Most banks and enterprises know the pain of outdated payment rails. If you have ever waited two days for a cross-border payment to clear or scrambled around cutoff times, you already know how fragile the system can feel.

The gap between what businesses need and what banks can deliver is becoming pretty obvious, and the growth of stablecoins has made it even more noticeable.

It is frustrating on both sides.

Enterprises want predictable settlement and cleaner workflows. Banks want to stay relevant while keeping risk under control. Everyone is stuck working around infrastructure that was never built for the pace of digital commerce.

Tokenized deposits offer a way out.

They let actual commercial bank money operate on blockchain rails, with the safeguards of the existing banking system still intact. You get speed, transparency, and programmability without stepping into a completely new form of money.

Let’s look at what tokenized deposits are, how they differ from other digital money models, and where all of this may be headed.

If you need expert fintech developers to help you implement tokenized deposits into your banking system, we can connect you with those experts through hiring models like staff augmentation and outsourcing.

Understanding Tokenized Deposits

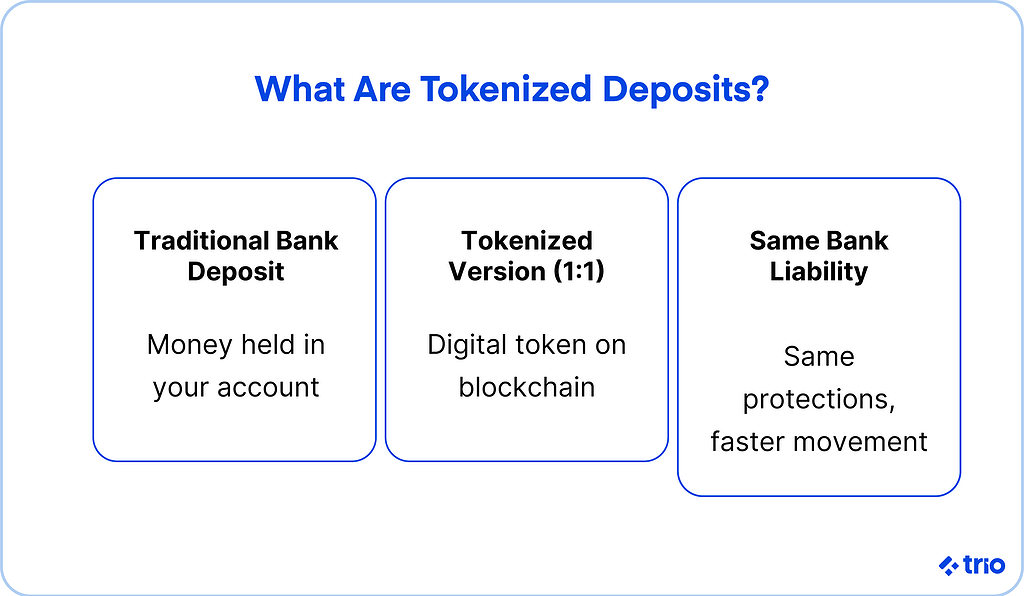

Tokenized deposits are digital representations of your ordinary bank deposits. Instead of sitting only on a private bank ledger, a portion of your balance can appear on a blockchain in token form.

It is still commercial bank money, backed by the same rules and protections you already rely on, but now it moves with the speed and certainty of on-chain assets.

What Are Tokenized Deposits?

A tokenized deposit is basically a claim on a regulated bank that has been mirrored on a blockchain. The token and the off-chain balance map to each other one-to-one.

Nothing about the underlying liability changes. What changes is how quickly that liability can move, how easily it can interact with smart contracts, and how transparent the flow of funds becomes.

