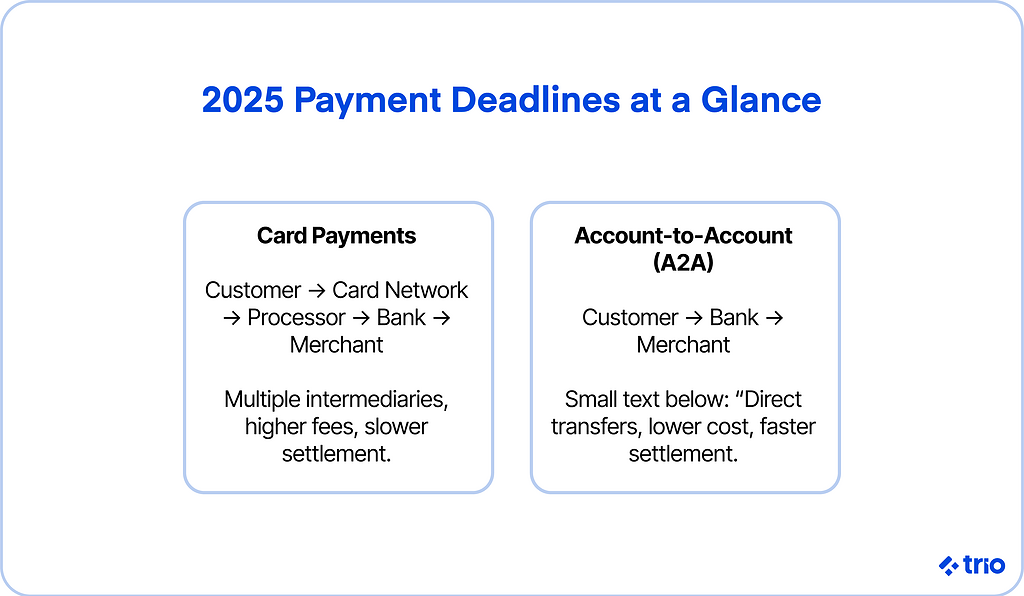

If you’ve ever looked at your payment processing bill and winced, you’re not alone.

For many businesses, card networks and intermediaries quietly eat away at margins. Fees creep higher, settlement takes longer than it should, and every extra step in the chain is another point of friction for customers who want to pay and move on.

The frustration isn’t just about cost. There’s also the question of control.

Relying on multiple intermediaries means you’re subject to their rules, their timelines, and their limits on what data you can actually access. If you’re building platforms or scaling internationally, that lack of visibility makes planning harder and compliance riskier.

Account-to-account (A2A) payments are often held up as the alternative.

The idea is simple enough: move money directly between bank accounts, bypassing card networks altogether. But while the concept appears straightforward, the execution can be anything but.

Not all banks support real-time transfers. Integration can vary widely by region. And while A2A may promise lower costs and faster settlement, those benefits hinge on how well you implement it.

Let’s walk through what A2A payments are, why they’ve become a bigger part of the conversation in global payments, and where the real opportunities (and challenges) lie for businesses considering them.

If you need a payments expert on your team, we collect the top 1% of developers specializing in fintech. These developers are located largely in LATAM, but are familiar with the U.S. and European markets.

What Are Account-to-Account (A2A) Payments?

At the simplest level, A2A payments are just money moving directly from one bank account to another.

No card networks. No intermediaries skimming a fee along the way.

That directness is what makes them so appealing to businesses hunting for efficiency.

Types of A2A Transfers

There isn’t just one way this works in practice.

