Fintech mobile app development is far from simple. The software development process is complicated in its own right, but the financial sector is riddled with security and data regulations that add further difficulties when developing a fintech app.

Let’s take a look at the entire process and how you can balance user needs, regulatory demands, and continued innovation and experimentation in this rapidly changing industry.

We’ll also go over how you can practically future-proof your fintech solution to stay profitable as long as possible.

If you are trying to put together an experienced team of developers, you are in the right place. Trio has been connecting companies with the best developers since 2019. With a success rate of more than 97%, our outsourcing and staff augmentation models offer cost-effective ways to get in touch with talent experienced in fintech development.

What Is Fintech App Development?

Before diving into how to develop your fintech application, we first need to cover some basics.

Fintech software development refers to creating apps that offer some financial services. This can range from formal mobile banking apps to mobile payment apps like PayPal, and even personal finance apps like YNAB and NerdWallet. Lending tools, insurance products, and crypto exchanges have also become more popular recently.

Many fintech app solutions are modern interfaces that integrate with legacy systems.

Key Benefits for Startups, Scaleups, and Enterprises

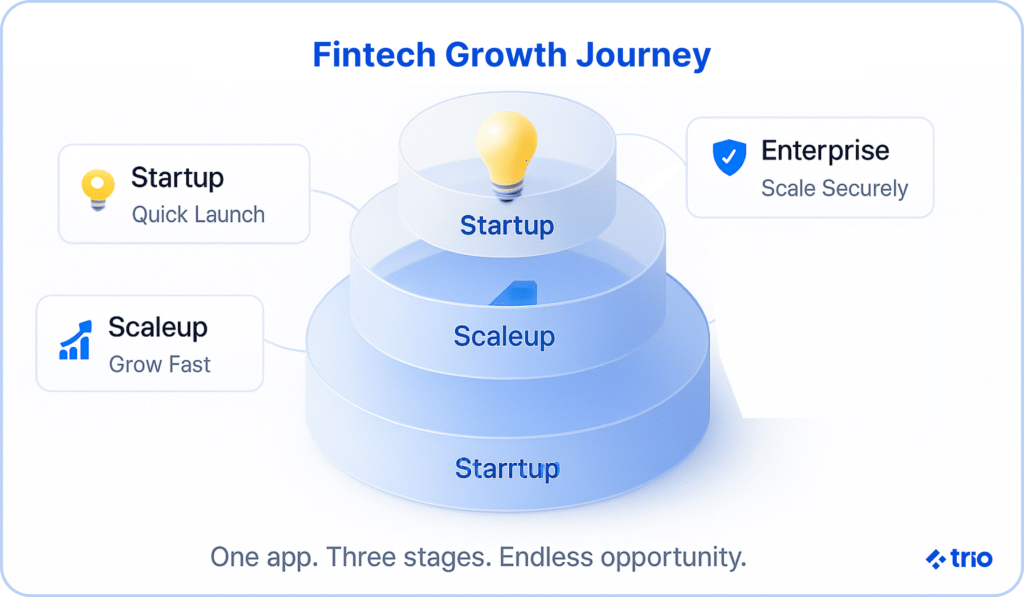

How could you benefit from developing a finance app as a fintech startup, scale-up, or enterprise? The truth is that this is not a simple question to answer and will differ from business to business.

As a startup, mobile application development costs a lot less than some other services you could provide in the financial sector. You don’t need to maintain a large location where you offer users a service, or get tonnes of staff in every day.

This means you can disrupt traditional markets and get your foot in the door.

It is also relatively simple to adapt to feedback and move quickly in the fintech sector, provided you have the right app developers on your team. The result is everything from faster iteration to practical tests as you start to expand your offerings.

You could also start with a smaller offering (MVP), perhaps specializing in a specific service that you market to your users, and then expand later, as you move from startup to scale-up, further decreasing the barrier to entry. For example, you could develop a simple user interface that collects all the news from certain stocks, and move to a full-blown investment app later.

As an enterprise, you can build a fintech app to keep up with global technology trends, not only offering your users a modernized way of accessing existing services but also easily providing them with new ones, and encouraging their loyalty. It is important to balance development with hard-earned trust, though.

Examples of Successful Fintech Apps

We’ve already mentioned a couple of examples above, but let’s take a deeper look at some of the most notable successes you may find in the app store.

Revolut is one of the best examples, as it hasn’t been around that long, yet it has managed to cement its position as one of the top neobanks used in the UK. It was also started in a tech incubator for startups. The initial fintech services provided were aimed at simplifying foreign exchange, but now it’s much more than that and offers most banking services.

