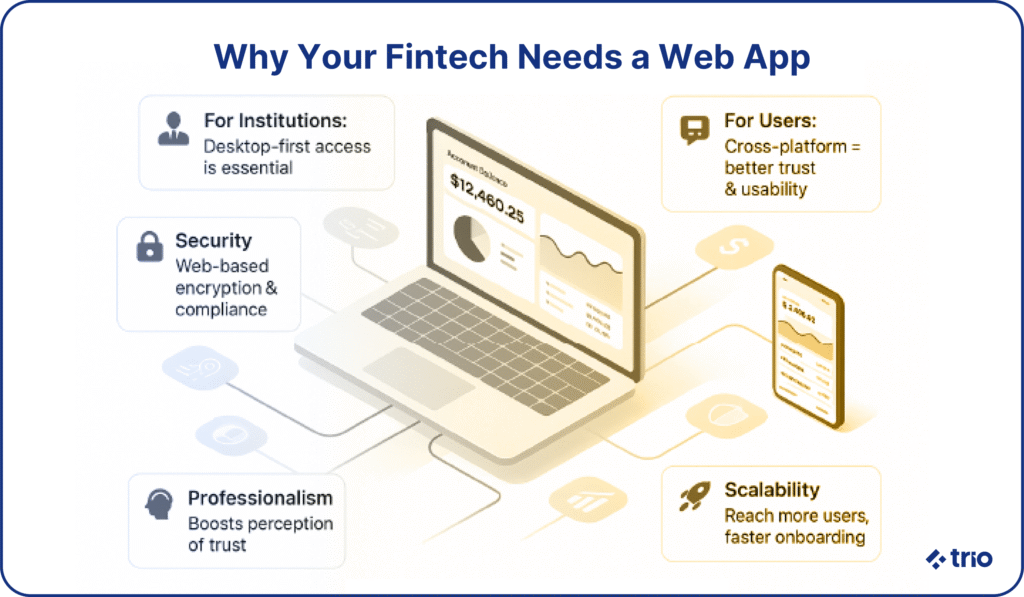

Fintech web app development is a critical component of most fintech solutions. While mobile apps are incredibly important, desktops are still widely used, especially in institutions where fintech applications mean traditional financial services.

Even if your fintech software is targeted at ‘everyday people’ who are more likely to take advantage of a mobile platform, ensuring you have a web app available could improve the overall user experience, and perhaps even influence their perception of your professionalism and trustworthiness.

So, let’s take a closer look at how you can go about building the web-powered version of your fintech app. We’ll go over the software development process from start to finish and address any challenges you may encounter that you may not have come across in strictly mobile app development.

If you are interested in finding the right developers for your fintech product, you are in the right place. Whether you are new to the game as a fintech startup or scaleup, or you are an established enterprise, our experienced web and mobile app developers have many years of experience in the industry and can help you bring your vision to life.

What Is Fintech Web App Development?

Fintech app development is a lengthy process, but it generally refers to creating some sort of browser-based technology solution that deals with an aspect of the financial sector.

Usually, you would be able to access these applications from any device using a URL, so they need to be optimized not only for different browsers, but also for entirely different devices.

The result is that your users don’t have to download anything from an app store, and can access your web app on their desktop, laptop, tablet, and even mobile device.

This means you are at an advantage not only in terms of accessibility but also in terms of iteration speed and general cost-effectiveness.

When it comes to fintech, web apps are usually used in conjunction with mobile platforms for things like personal banking, trading platforms, peer-to-peer lending, payment gateways, budgeting tools, and even internal operations in the finance field.

Why Web-First Still Matters in Fintech

If you have compared web and mobile apps, you have likely come across the widespread opinion that consumers prefer a mobile-first approach. However, fintech is one of many industries where web-first strategies might be the way to go.

A big reason for this is the fact that fintech is often used in B2B and enterprise workflows. In these cases, most users are based on a laptop or desktop to conduct their business. Large screens are also more user-friendly for data-heavy tasks like trading and analytics.

