Scaling fintech infrastructure can be challenging. However, scalability is crucial to the success of any company in the financial services industry. Without infrastructure that can securely handle large spikes in transaction volumes, you risk failures that could negatively impact your reputation in the long term.

So, how do you build high-volume payment systems that can keep up with real-time changes, while staying compliant? In our many years in the fintech industry, working with both fintech startups and established firms, we have seen that the only real way to ensure scalable app development is through cloud solutions.

Microservices and leveraging Infrastructure as Code (IaC) can also be helpful if you have experienced developers on board.

Having the right people on your team is incredibly important. You can build the best fintech product in the world, but it is no use if you aren’t prepared to address the unique challenges of the industry.

At Trio, we hire the top 1% of applicants and focus on pairing you with developers who have worked on similar projects, ensuring their fintech expertise and ability to help you make informed infrastructure decisions for your project.

Our outsourcing and staff augmentation hiring models also mean you get to focus on scaling your fintech project, without worrying about the commitment that comes with a long-term hire.

Before you start looking for the right person, let’s ensure you understand the key aspects of building scalable fintech apps, so you can make informed decisions for your company.

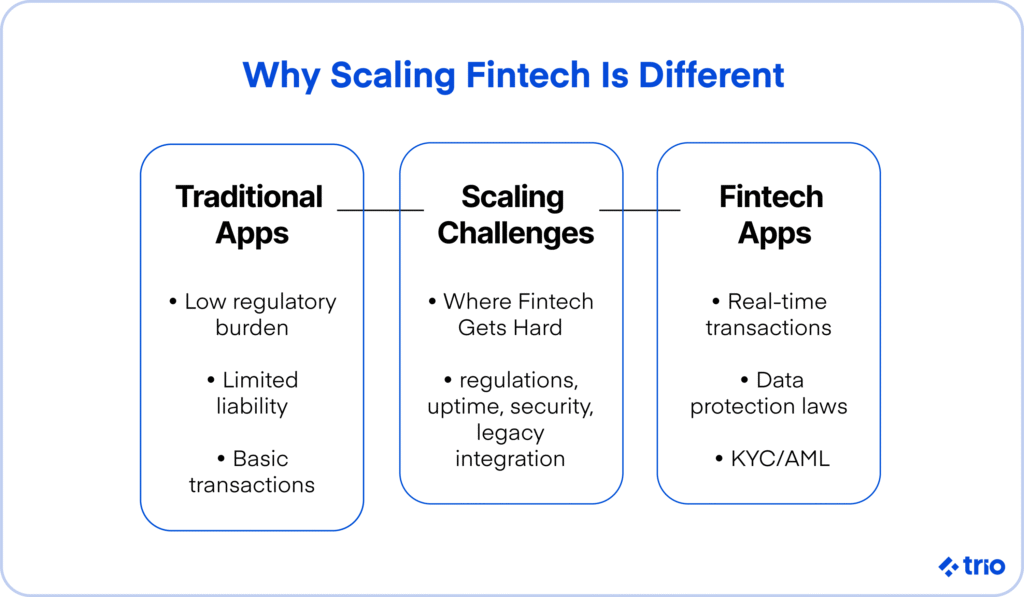

Why Scaling in Fintech is Challenging

Scaling regular applications is challenging, but fintech companies face some unique issues that others may not encounter. These challenges are both technical and regulatory.

The constraints of legacy systems

Fintech firms often partner with established companies, such as large banks and reputable institutions. These established companies almost always have some sort of software in place, whether it’s to facilitate banking services or regulatory compliance.

The issue is that these legacy systems are built for stability and compliance, making them difficult to scale, especially if they are slightly outdated.

Fintechs utilize the latest technology available, which may not be compatible with outdated languages used in existing technologies. You may also encounter issues such as rigid databases and limited interoperability, which can become a limiting factor and make integration very difficult.

Compliance, growth velocity, and technical debt

In addition to the technical issues, you will also need to consider regulatory issues. Laws surrounding data protection are incredibly stringent, and adhering to these regulatory guidelines is a non-negotiable requirement for fintech platforms that deal with not only personal information but also people’s actual money.

One of the biggest traps we’ve seen companies fall into when building fintech products is focusing too much on building scalable infrastructure and failing to consider regulations, which can lead to fines and issues running in certain regions.

This may not seem like a significant issue, but global fines related to fintech regulations reached $19.3 billion in 2024. Even temporary outages can significantly impact customer retention, making them incredibly detrimental to your company.

