Fintech moves quickly. Regulation rarely does. Somewhere between those two speeds sits the daily reality for founders, CTOs, and compliance leads trying to build products that can survive both markets and regulators.

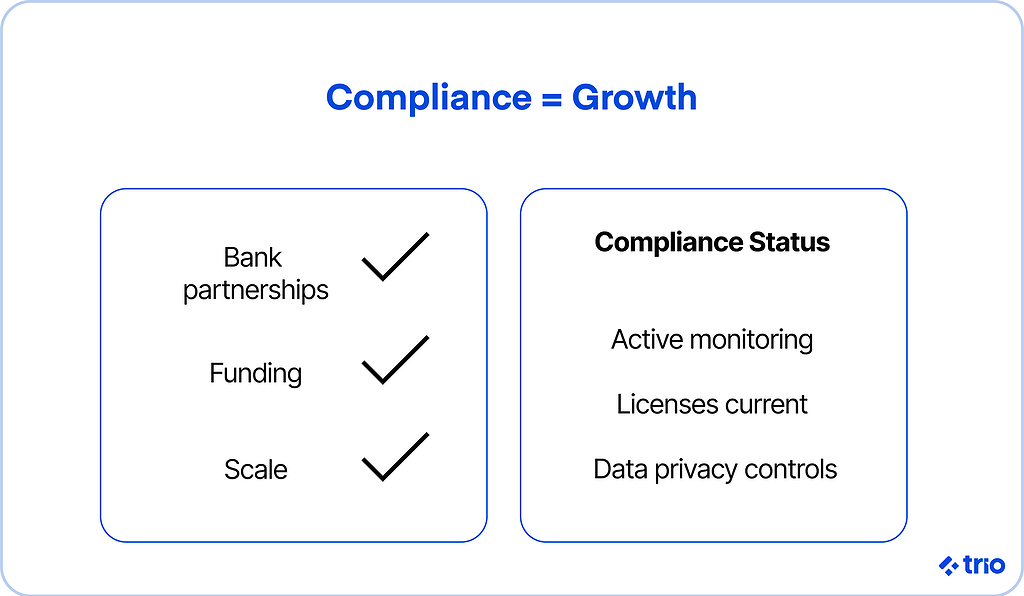

In 2025, compliance isn’t just a safety net. It’s a growth enabler.

If you can’t prove compliance, you can’t scale, raise capital, or partner with banks.

Yet, the rulebook keeps expanding.

Let’s break down what’s changing, what to expect next, and how fintechs can build compliance programs that work with, not against, their pace of innovation.

In most cases, you need to build compliance into your products from the ground up. This means you need a fintech compliance expert on your team.

Since we specialize in fintech software development here at Trio, we have a host of these developers on hand for you to choose from. Our staff augmentation hiring model means they join your team as a remote employee, without the need for overhead that comes with a full-time hire.

And, since we already have them on our staff, you get a handful of portfolios within a couple of days, taking the pressure off your HR department.

Understanding Fintech Compliance in 2025

Before we delve into new laws and frameworks, it helps to first understand what compliance actually means in a fintech context.

It’s no longer a back-office function handled by lawyers and auditors. It’s part of how your company operates day to day.

What Is Fintech Compliance?

At its simplest, fintech compliance means ensuring your business follows the financial, privacy, and consumer-protection laws that apply to your products. In practice, that can cover everything from licensing and anti-money-laundering controls to data protection and algorithmic transparency.

But the definition keeps shifting.

Regulators used to look for policies on paper; now they expect proof in code and data.

For example, if your lending platform uses AI for credit scoring, you’ll need to show how the model makes decisions and how bias is tested. That’s a long way from the tick-box approach most startups began with.

How Fintech Compliance Differs from Traditional Financial Services

Banks and insurers were built within regulation. They move slowly because their systems, committees, and legacy infrastructure were designed to keep regulators comfortable. Fintechs, by contrast, are often built on speed.

