If you work in fintech or broader financial services, you already know how unforgiving this industry can be.

Customers expect instant payments and zero downtime. Regulators expect documented operational resilience, rigorous compliance controls, and the ability to prove that you can stay online during an outage at any cloud service provider. Investors expect a disciplined cloud strategy and clear plans for scale.

Missing the mark in any of these areas is expensive and, frankly, embarrassing.

That is part of why multi-cloud strategies have moved from an interesting concept to a widely adopted approach in financial services.

We see this shift happening across neo-banks, lending platforms, digital payment providers, and even more traditional banks that are modernizing legacy infrastructure.

At Trio, our team of specialist developers has helped fintech companies navigate this journey, and one thing keeps coming up: multi-cloud done well is all about good engineering habits, practical risk management, and choosing what truly serves your customers.

Let’s look at everything you need to know about multi‑cloud strategies for fintech resilience and compliance.

Understanding Multi-Cloud in Financial Services

Before getting into implementation details, it is worth exploring the meaning of multi-cloud within this industry.

Most fintechs are not just spinning up workloads across multiple cloud providers to avoid vendor lock-in. The real intent is resilience, control, and the flexibility to operate across multiple environments and jurisdictions.

A strong multi-cloud architecture acknowledges the reality that cloud outages happen, regulations evolve, and regional rules around data sovereignty can be strict. Spreading workloads across different cloud providers gives you optionality when things shift, and things always shift in finance.

What Multi-Cloud Means for Banks and Fintechs

You will see different patterns across the sector. Some companies adopt a multi-cloud approach early to leverage strengths from AWS, Azure, and sometimes Google Cloud. Others start on one cloud, then expand once regulatory obligations or global reach require it.

We have also worked with firms that pair public cloud with private or hybrid cloud setups for legacy banking systems or ultra-sensitive data.

Regardless of how you get there, the idea remains similar. You are distributing workloads across multiple cloud environments to reduce dependency, support business continuity, and satisfy regulatory requirements around operational resilience and compliance obligations.

You may not need two production clouds from day one, but it is smart to plan like you eventually will.

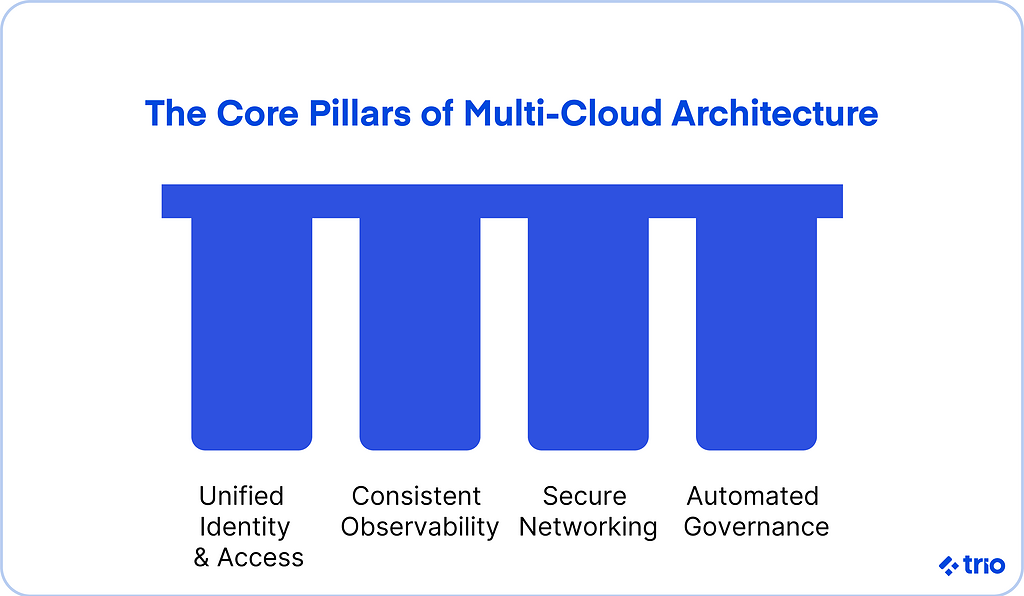

Key Components of Multi-Cloud Architecture

A multi-cloud strategy tends to include consistent identity and access rules, shared observability tooling, secure networking that works across different cloud providers, and automation that keeps infrastructure configuration aligned.

Instead of building two entirely separate tech stacks, you are trying to create one cloud architecture that can exist in more than one place.

Where we have noticed companies struggle most is usually with data.

Keeping data consistent, auditable, and recoverable across multiple clouds requires planning, tooling, and a willingness to test failover instead of just talking about it.

