The fintech sector is growing at a pace that feels almost impossible to keep up with, especially for mid-sized companies. Inevitably, squads start competing for the same engineers, recruiters get stuck running overlapping requisitions, and managers end up in endless interview loops that wear everyone down.

The challenge is maintaining delivery velocity without overextending your recruiters and hiring managers.

Some of the best solutions include fintech-specific hiring pods with clear governance rules, using staff augmentation to handle temporary spikes without diluting culture, and investing in mentoring programs that build resilience over the long run.

AI tools, when used thoughtfully, can also ease bottlenecks in recruitment and onboarding. Taken together, these approaches make it possible to keep squads productive while protecting your people from burnout.

Let’s go over some practical strategies you can actually apply in competitive markets to build engineering capacity without cutting corners, balance speed with quality, and, perhaps most importantly, hold your own in the fintech talent war.

At Trio, we help tech companies of all sizes connect with the right talent, ensuring productivity is maintained and a competitive advantage is preserved.

Our specialized fintech talent has all the skills that this heavily regulated industry requires, so they can start adding value within the first few days on your team. If you struggle to find the right people, reach out to get in touch!

The Role of AI in Fintech Recruitment

AI in recruitment is already woven into how fintech companies compete for talent. The pressure to scale quickly but with limited recruiting bandwidth makes AI less of a nice-to-have and more of a survival tool.

Leveraging AI for Efficient Hiring Processes

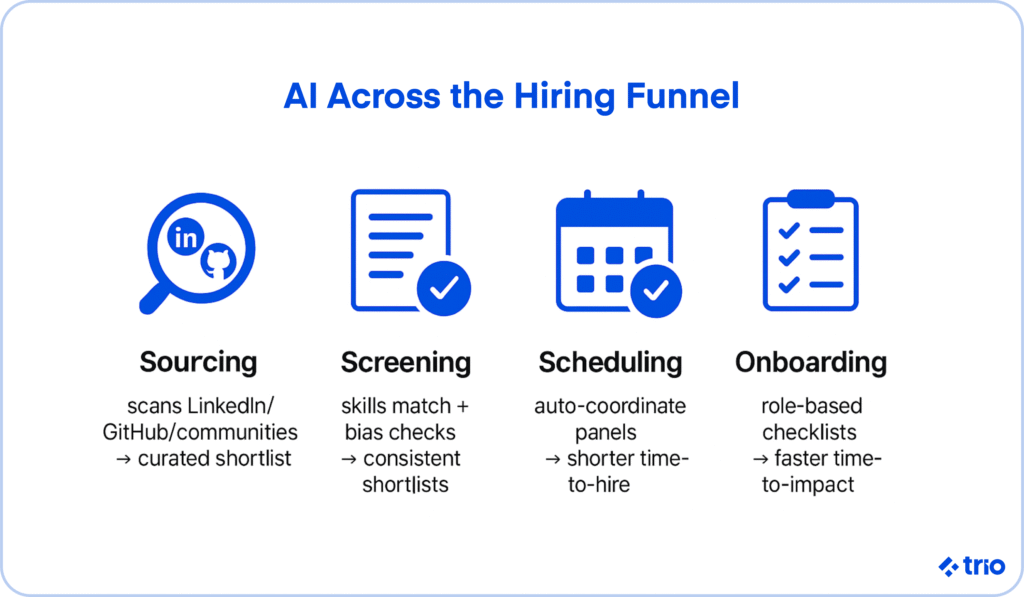

Where it shines most is in the time sinks: sourcing, shortlisting, and scheduling.

Instead of manually reviewing hundreds of LinkedIn profiles or juggling endless interview calendars, recruiters can let AI handle the heavy lifting.

That shift frees up engineering leaders to spend less time putting out fires in the hiring process and more time keeping delivery on track.

But the advantages aren’t only about speed. AI also adds consistency to candidate evaluation, which reduces the chance of unconscious bias creeping into decisions. And it allows recruiters to manage multiple squad requisitions in parallel.

