The financial world is changing faster than many lenders can keep up.

Legacy systems, often patched together over decades, still power critical banking operations, from loan origination to credit risk assessment.

These systems are slow, but also very fragile. When lenders try to build new products or connect to third-party services, even small integrations can take months and balloon in cost.

Meanwhile, digital-first competitors are launching entire lending platforms in half the time with a far better user experience.

The gap between what lenders need (speed, automation, and adaptability) and what their existing tech allows keeps widening. Decreasing this gap is quickly becoming an essential part of basic risk management.

That’s where API-first banking comes in.

Rather than treating APIs as an afterthought or integration tool, lenders design their systems around them from day one.

This approach enables you to connect systems, automate manual processes, and respond to market shifts without requiring an overhaul of your entire infrastructure.

At Trio, where our engineers build API-driven platforms for fintechs and financial institutions, we’ve seen firsthand how the right architecture can turn technical debt into opportunity.

The fintech industry requires nuance, whether that’s in terms of regulatory compliance or the unique changes and customer expectations, and having someone with industry knowledge on your team is essential.

Our fintech specialist can join your team through staff augmentation, giving you all the knowledge and technical ability you need.

Understanding API-First Banking

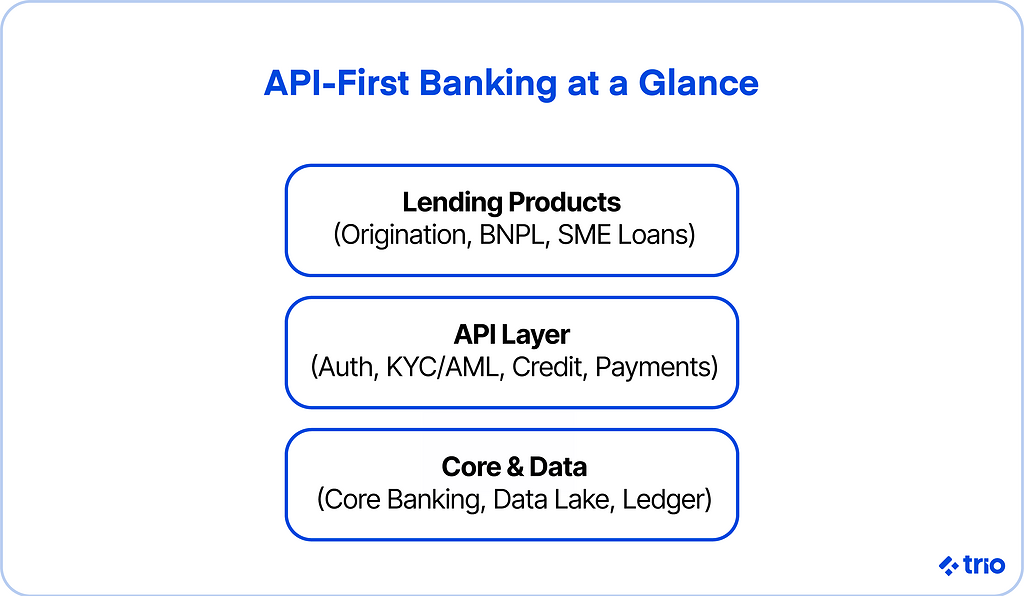

API-first banking represents a fundamental shift in how financial software is designed, deployed, and extended.

Before exploring its benefits, it helps to understand what sets it apart from traditional integration methods.

What Is API-First Banking?

In simple terms, an API-first approach means every function of a banking or lending system is designed to be accessed through a clearly defined application programming interface (API).

Instead of building a platform and then adding APIs later, the APIs become the blueprint for how the system works from the start.

This approach may sound technical, but its impact is strategic.

By structuring systems around APIs, lenders can treat internal functions, such as customer onboarding, KYC validation, or loan disbursement, as modular and interoperable services.

That makes it much easier to automate workflows, share data securely, and partner with fintechs or third-party platforms.

For instance, an API-first lending system can expose endpoints for checking borrower eligibility, retrieving credit scores, or updating loan status, all without manual data entry or complex middleware.

How It Differs from Traditional Banking Integrations

Traditional banking integrations were designed in an era when systems were closed, and interoperability was rare.