Cloud Types and Their Roles

Most financial organizations still lean on public cloud to gain elasticity, geographic reach, and access to powerful AI tools.

Some workloads remain in a private or hybrid cloud model for regulatory or operational reasons.

And then you have industry-specific options like Azure for financial services or AWS offerings designed around banking workloads, which appear to make multi-cloud adoption smoother by including built-in governance templates and financial-grade controls.

These trends suggest the industry is acknowledging reality. Not every workload fits neatly into one cloud.

Interoperability and Integration Requirements

The thing people sometimes underestimate is that multi-cloud is like running multiple cities that share infrastructure.

Identity must be unified, networking secure, audit trails consistent, and automation repeatable across environments.

If you treat each platform like a silo, you invite complexity and multiply the risks associated with cloud deployments, not to mention you create a need for people with different skill sets.

Benefits of Multi-Cloud Strategies in Financial Services

Done thoughtfully, multi-cloud strategies can enhance resilience, performance, and even investor confidence. There is no need to oversell this. The benefits are real, but they are earned, not automatic.

Operational Continuity and Reduced Outage Risk

Financial services teams talk a lot about operational resilience. Unlike other industries, downtime is not just inconvenient. Instead, it can trigger regulatory action, headlines, and incident reporting obligations.

A multi-cloud environment lets you distribute applications across multiple cloud platforms so you can continue operating even if one cloud experiences an outage.

That continuity matters.

There were well-known outages in recent years that disrupted single-cloud fintechs. Those events quietly accelerated multi-cloud adoption across the sector.

Vendor Independence and Cost Awareness

There is a practical financial angle here. Using multiple clouds gives you room to negotiate pricing, choose services that make the most sense for each workload, and avoid vendor lock-in that traps you with one cloud provider’s roadmap.

It is not always about saving money, though some companies do reduce cloud costs as a by-product of better architecture.

For others, it is about cost optimization and flexibility rather than chasing the cheapest compute unit.

We have seen teams adopt FinOps practices much faster once they move into multi-cloud, partly because managing multiple environments forces discipline. Tagging improves. Monitoring improves. Budget conversations become grounded in data, not hope.

Global Scale and Data-Locality Confidence

Fintechs increasingly rely on cloud computing to scale globally.

That creates a challenge when you must meet data residency rules in Europe, Asia, or other regions with strict regulatory requirements.

A multi-cloud approach allows you to place data and workloads across multiple cloud providers or regions without running into compliance conflicts.

We’ve seen businesses face this when expanding into regions governed by frameworks like GDPR or the Digital Operational Resilience Act.

Planning ahead here saves pain later. Hiring fintech developers who understand the industry’s compliance landscape can set you up for success.

Better Performance and User Experience

Customers expect instant transfers, responsive apps, and reliable authentication.

Running workloads across different clouds lets you choose the fastest route for each user and avoid latency bottlenecks.

It also helps you leverage specific cloud capabilities for tasks like fraud detection, AI-driven analytics, AML, or high-volume payment processing.

Challenges That Come With Multi-Cloud Environments

Multi-cloud is powerful, but it is not simple. There are genuine tradeoffs that deserve acknowledgment.

Technical and Data Complexity

As we have already mentioned, synchronizing data across multiple clouds introduces latency considerations, version control challenges, and architectural decisions that will shape your recovery strategy.

It can take some trial and error to get it right.

Companies that rush often discover complexity they wished they had planned for earlier, particularly when dealing with stateful workloads across different cloud providers.

Security and Identity Consistency

Security frameworks must extend seamlessly across multiple cloud platforms. That means unified identity, shared secrets management, consistent encryption practices, and common access policies.

There is no room for fragile “one cloud has stronger controls than the other” gaps in fintech.

Regulators care about consistency, and mistakes often result in fines, not being able to provide services in certain areas, and even losses in user trust that are very difficult to correct.

Financial Governance and Cloud Cost Control

It may sound obvious, but running applications across multiple cloud platforms means you need clarity on where spend flows and why.

FinOps becomes essential. Without it, managing multiple cloud environments may create surprise bills rather than value.

Skill and Culture Shifts

Multi-cloud adoption brings a learning curve.

Engineers need cross-platform literacy. Architecture decisions require more deliberate thinking. Governance frameworks evolve.

At Trio, we have helped our fintech teams upskill through this process. These developers, in turn, assist the teams that they work with.

The teams that succeed tend to ask thoughtful questions instead of trying to force one cloud’s mindset onto another platform.