Comparing Tokenized Deposits, Stablecoins, and CBDCs

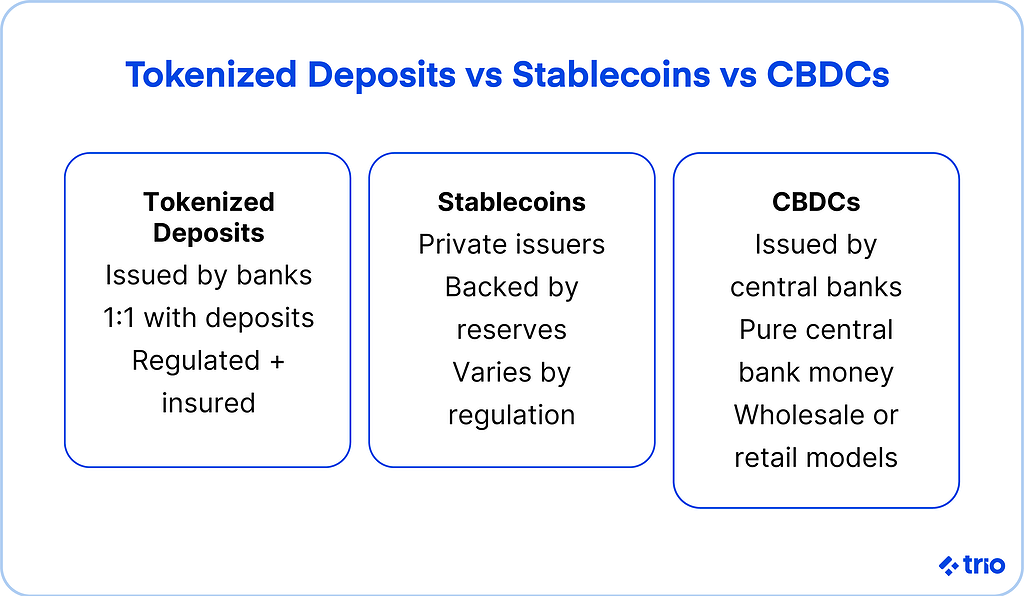

If you compare tokenized deposits to stablecoins or CBDCs, a few distinctions start to matter.

Stablecoins are usually issued by private companies that hold reserves to maintain the peg. Your relationship is with the issuer, not a bank.

CBDCs come directly from a central bank. Retail CBDCs target consumers. Wholesale CBDCs focus on high-value settlement between financial institutions.

Tokenized deposits sit in the middle. They carry the familiarity and regulatory structure of commercial bank money, while offering the utility that made stablecoins so appealing in the first place.

How Tokenization Works for Bank Liabilities

Banks typically use a combination of core ledger integrations and smart contracts.

When you convert part of your deposit to a tokenized version, the bank creates tokens and adjusts its internal records to match.

When you redeem your tokens, the bank destroys them and credits your traditional account. The bookkeeping on both sides remains synced.

Behind the scenes, permissioned blockchains or enterprise-friendly public chains handle the actual token mechanics. Banks lean toward controlled environments because they reduce operational surprises.

Benefits of Tokenized Deposits

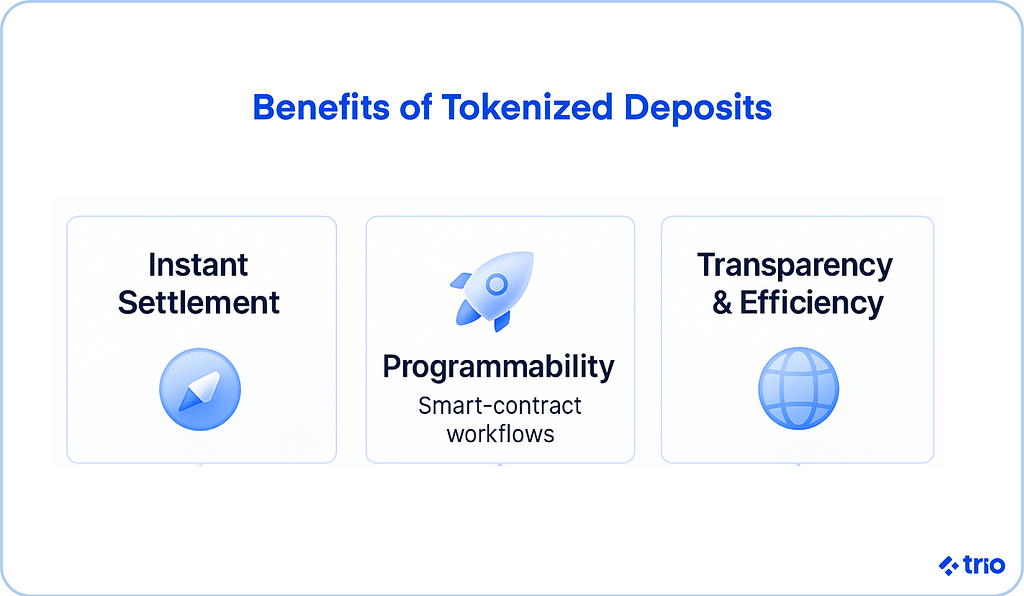

Tokenized deposits solve real problems that many teams deal with every day.

