Whether you are a small neobank with a growing user base or a technical leader at an established bank, modernizing core banking systems should be one of your primary focuses.

Many CTOs and team leads have come to us, realizing that the banking architecture of their legacy platforms, which once powered their growth, is now hindering them.

In most cases, being unable to support real-time payments, open APIs, and embedded finance is the biggest decision maker.

However, without a proper modernization strategy, you risk having your various services and business processes disrupted, potentially exposing yourself to security or compliance gaps. The result could be a massive, irreversible loss of client trust.

That’s why having the right people on your team is critical when modernizing legacy systems.

We have developers on our team who specialize in the fintech industry.

They are familiar with the modernization journey, best practices, and potential challenges they may encounter, and have proven they can implement digital transformation without affecting your services.

Since they are immersed in only fintech, they are also able to stay on top of the latest developments in regulatory standards. If you are interested in hiring fintech developers, we can provide them through outsourcing and staff augmentation. We have even established dedicated teams for our clients.

With these alternative hiring models, you get all the talent you need without any of the commitment of a long-term hire.

Why Core Modernization Can’t Wait

Modernization is an urgent matter. But why should you consider devoting time and resources to updating a seemingly effective platform? Let’s look at some of the reasons.

Legacy Systems Don’t Scale Well

Most companies, whether they are small fintechs or established institutions, begin building their core banking platform to enter the market quickly.

These MVPs (minimum viable products) serve their purpose, but over time, you might start to struggle with increased transaction volumes and customer bases.

You will also want to add more features when you realize there is an opportunity to market other financial services to your clients.

All of these changes mean that you can very quickly outgrow your core platform. Performance issues may start to creep in slowly, but with every new feature, you will encounter more problems.

It also becomes increasingly complex to migrate to a new core.

Cost-Effectiveness

Suppose a financial institution fails to modernize its core. In that case, it will have to contend with ongoing issues, including constant patches, manual workarounds, and the need for expensive external vendors to provide additional support.

All of this is expensive in and of itself, but then you also have to consider that you will probably be offering a sub-par customer experience, which will lead to you losing clients.

It will also be more expensive to create new features, as you’ll have to struggle with your old technology stack, spending countless hours that you will need to pay developers for, to get things to work.

New Technologies Create Competitive Pressure

Cloud-native, API-first platforms open up a world of possibilities when it comes to rapid iteration, easier integration, and improved delivery.

Falling behind means that you are not taking advantage of these products, while your competitors are using them to streamline their offerings.

If you want to defend or grow your market share, you need to ensure that you are using these systems effectively as well.

Talent Shortage

Old banking technology is no longer used as frequently as it was in the past. The result is that developers are not focused on learning how to work with it.

You may encounter issues not only in maintaining your existing systems or creating new features using the technology, but also when trying to find developers to assist you with the modernization process.

Even if you can find the right talent, with not only extensive knowledge of a core technology that is no longer in use but also of the fintech industry as a whole, they are likely to be incredibly expensive.

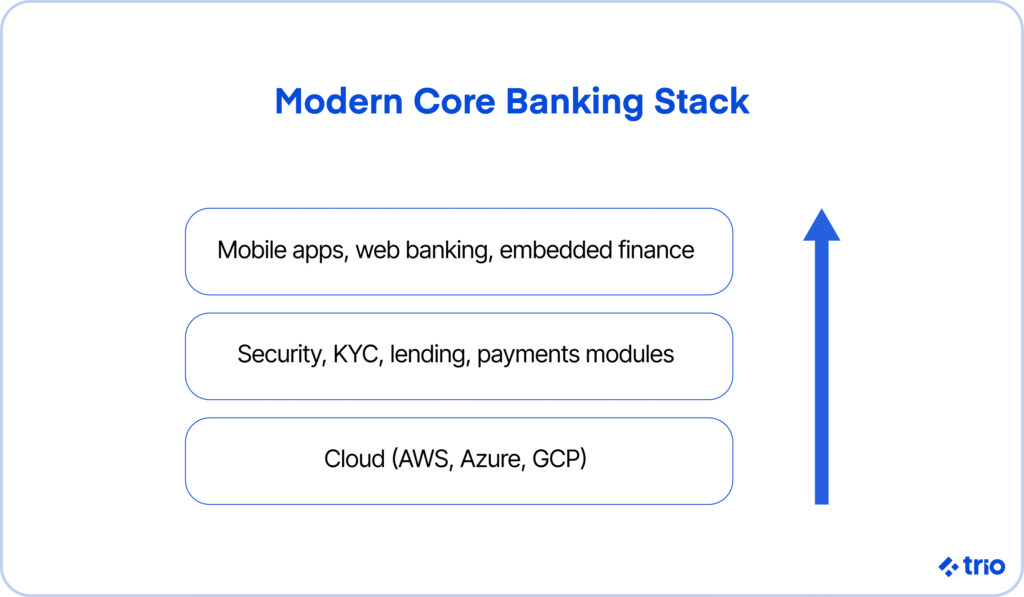

Understanding the Modern Core Banking Stack

Now that you understand why everyone in the digital banking sector must continually modernize their core, with some degree of urgency, let’s examine the various components that comprise a modernized bank’s core technology stack.

