The more complex global finance becomes, the harder it is for organizations to keep up with compliance expectations.

Between rising transaction volumes, new sanctions lists, and evolving AML directives, businesses face a recurring question: should compliance be managed internally, or is it smarter to consider outsourcing KYC and AML?

Both paths have trade-offs.

In-house control comes with clarity and cultural alignment but demands serious resources. Outsourcing offers speed and scale but adds questions around trust and accountability.

At Trio, we’ve been connecting companies with software developers, including fintech developers who understand the best practices of AML and KYC compliance, since 2019.

In this article, we’ll draw from our experience in fintech hiring and take a practical look at both sides and what might make sense for your situation.

Understanding AML and KYC Compliance

If you’ve ever opened a bank account or signed up for an investment platform, you’ve already seen AML and KYC compliance in action.

Definition of AML (Anti-Money Laundering) Compliance

AML, short for Anti-Money Laundering, refers to the framework of laws and systems designed to stop money laundering and terrorist financing.

Financial institutions are required to run transaction monitoring, flag suspicious activity, and maintain detailed audit trails.

Good AML is about identifying unusual behavior before it becomes a headline or a regulatory fine. The tricky part is that “unusual” can look different across markets, products, and customer types.

Definition of KYC (Know Your Customer) Compliance

KYC compliance is the process of verifying who your customers really are.

It typically involves collecting identity documents, validating addresses, and running customer due diligence (CDD) before any onboarding takes place.

It’s fundamental to financial crime prevention. If you cut corners here, your whole AML program starts on shaky ground.

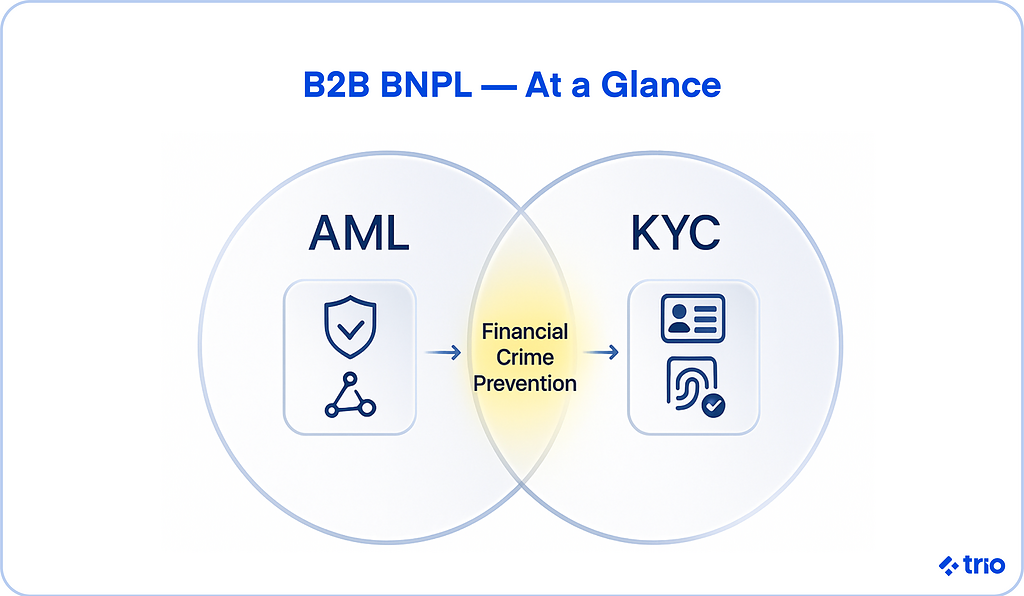

Why AML and KYC Are Foundational to Financial Crime Prevention

AML and KYC often operate together; one catches suspicious behavior, the other ensures you know who you’re dealing with.

When they’re well-aligned, they help prevent everything from basic fraud to large-scale laundering networks.

That said, compliance may look very different depending on the organization’s maturity.

Startups tend to prioritize efficiency; established banks focus more on governance and internal controls.

In either case, having an expert on your team who can streamline these processes and build them into your fintech products from the ground up can be incredibly helpful.

