Cash flow is a constant balancing act in B2B trade.

Buyers often want more breathing room to pay, while suppliers need timely cash to keep production moving.

Traditional credit terms can help, but anyone who’s dealt with 60-day invoices or drawn-out approval processes knows how much friction still exists.

The gap between what businesses need and how fast financing can adapt has given rise to B2B Buy Now, Pay Later (BNPL).

Once considered a consumer convenience, BNPL has quietly matured into a serious financial tool for modern commerce. It’s not perfect yet, but it’s reshaping how companies manage liquidity, build trust, and close deals.

Let’s unpack how business-to-business BNPL actually works, what technology sits behind it, and why it’s becoming central to digital trade.

Whether you’re a fintech building payment infrastructure or a supplier rethinking credit strategy, it’s worth understanding the forces driving this shift.

Since BNPL offers for businesses are still fairly new, there are many opportunities, but also many challenges.

Having expert fintech developers on your team, like the kind we have here at Trio, can make all the difference in your ability to take advantage of new technologies like these in secure, compliant ways.

Understanding B2B BNPL

Before getting into the mechanics, it helps to start with what BNPL really means in a business context, and why it’s not just a copy-paste of the consumer model.

What Is Buy Now, Pay Later (BNPL)?

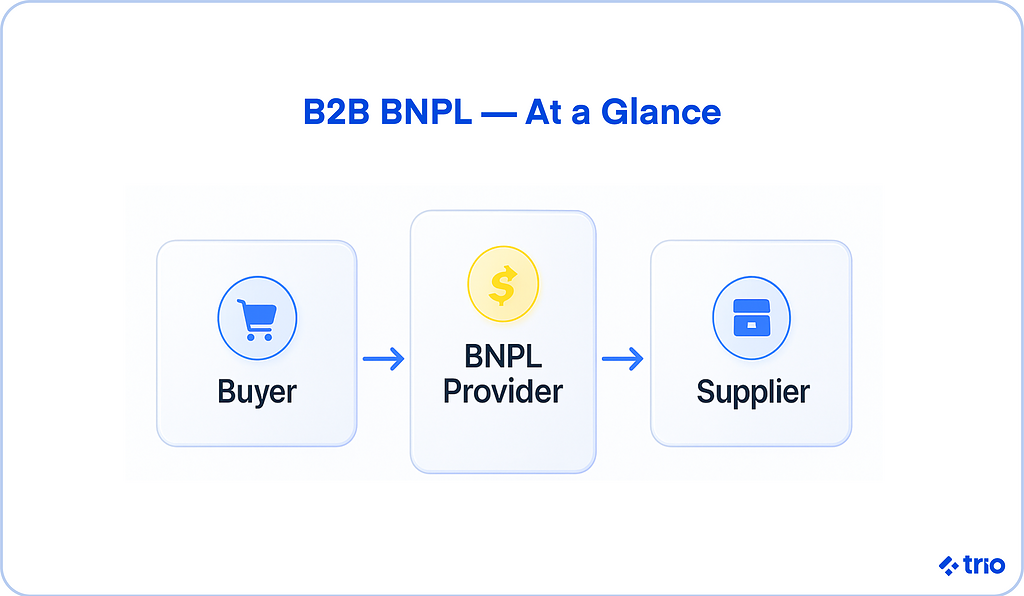

At its simplest, BNPL lets a buyer receive goods or services today and pay for them later, typically through short-term installments.

You’ve probably seen these kinds of flexible payment options on consumer checkouts through Klarna or Afterpay.

In B2B transactions, though, the model stretches beyond convenience. It supports larger invoices, longer terms, and multi-party approvals, often under strict accounting or procurement policies.

What makes B2B BNPL appealing is that it keeps both sides moving.

The supplier gets paid almost immediately, and the buyer preserves liquidity for other needs.

It’s a practical balance between growth and cash flow control, something that traditional loans or business credit often struggle to achieve quickly.

How B2B BNPL Differs from Consumer BNPL

Consumer BNPL focuses on accessibility and ease of purchase. B2B BNPL focuses on integration, risk control, and workflow alignment.

The purchase values are often higher, the relationships longer, and the financial scrutiny deeper.

Credit evaluation for businesses relies less on credit scores and more on financial performance indicators, such as revenue consistency, payment history, or even ERP-linked data.

Some providers now use AI to make these assessments in real time, though the accuracy of such models still depends heavily on the quality of available data.