Cloud-native banking

Cloud-native, in part, refers to hosting applications on platforms such as GCP, AWS, or Azure.

However, it is also a lot more than that. It is about creating your applications as microservices, with APIs that enable integration with embedded finance tools, allow for independent scaling, and facilitate the automation of various system aspects.

By taking a cloud-native approach, you mitigate the need for entire rewrites when regulations change in a single region, giving your banking platform incredible resilience.

Composable architecture

Composable architecture is the opposite of a single, inflexible system.

Instead of building something monolithic, using component-based banking systems means you can optimize one component at a time, or perhaps even take advantage of some pre-built components that can be swapped with relative ease.

Our developers have helped our clients assemble their composable systems from various lending, payment, KYC, and risk scoring models, which are considered some of the best in the industry.

Banking-as-a-Service (BaaS) infrastructure

Baas providers give you the ability to access and offer banking capabilities, which are heavily regulated in most countries, by utilizing their APIs.

The result is faster building, as you don’t have to constantly worry about building every component in-house and ensuring it meets regulatory standards. You can focus your resources elsewhere, allowing you to scale rapidly.

However, you must ensure that you integrate the banking services correctly; otherwise, you risk exposing yourself to security risks.

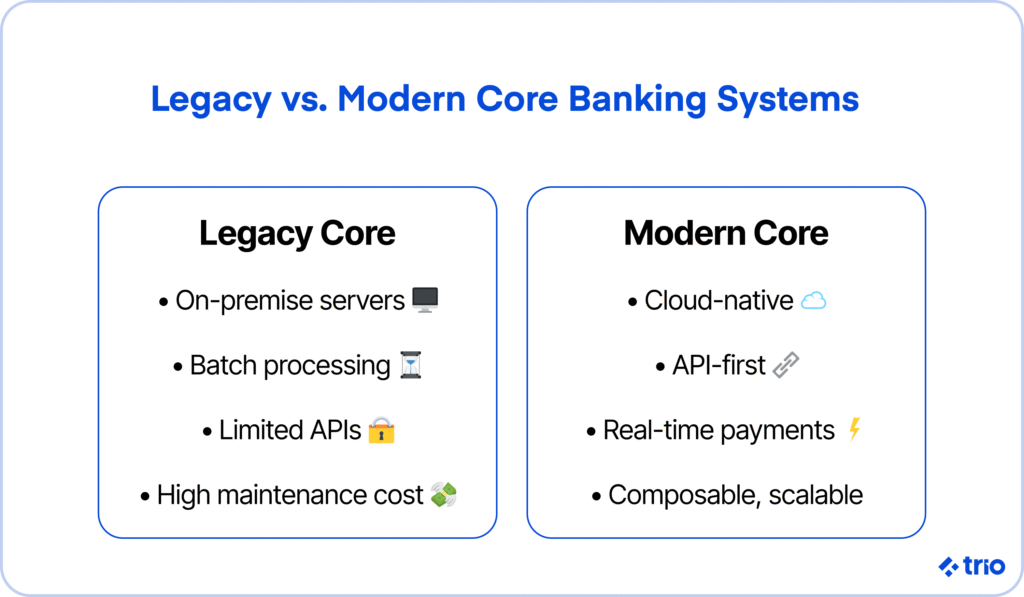

Legacy vs. Modern: Knowing Where You Stand

Are you in a position where you need to replace specific components of your digital core? The easiest way to determine this is to examine the most modern technologies and their predecessors to gain a better understanding of whether you have an outdated core.

We’ve already mentioned that legacy core systems are monolithic. In many cases, they are also on-premise and are built for batch payment processing.

Next-gen core systems are cloud-native, API-first, and designed with a focus on real-time capabilities and adaptability.

You need to be able to shift in a fast-changing market. Next-generation cores enable you to modify what you need, without requiring the entire system to go offline.

If you’re still unsure, begin with a comprehensive audit of your system architecture, integrations, compliance controls, scalability limits, and operational processes.

This should give you a good idea of where you stand in each case and will allow you to develop a plan to update your existing core systems most effectively.

Our experienced developers can assist with an initial assessment.

