As your fintech grows, investors want clean compliance records. Boards push for flawless infrastructure. Customers expect everything to just work, even when transaction volume quadruples in a quarter.

In the early days, generalists might be enough to code, patch systems, and handle basic risk controls. Yet as complexity rises, continuing this way can lead to issues in your various fintech products.

Payment failures that frustrate customers, regulators asking more challenging questions, and systems buckling under peak loads are just a couple of examples that can stall growth, trigger fines, or spook the board on the eve of a big funding round.

That’s the point when hiring developers who specialize in the fintech sector becomes non-negotiable.

Risk engineers, payments scaling experts, and infrastructure specialists may look like niche roles on paper, but in practice, they’re the difference between stumbling at scale or sailing through due diligence.

Let’s walk through where those specialists fit, why compliance isn’t optional, and how to recognize the signs that it’s time to bring in experts, fast.

If you are in that situation, you are in the right place. We have the industry specialists fintech companies rely on for their success.

Our focus on assigning these developers based on their past experience in similar roles results in seamless onboarding, so they can be productive from the first few days, giving you a competitive advantage.

Understanding Fintech and Its Impact

What started as small startups disrupting payments or lending has matured into an industry that banks, regulators, and investors all treat seriously.

What is Fintech?

At its simplest, fintech is the intersection of financial services and technology.

The category covers everything from digital wallets and real-time payments to blockchain-based settlements and AI-driven fraud detection.

In the past, fintech often meant moving fast and cobbling together solutions to stay ahead. But as operations scale, it shifts: fintech becomes less about raw innovation and more about scalable reliability, compliance, and resilience.

Growth of Financial Technology

Global payments volumes have climbed into the trillions, with real-time transactions accounting for an incredible $5.3 trillion.

Open banking regulations are pushing firms into new integrations, and customer expectations for faster and more efficient services show no signs of slowing down.

That momentum creates opportunity, but also exposes weak points. A payment pipeline that runs smoothly now can start misfiring as transaction volumes increase. A compliance framework designed for one market may not work when you expand to another.

In other words, the very success you’re chasing is also what creates the conditions for risk. And that’s where the need for specialized roles starts to become obvious.

The Role of Compliance in Fintech Projects

If there’s one theme that keeps coming up in boardrooms of scaling fintechs, it’s regulatory compliance. Issues can stop growth almost entirely.

Investors won’t back a company that looks exposed. Regulators don’t care how sleek your product is if customer protections are not in place. And customers themselves often make decisions based on trust.

Why Compliance Matters More as You Scale

Early on, compliance may be restricted to a few policies, some outsourced checks, and maybe a part-time officer. Since you deal with a smaller region, you have fewer regulations to worry about.

But as transaction volumes climb and geographic reach expands, the risk profile changes dramatically. Suddenly, you may be juggling multiple regulators, facing tougher audits, and watching fraud attempts increase in both frequency and sophistication.

Compliance helps you avoid fines and maintain your credibility.

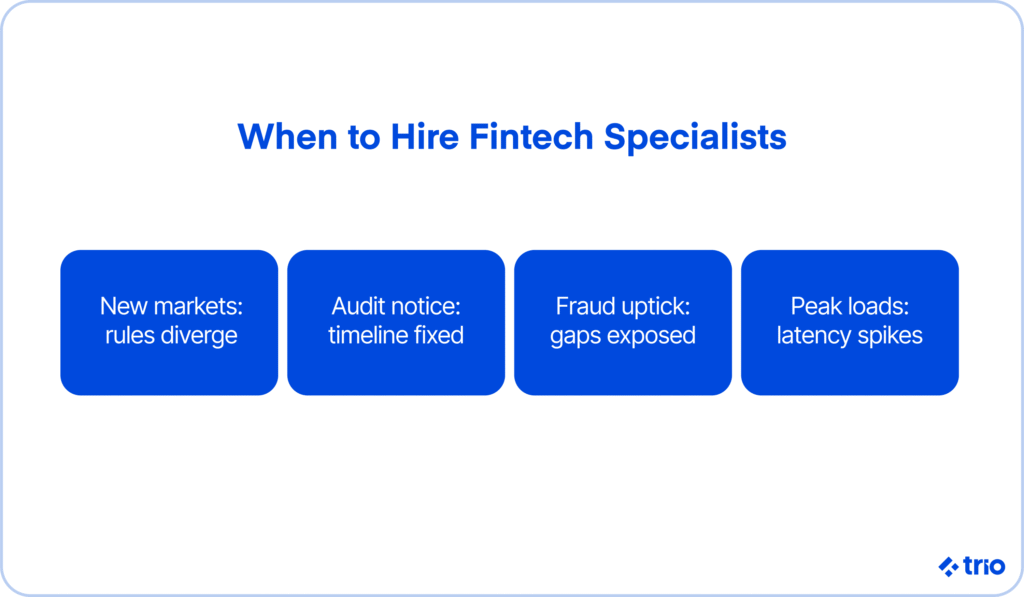

Signals You Need a Compliance Specialist

It’s not always obvious when previous compliance needs to be updated, but a few signs tend to appear:

