Cross-border payments keep the global economy moving. They fund trade, support families through remittances, and connect digital marketplaces that span continents.

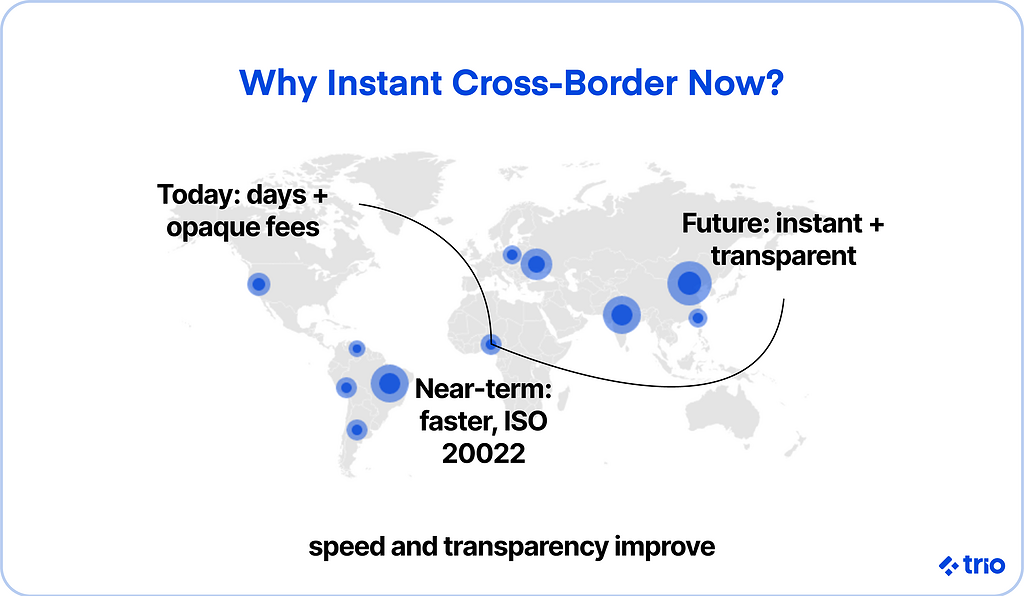

But despite the trillions that move each year, the system behind those transactions still feels slow, expensive, and oddly opaque.

Transfers can take days to settle. Fees are often unclear. And liquidity, arguably the lifeblood of finance, can get stuck in the wrong place at the wrong time.

In an era when people can message each other instantly across the world, it feels strange that money doesn’t move with the same ease.

That gap between expectation and reality has become hard to ignore.

Banks, fintechs, and central banks are now working to close it. The focus is on instant payment systems, better data standards, and smarter liquidity management.

Progress is uneven, but the direction is clear: the world is trying to make cross-border transactions faster, cheaper, and far more transparent.

There are many opportunities you can take advantage of as global payment service providers seek improvement. Let’s go through everything you need to know about instant digital payments and international trade.

Our developers here at Trio help people take advantage of those opportunities by providing all the skills you need from the get-go.

Not only can you hire our developers in as little as a few days, but you are guaranteed that they have the fintech experience to contribute immediately.

The State of Cross-Border Payments

Cross-border payments sit at the center of modern finance, yet the machinery that supports them still carries the weight of decades-old infrastructure.

Definition of Cross-Border Payments

A cross-border payment happens whenever the payer and the recipient are based in different countries.

