Payment gateway integration is critical to get your payment processor to work correctly with the rest of your web and mobile apps. It is an essential feature or even the most basic MVP, and allows companies to monetize their products securely, even in later stages of their development lifecycle.

According to Juniper Research, digital wallet transactions are expected to reach more than $12 trillion in 2026. Not utilizing different payment methods that allow users to make use of digital methods to complete a purchase is unrealistic in this day and age.

Waiting until your product is already quite established is leaving money on the table, but at the same time, rushing the integration process or going with the wrong payment gateway provider could be incredibly detrimental, especially to your compliance strategy.

Let’s take a look at everything you need to know about integrating payment solutions, from choosing the right online payment gateway for you to ensuring that it is set up correctly to enhance user experience and deal with security and compliance.

At Trio, we have developers who can assist with all of this. With our staff augmentation model, we can connect you with experienced fintech specialists who can help you not only choose the right payment systems but also ensure seamless integration and secure transactions.

What Is Payment Gateway Integration?

Payment gateway integration is the process of connecting payment gateway software, or a digital payment system, to your website or app. For e-commerce platforms and financial service providers, your customers can make secure online payments using their credit and debit cards.

In many cases, these platforms also integrate with other digital wallets like PayPal.

Although the basic versions of these integrated payment gateways have been around for quite some time, the more modern tools are built with a focus on speed, compliance, and user experience, rather than just getting the job done.

How Payment Gateways Enable Digital Transactions

Users will enter their payment information, usually the details of their credit card, mobile wallet, or bank transfer.

The payment gateway then encrypts and securely transmits the data to the acquiring bank and payment processor, which then communicates with the user’s bank or card network to confirm the transaction.

While this sounds like quite a long chain, the entire transaction process takes place in as little as a few seconds.

It is the job of the payment gateway to ensure this process is seamless, secure, and practically invisible to the user, which means it needs to make use of SSL/TLS encryption, tokenization, fraud detection, and a variety of other security and fraud detection tools.

Payment Gateway vs Processor vs Merchant Account

It’s important to understand the different terminology used to refer to all of the different parts of the payment process.

The payment gateway is like the digital point-of-sale terminal. It is what captures and encrypts payment data.

The payment processor, on the other hand, actually handles the transfer of funds.

Finally, the merchant account is your account, where the money ends up.

When choosing a payment gateway provider, you need to think about what exactly they offer. Some may be exclusively the gateway, while others may bundle all three and more.

