The crypto and fintech worlds have spent years operating in regulatory uncertainty.

Projects launched fast, capital flowed freely, and every jurisdiction had a different definition of what counted as a digital asset.

That era is ending. The European Union’s Markets in Crypto-Assets Regulation (MiCA) has introduced the first comprehensive crypto regulatory framework, aiming to bring order to a fast-moving industry.

For fintech companies, investors, and developers, this shift matters.

MiCA reshapes how crypto businesses operate across the EU and beyond.

Understanding its scope and how it connects to broader fintech regulatory compliance helps teams prepare for a future where compliance isn’t an afterthought but part of the product design.

Fintech companies working in the region, or dealing with crypto assets at all, need to move now, before it is too late.

We have experienced developers who are familiar with not only fintech software but also the EU regulatory environment.

Understanding MiCA Regulation

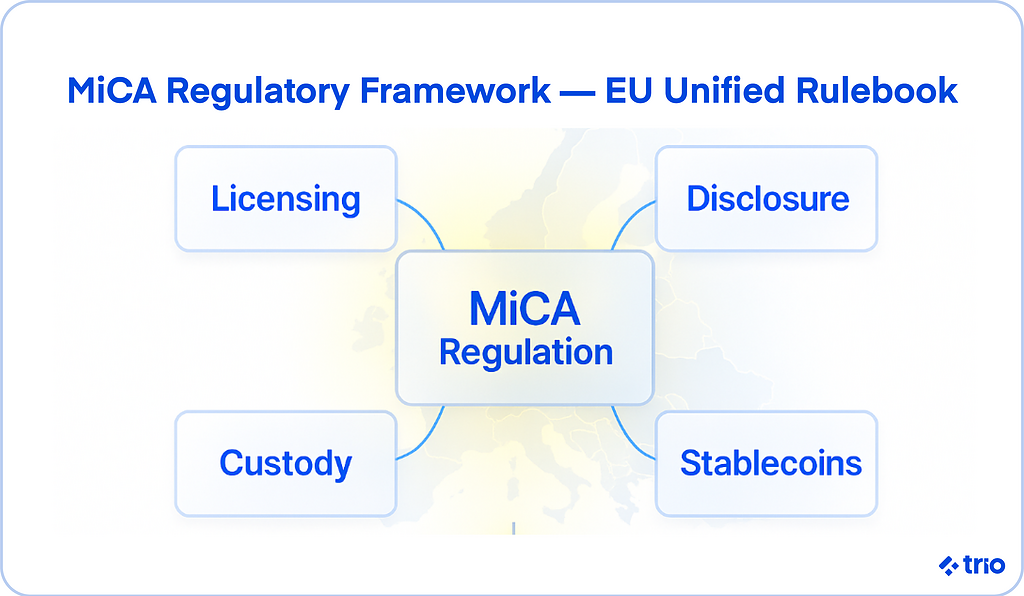

MiCA, short for Markets in Crypto-Assets Regulation, is the European Union’s flagship crypto law. It creates a unified regulatory framework for digital asset service providers, issuers, and stablecoin operators across the EU.

For the first time, the crypto market is being treated with the same regulatory seriousness as traditional financial institutions.

What Is MiCA?

At its core, MiCA represents an effort to bring consistency to cryptocurrency regulation across member states.

Before this framework, national regulations varied wildly; France’s AMF, Germany’s BaFin, and other regulators all had their own definitions and licensing models.

MiCA harmonizes these into one EU-wide rulebook, ensuring crypto-asset service providers (CASPs) can operate across the bloc with a single license.

MiCA introduces strict licensing and disclosure requirements for issuers and service providers, covering everything from token issuance to custody and exchange operations.

The idea is to build financial stability and consumer trust without choking innovation.

Core Objectives of MiCA

MiCA focuses on three main goals: protecting investors, safeguarding the financial system, and providing clarity for crypto businesses.

Consumer protection and market stability are central. The regulation requires issuers to publish whitepapers similar to IPO prospectuses, outlining token details, associated risks, and governance mechanisms.

This shift makes it harder for projects to operate in opacity, a problem that plagued the crypto industry for years.

MiCA also encourages innovation through legal clarity.

