When it comes to fintech, legacy modernization presents a significant challenge. The industry is constantly evolving, and working with outdated systems can significantly hinder your progress, causing you to fall behind your competitors and accumulate even more technical debt.

Additionally, outdated systems are often vulnerable to security breaches. Since you’re likely dealing with sensitive financial data, a breach could be enough to ruin your clients’ perception of your trustworthiness, and even sink your company.

Understanding the challenges of legacy systems that are often present and which modernization approach might be best for you is essential to the continued success of your fintech company.

In this article, we’ll examine everything you need to know to transition your old systems into more modern counterparts, including common strategies such as rehosting and replatforming, refactoring legacy code, adopting a microservices architecture (e.g., the strangler pattern), API-led modernization, and best practices for cloud migration.

At Trio, we’ve helped countless businesses migrate to new systems and assisted in the modernization of legacy software. Our developers have industry experience and understand the unique business needs that may arise in the financial technology sector, ensuring that you do not encounter any issues.

Through agile development, they collaborate with your existing team to create solutions that you can adapt over the long term.

However, before you consider hiring, let’s take a closer look at the potential benefits of modernization and the risks of allowing existing systems to fall behind.

What Is Legacy System Modernization in Fintech?

A legacy system refers to outdated technology systems that ultimately limit the performance of user-facing features. In fintech, these legacy systems usually play a role in some part of a financial system.

Think of the basic architecture of banks that have been around for hundreds of years, or the platform on which the stock exchange has been built.

Common Examples of Legacy Systems

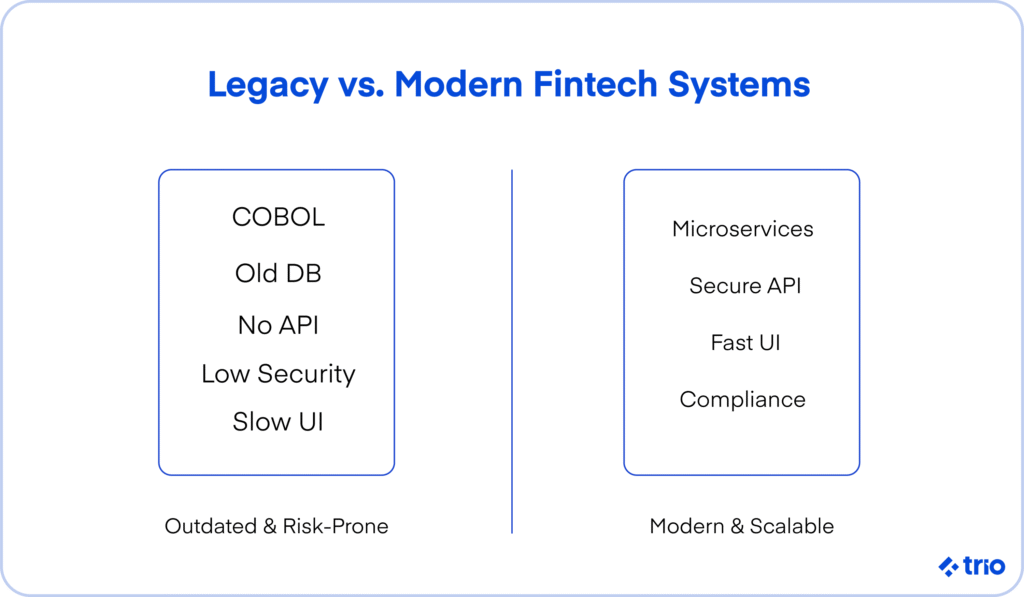

Most legacy systems are built on monolithic architecture.

Many applications also struggle with legacy systems built on outdated frameworks, those that no longer receive support and updates, COBOL-based infrastructure, or even siloed, on-premises databases.

The types of technology are problematic in the fintech landscape because they cannot integrate with today’s cloud-native tools, and their real-time capabilities may be severely limited.

Why Modernization Is Unique in Fintech

The fintech industry is highly regulated.

To receive the necessary certifications and approvals to work in certain regions, systems must be secure, audit-ready, and flexible. The latter is important due to the ever-changing regulatory landscape, which requires continuous adjustment.

All of this makes sense, considering the sensitive information and financial data you will be dealing with.

