Bitcoin and blockchain were once breakthrough technologies, but even established financial institutions are now leveraging similar technologies to enhance their cross-border payment infrastructure. They are also utilizing CBDC (Central Bank Digital Currency) technology to promote economic stability and make real-time payments more feasible.

However, with the increased use and development of these payment networks, companies in the fintech sector are experiencing a mixture of challenges and opportunities.

With countries piloting CBDCs and the ongoing demand for faster, cheaper international payments, you need to understand how to adapt your infrastructure to these new systems so that you can not only deal with cross-border transactions effectively but also potentially find opportunities to create solutions for existing financial systems.

As a company focused solely on fintech development, we have remained at the forefront of the industry, enabling our developers to stay familiar with emerging threats and the latest best practices. We can then connect companies in need of talent with those who possess the necessary knowledge and coding ability.

But before you start making hiring decisions, let’s make sure you understand everything you need to know about cross-border payments and CBDCs.

What Are Cross-Border Payments?

The best place to start is with what cross-border payments are and how they currently work.

Definitions and Types

Cross-border payments refer to transactions in which the payer and payee are located in different countries. The payment, if made in cash, would have to cross borders.

This is rarely the case today. Instead, the process occurs through electronic payment methods, which can include B2B transfers, card payments, e-commerce settlements, interbank settlements, and many others.

The list is far from exhaustive, as cross-border payments can span a wide range of use cases, from consumer to corporate, and even include financial institutions.

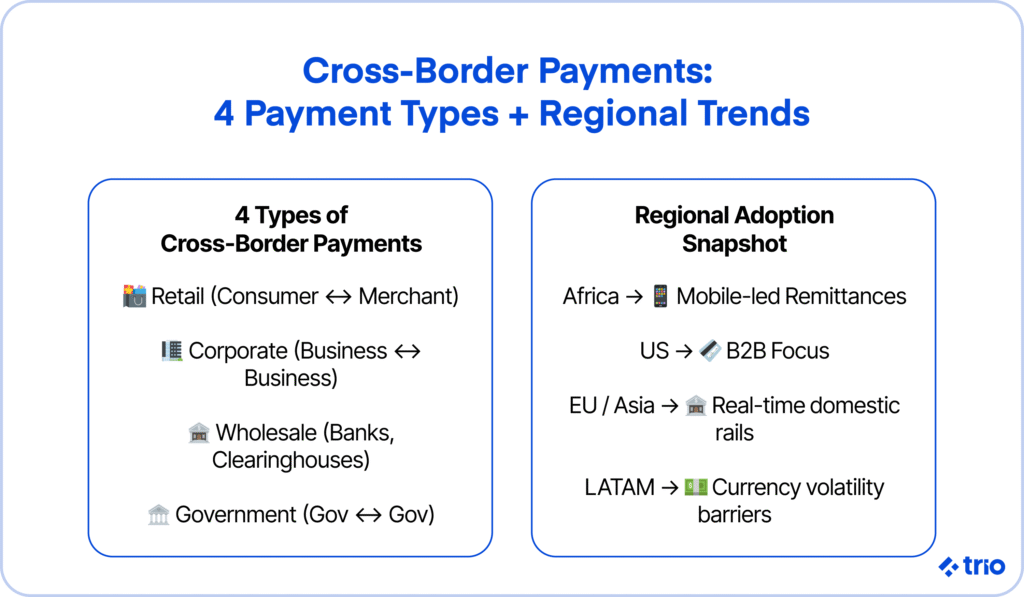

A lot of people like to split the types of cross-border payment systems into four different categories:

- Retail payments: usually between consumers and merchants.

- Corporate payments: between businesses.

- Wholesale payments: between financial institutions and clearinghouses.

- Government payments: between different governments.

Popularity by Region

Essentially, every country in the world is interested in making instant payments across borders. However, we have noticed that their motivations for doing so, as well as the payment service providers they utilize, can differ vastly.

In Africa, mobile-led remittances are gaining significant popularity. Sub-Saharan Africa accounted for almost 70% of the total growth in mobile money accounts in 2023, according to a press release by GSMA.

In more developed economies like the United States, B2B payments are the focus, and many companies are focused on getting speed up and cost down.

Outside of consumer demand, region-specific regulations, currency volatility, and banking infrastructure all impact the frequency and efficiency of these payments.

The Current Cross-Border Payment Infrastructure

Now that you have an idea of what cross-border payments are, let’s examine the infrastructure required to support them, along with the changes that may be necessary when working with legacy architecture.

