Mergers and acquisitions in fintech promise scale, new markets, and technical advantages. Trends indicate that they are becoming more common, and we see no reason why that should not continue.

Yet, for late-stage companies racing toward IPO, two engineering teams in different time zones, two tech stacks with overlapping services, and two sets of compliance obligations that don’t quite match can cause significant issues.

Product roadmaps get delayed because development pipelines haven’t been harmonized. Teams often duplicate work or, worse, disagree on whose system wins.

Regulators are also starting to ask pointed questions about data flows across borders.

The acquisition, intended to accelerate growth, has instead led to rising costs and shrinking morale.

What matters most isn’t strategic alignment, but rather a deliberate effort to connect engineering priorities, operating models, and cultural norms to the business outcomes that justified the deal in the first place; these elements are all essential for synergy.

Let’s examine how fintechs can approach post-merger integration by aligning engineering teams across geographies, selecting a shared technical direction without compromising critical capabilities, and establishing accountability to ensure integration work progresses.

Done well, integration doesn’t just combine companies. It gives the merged organization a sharper edge in a market that isn’t waiting around for it to catch up.

If you need expert developers to fill temporary gaps, Trio can provide. We have a host of developers who specialize in the fintech industry and who have even been part of facilitating mergers and acquisitions in the past.

Our staff augmentation and outsourcing hiring models enable you to access the right people without the commitment of a long-term hire.

Understanding Post-Merger Integration

Before exploring how alignment works in practice, it helps to get clear on what post-merger integration actually involves, and why it so often becomes the stumbling block rather than the stepping stone.

Definition of Post-Merger Integration (PMI)

Post-merger integration (PMI) is the process of combining two organizations into a single functioning whole after an acquisition. In simple terms, it’s where the deal on paper turns into an operational reality.

The process covers everything from aligning strategy and business models to unifying systems, workflows, and, especially in fintech, compliance structures.

For engineering leaders, PMI is where they’re asked to fold one company’s services, APIs, and infrastructure into another without breaking customer trust or slowing delivery.

That may sound straightforward, but in practice it requires dozens of careful trade-offs and a willingness to rethink assumptions on both sides.

Importance of Post-Merger Integration

Integration determines whether the financial logic of a merger holds up.

Companies may promise investors millions in cost savings or faster entry into new markets, but those promises only materialize if teams actually succeed in merging their operations.

In fintech, the stakes run even higher: regulators expect continuity, customers expect instant access to their funds, and outages can quickly erode the credibility of both companies.

Key Challenges in PMI

The obstacles you need to account for in your integration strategies are plentiful. Some of the most common examples include:

- Cultural clashes: one team prizes rapid iteration, the other values tight controls; neither wants to budge.

- Cross-geography coordination: engineers in New York and Singapore struggle with a twelve-hour time gap, which slows down critical decision-making.

- Regulatory friction: customer data stored in the EU can’t legally be mirrored to U.S. servers, complicating system design.

- Technical debt: one company brings a modern cloud-native stack, while the other still relies on a monolith patched together over a decade.

Each of these can derail momentum. And while they don’t make integration impossible, they do explain why so many mergers fail to realize their expected value.

It’s often impossible to avoid these issues altogether, but having a framework to anticipate and address them directly is beneficial.

Strategic Alignment for Effective Integration

Without strategic alignment, even the most technically skilled teams can end up working at cross-purposes, burning time and goodwill instead of creating value.

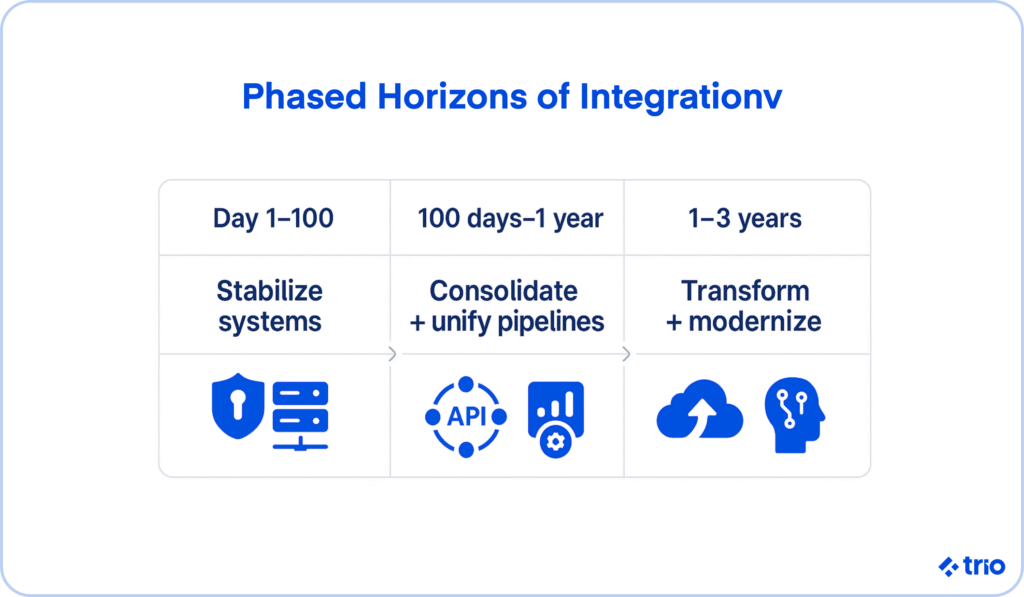

What is Strategic Alignment?