Another distinction is transparency.

Because corporate finance teams must reconcile every transaction, B2B BNPL systems need to integrate seamlessly with accounting software, invoicing tools, and audit trails.

The result is a data-aware financing layer that fits neatly into existing business operations.

Core Components of a B2B BNPL Model

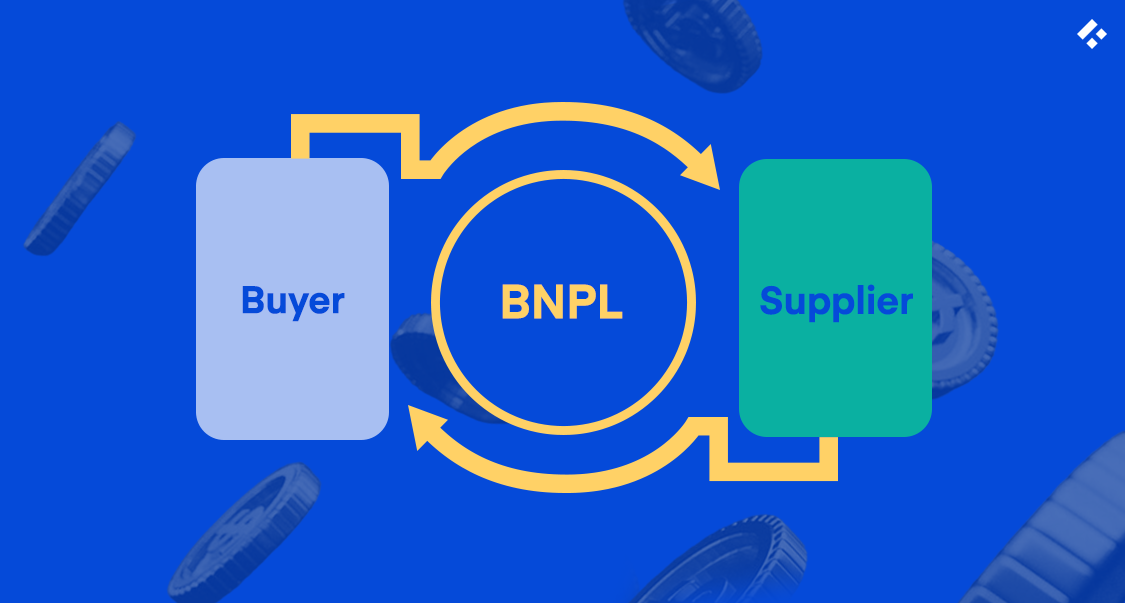

To understand how the system works, it helps to break down the main players involved.

Lenders and Credit Providers

These are the financial institutions or fintechs funding the transaction. They shoulder the credit risk and handle repayment collection.

As already mentioned, many now use automated scoring engines that evaluate transaction data, sector exposure, and repayment history in seconds.

Still, underwriting isn’t foolproof.

Merchants and Suppliers

Suppliers offer BNPL to attract and retain customers while getting paid in full upfront.

The provider covers the invoice, less a small fee, and the supplier avoids the uncertainty of extended payment cycles.

In competitive markets, this setup can mean the difference between closing a deal and losing it to a competitor offering more flexible terms.

Business Buyers and End Clients

For buyers, BNPL provides short-term breathing room without taking on long-term debt.

A growing number of small and mid-sized businesses rely on it as an alternative to credit lines, especially when banks are slow to respond or tighten lending criteria.

Still, responsible use matters. Stacking multiple BNPL arrangements can easily strain liquidity if repayments overlap.

How B2B BNPL Works

Now that you know the key players, let’s look at what actually happens behind the scenes, from credit application to repayment.

Step-by-Step Transaction Flow

1. Application and Instant Credit Decision

When a business buyer chooses BNPL at checkout or during the invoicing part of the payment process, the platform instantly pulls key financial details, sometimes through open-banking connections or accounting integrations.

An automated credit engine reviews these inputs and decides whether to approve, decline, or adjust the credit limit.

2. Supplier Payment and Buyer Repayment

If approved, the BNPL provider pays the supplier, often within 24 to 48 hours.

The buyer then repays the provider over agreed terms, commonly 30, 60, or 90 days.

Some platforms allow installment plans, while others require a single payment. The structure depends on transaction value, sector norms, and credit profile.

