If your product accepts, stores, or even briefly touches card payments, PCI compliance becomes part of your world pretty quickly.

Teams often expect a checklist or a simple certification, but the reality is that PCI DSS compliance depends far more on your architecture than on your paperwork.

The cleaner your infrastructure design, the easier it is to protect cardholder data and prove that you meet PCI requirements.

Let’s look at how to build a PCI-compliant infrastructure without tying the conversation to any single cloud provider.

We’ll cover how to shape data flows, isolate workloads, implement access control, secure networks, and design a cloud environment that supports long-term PCI DSS compliance.

What PCI compliance means for your systems

PCI DSS, short for Payment Card Industry Data Security Standard, exists to protect cardholder data across the global payment ecosystem.

The PCI Security Standards Council oversees these security standards, and every business that interacts with card data must comply with them.

PCI compliance is essentially the proof that your systems and processes actually meet these expectations.

At a practical level, PCI DSS compliance asks you to demonstrate that:

- You control access to cardholder data strictly

- You secure the network around cardholder data

- You encrypt sensitive data properly

- You maintain clear, documented security policies

- You log activity and keep evidence that your environment behaves as intended

Although PCI DSS is a single standard, people sometimes forget how deep and specific it gets.

The requirements touch everything from operating system configuration to logging formats to how often passwords rotate. Nothing sits in isolation; it all ties back to one question: Can you protect cardholder data consistently?

It helps to treat PCI requirements as design constraints instead of something you bolt on later. Systems built with PCI in mind from the start usually require far less effort to maintain compliant behavior over time.

PCI compliance levels and what they mean for you

PCI compliance levels are based mainly on transaction volume. The higher the volume, the more formal your validation.

Large merchants often undergo a full PCI DSS audit performed by a Qualified Security Assessor. Smaller organizations may complete a self-assessment questionnaire instead.

Regardless of your level, the technical controls do not change much. PCI DSS requirements apply consistently whether you process fifty thousand transactions or several million.

What shifts is the amount of validation and the need for an attestation of compliance signed by a security assessor.

If you aim for long-term stability, it is smart to design your infrastructure as though you will one day undergo the highest level of scrutiny.

That mindset reduces surprises later and aligns your systems with the expectations of auditors, processors, and banking partners.

Step 1: Map your PCI scope and understand cardholder data flows

The first practical step toward achieving PCI compliance is mapping your PCI scope.

Without understanding where cardholder data actually flows, you cannot protect it or design effective boundaries.

Narrow your PCI scope before building anything.

Infrastructure that is PCI DSS compliant is easier to build when your PCI scope is small.

You do that by mapping every place where cardholder data appears. This includes user entry points, backend APIs, services that store or process card data, caches, logs, failed transactions, and any third-party integrations.

More than one team has been surprised to discover that a forgotten log line secretly expanded their entire PCI scope.

A careful mapping exercise may suggest that certain systems do not need to handle cardholder data at all.

Tokenization services, hosted payment pages, and vaulted storage from payment processors can remove raw card data from your environment entirely.

When that happens, you reduce the PCI impact on your infrastructure and decrease your overall compliance burden.

Separate what must meet PCI DSS requirements.

Once you understand your cardholder data flows, you separate systems into two categories:

- Systems that store, process, or transmit cardholder data

- Systems that use only derived data and operate outside the PCI scope

Good boundaries make the difference between a manageable PCI environment and one that consumes your entire engineering bandwidth.

Clear segmentation also helps you maintain PCI over time because the sensitive systems are smaller, sharper, and easier to monitor.

At this stage, many companies formalize the idea of “the PCI zone,” a limited section of their cloud environment dedicated to workloads involving card data.

Everything else interacts with the PCI zone only through tightly controlled interfaces.