The MVP Trap: Common scaling pitfalls post-launch

When creating your minimum viable product (MVP), you’re trying to assemble your most essential features so you can go to market and start generating revenue. However, there are some issues with this mentality when it comes to fintech and future-proofing your apps to ensure you can support sustainable growth in the future.

Monolithic architecture vs Maintainability

Many companies launch their MVPs with monolithic architecture to get them out as quickly as possible. While this definitely decreases your speed to market, it can be challenging to maintain in the long term.

This means that you start experiencing infrastructure bottlenecks and scalability issues almost immediately after launch.

This only adds more pressure to your teams, who now need to revise existing work while scrambling to keep up with the increasing load, reliability issues, and any integration issues that may result naturally or as a consequence of the massive changes they now need to implement.

Why MVP decisions create long-term bottlenecks

Vendor lock-ins, hard-coded workflows, and limited observability can all be incredibly restrictive going forward.

If you can’t adapt and switch seamlessly in the future, your developers will waste continuous energy trying to fight outages or patch any potential issues. They may even end up redoing all of their previous work so that you can change over later.

Your MVP architecture can either set you up for all your infrastructure needs going forward, or it can become the bane of your existence, so choose wisely.

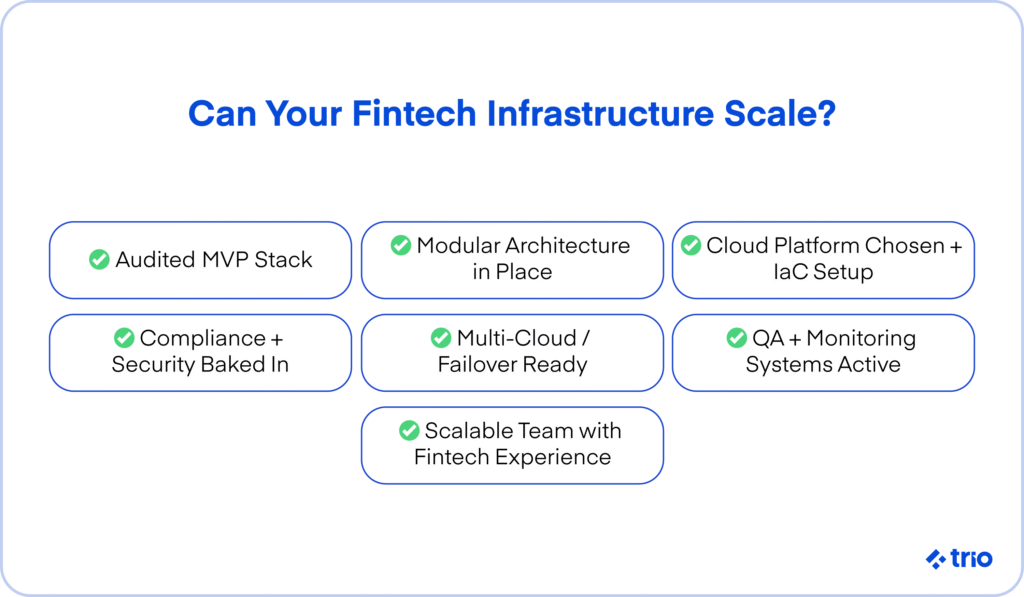

Before You Scale: Audit Your Stack, Strategy, and Spend

One of the best ways to ensure your infrastructure isn’t a problem is to audit it before implementing any scaling.

Tech audits are a process of identifying potential bottlenecks, latency hotspots, or areas where your app could be more efficient. These audits will help you identify and address any issues before they become a concern, such as being unable to scale or negatively impacting customer acquisition and retention.

Identifying product velocity bottlenecks means that you can ensure you have infrastructure that’s ready to grow, before your developers spend countless hours creating new features.

Budget and cost inefficiency risks are also very important to consider. Yes, you want the best possible user experience, with as many different features as possible. But not all of those are going to make a big difference in your net income. You could also create the features and run them more cost-effectively using cloud or hybrid cloud development.