3. Fees, Interest, and Risk Management

There’s no single pricing model.

Sometimes the supplier covers a small fee to access early payment; other times, the buyer pays low interest on the deferred amount.

Providers mitigate default risk through continuous credit monitoring, fraud checks, and occasionally insurance partnerships.

The result is a system that shares financial risk across all parties rather than isolating it.

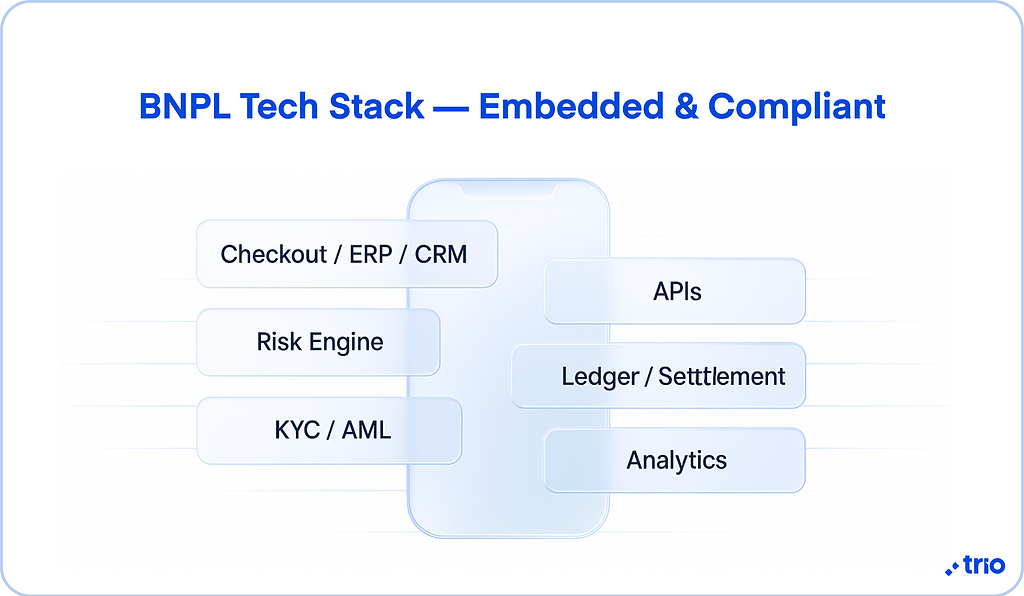

Key Technology Behind BNPL Platforms

Behind every smooth BNPL experience sits a fairly complex technology stack designed to make risk management feel invisible.

APIs, Credit Engines, and Risk Scoring Models

Most BNPL platforms use API-based infrastructure to connect merchants, buyers, and lenders in real time.

The credit engines assess data from multiple sources, bank feeds, transaction histories, and even behavioral patterns, to assign limits dynamically.

These models are powerful but still face scrutiny for their transparency and bias, especially when used in regulated industries.

Integration With ERP and Accounting Systems

For BNPL to work at scale, it has to talk to a company’s existing systems, ERP, CRM, and accounting tools.

Integrations ensure that deferred invoices automatically sync, reconciliations run smoothly, and finance teams maintain accurate records.

Without this layer, BNPL can quickly turn from convenience to a compliance headache.

If you are considering a BNPL service and require integration, we always recommend that you hire a fintech developer who understands compliance and security in the industry, even if it is just temporarily through staff augmentation.

