2026 isn’t just another year on the regulatory calendar; it’s a reckoning for how payments actually work.

Fintech leaders are being pulled in two directions at once. On one hand, regulators in Europe are tightening the screws with SEPA Instant requirements. On the other hand, the world’s largest payment rails are transitioning to ISO 20022.

Neither can be ignored, and neither is as simple as a patch or an upgrade.

The problem is timing.

Deadlines land in rapid succession: SEPA Instant rules required inbound support by January, FedWire’s message format shifted to ISO 20022 on July 14, and SEPA mandates outbound instant payments in October.

By late 2026, SWIFT’s cross-border rails are expected to retire legacy MT messaging in favor of ISO.

That’s not a lot of breathing room for anyone whose core systems weren’t built for real-time flows and structured messaging.

Missing the deadline means you risk being shut out of the rails your customers expect, paying penalties you can’t budget for, or losing credibility when transactions stall.

Even if you scrape through the compliance checks, you’ll be left with fragile payment systems, jury-rigged translations, and fraud controls that can’t keep pace with instant settlement.

However, you can also view this as an opportunity to create infrastructure that is faster, safer, and more globally connected than what most banks currently operate.

That means stronger fraud detection, cleaner reconciliation, and a foundation for the services customers actually want, like Request-to-Pay and intelligent cross-border routing.

Let’s walk through the deadlines, the pitfalls that trip teams up, and the practical steps you can take now to not only stay compliant but also build a payments stack that sets you apart when the dust settles.

If you need experienced developers who are already familiar with the requirements of the iso 20022 standard and other regulatory changes, you are in the right place.

At Trio, we specialize in fintech, allowing us to afford our developers the time and resources to keep up to date with everything happening in financial services, including the different global compliance standards.

The 2025 Regulatory Timeline

The compression of some massive changes is what makes 2025 so challenging.

You’ll barely finish adjusting to one milestone before the next comes due.

January 2025: SEPA Instant inbound enforcement

From January 9, payment service providers in the eurozone needed to be able to receive SEPA Instant Credit Transfers.

Even if you’re not a bank, if your fintech partner institution touches Europe, you’ll be expected to process inbound instant payments.

Note that some providers outside the eurozone, including certain EMIs and PIs, have slightly later timelines; however, euro-area PSPs are now on the clock.

July 2025: FedWire migrates to ISO 20022

The U.S. Federal Reserve kept to its delayed date of July 14, 2025, as the migration date for the Fedwire Funds Service.

Now, all Fedwire messages must adopt ISO 20022; the legacy FAIM format is no longer supported.

October 2025: SEPA Instant outbound enforcement

By October 9, eurozone PSPs must also send SEPA Instant payments.

For many firms, this is the heavier lift, since outbound flows require changes to customer-facing systems, fraud controls, and reconciliation engines.

As with inbound, there are some limited exceptions for non-eurozone PSPs, but for most, the autumn deadline is firm.

Late 2025: SWIFT cross-border cutover

SWIFT is in the process of migrating all cross-border payments from MT to ISO 20022 messaging types (MX).

Many financial institutions, including banks and service providers, are working toward a complete transition by November 2025; however, the exact date may vary by corridor and institution.

The safe assumption is that by the end of the year, ISO 20022 fluency will be mandatory for use cases like global transfers.

Why ISO 20022 Matters

ISO 20022 may seem like just another message format update, but reducing it to that undersells what’s actually happening.

The shift is less about compliance checkboxes and more about establishing a shared language for payment rails that actually carries meaning.

For years, legacy formats have left banks and fintechs passing bare-bones instructions, amount, account, reference, without much else. That made reconciliation clunky, fraud detection slow, and cross-border transfers prone to error.

ISO 20022 changes the equation by embedding structured, data-rich fields into every message.