How Payment Gateways Work

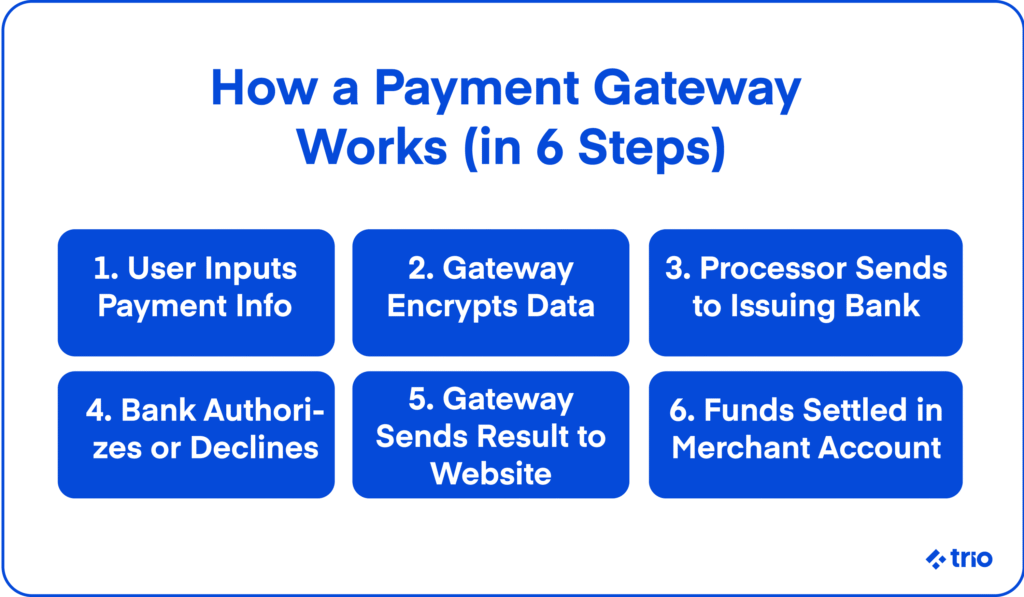

We’ve already gone through the basics of how payment gateways enable digital transactions. The detailed steps include:

- The customer initiates a purchase and inputs payment details on your platform during the checkout process.

- The website sends the encrypted data to the payment gateway, provided that you have integrated it correctly.

- The gateway routes the request to a payment processor, which has either been bundled in with the gateway service or which you will need to choose separately.

- The processor seeks authorization from the customer’s issuing bank. They will usually have their own fraud detection methods and will ensure the user has enough funds available.

- Once approved or declined, the gateway communicates the result to the website.

- Funds are settled into the merchant account, or your account, often in batches later.

As you can tell, it’s incredibly important that you have real-time processing abilities; otherwise, your customers will experience delays in their checkout experience and maybe even abandon the transaction. Similarly, downtime or a lack of error handling is the last thing your business needs.

Types of Payment Gateway Integration

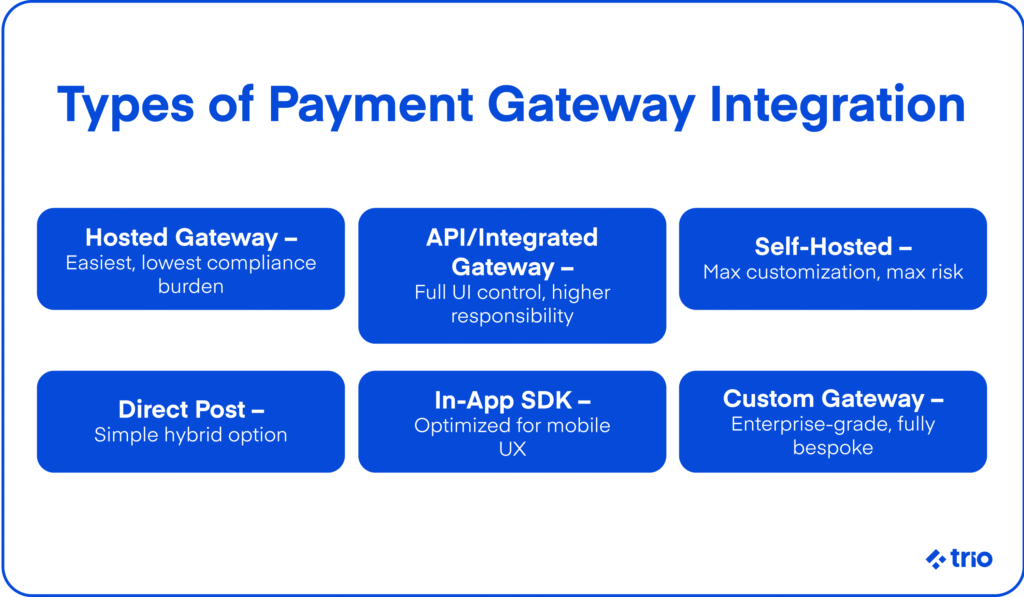

Now that you fully understand the role that a payment gateway has in your ability to accept payments, let’s take a look at some of the best payment gateway integration options. These include hosted gateways, integrated/API-based gateways, self-hosted gateways, direct post method, in-app gateway solutions, and custom-built solutions.

Hosted Payment Gateways

Hosted gateways redirect the user to a secure, third-party page that takes care of seamless payments and data security on its own.

Hosted gateways are probably one of the easiest to set up and completely remove any compliance burden, like PCI DSS, from your responsibility.