You can also consider that a web-first approach means a single app can be used over a myriad of devices and operating systems, provided you do it correctly, which means you can focus on centralized development to reduce maintenance and costs, as well as make the update and change integration process easier.

Web apps are also very discoverable in search. You could be discovered organically, which can help you stand out from competitors.

Performance, SEO, and Discoverability

If you run an app in a browser, how can you determine performance? Speed, accessibility, and visibility are all key performance indicators you can monitor. Depending on the browsers you expect to run on, there is usually a platform or page designed for developers to monitor these indicators.

For platforms like Chrome, you’ll want to look at Google Core Web Vitals.

You can also consider implementing progressive enhancement. This ensures the core functionality of your web app is available in conditions that are not ideal, like when users have an older device or a slower internet connection.

Certain key performance indicators, along with a variety of other SEO (Search Engine Optimization) best practices, can influence your app’s organic discoverability.

Accessibility is also important to consider, as being compliant with things like Web Content Accessibility Guidelines (WCAG 2.1) doesn’t just mean your app is usable by those with disabilities, but also tends to work in your favor for discoverability.

Key Categories of Fintech Web Apps

Now that you have a good idea of what web apps are and why you might want to pursue one, let’s take a look at some common applications in the fintech industry for both consumer and enterprise use.

- Digital banking apps: for managing accounts, initiating transfers, etc.

- Robo-advisory and investment apps: dashboards for stock trading and portfolio management.

- Payment and remittance gateways: facilitate real-time transfers, potentially cross-currency.

- Budgeting and personal finance tools: to track spending and saving, set goals, and automate budgeting.

- Lending and credit systems: P2P leading, underwriting platforms, and loan management tools.

- RegTech applications: compliance dashboards, anti-money laundering (AML) monitoring, and identity verification systems.

- Treasury and corporate finance management platforms: liquidity tracking and ERP integrations.

- Decentralized finance (DeFi) tools: interfaces for wallets, taken swaps, and smart contracts.

While fintech web apps do not fall into these categories exclusively, they cover most existing apps on the market at the moment.

The Fintech Web App Development Process

In order to create web apps that are scalable and compliant with a variety of regulations, we recommend that you take an iterative approach. Evaluating your requirements and coming up with a custom plan is also the way to go, but if this is your first time delving into fintech application development.

Step 1: Define Your Business Case and Target Audience

Before you can start writing the code, the most technical part of fintech software development, you need to figure out what problem your app is going to solve and who your users are.

For financial apps that run on the web, these users could be individuals, SMEs, or institutions.

You also need to decide if your fintech app will benefit from being browser-based or if it would be more beneficial to look into mobile application design and development.

Step 2: Analyze Regulatory and Legal Compliance Requirements

The fintech market is incredibly regulated, and with good reason. Whether you have a mobile banking app or a browser-based crypto wallet app, you are probably going to need to comply with data protection regulations.

These differ from region to region, so you need to do your research or, at the very least, go with a fintech app development company that is aware of the regulations you need to consider when you build a fintech app.

Some of the most likely regulations you will encounter for data protection include GDPR in the EU, PCI DSS standards for secure payment handling, and PSD2 for open banking integrations.

You may also need to take additional regulations into account, such as SOC2, HIPAA, or CCPA.

It might be tempting to skip this step, but if you go ahead without ensuring you are compliant, it may lead to constant reworks in the future, or you may even have to deal with fines.

Step 3: Define your Features and Information Architecture

Once you have a good idea of the equations you will need to take into account and the users you will need to provide for, you can decide on the features you want to include in your finance app.

Different types of fintech apps generally have different expectations from users, but regardless of whether you have a payment app, an insurance app, or something else entirely, you are probably going to need some sort of user registration, Know Your Customer (KYC) verification, dashboards, payment functions, and administrative tools.

You’ll need to think about what features your competitors have and what your users might expect from you. However, it’s also important to consider the development cost of these features. If you are a small startup, you could focus on an MVP (Minimum Viable Product) to get your most important features into the world, allowing you to add more as money comes in.

Step 4: Decide on Your Tech Stack

Now that you have decided on your features, you need to choose which technologies you are going to use. In the fintech sector, there are a couple of frameworks that are particularly popular for their performance, security, and scalability.

