Fraud doesn’t wait. In fintech, even a few seconds of delay can mean chargebacks, regulatory calls, or an angry customer wondering why their account was emptied overnight.

Real-time fraud detection and prevention have moved from nice-to-have to absolutely essential.

Let’s look at how these systems actually work, what makes them effective, and where fintech builders tend to get it wrong.

If you need experts on your team to help you prevent fraud, whether you want to build a real-time fraud detection system of your own or you just want to implement a series of holistic best practices through the development process, we can help.

Our expert fintech developers are available through staff augmentation and outsourcing, so you can get access to the right skills in the most cost-effective way possible.

Understanding Real-Time Fraud Detection

Every digital payment, login, or transfer is a small act of trust. Real-time fraud detection exists to make sure that trust isn’t misplaced.

At its core, it’s about spotting and stopping fraudulent behavior as it happens, not hours or days later when the damage is already done.

What Is Real-Time Fraud?

Real-time fraud covers any kind of fraudulent transaction that unfolds the moment a user acts: card testing, synthetic identities, account takeovers, or phishing-triggered transfers.

These events move fast, and detection systems have to move faster.

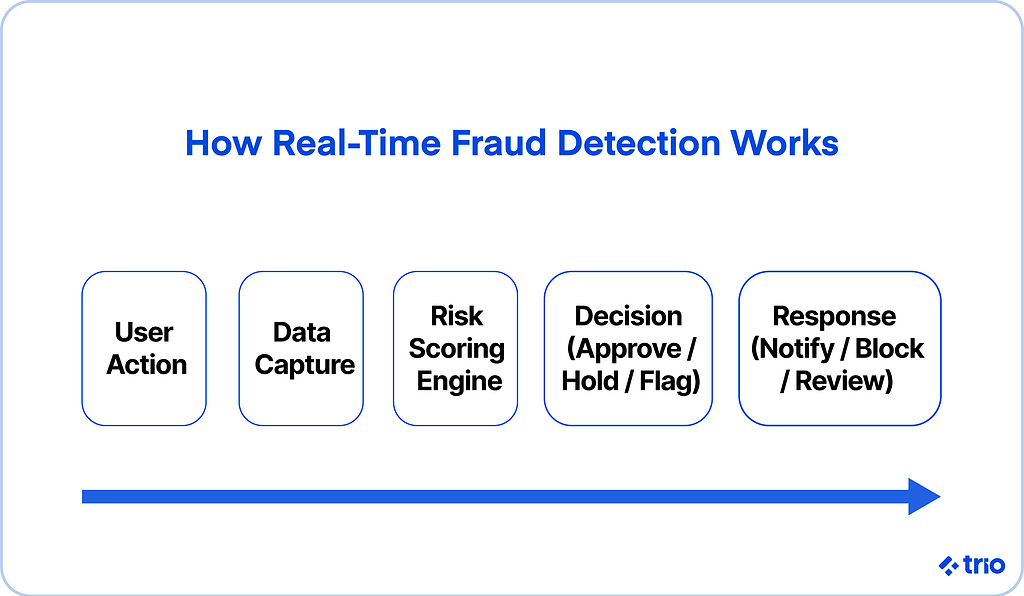

Real-time systems look at live transaction data and make immediate judgments, approve, hold, or flag, before money or credentials change hands.

The Importance of Immediate Detection

Once a fraudulent payment goes through, getting the money back can be incredibly difficult.

Detecting fraud at the exact moment it occurs dramatically reduces losses and keeps customers’ trust intact.

Real-time systems watch for anomalies like odd spending patterns or mismatched IPs while keeping the user experience smooth enough that genuine customers barely notice.