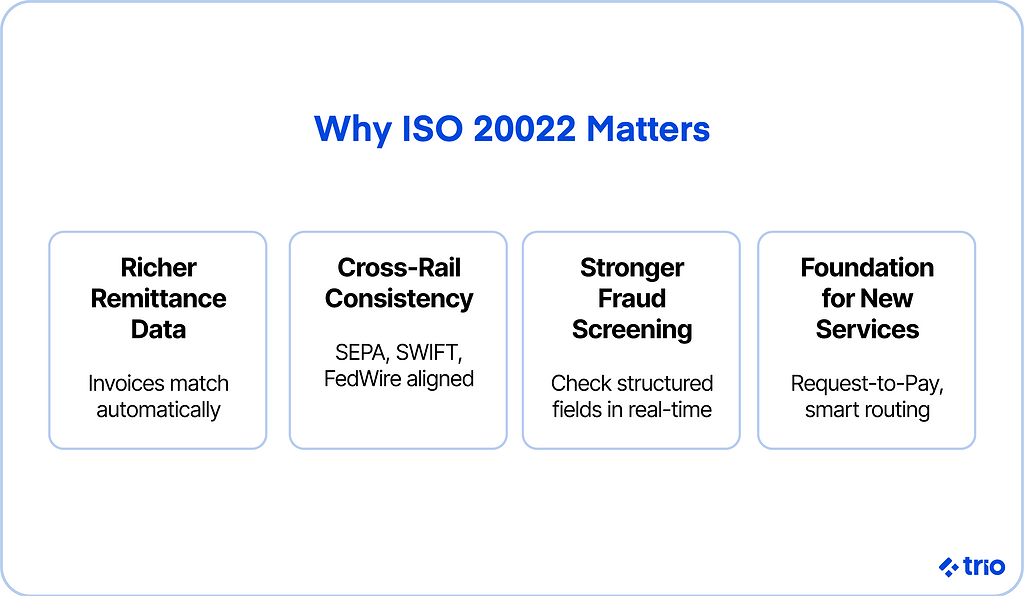

What that unlocks in practice

- Richer remittance information, which means invoices can match payments automatically instead of being reconciled by hand.

- Consistency across rails like SEPA, SWIFT, FedWire, RTP, and FedNow, so you don’t need a different mapping engine for every network.

- Stronger fraud screening, because you can actually check structured fields in real time rather than relying on free-form text.

- A foundation for overlay services, things like Request-to-Pay, instant financing offers, or analytics that depend on clean and complete transaction data.

What’s striking is how universal the opportunity is.

ISO 20022 isn’t tied to one geography or one rail. It appears to be the first genuine attempt at an end-to-end global payments grammar, and fintechs that adopt it fully will be positioned to plug into whatever rails emerge over the next decade.

If you’ve ever wondered if you needed an industry expert on your team, your Iso 20022 migration is the place to do it, even if you hire an employee through staff augmentation.

You need to be very careful. Treat this change as a one-time lift, and you may end up fighting constant translation issues. Treat it as a strategic investment, and it becomes the backbone for global reach.

Key Technical Challenges for Fintechs

Understanding why ISO 20022 matters is one thing; building systems that can actually handle it is another.

The truth is, most fintech stacks weren’t designed for instant settlement or for messages packed with structured data. That gap shows up in a few critical areas.

Coexistence of legacy and ISO messages

From what we’ve already seen, 2026 won’t be a clean cutover.

For months, and in some cases years, rails will run in both formats. Your systems will need to recognize, translate, and reconcile them in real time.

Without a translation layer, orchestration middleware that can smooth the differences, you’re left with brittle point-to-point fixes that collapse under volume.

Real-time fraud controls

Instant payments don’t leave room for manual review queues. Once the money’s gone, it may be impossible to get it back.

That puts pressure on your fraud models to operate at millisecond speed to keep up with these real-time payments in ways people can’t.

The upside is that ISO’s structured data fields give you more signals to screen against: KYC data, sanctions checks, and behavioral patterns. The challenge is pulling those signals into detection models that are fast enough to matter.