Another neobank that’s been very successful is Chime. Popular in the US, the company addressed pain points like excessive fees and monetized them in different ways instead. In April 2024, a survey suggested Chime has roughly 22.3 million customers.

Robinhood also found success by eliminating most fees in the investment process, providing educational material, and generally gamifying the investment process to lower the barrier of entry to their almost 11 million active monthly users.

Taking a step back, we can see that only specialising in one or two features can still rocket your company to success.

Klarna is also very popular. It jumped on global trends, especially amongst young people, with its buy-now-pay-later model, which it integrates directly with online retailers. Venmo lets people send money to one another, but it also includes features that make it easier to split bills. While these apps are quite simple compared to a financial management app like Chime, they are still widely used.

Fintech Market Landscape

As you’ve probably noticed from our look at the best fintech apps, success in the global fintech market relies on your ability to address pain points and meet user expectations. To identify an issue and eventually start considering product development, you need to have a good understanding of the fast-changing landscape.

Growth Trends in the Fintech Industry

Many trends are growing at a massive rate at the moment. Open banking and allowing third-party apps to access your data have allowed banks to provide more customized services, but it’s also brought more attention to security and data handling procedures.

Embedded finance, or integrating financial services into platforms that you wouldn’t otherwise consider finance platforms, is also growing. Just think of how buy-now-pay-later platforms like Klarna are appearing in even the simplest of online stores.

The traditional way of banking seems to be on its way out, with many digital-first banks, like Chime and Revolut, which we have discussed above, becoming increasingly popular. These banks are not only being supported by the general move to digitize, but also by user requirements for transparency, simplicity, and even cost reduction.

On the more experimental side, we’re still seeing a fair amount of interest in things like decentralized finance, with cryptocurrencies staying popular, and many developers experimenting with blockchain networks. However, it is difficult to say where this trend will go.

Above all, the age of being uneducated and uninformed is over. Users are flocking to online learning platforms and integrated learning tools that allow them to make informed decisions about their finances. This has led to a rise in things as simple as educational video catalogues in mobile apps, or features that simplify data comparison in things like insurance apps.

Mobile Penetration and Financial Inclusion

Thanks to the many different types of fintech products now available, financial services have largely been democratized.

With most development companies focusing on a mobile-first development approach, understanding that the majority of users will likely access their services in this way, those who have never had access to things like banking services can now take advantage of them.

Modern fintech application development services have even allowed people to take out microloans and insurance, or deal with complex issues like remittances and cross-border payments. All they need is a compatible device and an internet connection.

With almost 90% of the world owning a smartphone, it would be ridiculous for you not to consider a similar approach for your own app idea.

Fortunately, our developers, with many years of experience in fintech mobile app development services, can help set you up for access by ensuring the right people have access to your app without any issues.

Emerging Technologies Driving Fintech

We’ve already mentioned some trends that are incredibly popular and growing, but what are some of the newer technologies you need to know about?

AI and machine learning are probably some of the most influential technologies, completely changing our approach to fintech app development.

Not only can you actually write code with generative AI or get it to power your chatbots, but you can also integrate it into your workflow to deal with large quantities of data. Some popular fintech applications of AI and ML include more accurate credit scoring, real-time fraud detection, and even personalized user interfaces.

Cloud computing is another emerging trend, allowing fintech companies to expand their reach and power complex, high-performance apps with no issue.

With this increase in globalization, especially now that most of the world is able to download an app with a simple click on the Apple App Store and Google Play, security and decentralization are becoming more important, again promoting blockchain as well as security features like biometric authentication.

Finally, Open APIs are seeing a rise. They make complex fintech integrations far easier, which is essential if your app needs to integrate with large legacy systems, like the kind you might find in a traditional bank.

The Fintech App Development Process (2025 Edition)

Now that we’ve got the basics covered, we can dive into the steps you need to follow in order to build a successful fintech app.

We’ve put these steps together based on our many years of experience in the industry, but we generally provide a custom solution for each of our clients based on their needs.

Step 1 – Define Your Niche and Target Market

Choosing the right niche is the very first step. You can’t move into web and mobile app development if you don’t even know what your app is going to do or what software development services are going to entail.

This niche could really be anything; the most important thing is to solve a problem or improve a process, but here are some ideas:

- Digital Banking

- Payments & Transfers

- Budgeting & Personal Finance

- Investing & Robo-Advisors

- P2P Lending & Microloans

- Insurtech

- Regtech

- Crypto & Digital Assets

Choosing your niche will rely heavily on any market opportunity that you identify, which is why it is so important to keep up with the latest trends in the industry and watch the major companies leading fintech mobile app development.

Step 2 – Conduct Regulatory and Compliance Research

If we were talking about a normal app, the preparation process would be a lot simpler, but when you build fintech apps, you need to pay careful attention to regulations that may affect you.

