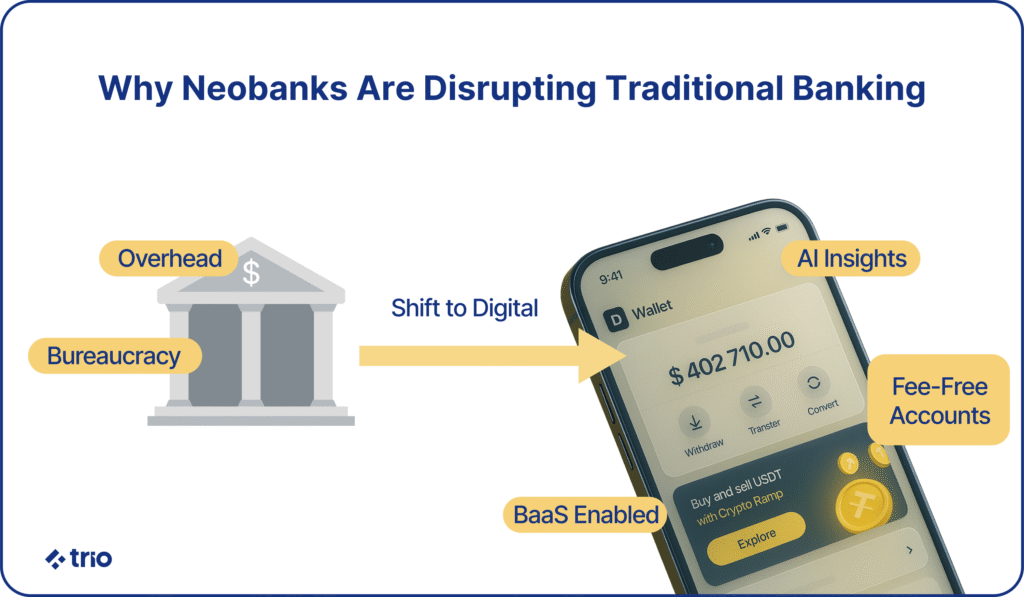

Neobanks (sometimes called Neo banks), with their incredibly low overheads and a focus on user experience, are changing the way banks all over the world function. By 2028, it is estimated that almost 386.35 million people will be making use of neobanks instead of traditional banking services.

Why are neobanks so popular? Since they only have a mobile app and avoid the costs of traditional infrastructure, they are able to offer fee-free accounts and make use of the latest innovations, including AI and machine learning to provide personalized insight, and tools like blockchain and DeFi (decentralized finance) to optimize payments.

So, how does neobank app development work? Each case will be different, but there are some steps you can follow as a general structure:

- Step 1: Market & Competitor Research

- Step 2: Define Your Value Proposition and Vision

- Step 3: Choose the Right Business Model

- Step 4: Design User-Centered UX/UI

- Step 5: Choose Tech Stack & Architecture

- Step 6: Partner With a Neobank App Development Company

- Step 7: Build an MVP with Essential Neobank App Features

- Step 8: Ensure Regulatory Compliance

- Step 9: Test, Scale & Maintain

In this article, we’ll cover all of these steps in detail, as well as anything else you need to know about how to build a neobank.

If you are interested in getting your software development started or perhaps expanding your existing team, Trio can assist you. Our developers have domain expertise, so they are able to code fast and reliably, creating banking apps that work well in record time, while integrating seamlessly with your existing development team.

But first, let’s make sure you have all the information you need.

What Is a Neobank?

A neobank is another term for a digital-only bank. There are no physical locations, no traditional infrastructure, and no associated costs.

This means neobanks are more adaptable, and they are able to offer financial services at a reduced cost or with alternative monetization methods. They are also able to focus on rapid deployment by avoiding the bureaucracy that’s associated with large, traditional institutions.

Usually, these banks will operate through a mixture of web-based and mobile neobanking apps. Since these are the only ways that clients interact with Neobank and its services, the focus is on making these banking solutions as efficient and user-friendly as possible.

In some rare cases, neobanks don’t operate independently, but instead form partnerships with institutions that already have banking licenses in the form of Banking-as-a-Service (BaaS) platforms.

How Does a Neobank App Work?

