AI models, particularly generative AI, are upending many industries. The AI revolution in finance is particularly notable. The use of AI and large language models has redefined how financial systems operate, making them more efficient, improving customer experiences, and reshaping the entire market.

With these massive changes, we’ve seen a myriad of opportunities and challenges emerge. So, let’s take a look at AI use in the global financial landscape and see where technology might play a role so that you can have a better understanding of how to prepare yourself for the changes to come and maybe even be able to lead the market, paving the way at the forefront of innovation.

Understanding the AI Revolution in the Financial Sector

The financial ecosystem has been stagnant for some time, with tradition and trust being some of the biggest focuses of companies involved. To understand the transformative potential of AI, we first need to understand what it is and how it is being integrated into the sector.

Defining Artificial Intelligence (AI) and Its Role in Financial Services

Artificial intelligence is a term used to refer to a wide range of technologies. This includes anything from machine learning to natural language processing and even predictive analytics. What binds all of these together is the fact that they let machines simulate human cognitive functions.

People like to use AI in finance for more intelligent decision-making, automation of tasks, and anything else that could reduce operational costs overall or enhance user experience by providing more value.

AI Applications Transforming Financial Services

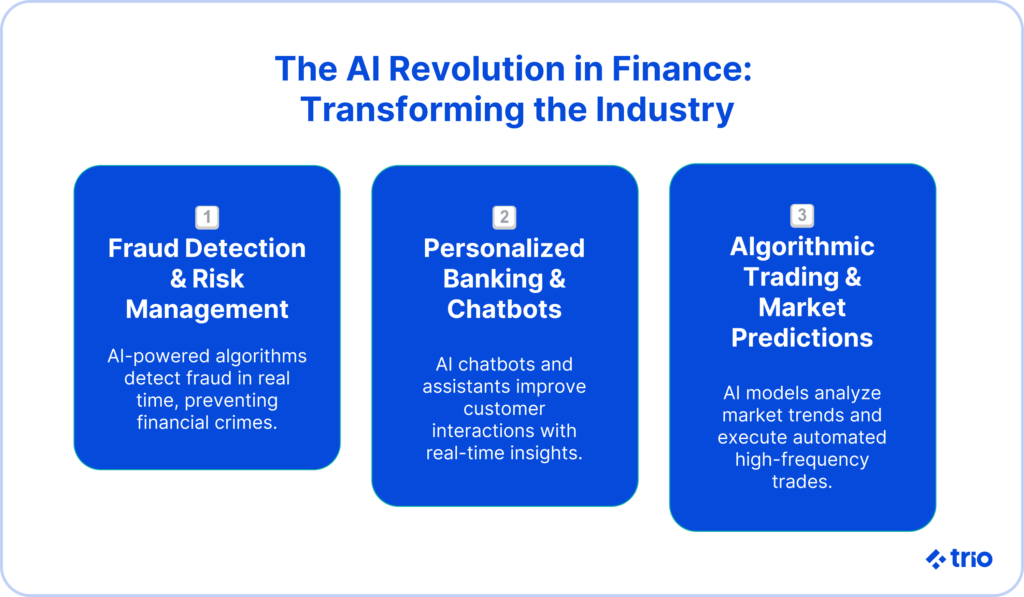

The integration of AI in finance is not only helping services become more efficient and faster, but also helping companies achieve transparency. Automation is also upending the industry, changing everything from unseen backend operations to client-facing services.

Some common examples include the ability to automate risk assessments and analyze larger quantities of data, making the assessments more accurate as well as less labor-intensive. The same is valid for fraud detection. Personalized financial products are also taking the industry by storm, reshaping the entire landscape. Let’s look at each of these in more detail.

Personalized Financial Advisory Through AI

Financial advice is one of the most client-facing ways in which people who have seen the application of AI affect the industry.

Robo-advisors are now possible, powered by incredibly sophisticated algorithms that can look at everything from the client’s financial history, their current circumstances, and whatever their future objectives are.

By processing large quantities of information, these robo-advisors can use advanced AI capabilities to create personalized investment strategies, democratizing access to expert financial guidance and promoting financial inclusion in a way that traditional financial institutions have never been able to before.