However, you don’t have any control over the checkout experience, making your choice of hosted payment gateways incredibly important.

Integrated Payment Gateways and API-Based Gateways

In these cases, your frontend and backend of your website or application are connected directly to the gateway. This is usually done using API or SDKs.

With integrated or API gateways, you have a lot more control over the UI, but it does mean that you need to deal with everything regarding security and compliance on your own.

Self-Hosted Gateways

Probably the most complicated web and mobile payment gateway integration method, but also the most flexible and customizable; all transaction logic and customer data are hosted on your own infrastructure.

Self-hosting is usually a suitable payment gateway option if you are a larger enterprise that needs custom workflows and data control, but also has the resources required to pull this gateway type off.

Direct Post Method

Direct post usually refers to when customer data is ‘posted’ to the gateway from the client’s browser.

While there is some decrease in the required security measures you need to implement in order to be compliant, you still need some careful security implementation.

Mobile and In-App Gateway Solutions

SDKs let you integrate all of your payment processing needs into your app directly.

Usually, this is the best option if you are offering some fintech service, like a digital wallet, peer-to-peer payments, or mobile banking.

Specialist developers have extensive experience in in-app gateway integration and many other ways to facilitate payments from customers in the fintech industry.

Local Bank Payment Integration

Local bank payment integration options are generally more regional, and providers offer integration for banks and mobile money platforms from a specific location.

If you are trying to target a specific country or region, this is a good option to avoid relying too much on international processors.

Custom-Built Payment Gateway Solutions

Building a custom gateway for your payment options is definitely the most labour-intensive and expensive of all of the options that we have covered, but if you have a unique business model or you work with very high transaction volumes, then it may be worth your trouble.

Just know that you are going to need to put a lot of time and money into security, compliance, and even network connectivity.

Essential Features for Modern Payment Gateway Integration

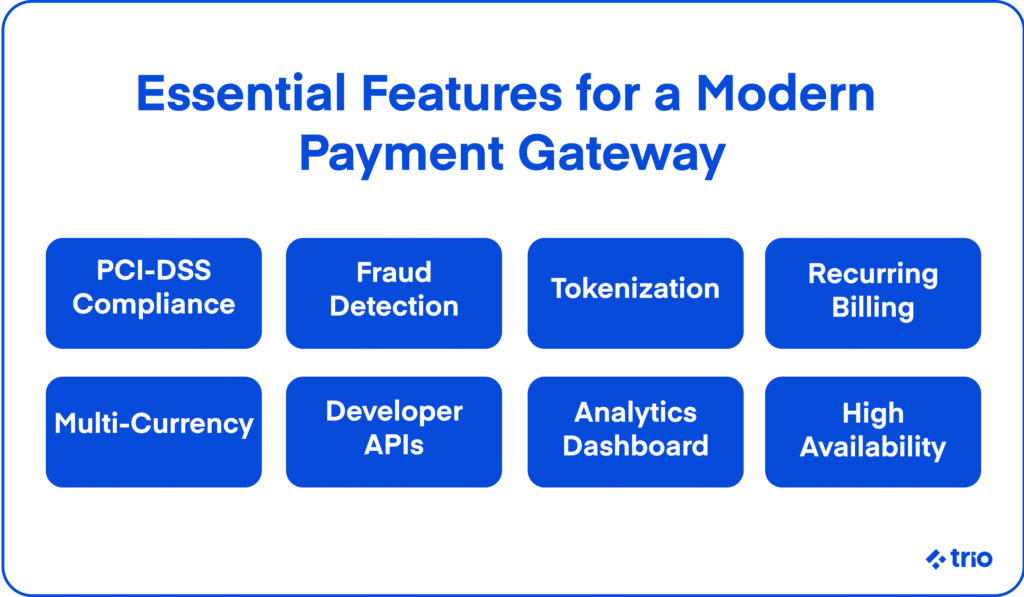

A lot of modern payment gateways offer features beyond just basic payment capabilities. These features have become industry standards to a degree. Consider carefully when your chosen payment gateway has these features, and make sure to test that they have been integrated correctly.

