If you’ve ever tried to launch a platform that accepts payments on behalf of multiple vendors, say a marketplace, SaaS platform, or gig app, you’ve likely run into the labyrinth of merchant onboarding, compliance, and payment infrastructure.

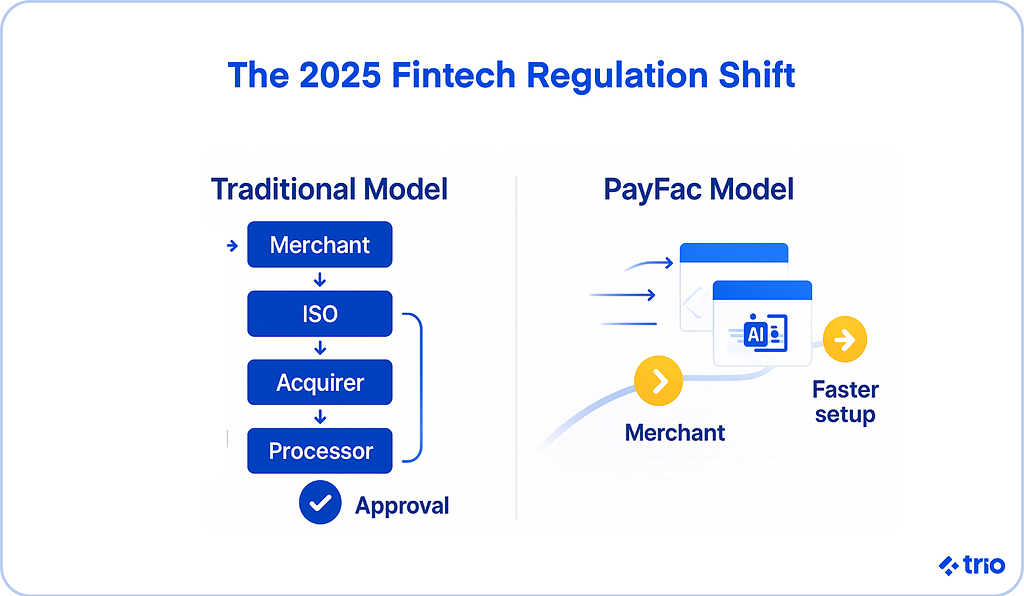

Traditional payment setups can take weeks to approve merchants, require complex contracts, and still deliver a fragmented experience for both you and your users.

This is where payment facilitation (also known as PayFac) steps in.

It offers a faster, more flexible way for platforms to enable payments at scale.

But as with most things in fintech, the simplicity on the surface hides serious technical and regulatory complexity underneath.

In our years working with fintech clients at Trio, we’ve seen how businesses often underestimate what’s involved in becoming or integrating a PayFac and how transformative it can be when done right.

Let’s unpack what payment facilitation really is, how it works, and why it has become the backbone of modern embedded finance.

Understanding Payment Facilitation

Before diving into the mechanics, it’s worth clarifying what payment facilitation actually means in practice, and how it differs from the traditional way businesses handle card payments.

Definition of a Payment Facilitator (PayFac)