Of course, there’s room for debate. While AI promises objectivity, algorithms are only as unbiased as the data they’re trained on, and fintech leaders need to keep that in mind.

Still, as competitors lean into these tools to find their tech talent, the risk of ignoring them grows. AI is increasingly an essential lever if you want to scale without exhausting your people.

Here’s a summary of how the impact plays out if you can use AI effectively:

| AI’s Role | Benefit for Hiring Managers |

|---|---|

| Automating repetitive tasks | Reduces admin burden and prevents recruiter burnout |

| Prioritizing qualified candidates | Ensures top talent isn’t lost in crowded pipelines |

| Predictive matching | Aligns candidate skills with squad-specific needs (Payments, Risk, Platform) |

| Interview scheduling | Shortens time-to-hire and speeds time-to-impact |

One often overlooked angle is time-to-impact, the moment when a new engineer shifts from ramping up to contributing fully.

For fintech squads racing against regulatory deadlines or chasing a product launch window, saving even two or three weeks here can mean hitting the market ahead of a competitor or avoiding costly compliance setbacks.

This is why AI in hiring is more than an operational convenience. Used well, it becomes a strategic advantage, helping you scale while allowing recruiters to focus on higher-value, more human parts of the process.

Enhancing Candidate Experience through AI

The best engineers often juggle several offers at once. If your process drags, feels inconsistent, or comes across as impersonal, they will almost certainly move on.

If you are part of a mid-sized fintech, every hire directly shapes delivery capacity. That risk is hard to afford.

AI can smooth the rough edges here without creating more work for already stretched recruiters.

Automated updates eliminate the dreaded black hole silence that makes candidates feel forgotten.

Chatbots, while not perfect, can answer routine questions at any hour, such as “When is my next interview?” or “Which tech stack does the Payments squad use?” That frees hiring managers and HR from endless follow-ups.

Assessments powered by machine learning also offer candidates feedback.

Instead of a coding test with a pass/fail outcome, applicants can walk away knowing where they did well and where they can improve.

That kind of transparency doesn’t just improve perception; it positions your company as serious about both professionalism and people, and that kind of reputation often spreads.

Improved candidate experiences increase offer acceptance, lower the chance of mid-loop drop-offs, and strengthen your employer brand in ways that generic job ads never will.

It signals that your fintech values individuals as much as it values financial innovation, an important message when you’re competing not only with Big Tech but also with larger, more resource-rich fintech rivals who can offer high salaries.

For recruiters and engineering leaders who already feel like they’re doing two jobs at once, this is the real payoff: with AI, you don’t have to choose between efficiency and candidate care. You can, at least in this case, have both.

AI Tools for Sourcing Technical Talent

Unlike traditional keyword searches, AI-driven systems scan a broad mix of sources, including LinkedIn, GitHub, Kaggle, online job boards, even fintech and security-focused communities, and then run those profiles against your actual requirements.

Instead of hoping a good candidate happens to float to the top, you get a curated shortlist that already appears aligned to what your squads need.

Machine-learning models can highlight candidates with particular financial characteristics, fraud analytics expertise, scheme-compliant payments engineering, or experience designing scalable infrastructure for regulated environments.

That’s what a manual recruiter search often misses.

Here’s a simple example of how skills can be mapped to common fintech squads:

| Squad | Critical Skills & Experience |

|---|---|

| Payments | Transaction processing, ledger integrity, API integrations, and compliance with scheme rules |

| Risk | Fraud detection models, data science, machine-learning feature stores, and explainability in ML |

| Platform | Site reliability engineering, Infrastructure as Code, CI/CD pipelines, cloud security |

Of course, you can set up your own tools, but that takes both time and money. Instead, you could use a variety of existing tools, many of which are provided by SaaS companies specializing in this kind of technology.

All you need to know is the skills and experience you want.

Many of these tools also assist with other parts of the hiring process.

Some popular examples on the market right now include:

Scaling Your Startup: Recruitment Strategies

Scaling engineering involves hiring more people, but without structure, it often leads to chaos, overworked recruiters, frustrated managers, and teams tripping over each other’s requisitions.