- Expanding into a second or third market where the rules don’t align neatly with those of your home regulator.

- Your first formal audit, or worse, a notice that one is coming.

- Fraud or suspicious activity is suddenly slipping past existing checks.

- Board members are asking whether compliance is keeping up with growth.

Each of these is a red flag that you’ve outgrown a generalist approach. At this stage, a dedicated compliance specialist (or even a team) moves from optional to essential.

Career Paths in Fintech

Your need for industry leaders means that you are going to have to adjust your talent strategy.

In-Demand Fintech Careers

Some engineers are exceptionally in demand thanks to the unique challenges the fintech industry faces:

- Real-time payments and API specialists

- Compliance officers who understand multi-jurisdiction AML (anti-money laundering) frameworks

- Data Scientists and analysts who can turn billions of transaction rows into actionable risk insights.

- Artificial intelligence and machine learning specialists.

- Blockchain technology and DeFi developers are familiar with smart contracts.

These people prevent downtime, fines, and reputational hits when transaction volume or regulatory scrutiny jumps.

Exploring Various Roles in Fintech

Product managers, data scientists, and customer-experience leads still matter, but their scope narrows as you add specialists around them.

For example, your product manager, who once oversaw payments in general, will eventually collaborate with a payments scaling engineer whose sole responsibility is ensuring transactions clear at scale, with the right latency and reconciliation.

The shift is subtle but significant: from broad innovation roles to niche positions that keep growth sustainable.

Specialized Roles in Scaling Fintechs

Hiring gets harder as you scale, not easier. The more specialized the skillset you need, the more difficult it is to find developers with all those skills and the relevant soft skills and risk management acumen to get you ahead.

With these highly sought-after fintech skills, these developers can also command significantly higher fees.

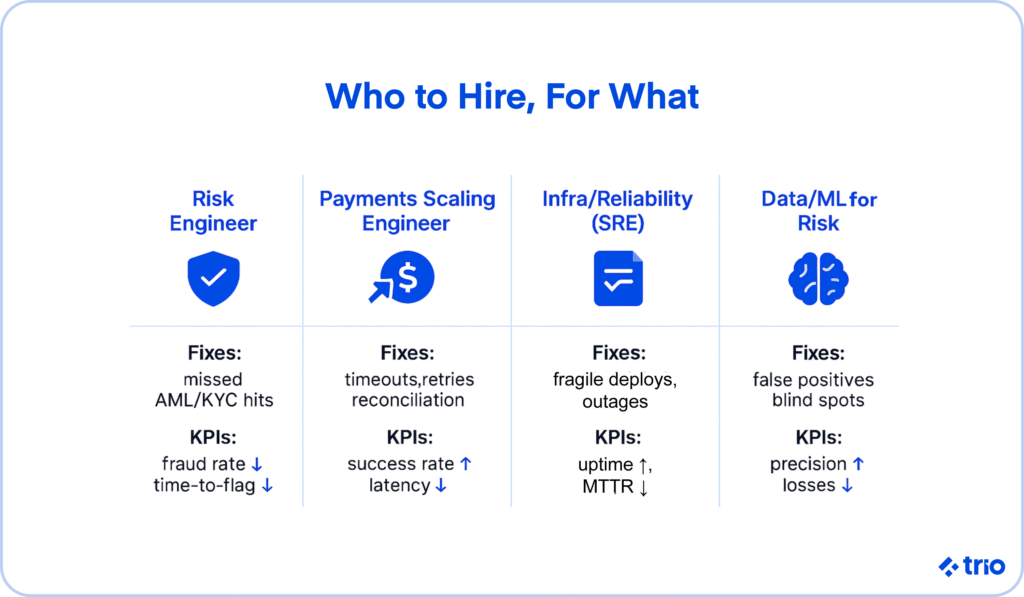

Risk Engineering Specialists

Risk engineering may sound abstract, but rising fraud losses, missed AML alerts, or regulatory consequences are issues that most companies can’t afford.