AI’s Role in Lending and Credit Scoring

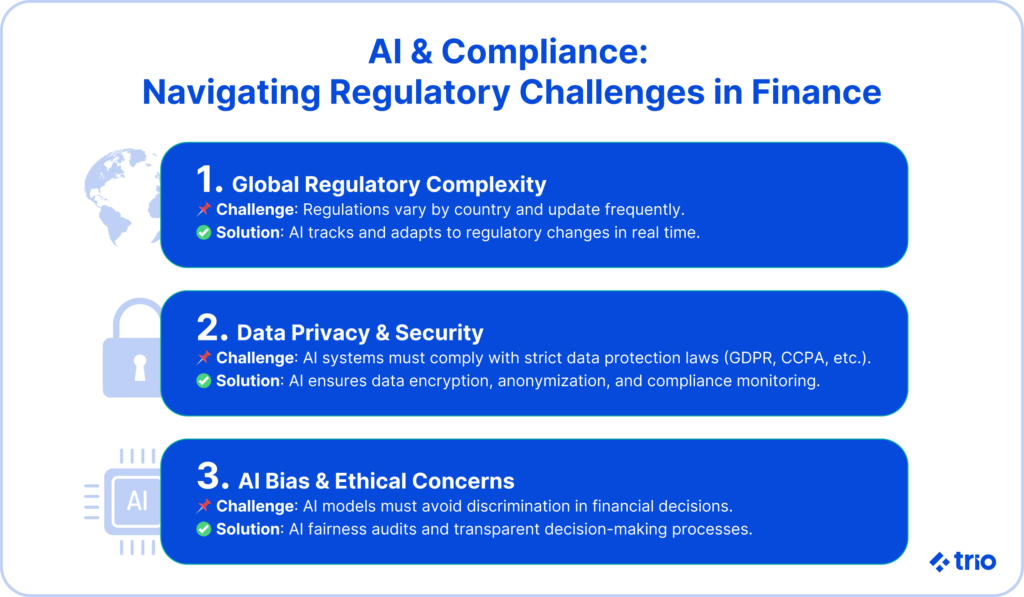

Just like with financial advice, traditional lending models found in the banking sector have been marred with inherent biases and inaccuracies. Now, you can get a credit score using the power of AI.

The ability to deal with massive amounts of data means that these credit scores are produced using alternative data sources like transaction histories, not just previous credit use. Sometimes, AI advancements enable inferences from social media behavior and psychometric testing. The result is fairer and more inclusive lending.

Additionally, the possibility of human error is removed, making the process far more accurate, even when using unconventional data. This also opens up the potential for further financial inclusion amongst people where the kind of economic data typically used might not be available.

AI Applications in Fraud Detection and Risk Management

Fraud detection is a big challenge for most financial institutions. It is vital to catch issues early to make sure that any potential losses are minimized. AI offers an unmatched advantage by analyzing massive amounts of data, finding trends, and spotting anomalies. All of this allows it to identify fraudulent activity in real-time and sometimes even predict fraud proactively.

Machine learning algorithms are also able to adapt as threats change. This means that there is minimal delay in protection.

All of these factors work together to allow users to feel confident placing their trust in digital transactions and online banking platforms.

Streamlining Payments and Transactions with AI Systems

The use of online payments and transactions is now so common that many businesses have become cash-free. The use of AI across these systems, particularly in the form of automation, is only making these processes even more refined and easier to use than ever before, while reducing errors and transaction times.

AI tools improve workflows by intelligently routing payments, reducing settlement times, and enhancing compliance. Financial institutions utilizing AI-driven payment processing also benefit from improved regulatory compliance and customer satisfaction. This latter is, in part, due to their improved trust in the bank’s security, as well as the overall transaction speed improvement.

Challenges and Opportunities in AI-driven Risk Management

Significant change can be difficult for many. Although AI is making many positive changes, there are also potential issues that will result from its increased adoption. Let’s take a closer look at the risks and opportunities of using AI solutions in risk management.

Navigating Financial Market Complexities Using Artificial Intelligence

Financial markets are volatile. This means that any tools used need to be able to deal with the inherent challenges of sometimes unpredictable changes as they occur in real-time. This is one of the reasons why integrating AI technologies into decision-making processes might be the way forward.

As discussed above, one of the many benefits of AI-driven predictive analytics is that it enables more accurate market trend identification, portfolio optimization, and risk assessment.

However, before deciding to embrace AI’s opportunities, it’s essential to understand that AI systems require continuous training with relevant, bias-free data to prevent algorithmic errors from translating into financial risks. This is not possible in all cases, and even when it is possible, you will need someone knowledgeable to oversee this process.

Overcoming Regulatory and Compliance Challenges in the Financial Sector

Just like the changes in the market itself, regulatory requirements can be pretty complex. They change often and differ from country to country, even differing across regions in a single country. The benefits of AI integration in the financial sector include automating compliance with these regulations, reducing the amount of manual effort required, and decreasing error rates.

However, despite this advantage, the impact of AI has also resulted in a few challenges. Technology has continually evolved rapidly, but we’ve noticed that it is changing even faster now. This is primarily thanks to AI. While this can be a good thing, it poses regulatory challenges as existing frameworks struggle to keep pace.