- PCI-DSS Compliance and Secure Protocols

- Fraud Detection and Prevention

- Tokenization and Data Encryption

- Subscription and Recurring Billing

- Multi-Currency and International Support

- High Availability and Scalability

- Developer-Friendly APIs

- Robust Reporting and Analytics

- Optimized Checkout UX

How to Choose the Right Payment Gateway for Your Business

When considering which payment gateway is right for your business, whether you are just thinking about the type of gateway or you are considering a specific option, like Stripe, you need to consider your business model, audience, and growth strategy.

For example, if you are trying to run a SaaS business, you’ll encounter subscriptions or recurring billing.

Also consider where your users are located, and how they prefer to make their payments. If you are a global business, you will need to support a bunch of different payment types and may have to make use of regional vendors.

Don’t forget about documentation and customer support. This helps you not only enhance the customer experience but also address any regulatory concerns or audits down the line.

Similarly, going with a reputable vendor whom you know is compliant will ensure the use of their product is smooth and secure.

Step-by-Step Guide to Payment Gateway Integration Implementation

There are several steps you can follow to increase the chances of your online payment gateway integration being successful.

1. Technical Discovery and Scoping

First, you need to figure out what your requirements are. This can include the payment methods you need to support, expected transaction volumes, and even compliance.

You should take your tax obligations into account here to avoid costly mistakes going forward.

The more information you have before you start, the more accurate and efficient your technical decisions will be going forward.

2. API Setup and Authentication

Set up a merchant account with the payment gateway provider that you have decided to go with.

Your account will allow you to receive funds and will give you access to sandbox credentials and API keys, which will allow you to do things like test your integration without actually having to make a payment.

If you are creating a custom solution, you will need to create your own APIs here.

3. Backend and Frontend Integration

Once you have signed up successfully, you should be able to easily integrate your frontend and backend systems using SDKs or RESTful APIS.

If you are struggling, it is best to get an expert on your team. Luckily, at Trio, you can find someone with not only the necessary technical skills but also the soft skills required to slip seamlessly into your existing group of developers.

Once these developers have finished their work, you do not have to continue employing them.

It is best to get your initial integration right, as it will determine the quality of your checkout flow, payment routing, and transactional data handling.

4. ERP, CRM, and Checkout Synchronization

Once you’ve ensured that your gateway is connected to your payment screens, check your broader infrastructure.

Your ERP and CRM should be able to connect to your payment gateway for automated reconciliation, customer data updates, and even inventory tracking.

The latter is exceptionally relevant if you have a web or mobile commerce solution like an online store.

5. Sandbox and Live Testing

Most of the payment gateways out there offer some sort of sandbox mode for your various integration needs.

These sandbox tools are great for simulating things like successful transactions, failed transactions, refunds, errors, fraud detection, and anything else you can think of.

You can do thorough tests without needing to launch the payment gateway on your live app, ensuring that you aren’t caught by surprise when you move on to live testing.

6. Deployment and Go-Live Checklist

Quality assurance is critical, so much so that there are developers who specialize in it.

Once you are finished, you can move towards deployment.

Remember that your job isn’t, but instead you should be carefully observing your transition to ensure you create a smooth changeover for your customers.

Double-check anything related to security and data handling, like your TLS certificates, before you switch to live APIs, and make sure that everything still functions under real traffic.

Cost Considerations for Payment Gateway Integration

There are various ways that your payment gateway might incur some costs.

Setup and monthly fees are the most common costs that we see. In some instances, startups and scaleups of a certain size might be able to take advantage of reduced setup fees or waive the fees entirely. If you are on a limited budget, you should consider where these fees may be waived when making your initial choice.

Per-transaction charges are also relatively common. These fees are often the most realistic if you don’t have a bunch of capital, but they may add up long-term, especially if you are dealing with large transaction volumes.

You also need to consider how your users will primarily be paying, as transaction charges may vary.