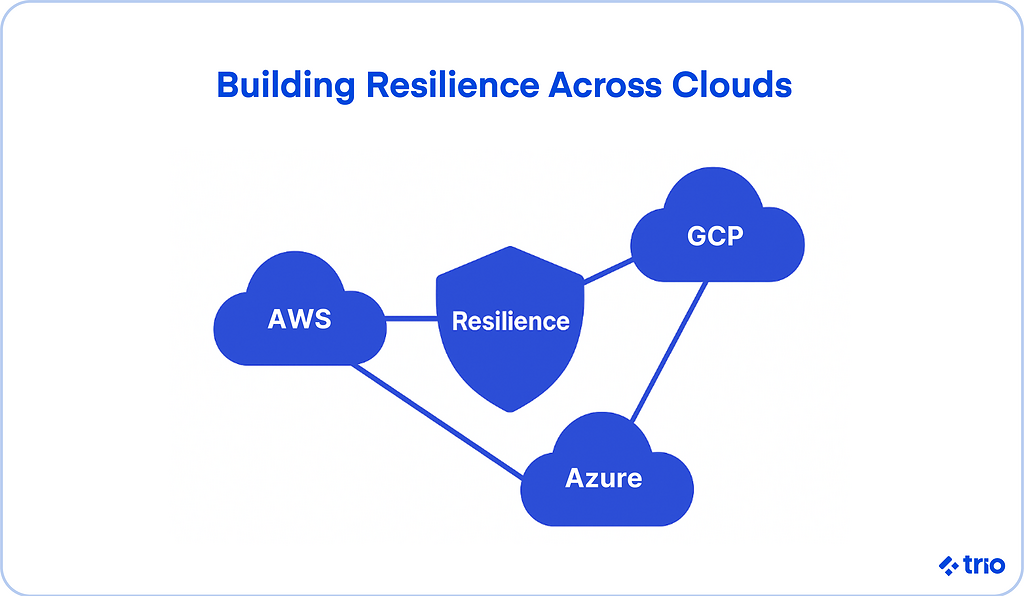

Enhancing Resilience Through Multi-Cloud Strategies

Achieving operational resilience in financial services is a regulatory requirement.

Multi-cloud resilience supports this expectation by ensuring the business remains functional during disruption.

Regulatory-Grade Operational Resilience

Regulators increasingly require proof that companies can maintain critical services during cloud outages, cyberattacks, or extreme stress scenarios.

Some jurisdictions expect documented exit plans if a cloud provider fails to meet obligations. Having an alternative provider ready at all times can help you meet regulatory expectations without scrambling when auditors ask for real evidence.

Deployment Approaches for Resilience

There are two paths companies often explore.

Active-active deployment handles workloads across multiple clouds at the same time, which delivers very strong uptime but demands careful architecture. Active-passive keeps capacity ready in a secondary platform for failover.

Decisions here depend on workload type, risk appetite, latency tolerance, and budget.

Data Protection and Recovery

Data replication matters a lot in this world.

Companies define recovery time and recovery point objectives and build data pipelines that support them.

Some use automation to fail over workloads across multiple cloud providers. Others lean on regional replication combined with secondary cloud failover.

Observability and Engineering Practices

Real-time insight across different cloud environments gives teams the confidence to respond quickly when issues arise.

Many fintechs adopt site reliability engineering practices to support this, pairing logs and telemetry with automation and on-call processes that keep operations smooth.

Navigating Compliance and Regulatory Requirements

Compliance in financial services is always evolving.

Multi-cloud adds another layer, though it also supports stronger operational resilience and transparency when handled correctly.

Core Compliance Priorities

Regulatory requirements around data sovereignty, operational resilience, auditability, and security controls remain central.

You should be able to demonstrate exactly how you enforce access control, encrypt data, track changes, and maintain audit trails across environments.

Without consistency, you risk audit findings. With it, you improve trust.

Regulatory Landscape

Bodies like the FFIEC, EBA, FCA, MAS, and OCC have guidance that touches on cloud concentration, cloud security, and outsourcing risk.

Europe’s Digital Operational Resilience Act adds another layer.

All signs point toward growing expectations for multi-cloud governance and reporting.

Compliance as a Continuous Practice

Some fintechs now embed compliance checks into cloud infrastructure pipelines, using automation to enforce security policies and generate audit evidence.

This avoids last-minute panic before examinations and lets engineering teams move faster with confidence instead of fear.