The main challenge is creating repeatable systems that foster growth without leaving teams burned out or disorganized.

Developing a Scalable Hiring Process

A hiring process that scales well involves building an intelligence framework to prioritize intelligently, avoid duplication, and maintain quality as requisition volume increases.

What sets strong organizations apart are the guardrails:

- Headcount councils that align hiring with real business priorities, not just wish lists.

- Pod intake gates to ensure new squads are in place only launch when the business case is clear.

- Standardized rubrics so every squad isn’t reinventing assistants from scratch.

Put together, these initiatives protect recruiters and hiring managers from being pulled in too many directions.

They also give engineering leaders confidence that hiring decisions are tied to strategy rather than urgency.

The end result is a recruit engine that grows alongside the company, without creating bottlenecks or burning out your people.

Attracting Global Talent in Fintech

Relying only on local talent often feels like trying to win a race with half a team. Competing head-to-head with Big Tech in major hubs is rarely sustainable.

Looking outward, toward international talent, broadens the playing field and, in many cases, makes hiring more cost-effective.

AI-powered sourcing tools make this much more feasible. But tools aren’t enough.

To attract global talent, your employer brand has to resonate across borders. That means clearly communicating your mission, values, and opportunities on platforms like LinkedIn, while also showing tangible commitments to diversity and inclusion.

And global recruiting doesn’t have to mean long-term hires right away.

Staff augmentation can give you short-term access to international expertise, letting squads add surge capacity for critical projects without permanently inflating headcount.

When managed with cultural guardrails, such as pairing contractors with in-house engineers or rotating them between pods, you gain speed without fragmenting your culture.

Cost of Hiring: Balancing Quality and Budget

For most, hiring budgets are limited. Fintech talent can also be costly, thanks to the unique skillset required.

The challenge lies in matching the need for strong engineering talent with the financial discipline that keeps the business sustainable.

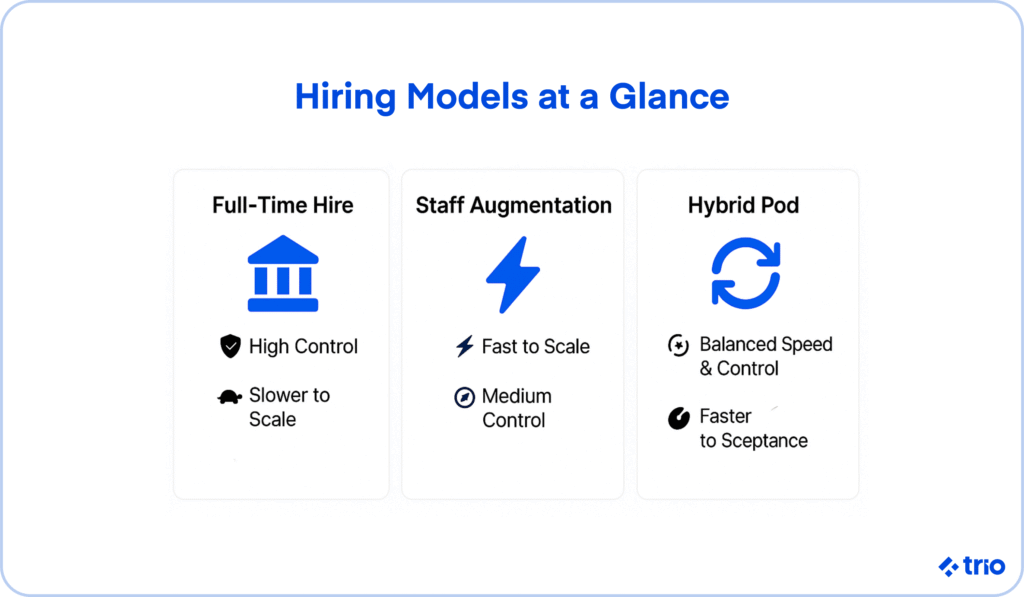

You could look beyond base salary and consider trade-offs between hiring models.

For example, stock options, performance-based bonuses, or unique cultural perks can often tilt the scale when salary alone can’t.