APIs were often added later to connect core banking systems, CRMs, and accounting tools. These were typically point-to-point integrations, fragile links that had to be updated every time one system changed.

An API-first platform flips this model.

Instead of connecting rigid monoliths, it creates an ecosystem of services that communicate through stable, well-documented interfaces. Rather than one-off integrations, you get continuous extensibility.

In practice, this means that when your lending business wants to plug in a new credit scoring service or connect to an open banking data source, it can be done through a standardized API, not a months-long IT project.

The Strategic Role of APIs in Modern Financial Infrastructure

APIs have evolved from technical plumbing into strategic infrastructure. They’re what enable banks and fintechs to launch new lending models, whether embedded credit, BNPL, or instant loan approvals, without rewriting legacy code.

For lenders, APIs create a foundation for automation, data-driven decisions, and compliance monitoring. They allow you to:

- Expose key business functions to internal teams and external partners

- Move data securely between systems in real time

- Build modular services that can scale independently

From our perspective, API-first infrastructure plays a big role in future-proofing your technology stack so it can adapt to whatever regulatory, economic, or market changes come next.

The Role of APIs in Modern Lending

Before lenders can automate, they need systems that talk to each other. APIs make that possible by creating reliable, two-way communication across core platforms.

Connecting Core Systems, CRMs, and Credit Platforms

Modern lending relies on a network of systems, core banking software, CRM tools, credit bureaus, payment processors, and compliance platforms. APIs act as the connective tissue between them.

For example, when a customer applies for a loan, the application data may flow through an API from the CRM to the core system, trigger a credit check through another API, and finally feed into a risk assessment model hosted elsewhere.

Without APIs, these steps often rely on manual uploads or batch file transfers, introducing delays and errors.

An API-first model allows each system to stay in sync automatically, improving accuracy and reducing processing time.

Streamlining Loan Origination and Decisioning

Loan origination is one of the most resource-intensive parts of lending.

You’re dealing with customer data, eligibility checks, underwriting models, and regulatory validation, all of which require real-time data movement.

With lending APIs, you can automate large parts of this workflow. Customer details can be validated instantly, risk profiles updated dynamically, and approval decisions triggered as soon as conditions are met.

This not only speeds up approvals but also enables consistent decision-making.

Lenders using API-first systems can build transparent, auditable processes where every data point, from application to funding, is logged and traceable.

Real-Time Data Access for Credit Risk and Underwriting

Credit risk models are only as good as the data they’re built on. APIs allow lenders to pull in real-time information from multiple sources, credit bureaus, open banking feeds, transaction histories, and even alternative data like utility or payroll APIs.

By doing so, underwriters can see a complete and current picture of borrower health rather than relying on outdated reports.

This kind of real-time access isn’t just convenient; it’s essential for accurate credit scoring and compliance in fast-moving markets.

We often design data pipelines that pull, process, and analyze credit information through API gateways.

Benefits of an API-First Approach in Financial Services

An API-first strategy changes how your business operates and competes.

Enhanced Agility and Faster Fintech Product Launches

When your systems are modular, your teams can move faster. APIs let you experiment with new financial products or integrations without disrupting core services.

For example, if you want to launch a small-business loan product that connects to accounting software like QuickBooks or Xero, you can do it through APIs rather than custom connectors.

What used to take six months can now take six weeks.

Reduced Operational Costs Through Automation

Every manual step in a lending process costs time and money.

APIs can eliminate many of them, such as data entry, document validation, and eligibility checks, by automating interactions between systems.

While the initial investment in an API management platform can seem high, the long-term savings in reduced errors, faster processing, and lower maintenance costs usually outweigh it.

Lenders also benefit from leaner operations that scale more predictably.

Improved Customer Experience and Transparency

Borrowers expect speed and clarity. With API-driven systems, applicants can receive near-instant status updates, digital contract signing, and transparent timelines.

APIs also enable lenders to offer self-service portals or embedded lending experiences through third-party apps.

Transparency goes both ways. APIs create digital audit trails that make it easier for compliance teams to monitor decisions, reducing the risk of bias or regulatory breaches.