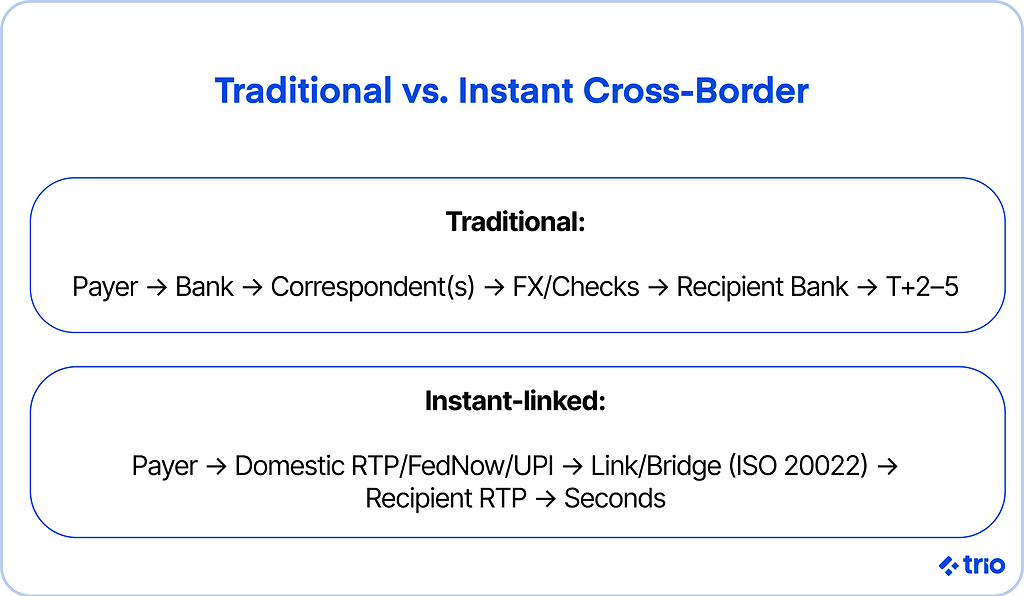

Behind the scenes, a web of payment systems, financial institutions, and correspondent banks handles the routing, currency exchange, and compliance checks that make the transfer possible.

Importance in Global Trade, Remittances, and Financial Inclusion

These payments aren’t just for corporations and banks. They matter for small exporters, families sending remittances, and even gig workers paid through global platforms.

The World Bank estimates that personal remittances reached about $860 billion in 2023. We can only assume that number has grown.

Yet the average fee for sending money internationally is around 6.49 percent, a reminder that access and financial inclusion remain uneven.

Market Size and Growth Outlook

Total cross-border payment flows reached roughly $156 trillion in 2023.

Growth is coming from B2B, e-commerce, and SME trade, especially across Asia and Africa.

As more markets adopt ISO 20022 messaging and real-time payment rails, some of the old frictions may start to fade, but only if the different systems can actually talk to each other.

The Rise of Instant Payments in Cross-Border Transactions

Speed has always been the weak link in international transfers.

Domestic payments are often instant, while international ones can take several days.

What Are Instant Payments?

Instant payments, sometimes called real-time payments, allow money to move and settle within seconds, all day, every day.

Extending that experience across borders is harder than it sounds.

Different rules, currencies, and time zones can complicate things.

Benefits of Cross-Border Instant Payments

Our experience working with fintechs that build and scale payment infrastructure has shown how real-time systems reshape the way liquidity is handled, particularly in regulated markets where compliance and uptime both matter.

For businesses, faster settlement can free up working capital and smooth out cash flow.

For individuals, it means remittances arrive when they’re needed most.

And for financial institutions, instant payments make it possible to reconcile transactions in real time, lowering operational risk.

Challenges in Implementing Instant Payments

Interoperability is the sticking point. Every country runs its own systems and enforces its own rules.

The G20 roadmap led by the Financial Stability Board (FSB) and the Committee on Payments and Market Infrastructures (CPMI) under the Bank for International Settlements aims to set measurable improvements in speed, cost, and transparency by 2027.

But coordination across dozens of regulators and systems rarely moves quickly.

Key Trends Shaping the Cross-Border Payments Landscape

The cross-border payments market is evolving, but not in a single direction.

Technology, policy, and private-sector innovation are pulling at it from different angles.

Trend 1: Faster Payments and the Modernization of Payment Rails

Governments and central banks are upgrading the pipes.

Europe’s TARGET Instant Payment Settlement (TIPS) and the U.S. FedNow network mark real progress toward faster cross-border payments.

The adoption of ISO 20022 may finally help align the data flowing between systems, though full global compatibility still feels a few years away.

Trend 2: AI, Data, and Automation in Payments Processing

Automation is quietly reducing friction.

Financial institutions are using AI for compliance checks, fraud detection, and reconciliation.

The change may sound technical, but it affects speed and reliability at scale. Payments that once required manual review now clear in seconds, with fewer errors.

Trend 3: Blockchain, Digital Assets, and Tokenized Liquidity

Several central banks are exploring central bank digital currencies (CBDCs) or tokenized deposits to improve settlement efficiency.

Projects like BIS’s mBridge appear to demonstrate how tokenized liquidity could streamline wholesale cross-border transactions, though questions around governance and privacy remain open.

Trend 4: Embedded Finance and Emerging Retail Corridors

Recently, we’ve seen how embedded payment infrastructure changes the economics of scaling across markets. It’s less about launching new rails and more about connecting the right ones.

In fast-growing regions, embedded payment solutions are enabling SMEs to trade across borders with minimal friction.

An exporter in Nairobi, for instance, can receive payment from a buyer in Singapore using API-based services that bypass older networks altogether.

Trend 5: Cybersecurity, Fraud Prevention, and Resiliency

Speed without security is a bad trade-off.

As instant systems scale, they invite new forms of attack.

The industry is responding with real-time fraud analytics and stronger authentication protocols, but full resilience requires ongoing cooperation between providers, regulators, and users.

