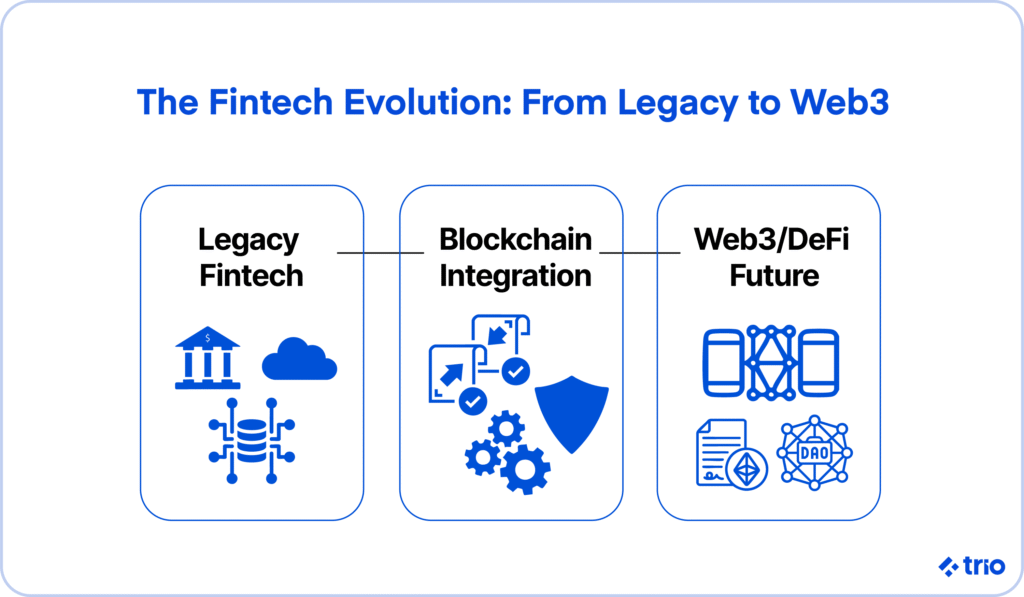

Web3, blockchain, and decentralized finance (DeFi) are playing a major role in fintech innovation. These solutions are changing traditional financial services forever, with the global value of blockchain solutions reaching as much as $306 billion by the end of the year.

The shift to these technologies has been happening for a long time, and as a CTO or technical decision maker of a fintech company or even traditional financial institutions, it is important to evaluate any changes in the financial industry and to decide if you are going to integrate these tools into your fintech services.

Let’s take a look at the different applications of blockchain, Web3, and DeFi, including how companies are using these technologies securely and compliantly, even when integrating them with legacy systems.

We will also look at some of the trends or developers here at Trio have noticed, that you should be keeping an eye on if you are using these technologies in any of your fintech solutions.

At Trio, we don’t do everything. Instead, we focus on fintech. This approach enables our developers to stay current with the industry, keeping up to date with the latest regulatory changes, new industry standards for security, and shifts in user expectations.

If you are developing fintech platforms of your own, getting some industry expertise on your team is invaluable.

Web3 and Blockchain in the Fintech Industry

Web3 is the next step in the internet, where users control their data and everything else you can think of. As security and privacy become increasingly valued, users are demanding more control, particularly over their financial data.

Blockchain is going to be a crucial component for driving Web3, thanks to its distributed ledger system, which makes sure any data handling is transparent, without relying on centralized control.

Blockchain’s Value Proposition for Financial Systems

Blockchain networks act more as a backend driver behind data and transactions.

In the financial services industry, blockchain platforms are reducing the number of intermediaries that companies have to rely on. This reduction ends up cutting costs and increasing transaction speed, benefiting both users and providers.

Since you cut out all of the middlemen, you also end up having verifiable ledgers, which allows you to trace money with more ease, making it easier to reduce fraud if you have the right measures in place.

If your company deals with cross-border payments, asset custody, or you even offer services like trading, blockchain platforms may help you with regulatory compliance and even increase user trust, which may bring in more clients in the long term.

The Rise and Maturation of DeFi

DeFi has matured into a powerful force in the fintech ecosystem, playing a role in lending protocols, decentralized exchanges (DEXs), insurance platforms, and even asset management tools.

