Embedded finance solutions are making it easier than ever for fintech companies to provide high-quality products and services to their customers, without needing to commit time and money that they might not have available to create the components themselves.

If you are the CTO of a startup or a technical leader in an established company, looking at how you can embed financial services directly into your apps is a great way to start exploring further offerings without needing to devote extensive time and resources, as you would have had to otherwise.

In this article, we’ll examine everything you need to know about the embedded finance ecosystem, including the technical requirements for seamless integration, data sharing implications, and potential new revenue streams.

Even though it requires less development power to integrate existing financial services within your offerings, you still need the right people to integrate the tools properly. At Trio, we offer a variety of developers with the right skills and extensive experience in similar projects.

Our staff augmentation and outsourcing hiring models mean that you can keep the right people around for as long as you need them, but do not need to worry about long-term hires and the associated costs.

But before you decide to hire someone new to help you integrate financial services, let’s make sure you understand everything you need to know about embedded finance products and their uses in both fintech and non-financial companies.

Understanding Embedded Finance

As we have already discussed, embedded finance enables companies to integrate financial solutions that have already been created directly into their platforms.

Examples of Embedded Finance

Embedded payment service providers are probably the most common type of embedded finance the average user encounters. Stripe, PayPal, and Plaid are all common solutions available at checkout, but not every company has coded these services individually. Instead, they are all using the PayTech products offered by these companies.

Other than payments, some common examples of embedded finance include banking, insurance, lending, and even investing.

All of this is usually powered by APIs, Banking-as-a-Service platforms, and the ever-changing regulatory landscape, which is now allowing more companies to move away from traditional banking services with large financial institutions.

But, even though it is legally fine to go with a lot of these smaller companies that offer embedded finance services, it might not always be the right move. There are certain risks related to security and vendor dependence that you need to weigh up before making your final decision.

Why Embedded Finance Matters Now

Embedded finance is opening up a variety of ways to monetize your financial products and services. As already discussed, traditional financial institutions are no longer the only option, and software companies can now offer more and more financial services like credit, payments, and insurance.

The problem is that users are starting to expect these services as the baseline, rather than the additions that they originally were.

If you are a smaller company, trying to code all of these services and get the relevant licences is not only difficult, it’s pricey and time-consuming, increasing the barrier to entry in the industry.

If you consider the integration of financial services that you know are compliant, secure, and function well, you can focus your resources elsewhere to get your product to the market sooner and start making some money.

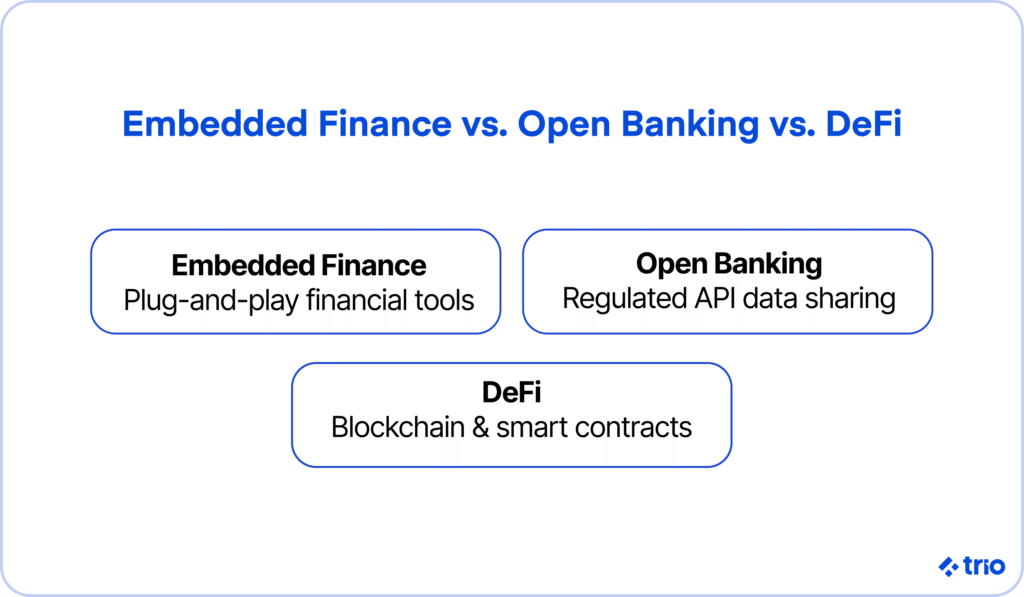

Embedded Finance vs. Open Banking vs. DeFi

Embedded finance, open banking, and decentralized finance (DeFi) are all very closely related, but each plays a distinct role in modern fintech applications.