Everything, from international to regional payments, still relies heavily on correspondent banking relationships and centralized messaging systems. However, working with these systems can be expensive, so knowing what you are up for ahead of time is a non-negotiable for any CTO or team lead.

SWIFT, Correspondent Banks, and Their Limits

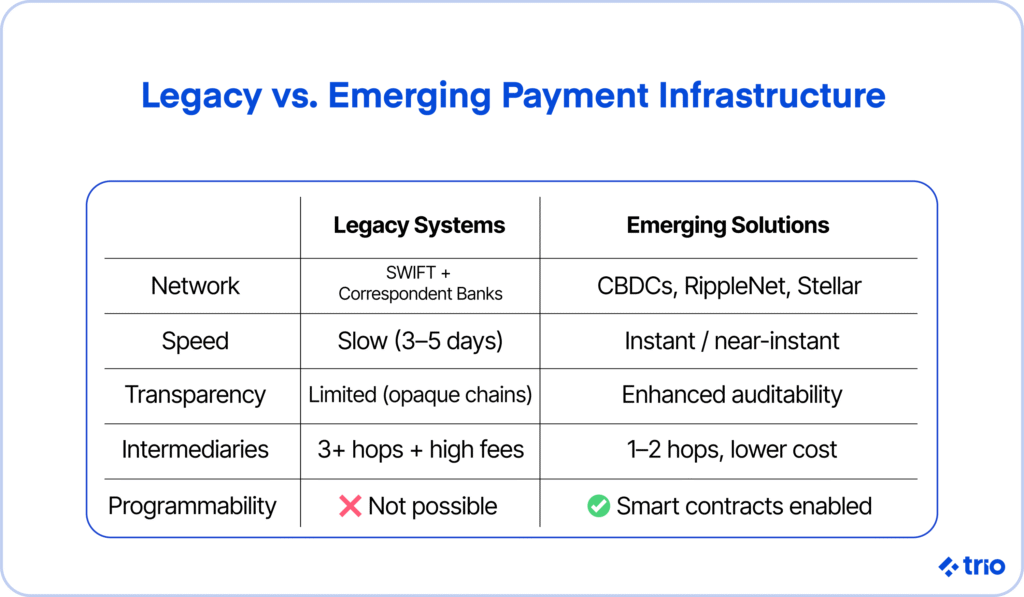

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is the primary messaging network banks currently use. Many people believe that it moves the money, but this is not true. Instead, it sends payment instructions between banks using a standardized format.

So, how are funds settled then? SWIFT messages must be paired with correspondent banking, which involves one bank holding accounts with another. This account is used to fulfill any monetary obligations.

This works, but it can get complicated. You inevitably end up working with long chains, especially if you are dealing with minimally used currencies, like the kind that you will encounter in less developed markets. Settlements are also incredibly slow, with high intermediary fees and exchange markups.

And, to make matters even worse, there is very little that end users and compliance teams can see, making KYC processes difficult to implement and enforce.

Real-Time International Payments

SWIFT is a nightmare for fintech platforms trying to enhance cross-border payment services. It acts as a massive infrastructure bottleneck.

The result has been that many different regions are investing in faster technology, such as the EU’s TARGET Instant Payment Settlement (TIPS), India’s UPI, and the UK’s Faster Payments. These are probably some of the best examples of domestic payment systems. The issue is that they still do not improve global networks.

SWIFT gpi and Visa B2B Connect are some ways in which people are trying to make cross-border payments. However, even though they offer some improvements in terms of speed and transparency, they are still based on legacy technology, which significantly limits their capabilities.

The only real solution that has emerged in recent years has been blockchain-based networks and CBDCs.

Rise of Fintech SWIFT Alternatives

RippleNet and Steller are providing crypto-native infrastructure, while companies like JP Morgan and Visa are turning to hybrid models and stablecoin experiments.

Fintech companies are capitalizing on the shift in industry standards to develop products that leverage alternative cross-border payment methods and address the issues associated with previous systems.

These smaller companies are transforming the payments landscape by reducing intermediaries (or “hops”), facilitating instant currency conversions, and enhancing both transparency and auditability.

They also enable programmable logic, which would have been impossible in many legacy systems. The new technology allows companies to leverage smart contracts and similar blockchain-based technologies, which can help them ensure security and prevent fraud.

However, if you are interested in building similar technologies to enhance cross-border payments, you must exercise great care. Making mistakes in the fintech sector is not an option. You are handling people’s money and their sensitive personal information.

You need to ensure that you have expertise on your team in areas such as compliance, digital identity, and secure API use. That’s where we can give you an advantage. Hiring the typical way can be time-consuming, and you risk making mistakes. When you hire with Trio, you only need to choose from a handful of portfolios, all guaranteed to have the right skills for your project.