Regulatory Frameworks: FATF, EU AMLD, FinCEN, FCA, and MAS

Several major regulators set the tone globally.

The Financial Action Task Force (FATF) publishes international AML standards. In the EU, the AMLD directives guide national frameworks. The FCA leads regulation in the UK, while FinCEN does so in the US, and MAS in Singapore.

Each regulator defines what effective compliance means, but most now expect near real-time monitoring, clear escalation paths, and board-level accountability.

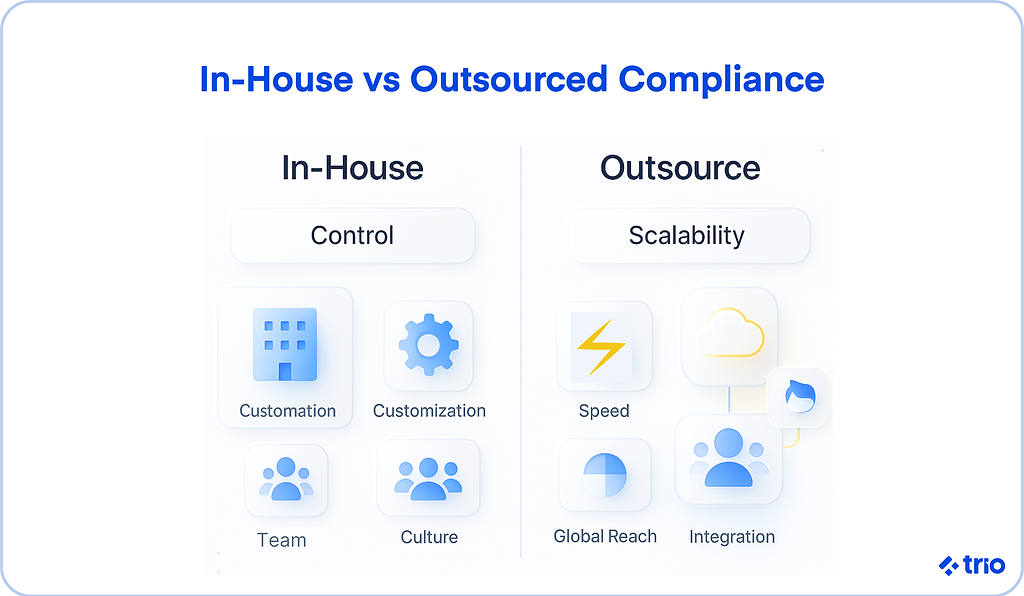

In-House vs. Outsourced KYC and AML Solutions

When compliance leaders consider their setup, they usually weigh two main options: build internally or outsource key processes.

There’s no one-size-fits-all approach, and your choice depends on cost tolerance, risk appetite, and internal expertise.

This is one of the many reasons we insist on a consultation before helping our clients hire fintech developers.

What Does In-House Compliance Involve?

Running compliance internally means developing your own policies, tech stack, and governance systems.

Building internal teams, systems, and governance involves hiring analysts, legal experts, and system engineers who understand both finance and regulation.

It’s resource-intensive but gives you full visibility into how AML alerts are generated and resolved.

Maintaining direct oversight and data ownership allows you to manage sensitive information directly. That’s a big plus if your institution handles high-risk clients or operates across strict data jurisdictions.

What Does Outsourcing Compliance Look Like?

Outsourced AML and KYC models delegate some or all of your compliance functions to specialized third-party providers or RegTech platforms.

Partnering with third-party providers or RegTech platforms often means that you get access to tools like automated screening, AI-based risk scoring, and continuous regulatory updates.

In practice, most vendors integrate with your existing systems and workflows through APIs. Your team can still oversee the process, but without building every component from scratch.

Pros and Cons of In-House Compliance

Choosing an in-house model often feels reassuring. You know who’s handling your data and how. But it can quickly turn into a heavy lift as you scale.

Advantages

An internal compliance team can fine-tune workflows for your products, adjust policies to match specific jurisdictions, and implement changes without waiting on a vendor.