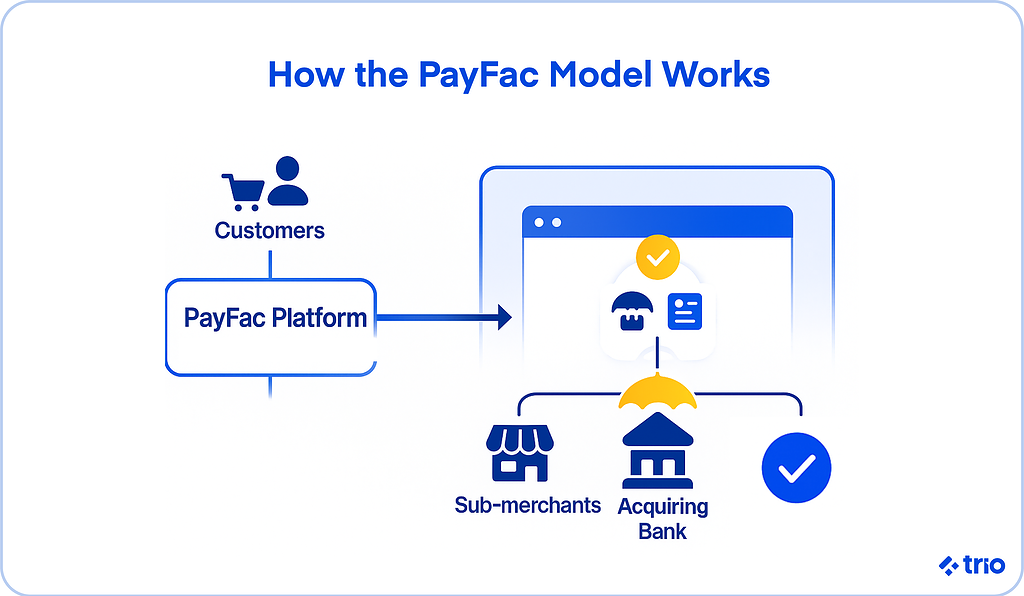

A Payment Facilitator, or PayFac, is an entity that enables sub-merchants (such as independent sellers, contractors, or SaaS customers) to accept electronic payments under its master merchant account.

Instead of every small business or vendor applying directly to a bank or acquirer for a merchant account, PayFac payment solutions act as an intermediary.

It handles onboarding, underwriting, compliance, and transaction processing on behalf of those sub-merchants.

The key distinction is that sub-merchants don’t interact with the acquirer directly. They transact under the PayFac’s umbrella, which significantly reduces friction and speeds up time-to-activation.

You can think of PayFacs as the infrastructure layer powering modern platforms like Shopify, DoorDash, and Uber, where thousands of independent sellers or drivers process payments seamlessly through a single ecosystem.

How Payment Facilitation Differs from Traditional Payment Processing

In the traditional payment model, each business has to set up its own merchant account through an acquiring bank or ISO (Independent Sales Organization).

This process often involves lengthy applications, credit underwriting, and compliance verification.

With payment facilitation, the PayFac aggregates these merchants into a single master account.

This structure lets the PayFac streamline the approval process of sub-merchants, sometimes instantly, while still ensuring compliance through automated KYC (Know Your Customer) and risk checks on your digital payments.

The trade-off is that PayFacs assume a higher share of operational and financial risk. They’re responsible for monitoring fraud, ensuring chargeback compliance, and maintaining adherence to PCI DSS standards.

In other words, PayFac solutions simplify life for sub-merchants but take on the heavy lifting of regulation and oversight themselves.

The Role of Acquirers, ISOs, and Processors

Even in the PayFac model, several traditional players remain part of the picture. Understanding how they fit together helps clarify why this system works the way it does.

- Acquiring Banks (Acquirers) are licensed institutions that hold merchant accounts and facilitate the flow of funds from issuing banks. Every PayFac must operate under an acquirer’s sponsorship.

- ISOs (Independent Sales Organizations) resell payment processing services but don’t aggregate sub-merchants under their own account. They’re essentially intermediaries that help merchants connect to acquirers.

- Payment Processors handle the technical routing of transactions, authorizing, capturing, and settling payments.

The PayFac sits between these players and the sub-merchants, bundling their roles into a unified experience.

While an ISO connects merchants to processors, a PayFac becomes the merchant of record, embedding payments directly into the platform’s user experience.

How Payment Facilitation Works

Now that you understand who’s involved, it helps to see how the PayFac model actually operates on a day-to-day level.

The PayFac Model Explained

At its core, the PayFac model transforms how businesses integrate and control payments.

The PayFac holds a master merchant account with an acquiring bank and onboards sub-merchants beneath it. Each sub-merchant is given a virtual account ID for tracking transactions and settlements.

The PayFac is responsible for ensuring each sub-merchant complies with regulations, processes transactions securely, and receives timely payouts.