Banking and Liquidity Management in Cross-Border Transactions

The technology might be new, but the core challenge hasn’t changed: how to keep money flowing across borders without locking up too much capital.

The Role of Banks and Correspondent Networks

Correspondent banking remains the backbone of global transfers.

These relationships allow banks to settle in multiple currencies and jurisdictions.

Still, the network has been shrinking, down more than 22 percent between 2011 and 2019, according to the BIS, as compliance costs rise.

Liquidity Management for Real-Time Cross-Border Flows

Real-time settlement forces a rethink of liquidity management.

Banks are investing in automated tools that forecast balances and trigger intraday funding.

Systems such as SEPA Instant Credit and TIPS show how shared liquidity pools can maintain speed without excessive pre-funding.

Central Bank Initiatives and CBDC Pilots

We’ve already mentioned how many central banks are now testing CBDCs for cross-border use.

Several major central banks, including those in Europe, the UK, and Singapore, have explored how interoperable CBDCs might enable more direct settlement between institutions.

Still, it’s early. Technical and legal hurdles continue to slow broad adoption.

How Fintech Partnerships Are Transforming Liquidity Models

Fintechs and banks are experimenting with joint liquidity tools, API-driven dashboards, automated sweeps, and cross-currency matching engines.

These collaborations are reshaping the economics of settlement, though they depend heavily on shared standards and trust.

Regional Perspectives on Cross-Border Payments

No two regions are modernizing in quite the same way.

Regulation, market maturity, and infrastructure all influence what instant actually means.

Europe: SEPA Instant and ECB Initiatives

Europe’s Single Euro Payments Area (SEPA) and TARGET Instant Payment Settlement programs have created a unified space for instant payments in euros.

The European Central Bank continues to push for full adoption, but smaller institutions are still catching up.

United States: FedNow, RTP, and Cross-Border Expansion

The launch of FedNow in 2023 added momentum to U.S. modernization efforts.

Combined with The Clearing House’s RTP network, it could open the door to international linkages that make international payment processing more predictable.

Asia-Pacific: Singapore, India, and China as Innovation Hubs

Singapore’s PayNow-FAST linkage with India’s UPI lets users send money directly between accounts in seconds.

China’s cross-border e-CNY pilots also point toward practical CBDC use.

For now, Asia seems to be setting the pace.

Latin America and Africa: Mobile-First Corridors and Remittance Growth

In Latin America and Africa, mobile-first ecosystems like Pix and M-Pesa are expanding retail cross-border payments.

These systems may not always meet the technical definition of instant, but they’ve drastically reduced remittance costs and increased access for unbanked users.

Challenges and Risks in Cross-Border Payments

Progress hasn’t removed complexity.

In some ways, faster systems expose how fragmented the global regulatory landscape still is.

Regulatory and Compliance Hurdles

Licensing, AML rules, and data protection laws differ from country to country. That patchwork makes scaling cross-border services slow and expensive.

From what we’ve seen, it’s safe to say that global alignment is unlikely for a while longer, but there’s growing pressure for baseline standards that at least make compliance less redundant.

Anti-Money Laundering and Counter-Terrorism Financing Obligations

Stronger oversight remains non-negotiable. Yet stricter controls can delay legitimate transfers.

Shared KYC databases or digital ID frameworks might help, though privacy concerns often limit how much information can actually be exchanged.

Transparency Issues and Hidden Fees

Hidden FX spreads and unclear charges still frustrate users.

Initiatives from the Financial Stability Board and the Bank for International Settlements focus on promoting transparent cross-border payments, but the market’s incentive structure, where intermediaries profit from opacity, makes reform slow.

The Decline of Correspondent Banking Relationships

Fewer correspondent banks mean fewer corridors.

Small economies are hit hardest, losing access to affordable settlement routes.

Restoring coverage may depend on shared digital infrastructure rather than rebuilding old bilateral relationships.

The Future of Cross-Border Payments

The next decade may see the boundaries between domestic and international payments blur entirely.

The Convergence of Instant Payments, CBDCs, and Blockchain

CBDC projects and blockchain-based settlement layers are starting to overlap.

If these systems can connect reliably, cross-border payments could clear in seconds, not days.

That said, interoperability is harder to achieve than to promise, and it may take years before pilots turn into production networks.

The Impact of Open Banking and Interoperability Standards

Open banking APIs are creating new pathways for payments.

Combined with ISO 20022 data, they allow financial institutionsto plug directly into each other’s systems rather than rely on messaging chains.

Early results suggest fewer errors and fewer intermediaries.

How Retail Payment Trends Are Reshaping Cross-Border Adoption

Consumer behavior is pushing the industry forward.

Shoppers expect seamless checkouts and instant refunds.

