Every engineering decision you make in the first few years has a direct impact on your profitability. In the fintech sector, where software engineers come at incredibly high costs, this is more true than ever.

The tricky part is getting access to specialized talent for your development team as affordably as possible.

Do you put all your chips on an in-house team, even though salaries and benefits can drain half your budget before you launch an MVP?

Do you outsource to a partner who promises speed but may cut corners or miss the nuances of a heavily regulated industry?

Or do you try something in between, pulling in outside engineers temporarily to plug skill gaps without committing to permanent headcount?

There isn’t a simple correct answer, though some investors may suggest otherwise. Many believe the first 20 engineers should sit in-house.

That instinct makes sense, especially for something as sensitive as financial data, but it’s not always practical when you’re trying to balance cost, speed, and risk.

Let’s examine the key differences between outsourcing and growing internal teams, so you can better understand which option is right for your fintech product development.

We have been outsourcing software development and augmenting teams with skilled developers since 2019.

At Trio, we specialize in fintech, enabling us to retain top industry talent on our team. This means you don’t have to worry about a lack of skills, and the developers you hire can focus on app development with no learning curve.

Understanding the Basics

Before you start running numbers, it helps to get clear on what we actually mean by in-house, outsourced, and the middle ground of staff augmentation that often gets overlooked.

Each model carries a different set of expectations and other pitfalls.

What Is In-House Development?

In-house development is the most straightforward path: you hire engineers as full-time employees and make them part of your company.

They sit (or work remotely) alongside you, live inside your culture, and focus only on your roadmap.

If you choose in-house development, you get full control of the quality, and most importantly, the intellectual property.

But control comes with a steep price tag.

Competitive fintech engineers in the U.S. or Western Europe can cost upwards of $110,000 a year, including benefits and equity.

That’s before you factor in recruiting fees, onboarding time, and the infrastructure needed to keep them productive.

For a seed-stage fintech with maybe $2–3 million in the bank, a 10-person engineering team can swallow most of your funding in a single year.

What Is Outsourced Development?

Outsourcing flips that equation.

Instead of building the team yourself, you contract external development companies, sometimes offshore, sometimes local, to deliver a specific product or feature.

In theory, this means outsourcing offers a way to skip the long recruitment cycles and get immediate access to a vast pool of talent, often at lower hourly rates.

Still, there are some challenges.

Outsourced work comes with hidden costs, including miscommunications across time zones, rework due to unmet expectations, and the overhead of managing a team that isn’t truly yours.

In fintech, compliance failures can lead to fines or worse.

Introducing Staff Augmentation (The Hybrid)

Staff augmentation is a middle option between in-house development and outsourcing.

Rather than handing off the whole project, you embed external engineers from a development partner directly into your in-house team.

These software developers work alongside your people, usually on contracts that last months instead of years.

For an early-growth fintech, this model can strike the right balance.

You can bring in specialized skills, say, a cloud security expert for your first PCI DSS audit, without committing to a full-time salary.

Although it doesn’t reduce costs as fully as outsourcing, it offers more control and avoids the delays associated with hiring.

Key Differences Between In-House, Outsourced, and Staff Augmentation

There are pros and cons to each hiring model.

Three dimensions tend to dominate the decision of in-house vs outsourced software development (vs staff augmentation): control, cost, and speed.

Risk sits across all three.

Control and Oversight

A full in-house team gives you the tightest grip. Every line of code is produced under your roof. That control matters when you’re dealing with sensitive financial data or navigating regulatory audits.

The flip side is that control can slow you down; layers of process and internal debates sometimes creep in faster than you’d like.

Startups often rely on speed to get their MVP out before competitors.

Outsourcing allows you to loosen that grip considerably.

An outsourcing firm may appear aligned during sales calls, but its priorities are ultimately its own.

Deadlines, resourcing, and even coding standards may not match yours unless you’re meticulous about contracts and oversight.

Staff augmentation sits somewhere in the middle: the engineers work within your team and systems, so alignment tends to be stronger, but they’re still technically outsiders.

Cost Drivers and Hidden Expenses

It’s tempting to think of cost as simple math: salary vs hourly rate. In reality, each model hides expenses in different corners.