DeFi relies on both blockchain and cryptocurrency to facilitate peer-to-peer transactions. Aave, Uniswap, and MakerDAO use blockchain-based smart contracts to let users transfer large quantities of money.

In the finance industry, you could take advantage of the open financial services applications of blockchain for things like liquidity provision, stablecoin infrastructure (which is becoming more normalized), and even non-custodial wallets.

Key Trends Shaping the Future

Our developers have picked up on a couple of key trends around Defi, Web3, and blockchain in fintech, including:

- Interoperability: for seamless asset movement.

- Zero-Knowledge Proofs (ZKPs): to preserve privacy and verify data.

- Tokenization of Real-World Assets (RWAs): to trade real-world assets through non-traditional transactions.

- Regenerative Finance (ReFi): to ensure you balance profit and sustainability.

- Layer-2 Scaling: to reduce fees and increase throughput.

- Compliance-Embedded Protocols: for better KYC, AML, and regulatory reporting.

Smart Contracts, DAOs, and Decentralized Identity

As the financial sector changes, we need to step away from traditional fintech operations to meet changing demands.

Decentralization is proving to be a major opportunity for fintech startups, who want to pull ahead of traditional firms that have not been able to adapt quickly.

Automating Trust: Smart Contracts in Lending, Insurance, and Escrow

We have already mentioned that a bunch of companies are leveraging blockchain in decentralized finance to facilitate things like peer-to-peer transactions. Smart contracts ensure these transactions are secure.

These contracts let fintech firms define and enforce logic directly on the blockchain, even automating these processes to reduce the risk of human error while decreasing the need for middlemen.

The result is not only ensured security through enforceable agreements, but speed that facilitates everything from real-time loan approvals to conditional insurance payouts. It is no wonder that the global smart contracts market is expected to grow at a CAGR of 24.7% by 2032.

However, the widespread adoption of smart contracts has already shown us that there are some potential issues.

Fintech developers need to make sure that contracts are secure, with regular audits and tests ensuring that they can’t be manipulated. If you need a blockchain expert with proven experience in fintech software development, we can connect you with someone who has worked in similar projects before.

Decentralized Autonomous Organizations: Governance and Capital

DAOs, or Decentralized Autonomous Organizations, are changing the way fintech technologies are governed and the way that capital is managed. They are essentially member-owned communities with no centralized leadership that rely heavily on smart contracts and voting.

These organizations often embed governance rules directly into their code, with a focus on blockchain use to promote transparency.

If you are exploring community funding, collective ownership, or protocol-based governance, there is much we can learn from DAOs. Particularly, the use of blockchain to carefully design secure voting mechanisms, incentives, and even their legal structures, all in an effort to make sure they are protected against fraud and other vulnerabilities.

Digital ID and KYC in a Decentralized World

Decentralized identity protocols can help with KYC, user authentication, and fraud prevention. Essentially, decentralized ID (DIDs) and verifiable credentials are used when users are trying to share their information.

Previously, we would have had to rely on limited, centralized databases that users had limited control over, which might have resulted in missing critical information in high-stakes fields like lending.

Now, they not only choose what to share, but can do so with greater ease, making onboarding easier. The new technology has also played a role in cross-platform compliance, and since there is a greater emphasis on privacy, it has resulted in increased trust, especially in fintech applications where both users may be wary about sharing sensitive information.