These added controls and customization are invaluable when you are trying to stand out in a competitive market like fintech or when you are dealing with unique issues.

Another benefit is that, when compliance sits inside the organization, it becomes part of the company culture. Staff are more likely to see it as a shared responsibility rather than an external checkbox.

Disadvantages

Hiring and training experts, paying for software licenses, and running internal audits add up. The cost and complexity might be manageable for established banks, but it can strain smaller fintechs.

Another big challenge lies in the speed of adaptation. When regulations change, internal teams often struggle to pivot quickly, especially if legacy systems are involved.

The same can be said for scalability. If your customer base or transaction volume doubles, scaling manual reviews and due diligence checks can become a bottleneck.

Benefits and Drawbacks of Outsourcing AML & KYC

Outsourcing offers efficiency and access to technology that many organizations can’t justify building in-house.

But it does shift some control out of your hands.

Advantages

Because vendors serve multiple clients, they can spread costs and offer AML compliance services at lower prices. Deployments are typically faster, too, weeks instead of months.

Specialized providers bring compliance experts who stay on top of new regulatory requirements. This means that they can detect suspicious activities faster using automation and machine learning.

Since we focus on fintech here at Trio, we have been able to get these experts on our team and provide them with the resources they need to stay on top of recent developments.

Finally, if you operate across multiple markets, outsourcing can make it easier to stay compliant everywhere without duplicating systems.

This is mostly because of the expert talent, but also the fact that outsourced companies collaborate with international developers and compliance experts.

Risks and Challenges

Once you integrate deeply with a provider, switching later can be expensive or disruptive. This is known as vendor lock-in. It’s wise to negotiate exit clauses early.

Your customers’ personal data may pass through other jurisdictions, creating added exposure that leads to data security and privacy concerns.

To avoid this, you need to confirm that your vendor meets GDPR and ISO standards.

Outsourcing doesn’t remove your responsibility. Regulators still hold the financial institution accountable, even if a third-party service fails.

Risk Management in AML and KYC Operations

Whether internal or external, risk management is the cornerstone of effective compliance.

- Identifying and Mitigating Financial Crime Risks: Start by mapping out exposure points, transaction types, customer segments, and regions. Some industries, like crypto exchanges or remittance services, carry higher risk and require tighter controls.

- The Role of Transaction Monitoring and Risk Scoring: Transaction monitoring systems track behavior over time, assigning dynamic risk scores. When alerts rise above thresholds, analysts conduct deeper due diligence reviews.

- Vendor Risk Assessments: If you outsource, periodic audits are essential. Evaluate your provider’s internal security, response times, and ability to meet technology and regulatory standards.

Scalability and Flexibility in Compliance Models

Scalability has a way of testing every compliance model. Internal teams are stretched thin, and external providers sometimes struggle to adapt to unique organizational needs.

Scaling Internal AML Operations

Hiring experienced analysts is tough in a competitive market, and training new ones takes time.

As workloads grow, you may find your team buried under repetitive reviews or struggling to keep up with new regulatory expectations.

Dabbling with outsourcing or staff augmentation in these instances can be useful.

Flexibility of Outsourced Solutions

Outsourced providers tend to handle large volumes more smoothly.

A seasoned RegTech partner can quickly scale operations for new markets or regulatory jurisdictions.

This flexibility is a major advantage for fintechs and financial institutions that move fast or operate globally.

Cloud Platforms and APIs

Modern compliance technology relies heavily on cloud-based platforms and real-time APIs.

These tools streamline workflows such as client onboarding, sanctions screening, and customer due diligence. When systems communicate seamlessly, scaling up becomes far less painful.

