The way SaaS companies handle payments has changed dramatically over the last few years.

What used to be an afterthought, a Stripe integration bolted onto a product, has become a strategic lever for revenue, user retention, and market differentiation.

Yet for many SaaS teams, the shift toward embedded finance feels complex.

They see competitors monetizing transactions and offering seamless payment experiences, but aren’t sure how to get there themselves.

The challenge is that embedded payments aren’t just about adding a “Pay” button.

They touch licensing, risk management, underwriting, and customer experience all at once. Missteps here can slow your time-to-market or expose you to compliance risk, which can all affect your customer relationships.

The good news is that the tools, partners, and infrastructure have matured.

You don’t need to become a bank to build a financial layer into your product. You need to understand the models, players, and decisions that shape the embedded finance landscape, and how to apply them to your business.

Our specialist fintech developers have worked with a variety of embedded financial services, including payment solutions.

We place our people based on the developer’s direct ability and past experience. This has resulted in an incredible 97% placement success rate.

Understanding Embedded Finance

Before diving into embedded payments specifically, it helps to step back and understand the broader idea of embedded finance, what it actually is, how it works, and who makes it possible.

What Is Embedded Finance?

Embedded finance refers to the integration of financial services, like payments, lending, insurance, or card issuing, directly into non-financial software products.

Instead of sending users to a separate bank or payment processor, you integrate financial services directly into your app.

You’ve seen this model everywhere: ride-share drivers getting instant payouts, e-commerce sellers accessing loans from their platform, or accounting tools letting clients pay invoices right inside the software.

The financial service disappears into the workflow, which is the point; it becomes a feature, not a destination.

For SaaS providers, this shift has opened up new ways to create value by empowering customers through your payment services.

How Embedded Finance Works Behind the Scenes

Under the surface, embedded finance depends on a network of APIs and partnerships that bridge regulated financial infrastructure with software platforms.

Banks hold the licenses and handle custody of funds, while fintech enablers provide compliant APIs, and SaaS providers integrate those APIs into their products.

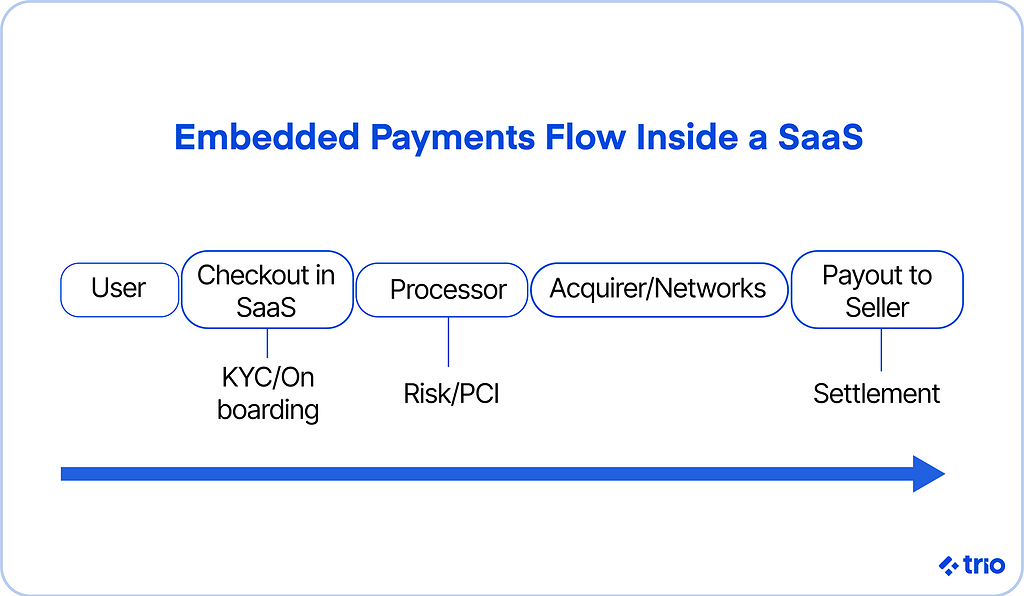

When a user initiates a payment or requests a card, the action moves through several layers, from the app interface to the payment processor, acquiring bank, card network, and sometimes a sponsor bank.

Each step has technical, regulatory, and financial implications.