Frontend development frameworks like React.js, Vue.js, or Angular are often used for their ability to create dynamic and interactive interfaces. For backend development, you could consider Node.js, Python, or .NET Core, depending on your needs.

You also need to consider databases like PostgreSQL, MongoDB, and Redis, as well as hosting and CI/CD (continuous integration/delivery) platforms like Vercel, Netlify, AWS, GCP, or Azure.

At Trio, we have developers skilled in a variety of technologies. With their experience in previous fintech product development, they are able to advise you on what would work best for your custom fintech ventures, and will even be able to advise you on security features, like HTTPS, OAuth2.0, JWT, HSTS, and CSRF protection.

This means you know that they can help you build an app that sets you up for success from the start of the development process.

Step 5: UX/UI Design

User experience is a tricky field to master. As we’ve already mentioned, modern fintech apps often benefit from the larger screen sizes. The designs can also benefit from more interaction models like modals, tabs, and expandable sidebars.

The important thing, however, is that navigation is intuitive and accessible. Users should be able to use a mouse and keyboard, as well as browser-based tools like ‘read aloud’ features.

Accessibility standards like those related to text and background colors, as well as the ability to adapt to desktop settings for light and dark mode, are usually preferred by users, too.

Our developers build fintech app user interfaces using tools like Figma and Adobe XD. These allow you to prototype your entire fintech app solution before you start development, which means you can not only iterate faster but also get initial user feedback to help you improve in a practical sense.

Step 6: Develop a Secure Codebase

Finally, you are able to actually start developing a fintech app and all the features you have decided on. When hiring a company for fintech application development services or hiring in-house developers for the process, it is important to ensure they use a modular architecture.

Modular code will be easier to scale in the future and will be far more flexible.

Component-based frontends, micro frontends, and API-based backends are also ideal for efficient development and future expansion, but it is important to ensure security is embedded into every line of code through best practices like the OWASP Top 10. By doing this, your fintech app developers can prevent common security vulnerabilities.

We’ve already mentioned that you should consider CI/CD tools when deciding on the tech stack you will be using in your development solutions. These pipelines help you automate testing.

Testing the entire app can be considered a step on its own, but we also recommend that your fintech software developers test throughout the development process to save you time later and catch issues while they are still very easy to resolve.

Step 7: Test Across Multiple Browsers and Devices

It’s important that you test for user experience across multiple browsers. Some of the more popular ones include Chrome, Safari, Firefox, and Edge.

You should also test your completed app on various screen sizes.

It is incredibly important that you get the final testing right, as even the smallest issue can greatly influence the way users perceive even cutting-edge fintech solutions. If there is an issue in the responsiveness of your design, or you missed something in your security evaluations or accessibility audits, users may lose trust in you, regardless of what your app offers.

That’s why a lot of companies take advantage of a QA developer who specializes in fintech app development services. These developers make use of tools like Cypress, Selenium, Lighthouse, and Axe-core, which provide robust testing capabilities.

Step 8: Deploy and Monitor

Once you are confident that your financial application development is at a point where you can go to market, you can start deploying. Containerization tools like Docker and orchestration via Kubernetes help you create a consistent experience across a variety of environments.

Real-time monitoring tools like Datadog, Sentry, and New Relic can also help you track how your app is performing and pick up on any issues as soon as possible.

Don’t forget to keep monitoring performance metrics and security logs long-term, as issues can pop up at a moment’s notice. Even if you don’t change anything in your web app, the world around you continues to change, which may cause integration issues.

In many cases, successful fintech startups, scaleups, and enterprises outsource this portion of their development to a software development company. These companies, like Trio, provide affordable developers by hiring from nearshore and offshore locations. They take the load off your hands, allowing you to keep a smaller internal team and spend resources on other issues.

Cost Breakdown: What It Takes to Build a Fintech Web App in 2026

Generally, fintech apps are more expensive, thanks to the additional security and regulatory considerations. This can also lead to an increase in development time.