At the same time, you can blend different hiring models, including full-time hires, staff augmentation, and hybrid pods, depending on the situation.

Here’s how the models compare:

| Model | Cost Profile | Speed to Value | Cultural Impact | Best Use Case |

|---|---|---|---|---|

| Full-Time Hire | Higher upfront cost (salary + benefits) | Slower (recruiting + onboarding) | Strong long-term cultural integration | Core squad growth, leadership roles |

| Staff Augmentation | Variable/contract cost | Fast (on-demand capacity) | Risk of dilution if unmanaged | Surge projects, regulatory deadlines |

| Hybrid Pod | Balanced cost with managed governance | Moderate (pods ramp quickly under guardrails) | Preserves culture via pairing + oversight | Scaling multiple squads sustainably |

Balancing these models lets you stretch budgets further while still providing squads with the necessary capabilities.

Evolve your onboarding process.

What often gets overlooked is how quickly and effectively new engineers become productive once they arrive.

This can be a big issue in fintech, particularly. Some of the companies we have worked for have had to onboard developers for weeks before they started contributing in any meaningful way.

When squads are already under constant delivery pressure, you need to avoid this.

Fierce Competition for Technical Talent

A clumsy or poorly structured onboarding process is one of the top reasons new hires leave within their first year.

And when that happens, recruiters and engineering managers are thrown back into the cycle of backfilling, interviewing, and context-switching across squads, a treadmill that drains both morale and capacity.

To break that cycle, fintechs need to treat onboarding as the natural continuation of recruitment.

A strong onboarding process should do three things at once: ramp up technical capability, integrate new hires into the culture, and set clear expectations about the role and its impact.

Global Talent Shortage

All of this is made harder by the reality of a more complicated global shortage.

Specialists in AI, machine learning, and data science are particularly scarce, which leaves fintech startups competing not just with peers but also with well-funded unicorns. That imbalance makes it harder to win top candidates and increases the cost of failure if you lose them after onboarding.

Hiring remotely opens the door to global talent pools. Still, it also introduces challenges: working across time zones, adapting to different cultural norms, and ensuring distributed teams feel part of the same mission.

You need to be intentional about diversity and inclusion, and make sure your onboarding accounts for the differences to ensure your team works well together. Without this, even the most advanced sourcing strategy won’t stick.

Level Up With Mentoring

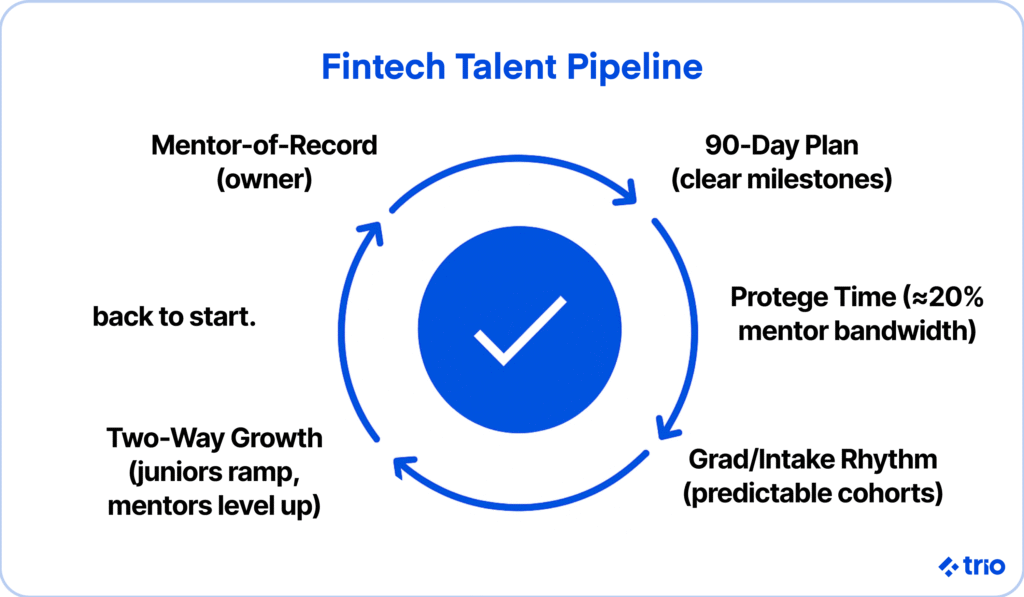

Mentoring is one of the most reliable engines for turning fresh hires into long-term contributors.