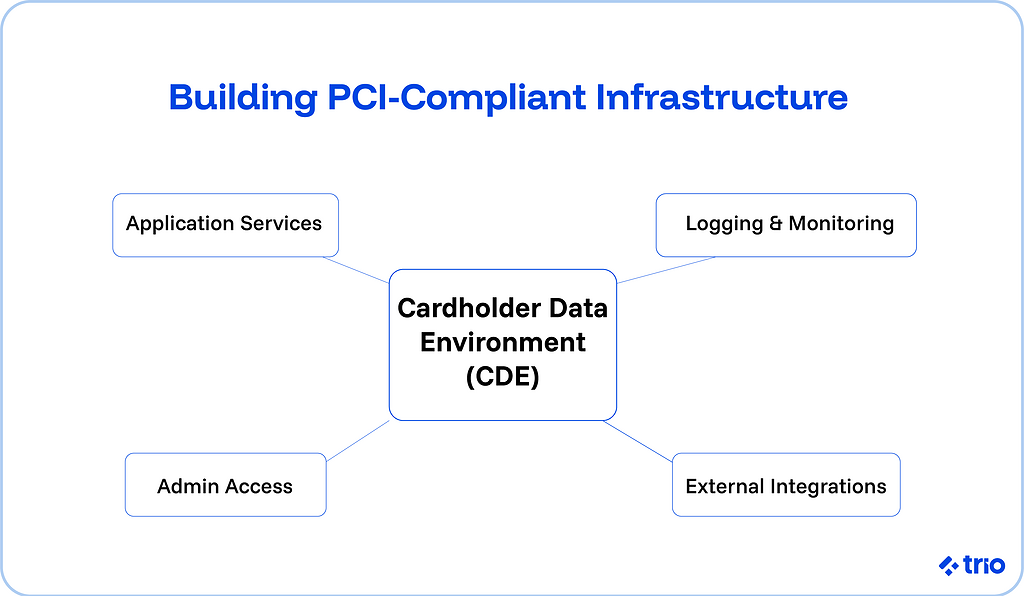

Step 2: Design infrastructure that supports PCI DSS compliance

Once the PCI scope is mapped, you can design an infrastructure that meets PCI DSS requirements naturally rather than through constant firefighting.

Build intentional boundaries around cardholder data.

The more isolated your sensitive workloads are, the easier it is to comply with PCI.

You can organize your cloud environment so that databases storing card data, payment processing services, and secure APIs live in dedicated segments of your network.

Access control rules and routing rules restrict these systems from talking to anything that does not need access.

This kind of segmentation helps both engineering teams and auditors. For engineers, it creates clean interfaces.

For auditors, it provides a clear story that supports assessing your compliance level and evaluating your controls.

Use secure storage, encryption, and access control by default.

A PCI environment benefits from strong defaults. Encrypting all cardholder data at rest, forcing TLS for data in transit, and storing keys in secure vaults is not just a recommendation; it is part of PCI DSS.

Rather than treat encryption as an optional step, you can assume it is always present. Doing so keeps data protected even when new services are added later.

Access control is equally fundamental. Least privilege is not optional when building PCI-compliant infrastructure.

Every system that touches card data must require authentication and must log which identities access what. Administrative access is restricted to a small group of individuals using multi-factor authentication.

When decisions like these are part of your infrastructure templates, PCI compliance requirements become a natural part of your workflow.

Standardize configuration to avoid drift.

One of the biggest risks in maintaining PCI DSS compliance is configuration drift. A cloud environment evolves fast, and what was compliant last quarter might not be compliant today.

Infrastructure as code helps here because it lets you define approved configurations and catch unintended changes early.

This approach also supports smoother audits. An assessor can see exactly how your systems are configured, not just how they were configured months ago.

Step 3: Implement key PCI DSS controls across your cloud environment

Even with a well-designed environment, you still need to apply specific PCI DSS controls.

The payment card industry data security standard is explicit about what you must prove, and a few areas tend to carry the most weight.

Strong access control practices

PCI demands strict control over who can access cardholder data and the systems that manage it.

That typically means role-based access control, separation of duties, and clear operational boundaries. Administrative accounts are limited, monitored, and protected with multi-factor authentication.

Teams often underestimate how much this matters. Access control is one of the easiest topics for auditors to test, because gaps show up quickly in logs and role definitions.

Network security is aligned with PCI requirements.

PCI DSS expects you to protect sensitive systems with layered network security.

That involves firewalls or security controls that restrict unapproved traffic, segmentation that isolates PCI systems, and monitoring that captures network-level activity.

In a cloud environment, network security becomes a combination of routing rules, firewall configurations, virtual network segments, and access lists.

Even though the technology stack may differ from traditional data centers, the intent is the same: isolate cardholder data and limit exposure.

Protecting cardholder data with encryption

PCI DSS treats encryption as one of the primary ways to protect cardholder data.

Protect cardholder data at rest, encrypt it during transmission, and manage your keys with clear policies. Even if someone were to gain access to your systems, encrypted card data remains unreadable without the proper keys.

Key management deserves careful thinking. Who can rotate keys, who can view them, and which services can use them are all part of PCI DSS controls.

These policies shape the overall security posture of your environment.

Logging and evidence for compliance

PCI auditors will ask how you know your environment behaves as expected. Logging helps answer that question.