The tension shows.

Fintech companies are expected to meet the same standards as banks, but with leaner teams and less bureaucracy.

The cost of misalignment can be painful. In the past year alone, several digital lenders have faced fines for sloppy compliance measures.

Fintech compliance today demands both agility and maturity: the ability to move fast, but with traceable logic behind every product decision.

Overview of the 2025 Regulatory Environment

The regulatory map in 2025 looks like a patchwork quilt stitched with different levels of stringency. Yet a few themes are emerging globally.

In the U.S., state licensing for payments and lending keeps expanding while federal agencies test new frameworks for digital assets.

Europe is tightening its grip on data and AI with PSD3, MiCA, and the AI Act.

Regulators in Asia and Australia are formalizing digital-banking standards. Even emerging markets like Brazil and Kenya are setting up sandboxes for crypto and payments firms.

So what have we taken away from this as a fintech development firm? Probably the most important thing is that fintechs can’t rely on a single global compliance model anymore.

Each market demands localization and constant monitoring, and regulators are sharing information faster than ever.

Key Regulatory Changes to Expect in 2025

Regulation rarely feels exciting, but this year’s shifts will shape how fintechs grow.

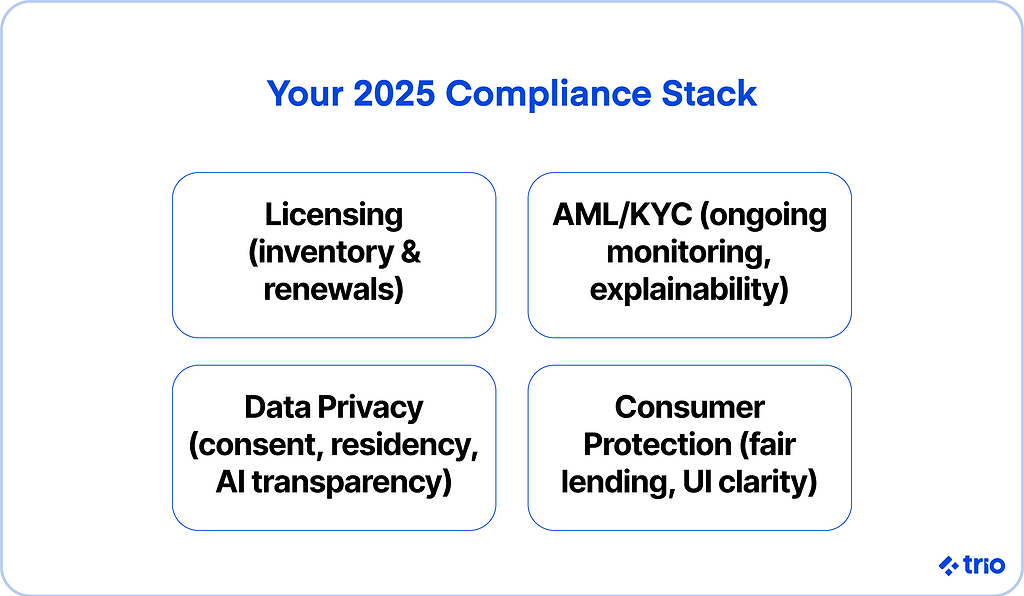

Most of the changes fall into four buckets: licensing, financial crime prevention, data privacy, and consumer protection.

Licensing and Registration Updates

Licensing used to be a one-and-done formality. Those days are over.

Regulators now treat licensing as a continuous relationship, not a certificate on the wall.

In the U.S., we expect to see tighter collaboration between the OCC and state agencies, with regular operational reviews.

In Europe, PSD3 adds new rules around business continuity, incident reporting, and third-party oversight.

It is becoming increasingly important to keep an updated license inventory and renewal calendar. Many fintechs now automate it through RegTech dashboards that flag expirations and link directly to regulator portals.