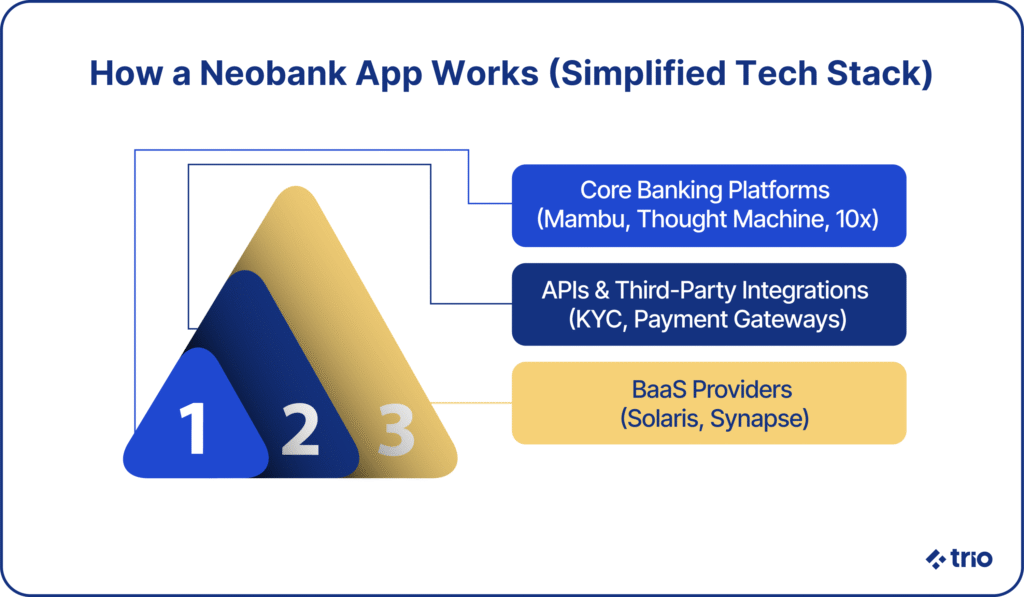

Neobanks rely on cutting-edge technology that powers sophisticated backend and frontend infrastructure. This technology can be split into four categories: core banking systems, integrations, BaaS, and embedded finance.

You can think of core banking systems as the foundations of neobank solutions. They cover all of the basics that define usual banking software, like deposits, withdrawals, interest, and anything else. Mambu, Thought Machine, and 10x Banking are all quite popular at the moment, thanks to their scalability and cloud-native nature.

APIs, or application programming interfaces, let these core systems communicate through third-party integrations. This third-party software could be anything, but some popular examples you may encounter when you develop a neobank app include KYC/AML identity verifiers, payment gateways, credit bureaus, utility company aggregators, and even wealth management tools.

By using third-party software, you are able to save valuable time and money, focusing your development efforts on things like user experience, while knowing that the experts cover certain features of your app.

Banking-as-a-Service, or BaaS, works in a similar fashion. Instead of going through all the regularity and infrastructural requirements to get licensed, you use a provider like Solaris, Synapse, or Railsr, which takes care of everything from account creation and card issuing to compliance and transaction processing.

While BaaS might not be the best option for everyone, it’s quite attractive if you are a startup trying to build a neobank from scratch, and you just want to focus on your MVP’s web and mobile app development without worrying too much about regulatory compliance.

Embedded finance capabilities are also useful in these situations, as they let you integrate non-financial apps into your platform to expand your offerings.

Neobank vs Digital Bank: Are They the Same?

While you can use the terms Neobank and digital bank interchangeably most of the time, there are some differences you should know about.

First, digital banks can sometimes refer to the digital portions of traditional banks. These digital portions will face the same compliance restrictions and issues as the institution they belong to.

Neobanks, on the other hand, are entirely independent from traditional banks and are usually startups or scaleups. They still need banking licences, which they acquire on their own or through BaaS, but they have incredible freedom and flexibility.

Ten Examples of Successful Neobanks

Some of the most successful examples of neobanks include:

- Monzo (UK)

- N26 (EU)

- Chime (US)

- TymeBank (South Africa)

- Judo Bank (Australia)

- Revolut (UK/EU)

- Starling Bank (UK)

- NuBank (Brazil)

- Varo Bank (US)

- Ziglu (UK)

Overall, the global neobanking market was valued at $143.29 billion in 2024, and it’s only expected to keep growing moving forward.

Why Create a Neobank?

There are many reasons you should create a neobank app. First, there are market trends and growth projections, then there are the competitive advantages offered by neobanks, and finally, there’s the target audience’s demand.