Many fintechs have struggled to navigate grey areas around digital asset regulation, unsure whether a token counts as a security or a utility. MiCA’s definitions appear to resolve that ambiguity, allowing compliant businesses to scale faster across the EU.

Finally, the regulation seeks to combat market abuse and fraud.

By setting uniform transparency and conduct standards, MiCA helps prevent wash trading, insider dealing, and other forms of manipulation that have undermined confidence in the crypto space.

The Broader Crypto Regulation Landscape

Around the world, regulators are racing to define how digital assets fit into existing financial systems.

The global crypto industry is now confronting a period of consolidation, where compliance becomes a prerequisite for legitimacy.

Current State of Global Crypto Oversight

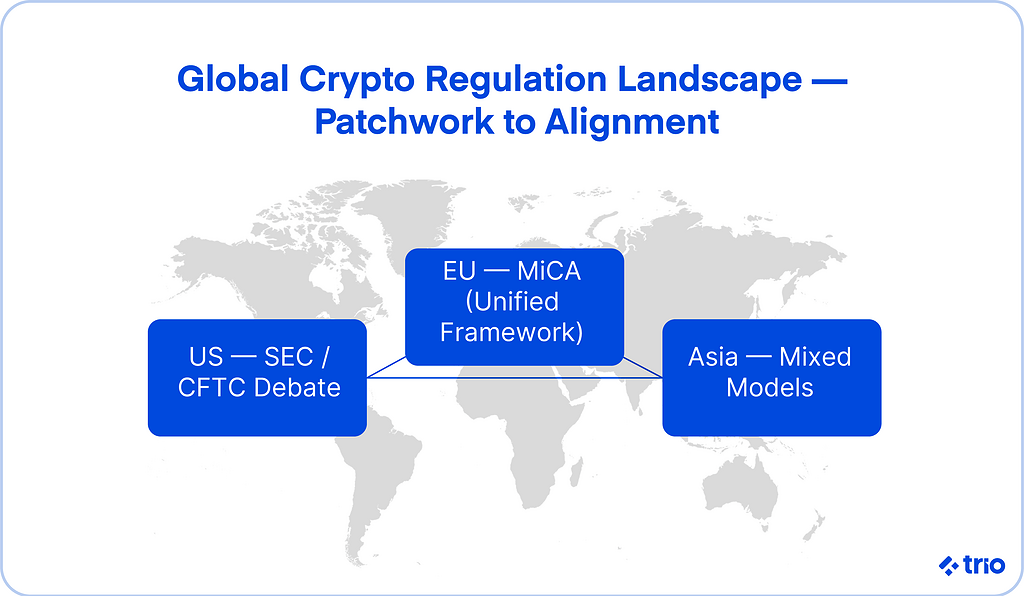

The current regulatory landscape is fragmented.

The United States is still debating whether cryptocurrencies are securities or commodities. The UK has taken a disclosure-based approach under the FCA, while Singapore’s MAS focuses on risk management and anti-money laundering.

Asia’s diversity is striking: Japan enforces strict licensing for exchanges, whereas Hong Kong is reopening its market after years of restriction.

This patchwork allows for regulatory arbitrage, and crypto platforms shift operations to lenient jurisdictions.

MiCA aims to end that by setting a high, unified standard within the European Union. Other regions are watching closely, and many are likely to adopt similar frameworks.

Key Challenges Facing Regulators

Regulating crypto means walking a tightrope between control and innovation.

DeFi governance remains a particular headache, as decentralized finance protocols often have no identifiable operator to regulate. Some regulators are experimenting with “responsible entity” models, but enforcement remains murky.

Cross-border compliance is another concern.

When crypto-asset service providers operate across multiple jurisdictions, ensuring consistent oversight becomes nearly impossible. MiCA’s one-license model may help, but it also depends on how national regulators interpret and enforce the rules.

Data privacy adds a further layer of complexity. The EU’s GDPR demands strict data protection, while blockchain’s transparency thrives on public, immutable records.

Balancing those two ideals, privacy and accountability, will test regulators and developers alike.

Emerging Standards and International Cooperation

Alongside MiCA, new global frameworks are taking shape. The FATF Travel Rule requires crypto businesses to share sender and receiver information, similar to traditional wire transfers.