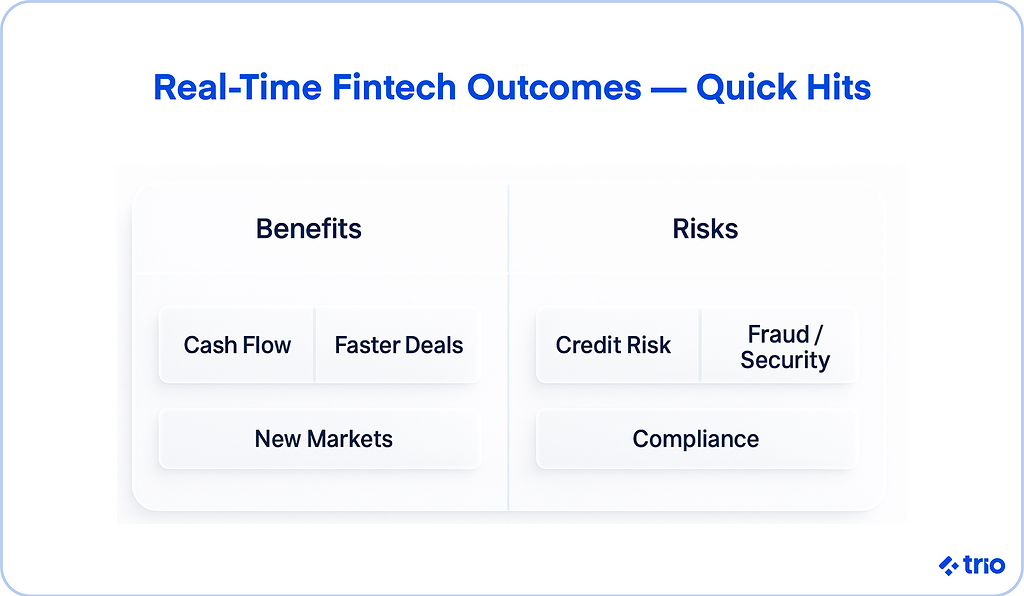

Benefits of B2B BNPL for Businesses

The real benefits of B2B BNPL solutions depend on how you use them and whether they fit your broader cash flow strategy.

Improved Cash Flow and Working Capital Management

Most businesses know the pain of mismatched timing between paying suppliers and getting paid by customers. BNPL helps smooth that friction.

Buyers can secure materials, tools, or software upfront while deferring payment until revenue comes in.

Suppliers, as we have already mentioned, get paid almost immediately by the BNPL provider, sidestepping the uncertainty of late invoices.

That is incredibly convenient, and it can stabilize liquidity in industries where one delayed payment can ripple through the supply chain.

Some CFOs even describe BNPL as a “buffer” that makes budgeting a little less stressful.

Enhanced Supplier and Buyer Relationships

When both sides can trust that payments will be handled smoothly, relationships improve.

Suppliers offering flexible terms often notice better customer retention and fewer disputes about late payments.

Buyers appreciate the transparency and speed. They don’t need to negotiate every transaction or request ad hoc extensions.

Seamless Digital Payment Experiences

Even B2B buyers expect the kind of checkout experience they’re used to as consumers, fast, paperless, and integrated. BNPL platforms cater to that expectation.

Credit checks happen in seconds, invoices sync automatically, and approval workflows fit neatly into digital procurement systems.

When done right, BNPL doesn’t feel like a financial product at all. It feels like a natural part of doing business.

Access to New Markets and Faster Deal Closures

BNPL can also unlock opportunities that traditional credit structures often block.

For smaller buyers, access to short-term financing means they can bid on contracts or stock up for seasonal demand without overextending capital.

Suppliers, in turn, can sell to customers they might otherwise consider too risky.

That flexibility tends to speed up deal cycles.

Buyers make faster purchasing decisions, suppliers close sales sooner, and both sides see less delay between quote and cash.

In competitive industries like wholesale or SaaS, that speed can easily translate into market advantage.

Data-Driven Insights for Credit Optimization

Every BNPL transaction leaves behind valuable data, payment patterns, invoice timing, and industry risk trends.

Over time, these insights can help both suppliers and lenders refine credit policies and forecast cash flow with far more precision.

Some providers even share analytics dashboards showing repayment behavior by sector or region.

Using BNPL not just as a financing tool, but as a source of financial intelligence, is a small but growing trend.

BNPL Solutions in the Market

The rise of B2B BNPL has sparked a new wave of fintech specialization.

A few years ago, only a handful of providers were experimenting with the concept.

Today, dozens compete to serve different industries, transaction sizes, and risk appetites.

Leading B2B BNPL Providers and Platforms

Each major provider has its niche, shaped by geography, regulation, and target market.

Mondu

Headquartered in Berlin, Mondu focuses on SME buyers and mid-sized merchants across Europe.

Its checkout integrations allow for instant payment deferral, and its underwriting models are tuned for EU regulatory environments, something not every provider handles gracefully.

TreviPay

The United States’ TreviPay serves larger enterprises needing scalable B2B payment networks.

It’s especially strong in manufacturing, logistics, and wholesale distribution, where complex invoicing structures require deeper system integration.

Hokodo

Operating mainly in the UK and EU, Hokodo blends credit insurance and payment automation, helping merchants extend terms without assuming full default risk.