New AML and KYC Rules

Anti-money-laundering (AML) and know-your-customer (KYC) rules are evolving from static onboarding checks into live, behavior-based monitoring.

The Financial Action Task Force’s updated standards now emphasize ongoing due diligence for higher-risk accounts, requiring authorities and regulated entities to maintain accurate beneficial-ownership information and trace ownership through complex corporate layers.

That sounds heavy, but modern tools can lighten the load.

Transaction-monitoring systems powered by machine learning can detect unusual behavior faster than any analyst could.

The challenge is explainability.

Regulators want to know why an alert triggered, not just that it did. If you are going to use these tools, you need to have some way to document these decision paths early, ideally baked into your architecture from day one.

If you don’t have the necessary talent on hand, we highly recommend hiring a RegTech specialist to set you up for success later on.

Data Protection and Privacy Regulations

Data privacy is no longer an EU-only problem. The AI Act, the updated CCPA, and India’s DPDP Act all tighten the rules around how customer data can be used, stored, and shared.

If your product touches EU citizens, even indirectly, expect obligations around consent, data residency, and explainable AI. Even if it doesn’t, you don’t want to limit your scalability later on.

A good starting point is a data map that tracks where each piece of information lives, across regions, cloud environments, and vendors. It’s a simple tool that can save weeks during audits and builds trust with both regulators and partners.

Consumer Protection and Fair Lending Standards

Consumer fairness has become the global north star for fintech oversight. Regulators now expect proof that pricing, eligibility, and credit-scoring models treat customers equitably.

The CFPB’s recent focus on digital dark patterns has even turned interface design into a compliance topic.

For fintechs of all sizes, that means aligning product and compliance from the first design sprint. A lending flow that hides terms or nudges users toward riskier options won’t survive the next exam cycle.

Building an Effective Fintech Compliance Program

Strong compliance may feel like a massive hurdle at the start, but it gives you room to scale confidently. The best fintechs treat compliance as a product feature, not a barrier.

Components of a Strong Compliance Framework

An effective framework typically covers four layers: governance, policies, monitoring, and training.

That may sound corporate, but each piece plays a practical role. Governance sets ownership. Policies define the rules. Monitoring catches what slips through. Training ensures people know why it matters.

Small fintechs sometimes start with templates borrowed from advisors, but as they grow, those templates need tailoring.

A compliance framework should reflect the actual business model, risk profile, and tech stack, not just generic best practices.

Governance and Risk Management Models

Who signs off on new markets? Who owns AML oversight? When does an issue escalate to the board? These questions determine how quickly a company can respond when regulators come calling.

Risk management should feel like a living process that keeps evolving.

Some fintechs now run mini red team exercises where compliance officers simulate potential failures. We’ve seen these exercises pick up on issues like data leaks, false-positive AML flags, or API outage during reporting season.

Compliance Training and Awareness Across Teams

Teams that understand the “why” behind regulations build better products and catch issues early.

Short, scenario-based sessions, like walking engineers through an example of a suspicious transaction pattern, work far better than static presentations.

When compliance awareness becomes part of onboarding and sprint planning, it naturally integrates into company culture.

Monitoring, Auditing, and Reporting Requirements

Real-time monitoring tools have become a regulatory expectation. Whether it’s AML alerts or data-access logs, regulators want continuous visibility. Audits now include system-generated evidence, not just spreadsheets or PDFs.

If this is the route you decide to go, you will benefit from unified dashboards that feed data from multiple systems, payments, customer onboarding, and analytics into a single compliance view.

That visibility also reduces panic when a regulator requests information on short notice.

Global and Regional Regulatory Perspectives

Regulation may not move uniformly, but certain trends are shaping how fintechs operate worldwide.

Knowing which regions are aligning and which are diverging helps founders prioritize markets intelligently.

United States: SEC, OCC, and State Licensing

In the U.S., fragmentation remains the story. The OCC continues to explore a fintech charter, while the SEC expands oversight on digital assets and embedded investing platforms.