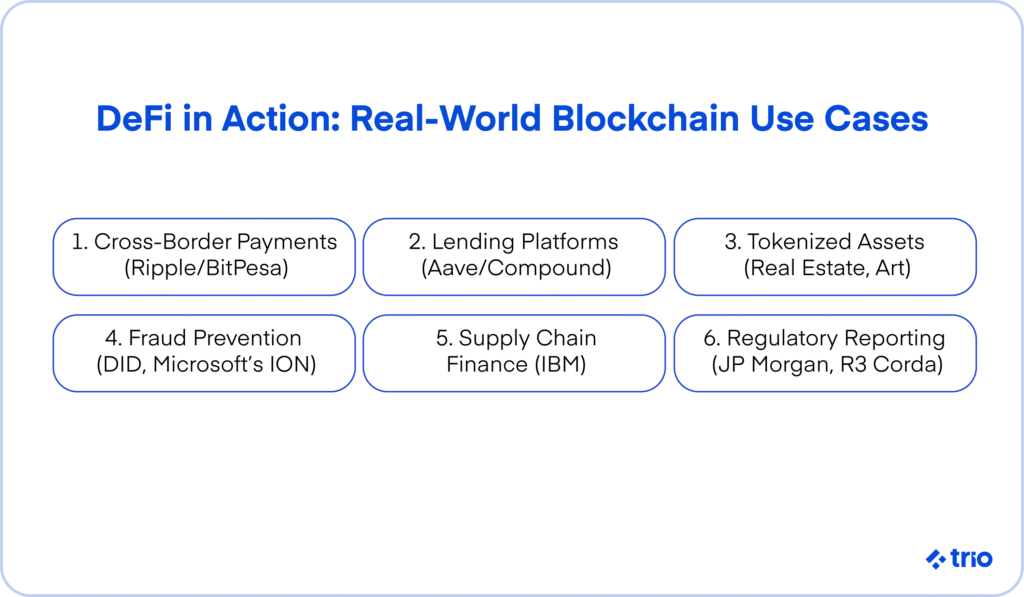

Use Cases: Blockchain Technologies and DeFi in Action

DeFi and blockchain applications used to be largely theoretical. Now, many major players have put these tools into practice. Let’s take a look at some of the use cases for implementing blockchain in finance, specifically, with real examples.

Payments and Cross-Border Transfers

Blockchain makes it easier than ever to send money. With just the click of a button, users can now send money with fewer fees and a far lower settlement time, even when they are trying to make cross-border payments.

BitPesa and Ripple are two examples of how the fintech blockchain market is booming in regions where remittance is particularly high.

These companies are allowing more traditional firms to adopt blockchain infrastructures, allowing them to improve their services and benefit monetarily.

Lending Platforms

Aave and Compound are two examples of decentralized lending platforms. They let users borrow without needing to go through traditional intermediaries, sometimes even using their crypto as collateral.

These platforms are also globally accessible, which means that fintech companies offering these kinds of services can deliver international products, all while taking advantage of the many benefits of modern technology adoption, like automated underwriting, interest accrual, and easy liquidation processes.

Asset Tokenization (Equities, Real Estate, Art)

Tokenization is the process of converting physical or traditional financial assets into tokens that can be accessed on the blockchain.

When you use blockchain for tokenization, you get access to fractional ownership models and can trade assets in markets that are otherwise pretty illiquid. Settlement and compliance are also far easier.

A lot of real estate platforms are starting to explore how they could benefit from blockchain and fintech.

Digital Identity and Fraud Prevention

We have already mentioned the role of blockchain in facilitating DIDs. Companies can access a shared DID and access selective information that has been cryptographically verified.

There are a variety of projects out there trying to use blockchain in this way to improve KYC/AML processes, amongst others. Microsoft’s IoN network and Sovrin are currently some of the biggest names in the space.

Supply Chain and Trade Finance

Blockchain ledgers let you trace global supply chains from one end to the other. IBM provides services related to transaction and hand-off recording, which help fintech companies with regulatory compliance.

Trade finance and invoice factoring operations are also very helpful, especially considering the reduction in paperwork and the resulting acceleration of workflows from these sorts of services.

Compliance and Regulatory Reporting

Compliance and regulatory importance are critical in the fintech industry. Companies face fines and loss of trust if they fail to meet regional requirements.

JPMorgan has created its Kinexys platform. Alongside projects like R3 Corda, you can access ledgers to automate the logging that you need. Not only are these trails transparent, they are auditable.

Investment Management and Robo-Advisors

A lot of the major asset managers, like Vanguard, are deploying blockchain solutions to streamline their administration.

This could be everything from automated portfolio strategies for tokenized assets to robo-advisors powered by complex AI and ML algorithms that advise users regarding those tokens.

The Challenges of Blockchain in Fintech CTOs Must Overcome

Before you start implementing blockchain in fintech products, you need to be aware of certain challenges that you might encounter so that you can prepare.

Regulatory Ambiguity and Jurisdictional Complexity

While the use of blockchain technology in fintech isn’t nearly as new as it used to be, global regulations on everything from digital assets to DeFi protocols are still rapidly changing.