Challenges Associated With Cross-Border Payment Systems

If you decide to build anything related to cross-border payments, you should be aware of the challenges you will encounter. Knowing the pain points ahead of time allows you to plan for them and address them in the most cost-effective way possible.

Cost, Complexity, and Transparency

Cross-border payments can get very expensive. While it varies from region to region, usually it is a percentage of the amount being sent.

These costs generally include the SWIFT fees, intermediary bank charges, foreign exchange markups, and additional overhead related to security and compliance.

There is a notable lack of price transparency for individuals seeking to utilize traditional services.

As a rising fintech or someone new to the cross-border payments landscape, you may have to be prepared to deal with very slim margins and focus on transparency to stay competitive. Hiring developers from nearshore or offshore countries who have a good idea of the U.S. regulatory landscape can help you cut costs.

We have been able to provide our clients with some incredibly cost-effective development by sourcing developers from countries like Brazil, Argentina, Chile, Mexico, Poland, and even South Africa.

Regulatory Requirements Across Jurisdictions

Compliance can be intense, especially when considering the numerous differences across the global financial system. Regulations don’t just differ from country to country, but sometimes even differ in different parts of the same country.

Typically, these regulations encompass all aspects related to anti-money laundering (AML), know-your-customer (KYC) requirements, foreign exchange controls, and capital flow restrictions.

The fragmented nature of these regulations results in differences in services depending on the user’s location, which drastically increases development and operational costs while complicating client onboarding and transactions.

CBDCs offer a way to mitigate some of these differences, as they are governed globally; however, we expect significant changes shortly, given the rapid increase in the adoption of stablecoins.

Long Transaction Chains and Legacy Tech

If you are working with traditional financial institutions, you’ll need to be prepared to deal with the long chain of intermediaries that money traditionally goes through.

These chains often result in delays, data truncation risks, and make tracking and reconciliation incredibly difficult. With so many go-betweens, it’s also far more likely that something will go wrong, and you won’t be able to identify where the issue occurred.

Additionally, traditional banks often still batch their transactions, rendering real-time payments impossible, even if other parties in the transaction chain can ensure instant settlement on their end.

High Funding Costs and Operating Hours

Since many parts of the world are still working with traditional banks, you’ll need to be prepared to do things their way. In other words, you will need to have funded accounts with those banks.

Even if you have a handful of customers, this can get very expensive. While the money can technically be returned, having all of your capital tied up can hinder your growth in other areas.

Banks also have limited operating hours, to which those accounts will be subject.

CBDCs can be an incredible solution here, as they enable you to implement an always-on infrastructure and integrate liquidity mechanisms into your product, facilitating the creation of an instant payment system and maintaining your liquidity.

Limited Data Standards and Compliance Checks

We have already mentioned that SWIFT is still considered the industry standard. Which means you may encounter it in your workflows, leaving you subject to its limited field capacity.

You may be forced to reduce transparency, or you may notice your AML efforts are not practical.

ISO 20022 was designed to address these issues; however, many legacy systems lack the necessary support for automated compliance processes, such as sanctions filtering and fraud detection. You may need to integrate these capabilities into your products manually, which can make your tech stack more complicated.

Central Bank Digital Currencies (CBDCs) Explained

CBDCs are digital currencies. Think of bitcoin, but more formal, issued by central banks, and designed to be legal tender.

Since they are formally issued, they are also centrally governed, and banks generally aim to have them reflect the value of an existing currency. For example, the digital yuan (e-CNY) is tied directly to the Chinese Yuan. In theory, it’s just a digital version.

The U.S. doesn’t have a digital currency of its own yet.

Retail vs. Wholesale CBDCs

Retail CBDCs are typically intended for general use by everyone. It’s a digital form of cash that can be stored in a digital wallet and spent as you’d like, typically through peer-to-peer (P2P), consumer, or merchant payments.

Wholesale CBDCs are only for financial institutions. They are used to try to modernize transactions between banks.

Between the two, wholesale CBDCs are likely to have the most significant impact on global cross-border payments at present. Since banks and similar institutions primarily use them, they are easier to govern; however, they still enable increased payment speed for the average consumer, thanks to reduced transaction chain delays.

mCBDC Bridges and Interoperability Models

We are very excited about the development of multi-CBDC arrangements (mCBDCs). Project mBridge, which central banks are using in Asia, and Project Dunbar, led by the BIS Innovations Hub, are testing how cross-border payments can be made across multiple CBDCs.

Currently, these systems employ a shared ledger model, where each bank maintains its own CBDC, but inter-bank transactions take place on a common platform.