You don’t need to build all of that yourself.

What matters is knowing which layer of the stack you’ll own, which you’ll outsource, and how that choice affects your business model.

Key Players: Banks, Fintechs, and SaaS Providers

The embedded finance ecosystem typically involves three key players:

- Banks and financial institutions provide the regulatory foundation and handle fund movement, compliance, and KYC/AML oversight.

- Fintech infrastructure providers (like Stripe, Marqeta, or Adyen) act as intermediaries, offering APIs and SDKs that abstract away the complexity of financial systems.

- SaaS platforms integrate those capabilities, creating a tailored experience for their users, and capturing part of the value chain that used to belong solely to banks.

We’ve seen SaaS teams succeed when they treat this as a partnership network rather than a vendor list.

Collaboration between these layers determines how quickly you can go to market and how much control you retain over the experience.

Embedded Payments in SaaS Platforms

Embedded payments are often the first and most powerful entry point into embedded finance for SaaS platforms.

Definition: What Are Embedded Payments?

Embedded payments are payment capabilities built natively into a software platform, allowing users to send or receive money without leaving the product.

Think of a booking platform where service providers get paid directly through the app, or a B2B tool that lets companies pay invoices in a few clicks.

Instead of redirecting users to a third-party payment page, embedded payments make the transaction a natural part of the workflow, invisible, seamless, and fast.

Core Components of Embedded Payments

While the user experience might look simple, several layers make up a functioning embedded payment system.

Merchant Onboarding and Underwriting

Before merchants can accept payments, they need to be vetted.

This process, called underwriting, assesses whether a business is legitimate and compliant with financial regulations.

In an embedded model, your SaaS becomes part of this flow, often collecting business details and verifying identity through an API connection to a payment facilitator (PayFac) or sponsor bank.

Smooth onboarding can be the difference between quick adoption and customer frustration.

Payment Processing and Settlement

This is the technical core: capturing payment details, authorizing transactions, routing funds, and settling payouts to the proper accounts.

Payment processors handle much of the heavy lifting here, but your platform controls the flow and experience.

For example, you might display transaction statuses, update account balances, or manage refunds, all within your own interface.

Risk Management and Compliance Layers

Embedded payments bring you closer to financial data, which also brings you closer to risk.

Chargebacks, fraud detection, PCI compliance, and dispute resolution all need to be accounted for.

Fintech partners can handle some of this, but you’ll still need visibility and governance to protect your brand and your users.

The best SaaS companies design for transparency from the start, showing customers how funds move and when to expect payouts.

Integration of Payments in SaaS Solutions

Integrating payments into your product isn’t a one-size-fits-all process. The right approach depends on your technical stack, user base, and how much of the financial infrastructure you want to control.

A lightweight integration might use a white-label provider’s API to handle everything end-to-end, while a more mature platform might take on underwriting and sub-merchant management itself.

The goal is to align integration depth with business goals, not to chase technical complexity for its own sake.

Choosing the Right Embedded Payment Model (PayFac, ISO, Partner, API)