You need a Fintech specialist on your team who is familiar with the regulations, both international and in the specific region that you are intending to work in.

Failing to comply can, as we mentioned above, result in fines and a loss of user trust.

If you need a fintech specialist with regional knowledge, we can help you out. Our developers are mostly based in LATAM, but they are familiar with the U.S. regulatory landscape.

Security Vulnerabilities and DeFi Risks

Smart contracts are great. But, they are also susceptible to certain issues, including exploits, flash loan attacks, and oracle manipulation.

Even if you think you have taken all of the necessary steps to secure your smart contracts, you need to be auditing your protocols regularly to make sure that they are up to date with the latest industry standards. These audits should span your security architecture and should test your rapid incident response.

Legacy Integration with Blockchain Systems

Fintech and blockchain platforms rarely work in isolation. Instead, you’ll be integrating your blockchain operations into existing systems that may not be designed to interact with the new environment.

You might need to use custom middleware, rethink your user flows, or even take into account new forms of data persistence. If you are able to consider these factors early in the blockchain development process, you can prepare. Failing to take certain factors into account may result in delays later.

Privacy vs. Transparency Tradeoffs

Public blockchains are very commonly used, and they are great for transparency. However, some of them may expose all of the relevant transaction data automatically, which a lot of users may not like.

If you are entering the fintech blockchain sector, consider zero-knowledge proofs, off-chain storage, and permissioned ledgers.

The important thing is to consider what your user base values in terms of privacy.

Talent Shortage in Smart Contract Development

Smart contract development is an essential part of blockchain for fintech use. However, since it is still a relatively new technology and requires a mixture of cryptographic knowledge and regulatory awareness on top of a reasonable programming expertise, the hiring pool is quite small.

Hiring mistakes can cost you a lot in terms of both time and money. That’s why partnering with a company like Trio can be so beneficial.

We listen to your unique needs and recommend specialists who are guaranteed to have all of the required skills, providing only a handful of portfolios for you to choose from.

Energy Efficiency and Sustainable Infrastructure

Blockchain is far from energy efficient. Proof of Stake (PoS) chains have been implemented in recent years to improve the overall energy consumption, but they haven’t been nearly successful enough for sustainability concerns to be quelled completely.

If you have an ESG mandate or plan to work with a company that has ESG requirements in the future, you need to carefully consider the energy impact that blockchain is going to have on your offerings.

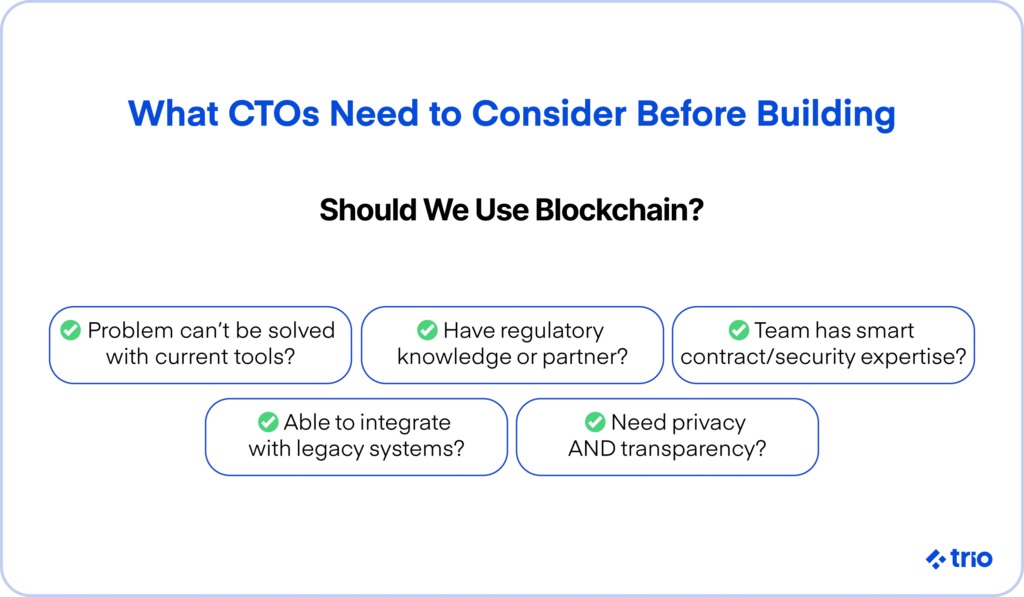

Key Questions to Ask Before Integrating Blockchain for Innovation

We have explored the numerous challenges of implementing blockchain, as well as various use cases. As a CTO or development leader, there are a couple of questions you can ask to make sure that it is worth dipping your toes into a new blockchain tool:

- What problem are you solving that only blockchain can fix?