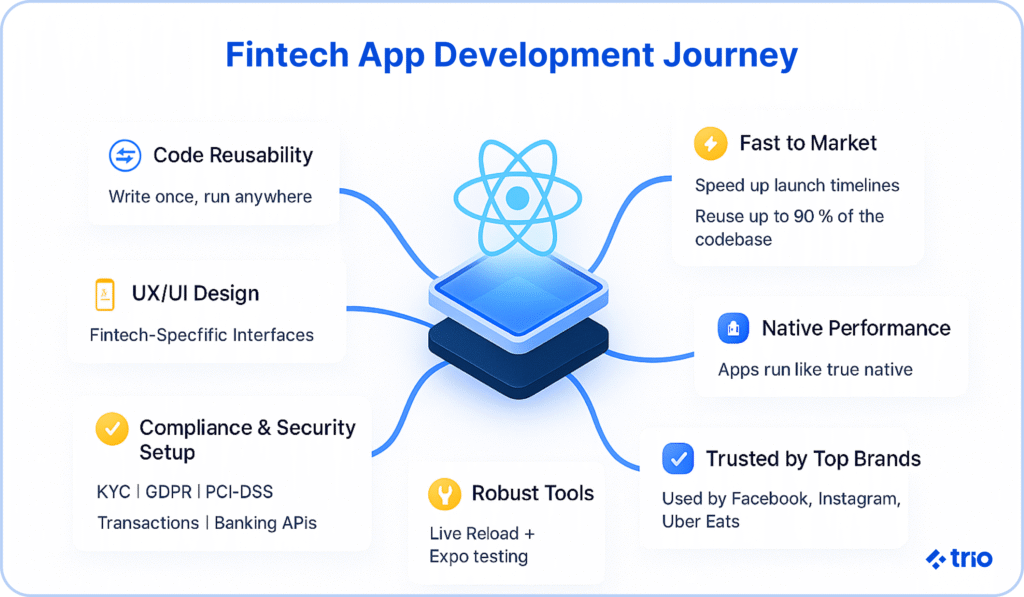

When dealing with people’s money, compliance is a non-negotiable. Your fintech apps must be in line with global and regional standards like GDPR, PSD2, AML, and PCI-DSS.

Getting a fintech expert or a leading fintech app development company on board can help you out with this, as they will be able to identify any issues you may have overlooked, or may even bring additional regulations to your attention that might only affect you once you start scaling, but would be relatively simple to prepare for.

Some of the things experienced fintech developers could help you with practically include KYC (Know Your Customer) processes, secure data handling, and even obtaining consent to access data and finances. They could also ensure that any third-party services you are using, like the APIs we mentioned above or even banking-as-a-service platforms, are compliant and secure.

If you are not prepared to comply with regulatory requirements, you could be fined heavily later or even lose the trust of your user base. These kinds of mistakes are generally quite expensive to fix once you have a fully functional fintech app as well.

Step 3 – Choose a Monetization Strategy

As you would have already noticed, there is more than one way you could monetize your app. Traditional banking and trading apps have benefited from transactional fees or commissions, but that tends to create a barrier to entry for using your app.

Some platforms, like budgeting apps, may implement subscriptions and tiered plans, with a basic, free version of their app that users can try out. Other types of fintech apps have found success with premium feature upselling, ads, or even referral programs.

You could also monetize from sources other than your users. With their consent, you could monetize data, but it is important that you focus on doing this ethically and that you are transparent about it.

You could also offer paid access to any APIs that you create. In this case, your income will most likely come from another mobile app development company.

Step 4 – Define MVP Features

While the idea of creating a massive app with all the features you could ever want is incredibly appealing, it just isn’t realistic for most. Not only will it take an incredibly long time, but the cost to build a fintech app of this calibre is not possible for a startup or scaleup in most cases.

Instead, you can focus on building a minimum viable product (MVP) with a shorter development time and all your most important features for users to enjoy.

Talk with your developers or your financial app development company to figure out what is most important. Generally, we’ve found that a good UI with real-time dashboards and alerts, secure verification, enterprise-grade encryption, and maybe some personalization using AI and machine learning can all make a big difference.

You will have to tailor the rest to your user base and whatever issue you are trying to fix.

Remember, this is just the first part of your fintech app development journey. Once you have your MVP out there, you can continue developing additional features.

Step 5 – Select Your Tech Stack

Once your developers understand what you need, they will be able to identify the best tools for your custom fintech mobile app development. If you work with a software development company like Trio, you won’t be limited, as we have elite developers ready with experience in a myriad of tools and frameworks.

