Fraud has always followed money, but in fintech, it moves incredibly quickly.

The industry’s constant innovation, real-time payments, and data-driven systems have created both unprecedented convenience and a vast new attack surface. As fraudsters adopt the same AI tools that are used in financial services, staying ahead has become a race of best practices, intelligence, and adaptability.

Digital payments, mobile banking, and open-banking APIs have transformed how people interact with money. But every new digital pathway introduces a new vulnerability.

Fraud in fintech today is a sophisticated ecosystem of automation, deception, and exploitation.

AI-powered fintech fraud detection and prevention are emerging as the backbone of trust in modern finance. But like any tool, they’re only as effective as the people and processes guiding them.

Understanding Fintech Fraud

Before we can prevent fintech fraud, we need to understand how it operates and why it’s spreading so quickly.

What Fintech Fraud Is and Why It’s Rising

Fintech fraud encompasses any fraudulent activity within the financial technology ecosystem, where criminals exploit digital systems to steal, launder, or manipulate funds or even personal information.

It can involve synthetic identities, account takeovers, investment scams, or money laundering through peer-to-peer platforms.

Because fintech platforms operate almost entirely online, many traditional safeguards, like manual verification or in-person identity checks, have disappeared.

Automation that accelerates legitimate transactions also accelerates fraudulent transactions.

Attackers now use machine learning algorithms, AI-generated documents, and deepfakes to mimic real users or create convincing fake profiles.

In short, the same tools that drive financial inclusion and innovation are being weaponized. The risk of fraud has become a structural feature of growth in the fintech industry.

Why Fintech Companies Are Prime Targets

Fintech startups often scale faster than their security frameworks.

Many prioritize user experience and rapid onboarding before implementing robust fraud prevention measures. Each integration, from banking APIs to payment gateways, adds another potential weak link.

While compliance regimes like KYC, AML, PSD2, and GDPR set boundaries, breaches still occur in familiar ways: phishing emails, credential reuse, or cloud misconfigurations.

And because fintech platforms are so interconnected, a single compromised partner can expose dozens of others.

Criminal networks collaborate globally, share playbooks, and use automation to scale attacks far faster than manual defenses can respond.

Common Types of Fintech Fraud

Fintech fraud prevention starts with recognizing the patterns.

Below are some of the most common fraud schemes that continue to evolve across the fintech sector.

Synthetic Identity Fraud

Synthetic identity fraud involves creating fake profiles using a mix of real and fabricated information, for instance, combining a stolen social security number with a new name and address.

These hybrid identities often pass standard KYC checks and are used to open accounts, secure loans, or build credit histories before “busting out.”

Such schemes exploit gaps in verification systems and can result in financial losses across multiple institutions.

Account Takeover (ATO)

An account takeover occurs when fraudsters gain access to financial accounts, typically through social engineering tactics such as phishing, credential stuffing, or data breaches.

Once inside, they can transfer funds, change contact details, or apply for credit in the victim’s name.

Many victims only notice after financial losses have already occurred.

Card-Not-Present (CNP) and Payment Fraud

As e-commerce and contactless payments rise, card-not-present fraud has surged.

Attackers use stolen credit card information to make unauthorized purchases or test payment systems for weaknesses.

Because no physical card is needed, detecting these patterns in real time requires effective fraud detection systems that can score transactions in milliseconds.

Money Laundering and BNPL Fraud

Criminals exploit Buy Now, Pay Later (BNPL) and peer-to-peer platforms to disguise fraudulent activities or launder money.

Rapid approvals and small-ticket transactions make it easy to fly under radar thresholds designed for traditional banking.

Deepfake and AI-Based KYC Fraud

AI now enables fraudsters to generate convincing faces, voices, ID documents, and other financial information.

These deepfake-based KYC attacks can trick verification software not built to detect such synthetic realism.

This is one of the emerging fraud trends most concerning to compliance teams worldwide, as attempts have increased 2137% over the past three years.

Insider Fraud and Exposed Keys

Not all threats come from outside. Insider fraud, whether malicious or accidental, remains a significant challenge.

Exposed API keys or developer credentials can grant unauthorized access to sensitive systems, something fintech companies must guard against through access controls, audits, and employee training.

Each of these schemes highlights the tension between speed and security.

Instant onboarding and instant payments come with instant risk, and detecting anomalies in that time frame requires intelligent, adaptive systems.