Embedded finance is the ‘plug-and-play’ of financial components. Usually, this is done by partnering with licensed providers. Open banking is a model where information is shared between banks or between you and your third-party provider through a regulated API.

Decentralized finance is an approach where any services are offered through smart contracts and blockchain, which means you don’t have to use middlemen like banks or brokerages to complete transactions.

Open banking and embedded finance are generally used together, while DeFi is quickly becoming a standard for cross-border transactions since it doesn’t fall under the same regulations that a lot of traditional systems do.

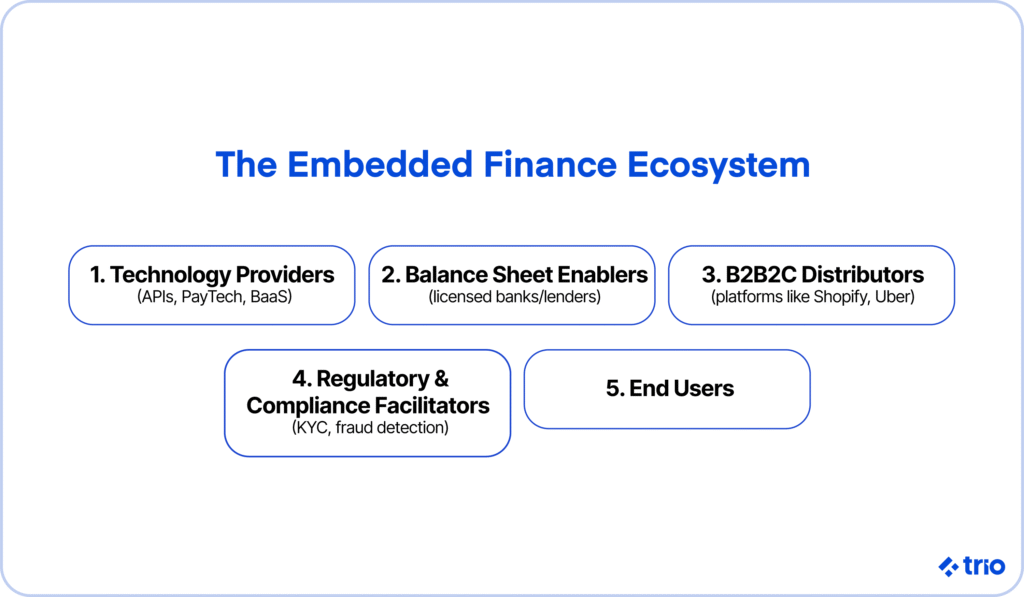

The Embedded Finance Ecosystem

When dipping your toes into the embedded finance ecosystem, you need to consider a variety of components, including the actual provider, balance sheet enablers, B2B or B2B2C distributors, and other regulatory and compliance facilitators.

Technology Providers

When it comes to the provider, there are a variety of options out there. You need to consider what you need the service to do. Common examples include payments, lending, and account issuance. There are also some full-stack solutions out there.

Some platforms might focus on very niche verticals, and others will provide very broad APIs that will allow you to ensure multiple financial services are delivered.

The right choice will depend on your business, the reason why you are trying to offer financial services to customers, and the direction you expect your company to go in the future. Regardless of your needs, you must ensure that compliance and security are covered from the start.

Balance Sheet Enablers

Balance sheet enables are the licensed banks and lenders that provide the money for loans, hold deposits, and issue cards to your users.

If you want to offer banking and payment services, you are probably going to need one, or you may need to investigate which balance sheet enabler your banking and payment technology provider works with.

These companies usually provide all of the regulatory compliance and also take on a lot of the financial risk.

B2B2C Distributors

Embedded finance involves integrating financial services that both your business (B2B embedded finance) and your customers deal with (B2C embedded finance). This means that a lot of providers can be considered B2B2C distributors.

Think of Shopify, Uber, and Toast, which have all pioneered this kind of model by integrating banking and credit services into their ecosystems that create end-to-end value.

If you will need this kind of solution, you are not only going to want someone who can help you control the interface, but also the rest of the financial experience. Fintech specialists who are immersed in the industry and who understand user demands and market expectations are the best. Trio offers exactly those kinds of software developers.

Regulatory and Compliance Facilitators

If nothing else in your embedded finance ecosystem is taking regulatory compliance, and you are unsure of taking care of it yourself, or perhaps don’t have access to someone with regulatory awareness in a specific region, then embedded RegTech might be the way to go.

Alloy is a good option for KYC, while something like Unit21 is a great choice for fraud detection.

Ensuring that your product is safe, reliable, and audit-ready is one of the most beneficial uses embedded finance provides. That’s why these tools should form core components of your system, with you getting them integrated as soon as possible.