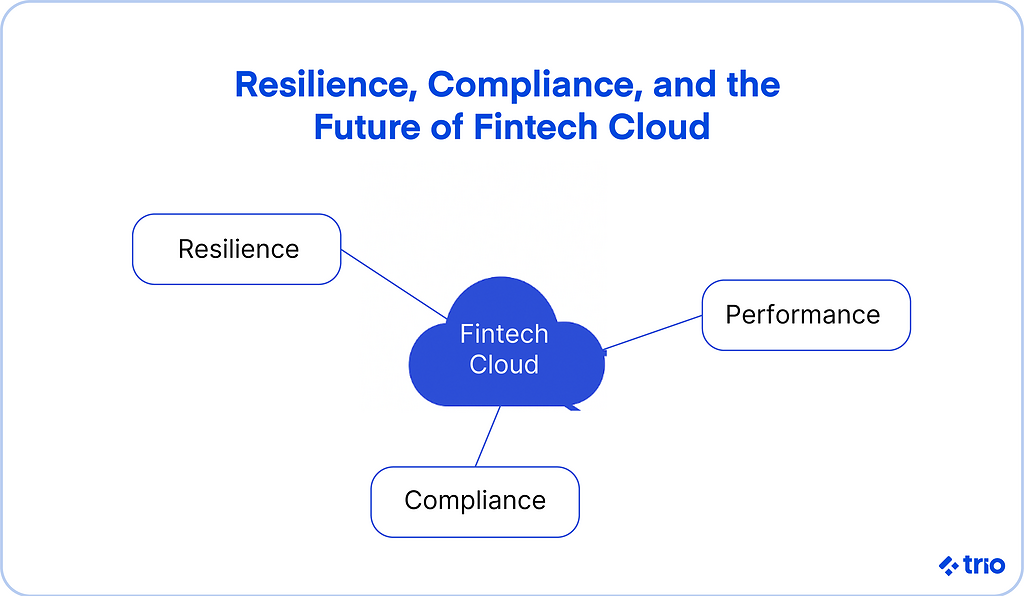

Future Outlook and Competitive Advantage

The future of multi-cloud in fintech appears to be shaped by AI adoption, global expansion, and more mature governance frameworks.

Cloud Adoption Trends

You can already see hybrid strategies combining public and private cloud, adoption of industry-tailored platforms like Azure for finance, and a push toward well-defined cloud governance.

As more financial services teams manage multiple environments, multi-cloud security and automation tools continue to mature.

AI and Intelligent Workload Placement

AI is starting to play an operational role in cloud management.

Systems can analyze usage patterns, predict cloud outages, optimize costs, and suggest where to run workloads across multiple clouds.

That has huge implications for agility and cost optimization.

Conclusion

Multi-cloud strategies in financial services exist because the sector demands resilience, regulatory compliance, and reliable performance across different cloud providers and regions.

Implementing a multi-cloud strategy will test your team and your architecture, although it will also strengthen your business.

If you want help evaluating your cloud infrastructure or planning how to adopt multi-cloud without unnecessary friction, reach out to us.

At Trio, we have supported fintech organizations at every stage of their cloud journey. Whether you are distributing workloads across multiple cloud platforms for the first time or modernizing an existing multi-cloud environment, we are happy to help you hire fintech developers for your needs.

FAQs

What is a multi-cloud strategy in financial services?

A multi-cloud strategy in financial services means using multiple cloud providers to enhance resilience, compliance, performance, and flexibility rather than relying on one cloud.

How do multi-cloud strategies support resilience in fintech?

Multi-cloud strategies support resilience in fintech by spreading workloads across multiple clouds, so a single outage does not disrupt services, and regulatory obligations for operational resilience are easier to meet.

Why do fintech companies avoid vendor lock-in?

Fintech companies avoid vendor lock-in to maintain flexibility, reduce risk tied to one cloud provider, and negotiate better pricing and performance options across different platforms.

How does multi-cloud improve compliance?

Multi-cloud improves compliance by allowing data to stay in specific regions, aligning with regulatory requirements, and giving teams built-in redundancy and audit trails across environments.

Is multi-cloud more expensive than using one cloud?

Multi-cloud can be more expensive than using one cloud if unmanaged, although many fintechs find costs stabilize or drop once FinOps practices help optimize costs across platforms.

Which cloud providers are most common in fintech multi-cloud setups?

The most common cloud providers in fintech multi-cloud setups include AWS, Azure, and Google Cloud, often combined with hybrid cloud environments or private workloads for regulated data.

Can small fintech startups adopt multi-cloud?

Small fintech startups can adopt multi-cloud, though many begin with one cloud and gradually expand as compliance, scale, or global operations make a second provider practical.

How does AI fit into a multi-cloud strategy?

AI fits into a multi-cloud strategy by helping optimize workload placement, predict outages, improve security, and support automated resource decisions across multiple cloud platforms.