They help payments settle on time, reduce manual reconciliation, and often make liquidity planning less chaotic.

Faster Settlement and Interbank Transfers

One of the clearest advantages is settlement speed.

Instead of waiting for ACH windows or navigating SWIFT hops, transfers can settle instantly.

Some early adopters note that intraday liquidity management becomes more manageable, and that alone makes the model appealing.

Programmable Financial Workflows

Once the deposit sits on-chain, smart contracts can automate tasks that used to require hands-on attention.

Conditional payouts, supplier payments that trigger on delivery status, and automated escrow are all becoming more realistic.

These tools help enterprises that juggle complex financial workflows or high-volume transactions.

Liquidity, Transparency, and Operational Efficiency

Because everything settles in real time, you get a clearer view of where money actually is.

This reduces credit exposure and shortens the list of reconciliation tasks.

On-chain records also make audits and regulatory checks feel less like a root canal. They are not painless, but the data is easier to work with.

Stablecoins in the Digital Money Ecosystem

Stablecoins are worth understanding because they played a major role in pushing banks toward tokenization. They showed what was possible, even if the model had tradeoffs.

What Stablecoins Are and Why They Grew

Most stablecoins aim to hold a one-to-one relationship with fiat currency. Some rely on cash and T-bills. Others use crypto collateral.

The growth was driven by real needs.

Traders needed something stable that could move quickly. Businesses needed a faster way to move money across borders. Developers needed a predictable settlement asset.

Key Use Cases for Stablecoins

Companies use them to send funds internationally without waiting days.

Treasury desks sometimes hold small balances to support digital asset operations. They are also core to on-chain financial markets.

While these uses are compelling, they come with an uneven regulatory landscape and ongoing debates about reserve quality.

Why Banks Are Building Tokenized Alternatives

Banks saw how much demand existed for money that could move instantly.

What they did not love was the risk profile of non-bank issuers.

Tokenized deposits offer a familiar compliance model.

They keep deposits on a bank’s balance sheet, which appears to be more comfortable for regulators and large enterprises.

Blockchain Infrastructure That Enables Tokenized Deposits

Tokenized deposits only work because blockchain networks provide fast, predictable settlement.

They also give participants a shared source of truth, which reduces the constant back and forth common in traditional payments.

How Blockchain Facilitates Tokenization

Distributed ledgers keep everyone aligned on the state. Smart contracts enforce rules without relying on manual intervention. Consensus mechanisms offer a level of finality that legacy systems rarely match.

Banks seem to appreciate that these properties help them reduce operational overhead rather than increase it.

On-Chain Settlement vs. Legacy Payment Rails

Legacy rails batch transactions and often run only during specific windows. Anyone who has tried to send a payment on a Friday afternoon knows how awkward that can be.

On-chain settlement avoids these patterns.

Transfers can clear at any time, including weekends and holidays. For teams operating in multiple regions, this alone can improve cash positioning.

Interoperability and Universal Settlement Networks

As more banks experiment with tokenization, interoperability becomes a sticking point. That may include cross-chain transfers, shared token standards, or network-level integration.

Some institutions are exploring universal settlement layers that support tokens issued by multiple banks.

These networks may end up being the bridge between private and public ecosystems.

Real-World Institutional Systems

A few projects give us a glimpse of how tokenized deposits behave in production. Some are still early, but the direction is clear.

JPM Coin and Onyx by JPMorgan

JPM Coin lets clients move USD or EUR balances on a private blockchain operated by JPMorgan. Transfers settle instantly, and clients can integrate them into their treasury and payment flows.

It is one of the more mature examples, and many enterprises quietly treat it as a preview of what commercial bank money on-chain could look like in the near term.

Kinexys and Multi-Bank Tokenized Deposit Networks

Kinexys takes a different approach. Instead of one bank issuing tokens, multiple banks participate on the same network. Each issues its own deposit tokens that can settle against one another.

This setup feels closer to a shared market infrastructure rather than a single bank platform.

How These Systems Shape Expectations

These networks help banks understand practical challenges. Governance, access controls, token formats, compliance triggers, and operational integration all show up earlier than expected.

That experience is influencing the standards that newer entrants are adopting.