A risk engineer’s role is to anticipate these cracks and build systems that close them before they widen.

When to hire: The triggers are often clear, such as the first significant fraud incident, entering a new financial product category, or gearing up for IPO-level audits.

KPIs they affect: fraud detection rate, loss ratios, time-to-flag suspicious activity.

What to look for: candidates with both coding fluency and regulatory literacy. A sound risk engineer doesn’t just model threats; they know how those models hold up under compliance review.

Payments Scaling Engineers

Payment failures are a nightmare. At a small scale, errors are manageable. At a large scale, they snowball into angry customers, social media complaints, and nervous investors.

Payments scaling engineers ensure that every transaction clears quickly and reliably, even during spikes in volume.

When to hire: Expansion into new markets, crossing volume thresholds (hundreds of thousands of daily transactions), or when downtime starts creeping into uptime reports.

KPIs they affect: payment success rate, latency, and reconciliation accuracy.

What to look for: depth in real-time payment rails, settlement systems, and API resilience, not just generic backend experience.

Infrastructure & Reliability Experts

Infrastructure specialists are the ones who keep your systems standing under pressure. They design for uptime, redundancy, and fault tolerance.

When to hire: Downtime begins to eat into SLAs, deployment slows due to fragile systems, or expansion requires multi-cloud or global infrastructure.

KPIs they affect: uptime percentage, mean time to recovery, and deployment frequency.

What to look for: experience with distributed systems, observability tools, and scaling architectures that fit fintech’s regulatory environment.

Compliance Roles and Their Importance

The reality is that every fintech, once it reaches a particular scale, discovers that credibility with regulators, investors, and customers alike plays a significant role in its continued success and sets it apart in a highly competitive market.

Compliance teams translate shifting regulations into operational safeguards, integrate RegTech tools into daily workflows, and anticipate how a new product feature might trigger regulatory scrutiny.

Why These Roles Carry Extra Weight

Hiring managers sometimes underestimate compliance because the payoff is invisible when everything goes well.

But, as we’ve already discussed, very few fintech solutions can survive the consequences of failing to focus on compliance. No regulatory fines, no stalled IPO filings, and no reputational crises are essential for your growth.

RegTech as a Force Multiplier

Many teams now rely on machine-learning models to flag unusual transaction patterns, blockchain tools for tamper-proof KYC records, and API-driven platforms for real-time AML monitoring.

Fintech professionals who understand both the regulations and the technology behind these solutions are becoming indispensable.

They can assess whether a new RegTech vendor actually enhances your defenses or merely introduces another integration challenge.

Skills Required for Fintech Jobs

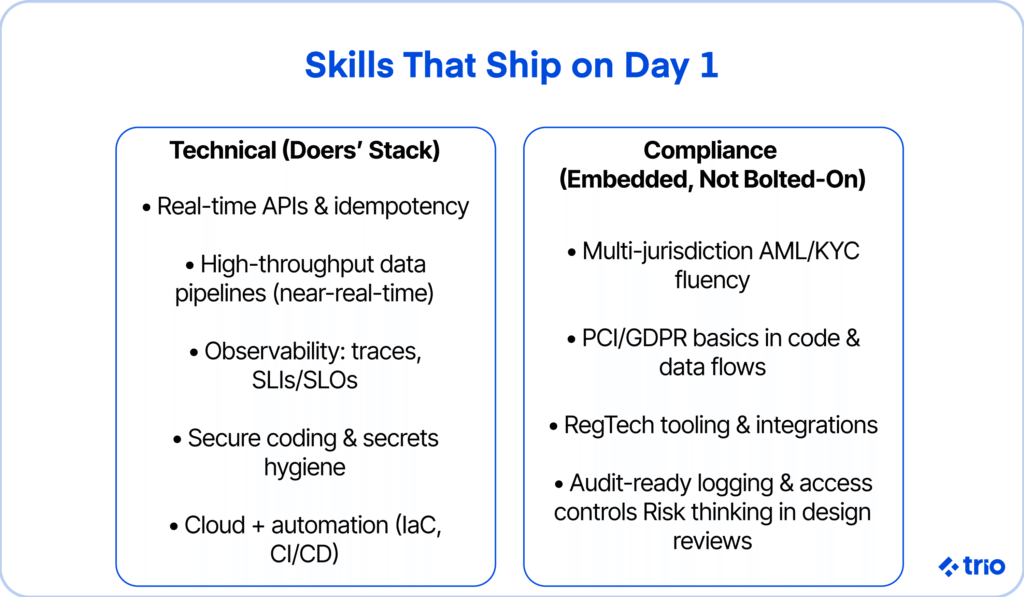

The distinction isn’t just technical vs. non-technical; it’s about which mix of skills lets a specialist step into a complex environment and deliver from day one.