The ISO 20022 standard is bringing message-level interoperability to digital asset payments.

Some regulators are also experimenting with regulatory sandboxes, letting crypto and fintech startups test products under supervision.

Impact of MiCA on the Crypto Market

MiCA regulation impacts crypto businesses across Europe in profound ways.

It introduces licensing, reporting, and capital requirements that will separate serious operators from speculative ones.

For the crypto market, it marks a shift from informal ecosystems to regulated financial infrastructure.

How MiCA Redefines Crypto Regulation in the EU

MiCA mandates that any company offering crypto services, exchanges, wallet providers, or issuers obtain authorization as a CASP.

This license allows them to operate across the EU without needing separate national approvals. It’s a major win for clarity, but a new challenge for smaller startups that may struggle with compliance costs.

Issuers must also publish detailed whitepapers explaining the token’s purpose, governance, and associated risks. For stablecoins, MiCA imposes even tighter rules, requiring adequate reserves and regular reporting to protect users from sudden collapses.

These measures appear to signal a maturing market, one more aligned with the expectations of traditional finance.

Custody providers face additional obligations around safeguarding client funds, maintaining capital buffers, and ensuring operational resilience.

Combined, these requirements make crypto operations resemble the compliance standards of banks or payment institutions.

Benefits and Challenges

The benefits are easy to see: higher investor confidence, fewer fraudulent projects, and stronger integration between fintechs and financial institutions.

Regulatory clarity attracts institutional investors who once viewed the crypto market as too volatile and opaque.

However, MiCA’s compliance obligations come with costs.

Smaller crypto companies may find the licensing process expensive and the paperwork burdensome. There’s also a risk that over-regulation could push innovation into decentralized spaces, where enforcement is harder.

Still, for fintech companies operating across the EU, MiCA provides a predictable path to legitimacy.

Stablecoin issuers, in particular, face new rules that align them more closely with banks. Issuers must hold fully backed reserves and maintain transparent redemption policies.

After the high-profile failures of algorithmic stablecoins, this step appears necessary for restoring faith in digital assets.

However, you are going to need developers who understand the current crypto ecosystem to help you move forward. That’s where our developers at Trio come in.

By hiring from countries like Brazil and Argentina, you get skilled people, in the most cost-effective way possible, taking advantage of all the benefits, while avoiding many of the challenges of MiCA.

Global Ripple Effects

MiCA’s influence extends beyond Europe.

The United States, UK, and Singapore are already reviewing their own digital asset laws, and many observers expect a gradual alignment with the EU model.

Global regulatory convergence may take time, but MiCA represents a template others can adapt.

If that happens, crypto regulation could finally achieve consistency on a global scale, something the industry has lacked since its inception.