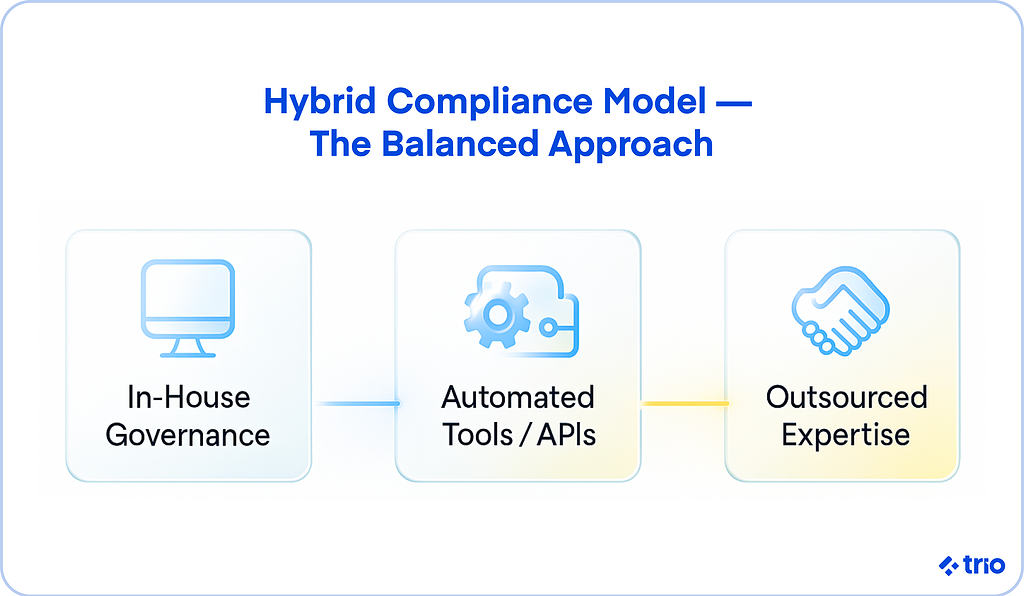

Moving Toward Hybrid Models

Over time, many organizations find balance in a hybrid approach.

Policy oversight and key risk decisions stay internal, while third-party tools handle automation and volume-heavy checks.

We often help clients set up this model, even adding developers to their team through staff augmentation.

Choosing the Right Approach for Your Business

So how do you decide? Start with a few questions.

- What’s your transaction volume and customer risk level?

- How complex are your regulatory obligations across markets?

- Do you have the internal expertise to run compliance efficiently?

Smaller institutions may find outsourced AML services the most practical, while established ones often prefer direct oversight. Many end up combining both, internal governance backed by external automation.

A clear roadmap, careful vendor selection, and regular performance reviews usually lead to the best balance between control and flexibility.

Future Trends in AML and KYC Compliance

The next phase of compliance will likely be defined by technology.

AI and Machine Learning tools can already recognize transaction anomalies and spot patterns humans might miss. But they’re not perfect; they still need oversight to avoid bias or false positives.

Regulators increasingly expect ongoing risk assessments that adapt to behavior in real time. These kinds of assessments are only possible thanks to powerful AI-driven models.

We’ve also seen an increased use of blockchain to facilitate distributed ledgers, which could soon make KYC verification faster and more secure by letting customers share verified credentials across institutions.

Finally, there’s growing cooperation between regulators, especially in the EU, to harmonize data sharing and reduce duplicate checks.

Conclusion

Running AML and KYC compliance internally gives you control and cultural strength, but it comes with cost and rigidity. Outsourcing saves time and money but requires trust and constant oversight.

For most organizations, the future probably sits somewhere in between: a hybrid model that combines in-house governance with external efficiency.

The real goal is building a compliance structure that scales with your growth, adapts to regulations, and quietly does its job, protecting your customers and your reputation.

If you need fintech software developers who are familiar with all the intricacies of fintech compliance processes, we can connect you with our experts through outsourcing or staff augmentation.

Get in touch!

FAQs

What is AML and KYC compliance?

AML and KYC compliance refer to the systems and processes that financial institutions use to prevent money laundering and verify customer identities before providing services.

Should you manage AML and KYC compliance in-house or outsource it?

It depends on your size, budget, and risk profile. In-house offers control and transparency, while outsourcing provides speed, scalability, and access to expertise.

What are the risks of outsourcing AML and KYC?

Outsourcing can introduce data privacy concerns, vendor dependency, and accountability challenges if the provider fails to meet regulatory standards.