Scaling Seamlessly Across Markets and Use Cases

APIs make scaling simpler. Whether you’re expanding into a new market, adding partners, or introducing new credit models, you can build once and deploy everywhere.

For instance, a regional lender that integrates local credit bureaus through APIs can replicate that framework in new jurisdictions with minimal code changes. The result is a consistent customer experience, regardless of geography.

Automation of End-to-End Lending Processes

Automation in lending doesn’t happen by accident; it’s the result of careful API design and integration.

How APIs Automate Key Lending Workflows

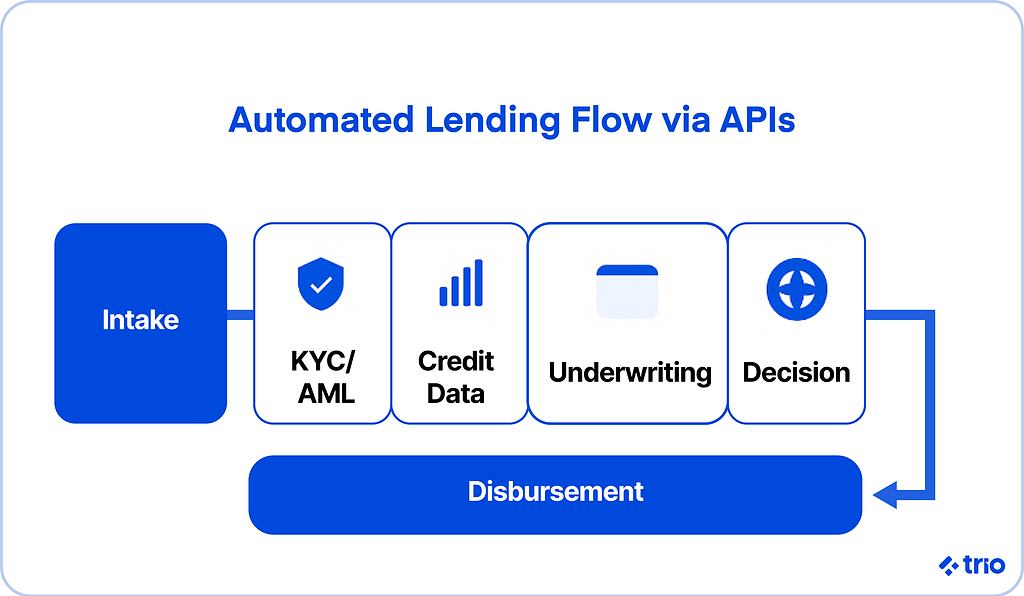

Lending is a chain of interdependent processes. APIs turn these into automated, data-driven workflows.

Loan Origination and Application Intake

APIs can collect application data directly from digital channels, web, mobile, or embedded finance partners, and sync it instantly with CRMs and decisioning systems.

This eliminates duplicate entries and ensures every record is complete and standardized.

Credit Scoring and KYC/AML Validation

Through API integrations with credit bureaus and identity verification providers, lenders can run KYC (Know Your Customer) and AML (Anti-Money Laundering) checks in seconds.

These APIs often return structured data, which can feed directly into decision models, accelerating compliance and reducing manual review.

Underwriting, Approval, and Disbursement

An API-first lender can trigger underwriting logic automatically once credit and identity checks are complete.

Approval decisions can be pushed directly to disbursement systems, which then initiate fund transfers or contract generation through connected APIs.

Collections, Notifications, and Reporting

APIs can integrate with communication platforms and accounting systems to manage repayment tracking, overdue notices, and reporting dashboards.

This ensures customers receive timely updates while your internal teams maintain real-time visibility.

Integration of Banking Platforms

To make API-first banking work in practice, every component of your financial stack has to speak the same language.

Integration is where the real transformation happens, but it’s also where many lenders stumble.

Seamless Integration in API-First Ecosystems

In an API-first ecosystem, integration is an ongoing process of connecting and refining services as your platform evolves.

The goal is to make data and functionality reusable across the entire organization.

For example, a single “customer profile” API might power everything from credit applications to personalized loan offers and compliance checks. This unified approach replaces dozens of isolated data silos with one consistent source of truth.

When our developers help financial institutions design API-first systems, we emphasize simplicity: build modular APIs, document them thoroughly, and standardize security across all endpoints.