Traditional Fraud Detection vs. Modern Real-Time Systems

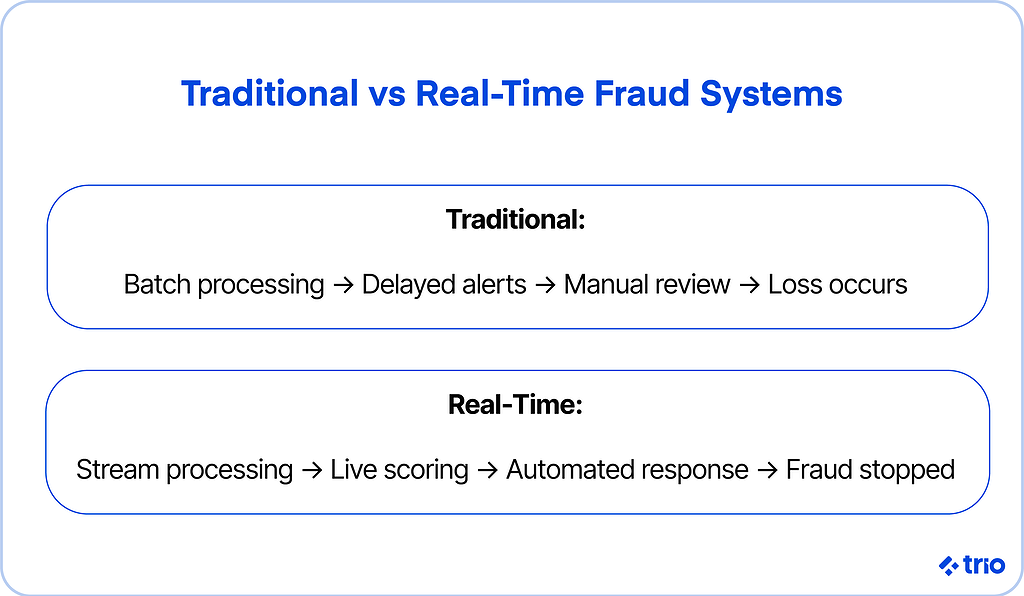

Older fraud tools were built for batch jobs and nightly audits.

They’d flag suspicious patterns long after transactions cleared.

Modern systems, in contrast, rely on stream processing, event-driven architecture, and machine learning.

They’re built for the fintech pace, and are fast, data-hungry, and always adapting to new tricks from fraudsters.

Core Components of Fraud Detection Systems

Behind every instant decision lies a network of moving parts, data pipelines, risk engines, alerts, and integrations, all tuned for speed and precision.

Transaction Data Ingestion and Processing

Fraud detection lives or dies by data quality.

Systems pull information from payment gateways, devices, networks, and behavioral signals, often processing thousands of events per second.

Frameworks like Apache Kafka or Tinybird help teams manage these data streams without lag or loss.

Risk Scoring and Decision Engines

Every transaction gets a risk score. That score might come from a simple rule (something like, “too many failed logins in a minute”) or from a trained model crunching hundreds of variables.

Tools such as Amazon Fraud Detector or homegrown engines combine static rules with predictive modeling to make those split-second calls.

Alerting and Response Mechanisms

Detection means little if the response is slow.

Good systems route high-risk cases straight to human review, auto-freeze accounts showing suspicious activity, or trigger step-up verification.

The trick is to keep thresholds smart enough to catch real issues without drowning analysts in false alarms.

Integration with Payment and Banking Infrastructure

Fraud tools don’t live in isolation. They sit between payment processors, core banking systems, and KYC/AML platforms.

When integration is done right, risk signals can stop a transaction before it clears the network, not after.

Real-Time Fraud Prevention Strategies

Stopping fraud in real time is largely about strategy. The smartest systems blend automation with human oversight and continuously learn from new patterns.

Rule-Based vs. Machine Learning Approaches

Rules still have their place. They’re transparent and easy to audit, but they age fast.

Fraudsters evolve daily, and static logic can’t always keep up.

Machine learning models fill that gap by finding patterns that humans might overlook, though they need careful tuning and solid data to stay reliable.

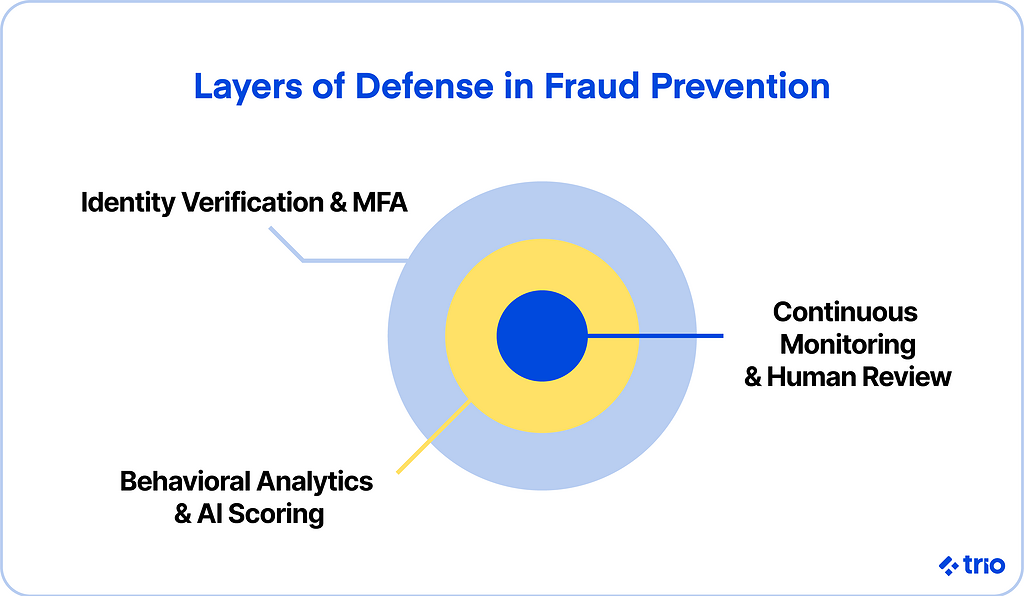

Behavioral Analytics and Pattern Recognition

Fraud detection works best when it understands what “normal” looks like.