AI and ML are showing promise, but developers need to be aware of global standards regarding security and data handling.

Scalability of infrastructure

“Always-on” is a technical requirement. Users expect to have access to their payment platform at all times. A crash might make them switch to one of your competitors.

Instant rails mean transactions flowing day and night, with spikes that don’t respect office hours.

Horizontal scaling, cloud-native deployment, and API-first design all sound good in theory, but unless you’ve load-tested against realistic payment volumes, you may discover bottlenecks when it’s already too late.

Testing and migration governance

The deadlines are public, but what they don’t show is the hidden complexity: parallel runs, version mismatches, and cutovers that can’t afford downtime.

A failed migration doesn’t just mean a bug; it can mean missing payments, regulatory fines, and customer churn, like we have already mentioned.

Automated testing, rollback strategies, and careful staging are the only safety nets.

By implementing DevSecOps strategies and encouraging a culture of personal accountability, you also increase.

How Fintechs Can Prepare

If the challenges sound heavy, they are. But they aren’t impossible to avoid if you prepare well.

The firms that come through 2025 in good shape aren’t the ones with the biggest budgets; they’re the ones that start early and design with both compliance and resilience in mind.

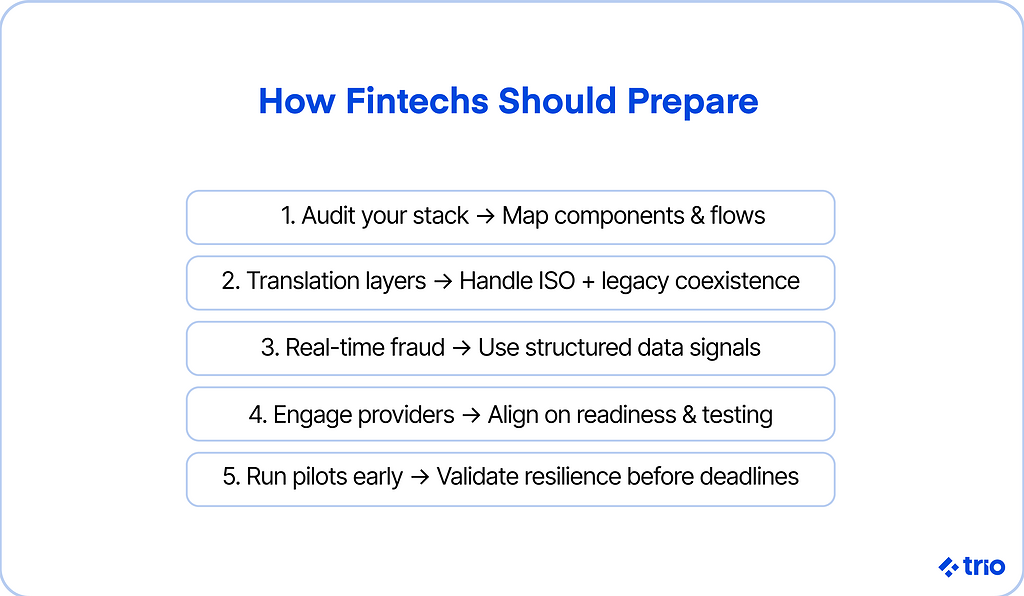

Audit your payments stack.

Start with a map. List out every component that touches payments, messaging engines, fraud detection modules, reconciliation tools, and trace how data flows between them.

You’ll quickly spot the points where ISO 20022 mapping is missing or where legacy assumptions will break.

Implement translation and orchestration layers.

During the coexistence period, you’ll need a way to process both ISO and legacy messages without breaking downstream systems.

Middleware that normalizes message formats buys you time and consistency, and avoids the dangerous temptation to hardcode patches in multiple places.

Embed real-time fraud detection.

Traditional fraud checks operate in minutes or hours. As we’ve mentioned above, with instant payments, that’s too slow.