- In-house: Salaries are only the start; recruiting fees, equity packages, training, and turnover make each hire more expensive than it looks on paper.

- Outsourced: Although rates may be lower, especially offshore, hidden costs can creep in through communication overhead, code rewrites, and management time.

- Staff augmentation: Hourly or monthly fees are higher than pure outsourcing, but you avoid recruiting costs and reduce the likelihood of expensive rework.

For budget-sensitive fintechs, these hidden multipliers matter just as much as the headline number.

Speed to Market and Scalability

Hiring in-house talent for your development projects takes time, often months, because strong engineers are scarce and competition is fierce.

Outsourcing can allow you to speed up development.

Outsourcing providers usually have teams ready to go, though you may sacrifice quality or oversight for that speed. Finding the right outsourcing partner is essential.

Staff augmentation typically falls between these two options: vendors can slot engineers into your team within weeks, which is faster than recruiting but still gives you more control than handing off the whole build.

Since we only focus on fintech here at Trio, we have been able to decrease this time to as little as a couple of days.

Scalability follows the same pattern.

Outsourcing scales up or down easily but risks uneven output.

In-house scaling is deliberate and slow, while augmentation lets you flex capacity without betting the company on permanent hires.

Risk Profiles

Each model comes with a different kind of risk:

- In-house: financial risk (high burn, slower time to market).

- Outsourced: compliance, IP leakage, and quality risk.

- Staff augmentation: dependency on a vendor, but it offers less exposure than a fully outsourced model.

None of these are deal-breakers by themselves; it’s about which risks you’re willing and financially able to carry at your stage of growth.

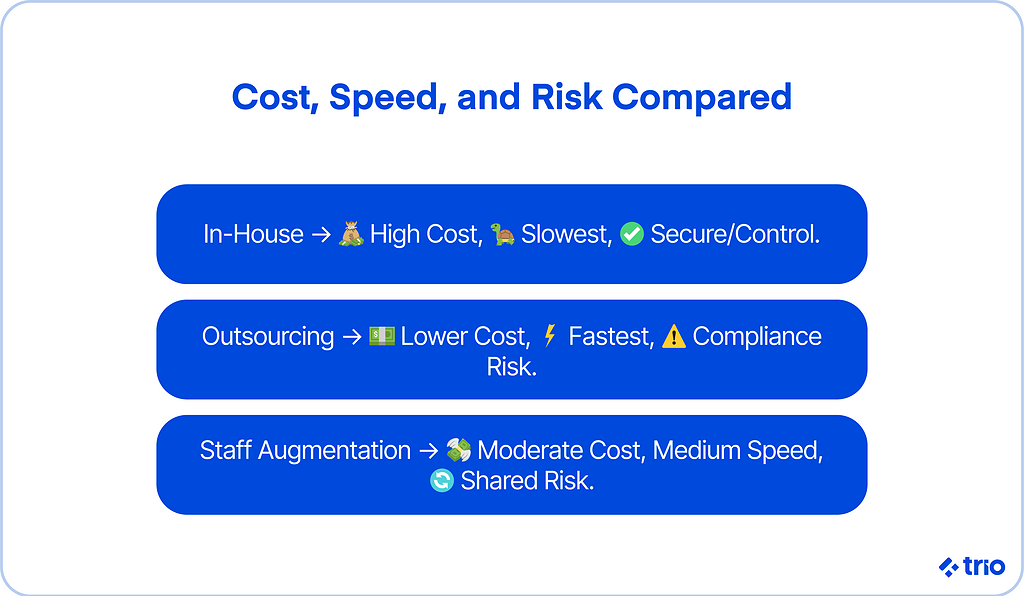

Cost, Speed, and Risk Side-by-Side

Here’s a side-by-side summary of in-house development vs outsourcing vs staff augmentation.

| Model | Cost | Speed | Risk |

|---|---|---|---|

| In-House | Highest upfront (salaries, benefits, recruiting, infrastructure). $2M+ per year for a 10-person team is common. | Slowest to get started (3–6 months to hire), but steady once built. | Financial risk from high burn; less flexible if you need to scale down. |

| Outsourced | Lower upfront (regional rates vary $30–$100+/hr), but hidden costs in rework and oversight. | Fastest path to an MVP (weeks, not months). | Compliance gaps, IP risk, and uneven quality can cause expensive setbacks. |

| Staff Augmentation | Moderate. Higher hourly than outsourcing, but cheaper than full-time hires once you account for benefits. | Middle ground (2–4 weeks to ramp up). Faster than hiring, more controlled than outsourcing. | There is dependency on the vendor, cultural gaps, and less exposure than with full outsourcing. |

Financial Considerations

When money is tight, the choice between in-house, outsourced, and augmented teams often comes down to one simple question: how far will this stretch my runway?