While there is no way to specify the time or cost to build a fintech web app without knowing what kind of features you plan to include, we can estimate based on other apps that you could pay anywhere between $30,000 and $100,000, with some of the more robust fintech solutions costing as much as $300,000.

You then need to factor in maintenance costs as well as long-term hosting and a variety of other ongoing expenses.

There are a variety of different ways you could decrease these costs without sacrificing quality. Outsourcing to an experienced firm that has worked on similar projects not only reduces your expenses but also allows you to rest easy, knowing that you’ll get a comprehensive fintech app with all the security and regulatory concerns taken care of.

AI in Fintech Web Development: Opportunities and Cautions

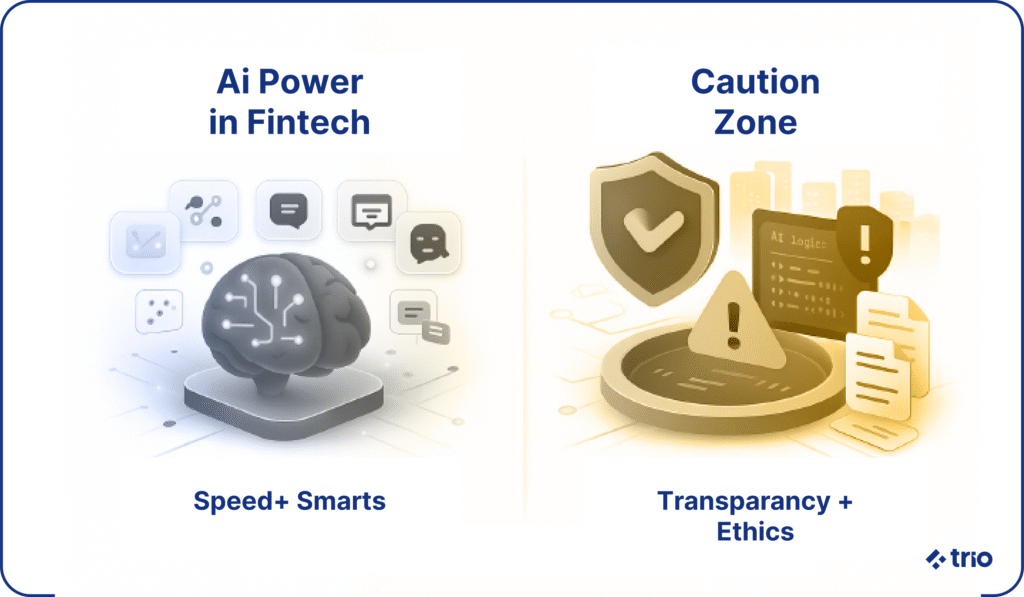

With how often we’ve seen AI making headlines in recent years, it would be unwise to ignore the impact it is having on web and mobile application development, and specifically, the considerations you need to make in your fintech business.

AI can analyze large quantities of data in real-time, allowing you to improve on fraud detection. AI-driven chatbots and personalization are also making waves in user interfaces, creating new standards and user expectations that you will have to meet.

It can greatly streamline tasks like loan application reviews and compliance checks, too, speeding up the internal processes required to provide a service to your clients.

However, with new features also come new challenges, particularly in a world where data privacy concerns are being emphasized more and more. You need to ensure that your AI models are explainable and transparent. Especially when dealing with people’s money or things like credit scores.

AI is a great tool, but it is far from perfect. The problem is that AI biases are not as easy to pick up on as human biases, as it can be easy to assume that the AI is infallible when this is, in fact, far from the truth.

You need to audit your models regularly and be able to produce evidence of that for regulatory purposes.

Security and Compliance in Fintech Web Apps

In the world of fintech software development services, security and regulatory compliance cannot be emphasized enough!

Security needs to be considered in every part of development. On the front end, your developers need to protect your app from things like cross-site scripting (XSS), clickjacking, and other browser-based exploits. When it comes to the backend of your app, they need to sanitize inputs, enforce role-based access control, and protect against injection attacks.

APIs are quite vulnerable, so make sure that you implement secure authorization methods, rate limiting, and IP whitelisting to minimize potential issues you might run into.