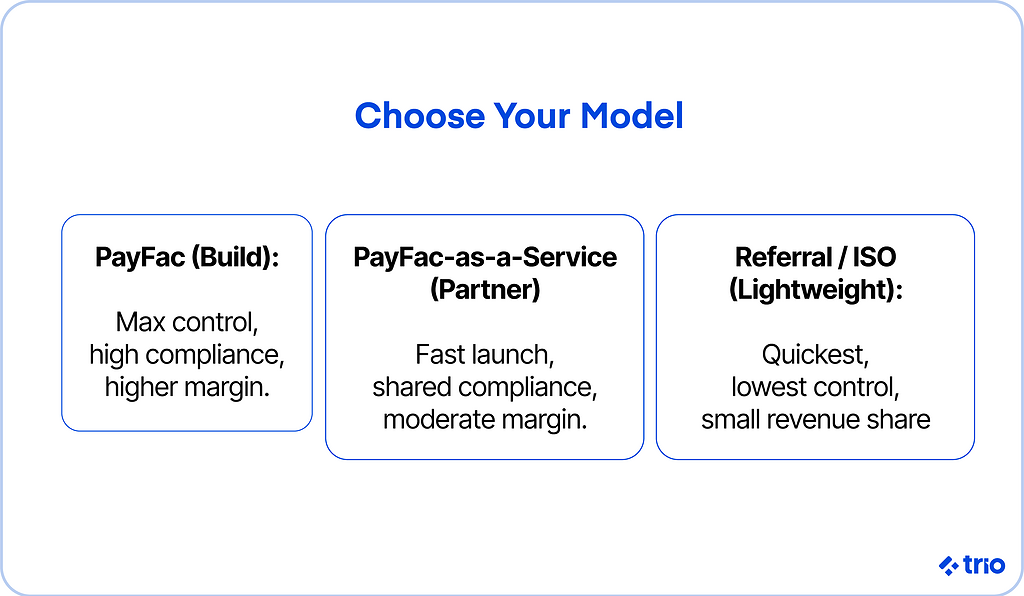

There are several models for embedding payments, each with trade-offs in control, compliance, and revenue share:

- PayFac (Payment Facilitator): You take on the most control and responsibility, managing sub-merchants and handling compliance. Higher revenue potential, but more regulatory exposure.

- ISO (Independent Sales Organization): You act as a reseller for a payment processor. Easier setup, but limited customization and smaller revenue share.

- Partner or Referral Model: You send customers to a processor in exchange for referral fees. Lowest lift, but no control over the experience.

- API Integration Model: You integrate directly via APIs, giving you flexibility to blend capabilities across providers.

Our developers often help teams map these options against their growth stage and risk appetite.

Benefits of Embedding Payments into SaaS Platforms

Embedding payments makes life easier for your users and can fundamentally reshape your business model, strengthening customer acquisition by making you a more attractive option.

New Revenue Streams Through Payment Monetization

By facilitating payments directly, you can capture a portion of each transaction’s processing fees. That may sound minor, but at scale, even a small take rate can translate into meaningful revenue.

Many SaaS platforms evolve from flat subscription pricing toward hybrid models, where transaction-based income smooths out cash flow and fuels reinvestment.

Better Control Over the Customer Experience

When payments happen within your platform, you control every touchpoint, from onboarding to settlement.

That means fewer redirects, fewer dropped transactions, and more trust in your brand.

It also gives you richer data about customer behavior, which can inform product design and help personalize future services.

Streamlined Onboarding and Reduced Friction

Embedding payments lets users start transacting faster.

They don’t have to create separate accounts with a third-party processor or navigate complex setup flows.

When done well, payment onboarding can feel like a natural extension of signing up for your app. It’s a subtle but powerful way to boost activation rates and early retention.

Competitive Differentiation and Stickier Retention

SaaS markets are crowded, and differentiation is hard to sustain. A built-in financial product can set your platform apart, especially in vertical SaaS, where payment flows often reflect niche workflows.

Once users start running revenue through your platform, churn naturally drops.

Payment processing creates what’s sometimes called “stickiness by necessity”, but the best companies turn that necessity into value.

Use Cases for Embedded Finance in SaaS

The principles of embedded finance apply across industries, but they show up differently depending on your vertical and customer needs.

B2B Marketplaces and Subscription Platforms

Marketplaces are classic candidates for embedded payments.

You can split payouts between buyers and sellers, automate escrow-like flows, and charge platform fees transparently.

Subscription-based SaaS products also benefit from built-in recurring billing and real-time reporting, with no third-party dashboards required.

Vertical SaaS (HealthTech, PropTech, EdTech, etc.)

In vertical markets, payment workflows are often tied to industry-specific processes, patient billing, rent collection, or tuition payments.

Embedding payments directly into these systems simplifies compliance and reduces friction for end users.

It also opens doors to adjacent financial services, like credit lines or insurance, further deepening user engagement.

Expense Management and Payout Platforms

If your software manages expenses, commissions, or reimbursements, embedded finance can handle payouts at scale.

You can issue virtual cards, automate approval flows, and track spending in real time.

This not only improves user experience but can become a key selling point in procurement and finance departments.

Accounting and ERP Software Providers

Accounting and ERP tools have a natural fit for embedded payments.

Allowing users to pay invoices, reconcile transactions, or manage vendor payments inside the same interface streamlines workflows and reduces manual errors.

It also turns traditionally passive systems into active financial platforms, a shift many SaaS providers are capitalizing on today.