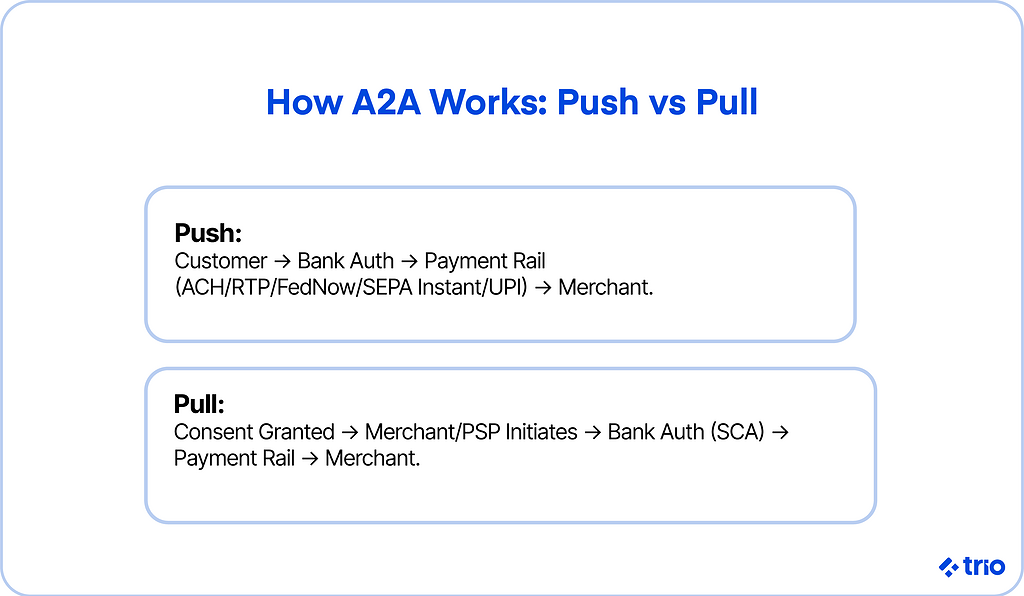

In some cases, the payer initiates the transfer themselves (a “push” payment). Think of a customer authorizing a one-off bank transfer for a large purchase.

Other times, the payee can pull funds from the payer’s account once permission has been granted, something closer to a subscription model or recurring bill.

You also see differences in how fast the money moves.

Traditional A2A transfers like ACH in the United States often take a couple of days to settle. Real-time payment schemes, which are gaining ground in regions like Europe and parts of Asia, promise near-instant transfers.

If you’re expanding globally, or plan to do so in the next few years, those differences affect liquidity planning, reconciliation processes, and ultimately the customer experience.

A provider like Trio may come into the picture here, not to reinvent the wheel, but to smooth out these inconsistencies. The rails exist, but stitching them together in a way that’s reliable across regions is where the real work lies, and you need an expert on your team to make sure the technical side works smoothly.

Why A2A Payments Are Gaining Momentum

For decades, account-to-account transfers were little more than a background process: direct deposits, bill pay, ACH, all familiar, but hardly exciting.

What’s changed is the combination of regulation, technology, and shifting consumer expectations.

Regulatory Push

In markets like the EU and UK, open banking rules have forced banks to expose APIs, making it easier for third parties to initiate secure transfers.

That’s not just a compliance checkbox; it effectively lowered the barriers for fintechs and merchants to plug directly into bank rails.

Similar efforts are trickling into other regions, though the speed and enthusiasm vary.

Technology and Infrastructure

Payment schemes are rolling out faster than most businesses can keep up.

The U.S. now has FedNow alongside ACH and RTP. India’s UPI has shown what’s possible when an entire population adopts instant A2A payments. They represent serious attempts to modernize money movement, and ignoring them can leave businesses behind.

Shifting Expectations

Customers have gotten used to instant payment services.

They don’t see why a bank transfer should be any slower than a peer-to-peer app, and they’re less tolerant of hidden fees.

That impatience puts pressure on merchants to offer cheaper, faster options, or risk abandoned carts and lost trust.

Where A2A Payments Are Being Used

The promise of lower costs and faster settlement only matters if you can point to real situations where it makes a difference.

That’s why adoption is happening first in areas where the pain of cards or slower bank rails is most apparent.

E-commerce and Marketplaces

Online retailers, especially those with thin margins, are drawn to A2A because it avoids interchange fees.

For a marketplace processing millions in monthly volume, shaving off even a fraction of a percent in fees can translate into meaningful savings.

Faster settlement also helps these platforms manage payouts to sellers without sitting on risk for days at a time.

Recurring Payments and High-Value Payments

Utilities, subscription services, tuition payments, and even mortgage installments are all scenarios where predictability is prized.

Pull-based A2A transfers can reduce late payments, minimize administrative overhead, and provide customers with a sense of control, unlike card-on-file setups that may expire or fail.

Cross-Border and International Expansion

Global businesses often find card penetration uneven. In markets like India or Brazil, A2A schemes are not just alternatives but the dominant rails for everyday transactions.

For a U.S. or European company expanding abroad, supporting A2A may not be optional; it may be the only way to meet local expectations.

Of course, these use cases aren’t universal. Adoption is patchy, and the infrastructure may be rock solid in one country but frustratingly incomplete in the next.

Advantages and Limitations of A2A Payments

It’s tempting to treat account-to-account payments as a cure-all for the headaches of cards and legacy bank transfers.

The reality is more complicated. A2A comes with clear advantages, but it also presents new challenges that businesses must factor into their decision-making.

The Advantages

- Lower transaction costs: With no card networks in the middle, fees tend to shrink. For high-volume businesses, that can mean millions in savings over time.

- Faster settlement: Depending on the scheme, funds can land in hours instead of days. That directly impacts cash flow and reduces the risk of holding unsettled balances.