AI itself is also regulated. Especially the use of AI in the financial sector and other industries where personal data is used, such as healthcare or education. You must maintain active engagement with regulatory authorities, ensuring AI-driven practices adhere to evolving standards and ethical guidelines.

Disrupting Financial Services: AI’s Impact on Financial Markets

AI is changing everything from investment strategies to asset management. Consumers are also seeing the effect of AI deployment on how they can access the market. Let’s take a look at exactly how this is done.

How AI Is Transforming Investment Management and Trading

When it comes to wealth management, regardless of whether the investments are in stocks, real estate, or any other asset, you can now use the power of AI to analyze large datasets and forecast market trends. These algorithms would likely outperform traditional methods for a variety of reasons.

Firstly, they are able to respond quickly, while many of them are incredibly adaptable thanks to the increasing complexity of AI. Secondly, they remove any propensity to human error as well as decision-making based on emotional biases.

However, like with many other areas, we would always recommend that the use of AI in financial services is closely monitored. In the case of finance, failing to make sure someone knowledgeable is working alongside the AI can have real-world consequences very quickly. Many others have noted that AI could also increase market volatility if it is widely used before being adequately tested.

Enhancing Market Accessibility and Inclusion with AI

We are seeing people leverage AI all over financial markets, not just in trading but also in making investment management more accessible.

AI is allowing more people to participate in financial markets, especially in developing regions, by automating significant portions of the platforms and generally making the investment process simpler. As long as you have a smartphone, you should now be able to invest whatever money you have.

We have also seen a significant rise in AI-driven financial literacy platforms. This has become particularly prominent in gamified investment apps and is helping to educate users, bridge knowledge gaps, and facilitate broader economic participation.

AI and Cybersecurity: Protecting the Financial Sector

Thanks in part to AI and other technological advancements, we are seeing the finance industry becoming increasingly digital. That means that cybersecurity is also becoming more critical.

Opportunities and Risks of AI in Cybersecurity

We’ve already mentioned how AI can be used in fraud detection. In a very similar way, AI can improve cybersecurity by detecting, analyzing, and even neutralizing cybersecurity issues in real time without the need for manual intervention. The detection process is usually based on finding unusual patterns, which AI can do very quickly.

However, AI is also introducing a lot of potential vulnerabilities. When embedding AI into critical services that deal with sensitive data, it is possible that these systems can be exploited. The result is often targeted attacks.

For this reason, it is important that you do not neglect security practices and that you continue to monitor and update your protocols. We always recommend that you get a developer who specializes in security on board to set up any initial systems, as well as to maintain and improve your security as the potential threats adapt.

At Trio, we can give you access to some of the top developer talent in this field, offering both outsourcing and staff augmentation so that you can make use of their services in the most cost-effective way possible.

Managing AI-related Cyber Threats in Financial Services

Being proactive is key in financial services. Some strategies we would recommend include continuous system monitoring, advanced threat detection models, and extensive employee training.

It is also a good idea to collaborate with other companies in your industry. This will allow you to share data on the latest threats and perhaps even develop standardized security practices that are as effective as possible.

Integrating AI into Financial Institutions: Strategic Considerations

AI integration is far from simple and often requires strategic foresight. It is important to consider not only legacy software and potential technological changes but also the human element of your business and any ethical issues that you may encounter.

