With almost 77% of consumers managing their accounts through an app, banking is becoming increasingly digital. If you are in fintech, having a good understanding of the mobile banking app development process is essential to understand how you can go about your own software development, the potential costs and timelines, and any potential risks or opportunities.

You will also be able to react to shifting trends in online banking and fintech mobile app development in general if you understand the complex requirements of the industry related to security, regulatory compliance, and regional differences in those environments.

We focus on facilitating rapid development and flexibility in the fintech sector. At Trio, we don’t do all kinds of software development. Instead, we focus on fintech only, which means our developers are highly skilled and able to master the industry, ensuring you get someone who is able to code quickly, without sacrificing quality.

These developers have worked on similar projects to your own and will have proven experience in digital banking, giving them insights that someone with less experience may not necessarily have. They also integrate into your existing team through staff augmentation, ensuring you only pay for them when you need them instead of needing to commit to long-term employment.

But, before jumping into hiring someone to help you develop a mobile banking application of your own, let’s make sure you understand mobile banking solutions and the steps you’ll have to take in the product development process.

Understanding Mobile Banking

Mobile banking generally refers to being able to use a banking app or access some sort of banking experience on a mobile device. In its simplest form, this fintech app allows users to check their balances, transfer their funds, and sometimes even apply for credit or loans.

A mobile banking platform, along with a web platform that facilitates internet banking, used to be a great way to stand out from other banks. However, these days, creating a digital banking app with the most essential features is no longer optional.

In fact, users expect a personalized banking experience on their Android or iOS device, with a multitude of convenient new features that often drive up development costs and increase the barrier to entry in the industry.

These features include AI-driven insight, integrated financial tools, biometric login, and a variety of other features.

Strategic Benefits of Mobile Banking Applications

Mobile banking applications come with a variety of benefits. These benefits include increased convenience, control, and security for users, as well as improved customer retention, monetization methods, and even data insight for businesses.

For Users: Convenience, Control, and Security

If you are able to download something from your app store and have instant access to all of your finances, it gives you an incredible amount of control. This is in the form of banking app features that facilitate mobile payments, but it is also just being able to see balances.

With biometric login and two-factor authentication, users can access their accounts or pay their bills without needing to worry about security.

For Businesses: Customer Retention, Monetization, and Data Insights

As a business, banking software development often leads to an increase in customer retention. By providing them with reduced service costs in comparison to traditional banking and by providing a variety of features, you not only create something that they use temporarily but also build a long-term customer relationship.

On top of this, custom mobile application development opens up potential monetization methods you could not use in the banking sector otherwise, such as advertising, alternative account fee structures, and even tiered plans.

You can then use any information that you are able to gather from your users and use it in your own risk management or strategic planning, even offering more personalized services.

Mobile Banking App Market Trends and Insights

Before you start developing, it’s a good idea to do some research into market trends in mobile banking application development, as well as how client expectations are shifting, and how people actually use mobile banking apps in your target regions.

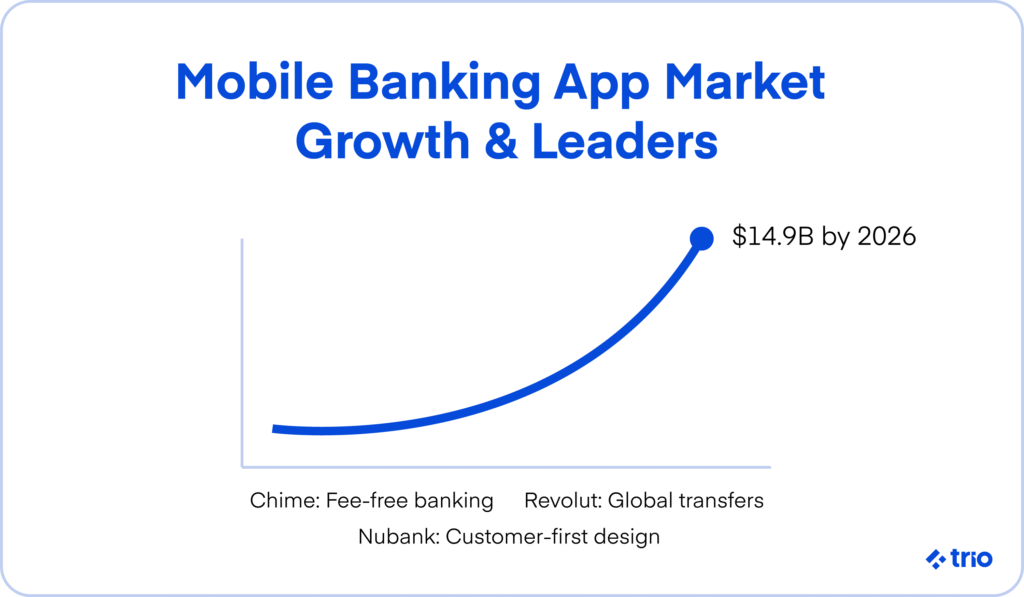

Key Statistics and Market Growth

The global digital baking industry is expected to reach a value of $14.9 billion by 2026! Today, there are more than 1.75 trillion accounts for online banking services, dealing with $1.4 trillion worth of banking transactions a year.