Legacy systems often struggle with performance and data-handling issues, which can also lead to downtime or other problems that damage your company’s reputation and user perception of your trustworthiness.

For companies aiming to stay competitive, converting old systems to modern alternatives is critical.

Why Fintech Companies Must Modernize Legacy Systems

There are several reasons, some of which we have already mentioned, that make it essential to transition to modern systems.

- UX demands are changing.

- Operational and integration bottlenecks and downtime.

- Regulatory pressures and security gaps.

- Skyrocketing maintenance costs and talent shortages.

- Stifled innovation and lost market share.

What Are the Risks of Avoiding Fintech Legacy System Modernization

There are various risks associated with maintaining your legacy systems.

User expectations are changing, of course, and legacy systems often struggle to support these changes. Consider old banking systems that are slow and frustrating to use. On the backend, modern systems require much more to work efficiently, and older systems often fail to provide what is needed, resulting in downtime, as we mentioned above.

Backend bottlenecks can also make it challenging to integrate with modern services and APIs, which means you need to design everything from scratch.

Outside of making it impossible to use RegTech or similar solutions, outdated legacy systems are typically prone to security issues. This makes regulatory compliance almost impossible.

And, since you are so far behind, using software no one learns or specializes in anymore, basic maintenance grows increasingly costly, while you continue to lose revenue due to a lack of innovation.

Even if you can keep your users, none of this is great for investor confidence.

How to Identify and Prioritize Technical Debt

Before your team of developers can start the modernization process, it’s important to identify which portions of your legacy systems may be holding you back the most, so that you understand where to focus your efforts.

Types of Technical Debt

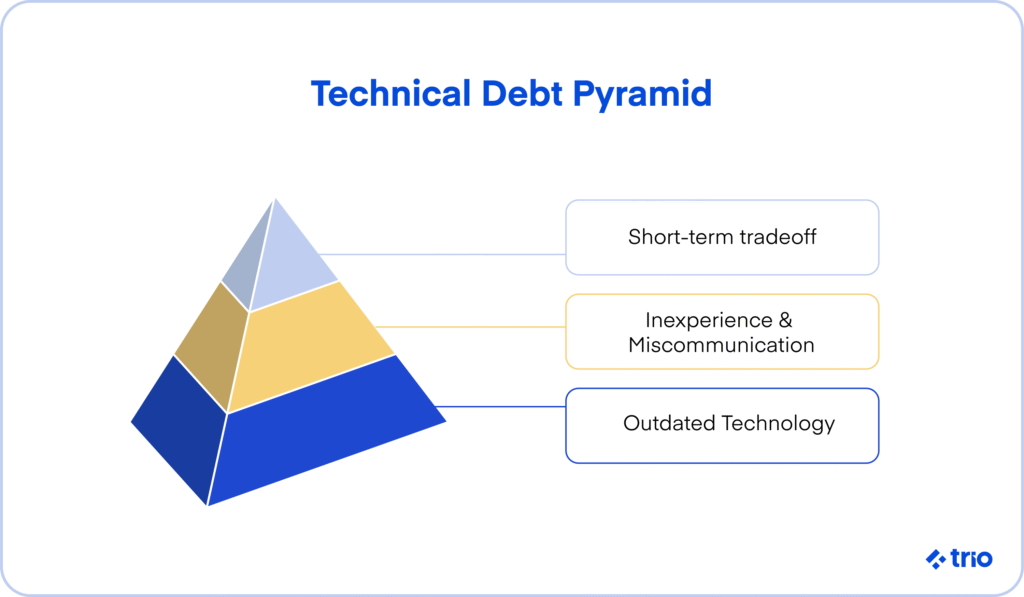

There are three main types of tech debt. Intentional, accidental, and legacy. Not all of these are equal.

When it comes to intentional tech debt, we’re talking about shortcuts you took on purpose to save money, or maybe to avoid unnecessary costs at the time. You’ve likely already weighed the risks of these gaps and are prepared for the types of issues these systems can lead to.

Accidental debt is usually a result of inexperienced developers or miscommunications within your team. They are unintentional, and the consequences may appear unexpectedly.

Finally, there is legacy tech debt, which results from not keeping up with continuous application modernization efforts. The code may have been suitable when it was created, but it no longer functions as intended.