And, above all, create encrypted backups you can fall back on if something goes wrong. This way, if your fintech app experiences issues from your side, you have a quick solution that you can implement to give you time to figure out what is wrong without needing to take the whole thing down.

As for your users’ side, strong authentication methods like two-factor authentication and passwordless logins, or even using AI to detect potential unusual activity, are all good ideas, but there is also a responsibility on the user’s side.

Your responsibility is to make them aware of how their data is collected, stored, accessed, and erased, according to certain regulations. You may even have to provide them with options related to how their data is handled, but there is only so much you can do after which they need to keep their passwords private.

Be prepared for issues on their side, and ready to provide the customer service they expect at a moment’s notice.

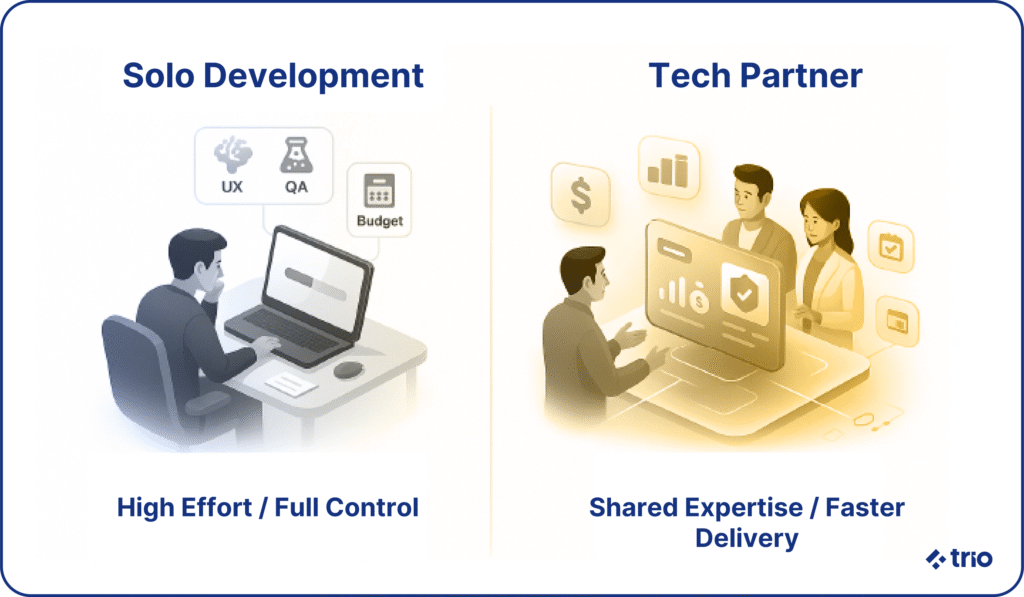

Hiring or Partnering for Web App Development

While it’s definitely possible for you to go through the fintech app development process on your own, there are many benefits to getting an experienced tech partner on board.

Not only can you take advantage of their specialized knowledge, but you can also potentially lower costs.

What to Look for in a Web-Focused Fintech Development Team

A portfolio of similar projects is one of the first things you should look for in a long-term tech partner. This means that they should have experience not only in the fintech industry but also in building fintech web apps. When these two are combined in previous projects, like financial management apps that have an online interface, it is ideal.

They should also have a strong track record when it comes to security and compliance, and evidence of this should be visible in their portfolios.

Agile development methodologies are also really great to look out for. This can include techniques like sprint planning and iterative development. Agile methodologies increase not only the speed of development but also efficiency.

At Trio, we have extensive experience with fintech web app development and agile methodologies. Our developers are the top 1%, nothing less. They are thoroughly vetted, so we can connect them to your team within as little as 24 hours sometimes.

You no longer have to sift through hundreds of portfolios and spend an excessive amount of time looking for the right people. Now, you can get a handful of portfolios in hours, with the guarantee that they are all suitable candidates.

If you are interested in exploring our outsourcing and staff augmentation hiring models, or perhaps putting together a dedicated team, you are in the right place! Reach out to set up a free consultation!