Use Cases Driving the Embedded Finance Market

Embedded finance could transform how you provide value. Let’s take a look at what some other companies have done so you can decide if you could benefit from embedded finance.

Embedded Banking and Cards

Embedded banking is designed to let you offer your users all of the core banking features you might expect from an established institution, like cards, credit, and even debit cards.

What does this look like practically, especially if you are trying to embed these kinds of financial services into non-financial companies?

If you have a ride-sharing platform, for example, you might be able to give your drivers a branded debit card where you deposit their pay. Potentially, this will result in lower costs on both sides and faster transfers.

In-App Payments and Branded Wallets

Everything from tipping features to mobile checkout is powered by in-app payments. They are designed to be as frictionless as possible so you can retain users and potentially even boost conversions.

In some cases, platforms might even decide to integrate some sort of digital wallet. Think of platforms that let you access a store fund of some sort, manage your earnings, or even make purchases within an app.

Embedded Lending and BNPL

Buy Now Pay Later (BNPL) is very popular at the moment. Along with forms of embedded credit, your users can access financing at the point when they are most likely to realize that they need it.

This is a great way to retain users. However, lending carries a risk of its own and is very heavily regulated. You need to consider integration very carefully, and be sure to clarify who will be responsible for the fund if users do not pay.

Embedded Insurance and Wealth Management

Offering added instances and investment products can deepen trust. For this reason alone, these tools are worth looking into, even if you think there is a very slim possibility that your users might use the provided services.

For example, if you have an e-commerce company, not all of your users might want to access shipping insurance. However, every user will see that you offer it.

The same can be said for trobo-advisory tools inside banking apps. If you are in the finance sector, you might not want to use these advisors thanks to your existing education on the matter. But if you are new to investing, the service might increase brand loyalty.

Vertical SaaS and Financial Products

Some industry-specific platforms are starting to adopt embedded finance tools. The result is that people who already use their app don’t need to go somewhere else for these additional tasks. You essentially create a niche-specific super app.

Depending on the industry that you are in, providing these additional features might be critical to helping you stay competitive.

Building an Embedded Finance Strategy

Now that you have a good idea of the kinds of problems embedded finance can address for users, you should be able to determine if it is the right fit for you and start building a strategy to guarantee that you are going to profit from your efforts.

Start with the Business Model: Monetization and Market Fit

Before you do anything else, make sure that you understand how the adoption of embedded finance is going to enhance your product. Are you trying to generate revenue through the exchange of money, or are you trying to offer additional services to increase client retention?

Once you figure out what your users need and what your business objectives are, you can then consider the sustainability of some potential products.

Align with Compliance from Day 0

Before you start integrating your new tool, you need to make sure that you are considering compliance. Making sure that you take care of it from the start is the easiest in terms of software development, and it also helps ensure that you do not miss anything that could prove to be a potential issue later.

Getting a compliance expert on your team is the best thing to do, even if you only connect with someone on a temporary basis. Our experts at Trio often assist our fintech clients in ensuring compliance through custom solutions or even additional integrations, and are then available to them again later if they decide they need to make changes.