Payment Volume and Its Business Impact

As your embedded payment volume grows, so does its financial significance.

Understanding how this volume translates into revenue and how to optimize it is critical for long-term success.

How Processing Volume Translates Into Revenue

Every transaction you facilitate generates a small fee, typically shared between you and your payment provider. As your total processing volume increases, that share compounds.

Even a modest SaaS app processing $10 million annually could generate tens of thousands in new revenue through payments alone.

This income is often more scalable than subscription revenue because it grows directly with customer success.

Understanding Take Rates and Fee Sharing

Your take rate is the portion of payment fees you retain. Depending on your model, this could range from a few basis points to several percentage points.

Negotiating favorable fee structures with payment partners, or eventually taking on more of the PayFac responsibilities yourself, can significantly impact profitability.

But it’s important to model this carefully; higher margins often come with higher compliance overhead.

Optimizing Cash Flow and Liquidity Management

Embedded payments can also improve cash flow visibility.

With direct settlement data, you gain real-time insights into when money moves through your ecosystem.

That transparency helps forecast revenue, manage reserves, and plan growth investments.

Many SaaS teams integrate this data into their analytics stack for smarter decision-making, something we often help clients implement seamlessly when aligning payments data with product metrics.

Key Considerations Before Embedding Payments

Before you start embedding payments, it’s worth stepping back to understand the obligations that come with financial functionality.

Building a smooth checkout experience is one thing; handling money on behalf of others is another entirely.

These considerations protect you from risk, and they shape how sustainable and trustworthy your platform becomes.

Compliance and Licensing Requirements

Financial compliance is the foundation of embedded payments.

Depending on your model, you may be required to register as a Payment Facilitator (PayFac), operate under a Money Transmitter License (MTL), or partner with an entity that already holds these licenses.

Regulations vary by region and by activity, for example, whether you hold funds, aggregate payments, or process cross-border transactions.

Partnering with a regulated provider can let you borrow their compliance framework while still offering an integrated experience.

It’s important to evaluate this early. Retrofitting compliance into an existing product is far harder than designing it up front.

Data Security and Fraud Prevention

Handling payments means handling sensitive financial data. You’ll need to ensure compliance with PCI DSS standards and implement best practices like tokenization, encryption, and secure data storage.

Fraud is another ongoing challenge. Even legitimate users can make mistakes that trigger chargebacks, while bad actors may exploit your system for testing stolen cards or laundering funds.

Modern fraud detection tools use machine learning to flag anomalies in real time, but they’re only as effective as your integration design.

Balance automation with clear escalation paths for your support team.

Risk Management and Dispute Handling

Every payment ecosystem faces disputes, whether from double charges, service dissatisfaction, or suspected fraud.

As the SaaS provider, you’ll often be the first line of contact, even if your partner handles the backend process.

Establish clear workflows for dispute resolution, including automated notifications and transparent communication with your users.

Your reputation, and ultimately customer loyalty, depends less on avoiding disputes altogether and more on how you handle them.

User Experience, Branding, and API Design

User trust is incredibly important. Payment flows should feel native to your app, visually consistent, intuitive, and responsive across devices.

The underlying API design also plays a major role.

Clean, modular integration helps you scale faster and experiment with new financial features over time.

We’ve found that design and engineering teams work best when they treat payments like any other core feature: something to iterate, measure, and refine with user feedback, not just a backend utility.

Integrating Embedded Payments: Step-by-Step Guide

Once you’ve aligned on compliance and risk, integration becomes a question of architecture and sequencing. Let’s go through a step-by-step process of integration so you understand what to expect.

Step 1: Assess Readiness and Select a Payments Partner

Begin by mapping your current stack and identifying what capabilities you already have, and what you’ll need to outsource.

Then, choose a partner that matches your scale, geographic reach, and compliance requirements.

Don’t just evaluate their documentation; assess their responsiveness, sandbox tools, and how they handle exceptions. A payment outage at 2 a.m. is when you’ll really see the value of the relationship.

Step 2: Define the Payment Flow and Monetization Model

Decide how money will move through your platform.

Will users pay each other, or are you collecting on their behalf? Will you charge platform fees or markups?

These decisions define your flow of funds diagram, which partners and auditors will expect to see.

It also determines your monetization strategy, whether you earn a percentage of volume, a fixed markup, or tiered fees based on user activity.