This model allows software platforms, especially SaaS and marketplaces, to make payments a built-in feature rather than a separate integration.

In our experience working with fintech platforms, this embedded approach has become a key differentiator. It allows businesses to keep users within their ecosystem and generate new revenue streams through payment margins and fees.

Components of a Payment Facilitation System

A functional PayFac setup involves the orchestration of risk systems, onboarding tools, data pipelines, and financial controls.

Underwriting and Merchant Onboarding

This is where a PayFac’s responsibilities begin. Before a sub-merchant can start accepting payments, the PayFac must verify its legitimacy and risk level.

This process involves identity checks, business verification, and sometimes credit assessments. Advanced PayFacs automate most of this using API-driven KYC tools and risk scoring algorithms.

The onboarding experience is what separates world-class PayFacs from average ones.

A well-designed system can approve legitimate merchants in seconds while quietly flagging high-risk entities for manual review.

Transaction Processing and Settlement

Once sub-merchants are onboarded, the PayFac facilitates payment authorization and settlement through its acquiring bank and processor.

When a customer pays, funds are first deposited into the PayFac’s master account.

After settlement, the PayFac disburses the appropriate share to each sub-merchant’s account, minus fees and any withheld reserves for risk management.

It’s a delicate process that requires accurate reconciliation, real-time tracking, and compliance with anti-money laundering (AML) regulations.

Risk Management and Compliance

Because PayFacs are financially responsible for their sub-merchants, they must continuously monitor transactions for fraud, chargebacks, and suspicious activity.

This often includes velocity checks, machine-learning fraud detection, and manual review of anomalies. From a compliance perspective, PayFacs must meet PCI DSS standards and maintain AML/KYC documentation for all sub-merchants.

At Trio, we’ve seen fintech clients invest heavily in this layer; it’s where regulators and acquirers focus their scrutiny, and where automation pays off most.

Reporting, Analytics, and Payouts

Finally, a PayFac’s value is reinforced by transparency.

Reporting systems give both PayFac and its sub-merchants visibility into transactions, fees, and payout timelines.

Advanced PayFacs often integrate real-time dashboards, predictive analytics, and automated payouts via APIs.

This not only simplifies financial operations but also builds trust, an essential currency in payments.

Typical Transaction Flow in a PayFac Ecosystem

Here’s what happens in a typical PayFac transaction:

- A customer initiates a payment through a sub-merchant’s checkout page.

- The PayFac’s system routes the transaction to a payment processor for authorization.

- The issuing bank approves or declines the payment.

- The funds settle into the PayFac’s master merchant account.

- The PayFac disburses the correct amount to the sub-merchant’s designated account.

While it looks seamless to the end user, each step involves complex orchestration of data validation, compliance checks, and fund movements.

Benefits of the PayFac Model

The PayFac model continues to gain traction because it offers clear strategic and operational advantages for software platforms, marketplaces, and B2B ecosystems.

Faster Merchant Onboarding and Activation

Traditional merchant accounts can take days or even weeks to approve. PayFacs, by contrast, enable near-instant onboarding.

This is achieved through automated underwriting and pre-vetted frameworks established with their acquiring partners.

For platforms, this means new sellers or service providers can start accepting payments within minutes, dramatically improving conversion and user retention.

Improved Control Over Payment Experience

When you operate as a PayFac, you control how payments are presented, processed, and settled. You own the checkout experience, the branding, and the payout logic.

That control allows for cohesive UX, reduced dependency on third-party providers, and the flexibility to introduce features like instant payouts or multi-currency support, all of which can strengthen your competitive position.

New Revenue Streams Through Fee Sharing

PayFacs lets you monetize payments. Because they process transactions under their own account, they can set custom pricing structures, collect margins on processing fees, or share revenue with partners.

Many SaaS companies now use embedded payments as a profit center, offsetting platform costs and increasing lifetime customer value.

Simplified Compliance via Aggregation

One of the most significant operational benefits of the PayFac model is aggregated compliance.

Instead of each merchant handling its own PCI certification or AML checks, the PayFac manages these obligations centrally.

