Cybersecurity and fraud detection are being turned upside down since the use of AI has become normalized, particularly when it comes to financial institutions that don’t have the luxury of making mistakes or falling behind.

AI-powered fraud detection fintech firms are popping up all over, taking advantage of real-time capabilities to use AI for fraud detection. But AI is also being used in financial crime. In fact, almost 69% of institutions say criminals are better at using AI for crime than banks are at using it for prevention!

And, to make matters even more complicated, the rise in embedded finance is also creating new vulnerabilities.

As a fintech software development partner, we’ve seen the effects that AI has had on the industry. Our experts, whom we provide to a variety of companies through staff augmentation, have real-world experience building and integrating fraud detection systems, and adapting to AI-driven fraud.

Let’s take a look at some of the strategies they are implementing to use AI effectively to detect fraud patterns, to secure API integrations, apply zero-trust principles, and build response plans that work for each business, rather than trying to use a one-size-fits-all solution.

What is AI Fraud Detection in Banking and Financial Services?

AI fraud detection, in the banking and financial services industries, generally refers to using machine learning models to analyze what is going on in real-time, analyze the behaviors, and even use predictive algorithms to identify fraud attempts and prevent those transactions from occurring.

Traditional fraud prevention and detection systems use rule-based systems, which cannot adapt and leave banks vulnerable when fraud tactics change. AI systems, however, can adapt without any human intervention.

This means that they can evolve as threats do, and prevent both the total number of fraudulent transactions and the number of false identifications, which often cause a problem for clients.

Why AI-Powered Fraud Detection Matters for Fintech

We’ve already discussed how AI models can adapt, making them more effective at anomaly detection, even as circumstances change.

This is even more important for fintech (financial technology).

Often, the services provided by fintech firms facilitate real-time payment systems. These systems are very convenient for users, but there are several real-time payment security challenges that only AI can solve.

Since everything happens so quickly, it means transactions can’t be manually reviewed. Combined with instant settlement, which means the transactions can’t even be reversed in most cases, any payment fraud can result in incredible financial losses. It’s no surprise that consumers reportedly lost more than $12.5 billion to fraud in 2024.

Phishing schemes, synthetic identities, and social engineering attacks are also becoming more complex and sophisticated; some of them are even powered by machine learning, leading to a greater success rate of everything from transaction fraud to identity fraud.

Using AI-powered fraud detection tools in fintech applications is no longer optional if we want any hope of keeping our clients’ money and information safe.

AI Fraud Detection Use Cases in Fintech

AI fraud detection use cases vary a great deal, especially in the evolving fraud climate. But, when it comes to fintech firms specifically, we’ve noticed that some of the main uses of the technology include:

- Phishing & Social Engineering

- Advanced Persistent Threats (APTs)

- Card & Credential Fraud

- API & Embedded Finance Attacks

How AI is Used in Fintech Fraud Detection

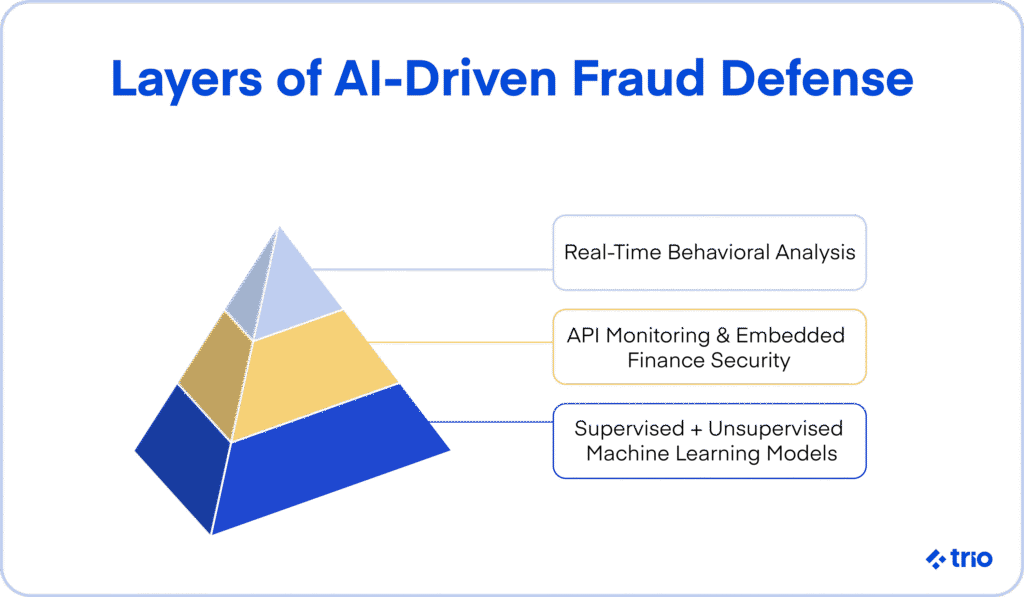

The most effective AI fraud detection systems have a layered approach that allows them to keep learning, analyze behavior, and protect any areas that have a particularly high fraud risk.