State regulators, especially in New York and California, have tightened annual reporting requirements for money transmitters and lenders.

If you are operating across multiple states, centralized license management and standard operating procedures can prevent inconsistent filings, a common source of fines.

Europe: MiCA, PSD3, and Open Banking

Europe’s regulatory ecosystem is maturing. MiCA brings long-awaited clarity for crypto and tokenized assets, while PSD3 strengthens authentication and API governance for open banking.

The EU AI Act overlays new rules for algorithmic accountability, affecting any fintech using machine learning for credit, fraud, or onboarding.

The silver lining is predictability. Once you align with European standards, you may be able to pass operations across different member countries, creating scale advantages.

Asia-Pacific: Singapore, India, and Digital Banking

Asia continues to balance innovation and control. Singapore’s Monetary Authority remains a global model for clear digital-banking regulation.

India’s Reserve Bank now enforces transparency rules for digital lenders, requiring disclosure of all intermediaries and data sources. Australia is piloting stronger operational-resilience tests for payments infrastructure.

Compliance maturity is increasingly a prerequisite for partnership with local banks or government programs.

Emerging Markets: LATAM and Africa

Brazil’s Open Finance ecosystem and Mexico’s Fintech Law show how regulation can spur adoption when executed pragmatically.

Across Africa, central banks are focusing on fraud prevention and data localization.

The challenge is keeping up with change. Guidance may update quarterly, and a few regulators publish full English translations. You may need to rely on local legal partners or compliance consultants embedded in-country to bridge the gap.

Operational Compliance Challenges for Fintechs

Every fast-growing fintech faces operational friction when regulation collides with scaling.

Balancing Growth, Innovation, and Regulation

It’s tempting to see compliance as something to fix later, especially during high-growth phases. Yet, most fintech failures trace back to compliance gaps rather than product flaws.

Building checks and documentation early might slow the first few sprints, but it prevents existential problems later, like losing a banking partner over missing AML records.

Balancing speed with oversight takes maturity, and a clear understanding that both serve the same goal: long-term survivability.

Managing Vendor and Third-Party Risk

Every API connection or cloud dependency extends your compliance perimeter.

Regulators are now explicit: fintechs are responsible for their vendors’ conduct, not just their own. That includes security, data handling, and continuity plans.

Practical steps, like maintaining a vendor inventory with risk scores and review dates, help manage this complexity.

Some companies in the financial services sector also conduct compliance onboarding for vendors, similar to technical onboarding, to ensure expectations are clear before integration.

Dealing with Fragmented Regulatory Systems

Operating across jurisdictions means juggling conflicting rules.

For instance, data residency requirements in India may clash with centralized analytics in the U.S. or EU. The only realistic solution is modular compliance through systems designed to adapt based on local regulation, not one global policy.

If you have the budget, you could hire regional compliance leads who can translate abstract legal language into practical engineering tasks. That translation layer keeps local teams aligned without constant legal bottlenecks.

Ensuring a Seamless Customer Experience While Staying Compliant

Customers hate friction, but regulators require it.

The art lies in designing verification and consent flows that feel seamless.

Modern KYC providers now combine biometrics, device fingerprinting, and behavioral analytics to verify identity in seconds without additional clicks.

Good compliance UX can increase conversion rates by reducing false positives and onboarding drop-offs. In that sense, compliance and growth often pull in the same direction.

Technology and Compliance in 2025

Technology has quietly become the compliance officer’s best ally. What used to take weeks of manual reconciliation or policy reviews can now be handled by software that never sleeps.

Still, automation comes with its own trade-offs, and regulators are watching that too.

The Role of Automation in Compliance Processes

Automation isn’t a shortcut to compliance, but suddenly it seems as if it’s become a prerequisite for scale.

Many of the fintechs we work with now use automation to manage everything from license renewals to suspicious activity reports. It cuts human error, improves traceability, and gives teams breathing room to focus on exceptions rather than paperwork.