That’s what allows your platform to grow without constant rewrites.

Common Integration Challenges for Lenders

Even with the right strategy, integration in the financial sector presents unique hurdles.

Legacy Core Systems and Data Silos

Many banks still rely on legacy core systems built before the cloud era. These systems often lack modern API support, which forces developers to rely on middleware or batch data transfers.

This slows everything down.

Data becomes fragmented across departments, and even small changes, like adding a new partner integration, can require months of testing.

Bridging this gap often involves creating an abstraction layer, sometimes called an “API facade,” which exposes legacy functionality through modern APIs.

It’s a pragmatic way to modernize without tearing down the entire core system.

Security, Authentication, and Governance

Security is another major challenge. Every new API endpoint is a potential attack surface, and financial data is among the most regulated in the world.

Implementing OAuth 2.0, OpenID Connect, and mutual TLS authentication has become a standard part of regulatory requirements; however, many lenders still underestimate the governance aspect, including tracking who can access which APIs, under what conditions, and for how long.

An effective governance model may include API keys, user-level access control, and detailed audit logs. It’s not just about keeping data safe; it’s about maintaining trust with customers and regulators.

Best Practices for API Integration in Financial Services

Once the foundational challenges are addressed, best practices ensure your API-first system remains reliable and scalable.

Use of API Gateways and Microservices

API gateways act as traffic controllers. They handle routing, authentication, and rate limiting, allowing you to manage hundreds of APIs efficiently.

Combined with a microservices architecture, they give your teams autonomy to build, test, and deploy updates independently.

For a lender, this means you can update the credit scoring module without disrupting loan disbursement, or roll out new payment integrations without touching the core lending engine.

Our fintech developers often build these environments using lightweight microservices that scale dynamically with demand.

Monitoring, Versioning, and Continuous Testing

Financial APIs are living systems. Continuous monitoring ensures uptime and compliance, while versioning prevents new updates from breaking existing integrations.

Real-time observability tools can flag latency spikes or failed transactions before they impact customers.

And with automated testing pipelines, lenders can validate API behavior under different scenarios, something that becomes essential as you scale.

BNPL and Pay-Later Solutions

Buy Now, Pay Later (BNPL) has redefined consumer lending, and APIs sit at the heart of this revolution.

The Rise of Buy Now, Pay Later (BNPL) in Digital Lending

BNPL started as a convenience feature for e-commerce but has evolved into a core product for digital lenders.

It appeals to younger consumers seeking flexibility without traditional credit lines and to merchants eager to boost conversions.

For lenders, BNPL represents both opportunity and complexity. Managing instant approvals, risk scoring, and repayment tracking at scale requires an agile, API-driven infrastructure.

How APIs Enable Embedded Credit and Instant Approval

Embedded credit, offering financing directly within a shopping or service experience, relies entirely on APIs.

When a customer chooses a BNPL option at checkout, APIs handle identity verification, soft credit checks, and risk scoring in seconds.

These APIs communicate with payment processors, fraud detection tools, and credit databases behind the scenes.

The customer experiences a seamless, two-click approval, while the lender runs a full compliance and underwriting process invisibly.

Impact of BNPL on Consumer Lending and Risk Models

Traditional risk models often struggle with short-term, high-volume lending like BNPL.

APIs make it possible to ingest real-time behavioral and transactional data, purchase history, repayment timing, and even device metadata to create adaptive credit models.

However, regulators are taking a closer look at how these products are marketed and assessed.

Transparency, affordability checks, and responsible lending practices will become central themes, and APIs can help automate compliance in these areas.

Future Trends: Subscription-Based Credit and Flexible Payments

BNPL appears to be evolving toward subscription-based and “credit-as-a-service” models.

Rather than offering one-time financing, lenders may provide flexible spending accounts that integrate across platforms.

APIs will make this possible by synchronizing credit limits, repayments, and user profiles across multiple merchants in real time.

This shift may blur the line between lending, payments, and personal finance management, something API-first systems are uniquely equipped to handle.

Compliance and Regulatory Considerations

No banking innovation succeeds without regulatory alignment. APIs can either complicate compliance or make it dramatically easier.

