Global fintech regulations cause issues for everyone, from startups to established financial technology firms. Thanks to the ever-changing nature of the fintech industry, financial regulators are forced to alter their frameworks and requirements to ensure that users’ safety is prioritized.

The result is incredibly varied regulatory requirements over time, as well as regionally.

Fintech companies don’t need to be aware of the various laws and regulations that they may be subject to, both now and in the future, if they choose to expand, so that they are ready for cross-border expansion and so that they can keep their regulatory compliance in the regions where they are already established.

Let’s take a look at everything you need to know about navigating global fintech regulation, including the regulations that are most likely to affect your fintech products in each region, and solutions like embedded RegTech that you may be able to use to make compliance as easy as possible.

Since we started in 2019, we’ve helped countless companies operating all over the world ensure that they comply with fintech regulatory frameworks. Our developers are mostly based in Latin America, but they are familiar with U.S. regulations and have proven their knowledge and ability on countless projects.

If you are interested in hiring a developer to ensure that you are compliant with any fintech laws and regulations, we might be able to connect you with the right person through our staff augmentation and outsourcing hiring models, so you don’t need to worry about the costs associated with a long-term hire.

But before you start thinking about adding to your team, let’s take a look at the fintech regulatory environment.

What Is Regulation in Fintech?

In fintech, regulations typically refer to the rules and frameworks that govern the operations of financial institutions.

Since you are dealing with so much sensitive information, as well as money, a great deal of these are data protection regulations or secure payment regulations.

Fraud and money laundering are additional challenges that play a role in the regulatory environment for fintech companies.

The difference between regulations across traditional banks and fintech firms is that fintech changes incredibly quickly, while banks are sluggish to evolve. This presents some unique challenges and opportunities for fintech products, which the regulatory landscape tries to account for with similarly fast adaptation.

Why Is Regulation So Critical for Fintech CTOs?

According to Corlytics, regulatory bodies increased their fines in 2024 to reach a colossal $19.3 billion.

This indicates that financial regulations are being strongly enforced. Failing to meet them can lead to massive financial losses for your company, potentially ruining your product launches and affecting your fundraising efforts.

However, the most severe consequence is likely to be the loss of client trust.

As a CTO, you are responsible for proactively building compliance into your app as a form of risk management within your development lifecycle.

Making sure you have the right people on your team, who are familiar with the regulatory environment you are going to need to tackle and have been able to keep up with any changes in the financial services industry, is critical.

That is why we focus on continued education for our developers and place them based on your unique project, rather than trying to apply a one-size-fits-all solution to everyone.