Fintech Regulation and Global Trends

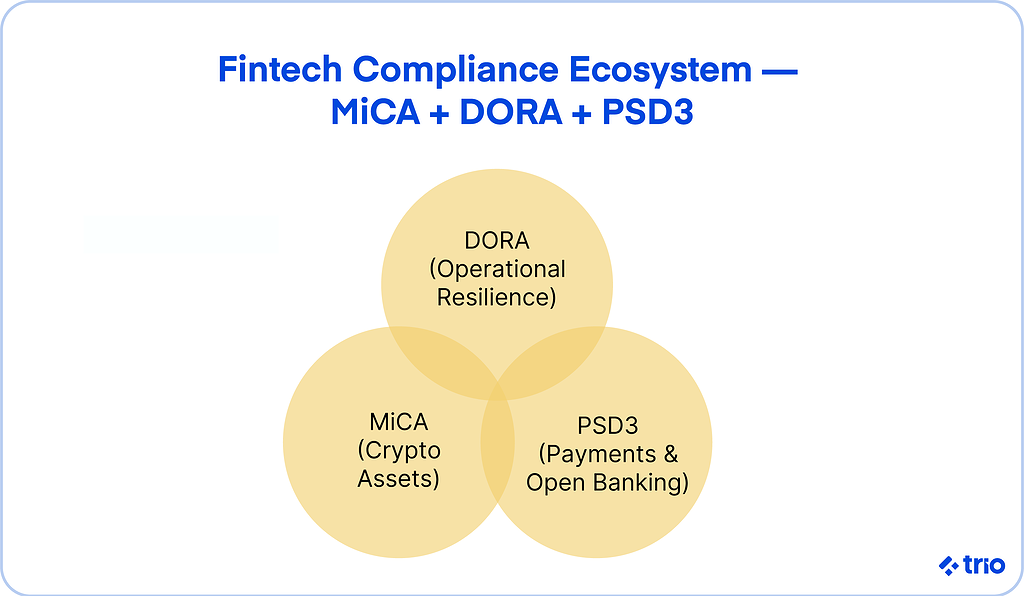

While MiCA takes center stage in the crypto conversation, fintech regulation has been evolving in parallel.

The line between the two sectors is blurring: digital banks now issue tokens, and crypto platforms are adding payment and lending features.

This overlap is pushing fintechs to rethink compliance from the ground up.

Why Fintech Regulation Matters More Than Ever

Fintech growth has outpaced most regulatory frameworks.

New players are emerging faster than supervisors can write guidelines. Payment apps, embedded finance, and Banking-as-a-Service platforms are reshaping how money moves, and every innovation introduces new risk.

Consumers now expect security and speed in equal measure, yet breaches and scams remain frequent.

Regulators are responding with more comprehensive frameworks like DORA (Digital Operational Resilience Act) and updates to PSD3 and GDPR.

You need to scale responsibly, or risk sanctions.

For fintechs, compliance is a credibility marker. Companies that design their systems to meet data protection, AML, and cybersecurity standards early on find it easier to expand into new markets.

Hiring financial developers, like those we provide at Trio, is no longer optional. You need them to ensure compliance is built into your product from the ground up.

Core Fintech Compliance Areas

At the heart of fintech regulation sit three core pillars: anti-money laundering (AML), data protection, and financial transparency.

AML and KYC checks are now baseline requirements across the EU, ensuring financial institutions verify identities and monitor suspicious transactions.

Data protection, led by GDPR and ISO 27001 standards, demands that fintechs control how customer data is stored, shared, and processed. DORA adds another layer by holding service providers accountable for operational resilience and cybersecurity readiness.

Meanwhile, the coming PSD3 framework will likely tighten open banking rules and clarify how third-party providers access user data.

It’s a step toward more integrated and regulated digital finance.

Global Regulatory Trends

Globally, fintech regulation is moving in three directions.

First, there’s a push toward ESG and ethical finance, where companies must report on sustainability and governance standards.

Second, regulators are exploring AI and algorithmic oversight, especially for credit scoring and automated decision-making.

And third, we’re seeing cross-border licensing models emerge, allowing fintechs to operate more easily across multiple jurisdictions if they meet shared compliance benchmarks.

Aligning with these evolving frameworks now can prevent future disruptions as rules tighten.

Compliance Requirements for Crypto and Fintech Companies

Both crypto and fintech organizations are being asked to prove they understand risk, document their processes, and maintain continuous monitoring.

Regulators expect transparency as a default, not an exception.

Shared Regulatory Expectations

Whether you’re a crypto exchange or a payment processor, the basics are the same: conduct risk assessments, implement customer due diligence, and establish robust reporting mechanisms.

Regular transaction monitoring and fraud detection systems are now mandatory for most financial services platforms operating in the EU.

Automation helps, but teams must still interpret alerts, escalate anomalies, and document every decision.

Compliance frameworks are becoming less about punishment and more about proactive governance, something many fintechs are learning to embed into daily operations.

Sector-Specific Frameworks

- Fintechs fall under familiar EU regulations like PSD2 (and soon PSD3), DORA, and AMLD6, all designed to enhance financial stability and consumer protection.

- Crypto firms, by contrast, will soon live under MiCA, the FATF Travel Rule, and new transparency laws aimed at tracking asset flows across jurisdictions.

Together, these frameworks create a more unified regulatory landscape.

While it can feel burdensome, it also simplifies cross-border expansion. Once a company meets these standards in one region, it’s often well-positioned to operate across others.

Consequences of Non-Compliance

The penalties for getting it wrong are steep.