It’s important to note that many of these neobanks have been extraordinarily successful because they have been able to offer banking to previously underserved populations or populations that have benefited from the reduced fees and embedded features.

As the market becomes more saturated in the future, we predict it will be more difficult to promote the success of your neobank without careful planning. Now is the ideal time to get started with your robust neobank app development to make sure you get your foot in the door and take advantage of market conditions.

The neobank market as a whole is projected to grow to more than $2 trillion by 2030, with a CAGR (compound annual growth rate) of 54.8%. Why not ride that wave?

You’ll be able to utilize the competitive advantage of neobanks like their agility, cost-efficiency, personalization, and overall user experience to jumpstart your projects, reaching audiences like freelancers and SMEs who need unique integrations, younger clients who value design, and the many underbanked who still exist.

Business Models for Neobank Applications

Making money is critical when you start a neobank. However, trying to minimize costs for the user can be difficult. Some of the most common ways neobanks make money include transaction fees, interest, interchange fees, subscriptions, collaborations, or a mixture of several of these.

Transaction-Based Revenue Model

Transaction-based revenue models are fairly intuitive. Usually, the neobank earns some amount with every transaction that occurs.

This includes typical transactions you might expect someone to make utilizing their mobile banking app, such as peer-to-peer transfers, withdrawals, international remittances, and currency conversions.

Withdrawals are a particularly popular transaction to add some sort of fee to. This is likely a result of additional costs on behalf of the neobank to the ATM vendor.

In some cases, neobanks offer several types of accounts, with those that are more expensive having set fees and transaction-based revenue being reserved for the fee-free or low-fee accounts.

Credit & Lending Model

Credit lines, personal loans, and overdrafts are not usually the primary focus when building a neobank app from scratch, but they can add a highly profitable income model.

Profit here will be in the form of interest margins and late fees. It is particularly effective when you use smart underwriting to gather alternative data, allowing you to make accurate creditworthiness estimates on typical customers and even conduct risk assessments on people without traditional credit scores.

Interchange Fees

If the bank that issues a credit or debit card and the merchant are not the same, the merchant may pay a small fee.

Usually, this is very small, but it may scale depending on the size of the user base.

Neobanks often use these schemes to create free accounts if they issue branded cards like Visa or Mastercard.

Subscription Model

The simplest way to guarantee a consistent income is a subscription plan. Most traditional banks have some sort of monthly or annual fee for their services. While you might not want to keep your basic services free, charging varied subscriptions to give users access to additional features offsets the additional cost their integration or development requires.

It also allows you to stand out amongst other fintech companies that might not offer those services at all.

Affiliate, Partner, and Ecosystem Revenue Models

We’ve already discussed how the best neobank apps often integrate third-party services to ensure they are getting the best when it comes to insurance, wealth management, or even features like travel booking tools.

In these cases, there will be an exchange of funds.

The neobank might earn some revenue in the form of a referral commission when users utilize the feature, but they may also have to pay to gain access to the feature in some cases, or at the very least pay to have it integrated optimally.

If you are looking for developers with expertise in integration who are familiar with the specific APIs and third-party services that are so often used in the fintech app development sector, Trio can provide them. Our focus on hiring developers with industry expertise and only taking on the top 1% of applicants means you’ll be in skilled hands.

Neobank App Development Process: Step-by-Step

Now that you understand what a successful neobank app might look like, let’s go over the steps you should follow when developing a neobank from scratch.

Step 1: Market & Competitor Research

Before you can start with the software development process, you need to evaluate the market around you.

Consider what users want from a new app, how you will stand out from your competitors, any regulations you will face, and what some of the top neobank app development companies have done to ensure their success.

You should also consider your monetization strategies, the overall user experience, the cost of all the features you may want, and what you would be willing to put off until later if it comes to it.

In many cases, getting user feedback from early mockups of your app is very helpful. At Trio, we create a skeleton, drawing out the app architecture before we move into development. This allows you to make any changes with minimal cost.

Step 2: Define Your Value Proposition and Vision

Your value proposition and vision go hand in hand with your target market. If you are serving younger clients, your focus may be on user experience and subscription-free banking. If you are serving SMEs, perhaps your value will lie in multi-currency accounts.

It is important to decide early on this value proposition so that all your developers and non-technical team members are on the same page and can collaborate on issues like which features are the most important.

Step 3: Choose the Right Business Model

Finalize your choice for anything from one monetization strategy to a few. Your decision will be based on your market research as well as your target market and unique value proposition.