The Global Compliance Landscape Frameworks You Can’t Ignore

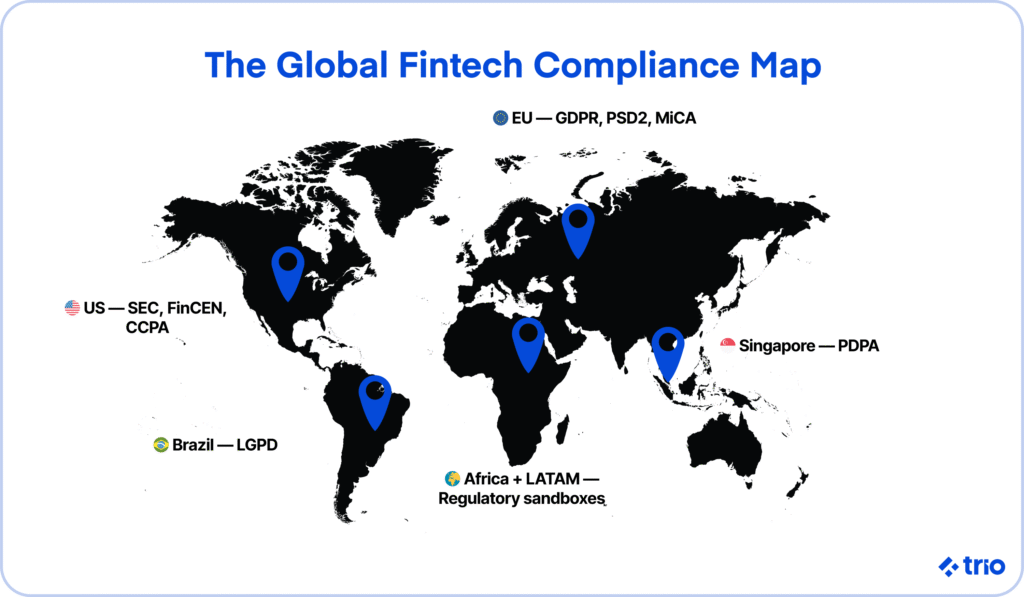

While it is impossible to provide a comprehensive list of exactly which regulations are likely to affect your product due to the continuous emergence of new regulatory frameworks, several rules and regulations have a massive impact on the fintech sector in certain regions.

Regardless of where you initially get started, even the smallest fintech startups should take all of these frameworks into account.

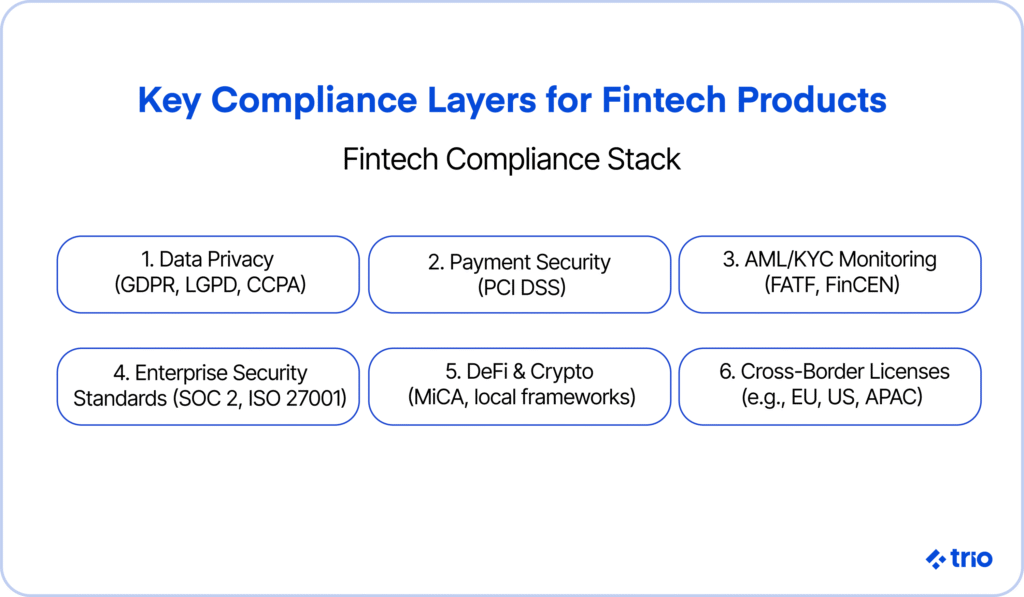

AML & KYC Compliance

Anti-Money Laundering (AML) and Know Your Customer (KYC) have pretty consistent global standards for fintech compliance, although they are still enforced locally.

Some key regulatory bodies include the FATF, FinCEN, and the FCA.

The basis of all of these frameworks is to monitor and regulate fintech use in an effort to avoid money laundering or fraud across the entire financial system.

Requirements include monitoring for suspicious activity, getting personal information, having secure authentication methods in place, and more.

Fintech companies must have these processes in place regardless of their size. The challenge then comes in scaling and adapting these solutions so that they stay viable as your client base grows.

PCI DSS for Payment Platforms

Any fintech companies operating in a part of the industry that requires them to deal with card transactions need to comply with the PCI DSS (Payment Card Industry Data Security Standard).