- Reduced chargebacks: Unlike card payments, A2A doesn’t rely on dispute-friendly rails, which means fewer forced reversals. Merchants often see this as a significant win.

- Broader reach in some markets: In countries where card penetration is low, A2A is not just cheaper but more inclusive.

The Limitations

- Patchy infrastructure: Not every country has a real-time rail, and even when they do, adoption rates vary by bank.

- Complex integrations: Connecting to multiple bank APIs or payment schemes can be technically messy. Standards are improving, but far from consistent.

- User experience hurdles: Customers may hesitate when asked to log in to their bank during checkout. Drop-off rates can spike if the flow feels clunky or untrustworthy.

- Fraud and compliance risks: Although chargebacks are less of a threat, unauthorized access and fraud attempts persist. Businesses still need layered defenses.

How A2A Payments Actually Work

At a glance, “money goes from one account to another” feels almost too simple to warrant explanation.

But once you peel back a layer, you see why adoption isn’t uniform across markets. The mechanics, who initiate the payment, which rails carry it, and how banks expose their systems, all shape the experience.

Push vs. Pull

In a push payment, the customer initiates the transfer from their bank account. That’s what happens when you authorize a one-time checkout using your banking app.

Pull payments work differently. Once a customer grants permission, the business can initiate recurring debits. This model is standard for utilities or subscription services.

Payment Rails

In the U.S., ACH has been the workhorse for decades, but settlement lags can be a dealbreaker for modern commerce.

Newer systems like RTP and FedNow promise near-instant transfers but are still climbing the adoption curve.

We’ve also mentioned India’s UPI, which demonstrates what happens when instant A2A is deployed at scale, while Europe’s SEPA Instant illustrates the regional push under PSD2.

The Role of APIs

Open banking regulations in places like the EU and UK require banks to expose APIs, allowing third parties to initiate secure payments.

In practice, this means that an A2A transaction often runs through an authorization layer, where the customer confirms access before the money is moved.

Outside regulated markets, banks may or may not expose these APIs, creating a patchwork that’s difficult for businesses to navigate, especially if they are new to these regions.

What to Consider Before Implementing A2A Payments

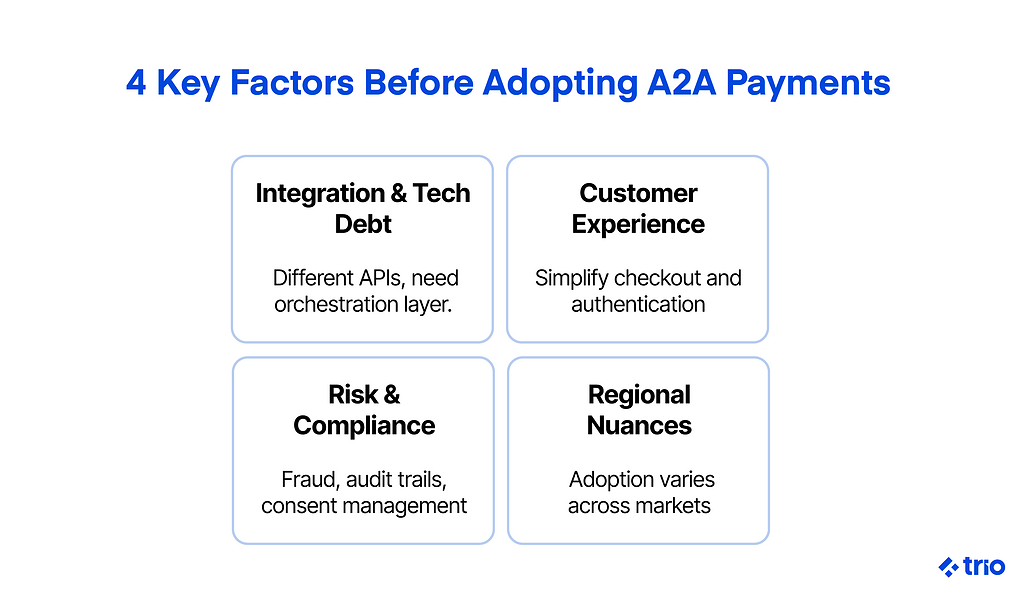

Deciding to accept account-to-account transfers isn’t just a matter of flipping a switch. The underlying rails may be available, but incorporating them into your payment strategy requires trade-offs and careful planning.

Integration and Technical Debt

Plugging into multiple bank and payment service provider APIs sounds straightforward until you realize each one speaks a slightly different dialect.

Some follow open banking payments standards closely, others take liberties.