Chime, Revolut, and Nubank are some of the fastest-growing industry leaders that have illustrated how various innovations are driving the industry forward.

A big part of their success has been attributed to fee-free banking options, the fact that these companies are facilitating global currency exchange, and their focus on customer-centric design.

Must-Watch Trends: AI, UPI, Biometrics, and More

Outside of the basic features users are coming to expect, there are several other trends that are making waves, which you should strongly consider when you develop a mobile banking app of your own.

AI (artificial intelligence) is being used in order to improve basic personalization on mobile applications, but beyond that, it is being used to analyze large quantities of data, which can then be used to make informed decisions related to financial planning. It even allows companies to identify fraud in real-time.

Then, UPIs (Unified Payment Interfaces) are being used to support peer-to-peer transactions. A lot of development teams are developing these interfaces on their own, while others are choosing to embed existing software into their apps.

Biometrics and behavioral security are another trend to keep an eye on. At the same time, the basics of these tools have been used to ensure the security of mobile banking software for some time. However, these tools are constantly adapting and shifting along with industry standards for security as a whole.

Types of Mobile Banking Apps

Banking apps can be split into several categories. You can split them into web, native, and cross-platform apps, SMS, USSD banking, and purely app-based banking apps.

App-Based Banking vs. SMS and USSD Banking

SMS and USSD banking used to be the cutting edge of mobile banking development. While they are now both considered to be legacy systems in the works of modern banking systems, they still play a massive role in underserved areas.

On the other hand, app-based banking is the new normal. Full-featured smartphone apps that deliver a comprehensive, user-friendly banking experience are expected from even the smallest institutions, with neobanks (mobile-only banks with no physical location) becoming more popular.

Web vs. Native vs. Cross-Platform Apps

A development company in the process of app design must consider the different formats in which it could deliver its basic banking features.

Web apps are a lot easier to maintain, but they just can’t live up to the speed or functionality of native-run solutions. Native apps take advantage of all of a device’s hardware in the most optimal manner, leading to better performance and security. However, they are costly to maintain, especially when you consider the number of different ecosystems and devices out there.

A good medium is cross-platform apps. They use technologies like Flutter and React Native, which allow you to reuse a lot of code across ecosystems, while only making small adjustments, like the small differences between the iOS and Android apps.

Cross-platform app development lets you code fast while making it easier to ensure a consistent experience.

Core Features of a Successful Mobile Banking App

Depending on which development stage you are at, there are a variety of different mobile banking app features you should consider including.

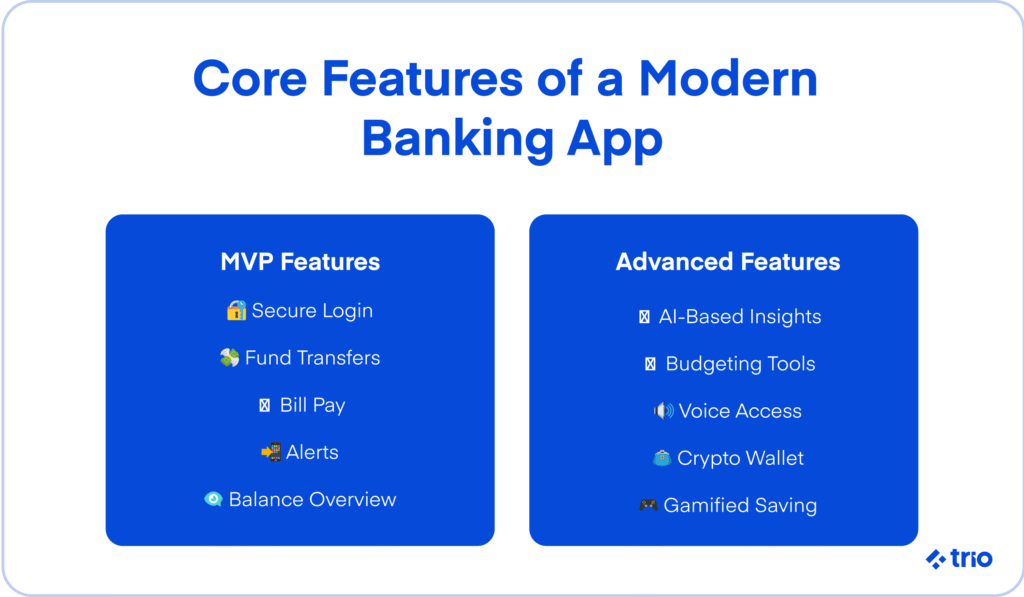

Essential MVP Features

An MVP (minimum viable product) is the simplest possible version of your app, with all the most critical features, designed so you can get something on the market quickly and then add to it later.