You need to assess your code for all of these types of debt, so you can start assessing the most impactful gaps in your systems and achieve the best possible results in relation to your efforts.

Prioritization Frameworks

Now that you are aware of all the different places your systems hinder your app, you need to consider in which order you will be dealing with them.

You could prioritize based on risk, frequency, or a value matrix.

Ask yourself questions like ‘How much does this impact my app?’ or ‘How much will fixing this cost?’

By doing a thorough analysis before starting, you can form a structured plan that is guaranteed to provide results.

Since modernizing your legacy systems is crucial for your success, we highly recommend getting experts on your team.

Our developers have worked on many similar projects before, and have extensive experience in legacy software modernization in the fintech sector specifically.

This means they can update your legacy application in such a way that it is not only compliant in terms of data handling and security, but also future-proof.

By providing developers from countries like Brazil and South Africa, you also receive incredibly cost-effective development, without sacrificing the quality of your work, and without all the hassle associated with long-term hires.

Modernization Strategies for Fintech Teams

Since modernizing legacy systems is crucial for everyone, and there is really no way to avoid the process, some tried-and-true strategies have emerged.

Rehosting and re-platforming, refactoring legacy code, adopting microservices architecture, API-led modernization, and cloud migration are all some of the most popular options. Perhaps one may work for you.

Rehosting and Replatforming

Rehosting is where you move your app over to a new infrastructure environment without changing your existing code.

Replatforming systems typically involves only a couple of changes to make sure that your product is optimized for the new environment.

When our developers have assisted in replatforming, some of the changes they have made include moving to containerized deployments or a cloud-based system.

While these strategies are quick and efficient, they don’t work with systems that are too outdated.

Refactoring Legacy Code

Refactoring is often done with legacy systems built on a monolithic architecture.

It usually involves modularizing code, replacing weak logic, and dealing with any imminent tech debt that shifts outdated systems to more modern expectations in preparation for something like service extraction or cloud migration.

This shift can assist greatly with efficient data handling, automation, and traffic peaks.

Adopting Microservices Architecture

Microservices architecture enables fintech companies to break their apps into modular, independently deployable services.

It’s the next step after something like refactoring.

With everything in individual pieces, you can iterate on individual components rapidly, scale faster, and your app is generally more resilient since only one component fails at a time.

The Strangler pattern is one example of how you can transition to a microservices architecture. This is where you build a new service that mimics the function of the legacy system and slowly takes over for it.

This means your team can rewrite smaller sections at a time and make sure they are perfect before moving on.

API-Led Modernization

APIs let you integrate third-party services by allowing you to expose your core business logic without opening yourself up to potential security risks.

This means getting outdated systems ready for API integration means you can isolate functionality and make use of those third-party integrations to support faster innovation going forward.

Cloud Migration Best Practices

Migrating data from legacy systems to cloud platforms is necessary if you want to make use of any real-time features. But the data needs to be prepared in order to make the migration possible.

You need classification, audit readiness, and some sort of reliable testing.

It is usually best to start with non-critical services and use simulations to make sure that the migration has occurred successfully.

You should also carefully consider which platforms are fintech-compliant. GCP (Google Cloud Platform) is a generally popular option, but AWS (Amazon Web Services) might be suitable too.

A successful cloud migration will assist you in everything from maintaining legacy systems to handling disaster recovery going forward.