Navigating Global Regulatory Frameworks (OCC, FCA, RBI, EBA)

Different markets enforce different standards, from the OCC’s guidelines in the U.S. to the FCA in the U.K., the RBI in India, and the EBA in Europe. Each mandates secure data handling, traceability, and customer consent.

An API-first system makes compliance more manageable because every transaction, access event, or approval can be logged automatically.

This provides an auditable trail that regulators increasingly expect.

Ensuring Security, Encryption, and Data Privacy

Encryption should be non-negotiable.

Financial APIs typically employ TLS 1.3, AES-256 encryption, and tokenized authentication to safeguard data in transit and at rest.

But privacy extends beyond encryption; it includes anonymization, data minimization, and role-based access.

Based on our experience, strong API governance frameworks, complete with automated access control and logging, often provide more security benefits than any single technical measure.

Leveraging APIs for Compliance Automation and Audit Trails

APIs can automate many compliance processes. They can feed real-time transaction data into AML monitoring systems, update KYC databases automatically, and generate digital audit reports on demand.

By integrating compliance tools via APIs rather than isolated interfaces, lenders can maintain oversight without adding manual overhead.

Future of Compliance in Digital and Open Banking

From everything we’ve seen, it seems that regulation is trending toward continuous monitoring rather than periodic reporting.

APIs will play a central role in enabling real-time regulatory access and self-auditing capabilities.

In time, compliance may become less about periodic audits and more about ongoing data transparency, something API-first lenders will be well-positioned to deliver.

Emerging Technologies in API-First Banking

New technologies are redefining what’s possible in API-first financial systems.

Artificial Intelligence and Machine Learning for Risk Analysis

AI models trained on live API data can assess borrower behavior, predict defaults, and optimize pricing.

The combination of APIs and ML pipelines creates adaptive lending systems that improve over time.

The challenge lies in governance: ensuring that AI-driven decisions remain explainable and compliant. Trio often helps clients structure APIs that serve both data and metadata for transparency and auditability.

Blockchain and Smart Contracts for Transparent Lending

Blockchain adds another layer of trust.

Smart contracts can automate loan disbursements, repayments, or collateral releases based on predefined triggers. When connected via APIs, these systems offer near real-time visibility to both lenders and borrowers.

This isn’t theoretical anymore; some digital lenders are already experimenting with blockchain-based credit instruments for SME financing and trade settlements.

Open Banking Standards (PSD3, Open API, UPI) Driving Interoperability

Open banking standards like PSD3 in Europe and UPI in India are driving API interoperability.

They define how financial institutions should share data securely with third parties.

Adhering to these standards helps lenders unlock new markets, partnerships, and revenue streams while maintaining compliance. In essence, open APIs are becoming the global language of finance.

Building and Scaling an API-First Banking Strategy

Designing an API-first strategy is one thing; scaling it sustainably is another. The process requires planning, technology alignment, and a clear understanding of business goals.