Since it can be incredibly costly to create a mobile banking app, startups and scaleups can benefit from this approach. It also allows you to get user feedback before you get started with the additional development phases.

Although it can be tempting to cut a lot of features when you design your MVP, your app must meet user expectations and cover all the industry basics related to data handling and security.

These must-have features include secure account management, simple transfers, bill payment capabilities, real-time alerts, and robust authentication methods.

Advanced Features for Competitive Edge

Once you create a banking app with all of the basics, you can start adding components that may give you a competitive edge.

Some examples we have seen in our time in the fintech and banking industry include cardless ATM access, biometric authentication, budgeting tools, and integrated customer support. In many cases, AI integration and anything else related to further personalization or speed of service delivery may also help you stand out.

If you have an existing banking app, gather user feedback to help you figure out what people are looking for.

Emerging Features in 2026

Voice-enabled interactions and gamified savings or investing models are incredibly popular at the moment.

Many users are also interested in alternative currencies like crypto and stablecoins, so digital wallets that can deal with these currencies are a good way to make a banking app stand out.

Step-by-Step Mobile Banking App Development Process

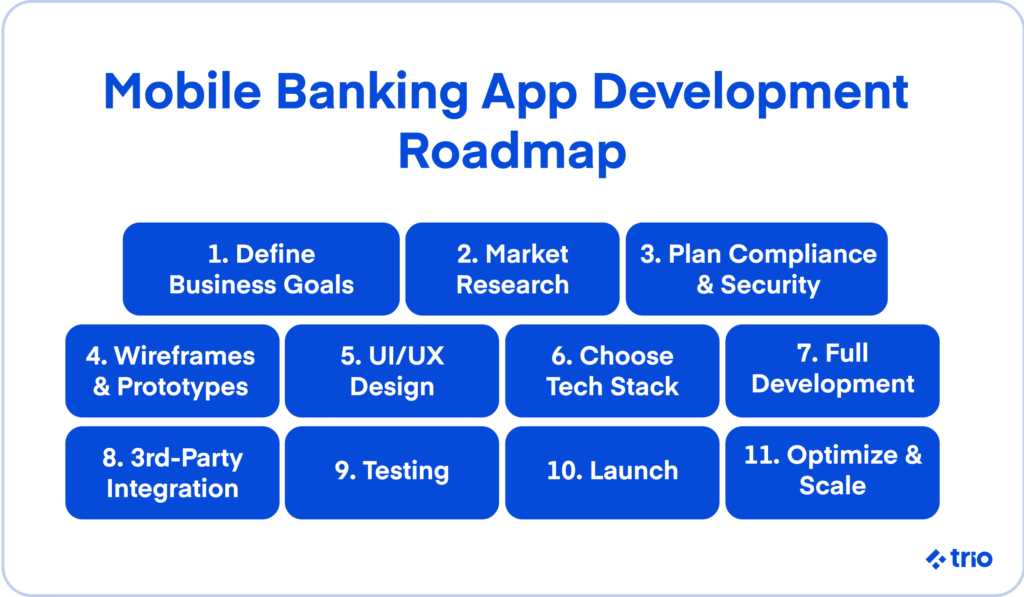

Now that you have a good idea of the information that you will need to have before you create an app, let’s take a more detailed look at the step-by-step process of mobile banking software development.

- Step 1: Define Business Objectives and Compliance Needs

- Step 2: Conduct Market and Competitive Research

- Step 3: Plan Security and Regulatory Architecture

- Step 4: Build Wireframes and a Clickable Prototype

- Step 5: Design a Seamless UI/UX

- Step 6: Choose the Right Tech Stack (React Native, Flutter, Python, JavaScript, etc.)

- Step 7: Begin Full-Cycle App Development

- Step 8: Integrate with 3rd Parties

- Step 9: Test for Performance, Usability, and Compliance

- Step 10: Launch the App and Gather Feedback

- Step 11: Maintain, Update, and Optimize Based on Analytics

Getting an experienced team can make all the difference. There are many challenges you may encounter in each step, especially if you are unfamiliar with the fintech industry.

At Trio, our developers have extensive experience in digital banking app development and can advise you on each step. They bring their incredible coding ability, as well as their experience on previous projects, to the table, allowing you to learn from other people’s mistakes without needing to make them yourself.