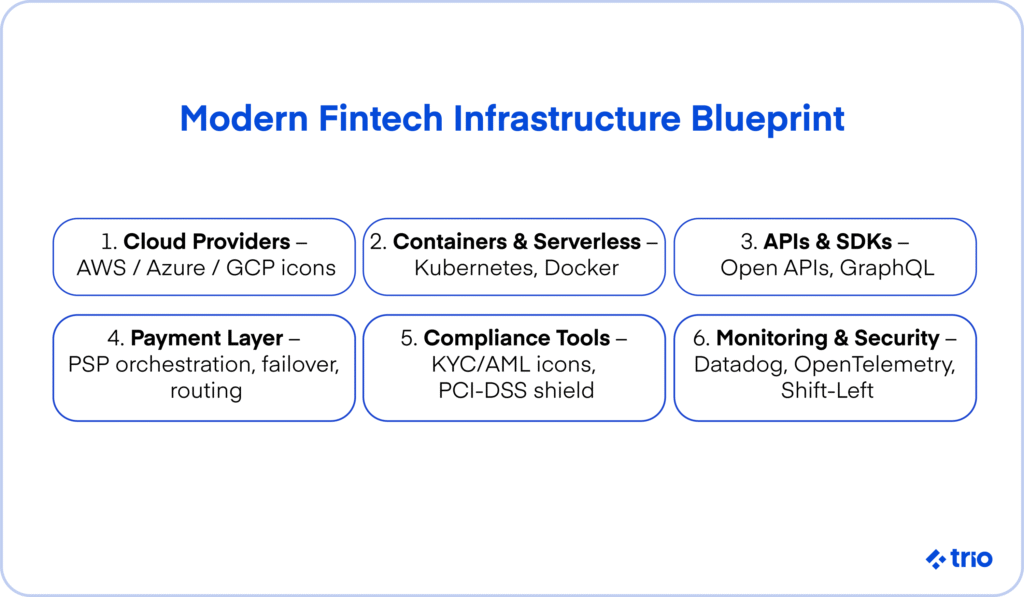

Build a Cloud-Native, API-First Core

We’ve discussed cloud-native development a couple of times. Now, let’s look at what that means practically, so you can build cost-effective infrastructure that grows as needed.

Choosing between AWS, Azure, and GCP

The most popular cloud-native platforms are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). While all of them are great, we’ve noticed that there are certain situations where one option works a little better than the others.

For example, AWS is recognized for its maturity and extensive service offerings. Azure is likely the best option if you’re already using a lot of Microsoft enterprise tools, thanks to its seamless integration abilities. If you plan to focus on numerous machine learning and AI-powered tools or require complex analytics, GCP is the industry leader.

The right one for you depends on a variety of factors, including the skills and expertise on your team, your product roadmap, and any compliance needs you may have.

If you’re unsure about your options, our developers can help you assess your requirements, enabling you to make an informed decision that meets your current needs and is relatively future-proof.

Serverless, containers, and multi-cloud readiness

Once you have selected the right cloud platform, you still need to build everything else.

Ensuring your infrastructure includes container orchestration and Kubernetes will enable you to offer modular, scalable services.

You could also consider a serverless option to reduce your overhead.

Given the potential consequences of downtime in the fintech landscape (such as people being unable to access their digital banking app), adopting a multi-cloud strategy is probably a good idea. That way, you can scale effortlessly without worrying about what will happen if a single provider experiences issues.

Open APIs and modular fintech systems

Cloud-native apps work best around open APIs.

These APIs enable integration with other products, whether through embedded finance to facilitate payments for your app or by integrating your app into legacy systems as part of their financial operations.

Modular systems, as we have mentioned briefly above, are also critical. These systems enable you to iterate multiple times on a single aspect of your code without breaking everything. The result is a product that is highly agile and able to keep pace with the rapid evolution of the fintech industry.

Infrastructure as Code: Scaling With Speed and Control

Your infrastructure becomes a limiting factor in scaling easily. Infrastructure as Code is one way we help fintech companies ensure they are prepared for whatever the industry throws at them.

Terraform, CDK, and Pulumi in fintech

Terraform, AWS CDK, and Pulumi are among the most popular Infrastructure as Code tools.

They allow developers to create, update, and manage any cloud resources you have through the use of configuration files.

These files are significantly faster and less prone to error than the manual processes they would use instead.

Compliance automation and rollback strategies

IaC is incredibly important when you deal with financial data. You can use it to support your audit readiness or manage version control changes.

It can also make any potential rollbacks easier if you do run into issues, drastically decreasing the possible downtime or the duration of buggy features.

You can also use IaC files that automate compliance controls and ensure your infrastructure is not only secure but also adheres to other regulatory requirements related to data handling.

IaC in CI/CD pipelines

Integrating continuous integration and continuous development pipelines (CI/CD) can be incorporated into your IaC so that you can review and test any changes extensively before you deploy them.

This prevents many potential disasters and improves overall code quality.

Design Payment Systems for High-Volume Scale

Finding or building the right infrastructure for payments will enable you to scale, as it allows you to handle massive quantities of transactions per second.

This is particularly crucial for mobile banks and e-commerce platforms.