Yet, automation works only when someone is accountable for what it automates.

Regulators expect you to know exactly how their compliance tools make decisions, whether it’s a script that flags anomalies or a bot that fills forms.

If no one can explain the logic behind an alert, the automation becomes a liability, not an asset.

Machine Learning and AI for Fraud and Risk Detection

Models trained on millions of transactions can spot money laundering patterns long before humans would. They can predict credit risk, flag synthetic identities, and even detect account takeover attempts in real time.

But regulators want explainability.

If your AI blocks a transaction or denies a loan, you need to show the reasoning in plain language. That’s why some fintechs now maintain model cards, or concise summaries that document training data, key variables, and performance thresholds.

Cybersecurity and IT Governance Requirements

The lines between regulatory compliance and IT governance are fading, with many regulators requiring cybersecurity audits as part of their supervisory exams.

Standards like ISO 27001 and NIST CSF have become the default frameworks. They cover everything from access control and encryption to incident response and third-party testing.

A company that can demonstrate adherence to these frameworks often finds smoother relationships with both banks and investors.

You also need to think about operational resilience, how fast your systems recover from failure, and how transparent you are when they don’t.

Leveraging RegTech and Embedded Compliance Tools

Tools that automatically monitor regulatory updates, track risk indicators, or generate audit-ready reports are helping many manage complexity without expanding their headcount.

The most forward-thinking fintechs now integrate these systems directly into their engineering workflows.

Developers see compliance tickets alongside product bugs. Auditors pull reports from the same dashboard that tracks code deployments.

It’s changing the perception of compliance from red tape to shared accountability.

Anti-Money Laundering (AML) and Financial Crime Compliance

AML compliance is one of the few areas where fintechs and banks face nearly identical expectations. But fintechs often have less margin for error, given the expected speed and volume of their transactions and the cost of a mistake.

AML and KYC Policy Requirements

An AML program in 2025 needs to go beyond identity verification. Regulators expect dynamic risk scoring, ongoing due diligence, and policies that evolve as customer behavior changes.

Risk-based KYC is one approach, adjusting verification depth based on transaction history or geolocation.

This approach balances compliance with usability. A first-time remittance customer might face standard checks, while a high-frequency crypto trader triggers deeper scrutiny.

Record-Keeping and Reporting Obligations

As mentioned before, you must retain clear records of every AML decision, what was flagged, what was cleared, and why. Data retention timelines vary by jurisdiction, but five years remains the general rule.

The most efficient systems automate audit trails so every investigator can trace a decision back to its data source.

Screening for Sanctions and Politically Exposed Persons (PEPs)

Sanctions screening has grown more complex with geopolitical instability. Regulators expect real-time updates and global coverage.

That means screening not only customers but also vendors, partners, and even beneficial owners of corporate accounts.

AI-driven matching tools now reduce false positives by understanding context, differentiating between people with similar names, or detecting indirect relationships through corporate networks. It’s far from perfect, but far better than the static databases of the past.

Data Protection and Privacy Regulations

Few topics generate as much overlap between compliance, technology, and ethics as data privacy.

Customer Data Rights and Consent Management

Every fintech holds data that regulators classify as high-risk. That includes financial behavior, transaction histories, and biometric identifiers. Customers have the right to know how that data is collected and used.

Due to this, you should implement consent dashboards that let users view and change their permissions at any time.

Beyond meeting compliance requirements, this transparency builds loyalty. Customers are far less likely to abandon a service they trust to handle their data responsibly.

Cross-Border Data Transfers and Cloud Compliance

Cloud infrastructure simplifies encryption and access control, but complicates data residency. Someone who processes European data in U.S. servers may now face double scrutiny under GDPR and U.S. privacy laws.

The safest approach is regional segmentation: storing data where it originates and using federated models for analytics.