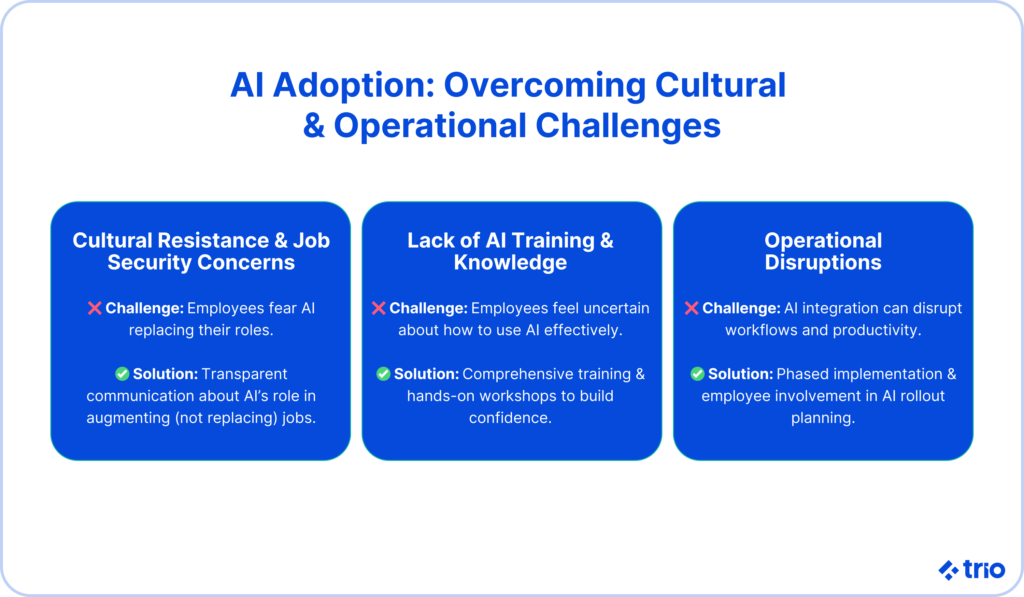

Cultural and Operational Challenges of AI Adoption

Cultural resistance is a common occurrence when integrating new software. Some level of resistance is expected with any change, but when it comes to AI, there are additional apprehensions with regard to job security, which may cause your employees to hesitate even further.

You also need to think about any operational disruptions that might occur as you transition to the new tools and systems.

Clear communication is critical so that your employees understand the purpose of the new software, as well as how their roles may change going forward. Comprehensive training can also ease the change as employees feel more confident using the latest technology without the fear of making mistakes that could drastically impact the results of their work.

We have also seen positive results in involvingteams throughout AI implementation processes. This will not only give your developers a better idea of how to best integrate the software to minimize operational disruptions but will also make them feel involved and valued in the process, increasing satisfaction and the likelihood of using the software effectively.

Forging Effective AI Partnerships in the Financial Sector

It can be expensive to create all of your own AI software. Not only do you have to design it from scratch, but you need to find the right people to do the job. Partnering with AI technology providers or outsourcing firms like Trio will increase your chances of success and accelerate the entire process.

Collaboration allows banks and other companies involved in financial operations to benefit from specialized expertise. They may even be able to find AI specialists who are familiar with the finance industry and have worked on similar projects before, reducing implementation risks and aligning technology with business goals effectively.

Here at Trio, our goal is to become your long-term tech partner, whether you need us in the initial design and coding phase or the implementation and maintenance of your AI project. We aim to promote businessgrowth through technology. After all, your success is our success.

Future of Finance: How AI Will Shape the Industry

The future is changing rapidly, and we don’t doubt for even a moment that AI is going to be a big part of whatever is to come. It’s important to understand any trends and potential issues that may arise so that you can be prepared.

Emerging AI Trends Transforming the Finance Sector

Quantum computing, blockchain integration with AI, and even machine learning models are becoming more commonplace in the finance sector.

Previously, hardware seemed to be the limiting factor, with the massive processing requirements of specific AI processes simply not being possible.

However, with the rise of new technology – like the Microsoft Majorana 1 chip – and breakthroughs in hardware, we have not only been able to see companies using AI for more complex processes but even making further developments and breakthroughs on the software side.

We expect, based on what we’ve seen before, that these enhancements will continue to make forecasting, cybersecurity, risk management, and regulatory compliance more straightforward and less resource-intensive. This means if you focus on staying ahead and adopting advancements early on, you may have a reasonable competitive advantage.

Ethical Implications and AI-driven Decision-making

With more sophisticated AI models being able to play an increasing role in the broader financial ecosystem, a lot of people are expressing ethical concerns.

As reputation is vital in the financial industry, it is crucial that institutions prioritize their considerations and ensure that they are transparent about the role that their algorithms play. It is also essential that they keep an eye on any tools that they are using to ensure the AI remains unbiased, especially in decision-making processes.

This rigorous oversight is critical to maintaining public trust.

The Regulatory Landscape: Adapting to the AI Revolution

We’ve mentioned the regulatory landscape a couple of times already. As AI adapts, so do regulations. Usually, the aim is to make sure that AI is being used safely and effectively, protecting consumers and preventing issues like the increased market volatility we have discussed above.

Experts are critical for this adaptation process. Let’s take a look at the role of central banks and regulators, key decision makers in the responsible use of AI, and how they may guide AI innovation.

The Role of Central Banks and Regulators in Guiding AI Innovation

Central banks and regulators need to be proactive instead of reactive. Financial institutions are already working on adopting AI models to get ahead of their competitors. It is essential that regulators work alongside these institutions, engaging with them to establish comprehensive frameworks to govern how AI is used in the future.

The issue that central banks and regulators will face is trying to balance ensuring the safety of the consumer, mitigating systemic risks, and maintaining general economic stability while still ensuring that innovation is possible.

Industry leaders will have to work closely with these governing bodies to ensure that this balance is struck.

If you are interested in getting a developer at the forefront of innovation on your team, you are in the right place. At Trio, we only have the best of the best, making sure our developers are skilled in a variety of industries and assigning them to you based on your unique requirements.

If you are interested in getting one of these industry leaders on your team, reach out to us to schedule a call!