s tempting to think of augmentation as a quick fix, but companies that treat it as an ongoing collaboration tend to see better results. Many of our developers have been with their assigned companies for years.

Integrating an Augmented Team into Existing Structures

Integration is where many teams stumble.

Without clear reporting lines or communication channels, augmented staff can focus on technically delivering, but not be aligned with company goals.

A smoother path often includes:

- Assigning a buddy or mentor from the in-house team.

- Setting a consistent cadence for updates and retros.

- Giving augmented staff ownership over specific deliverables, so they’re accountable and invested.

When engineers feel like part of the team rather than bolt-on labor, you get stronger collaboration and fewer misunderstandings.

Best Practices for Managing an Augmented Team

Managing augmented engineers isn’t wildly different from working with in-house staff, but there are a few nuances.

Set expectations clearly at the start: what success looks like, how feedback is delivered, and what the boundaries are.

Regular performance reviews help catch issues early.

And don’t underestimate the power of recognition. Even short-term engineers contribute more when they know their work is valued.

The common thread across successful augmentation efforts is mindset: if you treat augmented staff as expendable outsiders, that’s how they’ll perform. If you treat them as trusted teammates, they’re far more likely to deliver at the level you need.

The Role of AI in Fintech Software Development Staff Augmentation

AI has become a buzzword, but in fintech, it’s more than hype.

Done well, it can speed up development, tighten security, and even lighten the compliance burden. The catch is that most in-house teams don’t have deep AI expertise, which is where augmentation can fill the gap.

Leveraging AI for Enhanced Software Development

AI isn’t about replacing developers, at least not yet

More often, it handles the repetitive or error-prone tasks: scanning code for vulnerabilities, generating unit tests, or spotting anomalies in transaction flows.

For fintech companies, those efficiencies may translate into faster release cycles and fewer compliance headaches.

Augmented engineers who already know their way around AI tools bring an added edge. They can integrate fraud detection models, automate parts of the credit scoring process, or fine-tune risk management systems.

The value here is less about shiny new features and more about making existing processes more innovative and more reliable.

AI Tools to Support Your Augmented Team

The toolset is growing fast. Code review assistants can flag issues before they reach QA. RegTech platforms are starting to cross-check code and data handling against frameworks like PSD2 or PCI DSS in near real time.

Even testing platforms now use AI to auto-generate cases you might not think of manually.

These tools don’t replace oversight, but they can shift engineers’ time toward building rather than babysitting systems.

Future Trends: AI and Staff Augmentation in Fintech

Looking ahead, AI will likely move beyond support tasks into more complex and critical applications. This might include generating usable code blocks, simulating customer behavior, or running compliance checks continuously in the background.

That doesn’t mean every fintech needs an AI-first team today. Still, it does suggest that having access to augmentation partners who can supply AI-capable engineers will become a competitive differentiator.

The takeaway? AI in fintech isn’t just about speed. It’s about staying ahead of regulatory changes and customer expectations.

Case Studies: Successful Fintech Team Augmentation

Case studies make this less theoretical. They show where augmentation actually made the difference, and where it might for you.

Real-world Examples of Effective Team Augmentation

Take Poloniex, a global crypto exchange.

They were struggling to find senior mobile developers in the U.S. to bring their iOS and Android apps up to speed with the web platform. Instead of dragging out a six-month hiring cycle, they added vetted engineers through augmentation.

The result? Faster delivery, lower costs, and mobile apps that finally matched customer expectations.

Lessons Learned from Fintech Team Augmentation Projects

What stands out across these stories is that augmentation only works when there’s real integration.

Engineers need clear roles, steady communication, and a sense that they’re contributing to the same mission. Without that, they risk drifting into contractor mode, technically delivering but never really moving the needle.

Augmentation is less about extra hands and more about finding the right partner, one who knows the fintech space and can deliver people who fold naturally into your culture and processes.

Outcomes and Metrics of Success

Talking about speed or flexibility sounds nice, but what founders and CTOs really want to know is whether augmentation moves the needle. The good news is, you can measure it.

Some of the most evident signs include:

- Time to hire: Instead of a 3–6 month recruitment slog, augmented engineers can often be onboarded in weeks.

- Backlog velocity: feature delivery picks up, and deadlines stop slipping.

- Compliance milestones: audits and regulatory checks are completed on time, which is non-negotiable in fintech.

- Cost efficiency: fewer full-time hires, less recruitment overhead, and less money lost to delayed launches.

- Quality metrics: bug rates drop, systems stabilize faster, and customers complain less.

- Team morale: internal engineers report less burnout and more focus on work that excites them.

Tracking these KPIs consistently doesn’t just prove ROI, it gives you the confidence to scale augmentation up or down without guesswork.

Conclusion

Scaling software development in fintech is always a balancing act. You’re under pressure to ship faster, stay compliant, and keep teams motivated, all while struggling to attract senior talent.

Traditional hiring often can’t keep pace, and complete outsourcing can feel like giving up control.

Staff augmentation offers a middle path. By embedding experienced engineers into your team, you close skill gaps, accelerate delivery, and stay in the driver’s seat.

Case studies from companies like Poloniex show what’s possible: faster launches, compliance handled on schedule, and growth unlocked without ballooning headcount.

You don’t need 20 in-house engineers to scale effectively. You need the right engineers at the right time, working alongside your team.

Staff augmentation helps you get there, giving fintech companies the bandwidth and expertise to stay agile in a fast-moving market.

If you’re ready to explore how staff augmentation can accelerate your roadmap, get in touch with Trio. We’ll connect you with vetted fintech engineers who can embed directly into your team and help you deliver faster, safer, and smarter.

FAQ

What is team augmentation in fintech?

Team augmentation in fintech involves embedding external engineers into your in-house team to close skill gaps and accelerate delivery, without outsourcing entire projects.

How does staff augmentation differ from outsourcing?

Staff augmentation differs from outsourcing because staff work as part of your existing team, while outsourcing delegates an entire project to a separate provider.

When should fintech companies use staff augmentation?

Fintech companies should use staff augmentation when facing growing backlogs, compliance deadlines, or MVP-to-scale transitions where hiring full-time talent would take too long.