This aggregated oversight makes life simpler for sub-merchants, who gain access to enterprise-level compliance without the complexity.

It also strengthens the overall ecosystem by maintaining consistent standards across the board.

Comparing PayFac Models

Once you understand the basics of payment facilitation, it’s essential to recognize that not all models are created equal.

The structure you choose can shape your compliance obligations, technical architecture, and even your profitability.

PayFac vs. Traditional Payment Processing

In traditional payment processing, each merchant must independently establish a relationship with an acquiring bank. The merchant undergoes underwriting, maintains PCI DSS compliance, and pays fees directly to the acquirer or processor.

By contrast, a PayFac consolidates all of that. It onboards sub-merchants under its umbrella, handles compliance collectively, and manages settlements internally.

This model reduces friction and simplifies scale, but it also transfers risk and regulatory responsibility to the PayFac itself.

For software platforms, the PayFac approach generally means a faster go-to-market and a better customer experience, while legacy processing models can be more suitable for established enterprises that prefer direct control and lower exposure to aggregated risk.

We often recommend it for smaller fintechs on a limited budget and with limited development capabilities.

PayFac vs. ISO (Independent Sales Organization)

At first glance, PayFacs and ISOs might appear similar; they both connect merchants with acquirers and enable payment processing.

The distinction lies in ownership of the merchant relationship.

An ISO acts as a sales and distribution partner.

It helps merchants get approved but doesn’t handle funds, underwriting, or compliance after onboarding.

A PayFac, however, does all of those things. It becomes the merchant of record, processes transactions directly, and manages sub-merchants’ risk profiles.

This difference means PayFacs require far greater technical and regulatory investment, but they also have much more control and revenue potential.

Many ISOs eventually evolve into PayFacs once they build the infrastructure and partnerships to support it.

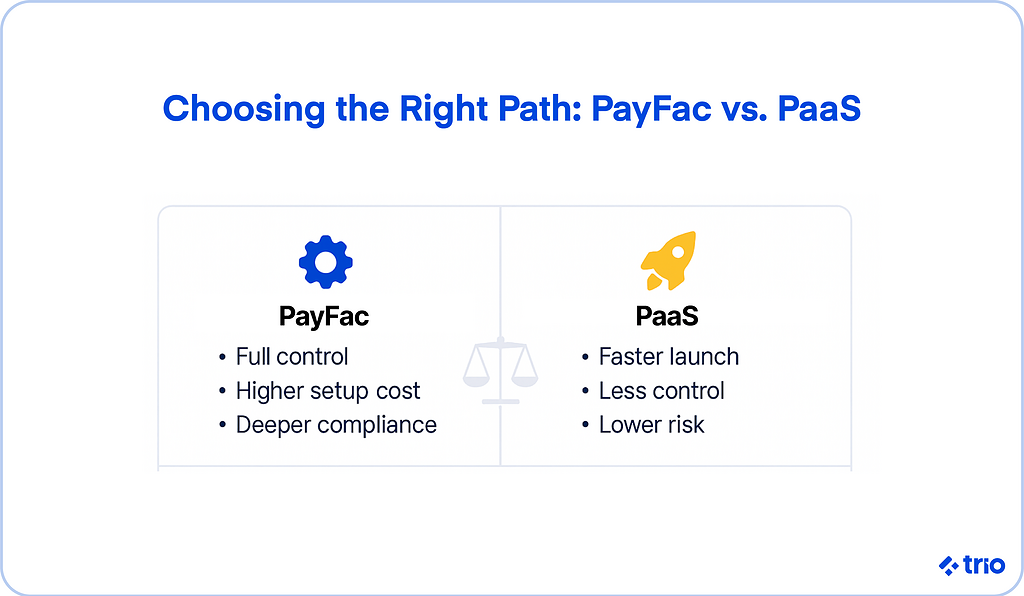

PayFac vs. PayFac-as-a-Service (PaaS)

A newer model, PayFac-as-a-Service (PaaS), has emerged for companies that want the benefits of payment facilitation without the regulatory and operational burden.