This standard is made up of twelve requirements for fintech companies that strive to ensure all of the cardholder data is stored, processed, and transmitted in a secure manner.

Some of these include:

- Firewall for data protection

- No vendor-supplied default passwords

- Protect stored data.

- Encrypt data when transmitted over open or public networks.

- Protect systems against malware.

- Develop and maintain secure code.

- Restrict access to data by businesses.

- Authenticate access to system components.

- Restrict physical access to data.

- Track and monitor all data and resources.

- Regularly test security.

- Maintain a security policy for personnel.

Compliance with PCI DSS for payment platforms is essential if you want to build trust with your users.

It is so important that banks, payment processors, and even other enterprises often have it as a prerequisite for adopting new fintech software.

Data Privacy Regulations in Fintech

Data privacy regulations are often regional, creating both challenges and opportunities for fintech startups.

GDPR (General Data Protection Regulation) is probably the most recognizable name, and it governs how data is protected across the EU.

The CCPA (California Consumer Privacy Act) in the U.S., the LGPD (Lei Geral de Proteção de Dados) in Brazil, and the PDPA (Personal Data Protection Act) in Singapore are all examples of other regional regulations governing fintech companies.

It is the responsibility of your development team to ensure that any requirements for these data privacy regulations are built into your systems, and that you can pivot to meet additional regulatory hurdles as you expand regionally without needing to recode everything.

Some examples of requirements from the above regulations include consent collection, minimizing stored data, and maintaining detailed access logs, but there are many more.

SOC 2 & ISO for Security and Trust

If you have a B2B fintech, you will need to have SOC 2 and ISO/IEC 27001 certifications.

Once again, these are often a prerequisite for working with enterprise customers.

Even if you have a couple of customers who do not require these certifications, they are still crucial for fintech companies that want to showcase their commitment to secure data management and want to build a reputation in the industry.

DeFi & Crypto Regulatory Frontiers

Decentralized finance (DeFi) and cryptocurrency platforms have some of the most volatile and complex regulatory landscapes.

Some countries love crypto, others are trying to minimize its use in an effort to promote financial stability, especially since it is so difficult to implement a reliable KYC and wallet traceability.

MiCA (Markets in Crypto-Asset Regulation) is one of the leading new regulations regarding the field.

We expect much to change in the future, so it is going to be incredibly important to stay up to date with the latest DeFi and crypto trends in fintech to make sure you are staying compliant with global regulatory standards.

Cross-Jurisdictional Fintech Compliance

It is very rare that a fintech firm does not consider expanding to different regions, whether it’s more than one state or even other countries.

Cross-border fintech compliance introduces even more complications for fintech products and services trying to stay within regulatory guidelines.

In the United States, fintech activities have to deal with federal oversight from agencies like the SEC (Securities and Exchange Commission), CFPB (Consumer Financial Protection Bureau), and FinCEN. They then have to manage 50 different state licensing regimes.

If you’re doing anything in the European Union or the UK, you will likely fall under PSD3, GDPR, and other Open Banking initiatives. The EU seems to be more consistent than the different states, but you should still confirm before spreading to additional countries.

In the Asia-Pacific region, you can expect to encounter fintech entities like MAS and AUSTRAC.

In most countries, regulatory sandboxes may be available to help you test your products before they hit the markets, ensuring that any fintech innovation occurs compliantly. These sandboxes are particularly popular in Africa and Latin America.

There are also international bodies that you may need to consider, like the FSB (Financial Stability Board).

The big challenge with these different compliance processes is providing a consistent user experience. At some point, it becomes almost inevitable that you will have to spread regionally, or your users may want to travel.

Failing to implement cross-jurisdictional compliance means you may hinder a client’s access to financial services or the features that they need.

Building Compliance into the Development Lifecycle

We’ve mentioned building compliance into your development lifecycle a couple of times, but what does this look like practically?