In a post-merger setting, strategic alignment is the deliberate process of ensuring that engineering priorities, business objectives, and operating models point in the same direction.

[image 3]

In fintech, that usually comes down to questions like: which payment rails will we support, which cloud vendor becomes the standard, and how will compliance requirements be met across multiple jurisdictions?

How Strategic Alignment Impacts PMI Success

When alignment is strong, integration tends to feel less chaotic.

Teams know what matters most, so trade-offs, say, whether to deprecate a legacy system or run it in parallel for another year, become easier to decide.

Product roadmaps stay credible because they’re grounded in a unified technical strategy rather than competing ones.

Metrics such as release velocity, uptime, or customer churn provide you with an honest picture of whether your integration efforts are delivering value.

Common Misalignments in Post-Merger Scenarios

Misalignment shows up in predictable ways.

Two firms may have contrasting strategies, one chasing enterprise clients, the other focused on consumer apps, making it unclear which market should guide development priorities.

Operating models can clash as well: a company built on microservices collides with one still running a single monolith, forcing engineers into messy workarounds.

Even values get in the way; a team accustomed to rapid experimentation may bristle at strict risk-management protocols. Add in poor communication or a lack of stakeholder buy-in throughout the integration, and friction quickly compounds.

Approaches to Post-Merger Integration

Knowing that alignment matters is one thing; translating it into day-to-day action is where most integrations succeed or fail.

Developing a Comprehensive PMI Strategy

You need a deliberate strategy that accounts for both business drivers and technical realities.

In fintech, we’ve noticed that means pulling engineering leadership into the conversation early, sometimes even during due diligence.

More technically, assessing APIs, data schemas, and compliance requirements before integration work begins allows you to put together a well-formed strategy that outlines which platforms will survive, where consolidation is sensible, and what temporary measures are necessary to keep customers served along the way.

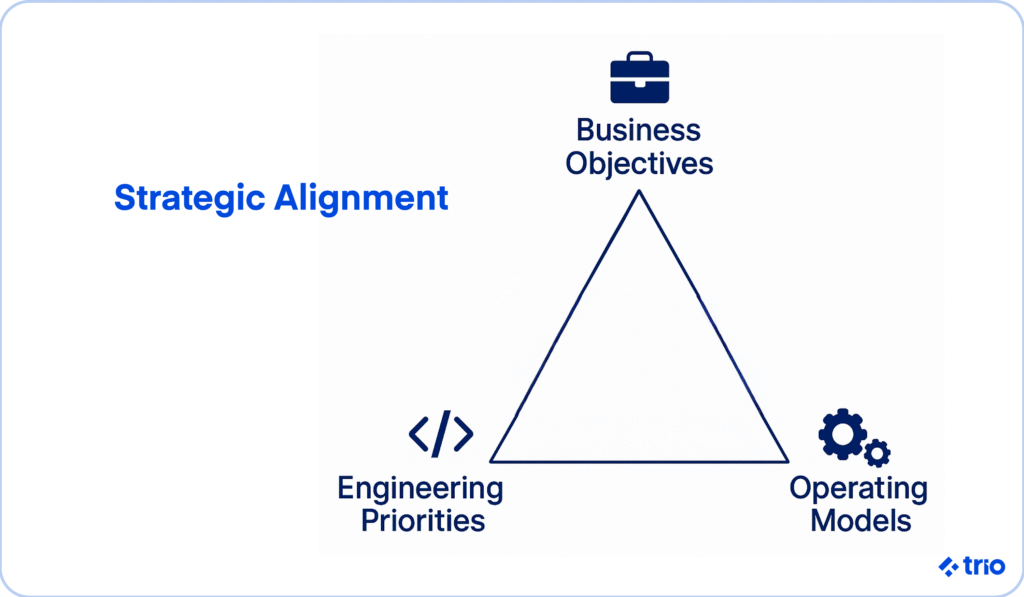

Phased Horizons of Integration

Not every decision can, or should, be made immediately. Competitors often use horizons to frame integration, and it’s a helpful way to keep expectations realistic:

- Day 1 to 100 days: Stabilize critical systems, secure sensitive data, and establish governance. In fintech, this often means ensuring transaction systems are uninterrupted and regulators are kept informed.

- 100 days to 1 year: Begin consolidating duplicated applications, unify CI/CD pipelines, and align monitoring/observability practices. It’s also the stage where you decide which services to retire versus run in parallel.

- 1 to 3 years: Transition from integration to transformation, modernizing legacy systems, addressing technical debt, and integrating automation or AI-driven monitoring to support scale.