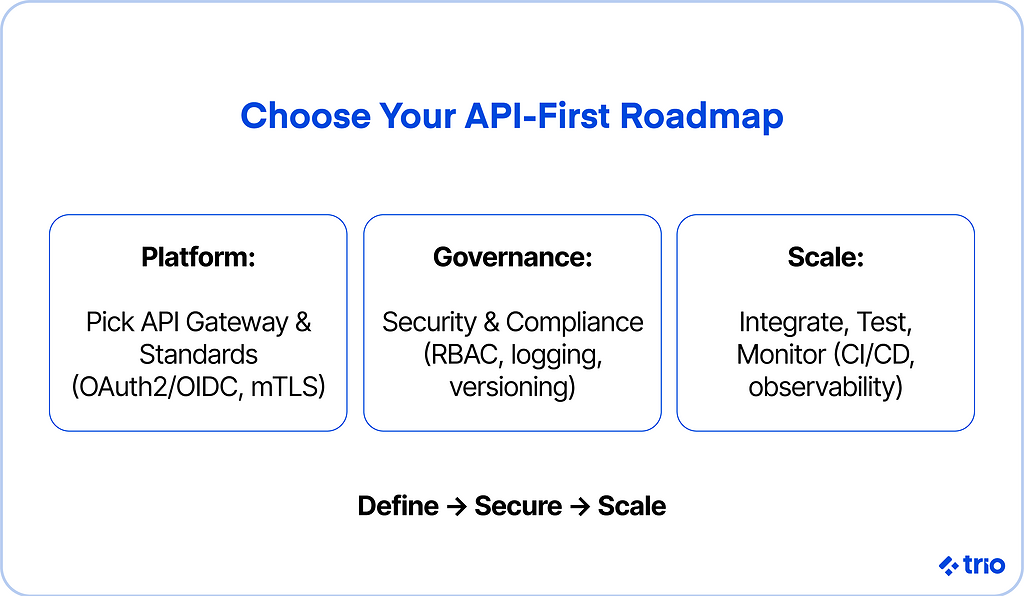

Step 1: Define Business Objectives and Architecture

Start by mapping your objectives.

Are you trying to reduce loan processing times, enable partnerships, or modernize compliance?

The architecture should reflect those priorities, balancing flexibility with security.

Step 2: Select the Right API Management Platform

Choosing a management platform, like Apigee, Kong, or AWS API Gateway, will determine how easily you can secure, scale, and monitor your APIs.

Our devs can help you evaluate these tools based on their integration potential with your legacy systems and fintech partners.

Step 3: Ensure Regulatory Alignment and Data Security

From the start, align your APIs with the relevant regulatory frameworks.

Build in auditability, encryption, and access control as core features, not add-ons.

Step 4: Integrate, Test, and Monitor Continuously

Once APIs are deployed, they should be treated like living assets.

Continuous testing, version control, and monitoring are essential to maintain stability and trust across partners and customers.

Partnering with Fintechs, Developers, and BaaS Providers

No lender operates in isolation anymore.

Partnering with fintechs and Banking-as-a-Service (BaaS) providers allows you to accelerate innovation while reducing technical overhead.

A well-designed API ecosystem makes these collaborations frictionless; developers can plug into your infrastructure with minimal onboarding, while you retain full visibility and control.

The Future of API-First Banking

Most new financial platforms are expected to adopt API-first or API-native architectures.

Lenders that embrace this shift will likely outpace those still locked into monolithic systems.

Automation, interoperability, and open finance will no longer be differentiators; they’ll be expectations.

From Open Banking to Open Finance Ecosystems

Open banking is only the beginning.

The next step is open finance, where data from investments, insurance, and even payroll systems is shared securely through APIs to create a unified financial experience for users.

Lenders that prepare for this now will find themselves better positioned for ecosystem-level innovation.

The Convergence of Lending, Payments, and Compliance Automation

Boundaries between financial functions are fading. APIs are enabling convergence, where lending, payments, and compliance share infrastructure, data, and automation layers.

This convergence promises both efficiency and stronger risk management.

How API-Driven Banking Enables Financial Inclusion

Finally, API-first banking has a social dimension.

By lowering technical barriers and enabling modular financial products, APIs make it possible to reach underbanked populations through mobile platforms and embedded credit.

Fintech partnerships, powered by APIs, can help create credit histories for first-time borrowers and extend fair financing to communities long excluded from traditional banking.

Conclusion

API-first banking is a foundational shift in how financial systems operate.

For lenders, it offers a path out of legacy constraints and into a world of automation, scalability, and collaboration.

When you treat APIs not as add-ons but as the architecture itself, you create systems that adapt rather than age. That’s the promise, and the challenge, of modern financial technology.

At Trio, we’ve seen how API-first design can turn ambitious digital banking goals into working, compliant, and scalable realities. If you are ready to bridge the gap between vision and execution and want to hire fintech developers, get in touch!

FAQs

What is API-first banking?

API-first banking is when a financial platform is built around APIs from the start, allowing systems to connect, automate, and scale seamlessly.

How does API-first banking differ from traditional integrations?

Traditional banking links systems one by one, while API-first design makes all services modular and ready for integration from day one.

Why are APIs important in lending?

APIs connect core systems, automate workflows like underwriting, and enable real-time data access for credit and compliance decisions.

What are the main benefits of an API-first approach?

The benefits include faster product launches, lower costs, improved customer experience, and easier scalability across markets.