Step 3: Integrate via APIs and SDKs

Once the flow is defined, you’ll integrate your provider’s APIs or SDKs.

Focus on modularity: separate the core payment logic from your app logic so you can swap providers or expand later without major refactoring.

If you’re building in-house or customizing heavily, prioritize robust webhooks for event handling (e.g., payment succeeded, payout delayed, dispute opened).

They’ll save you countless support tickets later.

Step 4: Test, Certify, and Launch

Before you go live, most providers require certification testing to confirm your integration handles edge cases correctly, refunds, partial captures, timeouts, and chargebacks.

Run these tests rigorously. Simulate real-world transaction volumes, latency spikes, and user behavior.

Once you’ve passed, roll out gradually with a pilot group before scaling to full production.

Common Integration Challenges and How to Solve Them

Most SaaS teams underestimate the complexity of reconciliation, user onboarding, and cross-system data sync. Payment data has to flow cleanly between your product, your provider, and your accounting systems.

Using event-driven architecture or a message queue helps prevent data drift and ensures payouts always match ledger records.

Another frequent pain point is UX consistency, especially if the payment provider’s hosted components don’t match your app’s design language.

Building lightweight custom wrappers around SDKs can keep the experience cohesive without sacrificing compliance.

PayFac-as-a-Service and BaaS Options for SaaS

For most SaaS teams, becoming a registered PayFac or licensed financial entity is overkill. That’s where PayFac-as-a-Service and Banking-as-a-Service (BaaS) platforms come in.

What Is PayFac-as-a-Service?

PayFac-as-a-Service providers offer a turnkey way to embed payments without taking on the full regulatory or operational load of becoming a PayFac yourself.

You still control the user experience, but your provider manages sub-merchant onboarding, compliance, and fund flows in the background.

Essentially, you get the benefits of a PayFac model, brand control, monetization potential, and faster onboarding without the licensing burden.

Key Features and Advantages of Building In-House

Building your own PayFac infrastructure is a multi-year project.

You’d need legal counsel, compliance officers, risk teams, and banking relationships before processing a single transaction.

PayFac-as-a-Service abstracts all of that. You integrate their APIs and instantly gain access to payment rails, KYC flows, and settlement systems that have already been audited and approved.

This approach is especially powerful for startups and mid-market SaaS companies that want to monetize payments quickly without overextending.

Reducing Compliance Overhead and Time-to-Market

By leaning on a compliant provider, you can launch faster and focus on what differentiates your product, not navigating regulatory paperwork.

We often help SaaS founders choose between direct and PayFac-as-a-Service models by modeling trade-offs in time-to-market and long-term margin. And then we provide the experts for whichever decision they make.

The right approach depends on how fast you need to ship and how much compliance risk you can realistically absorb.

Choosing the Right Embedded Payments Provider

The wrong choice of provider can lock you into pricing, regions, and compliance frameworks that limit your growth.

Evaluation Criteria (Scalability, Compliance, Global Reach)

When evaluating providers, look beyond feature checklists. Assess their:

- Scalability: Can their infrastructure handle your projected transaction volume and concurrency?

- Compliance maturity: Do they support KYC/AML and PCI DSS at the level your business requires?

- Geographic coverage: Will they help you expand into new markets, currencies, and local payment methods?

- Support and transparency: How do they handle disputes, downtimes, or roadmap updates?

Request references from similar SaaS platforms. The best insights come from teams already operating at your scale.

Comparing Stripe, Adyen, Square, and Marqeta

Each major provider has a distinct philosophy:

- Stripe emphasizes developer experience and rapid integration. Ideal for startups prioritizing flexibility and speed.

- Adyen focuses on enterprise-grade stability, compliance, and global reach. Best for high-volume or multinational SaaS.

- Square serves businesses with strong offline or hybrid operations and offers accessible APIs for smaller merchants.

- Marqeta shines in card issuing and embedded finance infrastructure, enabling payouts and expense management solutions.

The choice depends on your target market and technical maturity, not just pricing.

If you’re planning to expand internationally or layer additional financial features later, consider how each platform’s roadmap aligns with yours.

When to Build vs. Partner vs. White-Label

In general:

- Build if payments are central to your differentiation and you have in-house expertise.