Billie

Billie takes a more e-commerce-oriented approach, offering invoice-based BNPL to online merchants.

Its value lies in simplicity: real-time credit checks, flexible repayment schedules, and seamless ERP integration, all optimized for digital-first suppliers.

BNPL-as-a-Service and Embedded Finance Options

A growing number of companies are choosing not to rely on external BNPL brands at all.

Instead, they integrate BNPL capabilities directly into their own platforms through BNPL-as-a-Service (BNPLaaS) solutions.

This embedded finance model allows a marketplace or SaaS company to offer deferred payments under its own brand, backed by a white-labeled credit provider.

Comparing BNPL Providers: Key Features and Fees

Comparing providers can be tricky because pricing models vary by risk profile, region, and transaction volume. Still, a few patterns stand out:

- Speed: Approval and settlement times now average under 48 hours for most providers.

- Integration depth: The best platforms connect directly to ERP or CRM systems, not just e-commerce checkouts.

- Risk management: Providers differ widely in how they handle defaults; some carry the full risk, others operate on partial recourse models.

Fees typically fall between 1.5% and 5% per transaction, though long-term partnerships or volume agreements can bring that down.

As with most fintech products, the true cost depends on the value of liquidity and time saved.

Transaction Processes and Financial Workflows

Behind every smooth BNPL transaction lies a web of integrations that keep the money and the data flowing accurately.

How BNPL Integrates Into Existing B2B Payment Systems

Most providers now design their systems to slot directly into enterprise workflows.

APIs and webhooks connect BNPL approvals, invoices, and repayments with accounting software or ERP systems like SAP, NetSuite, or QuickBooks.

For finance teams, that means less manual reconciliation and fewer discrepancies between accounts payable and receivable.

Everything updates automatically, allowing teams to track payment status and cash positions in near real time.

Settlement, Reconciliation, and Risk Allocation

Once the buyer’s transaction is approved, the BNPL provider pays the supplier almost immediately, typically within 24 to 72 hours.

The buyer then repays the provider based on the agreed terms.

Risk allocation varies.

In recourse models, the supplier may share in repayment risk, while non-recourse models transfer all risk to the BNPL provider, often backed by insurance.

Each option has trade-offs: non-recourse models offer peace of mind but come at a higher fee, while recourse arrangements can reduce costs if you’re confident in buyer reliability.

Role of Banking and Fintech Partnerships

Most BNPL providers don’t operate in isolation but partner with banks for liquidity, insurers for risk coverage, and fintechs for data infrastructure.

It’s a model that marries financial stability with agility, the kind of hybrid approach that’s likely to define the next wave of business payments.

For suppliers, these partnerships add an extra layer of assurance that payments will remain secure and compliant.

For buyers, they expand the range of financing options available without introducing new administrative complexity.

BNPL Adoption and Market Trends

Over the past few years, it has moved from a fringe innovation to a serious component of global trade finance.

Yet, adoption still looks very different depending on who you talk to and where you are in the world.

Current State of the Global BNPL Market

Globally, BNPL’s rise has been driven by a mix of necessity and technology.

As businesses grappled with tighter cash cycles and supply chain volatility, digital lenders stepped in with faster, data-driven solutions.

Europe and the UK remain the most mature markets, supported by strong fintech ecosystems and clearer regulatory frameworks.

In the US, growth is catching up fast, though fragmentation and credit reporting gaps remain hurdles.

Meanwhile, parts of APAC, especially Singapore and Australia, are experimenting with cross-border BNPL, where trade and foreign exchange meet in one streamlined system.

BNPL Adoption Among SMEs and Enterprises

Small and medium-sized enterprises have been early adopters, which makes sense.

Many SMEs face chronic delays in securing bank financing, often waiting weeks for approvals or struggling with collateral requirements. BNPL fills that gap by offering instant credit decisions tied to actual transactions rather than broad financial history.

Larger enterprises have taken a more strategic view.

Some use BNPL to improve supply chain efficiency or standardize payment terms across vendors. Others integrate it directly into procurement systems, using it as part of working capital optimization programs.

In both cases, it’s less about replacing existing credit lines and more about making them more flexible.

Sector-Specific Adoption: Manufacturing, SaaS, Retail, Logistics

Different sectors use BNPL for very different reasons.

- Manufacturing: BNPL helps distributors purchase raw materials or components without disrupting production schedules.