In a PaaS model, a third-party provider (like Finix, Infinicept, or Payrix) offers APIs, compliance coverage, and banking relationships so a business can embed payments quickly while staying technically and legally compliant.

The business still controls the user experience and branding, but the provider manages licensing, settlement, and risk operations in the background.

This managed approach has become popular among SaaS platforms and marketplaces that want to monetize payments without fully becoming a regulated financial entity.

When to Build vs. When to Partner

The decision to build or partner hinges on your scale, technical resources, and long-term goals.

Building a PayFac from scratch gives you full control and margin ownership but demands millions in upfront investment and months, sometimes years, of regulatory approval.

Partnering with a PaaS provider, by contrast, allows you to launch in weeks but often limits customization and long-term profitability.

At Trio, we’ve seen high-growth fintechs start with a PaaS to validate their model, then transition to a full PayFac once volume and revenue justify the compliance investment.

It’s incredibly cost-effective, provided you can integrate everything correctly.

Becoming a Payment Facilitator

Transitioning into PayFac status isn’t simply about turning on new APIs; it’s a formal financial undertaking with legal, technical, and operational obligations.

Regulatory and Operational Requirements

Before launching a PayFac operation, you need to establish relationships with key financial partners and comply with stringent industry standards.

Sponsoring Bank Relationships

Every PayFac must partner with a sponsoring acquirer, a licensed bank that enables access to the card networks (Visa, Mastercard, etc.).

This relationship is foundational, as the acquirer ultimately bears regulatory responsibility and expects strict adherence to compliance frameworks.

Negotiating these relationships takes time, especially for early-stage companies without a transaction history or established risk controls.

PCI DSS and Data Security Obligations

Because PayFacs handle sensitive card data, they’re required to comply with PCI DSS (Payment Card Industry Data Security Standards). This involves securing networks, encrypting data, and maintaining annual audits.

It’s not optional; PCI compliance is a continuous process that demands both technology and a culture of security awareness across your organization.

AML/KYC Responsibilities

Regulators hold PayFacs accountable for preventing money laundering, fraud, and terrorist financing.

That means implementing AML (Anti-Money Laundering) and KYC (Know Your Customer) processes to verify the identity and legitimacy of each sub-merchant.

Modern PayFacs automate these checks through API integrations and continuous monitoring systems, but human oversight remains a key component of compliance integrity.

Steps to Establish a Payment Facilitation Service

Becoming a PayFac involves more than just technology; it’s an operational transformation.

Licensing and Registration

Depending on your region, you may need to register as a Payment Facilitator with card networks like Visa and Mastercard.

In some jurisdictions, you’ll also need money transmitter licenses or equivalent financial permits.

These regulatory steps can take months, requiring legal expertise and ongoing communication with financial authorities.

Technical Infrastructure Setup

The technical backbone of a PayFac includes payment gateways, APIs, KYC systems, data encryption, and reporting dashboards.

You’ll also need redundancy and failover systems for uptime guarantees.

Our developers have helped fintech teams architect modular systems that can scale safely, where risk engines, settlement logic, and onboarding flows are separated for easier updates and compliance audits.

Risk and Compliance Framework Development

Building a risk management program is critical. You’ll need clear procedures for fraud monitoring, chargeback management, and AML escalation.

Regulators and acquirers will expect you to demonstrate how you prevent financial crime in real time.

Ongoing Monitoring and Reporting

After launch, a PayFac must continue reporting transaction data, risk events, and financial metrics to its acquirer.

Internal audits and compliance reviews are typically conducted quarterly or semi-annually.

This ongoing scrutiny ensures consumer protection and payment system integrity.

Challenges in the PayFac Journey

Operating as a PayFac comes with real challenges that often surprise first-time entrants.

High Capital and Compliance Burdens

Becoming a PayFac requires significant upfront investment, not only in technology, but in licensing, legal counsel, and compliance staffing.

For most startups, this initial cost is prohibitive without investor backing or substantial transaction volume.