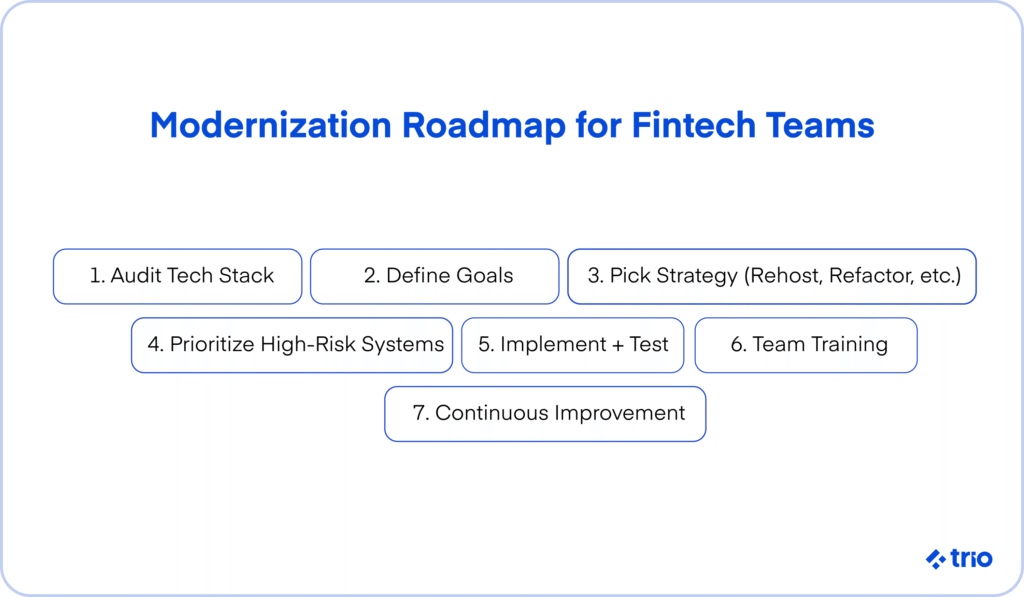

Creating a Modernization Roadmap: Step-by-Step

Upgrading legacy systems can be overwhelming. Here is a step-by-step roadmap to guide you through the process of modernizing your app.

- Assess Your Current Systems: Do a comprehensive audit of your tech debt and any compliance issues, so you have a good idea where you stand.

- Define Clear Modernization Goals: Why do you want to start modernizing these systems? Is your focus on speed, compliance, or user experience?

- Choose the Right Modernization Path: Get an experienced developer to help you decide how to proceed based on your goals. You can use different approaches for various components.

- Build a Phased Implementation Strategy: Prioritize the services that are opening you up to security risk, or where user expectations shift frequently.

- Test, Validate, and Monitor Progress: Make sure that you implement CI/CD tools and feedback loops so you can ensure the process goes smoothly.

- Train Teams and Align Ops: Don’t forget your documentation, and provide training to bridge any skill gaps in your current team.

- Continuously Improve Post-Launch: Remember to continuously modernize your systems to meet current technological requirements.

Common Challenges and How to Overcome Them

If this is your first time attempting a modernization project, there are some challenges that you should be aware of beforehand, such as cost, timeline concerns, legacy talent shortages, downtime risks, and internal resistance to change.

Cost & Timeline Concerns

Companies often don’t modernize their systems because this process costs a fair amount, and the timeline could affect other projects.

But you need to consider that the longer you put the process off, the more expensive it’s going to be and the longer it is going to take.

You also face additional costs related to security issues that might come up, or other consequences related to falling behind, like a loss of clients.

We offer outsourcing and staff augmentation hiring models to make sure that updating legacy systems is as cost-effective as possible while still getting the job done.

Legacy Talent Shortages

If you are working with outdated software, you may have some trouble finding talent familiar with your legacy systems.

Your developers will need to have some knowledge of the old technology in order to help you update it.

This is why working with a partner like Trio, which has a variety of developers on its team, can be incredibly helpful. Instead of wasting time looking for the right people, we provide only a couple of portfolios for you to look at, all guaranteed to have the right knowledge.

Downtime Risks

Modernizing legacy systems may result in downtime if not planned properly.

However, experienced developers understand how to implement techniques like blue/green deployments, canary releases, and parallel service rollouts to reduce the risk of lost income or reputation as much as possible.

We’ve already looked at the strangler pattern above, which can also allow your teams to phase changes without disrupting your entire application if there is a small issue.

Internal Resistance to Change

Unfortunately, any sort of change often receives some degree of push-back, whether it’s due to a fear of being made redundant or a potential steep learning curve.

While there is no way to get around this entirely, making sure that you openly communicate with your teams, start implementing your changes slowly, and provide opportunities for continued education can all help.

We have also found that getting your developers to contribute to decision-making conversations can be helpful.

If you want additional talent to help you ensure the modernization of your legacy fintech systems goes smoothly, we can help.

Our developers are familiar with working remotely with people from all over the world, and integrate well into your existing team, giving you everything you could want from a permanent hire without the commitment of one.

Thanks to our case-by-case developer placement and our focus on industry experience, we have been able to maintain a 97% placement success rate since we were founded in 2019.

If you want more information or you’re ready to get started, reach out for a free consultation!