- SaaS and Technology: Flexible payment terms allow clients to onboard new systems faster, aligning cost with recurring revenue.

- Retail and Wholesale: Seasonal inventory cycles often make BNPL a lifeline for maintaining stock without overextending capital.

- Logistics: With rising fuel and transport costs, deferred payments help operators manage unpredictable cash inflows.

In short, BNPL adapts well to industries that live on tight margins or extended cash conversion cycles, which, in reality, is most of B2B.

Future Trends in B2B BNPL

The next few years are likely to see BNPL evolve from a standalone product into a built-in financial layer across digital commerce.

Real-Time Credit Decisioning and Automation

Credit scoring models are getting smarter.

Instead of relying on static data, new systems tap into live business activity, transaction histories, invoice turnover, even supply chain behavior, to make credit calls in seconds.

That level of automation may soon make traditional credit reviews feel almost archaic.

Embedded BNPL via APIs and Payment Gateways

As open banking frameworks mature, BNPL will become a natural part of digital payments.

Imagine checking out on a B2B marketplace and instantly seeing a customized pay-later option based on your transaction history, all without a separate application.

Expansion of BNPL to Cross-Border and FX Transactions

The next big leap may come from cross-border BNPL, where currency conversion, compliance, and local regulations are handled in the background.

It’s ambitious, but several European and APAC providers are already piloting systems that make international trade as seamless as domestic transactions.

Risks and Considerations

Like any form of credit, BNPL isn’t risk-free.

Its flexibility can be a strength or a weakness depending on how it’s managed.

For all its convenience, it still introduces exposure to credit defaults, fraud, and even economic volatility, as with all other payment methods.

Credit Risk and Non-Payment Exposure

The most obvious risk lies in defaults.

BNPL providers take on repayment responsibility, but that doesn’t mean suppliers can ignore due diligence.

It’s worth verifying how each provider assesses and manages credit exposure, especially in volatile markets or when dealing with cross-border buyers.

Buyers also face risks of their own.

Multiple active BNPL arrangements can stack up quietly, leading to unexpected repayment pressure later on.

It’s easy to underestimate how quickly short-term credit can tighten working capital if not tracked carefully.

Fraud Prevention and Data Security

Because BNPL operates entirely online, fraud detection and data protection are crucial.

Most platforms use machine learning to flag unusual transaction patterns, identity inconsistencies, or repeat defaults. Still, no system is foolproof.

Businesses should confirm that their BNPL partners follow strict KYC, AML, and encryption standards before integrating the service.

Security breaches can also affect your reputation. A single data breach or fraudulent claim can erode trust faster than any payment delay.

Regulatory Oversight and Compliance Requirements

Regulation in the BNPL space is evolving quickly, and not all providers keep pace equally.

Some operate under consumer credit frameworks, while others fall into unregulated gray areas depending on jurisdiction.

For businesses, this means it’s worth partnering with providers who are proactive about transparency, the kind that clearly explains how credit terms, interest rates, and data usage comply with local laws.

As regulators tighten their focus, that kind of accountability will only become more valuable.

Macroeconomic Factors Affecting BNPL Stability

Interest rate hikes and shifting capital costs can have a direct impact on BNPL models.

Providers relying heavily on external funding or venture debt may tighten their lending criteria when markets fluctuate. In downturns, even small increases in default rates can ripple through the system.

That’s not a reason to avoid BNPL altogether, just a reminder that, like any financing tool, it’s tied to the broader economy.

Sensible adoption means using BNPL as part of a balanced credit strategy, not as a replacement for sound financial management.

Compliance and Regulation in B2B BNPL

As we’ve just mentioned, BNPL’s rapid growth has caught regulators’ attention around the world. As business adoption expands, governments are working to create frameworks that encourage innovation while protecting both lenders and borrowers.

Transparency, Disclosure, and Lending Ethics

The BNPL sector has learned from early consumer missteps, where a lack of transparency led to confusion and overextension.

Responsible B2B providers now publish clear repayment schedules, fees, and late-payment consequences upfront.

Ethical lending isn’t just good compliance, it’s good business.

Enterprises and SMEs alike value predictability and clarity. Providers that communicate openly tend to build longer, more resilient partnerships with their clients.

How Technology Supports Compliance and Risk Mitigation

Modern BNPL systems use built-in compliance automation to streamline checks and reporting.