So far, it seems promising. Some benefits include faster clearing, reduced costs, and all the benefits associated with a decrease in intermediaries. However, there are still some technical and regulatory challenges that need to be addressed regarding identity management, governance, and what happens in the event of a dispute.

Technology Implications for Global Payment Fintech CTOs

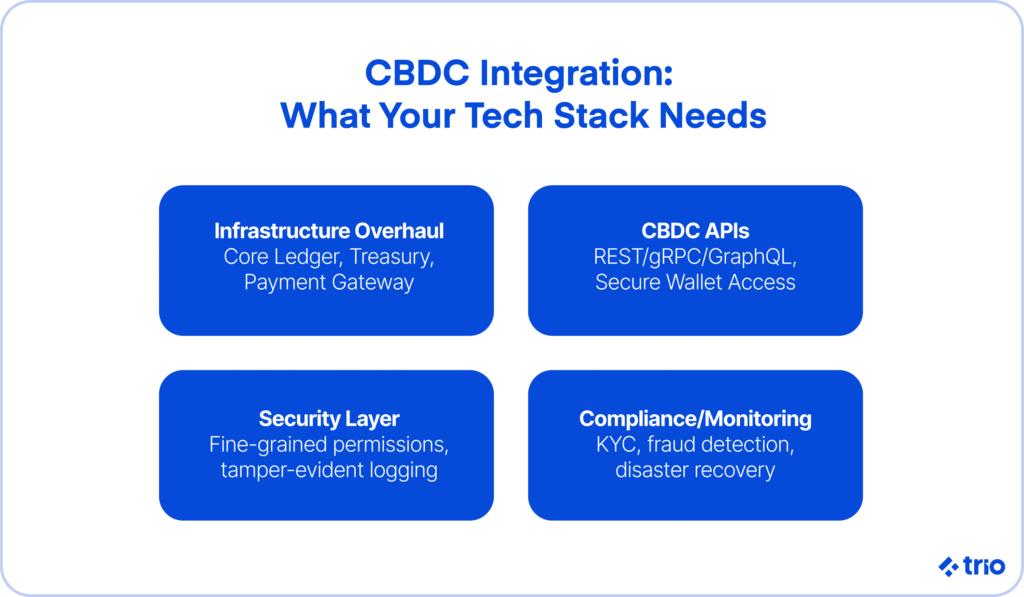

If you are a leader, preparing for CBCD integration is critical. You will need to audit your fintech stack to ensure you are ready to utilize the technology to facilitate instant cross-border payments.

For each component, consider agility, interoperability, and long-term resilience.

Core Infrastructure That May Need Overhaul

If you are working with a legacy system of any kind, issues with flexibility, speed, and auditability will hinder your progress. Since these are so critical in interlinking fast payment systems, a comprehensive overhaul may be necessary.

Consider your general ledger, treasury management systems (which must be auditable in real-time), and any payment gateways you may be using.

APIs for Real-Time CBDC Integration

An API is crucial for allowing you to interact securely with other systems. Most central banks are probably going to publish public or restricted-access APIs for their CBDCs. These APIs will facilitate issuance, redemption, transaction validation, and even wallet services.

There may be an opportunity for you to gain a foothold in the industry by creating secure APIs in collaboration with these institutions, provided you can assemble the right team.

The key is going to be standardizing your API architecture around protocols like REST, and either gRPC or GraphQL support. Ensure that you also consider global regulations, particularly as they evolve.

Any systems you create will need to have low latency, high availability, and strong observability.

Security, Compliance, and Resilience at Scale

Security, compliance, and long-term reliability are all things we have mentioned before. But what does this mean in practice?

You need to ensure that unauthorized individuals cannot access your infrastructure. Similarly, no one should be able to tamper with it.

Consider what would happen if sudden influxes of traffic were to occur. Would the system fail?

Our developers can help you implement fine-grained permissioning, ramper-evident logging, and automated transaction monitoring or fraud detection. They can also make sure that you are up-to-date with the latest regulations.

One area that many of our clients often overlook is their disaster recovery plan. What happens if there is a domestic or international failure? Do you have alternative providers or systems you can switch to, so that you can minimize potential downtime?

How to Integrate with CBDC Rails

You won’t be able to integrate anything concrete yet. As discussed, many central banks are still in the early stages of testing. However, many fintechs of various sizes are already preparing to integrate, so failing to do so will put you at a disadvantage when the time comes.

Pilot Participation and Dev Sandboxes

Pilot programs and regulatory sandboxes are sometimes launched by central banks or initiatives that are affiliated with these experiments. Ensure that you utilize the provided tools and familiarize your developers with any available information.