Assessing Fraud Risk in Modern Fintech Environments

Models must continuously adapt to new behaviors, attack vectors, and fraud patterns. A system that worked last quarter might be obsolete today.

Risk assessment involves evaluating behavioral signals, device consistency, network intelligence, and even subtle timing differences that might indicate fraud.

But fintech leaders also face trade-offs: stricter controls can drive away users, while lighter ones invite abuse. The best strategies accept a degree of friction as a trade-off for trust.

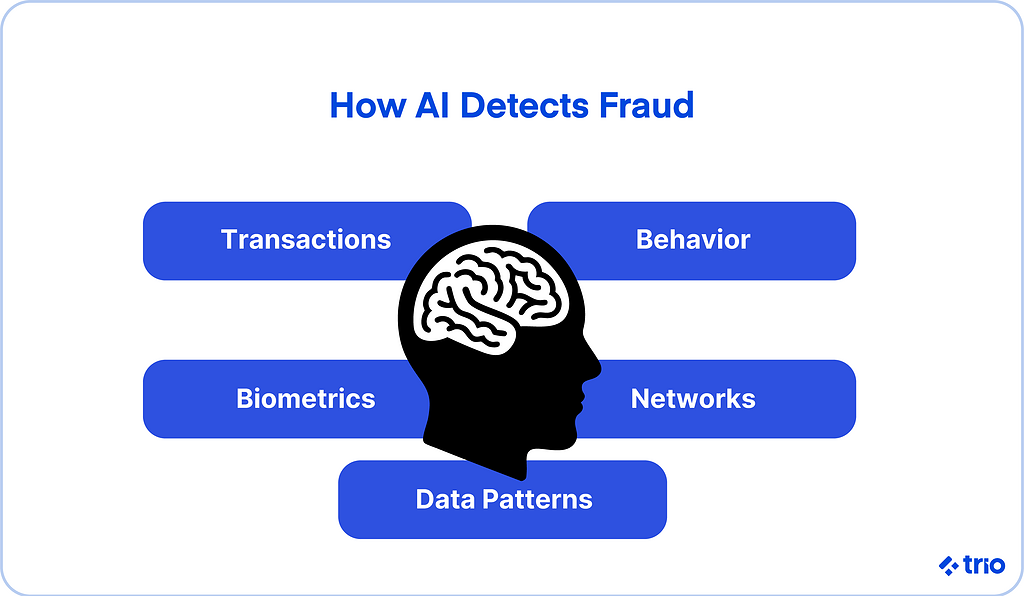

How AI Detects Fintech Fraud

AI and machine learning have transformed fraud detection from a reactive process to a predictive discipline.

Instead of waiting for alerts after a breach, modern systems detect and prevent fraud in real time, identifying risks before they cause damage.

From Reactive Monitoring to Predictive Intelligence

Traditional fraud detection systems rely on predefined rules: flagging large withdrawals, suspicious logins, or irregular spending. While useful, these systems struggle with new or subtle fraud attempts.

AI-driven systems learn what “normal” looks like, not just per account, but across millions of users, and then flag deviations that might indicate fraud even before losses occur.

This evolution allows fintechs to prevent fraud in real time and reduce the burden of manual review.

However, AI is not a magic bullet.

It can overfit to past data, misunderstand context, or flag too many false positives. Human oversight remains crucial.

Core Technologies Behind AI Fraud Detection

Several technologies enable today’s effective fintech fraud detection systems:

- Machine Learning Models: Both supervised and unsupervised learning analyze massive datasets to detect anomalies, while reinforcement learning adapts to evolving behaviors.

- Natural Language Processing (NLP): Scans communications or transaction notes for suspicious intent or phishing scams.

- Behavioral Biometrics and Device Fingerprinting: Track how users type, swipe, or navigate apps, comparing behavioral patterns against historical baselines.

- Graph Neural Networks (GNNs): These emerging AI models map relationships between accounts and devices, uncovering hidden fraud rings that span multiple platforms.

Together, these methods create a multilayered defense, an intelligent mesh linking identity, behavior, and device data to block fraudulent activities before they scale.

Benefits and Challenges of Using AI in Fraud Detection

AI offers clear advantages: faster detection, fewer false positives, and better scalability as transaction volumes grow.

But it also raises concerns.

Bias in training data can lead to unfair outcomes, and regulators increasingly demand explainable AI (XAI) to clarify how decisions are made.