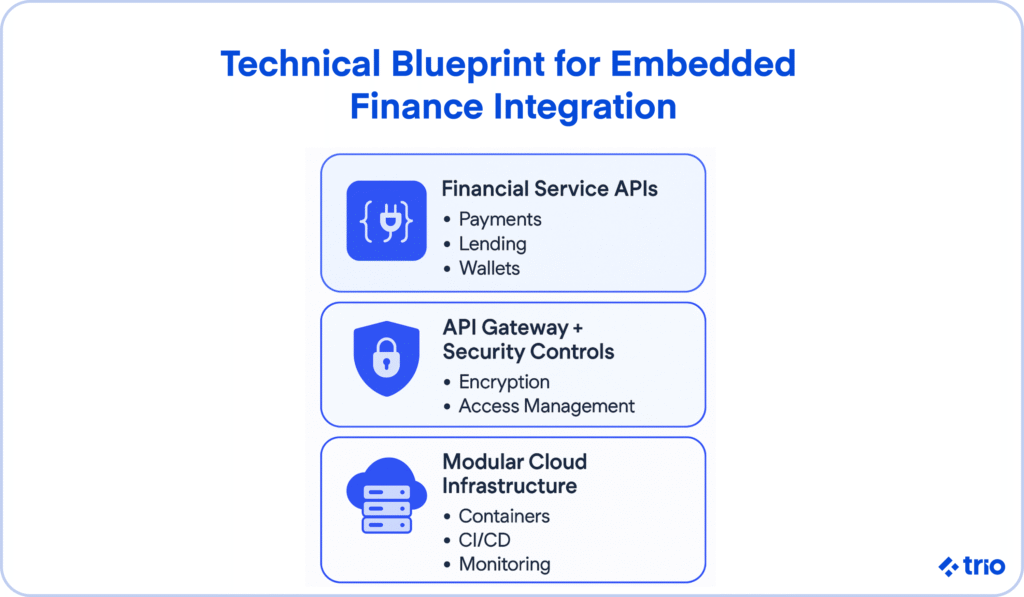

Technical Blueprint for Integration in Finance Companies

When moving on to the execution, a well-planned tech stack can make sure that you stay flexible and ready to scale. Both of these are critical in the fintech sector, where you will need to deal with massive fluctuations in traffic and changing industry standards.

An API layer like REST, GraphQL, or even event-driven web hooks is essential. These layers of your architecture in an API-first approach will enable secure, decoupled communication across your different services. They are also essential for any third-party integrations.

You’ll also need to make sure that all your partners and vendors deal with encrypted data. This encryption, in both transit and at rest, with clearly scoped access controls, is often a regulatory requirement to ensure that users’ data is secure.

If you focus on a modular architecture, with cloud-native components, containerization, and observability tools, you can easily pick up on any issues and fix them with relative ease. We have also found this to be helpful in rolling out updates, as it’s easy to update one component and revert changes quickly if you realize the changes create a vulnerability.

All of these techniques are part of what is called DevSecOps, which aims to make security considerations part of your development lifecycle. A good CI/CD policy, constant scanning, testing, and auditing are all critical, not only so that users can rest assured their information and money are safe with you, but also to avoid fines.

Key Challenges and How to Overcome Them

While embedded finance takes away a lot of the challenges of conventional software development, it comes with some challenges of its own, including:

- Managing Regulatory Complexity Across Jurisdictions: Different regions have their own laws and requirements, which require some planning if you want to expand.

- Balancing Speed with Security: Data security, authentication, and fraud prevention take a while to perfect, but it’s critical when dealing with people’s money.

- Third-Party Risk Management and SLA Structuring: Relying on someone else means you are susceptible to their outages and security gaps.

- Legacy Systems and Fintech Interoperability: Integrating modern tools with outdated systems may require abstraction layers, middleware, and even recoding.

Metrics That Matter: How to Measure Success

To make sure that the benefits of embedded finance outweigh the challenges, you can look at some specific metrics.

Integration time and costs should be considered, especially in relation to the revenue per embedded user. We also find it helpful to consider developer productivity in whatever form you may measure that in your company, and API adoption rates, to get a good idea of the state of your company internally.

A compliance and audit readiness score is also critical, especially if you are trying to plan for long-term operational resilience.

Future Trends: What’s Next for Embedded Finance?

The future of embedded finance is far from certain, but we are confident that the technology is going to stay around. Regarding the specifics, we can make some assumptions based on what we are currently seeing in the markets.

AI-powered personalization is being used by everyone on every user-facing interface, and we doubt embedded finance is going to be any different. These features have already become a part of normalized expectations, and in the fintech sector have spread to adaptive credit scoring and even context-aware insurance offers.

AI can take into account a variety of different information that traditional finance platforms have not been able to.

Cross-border fintech integration is also becoming more popular thanks to the globalization of services, so we’re probably going to be seeing a rise in embedded tools that help companies support multiple currencies in financial services, such as payments, or that assist with compliance.

Similarly, thanks to the rise in blockchain-powered real-time payments and open banking, we think we’re going to see a bigger emergence of companies that embed financial tools that assist with instant, frictionless transfers.

Choosing the Right Tech and Talent Partner

Choosing the right person to help you integrate your embedded finance tools, or even to choose potential options that will suit your situation the best, is critical.

You need someone who has worked on similar projects before. But, in a fairly niche market, finding those people can be costly and time-intensive.

Traditionally, you would need to have a fairly good understanding of your technical needs to put together a job listing, look at the portfolios of applicants, conduct a variety of interviews, and finally onboard the person. You also run the risk of choosing incorrectly, which can end up costing a lot of money.

A far better option is to go through a firm with extensive experience in the fintech industry, like Trio.

We meet with you to come up with a strategy unique to your situation and your requirements. If you do not have a good technical understanding, we help you with that too. Finally, we provide you with a handful of carefully selected portfolios to choose from, all guaranteed to have the right skills to get the job done.

Our commitment to long-term tech partnership has resulted in a placement success rate of 97%, and the host of experienced developers we have on hand allows us to place people in as little as 24 hours at times.

If you are interested in our services or want to know more about our process, reach out to schedule a free consultation.