KYC and AML processes now run in real time through integrated APIs, while audit trails document every transaction for future verification.

Encryption and tokenization safeguard financial data, and predictive algorithms can flag anomalies before they escalate into regulatory or security breaches.

Done right, technology doesn’t just enforce compliance, it simplifies it, freeing teams to focus on business growth rather than paperwork.

The Future of B2B BNPL

B2B BNPL isn’t standing still. It’s evolving into something bigger, part of a larger movement toward embedded finance, open banking, and AI-driven credit systems.

Convergence of BNPL, Embedded Finance, and Open Banking

Over the next few years, expect BNPL to become a built-in feature of digital commerce platforms, rather than an add-on service.

Open banking APIs already make it possible for lenders to access real-time business data, allowing instant credit decisions tailored to each buyer.

This convergence will likely blur the lines between payments, credit, and banking. For suppliers, that means smoother cash flow and fewer payment delays.

For fintechs, it’s an opportunity to build entire ecosystems around financial connectivity. Do you have the developers on your team to help you take advantage of these opportunities?

AI and Predictive Analytics in Credit Decisioning

Artificial intelligence is changing how risk is measured.

Instead of relying solely on static credit reports, AI can analyze live financial data, transaction velocity, invoice reliability, or even sentiment analysis from business communications to predict repayment behavior.

The potential upside is enormous: faster approvals, fewer defaults, and credit access for businesses that traditional banks might overlook.

Many challenges lie in keeping these systems transparent and auditable, so AI decisions remain explainable and fair.

BNPL’s Role in the Future of B2B E-commerce and SaaS

As digital platforms continue to replace manual procurement, BNPL will become a default expectation rather than a perk.

In SaaS, deferred payment models can make enterprise adoption smoother, aligning subscription costs with revenue recognition.

In supply chains, BNPL will help balance liquidity during economic shocks or high-demand seasons.

For fintech builders, it represents a fertile ground for API-driven financial tools that plug directly into existing workflows.

Predictions for the Next Five Years

If current trends hold, here’s what’s likely:

- Mainstream integration: BNPL will be standard across B2B marketplaces and procurement systems.

- Smarter credit models: Real-time analytics will continually adjust limits and terms as businesses grow.

- Cross-border growth: Unified standards will make international BNPL as seamless as local transactions.

- Bank-fintech collaboration: Traditional lenders will continue partnering with agile fintechs to expand reach and efficiency.

It’s a future built on data, trust, and partnership, not disruption for disruption’s sake.

Conclusion

B2B BNPL is quickly becoming part of the financial foundation of modern trade. It offers a rare combination of speed, flexibility, and risk-sharing that traditional credit systems struggle to match.

For suppliers, it ensures steady cash flow and healthier customer relationships. For buyers, it opens the door to growth without tying up capital.

And for fintechs building in this space, it’s a frontier rich with possibility, one that demands both innovation and responsibility.

As the ecosystem matures, the most successful players will likely be those who combine technical precision with ethical clarity.

They’ll view BNPL not just as a payment option, but as a tool for stability and collaboration across entire industries.

Used wisely, BNPL has the potential to make business payments faster, fairer, and far more connected than ever before.

And for the fintechs leading the charge, there are some incredible opportunities.

If you need to hire fintech specialists who can help you get ahead, get in touch for a free consultation.

FAQs

What is B2B Buy Now, Pay Later (BNPL)?

B2B Buy Now, Pay Later (BNPL) is a financing model that lets businesses purchase goods or services immediately and pay later in installments or after an agreed term. It’s designed to improve cash flow and simplify payments between companies.

Is B2B BNPL regulated?

Yes, but the level of regulation varies by region. The EU, UK, and parts of APAC already enforce disclosure and responsible lending rules, while the US is moving toward clearer national standards.

Will B2B BNPL replace traditional trade credit?

Not entirely. BNPL complements trade credit by adding speed, automation, and scalability, but traditional relationships and negotiated terms will still play a role in long-term business financing.

How does B2B BNPL differ from consumer BNPL?

B2B BNPL focuses on larger transactions, longer payment terms, and business-level credit checks rather than individual credit scores. It also integrates with ERP and accounting systems to support reconciliation and compliance.

Who benefits most from B2B BNPL?

Both buyers and suppliers benefit. Buyers gain flexible credit and improved liquidity, while suppliers receive upfront payment and reduced risk of late or missed invoices.