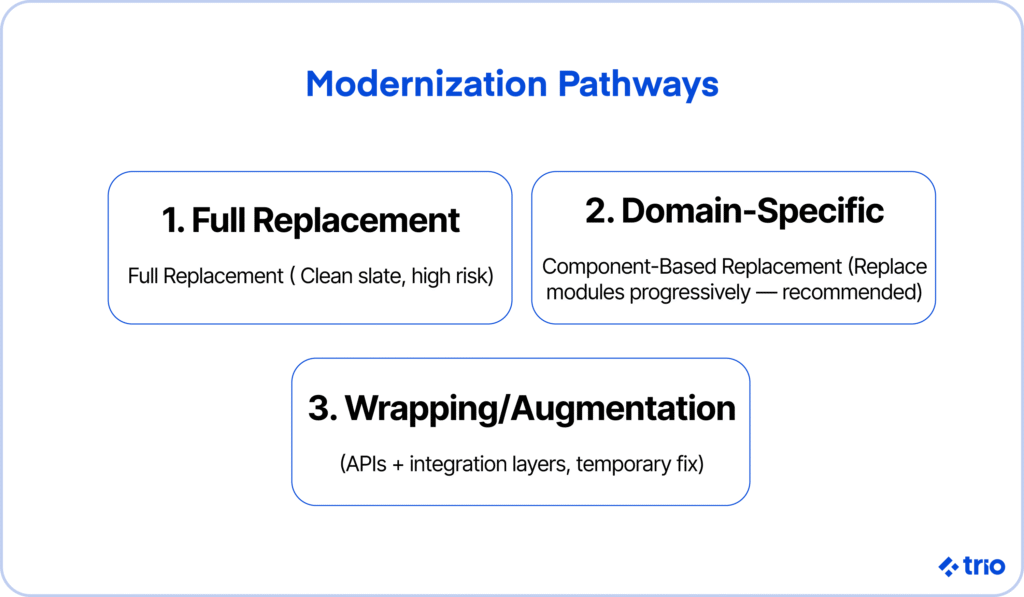

Modernization Pathways: Choosing the Right Option

In most cases, banks have three primary approaches to modernizing their core systems. They either decide to replace everything, replace specific modules, or augment existing systems with integration layers, APIs, and microservices.

The right choice will depend on your goals, risk management strategy, and numerous other factors.

Option 1: Full replacement

Completely replacing what you have in the process of system modernization is quite drastic, but we can’t deny that it is effective. You get to start over with a clean slate, with almost no technical debt to consider in the near future.

While this is the most expensive and time-intensive option, it does provide flexibility. The biggest concern is the risk of having your services disrupted during a complete core migration, and as a result of bugs that you may not have identified in your testing.

We would only recommend this if your systems are so outdated that they cannot be integrated with modern technology in any way, or if there is no possibility of bringing your security and data handling up to a level that achieves regulatory compliance.

Option 2: Component-based replacement

In this approach to modernizing core systems, you keep the majority of your existing code and replace specific modules. These modules could be related to payments, customer onboarding, lending, security, or any other aspect that you consider outdated.

This component-based replacement strategy is the one we recommend in most cases, as it enables you to address your most significant problems first, providing the greatest value with the time and money you invest.

Since you are working on progressive modernization, altering one aspect at a time, you also minimize the risk of disruption, all the while starting to reap the rewards of your modernization effort far sooner.

Option 3: Wrapping or augmenting existing systems

Suppose you are concerned about the instability of changing components in your systems, or you are in the process of a complete replacement, but need some improvements in the meantime. In that case, you can consider wrapping or augmenting your existing systems.

While we have only ever seen this used as a more transitional approach, adding integration layers, APIs, and microservices is quite effective at extending the life of your existing software. But it is far from a permanent solution.

Risk Management in Core Banking Modernization

Understanding your risks is critical for any sort of change in the financial technology sector. If anything goes wrong, it can have a direct impact on the trust that users have in your services.

IT risks

Downtime, data loss, and security breaches can all result from a poorly planned core banking transition.

Downtime, in particular, is terrible for customer trust. People need to have reliable access to their money. When they don’t, it’s a big deal. The greater the number of clients you have, the more likely it is that someone will be negatively affected.

The same can be said for data loss or corruption.

There are many instances where your clients may not be aware that their data has been lost; however, in most cases, that data will be of some importance, so you will need to inform them of what has happened.

The results span both reputational and regulatory consequences.

You need to make sure that you have a backup in place. Whether you temporarily revert to previous systems or have an alternative mechanism in place, you must be prepared to act at a moment’s notice. Monitoring tools can be handy.

Regulatory and compliance considerations

You must ensure that, in modernizing your banking system, you avoid any missteps that could result in the loss of regulatory approvals.

In some cases, you may need to reapply for specific certifications or notify the relevant authorities of adjustments to your compliance workflows.

It’s a good idea to review the requirements of the regulations you currently fall under, such as PCI DSS, AML, and GDPR. Failing to do so might result in hefty fines or even a temporary shutdown.