Supervised vs. Unsupervised Learning

Supervised learning is exactly what it sounds like: a person is involved. Usually, someone puts together a structured set of data, cleaned up and labeled, so that it can be used for effective training. This helps AI detection solutions learn to detect and prevent fraud patterns that we already know about.

Unsupervised learning occurs when your AI is trained on real data, with no labeling and very little cleanup, so that it can identify where fraud may have occurred. This is the kind of learning you need your AI-powered solutions to do in real-life scenarios to successfully mitigate fraud losses as criminals try new things.

Real-Time Behavioral Analysis

A lot of AI tools don’t just look at numbers, but at a variety of other factors to increase detection accuracy. Some common examples we’ve come across include models that look at user behavior, device fingerprints, and even access patterns.

For example, if you try to log in from a location you have never been in before, and then try to make a very large transaction, fraud detection solutions might be more likely to flag your payment.

This has been particularly effective in cases of credit card fraud.

AI for Embedded Finance and Open API Security

Using third-party apps to take care of a specific service is considered very normal. If you don’t have a banking license of your own, just run your transactions through a service provided by someone who does. Need regulatory technology? Someone else has probably created exactly what you need.

The issue is that you then need to control how this third-party interface works with your own platform, and make sure that you aren’t opening yourself up to any new vulnerabilities.

AI can monitor anomalous API behavior and look for things like real-time transaction spikes, malformed payloads, and anything else that might signal an attack, but which you would otherwise only pick up on when it is too late.

Generative AI in Fraud

At this point, pretty much everyone is familiar with generative AI solutions, and many have even used them themselves. ChatGPT is one of the most well-known names in the industry.

The issue is that fraudsters have taken to using it too, creating advanced, persistent threats that fintech companies need to deal with.

GenAI is being used in fraud attacks to make phishing attacks more realistic, and can even create more complete synthetic identities or try to imitate real customer interactions.

Luckily, we can also take advantage of generative AI when fighting fraud. Running fraud simulations, creating synthetic data, and even just generally improving new fraud detection patterns are all potential uses of generative AI.

Key Benefits of AI Fraud Prevention for Fintech CTOs

If you are a CTO considering some cybersecurity strategies and best practices for your own fintech company, there are a variety of different ways you might be able to benefit from using AI fraud detection and prevention systems as opposed to traditional fraud detection systems.

Real-Time Detection

We’ve already mentioned the incredible speed with which AI can identify signs of an issue. It can literally detect fraud in real-time, taking only a couple of milliseconds to analyze thousands of data points.

The incredible speed not only means that real-time payments can be analyzed accurately, but also that users do not experience any issues with lag, which may affect their perception of your company and the quality of the services you provide.

Fewer False Positives

False positives are a massive issue. With every false positive, users are unable to make their desired payment, and depending on your response protocol, they may not have access to that money for several days.

An AI fraud solution can help you reduce false positives while at the same time picking up on evolving fraud that your traditional system may not have flagged.

The result is greater overall accuracy and happier clients.

Scalability

AI grows as your transactions do. You may need to pay a little more, but that can be automated so that you only pay for what you need at any given time.

The result is that you can likely use the same AI model to take care of all your fraud and AML needs from your early startup days to when you join the list of Fortune 500 companies.

No change means less development is required, and there is a lower potential for mistakes in a future integration.

Customer Trust

Customer trust has been mentioned more than once. You want customers to feel confident in your services, especially if you are dealing with their money and other sensitive information.

When customers don’t trust you, they’ll find someone else. And when it comes to fintech, unless you are really offering a cutting-edge service, your customers will probably be able to find something comparable at one of your many competitors.

Leading financial institutions are already trusted. They have an established reputation. You don’t need to give clients any reason to question your competence.

Regulatory Alignment

Regulations like PCI DSS, SOC 2, and GDPR are all designed to protect clients and stop fraud. However, they can complicate things for fintech companies that don’t have the budget for large regulatory teams.

AI agents can support regulatory compliance by helping you automate audit trails and even sending out alerts when something important is happening.

Challenges of Implementing AI Financial Fraud Detection Systems

There is not a single software on this planet that doesn’t have its associated challenges, and AI fraud detection systems are no different.