In-Demand Technical Skills

There are the basics, like understanding Python or SQL, but you also need to be looking for people who can:

- Design systems that process millions of payments with minimal latency.

- Build data pipelines that keep compliance dashboards current in near real time.

- Harden APIs against both performance bottlenecks and security threats.

Blockchain knowledge, AI for fraud detection, and cloud-native infrastructure expertise are all valuable, but they matter most when paired with a clear understanding of the financial rails underneath.

Compliance and Risk Skills

On the compliance side, the skills to prioritize are equally specific. You need people who can interpret regulatory language, but also automate reporting and embed controls into production systems.

When we look for people, we often emphasize:

- Direct experience with AML and KYC in multiple jurisdictions.

- Familiarity with RegTech platforms and how to integrate them.

- Comfort working alongside engineers, not just auditors, so controls don’t become bottlenecks.

Navigating the Fintech Hiring Market

It’s easy for anyone to claim blockchain or AI on their CV, but very few can demonstrate how that skill scales a real payment system or survives a regulatory audit.

That gap between what candidates say and what you actually need is where most hiring processes stall.

Fintech Hiring Trends

The demand is especially sharp in three areas: risk, payments, and infrastructure.

Those roles have become the bottlenecks as companies cross into late-stage growth. Salaries are climbing, global searches are becoming the norm, and competitors are pulling from the same limited pool of specialists.

If you hire someone with less experience, it can take them months to onboard and start contributing to your product in any meaningful way.

That’s why we ensure our team includes specialists who can contribute from the outset. We also provide access to software engineers from regions like LATAM, which allows you to cut costs without sacrificing technical expertise.

Evaluating Candidates for Niche Roles

When you do reach candidates, the challenge becomes distinguishing between depth and surface knowledge.

A payments scaling engineer who has only built small integrations won’t be ready for cross-border volumes. A compliance officer who’s never handled multiple regulators may miss subtle jurisdictional conflicts.

Interviews should press on specifics:

- Ask about volumes they’ve supported, not just systems they’ve touched.

- Request examples of how they handled conflicting requirements across regions.

- Push for evidence of outcomes, lower fraud rates, improved uptime, and cleaner audits, rather than abstract claims of expertise.

Hiring this way requires more effort upfront.

Alternatively, you could reach out to a firm with a good track record in fintech specifically, like Trio.

Current and Future Trends in Fintech Compliance

New regulations appear faster than most teams can adapt, and technologies that once looked like fringe experiments are now mainstream. Digital assets and decentralized finance in particular are now squarely on regulators’ radar.

Investors are also increasingly asking for proof that systems can withstand scrutiny after some massive fines were issued in recent months. At the same time, consumers expect more.

We expect roles to evolve toward hybrid skill sets: officers who understand AML law and the cloud infrastructure it runs on, or engineers who can code payment flows while building in regulatory guardrails. This will help companies keep up with the rate of change.

New tools are also starting to lighten the load: AI systems that spot anomalies humans miss, blockchain-based identity checks that make KYC tamper-resistant, and API-driven RegTech platforms that can sync compliance data in near real time.

Conclusion

You need risk engineers who see fraud before it happens, payments specialists who keep transactions clearing at volume, and compliance experts who reassure both regulators and your board.

That’s where Trio fits in. We help fintechs of all sizes close talent gaps quickly, with specialists who understand the pressures of scale, compliance readiness, and board-level deadlines.

Our custom approach and emphasis on real-world experience mean you don’t just get people, you get the right people, at the right time, when the cost of delay is highest.

You need to bring in the specialists before you need them, not after.

Reach out to get in touch!

Frequently Asked Questions

Fintech compliance refers to meeting regulations like AML and KYC, and it matters because without it, you risk fines, stalled growth, or even losing your license.

A fintech should consider hiring a risk engineer when fraud incidents increase or when preparing for an IPO-level audit.

A payments scaling engineer ensures high transaction volumes clear quickly and accurately, without bottlenecks or downtime.

Compliance roles are necessary in every market, since even unregulated products touch regulated payment rails or data privacy laws.