The programming languages you will most likely use include JavaScript and Python. They will allow you to use powerful frameworks like React Native, Flutter, and SwiftUI for your frontend development, as well as Node.js, Django, and Ruby on Rails for your backend development.

You’ll also need a variety of tools to build and maintain your cloud infrastructure. AWS, Google Cloud, Docker, and Kubernetes are just the tip of the iceberg.

You could build your own APIs, but it’s likely that you’ll be able to use a third-party API that is already guaranteed to be compliant. In many cases, this might be the more affordable option to start with. You could also integrate other third-party tools into your app to speed up the development process.

Step 6 – Build or Augment Your Development Team

Depending on your budget and scope, you could hire each developer individually, either taking on freelance developers or hiring them full-time. However, this can be a very time-intensive and resource-heavy process filled with portfolio reviews, interviews, onboarding, and possible mistakes.

Instead, we recommend that you consider staff augmentation to supplement a small in-house team or outsourcing.

Staff augmentation is the process of collaborating with an experienced firm like Trio to connect you with the right developers. We already have experienced people who have worked on a variety of projects in the fintech industry before and will be able to identify the right people for you and get them on your team in as few as a few days.

You won’t have to go through hundreds of applications, just a few portfolios we’ve curated with a guarantee that each is a good fit, and you won’t have to commit to paying a full-time employee you might not have work for later.

Alternatively, if you don’t have an existing team at all and don’t have the technical expertise to manage an augmented team, we can take on all the management and development for you through our outsourcing models or put together a dedicated team from scratch.

Step 7 – Develop, Test, and Launch

Once you have your team ready, the exciting part starts. However, the development, testing, and launching are also where everything can go wrong.

We recommend that you use agile methodologies. Our developers here at Trio are experienced in them and have successfully written code as well as completed compliance tests and security audits.

When it comes to usability and accessibility, we recommend that you run automated tests, where user interactions are simulated, as well as tests using real people. This can include beta testing with early adopters. The combination of both forms of testing will better guarantee that no issues are missed.

When it comes to building mobile apps for fintech specifically, you’ll want to pay careful attention to reliability, low-latency performance, and error-free transactions.

Finally, you’ll need to ensure that your apps are compliant with any rules and requirements of whatever platform you are using to get the app to the user. The Apple App Store and Google Play are probably the biggest platforms, and where we’d recommend you start.

Step 8 – Gather Feedback and Iterate

If you get to this step, congratulations. The most difficult part is done.

Now you need to listen to what users say, figure out what needs to be changed or improved, and do just that.

Comments sections and reviews are a great place to start. You can also use in-app feedback, analytics, and anything else at your disposal. When it comes to the user experience, we’ve found that it’s really more of an art than a science, so A/B testing can be useful.

You can also start to develop the additional features you may have originally wanted, or any additional features your users recommend.

Future-Proofing Your Fintech App

Tech changes fast, and it’s very easy to fall behind and build up a massive tech debt that becomes very costly. You always need to be working on your app by changing existing features or creating new ones to stay competitive.

One of the best ways to do this at the moment is to use AI and automation. This does things like take care of menial tasks on your end, allowing your developers to focus on more creative issues, and also allows you to do things like personalize user interfaces with no additional effort on your part.

Also, start thinking about how you can scale to other regions. This might include preparing to meet different regulatory requirements or work with alternative currencies. Similarly, since things like Decentralized Finance are becoming more normalized, consider how you can prepare and stay ahead of developments regarding it.

Above all, make sure that using your app is easy and simple for as many users as possible. This could include continuous UI testing and maintenance, or accessibility considerations where you optimize your app for text-to-speech and other disability accommodations.

Choosing a Fintech App Development Partner

The key to finding the best fintech app development partner is to make sure that they have experience in a similar app and have proven, real-world successes in their portfolio.

At Trio, we have worked on a myriad of fintech projects before, and our developers are experienced with the nuances of the industry. We employ only the top 1% of developers, so you get an elite army, ready to bring your ideas to life. We don’t work with one-size-fits-all solutions, but provide custom development, so you always get exactly what you need.

If you would like more information or want to get started, reach out to schedule a free consultation.

Frequently Asked Questions (FAQ)

What are the challenges of fintech mobile app development?

The challenges of fintech mobile app development are largely related to security and regulatory compliance, which need to be updated and maintained constantly and may vary greatly in different regions.

How do you ensure data security in financial apps?

To ensure data security in financial apps, you can implement end-to-end encryption and secure authentication through biometrics or other techniques. Also, industry standards and region-based regulations should be considered.

How long does it take to build a fintech mobile app?

It can take anywhere from 3 to 12 months to build a fintech mobile app. The development time is dependent on your team size as well as the size and complexity of your app.