Data Quality & Bias

Your AI platform will make its decisions based on the data that it is trained on. This means that poor data quality or unbalanced datasets can lead to biases.

Practically, this may mean that your fraud detection system will be more likely to flag certain behaviors or certain types of users, while missing others completely.

Making sure you train your system on a diverse dataset that has been audited is essential.

Compliance & Transparency (Explainability)

Regulators often demand transparency. The issue is that it is sometimes difficult to walk someone through how AI has made its decision.

Explainable AI (XAI) is becoming more and more important as large institutions use it to make important decisions.

CTOs are ultimately responsible for ensuring they can justify the decisions that their models make. Working with a set of developers who understand explainability and how to build it into your tools is essential!

Building a Fintech-Specific Fraud Protection Strategy

If you have a fintech company, your fraud protection strategy is going to look a little different from the strategy that will be used by a large bank. There are several factors to consider when putting together your own comprehensive fraud prevention plan.

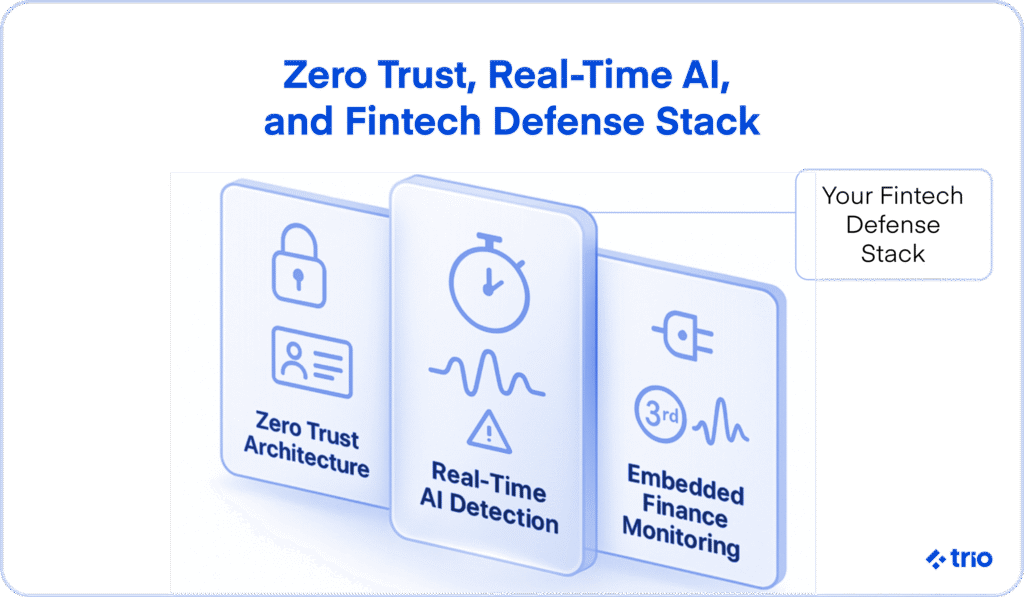

Adopt Zero-Trust Architecture

You need to assume that no user or system can be trusted. Guilty unless proven innocent.

This means you need to include things like microsegmentation, continuous verification, and role-based access controls.

AI can help you with its real-time behavioral analysis.

Secure Your Embedded Finance Stack

APIs and embedded finance are vulnerable, as we already mentioned.

OAuth 2.0, mutual TLS, and AI-powered anomaly detection can all help you, but you need to make sure that you are taking precautions for every single integration.

You also need to monitor third-party usage continuously to make sure that you are keeping an eye on your overall risk.

Simulate Attacks and Build Response Teams

Simulating attacks that are as realistic as possible on a regular basis can help you pick up on potential issues before others identify and take advantage of those same attacks.

The results of these simulations can then be used to build incident reports that your developers can use to further secure your app and that you can provide as documentation for compliance audits.

Embed AI-Savvy Engineers

You need skilled developers who are familiar with the latest trends in the industry and who have worked on similar projects before.

Even if you have all the knowledge in the world, you can’t do anything with it if you don’t have a skilled team.

At Trio, our developers have that experience in fintech-specific security and compliance, and have built and integrated AI-powered fraud detection systems for other clients before.

If you are a startup with a smaller budget, our hires from LATAM and Africa allow you to get the most cost-effective development possible, without sacrificing quality in any way.

We always start with a conversation about your requirements, to make sure that we connect the right people with you, who can integrate into your existing team with no issue.

If you are interested in development, or even just adding a fintech cybersecurity specialist to your team temporarily, reach out for a free consultation.