This phased view keeps the pressure where it belongs, on the essentials first, while acknowledging that deeper technical unification between the two companies takes time.

Checklist for Post-Merger Integration

While no checklist covers every scenario, a working list helps integration teams avoid blind spots. Key items to include:

- Conduct a complete inventory of systems and services, flagging redundancies.

- Establish unified security and compliance protocols across geographies.

- Create communication plans for engineering teams in different time zones.

- Define KPIs specific to integration: uptime, deployment frequency, the number of redundant systems retired, and the number of customer-impact incidents.

- Review and adapt regularly; integration isn’t static, and priorities may shift as teams uncover unexpected challenges.

Streamlining Processes for Integration Success

Duplicated or inconsistent processes are often the most significant drain on value creation.

Fintech engineering teams may discover two separate CI/CD pipelines, redundant authentication systems, or parallel customer support tools.

The goal is not to force a one-size-fits-all model overnight but to identify which processes must be standardized quickly and which can evolve gradually.

In many cases, you will need to leverage best practices from both companies, rather than simply imposing one set, to create a stronger outcome.

Automation tools can help here, but change management still plays a crucial role; engineers need clarity on why processes are changing, not just instructions to adopt new ones.

Roles and Responsibilities in PMI

Integrations involve so many moving parts that it’s tempting for teams to assume someone else is handling the tough decisions. Clarity on roles allows companies to prevent that drift.

Who is Responsible for Post-Merger Integration?

Responsibility usually rests with an integration management office (IMO), but in fintech, engineering leadership has to sit at the center of that structure.

Without direct involvement from CTOs and senior architects, critical decisions, such as which ledger system to adopt or how to handle cross-border data, may be made without the proper technical insight.

Ideally, the IMO becomes a cross-functional body where product, compliance, engineering, and operations are all represented, each accountable for a piece of the integration.

Leadership’s Role in Strategic Alignment

Senior leaders set the direction on which systems are non-negotiable, how regulatory obligations will be met, and how teams should resolve conflicts when trade-offs arise.

A CTO might decide that one company’s core banking system is too entrenched to replace immediately, while the CEO communicates that decision clearly to avoid confusion down the line.

Leaders also shape cultural integration: a transparent, collaborative tone from the top makes it easier for distributed engineering teams to trust the process rather than resist it.

Creating Accountability in PMI Teams

Accountability involves tracking whether integration is delivering what it promised.

This involves monitoring uptime, tracking deployment frequency, and verifying that redundant applications are indeed being decommissioned.

Regular reporting to senior leadership keeps progress visible and prevents teams from quietly parking challenging problems.

In practice, accountability mechanisms can range from simple shared dashboards to more formal quarterly performance reviews tied to integration KPIs that ensure alignment with your business strategies.

Transforming Your Business Through Effective PMI

The real payoff of a successful merger comes when the merged company begins to operate as if it were always one, faster, more resilient, and more capable than either predecessor.

Long-Term Benefits of Successful Integration

As discussed, a single, unified tech stack reduces operating costs and frees up talent to focus on new products, rather than patching old systems.

Cross-border teams that once struggled with coordination can begin to share knowledge and accelerate delivery.

Perhaps the most important outcome is credibility. A successful merger or acquisition means regulators view the company as stable, customers see uninterrupted service, and investors see an organization ready for scale.

Future Trends in Post-Merger Integration

Integration will likely become more complex while also becoming more automated.

Our fintech developers are already experimenting with AI-driven observability to catch issues during migrations before they impact customers.

Cloud-native architectures make it easier to scale globally, but they also force hard decisions about vendor lock-in and cost optimization. Regulators are pushing for greater transparency, meaning integration plans may need to account for real-time reporting or auditable pipelines.

Sustainability is also creeping into the conversation, with boards asking whether consolidation can reduce carbon footprints through smarter infrastructure choices.

Conclusion

Post-merger integration is never just about blending two sets of systems or ticking off tasks on a project plan. For fintechs, where engineering choices directly shape compliance, customer trust, and speed to market, integration becomes a test of strategic discipline.

The companies that succeed treat alignment as an ongoing practice, one that links technical decisions to business objectives, balances urgency with long-term transformation, and keeps leadership visibly accountable.

If you need fintech expertise to fill any gaps or account for the intricacies of a niche field like financial technology, reach out to get in touch!

Our custom approach, placing developers based on their past experience, has led to a 97% placement success rate and enables onboarding in as little as a couple of days.

Frequently Asked Questions

Post-merger integration in fintech involves unifying systems, teams, and compliance structures to enable the merged company to operate as one without disrupting services or breaking regulations.

Strategic alignment matters because it keeps engineering and business teams focused on the same goals, reducing duplicated work and helping the merger actually deliver its promised value.

Fintech faces unique hurdles, including cross-border compliance, data residency laws, and the complexity of merging critical payment infrastructure without downtime.

Engineering integration typically spans phases: immediate stabilization in 100 days, system rationalization within a year, and deeper transformation over 1–3 years.