The problem most smaller companies face is the incredible expense associated with this, but it’s becoming standard practice for global fintechs.

The Impact of AI and Algorithmic Audits on Data Use

As AI systems become central to credit, fraud, and pricing decisions, regulators are focusing on algorithmic audits. These audits verify that models aren’t introducing bias or using sensitive data without consent.

Some fintechs have begun publishing summary audit reports to investors and customers as part of ESG disclosures. It’s a bold move that signals transparency and confidence in their technology.

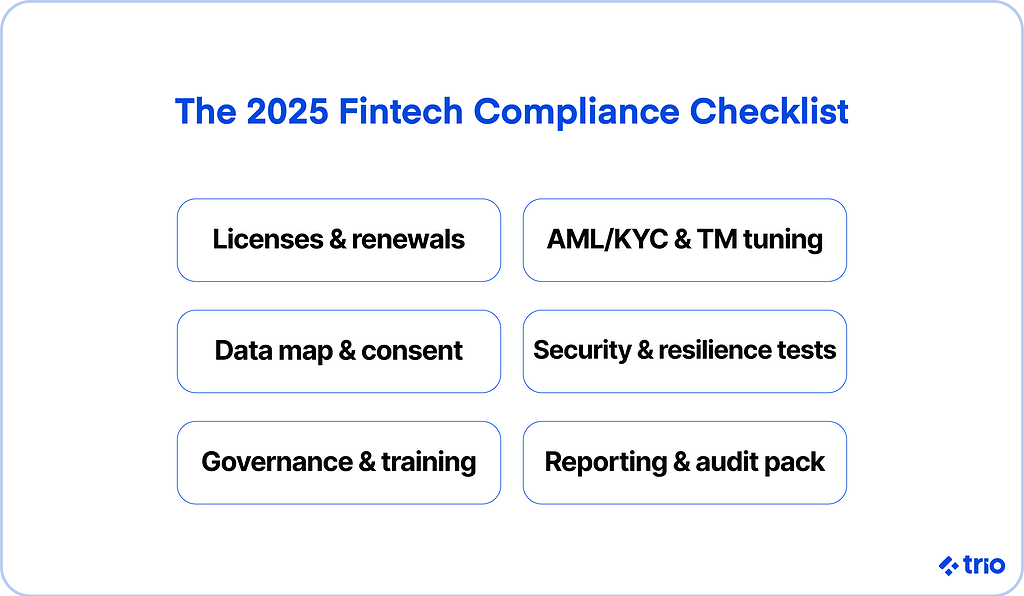

The 2025 Fintech Compliance Checklist

To make sure you have a practical understanding of what is needed for compliance, let’s review the recurring steps every fintech should review at least annually.

Essential Compliance Steps for Fintechs

Start by identifying which regulations apply to your business model and markets.

Assign ownership so that someone is responsible for keeping each area updated.

Document everything. Regulators reward transparency, even if you’re still improving processes.

Finally, train your teams regularly. Compliance is only as strong as the people following it.

Licensing, Registration, and Renewals

Keep a central license repository with renewal dates, jurisdiction details, and responsible officers.

Automate reminders where possible. Expired licenses don’t just risk fines; they can freeze entire business lines.

AML, KYC, and Transaction Monitoring

Review your KYC processes quarterly and update thresholds and watchlists.

Check that AML alerts are being investigated promptly and that reporting timelines match legal expectations.

Regulators often test this by asking for specific cases during reviews.

Data Privacy and Cybersecurity Controls

Run annual penetration tests and data protection impact assessments.

Ensure encryption standards meet current benchmarks and revisit vendor contracts to confirm that partners follow equivalent security practices.

Governance, Risk, and Operational Oversight

Hold quarterly compliance committee meetings with minutes and follow-ups.

Update your risk matrix when entering new markets or launching products, and treat compliance reports like financial statements, reviewed, signed, and archived.