These will provide your team with knowledge about potential technical constraints you need to address, API structures you will need to implement, and compliance requirements.

Central Bank Partnerships or APIs

Suppose it seems like you are getting closer to finalizing your region’s CBDC. In that case, you can start establishing a partnership with your relevant central bank or the intermediaries that will provide you with access to the APIs.

While there’s no way to say anything with certainty yet, past trends indicate that these CBDC APIs will probably be gated in some way. You should gain a good understanding of the types of legal and compliance documentation and governance protocols you will need by collaborating with the relevant leads.

The result will be far faster integration later.

Tools, SDKs, and Technical Docs to Watch

MAS (Singapore), Risbank (Sweden), and the Bank of England are all publishing resources.

The contents of these differ, but some include SDKs, interface definitions, and references to assist with tasks such as wallet integration or KYC verification.

While it is best to focus on region-specific documents, when it comes to global payment systems, it is probably safe to assume that there will be a fair amount of overlap.

International Standards and Roadmaps

International standards will be key if the global CBDC landscape is to be effective.

G20 CBDC Targets and Monitoring Framework

The G20 has been coordinated by the Financial Stability Board (FSB) and the BIS. The hope is that international payment options will be faster, more accessible, and more transparent in measurable ways.

The initial G20 cross-border payment targets have a deadline of 2027. CBDCs could play a significant role in helping countries reach these goals and increasing global financial inclusion.

ISO 20022 and Other Global Initiatives

ISO 20022 is quickly becoming a standard alternative to SWIFT.

It enables richer data sharing and greater transparency, making it the most likely option for CBDC systems to adopt.

Another global initiative to consider is the work of CPMI (Committee on Payments and Market Infrastructures) on standardizing APIs and digital identity frameworks. These standards aim to support overall stability and economic growth.

Private-Sector and Public-Sector Interoperability Plans

Interoperability is crucial at a policy level, but it’s also important to consider the efforts of leading fintechs, banks, and infrastructure providers who are forming consortia to create shared rails and interoperability layers.

We have been closely monitoring efforts such as the Universal Digital Payments Network (UDPN) and BIS’s Project Nexus, along with a few others, to ensure we have a clear understanding of the private sector’s plans to improve regional payment systems and, eventually, cross-border payments.

Risks, Opportunities, and Strategic Considerations

We would be remiss if we did not examine the risks that CBDCs pose. These risks span operational, technical, and regulatory fields. If you think you will need to design or evolve your architecture to utilize CMDCs for instant payments, then weighing the numerous risks against the potential benefits is one of the first steps to ensuring your company’s continued success.

Operational and Integration Risk

Adding CBDC infrastructure into your fintech products will mean that you have more code to write and a more complex tech stack to maintain. This will incur additional costs, both in initial development and long-term maintenance.

The added code and tools also mean that there are more opportunities for things to go wrong, whether that is due to an increased reliance on vendors or new hiring needs that you may fill incorrectly. The latter is easily addressed when you go through a company like Trio.

New APIs, identity standards, and compliance rules increase the attack surface.

You will need to focus on an extensive DevSecOps strategy, ensuring that you have all the necessary tools ready. This will enable you to identify issues as early as possible, pinpoint their origin, and develop comprehensive contingency plans as part of effective risk management.

None of this is free, and it can make it a lot more challenging to enter the field when CBDCs become more commonplace and users expect access as a bare minimum.

Transparency, Cost Efficiency, and Speed

If CBDCs are appropriately integrated, we could be looking at some new targets for cross-border payments. Instant settlements will be the norm, and you will need to adjust to the shifting metrics.

However, the reduced FX exposure and real-time reconciliation that are made possible will decrease the cost of these transactions, potentially allowing you to compete with established institutions by offering lower rates or achieving better margins.

Either way, if you rely on liquidity, speed, and trust, this potentially gives you an edge, provided you can capitalize on these technologies before most of your competitors.

One of the best ways to ensure you are ready is to have an industry expert on your team. We can help with that.

Our process begins with a complimentary consultation, during which we gain a deeper understanding of your company and its technical requirements. Based on this information, we can then connect you with the right developers. We can assemble a dedicated team or identify individuals who seamlessly integrate into your existing company culture, working alongside your in-house developers.

In some cases, we have been able to connect companies with the right people in as little as 24 hours. And, thanks to our alternative hiring models, you don’t need to worry about keeping the developer on your team indefinitely. Instead, they can help you get your products ready, finish the job, and be available to you at a later date if you require it.

Ready to get started, or need more information? Reach out to book a call!