- Partner if you want to share responsibility with a fintech enabler and move faster.

- White-label if you want control over branding without managing licenses or risk.

For many SaaS companies, a hybrid approach works best: start with a PayFac-as-a-Service partner, then gradually bring parts of the stack in-house as you scale.

The Future of Embedded Finance in SaaS

The embedded finance landscape is evolving fast. What’s now an advantage will soon be table stakes for SaaS platforms competing on user experience and customer lifetime value.

Trends Defining “SaaS 2.0”: Monetized Infrastructure

SaaS 2.0 is defined by platforms that facilitate economic activity. Payment volume, credit issuance, and transaction data are becoming core performance metrics alongside ARR and churn.

This shift rewards platforms that embed finance early and treat it as a long-term strategy, not a late-stage add-on.

The Role of Fintech and APIs in Scaling SaaS Platforms

APIs are the connective tissue between fintech and SaaS.

As financial infrastructure becomes more modular, smaller teams can launch sophisticated payment experiences without enterprise budgets.

For developers, this means faster iteration. For product leaders, it means new levers for retention and revenue.

AI-Driven Risk Assessment and Real-Time Payment Optimization

AI is beginning to reshape how platforms detect fraud, assess merchant risk, and optimize transaction routing.

Instead of static rules, systems now learn from live data, adjusting authorization paths to reduce declines and false positives.

Expect to see this technology built into more provider APIs, offering smarter automation with less manual tuning.

Global Expansion and Cross-Border Embedded Payments

Cross-border payments remain one of the hardest challenges in fintech. Local regulations, currency conversions, and differing fraud patterns add layers of complexity.

However, new networks and partnerships, particularly in Europe, Asia, and LATAM, are closing these gaps.

SaaS companies with global ambitions should plan for multi-currency infrastructure early, even if they start domestically.

Building an Ecosystem Around Embedded Payments

Once your payment layer is live, the next step is to expand its value.

The strongest SaaS companies treat embedded payments not as a feature but as a foundation for a broader financial ecosystem.

Partnering With Banks, Fintechs, and Developers

No single company owns embedded finance.

Banks bring regulatory depth, fintechs bring agility, and developers bring innovation.

Collaborating across these groups lets you extend your platform’s reach, offering users a suite of connected financial services rather than standalone tools.

Creating Value Beyond Payments: Credit, Payouts, and Cards

Once payments are established, the natural next steps are credit, debit, payout automation, and card issuing.

These expand your role in your customers’ financial workflows and unlock new revenue streams.

For instance, a SaaS invoicing app might start by processing payments, then introduce short-term credit lines or debit card functionality to help clients manage cash flow. Each layer strengthens user loyalty and business defensibility.

Positioning Your SaaS as a Financial Platform

Over time, your product can evolve from software to infrastructure, enabling transactions as well as becoming the system of record for your customers’ revenue and expenses.

That’s the long game of embedded finance: transforming SaaS products into ecosystems that power real economic movement.

We see this transition in our long-term partnerships often: SaaS companies realizing that by owning part of the financial layer, they’re no longer just serving customers; they’re participating in their success.

Conclusion

Embedded payments are no longer optional for SaaS platforms that want to grow sustainably. They deepen engagement, diversify revenue, and build competitive moats that pure software can’t match.

But getting there requires thoughtful sequencing, choosing the right model, the right partners, and the right timing for your business.

If you approach embedded finance as a strategic capability rather than a feature sprint, you can build something far more powerful: a SaaS product that becomes the financial engine of its ecosystem.

Regardless of which option you decide is best for you, having experts familiar with the fintech industry and all the nuances that come along with it is critical. At Trio, we have a host of those experts on our team already.

We provide you with a handful of portfolios, with all the developers guaranteed to be right for the job.

Get in touch to learn more or start your hiring journey!

FAQs

What are embedded payments in SaaS?

Embedded payments in SaaS are built-in payment features that let users send or receive money directly within your software, without using an external processor.

How do embedded payments generate revenue for SaaS platforms?

Embedded payments generate revenue through take rates or shared processing fees on each transaction your platform facilitates.

What is the difference between a PayFac and PayFac-as-a-Service?

A PayFac handles licensing and compliance directly, while PayFac-as-a-Service lets you offer the same experience under a provider’s regulated framework.