Underwriting Complexity and Fraud Exposure

With great control comes great risk. PayFacs underwrite sub-merchants and bear responsibility for their transactions.

If a sub-merchant engages in fraudulent activity, the PayFac absorbs the losses.

Advanced machine learning models and robust identity verification can mitigate risk, but fraud is a moving target. The system must evolve continuously.

Scalability and Maintenance Costs

Maintaining a high-volume PayFac operation involves constant DevOps attention, 24/7 monitoring, and infrastructure scaling.

Payment data pipelines are resource-intensive, and downtime directly affects revenue.

Cross-Border and Multi-Currency Barriers

Expanding internationally introduces regulatory fragmentation.

Each region has unique licensing, taxation, and anti-fraud frameworks.

Supporting multi-currency settlement also complicates reconciliation and liquidity management.

PayFac-as-a-Service (PaaS)

For platforms that want the upside of payment facilitation without the full regulatory weight, PayFac-as-a-Service provides a practical alternative.

What Is PayFac-as-a-Service?

PayFac-as-a-Service providers offer a turnkey solution: APIs, compliance coverage, and settlement tools that let you embed payments into your platform almost immediately.

You still control the merchant experience, but the provider handles the back-end infrastructure and compliance obligations.

Key Features and Capabilities

There are several key features to consider.

Plug-and-Play Merchant Onboarding

Merchants can be approved and activated instantly through API-based KYC and preconfigured risk rules.

This allows platforms to scale merchant acquisition without adding compliance bottlenecks.

Integrated Risk and Compliance Tools

PaaS vendors usually include built-in AML/KYC verification, chargeback monitoring, and risk dashboards, all managed centrally.

Simplified Settlement and Payout APIs

Payout automation and reconciliation APIs make it easy to distribute funds while keeping transaction data synchronized across systems.

Advantages Over Traditional PayFac Models

There are many advantages, but here are some of the main ones.

Faster Go-to-Market for Platforms

Instead of spending months on licensing and setup, platforms can go live in weeks.

For early-stage fintechs, this speed often determines market success.

Reduced Risk and Regulatory Overhead

The PaaS provider assumes much of the compliance and risk management responsibility, freeing you to focus on product development and customer experience.

Lower Development and Maintenance Costs

Because infrastructure and monitoring are managed externally, engineering and DevOps costs drop significantly, an advantage for lean teams or those testing new markets.

Technology and Architecture Considerations

Even with PaaS, technology architecture remains crucial.

Payment facilitation touches sensitive financial data, and poor design can lead to bottlenecks or compliance violations.

Integration Complexity and API Design

Clean, well-documented APIs are the foundation of scalable payment systems.

The challenge lies in managing versioning, sandbox environments, and backward compatibility as your platform evolves.

DevOps Load and Ongoing Maintenance

Monitoring, uptime management, and automated deployment pipelines are essential.

Payment systems must balance agility with reliability, especially when handling thousands of real-time transactions.

Compliance Automation and Audit Trails

Audit readiness should be built in from day one.

Automated data logging, user access controls, and change tracking simplify regulatory reporting later.

Scalability and Data Security in the Cloud

Modern PayFacs often operate in multi-region cloud environments.

Encryption, tokenization, and region-specific data storage help maintain compliance with both PCI DSS and GDPR.

Leading PayFac Providers and Market Landscape

Several companies have shaped the evolution of payment facilitation and continue to define its standards.

Stripe: The Pioneer of Embedded Payment Facilitation

Stripe effectively mainstreamed the PayFac concept.

Its infrastructure allows developers to integrate payments with minimal effort while maintaining full control of the user experience.

Stripe’s model inspired the next wave of embedded finance platforms.

Adyen, Square, and Marqeta: Expanding the Ecosystem

Adyen and Square built hybrid PayFac models, combining acquiring, processing, and risk management under one umbrella.

Marqeta, meanwhile, extended the concept to card issuing and spend management, proving that payment facilitation principles can apply beyond acceptance.