CBDCs and Hybrid Settlement Models

CBDCs add another layer to the conversation.

They are not meant to replace bank deposits entirely, but they do offer new settlement options that pair naturally with tokenized deposits.

Retail and Wholesale CBDC Approaches

Retail CBDCs focus on consumer payments. Wholesale CBDCs aim to simplify settlement between financial institutions and market infrastructures.

The wholesale category has the most overlap with tokenized deposits, but the two play different roles.

Integrating CBDCs with Institutional Deposits

Some banks are exploring platforms where CBDCs act as the settlement asset between institutions, while tokenized deposits handle customer flows.

This approach keeps the two-tier banking system intact while making settlement a bit cleaner.

Hybrid Systems Using CBDCs and Tokenized Deposits

Hybrid systems appear promising.

CBDCs offer strong finality. Tokenized deposits offer programmability and scale.

When combined, they create settlement layers that feel far more modern than the systems we rely on today.

Safety, Soundness, and Regulation

For tokenized deposits to gain wide adoption, they need to meet the same expectations as traditional bank deposits.

The good news is that most of the regulatory structure is already in place.

Prudential Regulation and Liquidity Requirements

Tokenized deposits stay on a bank’s balance sheet, so the same capital and liquidity rules apply.

This tends to reassure risk teams and regulators who may be wary of new instruments.

Credit Risk, Custody, and Operational Resilience

Because the liability sits with the bank, credit risk remains familiar and well understood. Operational resilience improves because the ledger is no longer a single point of failure.

Custody models vary, but institutions are experimenting with arrangements that blend bank-level controls with user-level flexibility.

How Digital Settlement Changes Risk Profiles

Real-time settlement reduces the time money is stuck in transit. That shrinks exposure windows and lowers reconciliation risk.

Audit trails are clearer because transactions are recorded on-chain. Regulators may find this appealing, although it introduces new questions around data access and privacy.

The Future of Tokenized Deposits and Digital Money

Tokenized deposits appear to be gaining momentum.

Banks want to modernize. Enterprises want faster and more predictable settlement. Regulators seem cautiously optimistic as long as the underlying liability stays inside the banking perimeter.

Emerging Trends to Watch

We are seeing early interest in programmable treasury flows, machine-triggered payments, and cross-market settlement that operates around the clock.

Some of these trends may take years to mature, but the direction is steady.

Enterprise and Institutional Web3 Adoption

Enterprises are gradually connecting blockchain rails to ERP and treasury systems.

When these integrations feel seamless, adoption will likely accelerate.

There is also growing interest in regulated versions of DeFi-style services, though this area still has more questions than answers.

Challenges and Opportunities Ahead

The biggest challenges center on regulation, interoperability, and the cost of upgrading legacy infrastructure. Some banks will move quickly. Others may wait for clearer incentives.

Still, the opportunity is hard to ignore.

Faster settlement, cleaner workflows, and better visibility into liquidity would benefit nearly every enterprise.

Conclusion

Tokenized deposits bring commercial bank money into a programmable environment without breaking the regulatory model that keeps the banking system stable.

They combine the strengths of blockchain with the reliability of traditional finance in a way that feels both practical and sustainable.

If you want to explore how tokenized deposits might fit into your own systems, or if you are considering blockchain-enabled payment or settlement architecture, Trio can help you think through the technical and business layers involved.

To find out if we have the right fintech specialists for you, get in touch!

FAQs

What is a tokenized deposit?

A tokenized deposit is a digital version of a traditional bank deposit that sits on a blockchain while keeping the same claim on the issuing bank’s balance sheet.

How do tokenized deposits differ from stablecoins?

Tokenized deposits differ from stablecoins because they represent commercial bank money, while stablecoins rely on reserves held by private issuers.

Are tokenized deposits safer than stablecoins?

Tokenized deposits are safer than stablecoins because they fall under banking regulations and use the bank’s own balance sheet rather than external reserves.

Can tokenized deposits run on public blockchains?

Tokenized deposits can run on public blockchains, although many banks prefer permissioned environments for compliance and operational control.

Do tokenized deposits replace CBDCs?

Tokenized deposits do not replace CBDCs because the two serve different purposes, with CBDCs representing central bank money and deposits representing commercial bank liabilities.

Why are banks exploring tokenized deposits now?

Banks are exploring tokenized deposits now because businesses want faster settlement and programmable workflows that legacy rails struggle to support.