- Do you have the expertise, or will you need to hire someone new?

- How will you approach security compliance, data privacy, and auditing?

- How are you going to integrate the new blockchain technology with old systems or APIs?

- Can you follow industry best practices like modular architecture for quick iteration?

Building with Confidence: Architecting a Decentralized Fintech Product

Once you decide that you would like to start building a blockchain tool of your own, you need to make some decisions regarding your Web3 and blockchain stacks, integrations, and compliance.

Web3 Stack: Wallets, Chains, Oracles, Bridges

We have already discussed smart contracts, but a Web3 stack has a little more to it.

You need to consider wallets, which are where you will manage private keys and user access. Some of the most common examples are MetaMask and Fireblocks.

Chains like Ethereum and Solana are what you will use to host your application logic, while oracles will feed real-world data into your contracts.

Bridges, as the name suggests, will connect everything together, including assets and logic.

Before you start, ensure that you choose or build options that are both secure and interoperable. Otherwise, you are going to run into issues when you try to use them alongside enterprise fintechs later.

Modular Infrastructure vs. Full-stack Blockchain

You can build everything yourself, or you could use modular, pre-built protocols, SDKs, and APIs. These modular systems are great to experiment with, but they might prove to be quite limiting.

Building full-stack solutions from scratch will definitely give you more customization and control. But they are expensive, and they take a great deal of time to build correctly.

If you are a small fintech startup, trying to get your first product on the market, we would recommend you go with a modular solution, with the goal of transitioning to something more custom as you have access to more funds.

Ensuring Regulatory Compliance from Day One

We can help you with regulatory compliance on a finished product. It isn’t impossible. But the truth is, it is far from ideal. Instead, considering your compliance from the start allows you to build in the required features from the ground up.

These features may be related to identity verification, transaction logging, audit trails, or even data encryption.

Having an expert on your team to advise you on the regulatory frameworks you may want to consider and how to best approach them is very helpful and definitely cost-effective in the long run.

The Future of Blockchain in Fintech

While the future of blockchain in fintech is not set in stone, we have been able to observe certain trends that could help us predict where it is going.

Institutional DeFi: Big Finance Meets On-Chain Liquidity

Some very big firms like BlackRock and Citibank are integrating DeFi and related services into their offerings. We expect that this is going to cement the presence of decentralized financing in the global market for fintech blockchain, but it is also probably going to affect regulations.

These shifts are going to be largely dependent on both users and investors.

Real-World Asset (RWA) Tokenization Acceleration

As mentioned above, assets that were less liquid before can now be converted into digital assets, or tokens. While this is not normalized yet, we don’t see any reason why it shouldn’t be in the coming years.

Potentially, we could be trading government bonds, real estate, carbon credits, and private equity on digital platforms using blockchain technology.

AI and Blockchain Convergence

AI has been making waves in the technology sector for a couple of years now. We are excited to see how it could be combined with blockchain for improved smart contract auditing, fraud detection, and even customer service.

Perhaps, the convergence of the two may even happen the other way around, with blockchain making AI more transparent and auditable.

Partnering Smart: How to Choose a Blockchain and Web3 Development Partner

When looking for a software development partner, you need to consider a variety of factors, including their experience working on similar projects before.

If you are working in both the fintech and blockchain sectors, this means your developers will need experience in both regulated financial environments and blockchain development. On top of this, they will need to be generally good developers with the skills to build your project for scalability and maintainability.

We have these kinds of developers at Trio, so instead of spending months creating job listings, interviewing, and onboarding developers you hope are suitable, the process can be shortened to several days.

To see if our people may be the right fit for you, reach out to schedule a free consultation.