The fix isn’t just about faster algorithms, but also about smarter use of ISO’s structured fields, enabling you to detect anomalies, screen against sanctions, and flag high-risk behavior before settlement occurs.

AI-driven monitoring helps, but it only works if it’s wired directly into the transaction path.

You don’t need to create your own models. Instead, we often recommend third-party models that are already compliant with recent changes.

Engage with your providers.

If you rely on payment service providers, correspondent banks, or vendors, don’t assume their migration schedule matches yours.

Ask for their readiness plans, integration details, and test environments. An honest conversation now is far cheaper than an outage later.

Run compliance-ready pilots

Don’t wait until October to flip the switch.

Pilot instant payment flows in sandbox environments with ISO message sets. Test not just the happy path, but the failure scenarios, malformed messages, payments that hit sanctions lists, and transactions that time out.

The goal is to validate resilience before you’re under pressure.

Strategic Opportunities Beyond Compliance

It’s easy to see 2025 as a wall of obligations.

But if you step back, the same shifts that create headaches also open doors.

ISO 20022 and instant payments aren’t just regulatory hurdles; they can also become the foundation for new products, enhanced customer experiences, and improved competitive positioning.

Cross-border reach

A fintech fluent in ISO 20022 can plug into multiple markets with less friction.

Instead of juggling half a dozen mapping rules, you’re working from a common data language.

That enables scaling into new geographies faster and with far fewer errors.

Overlay services that customers actually notice

Structured messages let you do more than move money.

Think about services like Request-to-Pay, dynamic payment scheduling, or financing offers that trigger at the point of transfer.

These aren’t futuristic ideas; they’re already being piloted, and ISO makes them workable at scale.

Analytics-driven products

When payments carry clean, structured data, you can stop guessing about customer behavior.

That data can power real-time dashboards for merchants, predictive cash-flow tools for SMEs, or even personalized financial recommendations for consumers.

In a market where differentiation is tough, and you’re already competing with big banks that have cemented their positions, insights like these are hard to replicate.

Building resilience as a differentiator

Most fintechs still see resilience and fraud prevention as overhead.

But if you can demonstrate faster settlement times with fewer false positives and tighter fraud controls, that becomes part of your value proposition.

Customers will notice if their transfers clear instantly and securely, while competitors are still fumbling with workarounds.

Conclusion

The deadlines that have already passed and are still looming in 2025 may look like a compliance marathon, but in reality, they’re a stress test of how modern your payments infrastructure truly is.

Instant rails and ISO 20022 don’t just demand speed and structure; they demand that your fintech rethink how it scales, how it prevents fraud, and how it competes in a market where customers expect immediacy.

Waiting until the final quarter to react isn’t a strategy; it’s a gamble.

The firms that start early will not only avoid disruption, they’ll build systems that make them faster, safer, and more adaptable than their peers.

If you want your payments stack to stand the test of 2026 and beyond, our payments experts can help you get on the right path, so you know your tech will stand up to scrutiny.

FAQs

What happens if my fintech misses the ISO 20022 deadlines?

If your fintech misses the ISO 20022 deadlines, you risk being cut off from key payment rails and losing customer trust. Regulators may also impose penalties for non-compliance.

Do all fintechs need to support SEPA Instant?

All fintechs operating in or connected to the European Union must support SEPA Instant. Even indirect participants may be affected if their partner banks require compliance with these regulations.

Why is ISO 20022 better than existing formats?

ISO 20022 is superior to existing formats because it contains structured, data-rich fields rather than minimal text. This enhances reconciliation, fraud detection, and cross-border interoperability significantly.

Is migrating to ISO 20022 only about compliance?

Migrating to ISO 20022 is not only about compliance; it also unlocks opportunities for enhanced analytics, overlay services, and faster market expansion.

How long will legacy and ISO 20022 formats coexist?

Legacy and ISO 20022 formats will coexist throughout 2025 and possibly longer. That overlap creates complexity, so fintechs need orchestration layers to manage both.