Businesses that can’t deliver that level of experience across borders risk losing trust fast.

Predictions: Faster, Cheaper, and More Inclusive

If current projects stay on track, we can only assume that global cross-border payments will likely become faster, cheaper, and more inclusive by the end of the decade.

But technology alone won’t guarantee fairness or access.

Policy choices, interoperability, and governance will decide whether the benefits reach everyone, or just the most profitable corridors.

Strategic Recommendations

Different players in the ecosystem face very different challenges, but a few principles hold across the board.

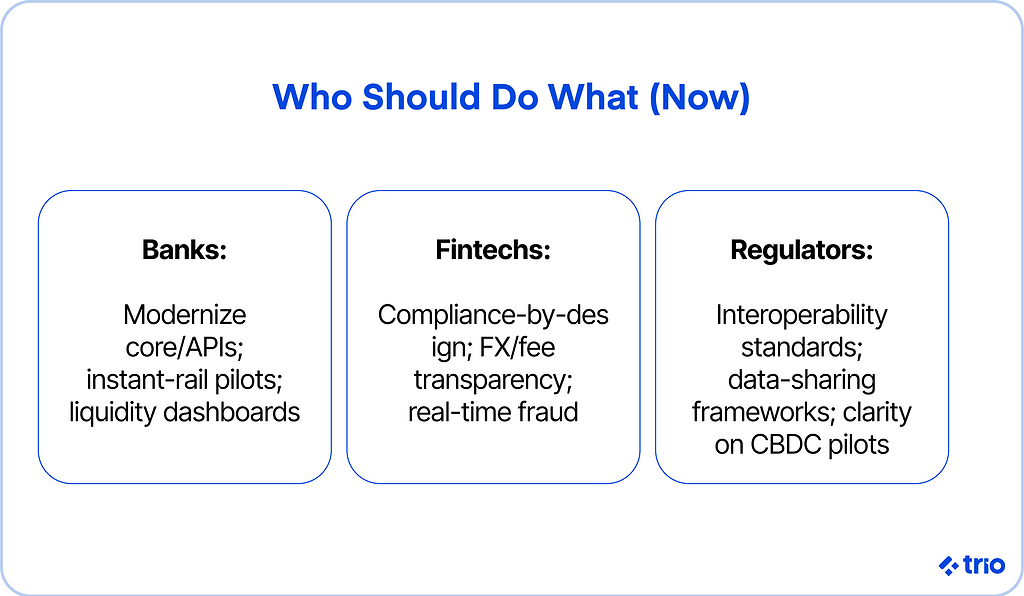

For Banks: Modernize Infrastructure and Embrace Partnerships

Banks need to keep modernizing legacy systems and adopt API connectivity where possible.

Partnering with fintechs often shortens the path to efficient cross-border payments and gives access to faster innovation cycles.

For Fintechs: Leverage Compliance and Liquidity Innovation

Fintechs that understand regulation as well as code will scale faster.

Tools that improve liquidity visibility and automate compliance can turn what used to be a cost center into a competitive edge.

Consider what you can provide to others, but also what others are already providing that you may be able to use in your own products.

For Regulators: Foster Interoperability and Transparency

Collaboration between regulators is improving, but gaps remain.

Shared data frameworks and consistent payment systems standards could enhance cross-border payments without compromising national oversight.

The world needs to adapt to changing risks, so regulators are going to need to be quick to adapt, and communication could make that a lot easier on a global scale.

Conclusion

The cross-border payments market is changing direction, but the transition will take time.

Systems built for a slower world are gradually being replaced with infrastructure that values immediacy and clarity.

Technology can solve much of the problem; alignment between banks, fintechs, and central banks will have to do the rest.

The promise of instant cross-border payments involves both trust and speed. A future where money moves as freely as information will depend on thoughtful design and credible execution.

If your fintech team is building that future, success will come from marrying ambition with precision and speed with compliance.

That’s where expertise in both technology and finance matters most. Our developers have the niche experience required to help teams build financial systems that move as quickly as the markets they serve.

To hire fintech developers with Trio, get in touch!

FAQs

What are cross-border payments?

Cross-border payments are financial transactions where the payer and recipient are in different countries, typically involving multiple banks, currencies, and regulatory systems.

Why are instant cross-border payments important?

Instant cross-border payments are important because they reduce settlement time from days to seconds, improving liquidity, transparency, and user experience.

What challenges affect cross-border payment efficiency?

Challenges include inconsistent regulations, limited interoperability between systems, high fees, and the decline of correspondent banking relationships.

How do central bank digital currencies (CBDCs) impact cross-border payments?

CBDCs could streamline international settlement by reducing intermediaries and improving the transparency and speed of fund transfers.