The shift-left security model is one great example, where your team is encouraged to consider the security of your product before they start coding it. This ensures that you meet any security requirements early in the software development cycle.

Usually, developers incorporate tools that scan code for vulnerabilities at certain checkpoints, set up CI/CD pipelines with built-in compliance checkpoints, design data schemas with access control in mind, and embed audit trail mechanisms.

These audit trail mechanisms often come in the form of RegTech.

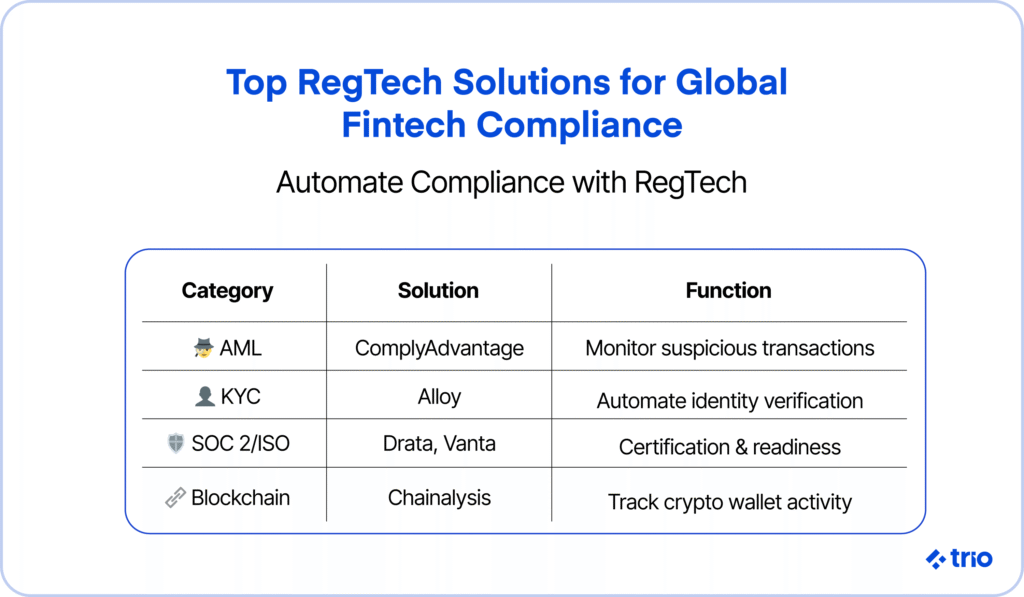

RegTech Solutions CTOs Should Be Evaluating Today

RegTech, or regulatory technology, is a great way to ensure you have a scalable way to automate your regulatory requirements across different regions.

As a CTO, you need to understand where best to spend your time and the resources of your development team.

By integrating a perfected, pre-made solution for regulations, you can spend more time on creating new features.

Some examples you can look at include:

- ComplyAdvantage for AML regulations.

- Alloy for automated KYC.

- Drata or Vanta for SOC 2 and ISO readiness.

- Chainalysis for blockchain monitoring.

If you need advice on which RegTech solutions will work for you, or you want to ensure that you integrate the RegTech platform optimally for all your regulation and supervision requirements without affecting the performance of your product, we can connect you with the right developers.

How To Stay Ahead of Fintech Regulation

Things change quickly. You need to start with auditing where your current compliance is across your entire tech stack. Only then can you start looking at RegTech platforms.

If you are unfamiliar with the fintech industry or you’re starting out, RegTech can help you stay up to date and automate a lot of regulatory challenges to help you decrease the pressure on your team.

Long term, you may want to ensure you are working with a well-trained team and that you are building your products with modular architecture, so you can ensure compliance of each component.

We can help you with all of this. Our developers have industry experience and have worked on a variety of projects in the fintech sector before. They can come in and provide practical, actionable advice based on your unique situation, and then help you execute those plans.

If you are interested in additional developers or regulatory guidance, reach out to schedule a free, thirty-minute consultation and get started.