Development Cost Breakdown

The headline numbers rarely tell the full story. Here’s how the true costs stack up:

- In-house: A senior fintech engineer in the U.S. may cost more than $110k in base salary. Add benefits, equity, recruiting fees, and equipment, and the real figure can creep closer to $200k per year. Multiply that across 10 hires, and you’re looking at $2 million annually before accounting for training or retention.

- Outsourced: Rates vary widely by region, ranging from $45/hour in LATAM to over $100/hour in Western Europe. Although it seems cheaper upfront, you’ll likely pay extra in management overhead, code reviews, and occasional rework.

- Staff augmentation: Augmented engineers are billed monthly or hourly at premium rates.. Although more expensive than pure outsourcing, it is cheaper and faster than full-time hires when you factor in recruiting and benefits. You can also reduce costs by hiring offshore or nearshore developers.

Budget Sensitivity and Burn Rate

Early-growth fintechs don’t have the luxury of unlimited cash.

Every dollar tied up in engineering reduces your margin for product delays or regulatory setbacks.

Hiring in-house looks like an investment, but if it consumes half your budget before you ship, you’re in a precarious spot. Outsourcing lowers the upfront cost but risks ballooning later if compliance or rework issues surface.

Augmentation may feel like a compromise, but for many, it’s the only way to balance speed with budget discipline.

Long-Term Financial Implications

It’s also worth looking beyond the next six months.

- In-house teams become a fixed expense, but they build institutional knowledge that compounds over time.

- Outsourcing can be cheaper in the short term, yet recurring contracts and patchwork code bases can drag down margins later.

- Staff augmentation offers flexibility, but if you rely on it for too long, the costs can rival or exceed an in-house team without giving you the same cultural cohesion.

The financial trade-offs aren’t just about cheap vs expensive. They’re about the balance between runway and ownership, speed and sustainability, and those balances will shift as your startup grows.

Compliance and Risk in Fintech

If you were building a fitness app or a marketplace, outsourcing might feel like a fairly straightforward financial calculation. In fintech, the stakes are higher.

Compliance and security can’t just be an afterthought. They need to be baked into the product from day one.

Regulatory Requirements

Most fintechs can’t avoid frameworks like PCI DSS (for handling payments), SOC 2 (for data security), or GDPR/CCPA (for user privacy).

Each framework demands not only technical controls but also documentation, monitoring, and audit readiness.

An engineer with no prior experience in fintech may overlook minor details that can later escalate into significant issues affecting your reputation and leading to fines.

That’s one reason why purely outsourcing development can be risky: not every vendor understands how regulators think.

Data Security and IP Protection

Financial data is uniquely sensitive since you’re dealing with addresses, social security numbers, and people’s literal money.

A leak has serious consequences, including fines, lawsuits, and reputational damage, which scare off investors.

In-house teams give you the tightest control over security and intellectual property, but they also concentrate the risk inside your organization.

With outsourcing, data flows across borders and through systems you don’t fully control.

Staff augmentation allows external engineers to work within your infrastructure, following your processes, which reduces (though not eliminates) the risk of exposure.

Vendor Risk and Mitigation Strategies

Even the best outsourcing partners introduce dependency.

If a vendor misses a deadline, rotates staff without warning, or folds entirely, your roadmap takes the hit.

Some fintechs mitigate this by splitting work across multiple vendors or requiring code escrow agreements. Others use outsourcing only for non-core modules (e.g., UI development) while keeping anything compliance-heavy in-house.

Staff augmentation reduces these risks because you’re not handing over the whole project, but you still need clear contracts, onboarding, and knowledge transfer plans.