Reporting, Documentation, and Audit Preparedness

Every fintech should maintain a single repository containing policies, audit results, and evidence logs.

It’s helpful to conduct mock audits yearly to uncover weak spots before regulators do.

Compliance as a Competitive Advantage

It’s tempting to think of compliance as a tax on innovation, but that view is increasingly outdated.

The fintech firms attracting the best partnerships and funding rounds are those that can demonstrate robust compliance without losing agility.

Building Trust with Regulators, Investors, and Customers

A proactive fintech that self-reports issues and shows improvement earns goodwill.

The same applies to investors, who now see compliance with regulatory frameworks as a proxy for operational resilience.

Even customers care. In our experience, users are more likely to stay with platforms that handle disputes fairly and communicate clearly about security incidents.

Accelerating Market Expansion Through Compliance Readiness

Market expansion goes smoothly when your compliance foundation is solid.

New jurisdictions require evidence of good standing in existing regulatory landscapes.

Companies that can produce clean audit histories and documented policies and procedures shorten approval times and gain first-mover advantages.

Using Compliance to Differentiate in Crowded Markets

In saturated sectors like lending and payments, compliance can become part of your brand.

Highlighting strong data protection or transparent lending criteria signals credibility.

It also builds partnerships faster, as financial institutions like banks and payment networks prefer reliable collaborators.

Future-Proofing Your Compliance Strategy

The fintech regulatory curve will keep bending. Companies must anticipate rather than react.

Preparing for ESG and Ethical Finance Regulations

Environmental and social governance (ESG) reporting is creeping into fintech.

Regulators are exploring frameworks to measure not just profit but impact, from sustainable lending to ethical investment screening.

Fintechs that prepare early, tracking metrics like energy use or diversity in lending alongside other financial data, will adapt faster when formal regulatory requirements land.

Cross-Border Digital Identity and Interoperability

The next frontier of compliance is digital identity.

Europe’s Digital Identity Wallet, India’s Aadhaar ecosystem, and similar programs elsewhere are reshaping verification.

Interoperability across these systems will matter for global firms, especially those in remittance or neobanking.

Investing in identity tech that supports multiple standards may save costly rework later.

The Convergence of Open Banking, Embedded Finance, and Compliance

As open banking merges with embedded finance, APIs have become compliance-critical.

Every endpoint is a potential exposure point for data misuse or security failure. Continuous monitoring and consent management are essential, not optional.

Building these controls directly into your engineering pipeline ensures compliance scales with your product.

Strategic Recommendations for Scaling Fintechs

- Embed compliance from your first sprint.

- Treat regulatory data as a product asset, structured, traceable, and reportable.

- Partner with experts who understand both code and compliance.

- Automate carefully, with oversight and documentation.

- Never view compliance as “done.” It evolves with your business.

Conclusion

The companies that will define this decade are the ones that can prove reliability under scrutiny.

At Trio, we’ve seen it firsthand.

Fintech teams that pair speed with compliance-aware engineering build products that last. Our developers understand the regulatory logic behind the code they write, from KYC flows to API logging. That’s what separates a working MVP from a product that earns regulatory trust.

The compliance landscape may look complex, but it’s navigable with the right mindset and partners. If you are interested in hiring senior fintech developers with the knowledge and skill to help you grow, get in touch!

FAQs

What is fintech compliance in 2025?

Fintech compliance in 2025 means following laws on licensing, AML, data privacy, and consumer protection while proving transparency and fairness in how products operate.

How do fintech compliance requirements differ from those of banks?

Fintech compliance requirements differ from banks because fintechs face similar oversight but must meet it with leaner teams, faster cycles, and less legacy infrastructure.

Why is AML compliance still such a big focus?

AML compliance is still a big focus because money laundering risks have evolved with digital payments and crypto, and regulators expect continuous monitoring, not static checks.

How does data privacy affect fintech growth?

Data privacy affects fintech growth because poor protection or cross-border data handling can block expansion and damage customer trust.