Mobile Banking App Development Challenges

A variety of challenges exist in general app development. Then, you may encounter additional difficulties when developing a banking app specifically.

Ensuring Bank-Grade Security and Privacy

While you may not have the resources of a bank, you are still dealing with people’s money. This means you need to ensure bank-grade security and privacy.

Encryption, tokenization, and session control are some key mobile banking app security best practices you will need to use.

Once you have your systems set up by skilled fintech security specialists, like the ones found at Trio, you then need to audit these systems regularly, and may even want to use something like ethical hacking to identify potential issues.

Navigating Complex Regulations and Audits

Compliance is incredibly important, but it is an ongoing process that can get very expensive.

There are many global regulatory frameworks, but there are also local ones to consider. Some of the most common ones our clients encounter include SOC2, PSD2, and PCI DSS.

Getting a compliance expert on your team from the start of the development process means that you can build compliance into your app from the first lines of code, making it far easier to stay compliant later.

Integrating Legacy Systems and APIs

Legacy systems can be large and complex, working on outdated software that makes them slow and difficult to alter. A lot of startups have taken to using some sort of middleware solution to integrate their new features or services with old banking software.

In rare cases, system overhauls might be the only solution.

One of the best things you can do is to choose modular, service-oriented architectures to try to make the integration with existing banking systems as easy as possible.

Managing Feature Scope and Technical Debt

In order to keep up with a rapidly changing industry, you may want to keep adding features to your app. However, with this increased scope comes a massive increase in cost. You also do not want to create the most basic app possible and build up technical debt that you need to address later.

A leaner MVP with a clear roadmap is the best option for most companies, and allows you to start monetizing, giving you access to more people from a software development company, and avoiding overwhelming either your users or your employees.

Sustaining UX Consistency Across Devices

It can be very difficult to create a consistent user experience over multiple devices. Even if you are creating an app for phones of similar sizes across the iOS and Android ecosystems, you may encounter challenges.

The reality is that there are a variety of different screen sizes and ecosystems that you need to account for.

Cross-platform development can make this a little easier, while adaptive layouts and performance tuning can help you take care of the smaller details.

Avoiding Vendor Lock-in and Scalability Bottlenecks

You don’t want to lock yourself into any single vendor without a backup. This would cause your success and stability to be tied to software that is out of your control.

For most, using open-source libraries, standardized APIs, and containerization technologies is an easy fix that allows you to be more flexible later on.

If you do decide to use a vendor for embedded finance or anything else, it’s always a good idea to have a couple of backups you are ready to make use of at a moment’s notice to minimize your downtime.

Technology Stack for Mobile Banking Apps

Your tech stack needs to be decided early on. Keep in mind that some platforms and tools are better for certain apps than others. Some are more popular than others, too, and thus have more available developers.

Backend infrastructure is essential to set up your speed and security in the long term. We always recommend cloud-native backends through AWS or GCP, as these are quite easy to scale. We also like to use tools like Kubernetes and Docker for the orchestration and deployment processes.

Jenkins and GitHub Actions are great for CI/CD as they can help you automate testing and update releases.

A lot of people forget about DevOps and APIs, but these are arguably the two most important considerations for your continued success, as they ensure deployments go smoothly and you are able to manage any third-party integrations.

How Much Does It Cost to Build a Mobile Banking App?

There is no singular price for banking mobile app development. Instead, your cost may depend on a variety of factors, such as your tech stack, the size and nature of your team, and the number of features you want.

It could fall anywhere between $40,000 and $400,000.

Native apps are usually more expensive due to the higher amount of development required.

Post-launch maintenance and factors like updates, security patches, and legal reviews can also drive up your costs.

One of the best ways to mitigate your expenses is to consider alternative hiring models like outsourcing and staff augmentation.

These models allow you to hire an expert team without needing to worry about factors like overhead, healthcare, equipment, or any other costs associated with a permanent employee.

We would like to make use of developers from Latin America and Africa to reduce costs further without affecting quality.

If you are interested in connecting with top fintech developers for your project, schedule a call today to figure out whether Trio development services may be the right fit for you.

We only provide custom solutions, connecting our clients with the top 1% of developers for the most cost-effective development possible. Your success is our success!

FAQs About Mobile Banking App Development

How long does it take to build a banking app?

It can take anywhere from 6 to 12 months to build a banking app, depending on your requirements and the size of your development team.

How can I ensure the app is secure and compliant?

You can ensure your app is secure and compliant by partnering with experienced developers who use secure frameworks to build your app. Regular audits and ethical hacking are also critical.

How do I attract and retain app users after launch?

To attract and retain app users after launch, you should provide value through relevant features and through personalization.