The issue is that you don’t want to pay to process thousands of transactions if you only handle a couple of payments each month. So you need a system that is highly adaptable.

Transaction routing, PSP orchestration, and failover are all necessary to create resilient systems that don’t simply crash when transaction volumes surge suddenly.

You also need to consider that even the smallest systems need KYC, AML, PCI, and regulatory readiness that you can maintain as you scale.

If you’re starting out, we highly recommend using an embedded payment system. It may not be financially worthwhile to develop your own system and take on all the challenges associated.

Instead, consider partnering with someone who has invested significant effort, offering modularity, observability, and even geographic flexibility.

Stripe is one of the most popular options, having processed a total payment volume of $1.4 trillion in 2024.

Optimize for Operational Efficiency and Cost

There are various ways to optimize operational efficiency and reduce costs.

Autoscaling and serverless savings

While the cloud is great, costs can add up very fast.

Autoscaling helps you pay as little as possible at any given moment. You can also rest easy that if any spikes happen, you won’t have to rush around to accommodate any spikes, which might even occur on a daily basis.

Monitoring and anomaly detection

Determining if any anomalies are occurring will enable you to address the issues. In fintech, anomalies could indicate potential fraud.

AI is a valuable tool for real-time fraud detection. If you set your models up correctly, AI and machine learning models can also continue to learn, adapting to real-world situations, rather than just relying on the data that you have trained them on.

With agentic AI, you could even have a predetermined chain of reactions that may be able to address the issues with minimal intervention.

Avoiding premature optimization

You need to focus on optimization, but if you’re a startup, you may not have the budget to optimize every aspect of your infrastructure.

It’s essential to have an expert on your team so that you can understand where optimizing will provide the most benefit and where you can hold off for a little while.

Bake In Security and Compliance from Day One

Security is very difficult to add later. Making sure you work it into your code from the ground up sets you up for success. It is one of the place we never recommend you cut corners.

In all apps, DevOps is essential, but in fintech, DevSecOps is the industry standard for development lifecycles.

Shift-left testing and policy-as-code can be very helpful when it comes to detecting vulnerabilities, while you could also use tools like AI, which we’ve already mentioned.

Geographic and Product Expansion Tactics

Since fintech is heavily regulated, you need to consider whether you may encounter varying regulatory requirements from region to region.

If you are partnering with infrastructure providers, also consider what will happen if you expand on a regional scale later.

One of the many challenges associated with these differences is meeting local compliance requirements while maintaining a standardized platform, ensuring clients receive a consistent experience.

This consistency builds customer trust and enhances their perception of your company overall.

However, it is sometimes unavoidable that different features will be available in other regions, whether due to various restrictions or demand differences.

Continuous Monitoring, Testing & Quality Assurance

You don’t just build security and scalability into your app and leave it. You need to be consistently monitoring your products to ensure that you aren’t running into any issues.

Setting yourself up for continuous monitoring is easiest right at the start of your development process because some tech stacks are just inherently more observable than others.

React, Angular, and Node are generally good options. When it comes to databases, MongoDB is fairly popular for its observability.

You could use tools like Datadog, Prometheus, and OpenTelemetry to access real-time data if you aren’t setting up your own systems.

We also always recommend stress testing and simulating high-load scenarios so you have a good idea of what to expect when any natural spikes occur.

Getting a quality assurance expert on your team can also be incredibly valuable. The fintech industry is evolving, which means you’ll constantly be adding to your product or optimizing certain processes.

Having someone who is dedicated to continuous QA means you won’t have as many issues appear, and will encourage an overall better user experience.

How to Build (or Hire) a Team That Can Scale You

The best way to scale is to ensure you have the right team in place, comprising knowledgeable individuals who can set you up for success from the outset.

These developers should have experience in growing apps in the fintech space, so they can help you choose the right architecture and tools and implement them efficiently using their industry knowledge.

Finding these individuals can be a challenging process, requiring several months of effort to post job listings, review portfolios, conduct technical interviews, and onboard new team members. Even if you are incredibly thorough, you still risk misunderstandings and incorrect hires.

Working through a company like Trio means you can connect with developers much quicker. Since we don’t try to apply a one-size-fits-all solution to your problem, but find developers with the exact experience you require, we’ve been able to maintain a 97% placement success rate.

We also utilize developers from countries such as LATAM and Africa, who are not only familiar with working on remote teams but also have extensive experience with the U.S. regulatory landscape. This means you get quality developers at a fraction of the cost.

If you’re interested in hiring developers through Trio or seeking advice on ensuring the scalability of your app, please reach out to schedule a free consultation.