Systems that interact with card data must log access attempts, system changes, and security events. These logs feed into monitoring tools that detect suspicious behavior and help you demonstrate compliance.

Evidence is easy to overlook until the week before an audit. Building it into your infrastructure from the start makes the entire process gentler and avoids rushed fixes later.

Step 4: Establish sustainable PCI compliance practices

Even the best-designed environment needs ongoing care. PCI DSS compliance requires continuous attention rather than a one-time certification.

Use continuous compliance tools.

Cloud environments change constantly. Without automated checks, your configuration will drift.

Continuous compliance tools compare your environment against PCI DSS controls and alert you when something moves out of alignment.

They can reduce your compliance burden dramatically by preventing issues instead of scrambling to fix them during audits.

Create predictable operational habits.

PCI DSS includes expectations around change management, reviews, testing, and incident handling.

Internal routines that support these expectations make it easier to maintain PCI DSS compliance year-round.

When your operational playbook matches PCI DSS controls, the line between “doing your job” and “preparing for an audit” gets pleasantly thin.

Prepare for audits with clear documentation.

PCI DSS audits rely heavily on structure.

The more clearly you document your architecture, your security policies, your data flows, and your evidence, the easier the audit becomes.

This is also where your choice to segment PCI systems pays off: smaller environments produce clearer evidence.

Working with security assessors

At some point, whether during an annual review or while onboarding with a payment processor, a security assessor will evaluate your environment.

They will check how you handle cardholder data, how you manage access control, and how your systems align with PCI DSS controls.

A good conversation with an assessor usually begins with a clear diagram of your PCI scope, a description of your network segmentation, and proof that your sensitive systems follow PCI security standards consistently.

When your infrastructure is designed for PCI from the start, these conversations feel more like verification than interrogation.

How Trio helps teams build PCI-ready infrastructure

Trio specializes in working with fintech companies, which means PCI DSS compliance is a familiar landscape rather than an occasional requirement.

When you work with us, you get engineers who think about security requirements, compliance standards, and operational realities while still building modern cloud systems that scale.

Trio has supported companies through early-stage PCI planning, full re-architecture of legacy card systems, and the creation of PCI-specific cloud environments that isolate cardholder data elegantly.

The team understands how PCI DSS requirements intersect with real-world engineering, and how to design systems that feel manageable instead of intimidating.

If you need engineers who can help you build infrastructure that is secure and compliant but also flexible enough for product development, Trio can act as an extension of your team rather than a temporary compliance consultant.

Final thoughts

PCI-compliant infrastructure involves shaping your cloud environment so that sensitive systems live inside clear boundaries, encryption and access control happen by default, and your monitoring provides ongoing evidence that you’re secure and compliant.

When you map your PCI scope carefully, control cardholder data tightly, and align your infrastructure with PCI DSS controls, the compliance process becomes far less overwhelming.

Instead of reacting to requirements, you build systems that already satisfy them.

If you want help designing, reviewing, or modernizing PCI DSS-compliant infrastructure, or you need engineering partners who understand both cloud environments and payment regulations, get in touch!

FAQs

What does it mean to build PCI-compliant infrastructure?

Building PCI-compliant infrastructure means creating systems that satisfy PCI DSS controls. Designing PCI-compliant infrastructure involves secure data handling, access control, encryption, and clear network boundaries.

How do I start building PCI-compliant systems?

Starting to build PCI-compliant systems begins with mapping your PCI scope. Once you identify where cardholder data flows, you can isolate those systems and apply PCI DSS requirements correctly.

Which parts of my environment fall under PCI scope?

The parts of your environment under PCI scope are any systems that store, process, or transmit cardholder data. Understanding PCI scope helps you separate sensitive workloads from non-PCI systems.

Do I need encryption to be PCI compliant?

You need encryption to be PCI compliant because PCI DSS requires protecting cardholder data in transit and at rest. Strong encryption and key management reduce risk and satisfy mandatory controls.

What role does access control play in PCI compliance?

Access control plays a major role in PCI compliance by limiting who can reach sensitive data. PCI DSS expects least privilege, multi-factor authentication, and detailed logging of privileged actions.

Can cloud environments be PCI compliant?

Cloud environments can be PCI compliant when configured with proper segmentation and monitoring. Achieving PCI compliance in the cloud relies on disciplined configuration and clear data boundaries.

How often must PCI DSS compliance be validated?

PCI DSS compliance must be validated annually, even though controls run continuously. Regular validation shows that your environment maintains PCI requirements over time.