Quantifying risk vs. opportunity for your institution

Quantifying risks and opportunities is critical to determining not only which model of modernization may be the best for you, but also to motivate the modernization entirely.

We recommend starting with a thorough cost-benefit analysis that considers factors such as the financial implications of all options, as well as operational resilience, compliance, and the speed of innovation.

Our experienced developers can assist you with all of this, working closely with your existing team and leveraging their expertise to ensure that your values are as accurate as possible.

Our focus on soft skills also enables us to communicate this information effectively to people who may not have the same technical background, such as investors and leadership.

Consider the cost of inaction in terms of lost market share, customer attrition, and inefficiencies so that decision-makers can get the whole picture.

Building resilience into your migration plan

Building resilience is, in part, planning for failure. As mentioned above, things may go wrong, which could have serious consequences.

You need to design your migration stages so that you can quickly roll back to previous versions.

Also, implement redundant environments to allow for the parallel operation of old and new systems during your most critical phases, making any downtime far less likely.

Trio’s developers can also help you conduct stress tests, penetration tests, and simulated failure drills to ensure that your plans are effective and your team is prepared for worst-case scenarios.

Blueprint for Modernizing Without Disruption

Modernization should occur in a well-planned, structured manner to ensure that you can transform your systems while maintaining the stability of any live services.

Step 1: Audit and map your existing core banking ecosystem

First, review everything you already have.

Document every single process, integration, and dependency. This will give you a good idea of any risks you could potentially encounter and any inefficiencies that need to be addressed.

It is also a good idea to have the bigger picture in mind when you start making changes so that you can keep your team on track.

Step 2: Define your target architecture

Once you know where you are, you need to figure out where you need to be.

It is not a bad idea to have the ideal target architecture in mind, but you also need to have a realistic idea of what would be suitable for all your needs.

Remember to consider a cloud-native, composable architecture. This is a good baseline.

On top of this, think about scalability, resiliency, modularity, and anything else that is relevant for the banking services that you offer.

Step 3: Phase migration to minimize risk and downtime

When you have your start and end points, you can break your transformation into manageable phases.

The goal of each phase will be to deliver as much incremental value as possible while minimizing risk.

Step 4: Build integration layers for interoperability between old and new systems

As you build your new core, you need to start utilizing APIs and middleware.

This technology will allow your old and new components to work together during the transition.

Consider each new component individually to ensure that a one-size-fits-all bridging solution overlooks nothing.

Step 5: Train teams for operational and cultural shifts

Do not forget to train your teams for the differences they will encounter.

By neglecting your people, you are far more likely to face resistance to the change, and much of your effort may go to waste.

Your team culture should always focus on progression and innovation.

Emerging Technologies Accelerating Modernization

Modernization is changing every day. New tools are emerging, and approaches to transforming your systems are evolving.

To ensure your upgrade timelines and costs remain as low as possible, stay informed about these trends, allowing you to remain competitive.

Unlocking legacy code with generative AI

AI tools can help developers analyze large quantities of legacy code in record time. This allows them to map dependencies, identify redundancies, determine which components pose the highest risk, and more.

Some of the more advanced models can even help developers auto-generate some of their integration layers and API endpoints, cutting down on the manual effort they need to put in and speeding up the development process.

Embedded finance and real-time payments

You used to have to code every single part of your application yourself. This is time-consuming, expensive, and requires niche expertise.

Now, thanks to microservices and APIs, you can make use of products offered by people who specialize in specific areas of the fintech industry, and who can devote the time and energy to ensuring their tools are not just efficient, but also secure and compliant.

While this is limited in some ways, it lowers the barrier of entry, especially as user expectations continue to increase.

The same technology enables real-time payment rails, allowing you to provide faster settlement and reduce the risk of fraud through technologies like blockchain.

Automation and orchestration in the modern fintech stack

Automation plays a significant role in coding, but it can also be applied to automate internal processes that are highly repetitive.

Some of the most common tasks our developers have helped fintech companies automate are deployment, scaling, monitoring, and compliance reporting.

Orchestration frameworks coordinate complex workflows across microservices and third-party APIs, so your systems stay stable even under heavy loads. When you combine automation and orchestration, you reduce the risk of human error, increase efficiency, and alleviate pressure on your teams.

The important thing is to set yourself up for success both now and in the future; otherwise, you are just building up technical debt that will have to be addressed at some point.

One of the best ways to ensure that you are approaching your modernization in the best way possible is to find talent skilled in core banking changes who have worked on similar projects before.

We can help connect you with the right people in as little as a couple of days. Our fintech experts are always placed on a case-by-case basis, which has resulted in a 97% placement success rate.

Our nearshore and offshore hiring models also allow you to access developers from countries with lower costs of living, and thus lower salary requirements, without sacrificing quality.

If you are ready to hire or want to learn more, please reach out to schedule a complimentary consultation.