Authorities are issuing larger fines, suspending licenses, and publicly naming violators.

For crypto businesses, losing a MiCA license could mean exclusion from the entire EU market. Fintechs face similar risks, from frozen accounts to reputational damage that lingers long after the fine is paid.

Recent enforcement actions show regulators are leading the conversation.

Implementing Effective Compliance Strategies

Meeting new regulations doesn’t have to slow innovation.

With the right systems, companies can transform compliance into a competitive advantage.

For Fintechs: Building Scalable, Future-Proof Programs

Strong internal governance is the foundation.

Fintechs should establish risk and compliance committees early, not as an afterthought.

Automation tools can handle repetitive tasks like report generation or real-time transaction flagging, while human oversight ensures context and accountability.

RegTech platforms now integrate directly into product workflows, providing dashboards that help teams visualize compliance metrics in real time.

Building compliance into the development cycle, often called compliance by design, helps you scale without constantly reinventing your reporting processes.

For Crypto Firms: Adapting to MiCA

Crypto companies preparing for MiCA will need structured frameworks for licensing and disclosure. CASP authorization requires detailed documentation, internal audit functions, and clear governance.

Whitepapers must be treated as regulatory filings, not marketing documents.

Many crypto firms are partnering with legal experts and compliance consultants to navigate these requirements efficiently.

In time, MiCA may create a more predictable business environment where licensed operators can build partnerships with traditional financial institutions.

The Role of RegTech and Developer Expertise

Technology plays an outsized role in this transformation.

Developers are now key to embedding compliance directly into the product architecture, encrypting data by default, enforcing access controls, and automating audit trails.

That’s where working with experienced fintech developers matters.

At Trio, we help fintech companies integrate compliance and security into their software from day one.

Our engineers understand both code and regulation, helping teams build systems that pass audits as easily as they process transactions.

The Future of Crypto and Fintech Regulation

Looking ahead, regulation appears set to deepen rather than loosen.

Financial institutions, fintechs, and crypto platforms are entering a period of global alignment.

Emerging Global Trends in 2026 and Beyond

AI accountability will probably dominate the next phase of oversight. Regulators are preparing frameworks for algorithmic transparency, ensuring credit models and trading bots can explain their decisions.

Tokenization is also moving mainstream, with real-world assets, from real estate to art, being represented on blockchains, creating new asset classes that will require fresh regulation.

At the same time, ESG-linked instruments and sustainable finance disclosures are moving from optional to expected.

And as digital identity systems mature under eIDAS 2.0, we’ll likely see smoother cross-border authentication for both fintech and crypto users.

Preparing for the Future

Companies that thrive will treat compliance as part of their design philosophy.

Building compliance-by-design architectures, investing in automation, and adopting predictive analytics will become baseline expectations.

In the next few years, there will likely be more cooperation between regulators and innovators, perhaps through public-private working groups and shared data initiatives.

Conclusion

The MiCA regulation signals the start of a new phase for the crypto and fintech industries.

For years, the absence of clear rules has hindered credibility and scared off institutional players.

Now, as markets mature and compliance frameworks take shape, companies that can balance innovation with accountability will lead the charge.

Trio helps fintech and crypto firms build that balance into their technology.

Our fintech-ready engineers design systems that meet regulatory expectations while keeping teams agile enough to compete globally. To find out more, get in touch!

FAQs

What is the MiCA regulation?

The MiCA regulation, short for Markets in Crypto-Assets Regulation, is the EU framework that unifies crypto licensing, investor protections, and compliance standards across all member states.

How does MiCA affect crypto businesses in the EU?

MiCA affects crypto businesses in the EU by requiring them to obtain a CASP license, publish detailed whitepapers, and meet strict capital and reporting obligations to operate legally.

What are the main compliance requirements for fintech companies?

The main compliance requirements for fintech companies include adhering to AML, KYC, GDPR, DORA, and PSD3 rules that govern data protection, cybersecurity, and customer verification.

Why is fintech regulation becoming stricter?

Fintech regulation is becoming stricter because the rapid expansion of digital finance requires stronger safeguards to ensure market stability, prevent fraud, and protect consumers.