Finding the right fintech developers is one of the most complex challenges growing companies face.

The demand for senior engineers with expertise in payments, compliance, and risk is sky-high, but the supply is painfully thin.

Startups compete with global banks, mid-sized fintech firms, and even other squads within their own organization for the same small pool of talent.

If you’re a tech leader or part of a stretched HR team, you likely face the frustration of hiring slowing down roadmaps, delivery deadlines slipping, and compliance deadlines not waiting for headcount approvals.

Let’s take a practical look at the skills that matter most in fintech engineering, the roles you’ll need as your product matures, and where you can realistically source talent in a crowded market.

We help companies bridge their gaps with pre-vetted fintech professionals, providing flexible hiring models like staff augmentation and outsourcing so you can rest easy knowing that you always have the right people on hand for your fintech software development needs.

Our developers specialize in financial technology, so there is no question about their skills and awareness of industry challenges.

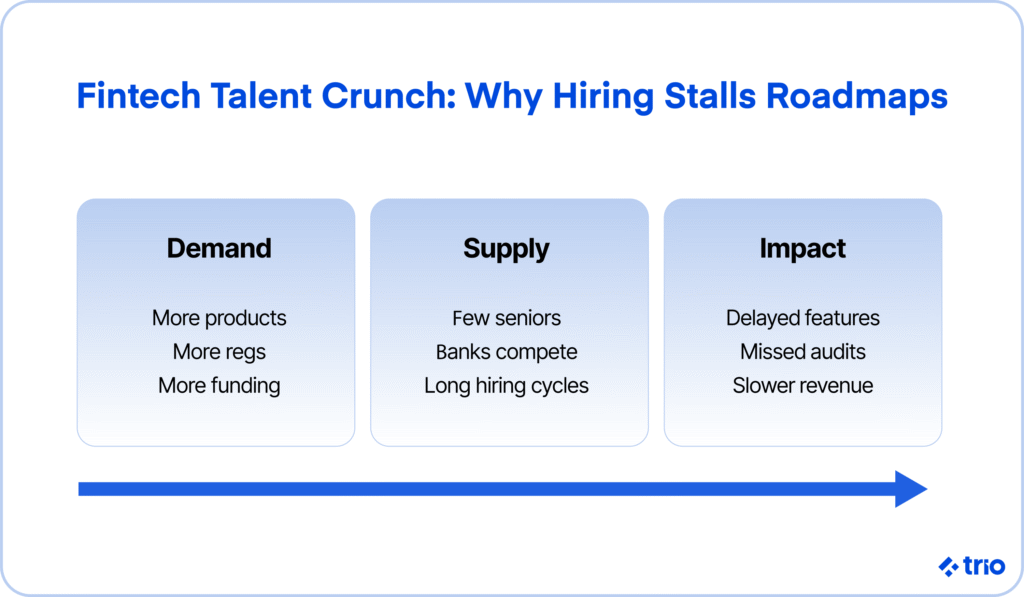

Why Hiring Fintech Developers Is So Difficult Today

The fintech industry is booming. Research by McKinsey and Company has found that revenues are expected to grow almost three times faster than those of more traditional banks.

We’re seeing more products, more regulations, and more funding flowing into startups than ever before. The problem is that the pipeline of senior fintech developers hasn’t scaled at the same pace.

The scarcity of senior fintech engineers

Many software developers are entering the workforce each year, but only a small fraction build careers in financial technology.

Why? Because fintech development isn’t glamorous to everyone.

It’s less about building shiny frontend apps and more about ensuring a payments API can handle high loads and a KYC system withstands audits.

Those who specialize in fintech app development often get scooped up by top fintech firms or transition into well-paid banking roles.

That leaves early-stage and mid-sized companies struggling to attract the level of seniority they actually need for their fintech development team.

Why multiple squads end up competing for the same fintech talent

Even within a single company, hiring managers can sometimes find themselves in conflict when it comes to hiring the right people.

One squad needs a compliance engineer, another is desperate for payments expertise, and suddenly the same short candidate list is being passed around internally.

We’ve seen companies spend months debating which team should get the potential new candidate, rather than questioning whether they might need to rethink their approach to sourcing fintech talent.

The impact of hiring bottlenecks on roadmap delivery and compliance

The consequences aren’t just delayed features. A backlog of compliance tasks may mean your product can’t pass a regulatory audit, which results in everything from immediate fines to long-term loss of trust with your users.

A missing payments engineer might stall the launch of a new transaction flow, which in turn delays revenue.

These bottlenecks are costly in ways that aren’t always visible on a hiring dashboard. Investors rarely care that you have more work than available fintech app developers; they care that your product shipped on time.