If your development team isn’t ready for that level of maintenance, you’ll need an orchestration layer or a provider that manages those inconsistencies.

Otherwise, you risk piling technical debt onto your payment infrastructure. Our developers have often helped clients clean up this mess, but it is far easier and less expensive to fix these issues proactively.

Customer Experience

Even if the backend is flawless, the checkout flow can make or break adoption.

Customers asked to leave your site, log in to their online banking app, and complete multiple steps may abandon the process.

That friction is especially costly in e-commerce, where conversion rates are already sensitive. Testing flows, simplifying authentication, and clearly explaining security measures are all part of making A2A feel natural.

We’ve also seen that it can be helpful to include multiple payment options so that users can choose one that they may already be familiar with.

Risk and Compliance

Lower chargeback risk doesn’t mean zero risk.

Fraudsters are creative, and regulators are watching.

In some regions, consent management and audit trails aren’t optional; they’re legal requirements. Ignoring them can cause bigger problems than the fees you were trying to avoid in the first place.

Users have always relied heavily on trust to make decisions regarding the financial institutions that they use, and the payment systems that they are happy to entrust their details to.

Regional Nuances

What works in one market may flop in another. In Europe, customers are used to authorizing bank payments.

In the U.S., cards remain dominant, and persuading consumers to switch from this more traditional payment method may be difficult because of the amount of trust required.

Expanding into markets like Brazil or India, meanwhile, almost requires A2A because that’s how people already pay. Understanding these nuances ahead of time can save both money and embarrassment.

The Cost and ROI Perspective

In the U.S., card fees remain a stubborn line item for merchants.

On average, interchange fees amount to around 1.8% of each transaction.

However, when processor markups, gateway costs, and network assessments are factored in, many businesses end up paying closer to 2–3% overall. For high-ticket payments, that’s not just a nuisance; it’s a serious drag on margins.

Account-to-account (A2A) transfers cut out card networks entirely. That means no interchange, though there are still costs to consider, such as scheme fees, bank charges, and whatever you spend building or integrating the connections.

Even so, industry estimates suggest U.S. businesses that adopt A2A can reduce payment costs by 1–2 percentage points per transaction.

Let’s put that in practical terms.

If your company processes $50 million annually through cards at an effective cost of 1.8%, you’re spending about $900,000 a year to move money. Dropping that cost by a single percentage point could save around $500,000.

And the ROI isn’t only financial.

Real-time rails like RTP and FedNow mean funds settle faster than ACH, which improves liquidity and working capital. Fewer chargebacks free up operational resources. Better access to transaction data streamlines reconciliation.

The catch is that the break-even point isn’t universal. If you have low card volume or high development costs, A2A may take longer to justify.

The Future of A2A Payments

The conversation around A2A isn’t standing still. A few signals suggest where it might be headed:

- Real-time rails are multiplying: FedNow in the U.S., SEPA Instant in Europe, PIX in Brazil, UPI in India, the list keeps growing. The challenge is less about availability and more about making them interoperable.

- Embedded finance is pulling A2A in: As platforms offer financial services natively, A2A becomes the natural way to move money behind the scenes, especially for payouts and treasury.

- Fraud detection is evolving: Without card dispute systems, merchants need other safety nets. Expect more use of machine learning and behavioral analytics to flag suspicious transfers in real time.

- Regulation will keep shaping adoption: PSD2 opened doors in Europe, but regions like the U.S. are still piecing together their frameworks. Businesses with global reach will have to juggle these differences for years to come.

Conclusion

Account-to-account payments are no longer just a quiet alternative to cards. In the U.S., the combination of new rails, regulatory shifts, and customer expectations is turning them into a real option for businesses that care about cost, speed, and control.

Still, success depends on how you implement them; the wrong flow or poorly chosen partners can undermine the benefits quickly.

If you’re weighing whether A2A fits into your strategy, the next step isn’t simply learning the terminology; it’s also about understanding the underlying principles.

You need to decide where it makes sense in your payment mix, and how to roll it out without tripping over compliance or technical debt. That’s precisely the kind of decision point where a partner who’s been through the process can make a difference.

Get in touch to find out if our fintech developers may be the right fit for you.

FAQs

What are A2A payments?

A2A payments are direct bank-to-bank transfers, meaning money moves directly between accounts without the involvement of card networks.

Are A2A payments faster than ACH?

Yes, A2A payments using real-time rails like RTP or FedNow can settle instantly, unlike ACH, which takes days.

Do A2A payments work for subscriptions?

Yes, A2A payments support pull-based models where businesses debit customer accounts for recurring services.

Are A2A payments safe?

A2A payments are safe because they rely on bank authentication and regulated rails, though fraud risks still exist.