Behavioral analytics profiles users over time, including information like where they log in from, how they type, and how quickly they navigate checkout screens.

Once that baseline exists, even small anomalies, a new device, or an unusual transaction size can raise early warnings.

Identity Verification and Multi-Factor Authentication

Simple passwords don’t stand a chance anymore. Adding identity verification and MFA cuts off many attacks before they start.

When combined with behavioral analytics, it creates a layered defense that catches both synthetic and stolen identities.

Balancing Security with Customer Experience

There’s a fine line between protection and frustration. Too many authentication steps or false declines, and customers start leaving.

Unless you are a financial giant with an incredible reputation, these issues could be enough to sink your company.

You don’t necessarily have to make fraud completely impossible. You just need to make it unprofitable while keeping genuine users happy.

Building a Real-Time Fraud Prevention System

Building a fraud detection platform requires a well-planned architecture.

Real-time systems demand thoughtful design across data flow, monitoring, and decision logic.

Data Architecture for Real-Time Detection

A strong data architecture pulls from multiple sources, transactions, devices, IPs, and behavior, and unifies them in milliseconds.

That may sound straightforward, but building low-latency data pipelines that stay consistent under load is a constant balancing act between speed and accuracy.

Stream Processing and Event Monitoring

Most modern fraud systems rely on stream processors like Kafka, Flink, or AWS Kinesis.

They let teams monitor events as they happen, apply rules instantly, and push suspicious activity to the right workflow without delay.

Visualizing Analytics and Risk Dashboards

Fraud teams can’t manage what they can’t see, so you need to make sure that they have access to all the information they need.

Real-time dashboards that visualize anomaly spikes, model performance, and alert history help analysts fine-tune rules and understand where fraud is slipping through.

A good dashboard turns chaos into something readable.

Example Frameworks and Tools

Many fintechs mix and match: Tinybird for fast stream handling, AWS Fraud Detector for ML-driven scoring, and the Elastic Stack for visualization.

What matters most is interoperability and low latency, not which brand name is on the architecture diagram.

The Role of Artificial Intelligence and Machine Learning

AI and machine learning have shifted fraud detection from rule-following to pattern-seeking. But they’re not magic.

The reality is that AI and ML are only as good as the data and monitoring behind them.

How Machine Learning Models Improve Detection Accuracy

Machine learning models spot connections that rule sets miss.

A model might notice that a legitimate customer’s behavior slowly changes as they get older, while a fraudster’s profile shifts instantly.

These subtle differences help the system detect fraud with fewer mistakes.

These models also learn while out in the field, allowing them to adapt in real-time.

Using Artificial Intelligence for Enhanced Fraud Prevention

AI also helps teams stay proactive. Instead of reacting to past incidents, it predicts what’s likely to happen next, testing scenarios, identifying vulnerable user segments, and even auto-adjusting thresholds.

While you shouldn’t rely on these predictions entirely, they can be a useful tool as part of a larger risk-management strategy.

Reducing False Positives Without Weakening Security

False positives are the hidden tax of fraud prevention. Each wrongly blocked payment chips away at customer satisfaction and trust.

The problem is not so much the inconvenience that you cause, but the visible mistake that your fraud-detection system makes, and the perceived unreliability of the system that comes along with that.

Advanced algorithms aim to reduce that tax, learning from past decisions and feedback loops to make smarter calls without opening new loopholes.

Continuous Model Training with Live Transaction Data

Fraud patterns change fast as fraudsters experiment and try new methods to get around existing detection solutions.

Models trained on last month’s data can already be outdated.

As we’ve already mentioned, continuous learning pipelines, fed by live transaction data, keep systems aligned with what’s happening in the real world rather than just what happened last quarter.

Key Use Cases of Real-Time Fraud Detection

Real-time detection shows up in almost every corner of finance, anywhere money or identity moves.

Banking and Card Transactions

Banks lean heavily on these systems to catch credit card fraud, suspicious transfers, and account compromises.

They cross-check transaction metadata, device fingerprints, and customer history before approving anything high-risk.

E-Commerce and Digital Payments

Online stores see fraud at scale: bots testing cards, fake returns, and chargeback abuse.

Real-time detection helps identify patterns that humans would miss, flagging potentially fraudulent transactions before the product ships.

Account Takeover and Identity Theft Prevention

Account takeover is one of the fastest-growing threats, resulting in nearly $13 billion lost in 2023.

A mix of MFA, anomaly detection, and behavioral monitoring gives platforms a fighting chance to spot logins that don’t fit the user’s usual profile.