The same can be said for regulatory bodies that show very little mercy and issue an unparalleled $19.3 billion in fines in 2024 alone!

What Makes a Strong Fintech Developer Different?

The skills required for fintech projects, whether payments, compliance, or risk systems, go far beyond coding proficiency.

These skills are part of the reason why fintech software developers are so few and far between, and why they can charge higher rates.

Core fintech engineering skills every candidate should have

At a baseline, you need developers skilled in secure backend systems, scalable infrastructure, and resilient data handling.

But that’s the floor, not the ceiling.

A good fintech hire understands transaction consistency, fraud detection patterns, and the subtleties of integrating with third-party financial APIs.

They remain unfazed by regulators’ requests for audit trails or customers’ expectations for real-time financial transparency.

In other words, they are skilled at development and have a good understanding of all the niche requirements that facilitate secure and compliant transactions and data handling.

Payments APIs, compliance, and risk management expertise

If you’re building a payments platform, you need someone familiar with REST APIs. Still, you will also require a developer who has successfully integrated Stripe, Plaid, or custom bank APIs and understands how these systems fail under stress.

On the compliance side, having a general knowledge of GDPR or AML is not enough. The best fintech developers have designed systems that hold up under real audits and can explain how risk management interacts with the code they write.

In other words, the key difference between a normal developer and a strong fintech developer is that the latter has experience in a similar project.

They know the issues you will run into and how to avoid them.

Balancing technical depth with financial technology domain knowledge

There’s a subtle but essential trade-off when hiring a developer who needs both fintech knowledge and technical ability.

A brilliant backend developer with no experience in fintech solutions may write elegant code that completely ignores compliance requirements, or perhaps relies on outdated practices.

On the other hand, someone who has lived through three rounds of audits but can’t ship production-ready features will slow your velocity to a crawl.

The strongest fintech developers balance both deep technical skills and practical financial technology domain knowledge. They know where regulators are likely to probe, and they can still get new features out the door on time.

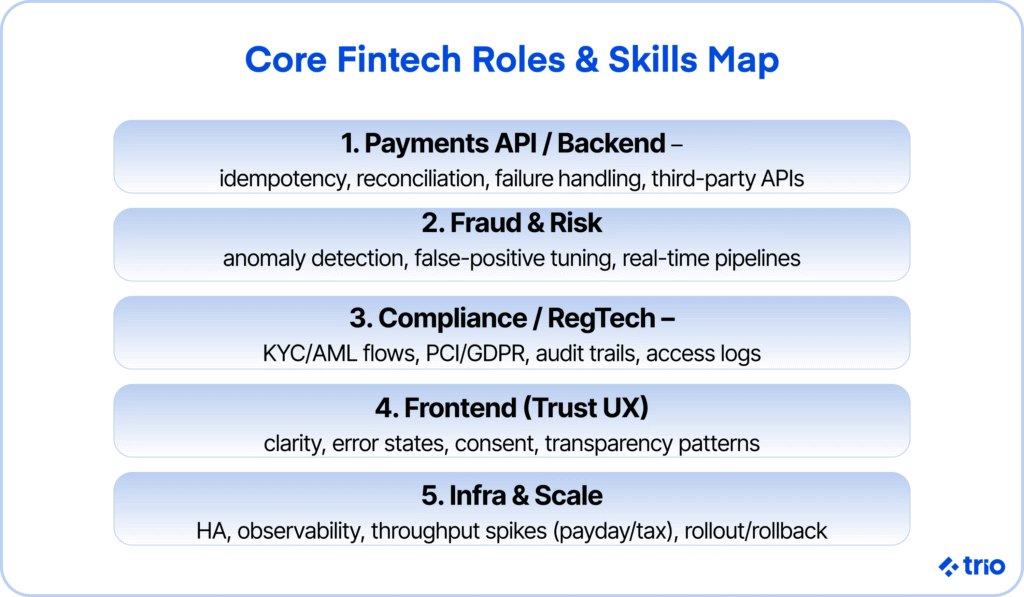

Key Roles Within a Fintech Engineering Team

As products mature, you end up needing a mix of particular roles. Overlooking these specializations often explains why teams struggle to ship on time or fail to pass audits.

You may have some overlap, but let’s take a look at the roles in isolation so you can have a better understanding of where your team may have a gap that you need to fill.

Payments API engineers and backend specialists

Engineers in this role design APIs that not only move money but also do so reliably, securely, and at scale.

They need to understand latency, reconciliation, and failure handling because, in fintech, a single dropped transaction isn’t just a business’s loss; it’s a customer’s paycheck or loan repayment.