Fintech companies must balance innovation with accountability, designing AI systems that are transparent, auditable, and aligned with privacy regulations.

AI-Powered Fraud Prevention Strategies

Prevention is based on detection, but it is about designing resilience into every layer of the fintech stack.

To implement robust fraud prevention measures, companies must combine data discipline, automation, and human expertise.

Building a Resilient Fintech Defense

Effective fintech fraud prevention usually includes:

- Strong KYC and customer due diligence workflows.

- Multi-factor or biometric authentication to protect users from unauthorized access.

- Behavioral analytics that learn from real-time activity.

- Continuous AML and sanctions screening to detect money laundering.

- Security by design, embedding protection during product development, not after deployment.

Fintech companies that integrate these from day one can prevent fintech fraud and recover faster from inevitable incidents.

Integrating AI Solutions for Prevention

Data pipelines must be clean, unbiased, and compliant. Fully automated systems can miss nuance; fully manual ones can’t scale. The best results come from a hybrid model that uses automation for volume and human intelligence for context.

Regulations like AML6, GDPR, and DORA add further layers of accountability. Aligning AI models with these frameworks ensures consistency across jurisdictions.

At Trio, we help fintech companies bridge this gap, connecting AI risk engines, structuring data flows, and ensuring new fraud detection systems meet both technical and regulatory standards.

Our fintech developers understand how to build compliance into your code from the ground up, setting you up for success long-term.

Action Framework for Fintech Teams

A practical roadmap for fintech fraud prevention could look like this:

- Centralize fraud data and remove silos.

- Integrate AI-driven risk engines into onboarding and payments.

- Automate alerts and escalation workflows.

- Audit models regularly for fairness, transparency, and drift.

- Upskill teams on AI literacy and fraud awareness.

Building a mature defense program takes months, not weeks, but steady improvement is the only way to stay ahead of evolving fraud threats.

The Future of AI in Fintech Fraud Detection

The future of fraud detection in fintech will likely emphasize collaboration, explainability, and privacy-first intelligence.

Emerging Technologies and Innovations

One of the most promising frontiers is federated learning, which allows institutions to train AI models on shared insights without exposing personal data.

This preserves privacy while broadening the system’s intelligence base.

Another is quantum-resistant encryption, an emerging safeguard for sensitive information that could one day protect digital identities from quantum computing threats.

While still experimental, it underscores how fintech fraud prevention continues to evolve at the edge of technology.

Global Collaboration and Regulation

Fraud networks are global, and regulators are catching up. Data-sharing initiatives between banks, PSPs, and fintechs are paving the way for real-time, cross-border alerts.

Compliance, once a backward-looking audit process, is becoming a living, predictive network that adapts in sync with fraud activity.

For fintech companies, this means building systems that can communicate securely with broader financial ecosystems while maintaining privacy and compliance.

Preparing Fintechs for What’s Next

The next generation of fintech defense will rely as much on people as on technology.

Upskilling teams in AI literacy, cybersecurity awareness, and fraud risk management will be essential. Fraud detection requires not just better algorithms, but better decision-making.

Trio often partners with fintechs at this growth stage, embedding fintech-savvy engineers who can design scalable, compliant AI systems and guide teams through testing and deployment.

Conclusion

AI gives financial institutions the analytical edge to detect and prevent fraud in real time, while human oversight ensures systems remain ethical and accurate.

No defense is perfect, but the right combination of automation, transparency, and expertise can protect what matters most: trust.

At Trio, our engineers help fintech companies design and deploy detection systems that grow smarter with every transaction, defending users, safeguarding compliance, and keeping the financial system secure as it accelerates into the future.

If you are interested in getting these developers on your team, get in touch!

FAQs

What is fintech fraud?

Fintech fraud refers to fraudulent activities within digital financial systems, where attackers exploit fintech platforms, APIs, or user data for financial gain.

How does AI help detect fintech fraud?

AI helps detect fintech fraud by learning normal user behavior and spotting anomalies in real time using machine learning and behavioral analytics.

What are the most common types of fintech fraud?

Common types of fintech fraud include synthetic identity fraud, account takeovers, card-not-present fraud, deepfake-based KYC attacks, and insider fraud.

How can fintech companies prevent fraud?

Fintech companies can prevent fraud by combining strong KYC, biometric authentication, continuous AML screening, and AI-driven fraud detection systems.