A mentoring flywheel reframes this challenge by making development part of the operating model rather than an ad hoc responsibility:

- Mentor-of-Record: Each squad designates one mentor who owns the first 90 days of a new hire’s journey.

- Protege System: Mentors are formally allocated ~20% of their bandwidth for coaching, ensuring it doesn’t become unproductive time.

- Grad Intake Rhythm: Internships and graduate hires arrive on a predictable cadence, so mentoring stays steady rather than sporadic.

- Two-Way Growth: Juniors ramp faster, and mentors themselves build leadership and coaching skills, preparing them for future management roles.

Over time, this system reduces backfill churn, alleviates recruiter stress, and distributes the workload across squads.

Done well, mentoring can even become self-reinforcing. In other words, as your headcount grows, so does your internal capability to train and retain talent.

Improving Company Culture to Attract Talent

Even the best-designed recruitment engine will sputter if it doesn’t support fintechs. Culture is one of the few levers you can pull to stand out in a crowded hiring market.

Diversity and Inclusion in Fintech Hiring

Diversity and inclusion are useful hiring strategies. Top engineers are drawn to environments where belonging and fairness are visible in practice.

That means making inclusivity tangible at the squad level, not just in corporate statements.

Practical steps include writing inclusive job descriptions, sourcing from non-traditional channels, and training hiring managers to recognize unconscious bias.

Building a Strong Onboarding Process

Role clarity, growth roadmaps, and mentorship reduce drift and disengagement.

AI-enabled onboarding tools help lighten the load, as we have already mentioned.

Internal chatbots can answer technical questions on demand, while searchable knowledge bases give new hires autonomy to find information quickly.

The blend of human mentorship and machine-driven support ensures consistency while avoiding bottlenecks for managers.

There is no single best way to onboard. What helps is asking recent hires where they found your process lacking, and working from there. If you go with an external firm like Trio, we assist with the onboarding process, ensuring that as much pressure is taken off your resources as possible.

Creating an Engaging Company Culture

Retention ultimately comes down to engagement.

Engineers stay when they see clear career pathways, feel recognized for their contributions, and have flexibility in how they work.

Engagement also means fostering continuous learning, creating an environment where engineers are encouraged to expand skills, experiment with new technologies, and take ownership of meaningful challenges.

When culture, onboarding, and mentoring come together, mid-sized fintechs can protect themselves against the constant churn of replacement hiring.

Recruiters and managers regain breathing room, and the company’s employer strengthens in the process.

Utilizing LinkedIn for Recruitment War

LinkedIn remains one of the most powerful platforms for reaching engineering talent.

It’s not just a digitized board; it’s a stage where you can showcase culture, product innovation, and career growth opportunities. Used with intent, it becomes both a brand-building channel and a direct sourcing tool.

Optimizing LinkedIn Profiles for Startups

A company’s LinkedIn page is its very first touchpoint for a prospective candidate.

An optimized profile signals credibility and helps attract interest before a recruiter ever sends a message. Beyond slick visuals and a polished mission statement, fintechs can highlight the real impact of their squads:

- Payments engineers enabling millions of daily transactions.

- Risk squads are developing fraud detection models that protect end users.

- Platform teams are building infrastructure capable of supporting global scale.

This approach demonstrates the kind of meaningful contributions engineers can make from day one.

Networking Strategies to Engage Talent

LinkedIn is as much about relationships as it is about job postings.

You can extend your reach by joining fintech-focused groups and communities and interacting with both the community and the individuals you connect with there in a meaningful way.

Encouraging employees to share updates and refer peers is also a great strategy. Some companies implement compensation for referrals to encourage this, but that isn’t always needed if you have a culture of innovation and sharing.