Fraud detection and risk management engineers

Risk engineers build systems to flag suspicious behavior in real time and minimize false positives that frustrate legitimate users.

This requires both technical chops in data science and pattern recognition, and domain knowledge about how fraudsters adapt to new defenses.

Compliance and RegTech developers

Developers focused on regulatory technology (RegTech) embed KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR processes into their applications.

They make sure data storage, access logs, and audit trails are ready for scrutiny.

In practice, this means writing code that regulators can trust, and, as already mentioned, regulators are not forgiving when corners get cut. The European Commission has even fined the tech giant Google for breaching its antitrust rules.

Frontend fintech application developers for user trust and transparency

People judge financial applications in seconds.

If your frontend developer doesn’t know how to signal security, clarity, and transparency, your drop-off rates will spike.

These roles require some level of creativity, along with a deep understanding of how people interact with financial data under stress (think: approving a high-value payment while commuting).

Infrastructure and scalability engineers for complex fintech projects

As your fintech product scales, infrastructure engineers become critical to make sure you avoid downtime and any loss of efficiency.

They handle high-throughput systems, ensure uptime, and architect services to survive traffic spikes like payday or tax season.

Remember that issues can affect clients’ perception of your professionalism and result in a loss of trust.

Evaluating Fintech Engineering Skills During Recruitment

Hiring fintech developers is challenging, partly because it’s not clear how to assess the right skills, and it can be challenging to determine if you have made a mistake until after they have spent several weeks on your team.

This means you lose a lot of time and money if you hire the wrong person.

Technical assessments tailored to fintech

Generic coding challenges are ineffective when trying to hire the best fintech developer for your team.

Stronger signals come from assessments that mirror real-world fintech problems.

For example, you could have your developersdesign an API that integrates with a payment processor and gracefully handles failed transactions while maintaining an audit trail.

Candidates who grasp both the code and the compliance implications stand out immediately. Just make sure that you consider the developer’s time and do not assign a task that is too large. They may be considering other options, too.

Screening for compliance knowledge and risk awareness

It can be difficult to assess compliance, knowledge, and risk awareness in a new developer. This is why we only hire developers who have proven industry experience.

During interviews, this allows us to ask candidates how they’ve handled KYC, AML, or PCI DSS requirements in past projects.

Even a simple question, “How would you log user activity in a way that satisfies auditors without overwhelming the database?”, can reveal whether a developer has practical experience or just surface-level familiarity.

Identifying soft skills and communication skills alongside technical skills

Fintech engineers don’t operate in a vacuum. They coordinate with legal, risk, operations, and customer support teams. That makes communication skills just as critical as technical skills.

If a candidate can’t explain their design to a compliance officer or justify a risk model to leadership, their brilliance in code may not translate into business value.

You also need to consider internal communication with shareholders and other non-technical staff members.

These soft skills are so vital that we provide additional training and support if we notice our developers are struggling in any regard.

Common red flags when assessing potential fintech developers

There are a few telltale signs that a candidate isn’t ready for fintech.

Overconfidence without regulatory experience is one.

Another is dismissing the importance of compliance and security as slowing down innovation or approaching it as something done retrospectively, rather than something that needs to be baked into your code from the ground up.

These developers may create liabilities your company can’t afford, especially if you lack the cash flow to cover fines or the history to compensate for a loss of reputation.

Where to Find Fintech Talent in a Competitive Market

Knowing what skills you need is one thing. Actually finding fintech developers who have them is another story.