Insider Threats and Enterprise Fraud Scenarios

What we’ve noticed in our time working on developing these detection systems for financial institutions is that not all fraud comes from outside.

Real-time monitoring can highlight irregular admin actions, privilege escalations, or data exports that suggest an insider problem.

You might not want to spend the time integrating or creating these systems, but they are as essential as any others.

Challenges in Fraud Prevention Without Impacting CX

There’s no perfect fraud system. Each improvement usually comes with a trade-off, cost, complexity, or friction for the user.

We’ve already mentioned a variety of these challenges, but let’s group them all together to ensure you understand what you need to be prepared for.

The Risk of Over-Blocking Legitimate Transactions

Overly sensitive thresholds may block legitimate transactions, creating frustration for both customers and support teams.

Finding the right balance is less about perfect algorithms and more about constant tuning, which takes specialist knowledge in not only fraud risk in finance, but also machine learning.

Data Privacy and Regulatory Compliance

Fintechs of all sizes must navigate privacy laws like GDPR and PCI DSS while still analyzing huge volumes of data.

The best systems are transparent about how they use data and give customers a sense that their safety and privacy aren’t in conflict.

These regulations change, so you need to ensure that you stay on top of the different developments and remain compliant.

Cost and Scalability Concerns

Real-time systems can get expensive, especially as transaction volumes scale.

Cloud-native tools have eased the burden somewhat, but small fintechs often face tough choices about what to automate first.

There is no right answer to this. Instead, you’ll have to carefully consider your own goals and funding.

Customer Trust and Transparency Issues

Trust takes years to earn and seconds to lose, especially in a highly competitive market like fintech, dealing with incredibly sensitive information.

Communicating clearly about fraud prevention, why a transaction was flagged, and what’s being done to protect users builds credibility even when security measures are invisible.

Future Trends in Real-Time Fraud Detection

While there is no way to say what we’ll need to fight fraud in the future, there are several trends that we can look at to guide us going forward.

Advancements in Machine Learning and Deep Learning

We’re seeing a shift toward deep learning systems that look for multi-layered relationships across data points, things that might take a human analyst days to spot.

These models may not be perfect, but they’re getting better at separating genuine behavior from subtle fraud signals.

Innovations in Fraud Detection Platforms

Vendors are racing to build platforms that can process billions of events daily without latency.

Many now combine low-code rule management with explainable AI, giving risk teams both speed and visibility into how decisions are made.

The Role of Blockchain and Digital Identity in Fraud Prevention

Decentralized digital identity systems could reshape fraud prevention by making it easier to verify users without storing sensitive personal data.

It’s early days, but this approach may reduce identity theft and synthetic account creation in the long run.

Preparing for the Evolving Fraud Landscape

Fraudsters adapt fast, and collaboration is often the best defense.

Shared fraud databases, cross-border intelligence, and open APIs for regulatory reporting are becoming essential tools for staying ahead.

Strategic Recommendations

The best fraud strategy depends on where you sit in the ecosystem, but some lessons hold true for everyone.

For Banks: Invest in AI-Powered Detection and Interoperability

Legacy systems can’t keep up forever.

Banks that layer in AI-driven detection tools and integrate them across payment networks will be far better prepared for the next wave of fraud incidents.

For Merchants: Prioritize Customer Experience in Security Measures

Security shouldn’t feel like punishment.

Merchants should test every safeguard against real users to make sure it doesn’t slow them down or drive them away.

For Regulators: Foster Global Standards for Data Sharing and Fraud Monitoring

Even though most governing bodies are bound to specific regions, fraud doesn’t respect borders.

Regulators who encourage responsible data sharing and align standards across markets make it easier for everyone to respond faster when new fraud patterns appear.

Conclusion

Fraud prevention in fintech is a race that never really ends. Since it is practically impossible to build the perfect system, the goal is to build one that learns, adapts, and protects customers in real time.

With the right mix of data architecture, machine learning, and human judgment, fintechs can stop most fraudulent activity before it becomes a headline.

The ones investing in these systems today will likely be the ones customers still trust tomorrow.

To do this, you need the right skills. Since we specialize in fintech development here at Trio, we have a variety of niche talent on hand and could connect you with the right people in as little as a few days, taking the pressure off your hiring resources.

To find out more about how you can hire expert fintech developers with Trio, get in touch!

FAQs

What is real-time fraud detection?

Real-time fraud detection is the process of analyzing live transaction data to identify and stop suspicious activity as it happens, before money or data is lost.

How does machine learning improve real-time fraud detection?

Machine learning improves real-time fraud detection by spotting patterns and anomalies that static rules can’t, and by adapting as new fraud tactics appear.

What’s the difference between rule-based and machine learning fraud detection?

Rule-based systems follow fixed logic, while machine learning models learn from data, adjusting over time to catch subtle or emerging fraud behaviors.