BaaS and PaaS Vendors Enabling White-Label PayFac Models

Today, Banking-as-a-Service (BaaS) and PaaS vendors like Finix, Infinicept, and Rapyd enable companies to white-label PayFac capabilities without managing licenses themselves.

These platforms are helping software businesses evolve into fintech ecosystems, without needing to reinvent the compliance wheel.

Choosing the Right Payment Facilitation Approach

Given the array of options, choosing how to approach payment facilitation is as much a business strategy decision as it is a technical one.

Key Evaluation Criteria (Risk, Cost, Time-to-Market)

When evaluating models, weigh your available capital, compliance expertise, and desired speed.

The PayFac model offers maximum control and revenue but carries the highest complexity.

PaaS solutions are easier to deploy but may limit future flexibility.

When to Build, Buy, or Partner

If payments are core to your business model and you have sufficient transaction volume, building may make sense.

If payments are a feature rather than a focus, partnering with a PaaS or acquirer-led program is more efficient.

Many of our fintech clients take a hybrid route, launching with a PaaS and transitioning to a full PayFac structure once they’ve validated demand.

Aligning the PayFac Model with Business Goals

Ultimately, your payment strategy should serve your users and your growth plan, not the other way around.

Aligning operational capacity, compliance readiness, and long-term product vision will determine whether you thrive in this space or drown in regulatory overhead.

Future Outlook: The Evolution of Payment Facilitation

The payment facilitation landscape continues to evolve rapidly, shaped by technology, regulation, and consumer expectations.

The Rise of Real-Time Settlement and Global PayFac Networks

Real-time settlement is emerging as the next frontier.

As instant payments gain traction globally, PayFacs that can deliver faster fund movement will redefine merchant loyalty and liquidity management.

Regulatory Shifts Impacting Aggregators and Sub-Merchants

Regulators are paying closer attention to PayFacs as they handle growing transaction volumes.

Expect tighter scrutiny on AML practices, sub-merchant disclosures, and consumer fund protection.

How AI and Data Are Shaping Risk and Compliance in PayFacs

AI-driven risk scoring, anomaly detection, and automated reporting are transforming how PayFacs manage compliance.

Machine learning models now identify potential fraud patterns long before chargebacks occur.

Predictions for the Next Generation of Embedded Finance

Payment facilitation will likely merge further with Banking-as-a-Service and card issuing, giving rise to full-stack embedded finance ecosystems.

Platforms that can orchestrate these layers seamlessly will define the next decade of fintech innovation.

Conclusion

Payment facilitation has fundamentally changed how businesses think about payments, not as a back-office function, but as a growth engine.

Whether you build your own PayFac infrastructure or partner through a PaaS provider, the goal remains the same: creating a seamless, compliant, and value-generating experience for your merchants.

At Trio, we’ve seen firsthand how the right approach to payments can elevate a platform from a simple software tool to a financial ecosystem in its own right.

As the PayFac model matures, the question isn’t whether to adopt it, but how to do it intelligently, sustainably, and in alignment with your broader business strategy.

If you need experienced fintech developers to help you do this, get in touch!

FAQs

What is a Payment Facilitator (PayFac)?

A Payment Facilitator, or PayFac, is a company that lets other businesses, called sub-merchants, accept payments under its master account. The PayFac handles onboarding, compliance, and payouts, making payment acceptance faster and simpler.

How does payment facilitation differ from traditional payment processing?

Payment facilitation differs because merchants are onboarded under one master account instead of getting their own. This means quicker activation, fewer compliance steps for each merchant, and smoother platform-level control of payments.

What are the main benefits of becoming a PayFac?

Becoming a PayFac speeds up merchant onboarding, improves control over the payment experience, and opens new revenue streams from processing fees. It also centralizes compliance, reducing friction for sub-merchants.

What risks do PayFacs take on?

PayFacs are responsible for fraud, chargebacks, and compliance failures across all sub-merchants. They must maintain PCI DSS, AML, and KYC standards, making risk monitoring a significant part of daily operations.