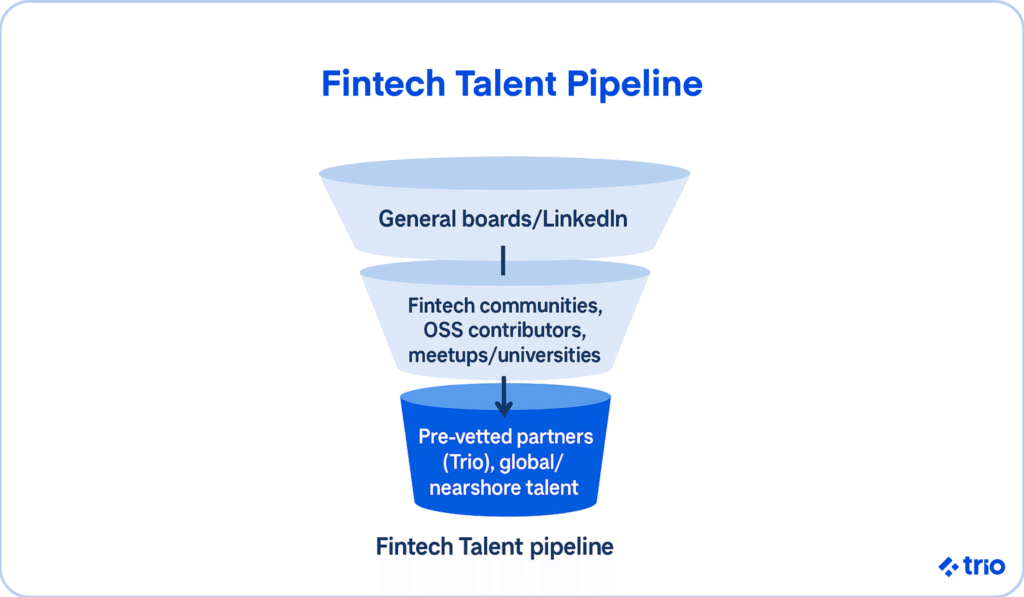

The usual job boards and LinkedIn searches may yield a list of applicants, but many lack the depth of experience with the specific tools your team requires.

Traditional recruitment channels versus fintech-specific communities

Engineering recruitment typically begins with mainstream channels, job boards, agencies, and LinkedIn outreach.

They’re fine for generating volume, but volume doesn’t guarantee fintech talent, especially in this age of automated applications.

Developers with payments or compliance backgrounds often cluster in smaller, more specialized spaces. Think niche fintech Slack groups, professional associations, or even fintech sub-forums on platforms like GitHub.

The best candidates sometimes aren’t applying at all.

Underused sources: open-source projects, meetups, and university partnerships

One surprisingly effective sourcing strategy is reviewing contributions to open-source fintech projects. Developers who’ve worked on things like payment reconciliation tools or blockchain integrations leave a trail of commits you can actually evaluate.

Local meetups and hackathons are another overlooked channel.

Yes, they’re informal, but they often attract engineers passionate about fintech outside of their day job.

And don’t forget universities, many now have fintech-focused programs where you can build early relationships with up-and-coming talent.

Global sourcing, remote engineers, and fintech outsourcing strategies

If you’re limiting your search to a single city, you’re almost certainly missing out.

Remote hiring expands your pool to engineers in markets where fintech is growing but talent is still relatively affordable, such as Eastern Europe, parts of Latin America, or Africa.

Working with a firm like Trio can make the process significantly easier. Not only can we guarantee that you are getting the most cost-effective development possible, but we also take care of all the legal intricacies that come along with hiring internationally.

You also get the added flexibility provided by hiring models like staff augmentation, so you don’t need to commit to a long-term hire and all the associated costs.

Fintech outsourcing can fill short-term needs too, but you’ll want to be cautious: not every outsourcing firm has actual fintech expertise, and plugging in generalist developers rarely works for complex projects.

We specialize in fintech, so you know you are getting the right people working on your outsourced projects when you go through Trio.

Why freelance fintech developers are rarely a complete solution

You’ll find plenty of freelancers advertising fintech skills.

Some are excellent. But relying too heavily on one-off freelance fintech developers may lead to inconsistencies in code quality, gaps in compliance awareness, or knowledge that disappears when the contract ends.

Freelancers can be a tactical solution, but rarely a strategic one.

Outsourcing vs Building In-House: What CTOs and HR Teams Should Consider

Should you outsource or build in-house? Unfortunately, there is no single answer, and you will have to decide based on your requirements.

The reality is that both approaches have trade-offs. Staff augmentation often lands in the middle.

Pros and cons of fintech outsourcing vs direct hires

Outsourcing gives you speed. You can scale up quickly without long recruitment cycles.

However, it’s risky if the provider doesn’t have a deep understanding of the fintech industry. A generic development company may deliver features that look fine but fail under audit.

On the other hand, direct hires give you long-term stability and institutional knowledge.

The cost is slower hiring cycles and higher salaries, which can weigh heavily on early-growth fintech startups.

Avoiding over-reliance on generic development companies

There’s a temptation to sign with the first outsourcing firm that promises fintech expertise.

The problem? Many redeploy generalist developers.

They may know how to build a payment form, but not how to ensure PCI DSS compliance or manage reconciliation processes.

If you go this route, vet carefully. Ask for case studies, references, and specific examples of compliance-heavy projects.

How to align hiring strategy with long-term fintech product vision

The best hiring strategy acknowledges your company’s stage and trajectory.

If you’re still proving product-market fit, a mix of in-house leads and outsourced contributors may make sense. If you’re scaling globally and preparing for regulatory audits, building a core in-house fintech engineering team becomes essential.