For example, if you are targeting digital nomads, it will be worthwhile to monetize through subscription as well as interchange fees. You may even benefit from travel-related integrations.

If you are targeting teenagers who want a cost-effective option for their first account, neither of these options is likely to prove profitable.

Step 4: Design User-Centered UX/UI

Once all your details are cemented, including the features you are likely to include, you can finalize your user interface. In the world of digital banking, where traditional firms often have clunky interfaces, this can make all the difference.

A user interface that looks professional and works well also markets your brand in a positive light. In the world of finance and fintech development, reputation plays a massive role in client retention.

Step 5: Choose Tech Stack & Architecture

You need to decide on the tech stack that you are going to use so that you can get the right developers on your team. Your primary considerations should include security, scalability, and development speed. While there is no one-size-fits-all answer for app development, there are some options that are particularly popular for the neobank development process.

- Frontend Technologies: React Native, Flutter, and Swift.

- Backend Technologies: Node.js, Django, and Golang.

- Cloud Infrastructure and Hosting: AWS, Azure, and Google Cloud

- Core Banking Platforms: Mambu, Thought Machine, or Temenos

- API and Microservices Architecture: Loosely coupled services are popular for flexibility and rapid iterations.

- Security Protocols and Data Encryption: Industry standards include AES-256 encryption, tokenization, and secure key management

Step 6: Partner With a Neobank App Development Company

You don’t want to choose the wrong tech partner. This not only leads to lost money because you have to develop some features twice, but it can also lead to a loss of your overall brand image.

Look for a company that has experience developing the kind of app that you are trying to create. Along with development expertise, they will be able to navigate the heavy regulations that apply to everything in the finance sector.

Trio ensures fast onboarding of engineers onto your team. We ensure these engineers already understand compliance, infrastructure, and everything else that they need to know so that you experience no delays and minimal hiring risk.

Step 7: Build an MVP with Essential Neobank App Features

There are a couple of must-have features you should consider for your neobank app. These include:

- Seamless Account Onboarding

- KYC/AML Integration

- Digital Wallet & Card Issuance

- P2P and Cross-Border Transfers

- Budgeting and Expense Tracking

- Real-Time Notifications

- Gamification & Loyalty Systems

- Chatbots & AI-Powered Support

- Fraud Detection & Risk Management

- Multi-Language, Multi-Currency Support

- Regulatory Compliance Features (PSD2, GDPR, etc.)

These features are quickly becoming expectations by users who prefer to use neobanks, rather than ‘nice-to-haves’. It is still critical to gather feedback from your unique target market, but these are generally a good place to start expanding first, once your MVP proves to be successful.

Step 8: Ensure Regulatory Compliance

As a neobank, you will need to be aware of the legal requirements of your region, as well as those in surrounding regions where users may want to use your services when traveling or where you may want to expand to in the future. These legal requirements usually require some sort of formal licensing.

You will also need to follow data protection and user privacy standards, ensuring that you do everything in your power to keep their finances and information safe.

Once you have all of this set up, you are far from finished. Ongoing audits and reporting are usually required in order to maintain licensing, and you may even be asked to provide proof of these measures, so make sure that you keep records of them.

Step 9: Test, Scale & Maintain

Once your app is on the market, you need to continuously monitor it for issues, running tests to ensure it is still secure and that any changes in third-party software are accounted for.

You can also start to scale in terms of both your user base and your offerings.

The focus should be on balancing long-term sustainability and rapid growth.