Time to Market

The longer it takes to launch an MVP, the more cash you burn on salaries, cloud bills, and compliance prep before revenue ever shows up.

In-House Timelines

We’ve already mentioned how hiring in-house is slow by nature.

Even if you start posting jobs tomorrow, it can take three to six months to recruit, interview, and onboard a small team.

That’s a long wait if investors are pressing you for traction.

On the plus side, once the team is up and running, iteration tends to be smoother because everyone shares context and works under the same roof.

Outsourced Timelines

Outsourcing looks faster upfront. Vendors often have engineers on standby who can spin up an MVP within weeks.

If you are under pressure to show a demo at the next board meeting or to complete a feature before launch, the temptation to speed up is understandable.

But the time you gain up front may be lost later if miscommunications or poor code quality force you into rework, which could derail your launch schedule entirely.

Staff Augmentation Timelines

As usual, staff augmentation usually falls somewhere in between.

Vendors can place engineers into your team in a matter of weeks, which is far quicker than hiring full-time, but slower than a vendor who hands you a ready-made team.

The upside is that these engineers build inside your systems and processes, so the likelihood of losing time to misalignment is lower.

Future Trends in 2026

The decision between in-house, outsourced, and augmented teams isn’t static. The ground keeps shifting, and fintech startups in 2026 are facing a different landscape than even a couple of years ago.

AI and Machine Learning Talent

The demand for AI and ML engineers continues to outpace supply.

These roles command premium salaries in-house, and they’re just as expensive through outsourcing vendors.

If you need AI-driven fraud detection, credit scoring, or personalization, it’s becoming harder to justify building that expertise entirely from scratch.

Cloud-Native and DevOps Practices

Cloud infrastructure is now the default, but the way teams build and deploy software keeps evolving.

DevOps and CI/CD pipelines are essential in fintech, where downtime can erode trust overnight.

Outsourcing partners are catching up here, but not all of them are fluent in the toolchains or compliance frameworks that regulated industries expect.

That gap means in-house or augmented engineers with cloud and security experience may be worth the extra cost.

Regulatory Scrutiny

Regulators are no longer giving fintechs much leeway.

Startups that rely heavily on outsourcing for compliance-heavy features, like payment processing or identity verification, will likely face more questions from auditors and investors.

The trend is toward keeping core compliance expertise closer to home, whether through full-time hires or embedded specialists, and making use of RegTech in an effort to cut costs.

Blended Teams as the Norm

Perhaps the most important trend is that the old “all in-house vs all outsourced” debate is fading.

Many fintechs are finding the sweet spot is a blend: a small, permanent in-house team that owns IP and product direction, supported by outsourced or augmented engineers who expand capacity when needed.

Conclusion

If you need deep control and can afford the cost, in-house hiring will serve you well. If speed is everything and compliance risk is low, outsourcing might get you further, faster. And if you’re trying to stretch capital without stalling, staff augmentation offers a middle ground.

The real takeaway?

Instead of treating this as a binary choice, view it as a set of levers you can pull at different stages.

There is no reason you can’t keep it in-house, but you may also benefit from providing engineers with external support to avoid higher costs.

That way, you’re not just building software, you’re building a sustainable path forward.

If you’re interested in learning more about outsourcing or augmenting your staff with Trio, please reach out.

FAQs

What is the difference between in-house and outsourced development?

The key difference between in-house and outsourced development lies in the teams: in-house teams are comprised of your full-time employees, whereas outsourced teams are external vendors hired for specific projects.

Why is staff augmentation proper for fintech startups?

Staff augmentation is ideal for fintech startups, allowing them to scale quickly with specialized talent without committing to permanent hires.

Which model is cheapest: in-house, outsourcing, or staff augmentation?

The cheapest model depends on context: outsourcing has lower upfront costs, in-house is most expensive, and staff augmentation falls in between.

How does time to market compare across the three models?

Time to market is slowest with in-house hiring, fastest with outsourcing, and staff augmentation usually sits in the middle.

What is the most significant risk of outsourcing fintech development?

The most significant risk of outsourcing fintech development is compliance gaps or security oversights that may trigger costly rework or regulatory issues.