Short-term speed should never undermine long-term stability; otherwise, you’ll pay for it when regulators or customers lose confidence.

Compensation and Retention in a Competitive Fintech Market

Attracting fintech developers isn’t just about finding them; it’s about convincing them to join and, equally important, stay.

Salaries are only part of the equation, but they do set the baseline.

Market benchmarks and realistic salary expectations

Senior fintech engineers almost always command a premium. That makes sense, given the mix of engineering skills and regulatory knowledge they bring.

According to Glassdoor, the total salary range you can expect to pay for a fintech developer is $105k – $164k per year.

While you don’t need to outbid banks on every offer, you should be prepared to compete with mid-sized fintech companies on total compensation.

Hiring nearshore or offshore developers can lead to lower local offers, potentially allowing you to offer lower rates.

Falling too far below market may suggest to candidates that your team isn’t serious about engineering investment.

Beyond salary: equity, mission, and growth opportunities

Many developers are drawn to fintech startups because of the chance to work on meaningful financial technology products, tools that improve access to credit, simplify payments, or make finance more transparent.

Equity grants, clear growth paths, and exposure to complex fintech projects can outweigh a slightly lower salary.

Other benefits, such as flexible work schedules, remote opportunities, and time for continued education, can also play a role in their final decisions.

Retaining fintech professionals when multiple squads compete for talent

Retention becomes tricky when different squads within the same company are all vying for the best engineers to work on their projects.

Transparent career paths, opportunities for rotation, and recognition of compliance-heavy work (which can be less glamorous) help.

Without these, developers may jump ship to another squad internally or to another company entirely.

Common Mistakes in Fintech Engineering Recruitment

Even well-funded fintech companies that have been in the market for several years stumble in hiring top talent.

The mistakes aren’t always apparent at the time, but they create compounding problems down the line.

- Hiring generalists without fintech-specific experience: A talented full-stack developer can be tempting to hire quickly.

- Underestimating compliance and risk expertise: If you don’t have that expertise on the team, regulatory fines, or worse, product shutdowns, are a real possibility.

- Neglecting cultural fit and communication skills: Fintech developers often need to explain complex systems to non-technical stakeholders, compliance officers, risk managers, and even auditors, and candidates who can’t adapt their communication style may cause friction.

Building a Long-Term Hiring Strategy for Fintech Teams

Hiring shouldn’t just be about filling today’s gaps. Without a long-term strategy, you’ll constantly be chasing talent instead of building it.

Planning for growth without inflating headcount

A common trap is over-hiring too early.

Teams add engineers faster than they add product maturity, which leads to bloated payroll and coordination headaches.

The more brilliant play is to scale incrementally, using outsourcing or augmentation where necessary, while keeping a lean, high-skill in-house core.

Building pipelines of top fintech talent across regions

Instead of scrambling every time a role opens, build relationships ahead of need. That might mean cultivating university partnerships, engaging in fintech communities, or maintaining warm connections with candidates who weren’t quite right last year but may be perfect now.

Global sourcing helps, too. Fintech talent in Eastern Europe or Latin America can bring world-class skills without Silicon Valley price tags. By partnering long-term with a trusted staff augmentation firm that hires from these regions, you can decrease costs in the long term.

Preparing for the future of a rapidly evolving fintech landscape

The fintech market moves quickly, with new regulations, emerging payment rails, and evolving fraud tactics.

Your hiring strategy should assume that skills in emerging technologies, such as blockchain integrations or AI-driven risk detection, may become essential for the most basic teams in the future. For these specific examples, this is already becoming the case.

Building a pipeline of adaptable, curious engineers is just as important as hiring for current needs.

You want to be at the forefront of fintech innovation, not constantly one step behind, and your people play a big role in that.

Conclusion

Hiring fintech developers is a strategic decision that shapes your product, compliance posture, and long-term growth.

The right mix of skills and roles, payments, risk, compliance, and infrastructure can mean the difference between scaling confidently and constantly fighting fires.

While the competition for senior fintech talent is fierce, companies that broaden their sourcing strategies, invest in meaningful retention, and carefully evaluate candidates stand a better chance of building durable teams.

If you can’t afford six months of open roles or endless recruiting cycles, we offer a practical solution: pre-vetted fintech engineers who can contribute from day one.

Frequently Asked Questions

Fintech developers need skills in payments APIs, compliance, risk management, and scalable backend systems.

To hire fintech developers, you define the roles, use niche sourcing channels, and evaluate both technical and compliance knowledge.

You can find fintech talent through global sourcing, fintech-specific communities, open-source projects, and vetted partners like Trio.