Cross-border fees and currency conversion can be incredibly costly if you are consistently dealing with international transactions. This is often a result of the different fees and processes required on the side of the gateway. If you are working within a region, you may be able to limit these fees.

However, it is almost impossible to avoid costs related to chargebacks and fraud handling. It is going to happen on occasion, even if you have the best security measures in place and the most comprehensive product in the world.

And then, of course, there are costs related to development, maintenance, security, and compliance. If you want to add more features later, which you may decide to do based on user demands or shifting markets, you will need to pay for all the additional development, integration, and testing as well.

This is all pretty standard, though.

One cost that we have noticed even large companies forget to factor into their decision-making process is opportunity cost. While you may be able to save money using a cheaper plugin or fewer features, this can cause users to abandon their transactions, or even negatively affect their perception of your company and brand long-term.

Should You Build or Integrate a Payment Gateway?

Custom solutions make sense if you have the time and money to devote to them, and need the added control that they provide, or you are struggling to deal with high transaction volumes. It is also worthwhile if you have very niche requirements that no one else can provide.

In almost every other instance, it just isn’t worth it. The added internal expertise is often too costly to justify, even if you make use of nearshore or offshore development.

However, what many people may benefit from, and which our experienced developers can help you with, is a hybrid model. In these cases, you would integrate multiple gateways for redundancy and risk management, or you could combine an existing gateway with custom development to get exactly what you need.

Compliance and Legal Requirements

PCI DSS (Payment Card Industry Data Security Standard) has been mentioned already. It is a framework that specifies how you should handle sensitive credit card data. It is often complemented by the likes of EMV and 3-D Secure in an effort to reduce fraud.

You will have to deal with these regardless of where you operate, but there are also regional laws that you need to consider, like Europe’s GDPR and California’s CCPA. Both of these examples are related to data handling.

Consumer protection laws generally target data storage, consent, and reporting. It is best to prepare as much as you can in advance, even if you are unsure of how you will scale regionally in the future.

Real-World Payment Gateway Integration Examples

There are many real-world payment gateway integration examples, including a few from some very notable names like Walmart, Lyft, and Due South.

Walmart + PayPal

Walmart partnered with PayPal on an enterprise level to allow its customers to check out on their online platform. Thanks to PayPal’s digital wallet, users don’t even need to enter their card details on Walmart’s platform.

The result is both an increase in conversion and overall user trust thanks to PayPal’s established fraud prevention systems.

Lyft + Stripe

Lyft partnered with Stripe in one of the biggest examples of gateway APIs. Stripe handles everything from user payments to driver payouts, while ensuring tax and banking compliance.

Stripe allows Lyft to manage everything related to these services in real-time, too!

Due South + Square

Due South benefited from Square’s all-in-one platform, allowing it to combine the tools that it was using in-store and online to unify the overall payment experience.

This also made it a lot easier for the company to manage its stock and finances as it could refer to a single dashboard.

All of this was made possible with relative ease, as Square is known for its quick setup.

Mistakes to Avoid in Payment Gateway Integration

People make many different mistakes when attempting payment gateway integration for the first time. As you will notice, most of these mistakes are entirely avoidable if you get someone with extensive experience on your team.

Choosing the wrong provider, for example, may lead to a generally poor experience for your users and make it difficult to scale later. Ignoring compliance from an early stage makes it expensive to integrate later on.

Failing to test everything that you should, even if it seems incredibly unlikely that things will go wrong, and not putting a system in place for documentation, can also make the overall user experience terrible and may massively impact your brand.

Trio’s developers are not only skilled in payment gateway integration but also in the fintech industry as a whole. They are able to consider factors that you may not even have thought of, and provide advice based on market trends and their personal experience working on similar projects.

We do not provide one-size-fits-all solutions. Instead, we pair you with the right people in a custom model that has been designed to benefit you as much as possible. And, if you grow in the future, we can make the same developers available to you, letting you move quickly and efficiently.

For more information or to get started with finding the perfect developers for you, reach out to schedule a free consultation.