Development Costs and Pricing Breakdown

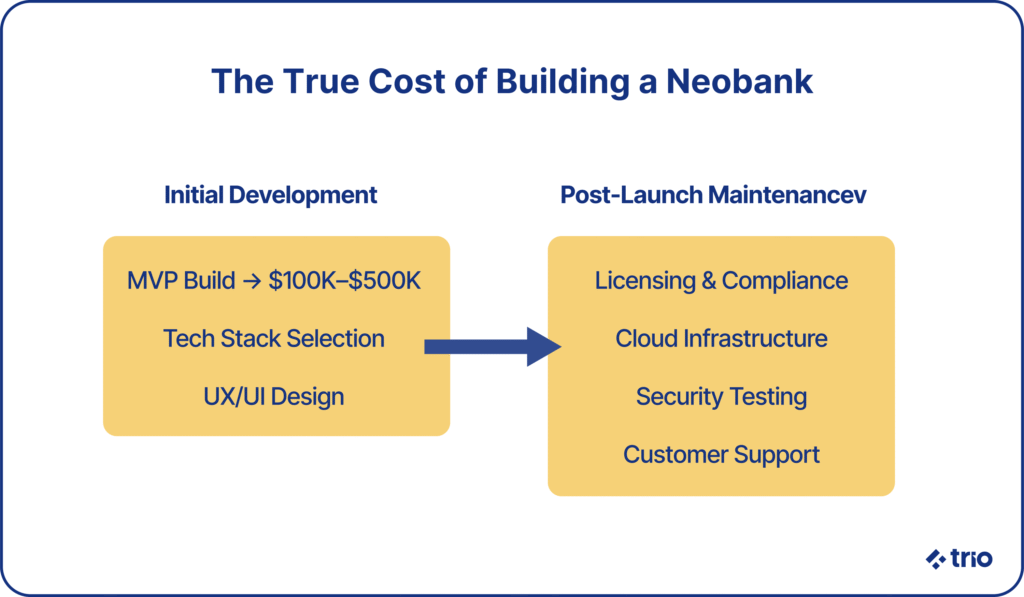

How much does all of this cost? The answer is far from simple. Cost comes in two forms: capital and time. Both should be considered thoroughly.

Custom Development Cost Factors

In terms of custom development, you get both flexibility and scalability. It is the only option we would recommend to clients who want to build a neobank or a digital bank.

However, it is far from cheap. Factors like the complexity of your features, your design, security measures, and integration requirements all play a role in the final cost.

You can expect anything from $100,000 to as high as $500,000 for a fully custom neobank MVP. At Trio, we like to utilize nearshore or offshore developers to mitigate the total cost without sacrificing overall quality.

White-Label and Modular Solutions: Pros & Cons

To further cut costs, you could invest in pre-built infrastructures. These are great in terms of lowering your overall development speed and initial costs. They are also usually accompanied by access to proven systems and compliance tools.

However, they are very limited, so unless you are willing to lock yourself into those vendors long-term, they are not a viable option. Even if you are willing to take the risk and bet on the vendor, it can be very difficult to scale or pivot.

Hidden Costs and Long-Term Budgeting

Outside of the cost of time and money that it takes to develop your app, you will probably encounter some legal and administrative fees for your regulatory filings, licensing fees, and compliance reviews.

Infrastructure is also not a one-time cost, with cloud storage, data management, and DevOps requiring ongoing payments. The same can be said for security penetration tests, audits, and vulnerability scans.

Then there’s customer support, which you want to get right from day one, and any continued maintenance or updates.

Challenges in Neobank Development

One of the best ways you can set yourself up for success when you launch your neobank is to be aware of some of the most common challenges in development and deployment, and prepare for them ahead of time.

High Competition and Differentiation

New neobanks are being created every day. Standing out requires more effort than it did several years ago. Along with a unique technical offering, you will probably need to develop a strong brand.

One of the best ways to do this is to make sure you get your unique value proposition right and niche down to offer better, more tailored services to a smaller group of people.

Partnership and Vendor Dependencies

Depending on a third party is quite normal for identity verification, payments, and compliance. However, while it makes development a lot faster, it introduces an element of risk.

If you come to depend on a vendor, your business is linked to theirs. If something happens, you will be dragged down with them. There is very little you can do to prepare for these issues, so the best course of action is to reduce your overall dependency and come up with contingency plans or alternate vendors you could switch to quickly.

Regulatory Barriers

Regulations vary from region to region, making it difficult to comply with them if you start to expand.

To complicate matters further, regulations within a single region also change relatively often. While the aim of these regulations is to keep users as safe as possible, and that responsibility cannot be denied, it does tend to make things difficult for you.

Working with regulatory experts and developers who are familiar with the regulatory landscape can prevent any serious issues.

Scaling Infrastructure

Scaling is a challenge for all cloud-based software. As you get more users, your architecture will need to adapt. Preparing for this by using microservices and containerization in the development process is critical.

Failing to do so results in massive tech debt that you need to catch up on later, and may result in complete failures when transactions spike.

If you are looking for a software development company to provide the right people for your neobanking app development, or if you want to know more about the technical requirements or the cost of your project, reach out to schedule a free consultation.

At Trio, we do not provide one-size-fits-all solutions, but create a custom plan to fit your development needs as a trusted, long-term tech partner.