Hosting webinars or meetups where candidates hear directly from engineering leaders is a great strategy that works well if you already have a reputation in the industry. You could still try it if you are starting out, but it really works best for mid-sized fintechs.

You need the leaders on your team, or access to the leaders who will speak.

These tactics reduce the cold outreach fatigue that many engineers feel and help build a reputation that attracts talent organically. Partnerships with universities and coding bootcamps can deepen this effect, especially when paired with mentoring programs that provide a clear growth path.

Showcasing Product Development on LinkedIn

Candidates want to see what problems your teams are solving and how.

Sharing behind-the-scenes updates, whether it’s a new product launch, the way a squad overcame a scaling challenge, or a story about improving platform reliability, signals that your company is a place where ambitious engineers can do work that matters.

Talent Management in the Financial Services Sector

Of course, hiring engineers is only half the battle. For mid-sized fintechs, the more challenging part often comes afterward: keeping those hires engaged, productive, and committed.

Without strong talent management practices, it’s easy to fall into the cycle of attrition and backfilling, a cycle that drains recruiters, delays delivery, and eventually wears down managers.

Retention Strategies for Technical Talent

Pay and benefits need to stay competitive, yes, but engineers also want meaningful work, recognition, and a balance between delivery pressure and personal well-being.

When squads are expected to sprint endlessly, burnout is all but guaranteed.

Leaders can counter this by weaving retention into everyday management.

Assign engineers to projects that stretch their skills, celebrate squad-level milestones, and protect work-life balance by setting realistic delivery expectations.

Fairness matters too, as we’ve already mentioned. Rotating engineers across pods where possible and distributing mentoring responsibilities can prevent senior staff from shouldering a disproportionate load.

Continuous Learning and Development in Fintech

Because the fintech industry evolves at breakneck speed, continuous learning is a necessity.

Risk squads may need more profound expertise in explainable AI, while Platform teams are expected to master cloud security and MLOps.

Companies that invest in training roadmaps, sponsor certifications, or support attendance at fintech conferences send a powerful message: your growth matters here.

That investment not only sharpens skills but also makes engineers less likely to look elsewhere when they’re ready to leave their careers.

Evaluating and Adjusting Recruitment Strategies

Traditional metrics like time-to-hire or cost-per-hire still have value, but they only tell part of the story. Leaders also need to pay attention to outcomes that affect squads more directly.

For example, if new engineers are taking months to become fully productive, or if certain pods are slipping on delivery targets because of attrition, those are signals that something in the hiring or retention process isn’t working as intended.

The key is to build regular review cycles where leadership examines these patterns and makes timely adjustments.

That might mean rebalancing mentoring resources across squads, refining onboarding to shorten time-to-impact, or recalibrating hiring priorities to align with business needs.

Conclusion

Winning the engineering talent war is about much more than adding headcount.

What really matters is building systems that scale, using AI to streamline recruitment, putting governance guardrails around pods to manage growth responsibly, leaning on staff augmentation when surges hit, and embedding mentoring so talent doesn’t just arrive but actually develops over time.

When those elements work in harmony, companies not only sustain delivery velocity but also avoid recruiter burnout and create teams where engineers genuinely want to stay and grow.

At Trio, we work with fintechs to accelerate delivery by providing highly skilled developers who integrate seamlessly into your squads.

Whether you need to augment staff quickly, strengthen your core engineering teams, or take pressure off your recruiters and managers, our developers help you scale without compromise.

If you’re ready to push past firefighting and build the capacity your fintech needs to thrive, get in touch with Trio today.

Frequently Asked Questions

A fintech pod is a small, cross-functional delivery unit created for specific outcomes, while a squad is usually a standing team; pods run with governance guardrails to prevent burnout and duplication.

You should use staff augmentation when you need surge capacity for deadlines or compliance work, and full-time hires when you’re building a core team or long-term leadership.

You prevent recruiting burnout by prioritizing requisitions through governance councils, using AI for automation, and balancing workload with shared mentoring responsibilities.